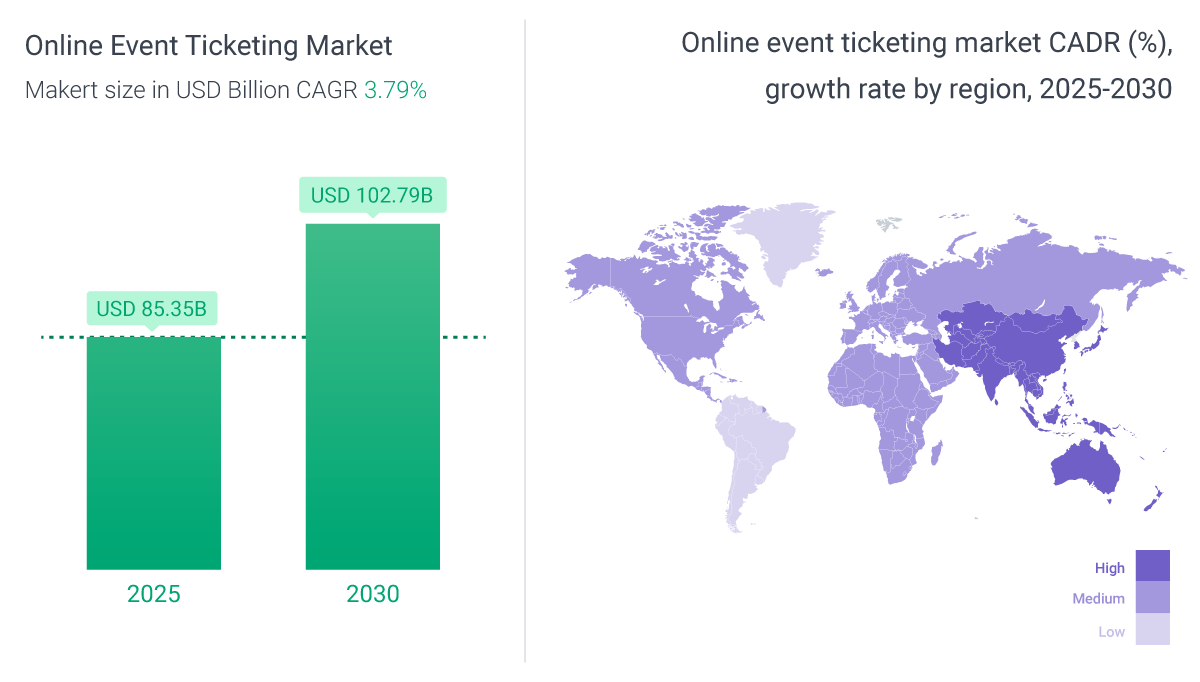

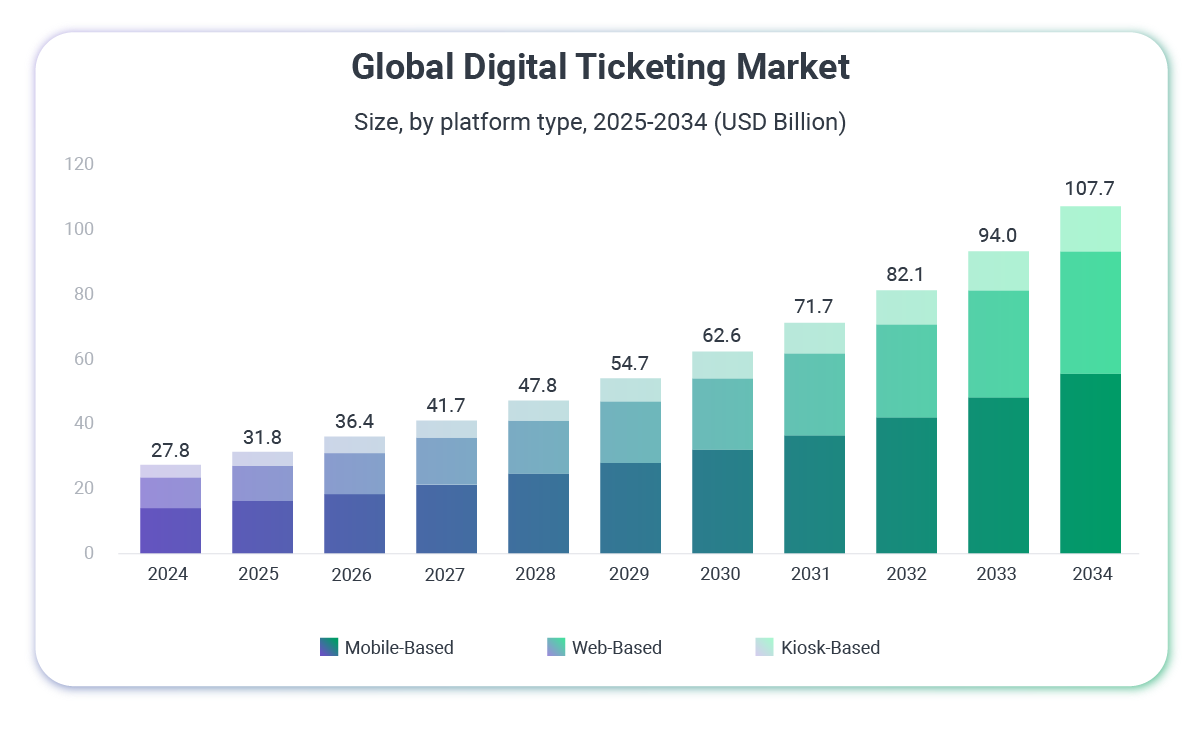

The event ticketing industry stands at an inflection point. The online event ticketing market size reached USD 85.35 billion in 2025 and is forecasted to touch USD 102.79 billion by 2030, advancing at a 3.79% CAGR according to Mordor Intelligence.

This expansion occurs in a digital ecosystem where mobile-first shopping, premium add-ons, and AI-driven pricing anchor revenue streams. Mobile devices already account for over half of total ticketing transactions, underscoring how 5G coverage, digital wallets, and social discovery reinforce friction-free purchases.

Over the past 20 years, Softjourn has developed ticketing technology for platforms processing millions of transactions, venues hosting sold-out shows, and entertainment companies navigating everything from sophisticated bot attacks to blockchain integration. We've architected scalable systems that handle ticket drops for major artists, built fraud prevention algorithms that adapt to new attack vectors in real-time, and created mobile experiences that convert browsers into buyers in seconds.

Lights, Camera, Trends: Navigating the Evolving Landscape of Event Ticketing

Our annual trends report isn't speculation. It's built on deep industry expertise, continuous research, and direct conversations with clients and industry leaders who are shaping ticketing's future.

This year, our research revealed three dominant themes:

- Identity becoming the new infrastructure. Tickets are transforming from static barcodes into programmable access objects linked to persistent customer profiles.

- AI moving from hype to operational reality. Artificial intelligence is delivering tangible value in automated customer support, fraud detection, and predictive capacity planning.

- Economic models under pressure. The industry is rethinking how and when revenue is captured, from dynamic pricing to post-purchase upsells.

Read on to discover the technologies, strategies, and behavioral shifts defining ticketing in 2026.

Identity-Linked Ticketing: Beyond Barcodes

The most fundamental shift in ticketing isn't about how people buy tickets; it's about what a ticket actually is.

For decades, tickets have been static: a barcode, a QR code, a piece of paper that grants one-time access to one event. In 2026, industry leaders are reimagining tickets as dynamic, programmable objects that exist as part of a persistent customer identity across multiple events, venues, and experiences.

Sébastien Braun, CEO at idloom, describes this evolution: "Ticketing is evolving from a transactional step to a persistent attendee identity, linked to access rights, certifications, loyalty data, and cross-event engagement. With more organizations running multi-event programs, the pressure to unify the attendees' identity and touchpoints is growing fast."

This shift represents more than a technical upgrade. It changes who owns the customer relationship, how data flows through the live events ecosystem, and where revenue opportunities exist beyond the initial ticket sale.

