Evolving Payments for an Evolving World

Adoption of contactless and digital payments is exploding due to current events. Set your payments company apart from the competition by offering instant digital issuance and push provisioning. With our payments expertise, you’ll meet consumers’ needs for contactless transaction methods that safeguard health.

Instantly generate new payment credentials to approved parties with instant digital issuance. By offering push provisioning, you give customers the ability to start using their cards right away, eliminating any wait for physical plastic or need for manual input. With these tools, your organization offers faster card replacement, quicker onboarding, higher activation, and maintains consumer spend.

Consumers want payment experiences that align with their shopping habits but maintain privacy and security. Our industry knowledge and technical acumen will help you deliver these experiences with customized solutions that instantly put digital payment methods into the hands of consumers.

What Is Mobile Wallet Provisioning?

The traditional issuance of a physical credit or debit card costs time and money to generate and mail. This can put card providers and processors at a disadvantage. Instant digital issuance removes this detriment by creating a virtual version of the payment method that can be instantly provided to the cardholder.

Research has shown that nearly 70% of cards instantly issued are activated and used within the next five days. Because cards are generated on demand, you preserve spend momentum with existing customers. You also create a positive first impression with new customers. Instant digital issuance means you can increase customer growth, usage, and loyalty.

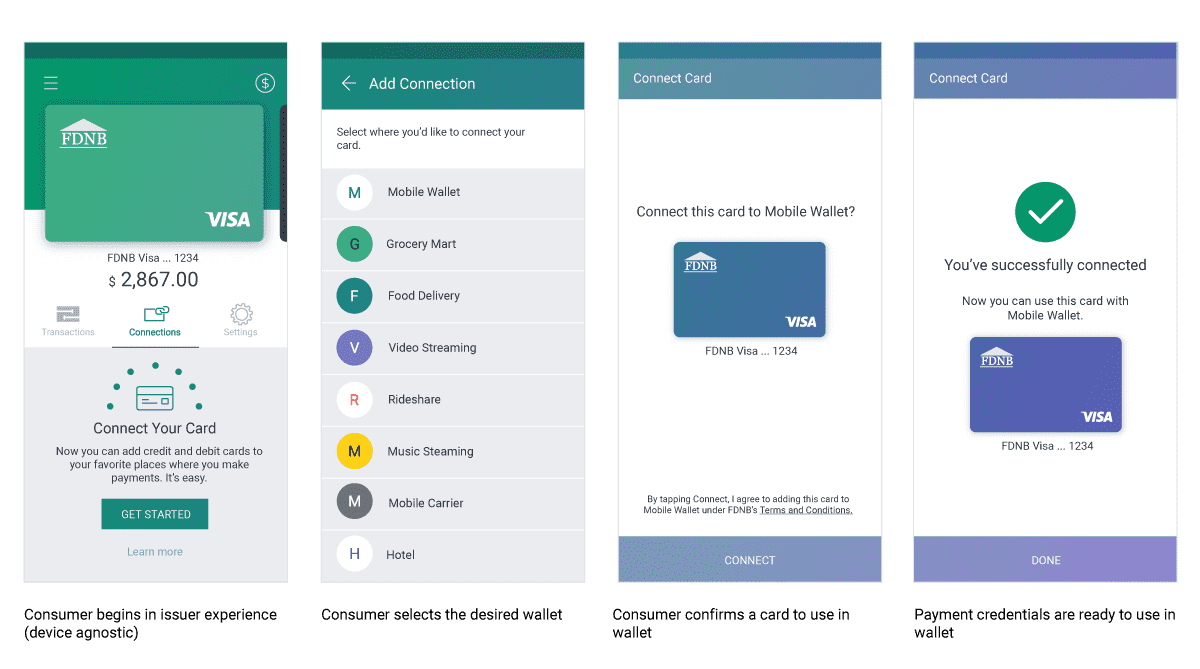

How Does Mobile Wallet Provisioning Work?

