The payments industry is constantly evolving, and 2026 is shaping up to be a year of significant innovation and change.

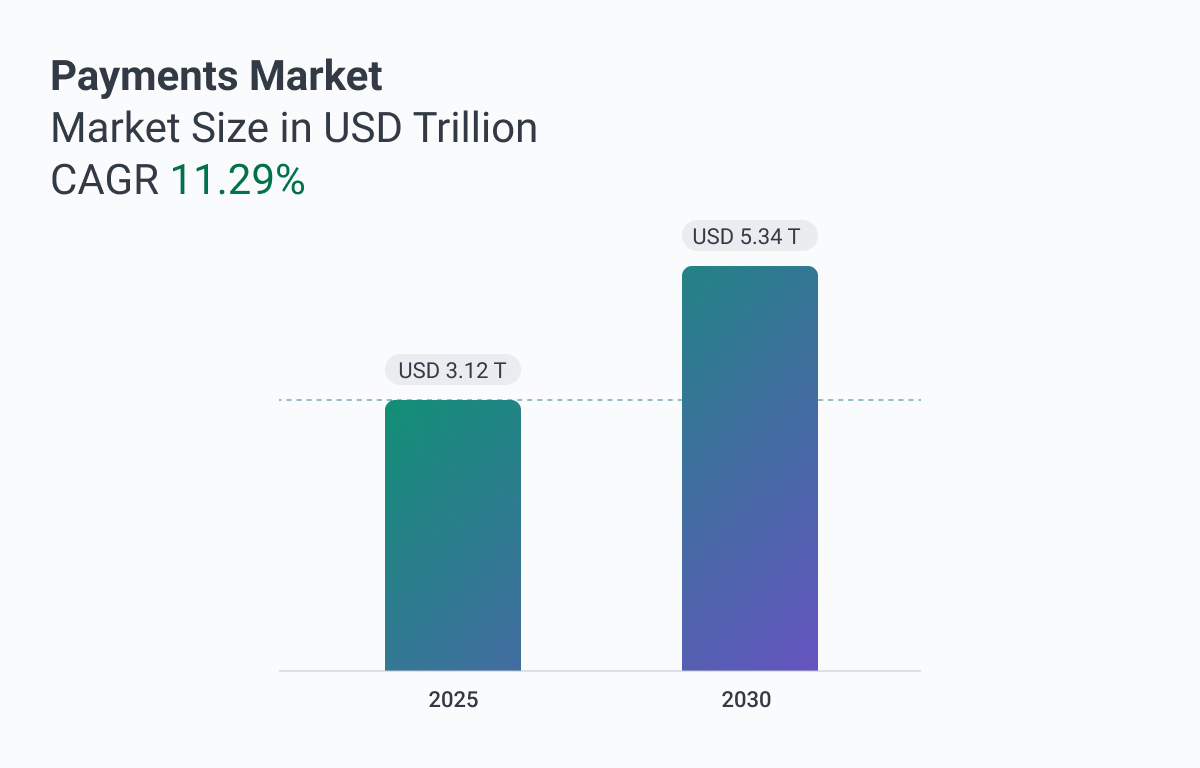

The global payments market reached $3.12 trillion in 2025 and is projected to expand to $5.34 trillion by 2030, reflecting an 11.29% CAGR driven by widespread consumer migration toward mobile-first transactions and the rapid expansion of instant-payment infrastructure. The more seamless payments become, the more complex they grow behind the scenes.

While consumers tap, scan, and voice-command their way through transactions in seconds, the infrastructure powering these experiences has become a sophisticated ecosystem of machine learning algorithms, blockchain networks, and real-time risk assessments.

In 2025, we saw major players in the fintech industry double down on making payments more convenient, secure, and personalized for consumers. This year, that focus intensifies as competition accelerates and consumer expectations continue to rise.

At Softjourn, we’ve spent over 20 years developing and integrating cutting-edge payment solutions, helping fintechs, banks, and businesses stay ahead in an evolving financial landscape. With the payments industry rapidly transforming due to new technologies, regulations, and customer expectations, staying informed is crucial.

We will discuss all the latest trends in the payments industry for 2026 and the key topics influencing change in business and payment practices, ranging from the rapid expansion of real-time payment infrastructure and the dominance of digital wallets to the growing significance of data security and the operational integration of artificial intelligence.

1. The Increasing Demand for Personalization in Payments

In the evolving landscape of payments, the emphasis on personalization remains a pivotal trend defining 2026.

Driven by consumer demand for tailored experiences, businesses are recalibrating their payment processes. This shift aims to seamlessly integrate payments with consumer purchases, optimizing operational efficiency, enhancing privacy, and ultimately elevating customer acquisition.

The payment landscape has become a critical battleground for customer retention, with research from PYMNTS Intelligence revealing that payment flexibility has a direct impact on purchasing decisions for the vast majority of online consumers. According to their report, 70% of online shoppers will abandon their purchase if they cannot pay using their preferred method—a figure that has remained consistent as payment expectations continue to rise.

The growing significance of customer-experience transformation can be achieved by hyper-personalization. As businesses leverage data-driven approaches, the focus on individualized customer journeys in finance becomes paramount.

The accessibility of item-level data acts as a catalyst, enabling highly tailored payment experiences that resonate with consumers on a deeper level. This trend isn't solely about making payments convenient; it's about creating a seamless, user-centric approach that aligns with evolving consumer preferences.

Payment processors and neobanks that effectively implement personalization strategies stand to differentiate themselves in a crowded marketplace and build stronger, more enduring relationships with their customer base.

These advancements in personalization aren't just a shift in the payments landscape; they signify a fundamental transformation in how businesses interact with and cater to their Millennial and Gen Z customers' needs. As Gen Z represents the first generation for whom digital payments are the default rather than an alternative, personalization has evolved from a competitive advantage to a baseline expectation.

Action Item

Implementing payment personalization in 2026 requires balancing user experience with data privacy:

- Payment method flexibility is non-negotiable: With the majority of online shoppers abandoning purchases when they can't use their preferred payment method, ensure your platform supports the full spectrum: cards, digital wallets (Apple Pay, Google Pay), A2A payments, BNPL, and regional payment methods. Payment method availability directly impacts conversion rates.

- Build intelligent payment routing: Go beyond simply offering multiple methods. Implement systems that learn user preferences and dynamically surface the most relevant payment options based on transaction context, purchase history, device type, and geographic location.