Programmable Access and Dynamic Entitlements

Industry innovators are exploring how tickets can become programmable objects with rights that change in real-time based on preset conditions. Sam Lake, industry expert in the sports sector, envisions tickets functioning as integrated access, identity, wallet, and membership. In this model, tickets could control entry, payments, loyalty programs, discounts, transportation, and even insurance.

Some venues are already implementing early versions of this approach. Dynamic access rights allow organizers to offer flexible benefits that respond to real-world conditions rather than remaining locked at purchase time.

Solving the Last-Mile Identity Problem

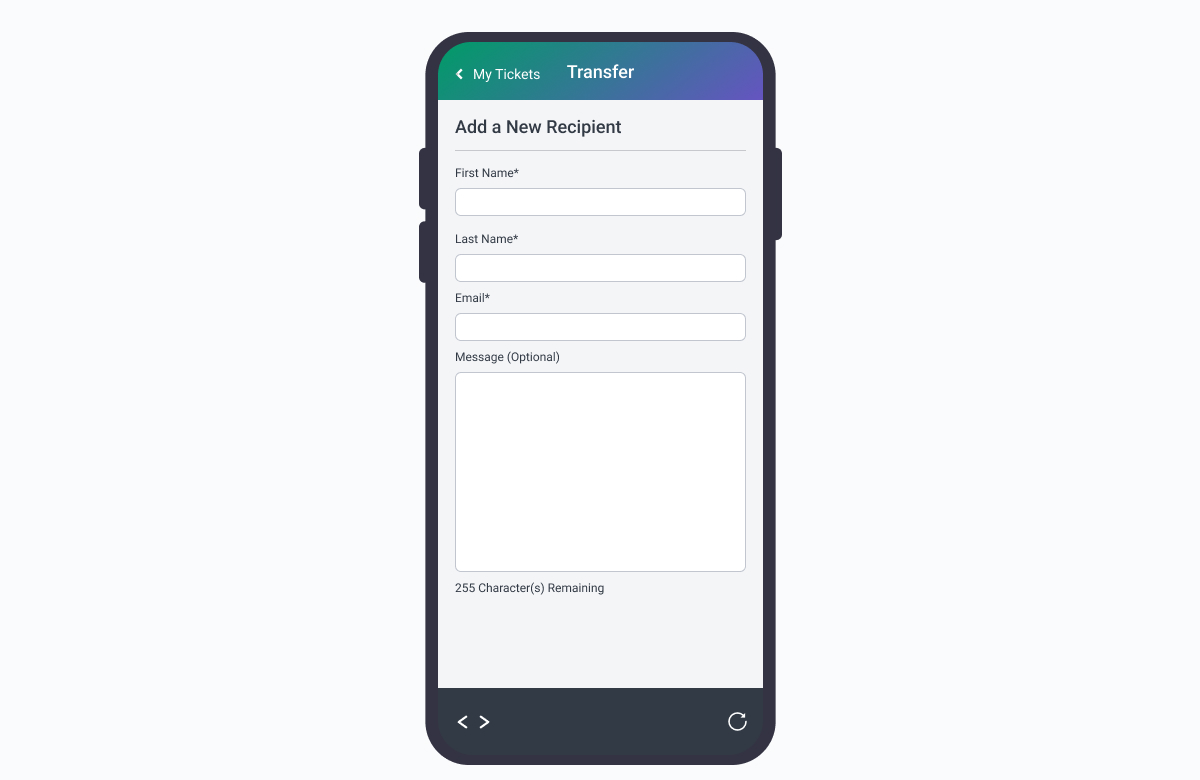

While the vision of programmable tickets is compelling, the industry still struggles with a fundamental challenge: knowing who actually shows up at events, especially after secondary market transfers.

Ruben Meiland, Chief Product and Technology Officer at TicketSwap, identifies this as one of ticketing's most persistent operational pain points. "Everyone talks about 'knowing your customer,' but ticketing systems still struggle to track the actual attendee, especially after secondary transfers," he explains. "This creates pain across the ecosystem, as organizers can't personalize communications or upsells."

Identity-linked ticketing solves this by maintaining verified connections between tickets and attendees throughout the entire lifecycle, including resale and transfer.

For secondary marketplaces, this means better fraud mitigation through secure, traceable handovers and richer data streams that allow targeted communications before, during, and after events.

CRM Integration as Foundation

The infrastructure enabling identity-linked ticketing relies heavily on CRM integration. Mike Geller, President of Spektrix (U.S. and Canada), notes that powered by CRM and the increasing use of AI and automation, the line between personalized marketing and the ticketing transaction will be thinner than ever in 2026.

"The ticket buyer is expecting a purchasing experience tailored to their interests, budget, and timeline. The ticketing function needs great CRM data to deliver the experience the ticket buyer expects. The great news is that building relationships with ticket buyers based on their particular interests and needs doesn't just improve the audience experience. CRM-based personalized ticketing strategies improve reattendance, increase upselling, and in the case of not-for-profit organizations, turn ticket buyers into donors."

— Mike Geller, President, U.S. & Canada, Spektrix

This CRM-first approach transforms tickets from isolated transactions into touchpoints within ongoing customer relationships. For organizers running multiple events, this unified profile approach reduces friction for repeat attendees while unlocking deeper behavioral insights.

Winners in 2026

Braun predicts that "in 2026, the winners will be those who move beyond 'selling a ticket' to managing a lifelong profile and experience, reducing friction for users and unlocking deeper insights for organizers."

The shift toward identity-linked ticketing won't happen overnight, and adoption rates will vary significantly across event types and organization sizes. But the direction is clear: tickets are becoming less about granting one-time access and more about establishing persistent relationships between attendees, organizers, and venues.

For ticketing platforms, the question isn't whether to adopt identity-based approaches, but how quickly they can build the infrastructure to support them.

AI: From Buzz to Business Impact

After years of hype cycles and ambitious promises, artificial intelligence is finally delivering measurable value in ticketing. But not in the ways many predicted.

Sébastien Braun, CEO at idloom, captures the current state precisely: AI is "both overhyped in vision, underhyped in practical impact." While consumer-facing AI features like chatbot ticket recommendations remain underwhelming, behind-the-scenes operational improvements are quietly transforming how ticketing companies function.

The real AI revolution in 2026 isn't about replacing human decision-making. It's about removing tedious manual work, accelerating processes that once took hours, and catching problems before they escalate into crises.

Operational Automation: AI as Infrastructure

The most immediate AI impact in 2026 is operational: ticketing platforms are deploying AI to handle the repetitive, time-consuming tasks that drain staff resources and slow down business processes.

Kayhan Ahmadi, CEO of Ticketbud, predicts that AI adoption will be widespread but largely invisible to consumers.

"AI is going to be like electricity at the turn of the century. It is going to be part of every business as part of their process. I don't think we are going to see tons of consumer-facing AI products at the moment, but we will see more and more AI products to help event organizers pull reports, organize data and speed reconciliation. The tedious tasks associated with events can be automated and streamlined with AI."

— Kayhan Ahmadi, CEO, Ticketbud

Sam Mogil, founder of SquadUp, sees similar patterns. He notes that real AI impact sits in automated customer support, dispute preparation, fraud triage, refund-reason classification, operational forecasting, and reconciliation cleanup.

For platforms handling thousands of transactions, these operational efficiencies translate directly to reduced support costs and faster resolution times.

Ruben Meiland, Chief Product and Technology Officer at TicketSwap, points to AI-powered support that can resolve 60 to 80 percent of cases instantly. "Refund questions, transfer issues, buyer and seller disputes get handled automatically, freeing teams to focus on the complex edge cases," he explains. This shift allows human staff to concentrate on situations requiring judgment and empathy rather than routine inquiries.

Predictive Analytics and Capacity Planning

Beyond automation, AI is improving how organizers forecast demand and allocate resources. Predictive models help platforms anticipate which sessions will hit capacity, when sales will spike, and how to optimize pricing in real time.

