APR – Annual Percentage Rate means the annual interest rate charged on cardholders if they don’t pay off the entire balance in full each month. In the U.S., APR is typically stated as the periodic interest rate multiplied by the number of compounding periods per year.

In addition, it may be not easy to come to the conclusion about which criteria issuers rely on to evaluate cardholders’ APRs, especially when APRs are attached to the prime rate - the lending rate that banks offer customers with the best credit. When the prime rate increases, credit card interest rates often do as well. Some cards have APR ranges which depend on the type of credit cards cardholders use and their creditworthiness. It means the better their credit score, the lower their interest rate and vice versa.

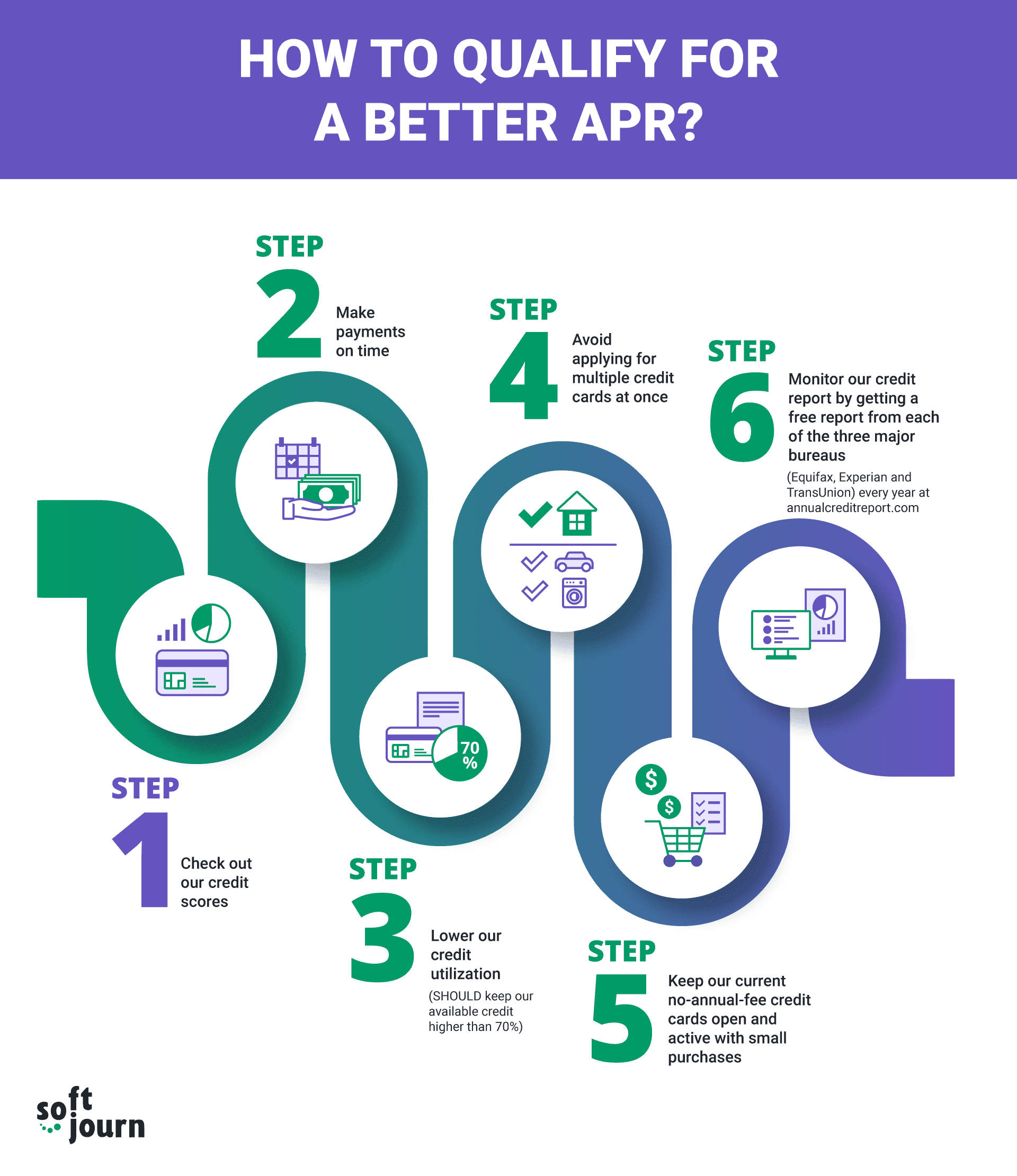

How to reach a better APR (a low APR)

It is worth noting that the following instruction is just applicable to the consumers whose credit scores need a boost and they are unable to negotiate with their creditor for a lower APR1,2.

- Step 1: Check out your credit scores

- Step 2: Make payments on time

- Step 3: Use less than 30% of your available credit

- Step 4: Avoid applying for multiple credit cards at the same time

- Step 5: Keep our current no-annual-fee credit cards open and active with small purchases

- Step 6: Monitor our credit report by getting a free report from one of the three major bureaus (Equifax, Experian or TransUnion) every year at annualcreditreport.com