- Leverage item-level data for contextualized experiences: Transaction data at the SKU level enables personalization far beyond payment method selection. Use purchase patterns to offer targeted financing options, suggest optimal payment timing, or proactively flag unusual transactions that might indicate fraud or account compromise.

- Design for Gen Z expectations: This demographic expects payments to be invisible, instant, and predictive. They won't tolerate multi-step authentication flows or payment method re-entry. Stored credentials, one-click purchasing, and biometric authentication are baseline requirements, not premium features.

- Balance personalization with privacy: Hyper-personalization requires extensive data collection and processing, creating privacy and compliance obligations under GDPR, CCPA, and similar regulations. Implement transparent data usage policies, obtain explicit consent, and provide users control over their data. Trust is a competitive differentiator.

- Measure and optimize continuously: Track payment method performance by user segment, device type, transaction size, and time of day. A/B test payment flows, authentication methods, and checkout designs. Small improvements in payment completion rates compound into significant revenue impact at scale.

Softjourn has helped payment platforms implement personalization strategies that increase conversion while maintaining regulatory compliance and user trust. We can help you design data architectures and user experiences that deliver the tailored payment journeys your customers expect.

2. A2A Payments Will Drive Profits

The surge in account-to-account (A2A) payments is revolutionizing the global payments landscape in 2026, building on the infrastructure breakthroughs achieved in 2025.

While Western markets predominantly rely on digital wallet proxies like Apple Pay and Google Pay, emerging economies such as India, Brazil, and China are spearheading the growth of A2A payments through the adoption of open banking, instantaneous transactions, and robust merchant support. This trend is driven by the promise of faster, cheaper, and more secure transactions, appealing to consumers and businesses alike.

The evolution of instant payments and the support of merchants are catalysts propelling A2A payments' popularity. Instantaneous transactions align with the modern consumer's demand for immediacy, while merchant support amplifies their adoption, the problems occur when bank digital transformation fails or when their infrastructure is less developed.

In 2025, the U.S. payments landscape saw significant growth in pay-by-bank services, driven by several factors. This momentum continues to accelerate in 2026:

- Growing availability of real-time payment rails: The Federal Reserve's FedNow instant payments service expanded significantly in 2025, increasing its network transaction limit from $1 million to $10 million in November. Combined with The Clearing House's Real Time Payments network, these rails are accelerating account-to-account (A2A) payment adoption.

- Increased interest from businesses: Businesses are seeking to avoid card processing fees and gain faster access to funds, driving the adoption of pay-by-bank services.

Increasing democratization of payments: The shift towards more accessible and user-friendly payment solutions will encourage more consumers to adopt pay-by-bank services.

The trajectory of A2A payments is set to influence cross-border and business-to-business transactions. The growing conversation among regulators and the deployment of pilots in 2024 established a solid foundation for the substantial growth expected in 2026.

The growth trajectory is staggering. Juniper Research projects that the value of global transactions via Account-to-Account payments (A2A) will rise from $1.7 trillion in 2024 to $5.7 trillion by 2029, increasing by 230%. At the transaction level, A2A payment value is forecast to grow 113% over the next five years from $91.5 trillion, driven by new use cases such as instant payroll and real-time bill settlement.

The economics are compelling: A2A payments can reduce processing costs by up to 30% compared to traditional card-based systems, with global A2A value forecast to reach $3.8 trillion by 2030.

The infrastructure cost reduction has been dramatic. Peter Connor, Co-Founder of BulletHQ, experienced this shift directly:

"We were looking to automate the sending of a €1 payment to customers when they onboard onto our product. To execute this, we were going to have to onboard a banking rails platform at a minimum cost of €10,000 with a minimum spend of about €2,000 per month. After looking around, we found that Revolut had an API, and for €35 a month, we could send that €1 payment. That was a whole section of the industry removed simply by the opening of that API."

This massive cost reduction isn't an isolated example. It represents a broader trend where large platforms are opening infrastructure APIs that bypass traditional payment processors. What required enterprise banking relationships and six-figure minimum commitments two years ago now costs less than most SaaS subscriptions.

Throughout 2025, hundreds of banks and payment service providers launched account-to-account faster payment capabilities, urged on by merchant sensitivity around card fees and banks delivering payment solutions to complement open banking. By 2026, this infrastructure has matured to the point where A2A is becoming a baseline expectation rather than a competitive differentiator.