Tokenization, or the replacement of sensitive data with a token, is the backbone of push provisioning. A consumer can download an issuer's mobile application, tap or press a button, and “push” the token associated with the virtual card from the issuer's app into the digital wallet or service they want to associate the card with.

This requires no input of physical card information, eliminating user error. This process also creates a chain of trust that assures the issuer that the owner of the card has authorized the provisioning of their card.

Tokens can be pushed into a variety of participating token requestors, including merchants, digital wallets, or commerce platforms. Issuer apps can offer cardholders special incentives or exclusive offers for integrating with a particular service. Push provisioning also only requires a single point of integration to connect with token requestors; previously, card issuers needed to separately contract and integrate with Card on File merchants and Card Present wallets.

Benefits of Push Provisioning and Instant Digital Issuance Implementation

- Cost effectiveness: Instant digital issuance and push provisioning costs you less time and money than that involved in generating and shipping a physical card to a cardholder.

- Preserved revenue: You avoid any revenue gaps by maintaining cardholder spend. Cardholders receive their cards instantly, and activate them more frequently.

- Simple integration: With just a single point of integration, you can connect with and enable push provisioning into all participating token requestors.

- Immediate service: Upon approval, you generate new cards and provide them to cardholders without delay; credentials can then be loaded into wallets immediately.

- Market expansion: Merchants and/or wallets may pay you for preferred placement and top-of-wallet status to encourage cardholder to sign up for their services.

- Faster implementation: Your cardholders don’t have to wait; instead, they immediately receive credentials and load them to their favorite wallets without the hassle of manual entry.

- Contactless experiences: Give your cardholders a touch-free payment method that aligns with current needs regarding health concerns.

- Extend access: You can allow cardholders to extend access to family members or friends, removing risks involved with sharing physical cards and potentially encouraging new applicants.

- Capture convenience and simplicity: Once your cardholders understand how easy mobile wallets are, it’s unlikely that they would want to return to physical cards.

Ready to Get Started with Softjourn?

We know client demands can divert attention from the ever-evolving innovation in payments. We can help — developing creative custom solutions for every aspect of the payments process is what we do, and better than most.

Because of our payments processing expertise and in-house R&D centers, we can build any application you can imagine. Users will love interacting with every system we develop for you, and we build ironclad security throughout every application.

From accepting customer payments to enabling users to pay one another, we ensure every aspect of a transaction is handled accurately. Whatever your role and to whatever extent you need help, we’ve got you covered.

Engagement Models

What We Offer

Whether upgrading an existing code or creating a new one, the most important expertise we offer is a proven approach to mitigating risk and containing costs. Discover more about Softjourn's expert Consulting Services.

Often clients don’t know what product they need, but do know the results they want. Our job is to help define the product and develop optimal solutions to get those results. Learn more about Softjourn's Discovery Phase Services.

To compete, our clients continually need to provide new and better services. We have our own R&D Centers – started in 2008 – which uniquely positions us to do just that. Read more about Softjourn's Research and Development Services.

Our developers and illustrators are experts at UI and UX design. They will work with you to understand your needs in going from idea to prototype to deployment faster and at less cost. Explore further into Softjourn's Digital Product Design Services.

Software development has grown exponentially in recent decades. Softjourn is the solution to help you define and develop forward-thinking technology that gets real-world results. Get to know more about Softjourn's Software Engineering Services.

Our core belief is that analyzing and testing is critical because the essential role of software is so important. In the process, our Quality Assurance team helps you create superior products. Explore further into Softjourn's QA services.

Since day one, we’ve been providing application support and maintenance services to each customer on every project. It’s why we’re a proven, trusted partner and reliable asset. Get to know more about Softjourn's Application Support and Maintenance Services.

Our technology stack at Softjourn is designed to empower us to deliver world-class services to our clients. With a strong focus on innovation and efficiency, we continually adapt our expertise to stay ahead of the curve. Discover the Technologies and Frameworks we utilize, and learn how we can bring your ideas to life.

.png)