Understand Your Future Transactions

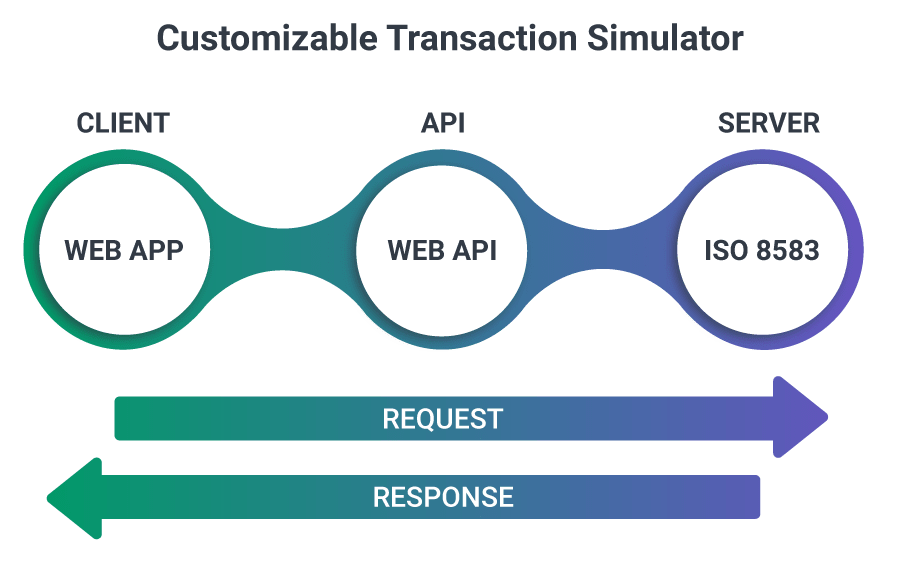

Transaction Simulator (TS) is a web app developed by Softjourn to mimic real-life financial operations in a virtual space. It is configured to process transactions according to the ISO 8583 standard, and it is highly customizable to fit a client’s changing needs.

The flexibility of the Transaction Simulator allows for it to be integrated and customized for any customer payment system that operates on ISO 8583. When our clients need to analyze their transaction models, TS is the solution that provides enough data to further understand how to improve their processes.

What a Transaction Simulator Offers

What makes our solution unparalleled? Beyond analyzing transaction models, our transaction simulator allows you to:

- Automate testing of complex financial transactions

- Test transactions quickly and efficiently

- Customize it to fit your needs

- Have a complete testing solution

Main Features of Softjourn's Customizable Transaction Simulator

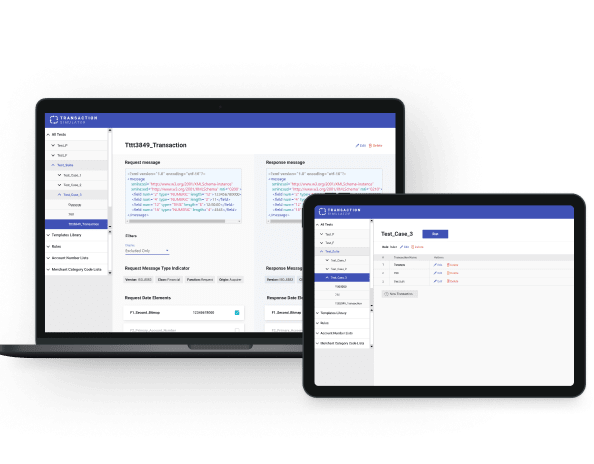

The primary functions of the Transaction Simulator (TS) are its ability to build and run transactions, generate and run test cases, test suites, and to compare expected and achieved results. Additionally, the simulator is equipped with additional features to automate parts of the process and ensure the accuracy of its results.

Which Companies can Benefit from a Transaction Simulator?

The prepaid card industry operates in a transaction-heavy environment. As companies in this space roll out new or enhanced solutions, they must test the speed and accuracy with which transactions are processed as well as whether or not these transactions work within the required parameters they have set. Hence the use of simulators that mimic both high-volume and specific types of transactions and essentially virtualize the end-to-end payment chain.

Softjourn has built several transaction simulators that generate a high volume of card transactions quickly and accurately.

Who can benefit from using Transaction Simulator:

- Merchants who want to use eCommerce APIs

- Companies using payment gateways

- Software development companies working on financial software

- Nearly any business in the banking and insurance industries, with Visa and Mastercard transactions (which use ISO 8583 protocols)

Please accept cookies to access this content

How The Transaction Simulator Improves Our Clients’ Processes

Softjourn has helped implement our transaction simulator for many satisfied clients in the fintech industry. When our client UPC began to plan an upgrade of its servers, it needed to run a load test to make sure that the new server configuration would meet the required transaction processing time. Read More.

With Softjourn’s solution, UPC liked our simulator because of:

- Improved efficiency. More tasks are handled by operations staff due to a new reporting system on failures, actions performed, and requests to the servers.

- Increased customer satisfaction. Fewer complaints due to upgraded infrastructure.

- Reduced costs. Reducing development costs means clients won’t be overspending on hardware.

- Regained confidence. Through better control of the testing process, understanding the limits of a system becomes easier.