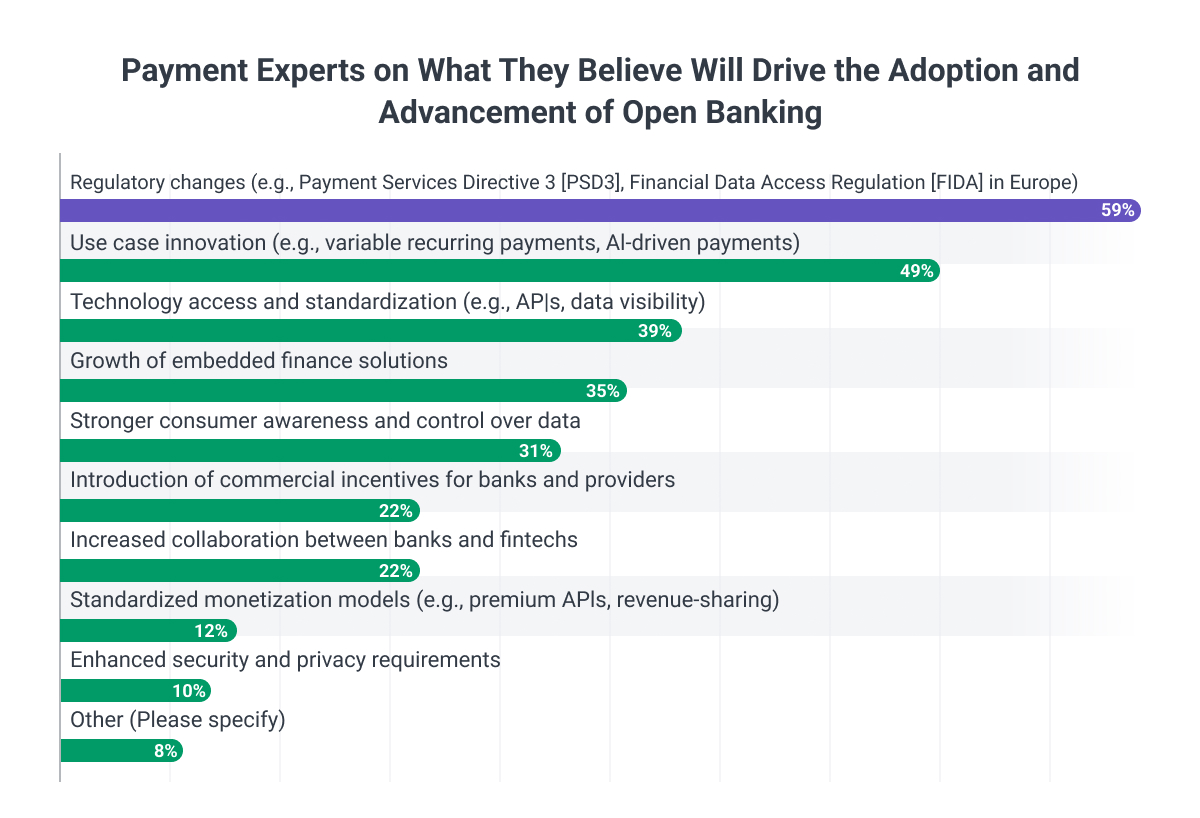

A critical development is the emergence of recurring payment capabilities. Variable Recurring Payments (VRPs) for businesses offer enhanced flexibility to set up multiple payments at once within approved parameters, minimizing administrative strain and optimizing cash flow.

In regions where recurring payments capabilities have been deployed, such as Brazil with Pix Automático, adoption has been strong, demonstrating the viability of A2A for subscription and recurring payment models.

The shift extends beyond traditional payment rails. David Kemmerer, Co-Founder and CEO of CoinLedger, points to another infrastructure evolution: "A year ago, tokenization was more theoretical. Now, property, payroll, and invoices are tokenized to move money across borders faster and cheaper. The rate at which regulators are adapting to this instead of resisting it is also fascinating." Tokenization enables fractional settlements, reduces currency conversion friction, and provides audit trails that traditional wire transfers can't match.

Action Item

Implementing A2A payments in 2026 requires strategic choices beyond simply adding another payment method:

- Infrastructure access strategy: Decide between traditional bank partnerships (expensive, slow to deploy) versus modern API platforms like Revolut, Stripe, or Adyen that provide instant access to A2A rails at fraction of traditional costs. The cost differential can be 100x or more, as demonstrated by API-based solutions at $35/month versus legacy banking relationships requiring €10,000+ minimums.

- Rail selection and routing: Implement intelligent payment routing that automatically selects the optimal rail based on transaction characteristics. FedNow for U.S. instant payments, RTP for commercial transactions, SEPA Instant for European transfers, and emerging tokenized asset rails for cross-border settlements each serve different use cases with varying cost structures.

- Recurring payment capabilities: If your business model includes subscriptions or recurring charges, prioritize Variable Recurring Payments (VRPs) implementation. Regions with VRP support like Brazil (Pix Automático) show strong adoption, demonstrating viability for subscription models without traditional card rails.

- Cost optimization: A2A payments can reduce processing costs by up to 30% compared to card-based systems. Model your transaction volumes and calculate break-even points for migrating payment flows from cards to A2A rails.

- Compliance and dispute resolution: A2A payments operate under different regulatory frameworks than card networks. Ensure your dispute resolution processes, refund mechanisms, and customer protection policies align with instant payment settlement realities where funds move immediately and irreversibly.

Softjourn has helped payment companies implement A2A infrastructure that balances speed, cost, and compliance requirements. Whether you're adding A2A capabilities to an existing platform or building from scratch, we can help you navigate the technical and strategic decisions.

3. Automated Software Will be Used to Secure & Optimize Transactions

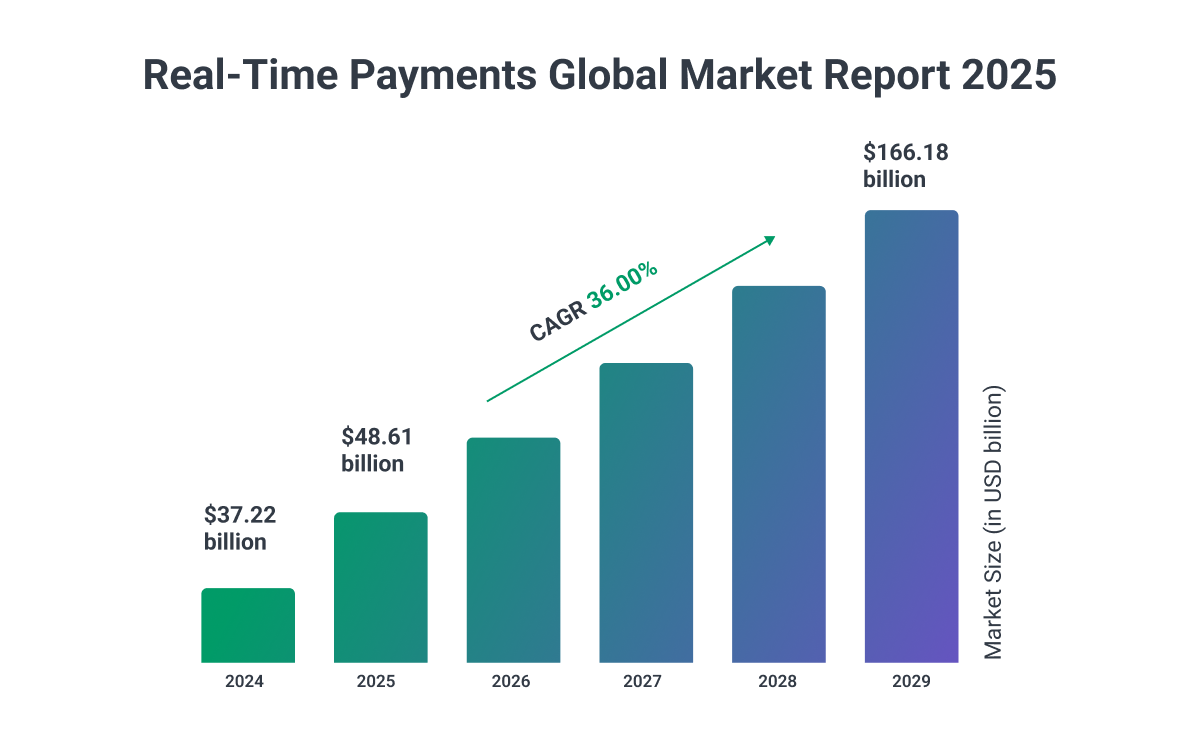

The Real-Time Payment market size is projected to grow from $16.26 billion in 2025 to an impressive $265.83 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 32.23% during the forecast period (2025 - 2035).