Jessica Stewart, who manages ticketing for The Event Planner Expo, has seen this transformation firsthand.

"What's genuinely changing operations behind the scenes is predictive analytics for capacity planning. AI tools now forecast which breakout sessions will hit capacity based on speaker popularity and topic trends from LinkedIn activity. This lets us reassign rooms three weeks out instead of dealing with overflow chaos on event day. We've cut our day-of logistics scrambling by at least 40 percent just from better predictions."

— Jessica Stewart, EMRG Media

Alex Grant, Co-Founder at Travel Curious Group, sees AI-driven demand forecasting enabling automated pricing changes as a near-universal capability by the end of 2026. "The most obvious place for AI to help is forecasting demand and allowing the automated pricing changes," Grant notes. This combination of prediction and execution removes guesswork from pricing strategies.

Customer Intelligence and Personalization

While operational AI runs in the background, customer-facing intelligence is becoming more sophisticated. AI systems now analyze registration data to match attendees with relevant sessions, recommend networking connections, and surface events aligned with individual preferences.

Stewart describes how AI-powered attendee matching works in practice: "When a marketing director from a Fortune 500 registers, the system knows to push them toward our enterprise-level content and connect them with similar professionals for networking before they even arrive."

Aaron Parris, EVP and Co-Lead of Partner Success at FEVO, emphasizes how AI is revolutionizing campaign creation and targeting. "Being able to use analytics to precisely segment and target fans gives promoters unprecedented efficiency and confidence in who they should market to and how they should do it," he explains.

Meiland sees personalized discovery as critical for cutting through event noise. "Users expect their ticketing platform to know their tastes. Generic feeds feel irrelevant. People want curated event experiences, not long lists," he notes. AI-driven personalization helps platforms surface the right events at the right moment based on intent, context, and historical patterns.

Hrefna Sif Jonsdottir, Managing Director at Tixly, believes AI is still underhyped in areas that actually matter. "It's not about the flashy features everyone talks about; it's about the daily work. If we can use AI to help venues save time and simplify their workflows, that's where the real value is. We're exploring this carefully at Tixly because it helps small teams do more with less."

Where AI Still Falls Short

Despite these operational wins, AI hasn't delivered universally on its promises. Braun identifies where AI won't move the needle: "Replacing organizers or fully automating event setup. There's too much nuance. Predicting perfect demand curves also remains difficult because there are too many externalities."

However, some platforms are beginning to bridge the discovery gap by building AI tools directly into their ticketing infrastructure rather than treating it as a separate feature. These conversational interfaces allow customers to describe what they're looking for in natural language and receive immediate, contextually relevant event recommendations with integrated booking capabilities.

Early implementations suggest that when AI discovery is tightly coupled with the transaction flow rather than operating as a standalone chatbot, conversion rates improve significantly.

Eric Tobias, founder and CEO of Opendate and venue owner at Forty5, frames the broader AI conversation practically:

"I think it's less about the technology itself and more about what it can do for venues that are often under-resourced. Margins are thin, and teams are small; if AI can actually accomplish real work for owners and operators, it will move the needle in a significant way. These owners and operators don't care about the technology. They care about building a sustainable business, and AI can help them do that."

— Eric Tobias, Founder and CEO of Opendate

The AI story in 2026 is less dramatic than the hype suggested but more practical than skeptics expected. It's not replacing ticketing professionals or revolutionizing how customers discover events overnight.

Instead, it's quietly handling the operational work that used to consume hours of staff time, allowing teams to focus on strategy, relationships, and the complex problems that still require human judgment.

The New Economics of Ticketing

The way revenue flows through the ticketing industry is being fundamentally rewritten. In 2026, two major shifts are changing when, how, and where money is captured: dynamic pricing is maturing from a controversial experiment into accepted practice, and the ticket itself is becoming less important than what happens after purchase.

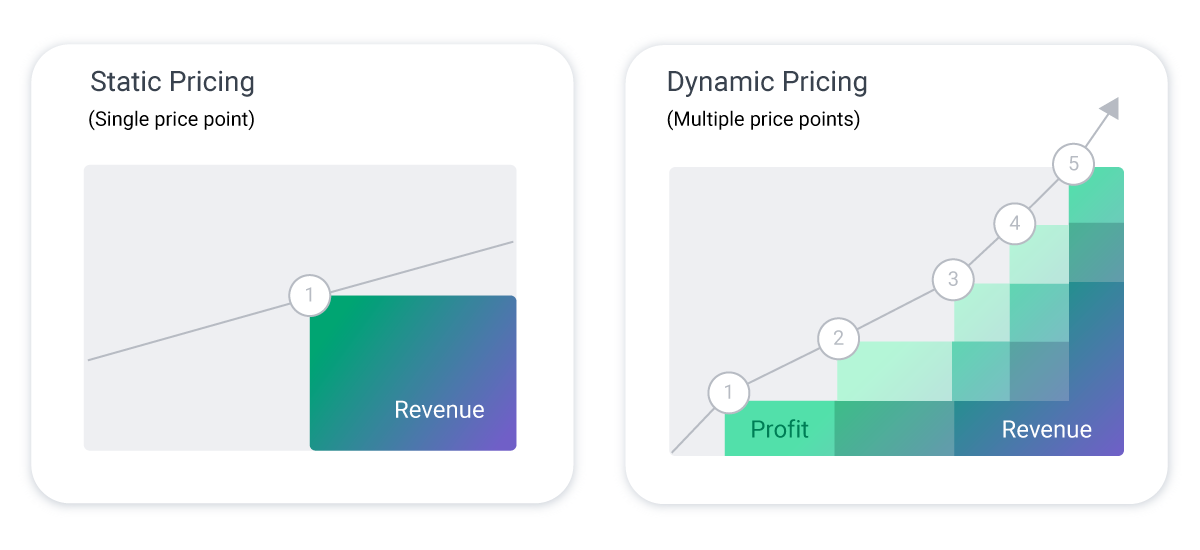

Dynamic Pricing Comes of Age

Dynamic pricing has been one of ticketing's most contentious topics for years. In 2026, the conversation is shifting from whether to use it to how to implement it transparently.

The secondary market has effectively forced the issue. Eric Tobias, founder and CEO of Opendate, notes that "for better or worse, the secondary market has made dynamic pricing a mandate for venues. The threat of not capturing all of the potential revenue or seeing your tickets being primarily sold on the secondary market means venues need to have dynamic pricing."

The key difference in 2026 is that providers and venues are approaching dynamic pricing more strategically, with clearer communication and better guardrails.

Toby Baptist, who works in ticketing at Las Vegas Tickets, argues that implementation matters more than the tool itself.

"I think it's an essential revenue tool when used correctly. In my opinion, the live entertainment industry has done dynamic pricing wrong for quite a while. They seem to start high and then need to lower the price when it exceeds the demand. The price should start at a fair point and follow demand upward. This not only rewards early buyers but also helps create buzz and demand for your event. If you start high and don't sell, it leaves a stain on the event as you have to lower prices, do discounts, and other things just to fill 75 percent of the room."

— Toby Baptist, Las Vegas Tickets

Nick Olivero, event producer at Redbeard Productions, has spent the last decade manually implementing dynamic pricing before AI tools became available. He defends the practice when done thoughtfully.

"Dynamic pricing lets price-sensitive buyers find their entry point while giving producers fair value on high-demand dates. No one should be punished for buying early or late. Pricing should follow demand," Olivero explains. "AI has been the missing link, giving us the ability to adjust prices instantly based on real behavior instead of gut instinct. Ticketing shouldn't be emotional, it should be strategic, and the future of live events isn't higher prices, it's smarter pricing."

Transparency remains the critical factor determining whether dynamic pricing feels fair or predatory. Sébastien Braun, CEO at idloom, emphasizes this point: "Dynamic pricing works extremely well in sports, travel, and entertainment because the rules are understood. In events, especially business events, it can easily feel unfair, opaque, manipulative, or unpredictable."

