If you pay off the balance of your credit card in full each month, you won’t have to pay any additional fees at all. Otherwise, you will be charged by the banks that issued your credit cards. If you have a card that comes with an introductory 0% interest period, then for that whole time, so long as you keep up with the minimum monthly payment, you won’t have to pay any interest whatsoever.

Tips to Avoid Interest on Credit Cards

Get a 0% purchase credit card allowing cardholders to repay their purchase balance without the cost of interest within the promotional period (typically between 6 and 15 months).

Repay balance before the due date

Cardholders should schedule automatic payments online, mail payments at least from one week to ten days before the due date to ensure that they will not miss it.

Maximize the interest-free days

In fact, the number of interest-free days varies from card to card but usually, issuers offer their cardholders between 44 and 55 or even 62 interest-free days. Therefore, cardholders should take advantage of the benefit to make free-interest purchases.

Avoid cash advances

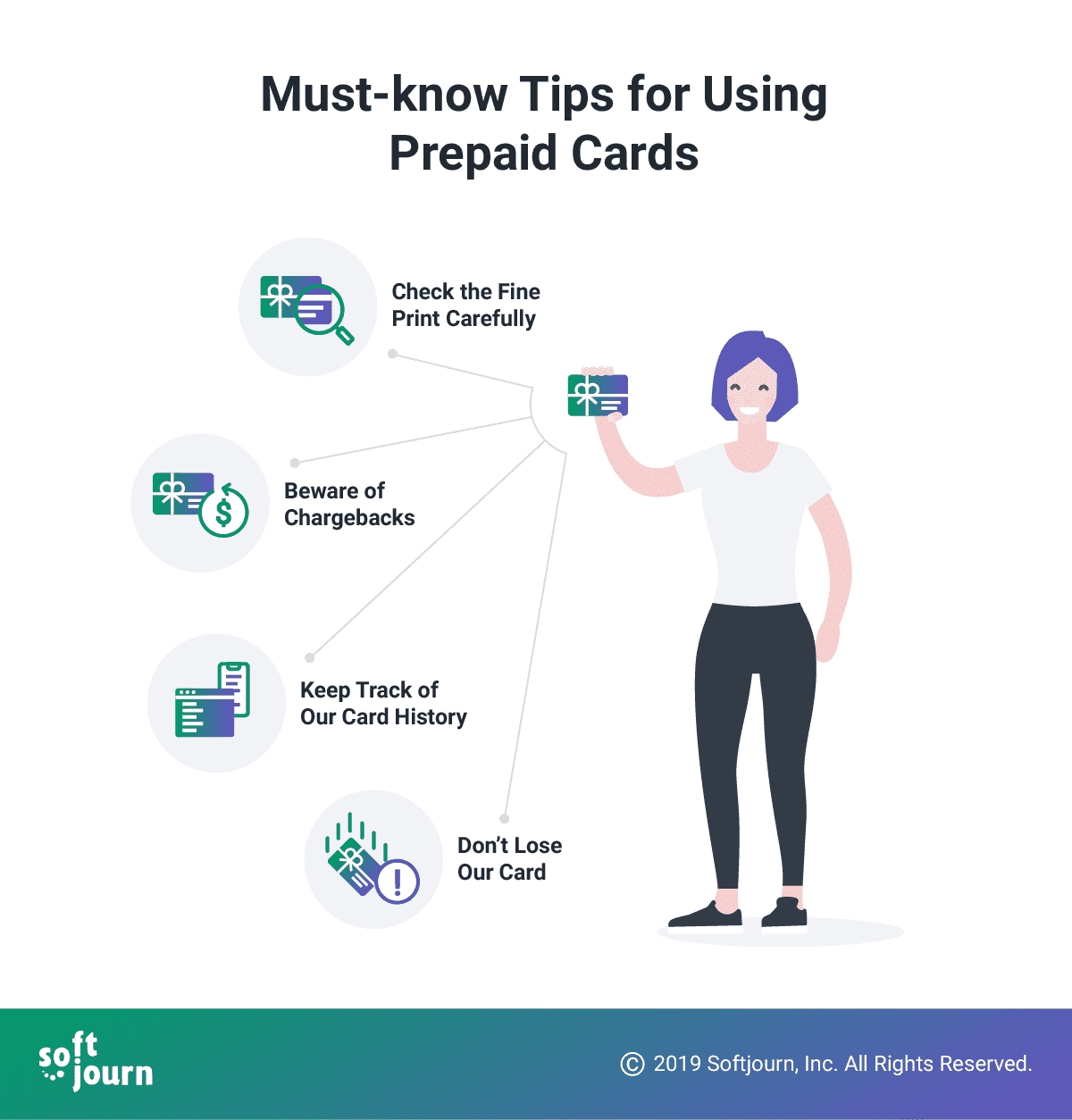

It often happens to ATM withdraws, gambling transactions, gift cards or prepaid cards, credit card cheques or buying foreign currency. In case it is unavoidable to use credit cards for cash advances, make sure you will pay them off on time. Otherwise, take debit cards into consideration for such cash advance transactions.