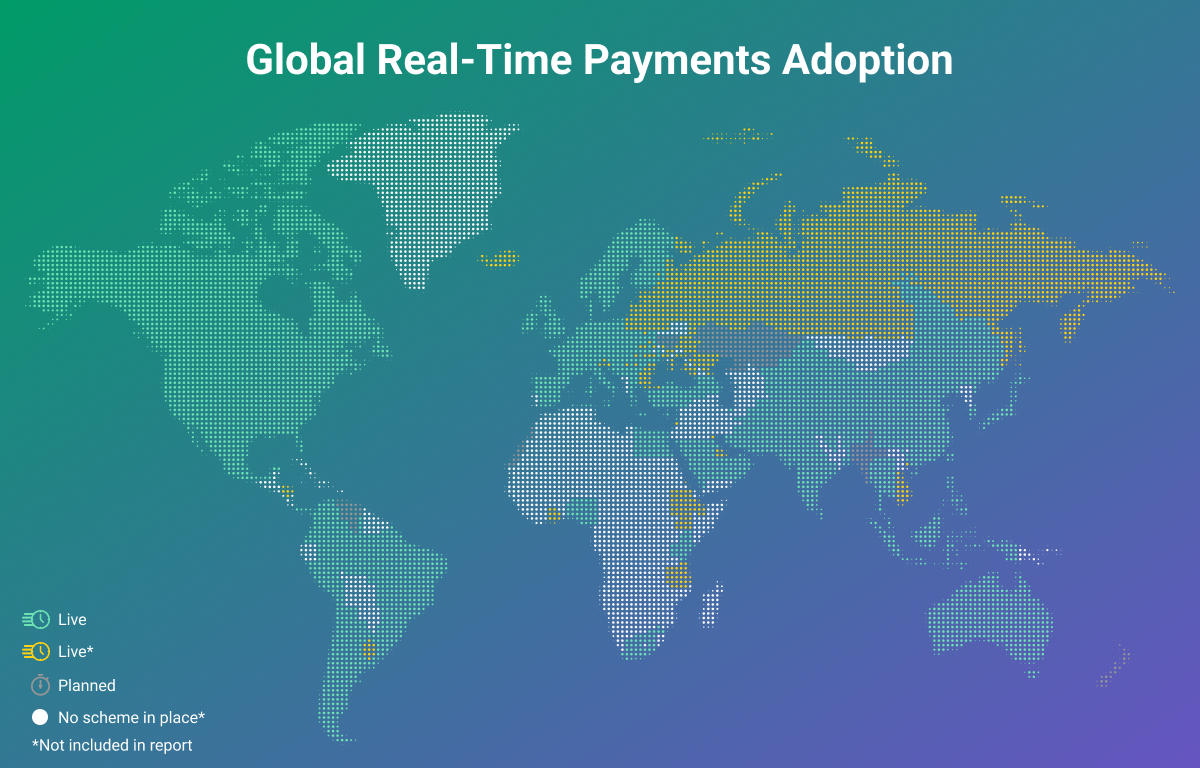

New payment rails enable faster, more efficient real-time payments for B2B transactions, which continue to have a transformative effect on businesses. The global implementation of the ISO 20022 messaging standard is having a positive effect on real-time cross-border payments and is enhancing security and compliance around the world. In Europe, SEPA Instant payments became mandatory in 2025, requiring banks to receive instant euro payments by January and send them by October, alongside testing "Verification of Payee" for fraud defense.

The US government's FedNow payment service, launched in 2023, has gained significant traction. By mid-2025, daily payment volumes reached millions of transactions as adoption accelerated among financial institutions. Banks have taken strategic steps to modernize their infrastructure, ensuring the flexibility needed to support real-time payment types and seamlessly integrate with this evolving ecosystem.

In 2026, companies are using a combination of efficient but expensive real-time payments and cheap but slow ACH transfers. We recommend using algorithms that can calculate the best and cheapest systems and providers to use, depending on your transaction needs.

Richard Dalder, Business Development Manager at Tradervue, emphasizes the broader transformation:

"The growth of digital payment platforms that offer integrated services through software systems does not get enough attention. These systems make payments easier and safer for businesses and customers. They support multiple ways to pay, manage transactions well, and help smaller businesses reach more customers. As these platforms become more common, they make financial operations smoother and open new opportunities."

Real-time payment infrastructure is particularly transformative for the gig economy, which is projected to include over 86 million workers in the U.S. by 2027. Earned Wage Access (EWA) platforms leverage instant settlement rails to allow gig workers to access their earnings immediately rather than waiting for traditional pay cycles, providing crucial financial flexibility for workers operating across multiple platforms.

This use case demonstrates how real-time payments extend beyond merchant transactions to reshape workforce compensation models.

Action Item

To implement real-time payment capabilities in 2026, businesses should focus on integration strategy rather than building infrastructure from scratch. Key decisions include:

- Multi-Rail Strategy: Determine which payment rails your business needs access to—FedNow, RTP, ACH, card networks, international rails like SEPA Instant. Most businesses benefit from accessing multiple rails rather than committing to a single method.

- Build vs. Integrate: Payment orchestration platforms and Banking-as-a-Service providers offer pre-built connections to multiple payment rails, eliminating the need to negotiate individual bank partnerships. This approach reduces time-to-market from months to weeks and avoids the overhead of maintaining direct integrations.

- Intelligent Routing: Implement algorithms that automatically select the optimal payment rail based on transaction characteristics—cost, speed, success rates, and regulatory requirements. This optimization can reduce payment costs by 20-30% while improving settlement times.

- Compliance & Risk Management: Ensure your payment infrastructure includes real-time fraud detection, automated compliance monitoring, and audit trail capabilities. As payment speeds increase, risk assessment must happen in milliseconds, not hours.

Partnering with an experienced development team that understands payment infrastructure can help you navigate these decisions and implement scalable solutions that grow with your business.

4. Digital Wallets Attract Record Number of Users

The proliferation of digital wallets continues its upward trajectory, transcending traditional payment boundaries to encompass digital identity management.