Braun predicts that dynamic pricing will grow in 2026, but in contained, transparent formats: "Early-bird incentives, loyalty pricing, engagement-based discounts, identity-based pricing for memberships, alumni, or certifications. The challenge is not the model. It's communication and trust. If organizers are transparent and predictable, dynamic pricing becomes value-based revenue management rather than a PR risk."

Sam Mogil at SquadUp frames it similarly: dynamic pricing is "essential when executed with clear rules, narrow guardrails, and pre-communicated rationale. A PR hazard when used as an opportunistic surge. For 2026, it behaves like airline pricing: acceptable when transparent, toxic when opaque."

Kayhan Ahmadi, CEO of Ticketbud, offers perhaps the most pragmatic take: "Nightmare, but maybe a necessary nightmare? Every good event organizer knows that whatever programming decision they make on the front end will have reverberations to their social and customer service channels on the backend."

Real-World Implementation: FIFA 2026

Dynamic pricing is moving from experimentation to mainstream adoption at the highest levels of live events. FIFA confirmed that tickets for the 2026 World Cup in the US, Canada, and Mexico will use dynamic pricing for the first time, starting with the Visa Presale Draw. Prices will initially range from $60 for group stage matches to $6,730 for the final, but could change based on demand.

Heimo Schirgi, FIFA's World Cup 2026 chief operating officer, advised buyers to "get your tickets early, especially if you know where you will be, because anything could happen." This represents a significant shift from the 1994 US tournament, where tickets ranged from $25 to $475.

However, regulatory resistance is building. Live DMA and partner organizations have urged the European Commission to ban dynamic pricing in live events under the upcoming Digital Fairness Act, citing concerns about opaque and inflationary pricing models.

This regulatory pressure highlights the tension between revenue optimization and consumer protection that will define dynamic pricing debates in 2026.

Balancing Demand with Variable Pricing and Timed Entry

Beyond dynamic pricing, other pricing strategies continue to evolve. Variable pricing, which sets different rates for various dates, days of the week, or specific times of day, allows attractions to optimize revenue while meeting customer expectations. By offering lower prices during off-peak periods and slightly higher prices for peak times, organizers can smooth demand curves.

Timed entry systems, which require or incentivize patrons to book tickets in advance and select specific time slots, aid in capacity planning while ensuring smoother visitor experiences. These systems pair well with dynamic pricing, allowing venues to charge premium rates for the most desirable time slots while offering discounts for less popular hours.

Subscription-based models are also gaining traction as a strategy to drive consistent revenue. These plans offer patrons access to multiple events for a fixed monthly or annual fee, catering to frequent event-goers and ensuring steady attendance even at lower-demand events.

Beyond the Ticket: Post-Purchase Revenue Streams

While pricing debates capture headlines, a quieter revolution is happening in how ticketing companies think about revenue. The ticket is increasingly becoming the entry point rather than the primary product.

Aaron Parris, EVP and Co-Lead of Partner Success at FEVO, predicts an aggressive push toward cross-promotion, add-ons, and bundling in 2026.

"The rest of the e-commerce world figured this out before the ticketing industry has, but we're faced with the opportunity to better represent and present added value opportunities to extract more revenue. The consumer gets an enriched, all-in-one experience like a ticket with parking or an F&B credit already built in, and the organization boosts revenue. Integrating things like merchandise or unique in-venue experiences right into the initial purchase flow is what moves ticketing from a simple commodity transaction to a true retail experience."

— Aaron Parris, EVP & Co-Lead, Partner Success - Sports, FEVO

Third-party add-ons are becoming standard in checkout flows. Kayhan Ahmadi, CEO of Ticketbud, observes, "We are seeing more and more weather guarantee products, refund protection products, hotel and accommodation products. Organizers are dealing with difficult economic pressures, and any product that can help event organizers capture additional margin will for sure be utilized."

The economics of ticketing in 2026 reflect a fundamental shift in thinking. The initial ticket purchase is no longer where the conversation ends. It's where the revenue opportunity begins. Platforms that can facilitate seamless upsells, integrate third-party services, and bundle experiences into compelling packages will capture more value per transaction than those treating tickets as standalone products.

For venues and organizers facing economic pressure and thin margins, these post-purchase revenue streams represent not just an opportunity but increasingly a necessity for financial sustainability.

Behavioral Shifts Reshaping the Industry

Consumer behavior around ticket purchasing has changed more dramatically in the past three years than in the previous decade. Three major patterns have emerged that are forcing ticketing platforms to rethink everything from pricing strategies to user interface design.

The Last-Minute Purchasing Phenomenon

One of the most significant operational challenges facing ticketing providers in 2026 is the collapse of the traditional purchase timeline. Events that once sold steadily over weeks or months now see the majority of sales concentrated in the final days before the event.

Nick Olivero, producer at Redbeard Productions, notes that "today most purchases are mobile and nearly half of all ticket sales happen in the week of the show, which was unheard of before Covid. Audience behavior has permanently shifted. Risk used to live in production budgets. Now it lives in the sales window."

Eric Tobias, founder and CEO of Opendate, describes the anxiety this creates for organizers.

"We've seen more last-minute purchasing. Our forecasting for any given show knows there's going to be a spike in the on-sale and then it's going to be quiet until the last 2-3 days pre-show. This makes it an anxious time for promoters and the entire market feels more volatile than 2-3 years ago. Consumers are becoming conditioned to large scale tours charging hundreds of dollars for a ticket, and paired with the threat of economic turbulence, smaller and local shows are a bit less predictable."

— Eric Tobias, Founder & CEO, Opendate

This shift affects different event categories in different ways. Jessica Stewart, who manages ticketing for The Event Planner Expo, has observed the pattern in B2B conferences. "Group buying has exploded, but the decision timeline collapsed. Three years ago, a corporate team would register individuals over several weeks. Now we see one person from a company buy 8 to 12 tickets in a single transaction within 48 hours of finding the event."

Ruben Meiland, Chief Product and Technology Officer at TicketSwap, connects this behavior to post-pandemic uncertainty. "Post-pandemic uncertainty trained people to buy closer to event day. This increases last-minute demand and volatility in both primary and secondary markets," he explains.

For ticketing platforms, this compressed purchase window creates multiple challenges. Revenue forecasting becomes less reliable, dynamic pricing algorithms have less data to work with, and the margin for error in capacity planning shrinks dramatically. Platforms that can provide organizers with better predictive tools and flexible pricing mechanisms will have a significant advantage.

Mobile-First Becomes Mobile-Only

The shift to mobile ticketing is complete. In 2026, mobile isn't just the preferred channel. For many buyers, it's the only channel they'll tolerate.

Jason Chan, Co-founder of Cinewav, identifies mobile-first as "probably the most significant change in recent years. Everyone expects to be able to have the tickets readily available on mobile." Chan expresses enthusiasm for digital wallets specifically: "We love the idea of digital wallets to create an ecosystem within the app that allows users to search for exciting events to go to next." He also notes that digital wallets help build loyalty with attendees.

Ruben Meiland at TicketSwap puts it more bluntly: "Mobile-only is now the norm. Expectations for frictionless mobile entry and mobile transfers are higher than ever. Anything that requires printing or multiple steps is perceived as outdated."

Sam Mogil at SquadUp emphasizes that mobile dominance extends beyond just having a ticket on your phone. "Mobile-first flows dominate, with near-total intolerance for slow checkouts, extra fields, or redirects. Repeat buyers expect stored credentials and one-tap flows as baseline," he notes.

Hrefna Sif Jonsdottir, Managing Director at Tixly, sees the challenge in balancing speed with authenticity. "Audiences today just expect things to flow. They find an event on their feed and want to book it on their phone in seconds. But in the performing arts, not everyone moves at that same digital speed. The challenge—and the opportunity—is balancing that modern, mobile-first simplicity without losing the personal touch."

The implications go beyond user interface design. Industry expert, Sam Lake, observes simply: "Mobile first by default." This expectation affects everything from how tickets are distributed to how venues handle entry and how organizers communicate with attendees leading up to events.