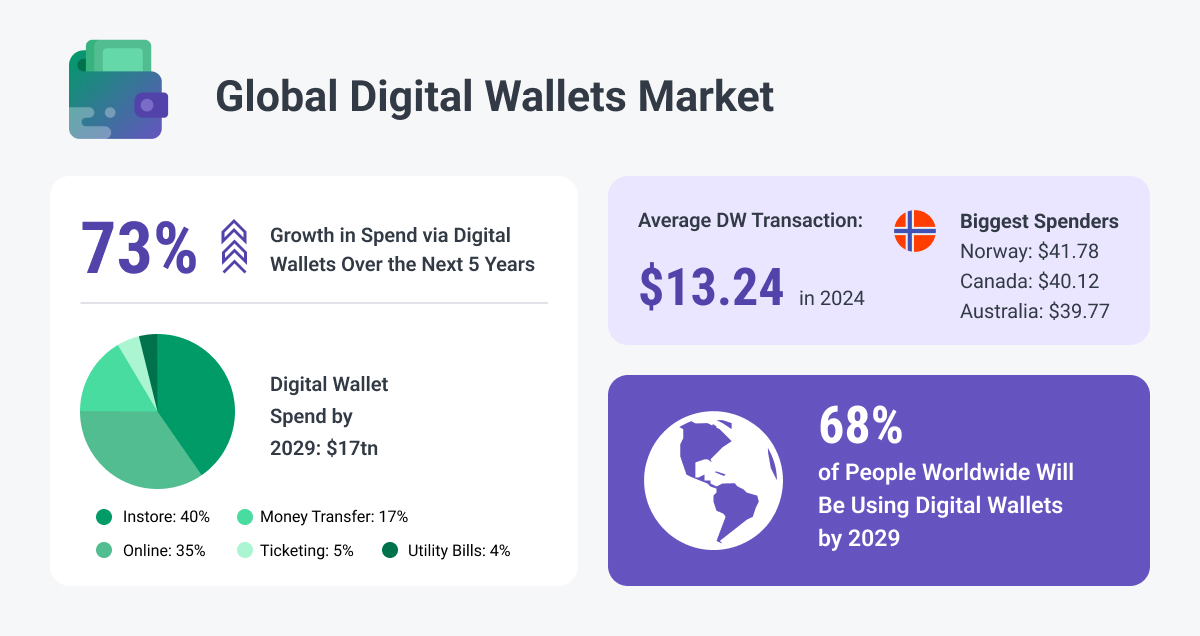

The digital wallet market reached $56.77 billion in 2025 and is projected to grow to $119.17 billion by 2029, while user adoption tells an even more dramatic story: 4.5 billion people globally used digital wallets in 2025, with projections reaching over 5.3 billion users by 2026 — more than half the world's population. What began as a convenient alternative to physical cards has evolved into the dominant payment interface for younger generations.

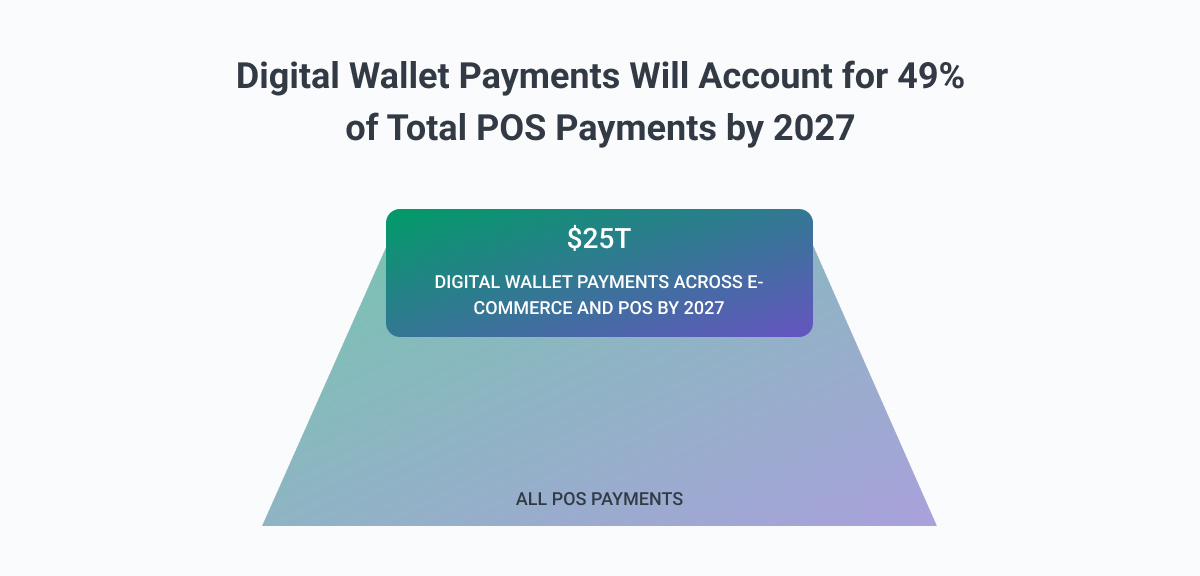

Worldpay projects continued dominance of digital wallets in e-commerce through 2027 and beyond, with digital wallets increasing their share of transaction value to 52%, while credit and debit cards fall to 22% and 12%, respectively.

Globally, digital wallets have secured the top spot for share of POS transaction value. In 2024, wallets accounted for 30% of POS spending, compared to credit and debit cards at 27% and 23%, respectively. By 2027, wallets are projected to account for 46% of that spending, approximately $19.6 trillion, more than credit and debit cards combined.