The data validates this shift conclusively. Mobile devices now account for 58.95% of all ticketing transactions and are growing at a 4.65% CAGR, driven by 5G coverage expansion, digital wallet adoption, and social media discovery mechanisms that make mobile the natural starting and ending point for the ticket-buying journey.

For ticketing platforms, mobile optimization is no longer a competitive advantage; it’s the standard. Platforms that haven't fully committed to mobile-first experiences are already losing transactions at checkout as users abandon cumbersome flows.

Value Consciousness Over Brand Loyalty

Economic pressure and an abundance of entertainment options have made audiences significantly more selective about how they spend on live events. The days when an event brand alone could drive ticket sales are largely over.

Jessica Stewart at EMRG Media has observed this shift in conference ticketing. "Early bird urgency disappeared. People now wait for speaker announcements. We used to sell 40 percent of tickets in the first early bird window. Now it's maybe 18 percent. Attendees don't commit to the event concept anymore. They're buying access to specific people. The brand name of the event matters way less than who's actually on stage."

Aaron Parris at FEVO sees a related pattern in sports and entertainment. "The most distinct shift is that people are craving a social and entertainment experience more than they are focused on the specific matchup or team performance. Younger generations, who are becoming a larger percentage of the purchaser base, prioritize the social element of the event."

This creates both challenges and opportunities. Kayhan Ahmadi at Ticketbud notes, "People are coming off of the post-pandemic high and exuberance of events. Now we are seeing people buying their tickets much closer to the day of the event and looking for the ticket option that gets them the most bang for the buck. The consumer cares about VALUE."

Ruben Meiland at TicketSwap observes that "value sensitivity has increased. Inflation and rising event prices mean fans scrutinize fees, seller transparency, and trust signals more than before. Clear value and trust indicators heavily influence conversion."

Martin Haigh at Menta Tech sees the economic pressure playing out in stark terms: "People can't afford to go to a lot of gigs now, so they save up to see their favourite artists and no longer can afford to go to see smaller emerging artists because the bigger artists have taken all their money."

The generational divide in event discovery and purchasing is particularly pronounced. Nearly half of Gen Z (49%) and Millennials (48%) discover new brands and products through social media, with 52% of Gen Z having made purchases via TikTok.

But social media isn't just about discovery. A Harris Poll found that 68% of Gen Z prefer spending money on live events over material goods, with 54% saying FOMO (fear of missing out) influences their decision to attend events. For ticketing platforms, this means integrating social discovery mechanisms is essential for reaching digital-first buyers where they spend the most time.

Hrefna Sif Jonsdottir, Managing Director at Tixly, sees this fundamentally changing how events are discovered. "We are so used to having content 'fed' to us on social platforms, and audiences are starting to expect that same ease when discovering cultural events. It's a shift towards meeting people where they are, rather than expecting them to come to us."

For ticketing platforms, this value consciousness means transparency isn't optional. Fees need clear justification, value propositions must be explicit, and the total cost needs to be communicated upfront. Platforms that bury fees or create friction in understanding total cost will see higher cart abandonment rates than competitors who embrace transparency.

The behavioral shifts reshaping ticketing in 2026 aren't temporary reactions to external pressures. They represent fundamental changes in how audiences approach live events.

Last-minute purchasing, mobile-only expectations, and heightened value consciousness are now permanent features of the ticketing landscape. Platforms that adapt their technology, pricing strategies, and user experiences to these realities will thrive.

Those who assume audiences will eventually return to pre-2020 behaviors will struggle.

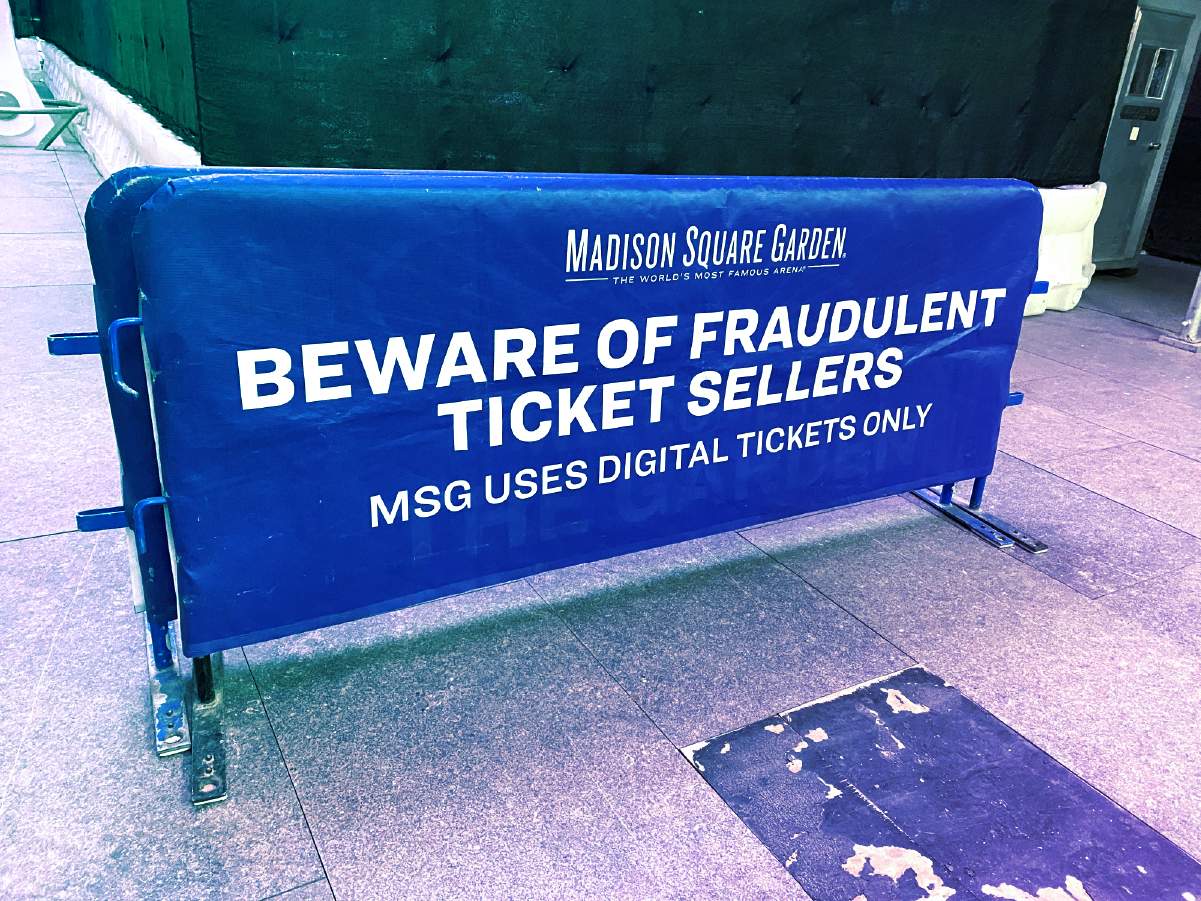

Technology Advancements to Prevent Fraud

The ticketing industry faces an increasingly sophisticated threat landscape. What began as individual scalpers using bots has evolved into organized criminal operations that exploit ticketing systems at scale.

The Escalating Threat

Automated bots remain a persistent problem, programmed to exploit vulnerabilities in ticketing systems and purchase tickets in seconds.

Synthetic IDs, which are fabricated identities created by fraudsters, have become increasingly prevalent for bypassing security checks and fraud detection systems. Account takeovers, where fraudsters gain unauthorized access to user accounts, continue to pose significant challenges.

But the threat has evolved beyond these familiar patterns. Maury Blackman, who handles transit ticketing globally at Masabi, describes a fraud vector that doesn't get enough attention.

"In 2025, we're seeing sophisticated bots buying blocks of popular event tickets using stolen payment credentials, then laundering them through 'legitimate' resale channels. It's not scalpers anymore. It's organized crime using ticketing as a payment testing ground. We tracked one operation that validated 47,000 stolen cards through ticket purchases in six weeks."

— Maury Blackman, Masabi

Martin Haigh at Menta Tech points to ongoing vulnerabilities on the consumer side. "The public capacity to still get scammed, buying non-existent or fake tickets online and on social media" remains surprisingly high, he notes. The proliferation of social media marketplaces has created new attack surfaces that traditional fraud prevention systems weren't designed to address.

Advanced Prevention Technologies

Ticketing companies and platforms are responding with more sophisticated defenses. Robust identity verification systems are emerging as critical tools, employing biometric authentication, device fingerprinting, and AI-driven fraud detection algorithms to distinguish between legitimate customers and bad actors.

Ruben Meiland at TicketSwap sees AI playing a crucial role in real-time threat detection. "Automated trust and safety through real-time fraud detection, anomaly spotting, and smarter seller and buyer verification will drastically reduce manual review overhead," he explains. This allows security teams to focus on sophisticated threats rather than routine verification.

Real-time monitoring of transaction patterns helps ticketing companies detect and respond to suspicious activities promptly. By analyzing the flow of ticket sales, sudden surges, or unusually high purchase volumes can trigger alerts, enabling platforms to investigate and take preventive measures before significant damage occurs.

Blackman advocates for identity verification that doesn't sacrifice user experience. "Identity verification without friction. Ticketing platforms need this: a way to confirm the buyer is real without making them upload their driver's license or killing the purchase flow."

Addressing Resale Market Abuse

Martin Haigh at Menta Tech proposes a different angle for combating organized scalping. "I think a different angle would be to stop [scalpers] selling tickets. The best way to do that is forcing secondary marketplaces to only pay out to bank accounts and only allow an account to be linked to a unique bank account," he suggests. This approach targets the monetization side of fraud rather than just the purchase side.

The challenge, as Blackman notes, is balancing security with user experience. Overly aggressive fraud prevention can create friction that drives legitimate customers away, while insufficient security leaves platforms vulnerable to exploitation.

The platforms succeeding in 2026 are those that have found ways to implement multiple layers of security that work invisibly for legitimate users while creating substantial barriers for fraudsters.

As fraud techniques continue to evolve, ticketing platforms must stay ahead of emerging threats. The combination of AI-driven detection, biometric verification, blockchain security, and real-time monitoring provides a more robust defense than any single approach alone.

For ticketing companies, fraud prevention isn't just about protecting revenue. It's about maintaining customer trust in an industry where a single security breach can permanently damage reputation.

Infrastructure Modernization

Behind the customer-facing innovations in ticketing lies an infrastructure transformation that's just as significant. In 2026, the industry is grappling with three critical technical challenges: hardware dependence in payment processing, fragmented integration ecosystems, and aging legacy systems that struggle to meet modern demands.

The Tap-to-Pay Revolution

Payment processing at events is undergoing a fundamental shift away from specialized hardware. Sam Mogil at SquadUp predicts a major industry trend for 2026: "The collapse of hardware-dependent onsite payments. Tap-to-pay on commodity devices becomes default."

According to Mogil, this shift has serious implications for providers. "Merchant processors that can't support it lose relevance. Platforms that still rely on Moby/iMagPro-tier hardware spiral into downtime, churn, and support bloat."

The move to tap-to-pay on standard devices reduces operational complexity for venues and event organizers. Instead of maintaining specialized point-of-sale hardware, venues can process payments through tablets and smartphones. This flexibility lowers costs, reduces training time for staff, and eliminates dependency on proprietary equipment that can be expensive to replace or repair.

For ticketing platforms, this means integrating with modern payment processors that support contactless payments on commodity hardware rather than maintaining relationships with legacy merchant services tied to specific device ecosystems.

Integration and API Challenges

While payment processing simplifies, the broader integration landscape remains frustratingly complex. Matt Smith at SUPER identifies a persistent pain point that affects the entire industry.

"There’s a disconnect between ticketing platforms and everything else they impact. A ticket drives hospitality counts, transportation, budgets, rooming lists, and guest communication. But the data rarely flows cleanly between systems. If we had cleaner APIs, shared standards, and better integrations, a lot of operational pain would disappear, and the fan experience would be smoother too."

— Matt Smith, SUPER

Smith points to another challenge that gets insufficient attention: exception handling. "Everyone knows how the process works when everything goes right. What no one talks about is what happens when it doesn't. Seat changes, last-minute guest swaps, accreditation issues, names changing after credentials are printed, or a ticketing system not matching what's in a hospitality system. These things happen constantly. Right now, they get solved with late-night emails, Excel tabs, and people who just 'know how to fix it.' There's a lot of room for better tools there."

Alex Grant, Co-Founder at Travel Curious Group, sees content as a particular API gap. "None of the APIs support content, which holds back the industry from growing as fast as it could. There is also the struggle with pricing structures as many resellers are geared to selling simple tickets but don't have the UI or the APIs to support more complex products, and products are getting more complex all the time."

These integration challenges affect ticketing platforms at every level. Without standardized APIs and data exchange protocols, each connection between systems requires custom development work. This increases costs, introduces points of failure, and makes it harder for platforms to scale efficiently.

Legacy System Modernization

Underlying many of these integration problems are outdated systems that were never designed for today's demands. Ticketing platforms that use legacy systems based on outdated technology struggle to meet current software needs. These systems can be costly to maintain, have poor performance, and may require hiring staff with specialized skills in obsolete technology.

Josh Katz, founder of YellowHeart and Beach Lane, sees the industry moving toward transparency but notes that technology holds some providers back. "AI is everywhere now. Most likely, it will eventually be used in ticketing. Historically, the live entertainment business has been very slow to move towards the use of new technologies. Eventually, I'm sure they will start using AI although I believe that many of the incumbent tech stacks might not be able to do much integration because of how outdated and old they are."

Taras Romaniv, Solution Architect at Softjourn, emphasizes the security implications:

Consider a common scenario: when releasing tickets for an event with massive demand, will your systems handle load spikes? Through modernizing efforts such as moving to the cloud, ticketing platforms can feel confident that their systems will be scalable and robust, able to adapt to any amount of demand or user growth.

Unfortunately, one poor user experience may cause fans to buy tickets elsewhere. Through strategic upgrades, platforms can eliminate common ticket-buying frustrations such as application crashes or slow page loads. With a faster, optimized buying experience, platforms retain users and gain new patrons.