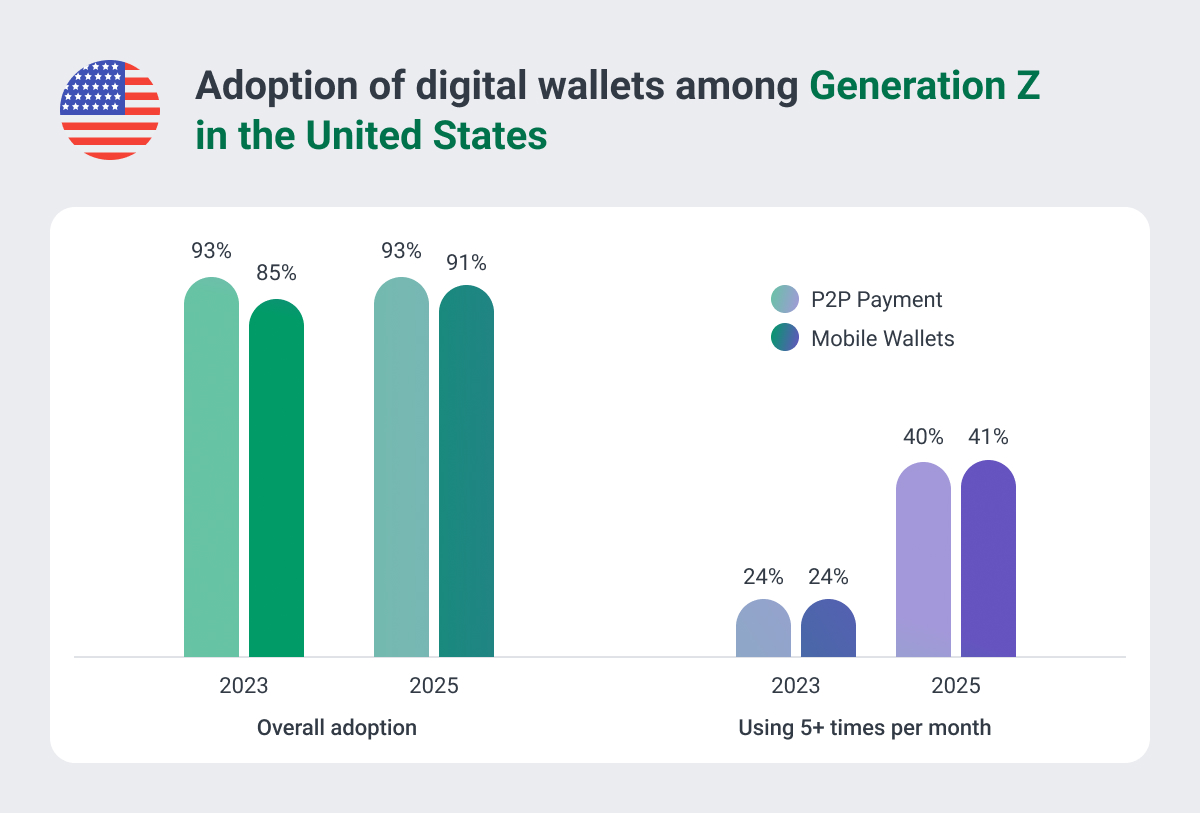

The generational shift is particularly pronounced among Gen Z consumers, where 93% use mobile wallets and 91% use peer-to-peer payment platforms, with over 40% using each more than five times monthly. For this demographic, digital wallets are not an alternative payment method but the default financial interface.

The integration of digital identities into everyday transactions marks a significant leap in the payments processing landscape. Initiatives like the EU ID Wallet (eIDAS2) and Apple's integration of digital driving licenses into its Wallet app represent pivotal steps toward seamless integration. This trend extends beyond payment transactions, offering users a centralized hub for storing credentials and identity attributes.

Holly Andrews, Managing Director of KIS Finance, captures the evolution of wallet implementation philosophy: "I believe contextual and embedded payments are flying under the radar. When payments sit quietly inside the experience, whether that is an app, a car, or a lending journey, everything just flows. It builds trust and reduces friction in a way people barely notice, which is exactly the point."

This invisible integration defines wallet maturity. The convergence of digital wallets and identity solutions symbolizes a transformative shift in how individuals interact with digital platforms, promising enhanced security, convenience, and a more integrated user experience.

In 2026, digital wallets will not only increase in use and popularity, but companies will continue adding innovative features to incentivize and persuade consumers to select their e-wallets, while 'super apps' like PayPal will continue expanding their offerings.

Merchant adoption reflects these pressures: 74% of merchants added at least one new payment acceptance method in the past 13 months, with digital wallets leading new integrations.

David Barrett, the CEO of Expensify, spoke to Softjourn about the connection he sees between payments and the integration of communication features:

“Payments and chat are fundamentally the same things; every payment is a structured chat to resolve some kind of debt tension between two people. There is a spectrum of functionality between freeform chat and expense management, and every form of payment is somewhere on that spectrum.”

Barrett believes that it’s time for expense and other platforms to step up their game by adding communication features - like Slack, SMS, or WhatsApp - but optimized for financial conversations at work and between friends.

Action Item

Digital wallet strategy for 2026 extends far beyond building another payment app:

- Define your wallet philosophy: Choose between a super app approach (embedded finance across multiple services) versus a specialized wallet focused on specific use cases. Gen Z expects digital wallets to be default payment interfaces, not alternatives, fundamentally changing design assumptions.

- Biometric authentication as a foundation: Multi-modal biometric verification (fingerprint + facial recognition + behavioral patterns) is now baseline security. Single-factor authentication cannot defend against AI-generated deepfakes and voice cloning. Plan for liveness detection and continuous authentication throughout sessions.

- Invisible payment integration: The best wallet implementations are those users barely notice. Payment authentication should happen seamlessly within existing user flows rather than requiring explicit wallet app launches. This "contextual payment" approach reduces friction while maintaining security.

- Digital identity capabilities: Consider whether your wallet will serve as digital identity repository (driver's licenses, credentials, loyalty cards) alongside payments. EU ID Wallet (eIDAS2) and similar initiatives are creating regulatory frameworks for digital identity that wallets can leverage.

- Multi-rail payment support: Modern wallets must support card networks, A2A payments, real-time rails (FedNow, RTP, SEPA Instant), and potentially tokenized assets. Users expect wallets to intelligently route payments through optimal rails without requiring payment method selection.

- Regulatory compliance: Digital wallets face complex compliance requirements spanning payment services regulations, data protection (GDPR), biometric data handling (BIPA), and potentially banking regulations depending on wallet capabilities. Build compliance into architecture from the start.

Softjourn has developed digital wallet solutions for fintechs and financial institutions navigating these strategic decisions. We can help you balance innovation with security, user experience with compliance, and time-to-market with long-term scalability.

5. The Battle Against Cybercrime Continues in 2026

With the dominance of digital payments comes heightened concerns about cybersecurity. Financial institutions are intensifying their efforts to combat cyber threats with ML and AI to protect customer trust. Technologies such as tokenization, machine learning, and advanced encryption continue to fortify digital payment ecosystems against evolving vulnerabilities.

The need for a collaborative approach between industry stakeholders to tackle cyber threats is gaining prominence. According to IBM, the global average cost of a data breach decreased to $4.4 million in 2025, a 9% reduction driven by faster identification and containment.

However, this improvement masks a troubling reality: 97% of organizations that reported an AI-related security incident lacked proper AI access controls, revealing a dangerous gap as financial institutions rush to deploy AI systems.

The data presents a stark dichotomy; organizations with extensive AI use in security saved an average of $1.9 million compared to those without these solutions, demonstrating AI's defensive power when implemented properly.

The challenge for 2026 is not whether to use AI for cybersecurity, but how to secure AI systems themselves while leveraging their protective capabilities.