Improved Access Control & Contactless Experience

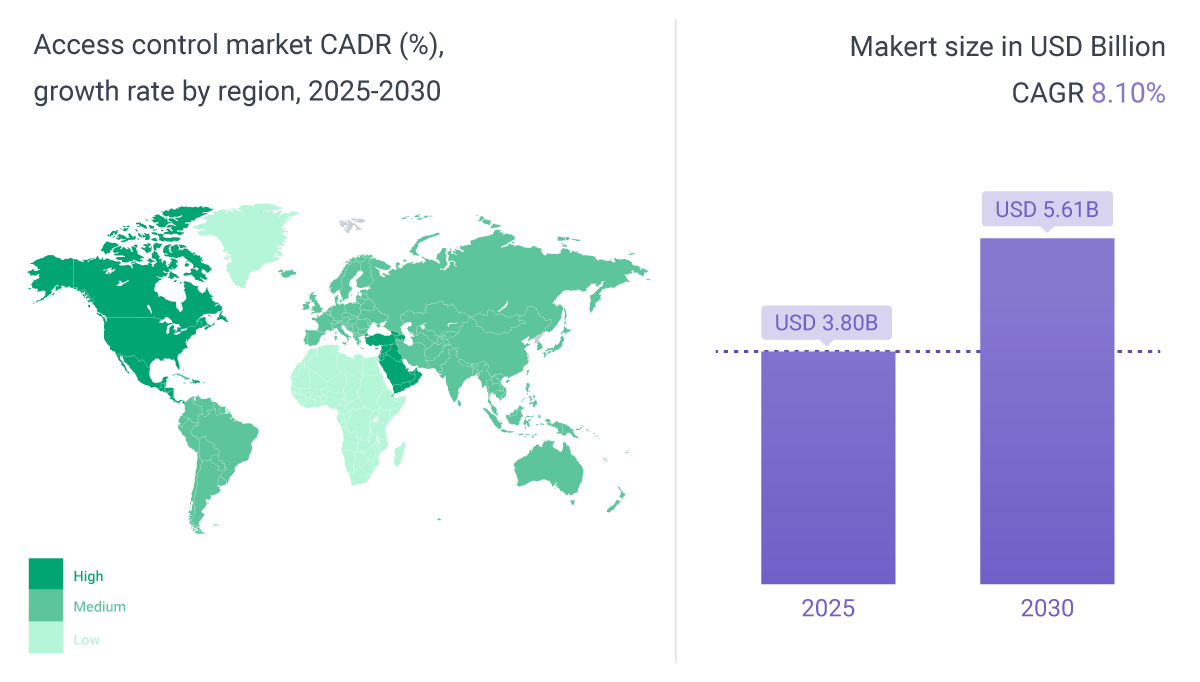

The access control market is experiencing rapid growth, valued at $3.8 billion in 2025 and projected to reach $5.61 billion by 2030, registering an 8.10% CAGR. This expansion is driven by cloud management adoption, mobile credentials, and biometric authentication replacing legacy keys and cards across venues. Stricter data-protection regulations and demand for contactless experiences are reinforcing the upgrade cycle.

Contactless ticketing has moved from emerging technology to an operational standard. In 2026, mobile ticketing through digital wallets like Apple Wallet and Google Wallet represents the baseline expectation for most event attendees, fundamentally changing how venues approach access control.

NFC and Digital Wallet Integration

Contactless ticketing, also known as mobile ticketing or NFC ticketing, allows patrons to store digital tickets in their electronic wallets. Fans access their tickets through their mobile devices, eliminating the need for paper tickets or even opening specific apps, making the process faster and more convenient for patrons and venue staff.

Terry Wilcher, Director at 123 Tix, notes that new developments in access control help them "streamline business processes and event ingress." By using electronic wallets with digital tickets, fans aren't required to download a separate application for each venue or platform from which they buy tickets.

The technology has evolved significantly. In the past, patrons were required to unlock their phones, find the app, navigate to the ticket, and enable the ticket to transfer via NFC. Now, technologies allow attendees to use their tickets in the same way they use their phones to pay: with just a simple tap to a specialized reader.

This seamless experience connects directly to the broader tap-to-pay revolution discussed in infrastructure modernization. As Sam Mogil at SquadUp noted, tap-to-pay on commodity devices is becoming the default, and the same principle applies to ticketing. Venues can use standard devices rather than specialized proprietary hardware for ticket validation.

Benefits Across the Ecosystem

NFC and contactless ticketing bring value to all parties involved in the event experience:

- Higher security through the use of Google and Apple Wallet data protection algorithms

- Fast recognition by ticket readers

- Increased reliability

- Faster processing of patrons

- More convenience for event-goers

- No risk of lost paper tickets

Jason Chan, Co-founder of Cinewav, expressed enthusiasm for how digital wallets extend beyond simple entry. "We love the idea of digital wallets to create an ecosystem within the app that allows users to search for exciting events to go to next." He also felt that digital wallets help build loyalty with attendees.

Adoption and Implementation

For venues, implementing NFC technology involves upfront costs for ticket readers and integration with existing systems. However, the prediction that we would see broader adoption each year is proving accurate. Patron convenience drives adoption, and in 2026, venues without contactless entry options increasingly face customer dissatisfaction.

The infrastructure requirements have become more manageable as the technology matures. Modern access control systems can integrate with existing ticketing platforms more easily than earlier generations of NFC hardware, and the cost of readers has decreased as the technology becomes standardized.

Contactless ticketing in 2026 isn't about whether or not to implement it but about how quickly venues can scale deployment across all entry points and how effectively platforms can integrate wallet functionality into their core offerings. The venues and platforms that have fully committed to contactless experiences are seeing faster entry times, higher patron satisfaction, and reduced staffing needs at entry points.

Open Distribution & Secondary Market Evolution

The traditional boundaries between primary and secondary ticketing markets continue to blur. In 2026, the industry is moving toward more open distribution strategies where tickets flow more freely across multiple platforms, and the conversation around resale markets has intensified both in regulatory circles and industry forums.

The Transparency Movement

Josh Katz, former founder and CEO of YellowHeart and Beach Lane, sees the industry headed in a clear direction. "I think overall the industry is headed towards more transparency in ticketing, and we will see that in 2026," he predicts. He observes that "consumers are looking for fair trade ticketing and are sick of getting ripped off by both Ticketmaster and secondary market providers with ridiculously high fees and zero transparency. I believe that the public will demand these companies do better."

This transparency push is playing out in multiple ways. Ticketmaster's rollout of all-in pricing nationwide following the FTC's Junk Fees Rule represents one visible shift. But the conversation extends beyond fee disclosure to fundamental questions about how tickets are distributed and resold.

The Secondary Market Debate

Toby Baptist, who works in ticketing at Las Vegas Tickets, sees the secondary market discussion dominating the industry conversation.

"I think the discussion regarding the secondary market and trying to institute no resale at all or resale price caps will continue to dominate the discussion in ticketing. I think when you try to stifle a fair and free open market, a lot of times there are several unintended consequences. In ticketing, there are thousands of transactions daily, both on the primary and secondary market, that process with no issues. For some reason, the focus is on a small segment of events, sales, or ticket listings, and these small issues are often pointed to in an effort to change an entire industry."

— Toby Baptist, Las Vegas Tickets

Baptist advocates for a different approach. "A more fair approach would be to make ticketing more transparent on the primary and from there allowing the buying public to make more informed decisions which will ultimately bring balance to the secondary market."

Martin Haigh at Menta Tech sees primary ticketing companies responding by building resale functionality directly into their platforms. He identifies "primary ticketing companies launching integrated official ticket resale marketplaces" as a major trend that will significantly impact the industry in 2026.

This integration of primary and secondary functions within single platforms represents a strategic shift. Rather than ceding the resale market to third parties, primary ticketers are increasingly offering official resale options that give them continued visibility into ticket movements and allow them to maintain the customer relationship throughout the ticket's lifecycle.

Open Distribution Benefits

Traditional secondary markets are evolving, and ticket exchanges are no longer confined to being secondary. Open or multichannel distribution strategies have become beneficial for both buyers and sellers. These technologies create trusted relationships across the entire ecosystem, broadening access to inventory where consumers shop.