The encryption software market has experienced explosive growth, expanding from $19.4 billion in 2025 to a projected $43.9 billion by 2030, reflecting a 17.8% CAGR. This acceleration follows the August 2024 release of the first three NIST post-quantum cryptography (PQC) standards and a 2035 federal deadline for PQC implementation, which together de-risk procurement decisions and unlock budget allocations.

Organizations are embedding encryption across zero-trust frameworks mandated by U.S. Executive Order 14028, while the permanent hybrid workforce drives the adoption of cloud-native deployment models and distributed key management. Key challenges include:

- Key Management Complexity: Encryption is only as strong as its key management practices. Poorly managed keys can render encryption ineffective, exposing sensitive data.

- Balancing Security and Performance: Encryption introduces computational overhead, potentially slowing down high-volume transaction systems. Hardware-accelerated encryption and optimized protocols help maintain security without degrading performance.

- The Looming Threat of Quantum Computing: Quantum computing threatens to render today's encryption algorithms obsolete. Organizations must begin preparing for post-quantum cryptography, a new class of algorithms designed to withstand quantum attacks.

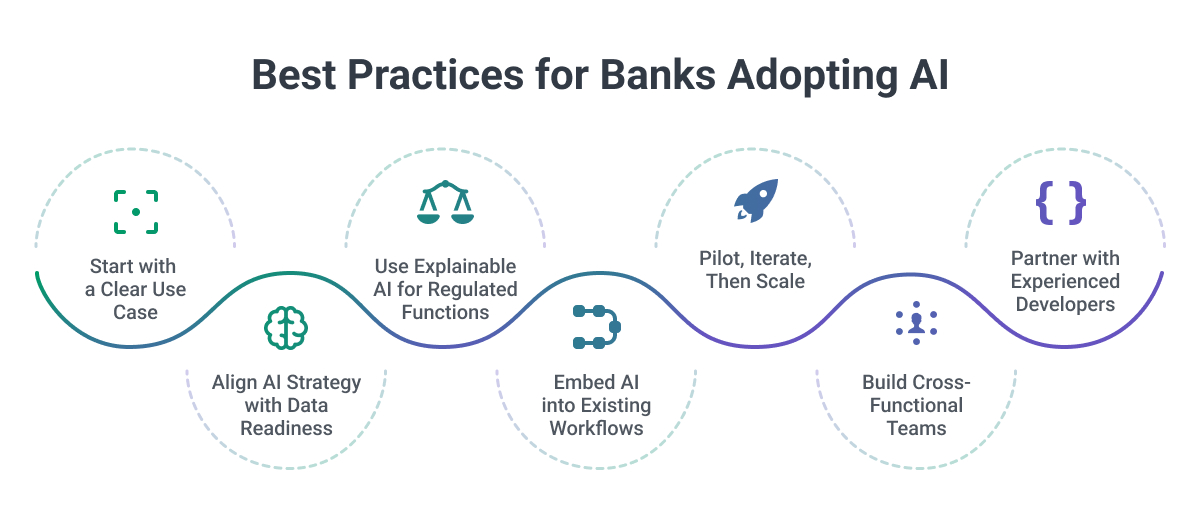

Artificial intelligence has become operational infrastructure for fraud prevention across fintech and banking. AI and machine learning systems analyze patterns and payment flows in real time, transforming client profiling, fraud monitoring, and risk assessment.

By developing mathematical models that determine normal user behavior, these systems monitor customer spending habits and detect unusual activity without inconveniencing customers with additional verification steps, enhancing operational efficiency in both customer-facing and back-office operations.

Christopher Ledwidge, Co-Founder & Executive Vice President of Retail Lending at theLender.com, emphasizes the trust dimension:

"Explainability and trust are now the true obstacles. Both regulators and consumers will want transparency in the process used to determine results as AI becomes more integrated into financial decision-making. 'Why was this borrower approved and that one declined?' is no longer a technical question, it's a reputational one."

The encryption landscape saw significant investment in 2025. Zama, an open-source cryptography startup specializing in fully homomorphic encryption (FHE), raised $57 million in a Series B round co-led by Blockchange Ventures and Pantera Capital, becoming the world's first unicorn in the FHE space.

Meanwhile, Belfort, a KU Leuven spinoff, closed a $6 million seed round to make encrypted data processing practical in real time with a hardware accelerator purpose-built for encrypted compute. These innovations enable computation directly on encrypted data without decryption, overcoming long-standing speed and cost barriers in applications like fraud detection, genomic analysis, and secure government operations.

Action Item

Cybersecurity for 2026 requires moving beyond baseline defenses to address emerging threats:

- AI security governance: With 97% of organizations reporting AI security incidents lacking proper controls, establish governance frameworks before deploying AI systems. This includes model access controls, audit trails for AI decisions, and explainability mechanisms that satisfy both regulators and customers.

- Post-quantum cryptography preparation: With NIST standards published and a 2035 federal deadline for implementation, begin assessing which systems require quantum-resistant encryption. Focus first on data with long-term sensitivity (customer records, authentication credentials) that could be harvested now and decrypted later.

- Homomorphic encryption evaluation: For high-security applications requiring computation on encrypted data (fraud detection, risk analysis), evaluate FHE solutions that enable processing without decryption. Recent breakthroughs have made this technology commercially viable for the first time.

- Continuous behavioral authentication: Static authentication (passwords, even biometrics) only verifies identity at login. Implement behavioral monitoring that detects anomalies throughout sessions, identifying account takeover attempts that occur after initial authentication.

- Zero-trust architecture: Traditional perimeter-based security fails in distributed, cloud-native environments. Adopt zero-trust frameworks that verify every access request regardless of network location, with encryption embedded throughout the infrastructure.

- Balance security with explainability: As regulators and customers demand transparency in AI-driven decisions, ensure your security systems can explain why specific actions were flagged or blocked. Opaque "black box" systems create compliance and trust risks.

Additionally, businesses can work with payment service providers and other partners who have experience in preventing and detecting payment fraud to help identify and mitigate potential risks.