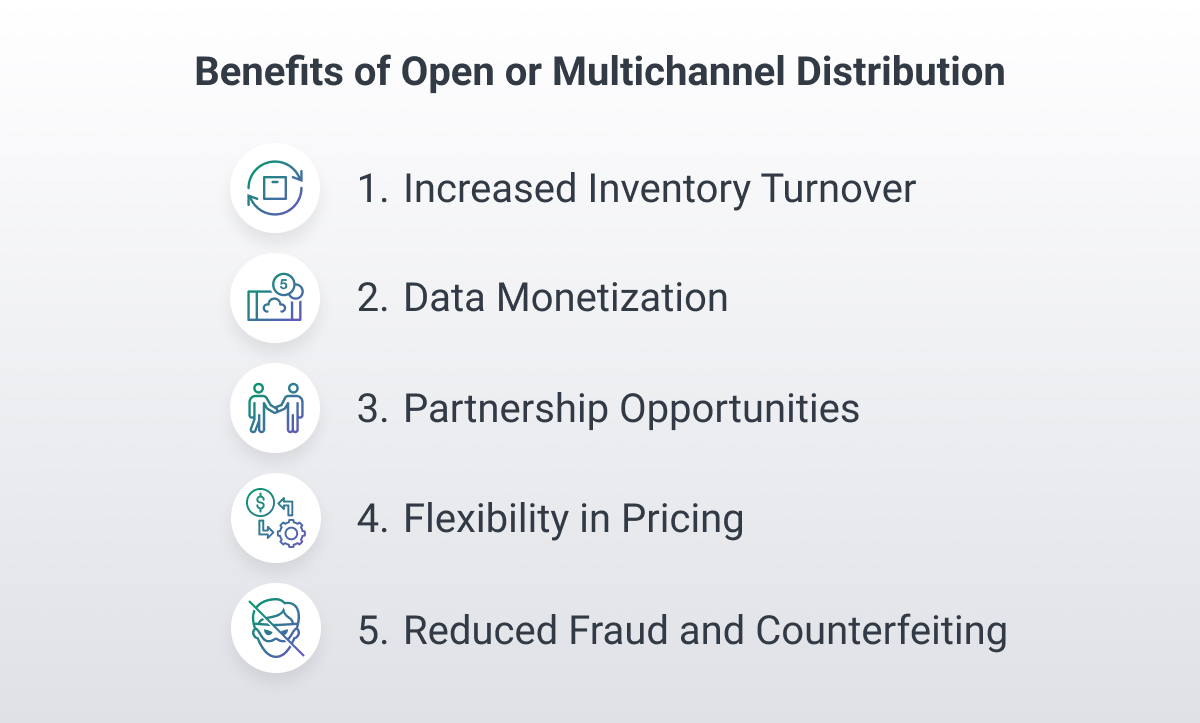

While open distribution can bring challenges, ticketing platforms also see these advantages:

- Increased Inventory Turnover: With the ability to distribute tickets through various channels, ticketing companies can optimize the utilization of ticket inventory. This means tickets are sold more quickly, leading to improved inventory turnover and increased revenue.

- Data Monetization: Open distribution provides access to a wealth of data from various channels and platforms. Ticketing companies can leverage this data for analytics and insights, offering data-driven services and reports to event organizers and promoters.

- Partnership Opportunities: Collaboration within the open distribution ecosystem can lead to partnerships with event organizers, venues, and other stakeholders. These partnerships can be lucrative and mutually beneficial, resulting in shared revenue streams and access to a broader customer base.

- Flexibility in Pricing: Open distribution strategies enable ticketing companies to have more control over pricing. They can adjust prices dynamically based on market demand, competitor pricing, and other factors, allowing them to maximize profit margins.

- Reduced Fraud and Counterfeiting: By implementing secure ticketing technologies and blockchain-based systems, ticketing companies can reduce the risk of fraudulent ticket sales. This not only protects consumers but also helps ticketing companies maintain their reputation and credibility.

Regulatory Pressure

The DOJ and FTC's public inquiry into anticompetitive practices in live entertainment signals increased regulatory scrutiny of ticketing practices. The agencies are seeking public input on issues like ticket scalping, bots, and monopolistic behavior, with the goal of informing new regulations or legislation.

This regulatory environment makes the transparency and open distribution conversation more urgent. Platforms that proactively embrace transparent practices and fair distribution models may find themselves better positioned when new regulations arrive than those resisting change.

The evolution toward open distribution and more transparent secondary markets isn't happening uniformly across the industry.

Some major players are embracing integrated primary and secondary models, while others maintain strict separation. But the direction is clear: consumers are demanding more transparency, regulators are paying closer attention, and platforms that can facilitate trusted ticket movement across multiple channels while maintaining security and fairness will have strategic advantages in 2026.

A Greater Focus on Accessibility

Accessibility in ticketing isn't just a trend for 2026. It represents an ongoing commitment that every platform and venue should prioritize to create ticketing solutions that better serve all patrons.

The ticketing industry has been increasing its focus on accessibility and inclusivity, with efforts to make ticketing systems more accessible for people with disabilities and to promote diversity and inclusion in events and venues. This focus extends beyond compliance to creating genuinely better experiences for all attendees.

Expedited Entry and Frictionless Experiences

The industry is prioritizing seamless and expedited entry experiences for event attendees. Beyond entry, venues are increasingly focusing on facilitating swift and convenient purchases of food, beverages, and merchandise. While the full integration of frictionless technology may not happen immediately, adoption continues to gain traction.

Tools and Technologies

Innovative tools have made it easier for ticketing platforms and venues to comply with ADA regulations while making events more accessible for patrons. These include:

- Accessible venue mapping software that clearly identifies accessible seating, routes, and facilities

- Voice-activated ticketing systems that allow people with visual or motor impairments to purchase and access tickets

- Biometric authentication options that can simplify entry for people who have difficulty with traditional ticket presentation methods

- Clear visual and text indicators for accessibility features throughout the purchase flow

These tools don't just help with regulatory compliance. They improve the experience for all users by making information clearer, navigation simpler, and entry more efficient.

Beyond Compliance

True accessibility goes beyond meeting minimum ADA requirements. It involves designing systems from the ground up with diverse needs in mind.

This includes considerations like color contrast for people with visual impairments, keyboard navigation for people who can't use a mouse, clear language for people with cognitive differences, and flexible purchase and entry options for people with various mobility needs.

Platforms that treat accessibility as a core feature rather than an afterthought create better experiences for everyone while expanding their addressable market. As the population ages and awareness of accessibility needs grows, this focus will become increasingly important for business success, not just regulatory compliance.

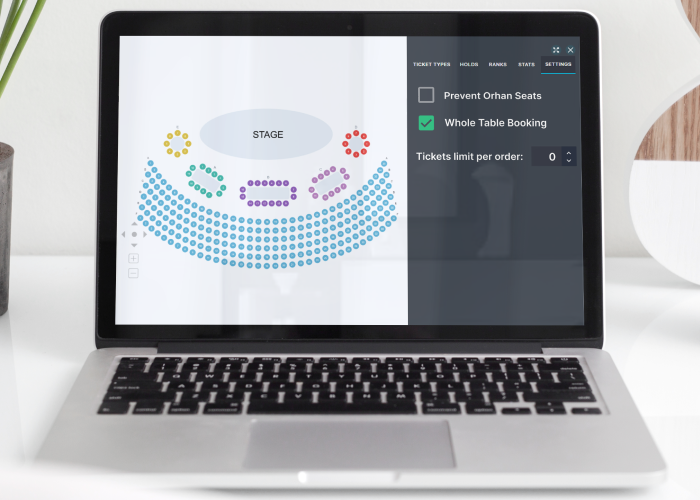

Advancements in Venue Mapping and Reserved Seating

Reserved seating and venue mapping technology have seen significant advancements, making it easier for event organizers to create seamless and customizable experiences for attendees. These tools are no longer just logistical necessities. They've become core ticketing features that influence purchasing decisions and drive revenue optimization.

Tools like Softjourn's Venue Mapping Tool now allow for precise floor plans, ADA-compliant seating, and real-time inventory management. New features, such as whole-table booking and orphan seat prevention, further enhance both operational efficiency and customer satisfaction. These capabilities streamline ticket sales while ensuring maximum occupancy and revenue optimization.

Kayhan Ahmadi, CEO of Ticketbud, emphasizes the staying power of this technology. While some popular trends may be overhyped, venue mapping is "here to stay and a core ticketing tool that wins business."

Final Word

As technologies continue to emerge and evolve, the ticketing industry will persistently adapt. The trends shaping 2026 reflect an industry in transition: tickets transforming into persistent digital identities, AI moving from experimental to operational, and economic models being fundamentally rethought.

The shifts we've outlined aren't temporary reactions. They represent structural changes in how live events are discovered, purchased, and experienced. The platforms that adapt their technology and strategies to these realities will thrive.

Whether you're looking to implement identity-linked ticketing, integrate AI for operational efficiency, modernize legacy systems, or build complex integrations, Softjourn can help. Our twenty years of ticketing expertise mean we understand the unique operational and business challenges that make ticketing different from other e-commerce verticals.

Did we miss any ticketing trends you're excited about? Let us know. We love to discuss all things ticketing.