6. Buy Now, Pay Later (BNPL) Continues to Allow More Spending Across Markets

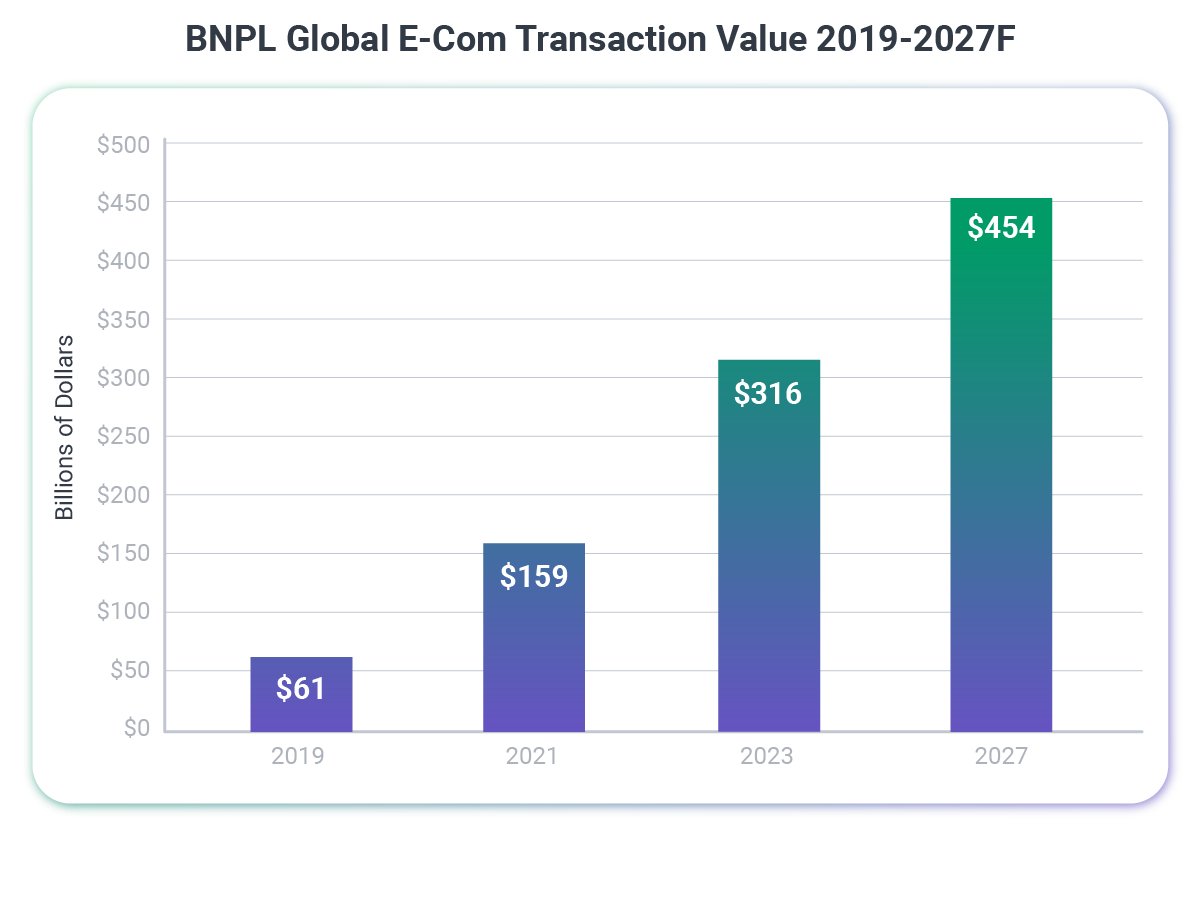

Buy Now, Pay Later (BNPL) has transcended its origins to become a cornerstone of consumer payments. In 2025, the market witnessed both explosive growth and regulatory reckoning, setting the stage for a more mature 2026 landscape.

The BNPL market reached $560.1 billion in 2025 and is forecast to grow at a 10.2% CAGR to reach $911.8 billion by 2030. Consumer adoption accelerated significantly throughout 2025, with PYMNTS Intelligence "Installment Persona" data showing usage climbing from 29.5% in April to 37.8% by September—a dramatic 8.3 percentage point increase in just five months.

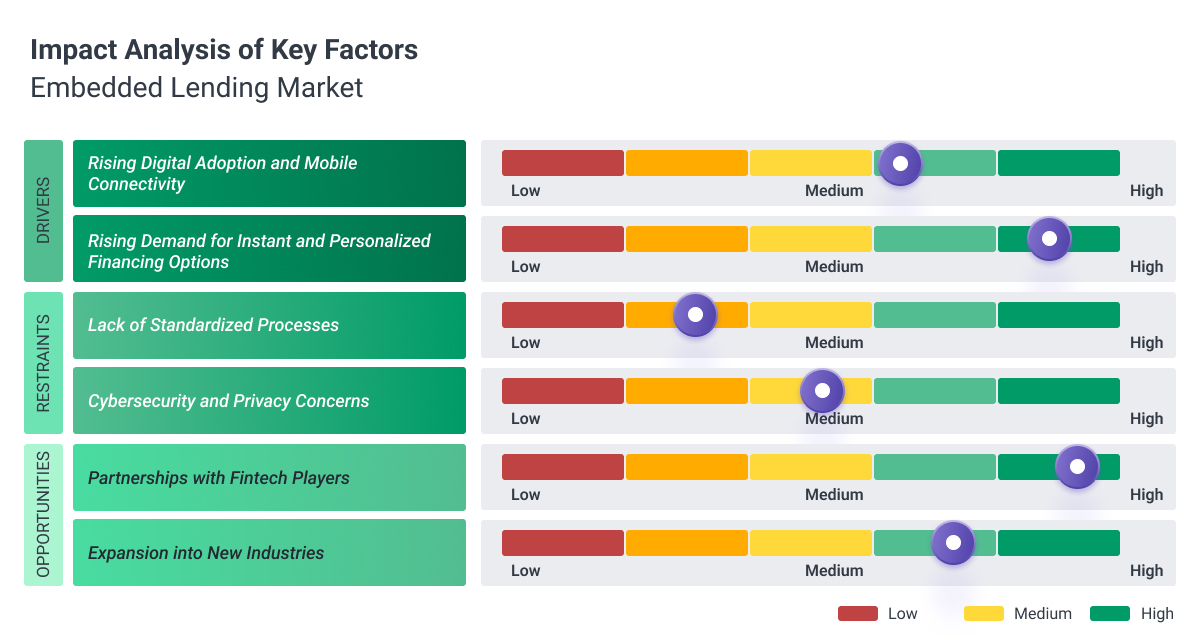

Companies are embracing embedded lending as one of the newest fintech strategies for business growth. According to Future Market Insights, the embedded lending market is projected to experience remarkable growth, expanding at a CAGR of 14.6% over the forecast period. The market value is expected to surge from $9.5 billion in 2025 to $35.8 billion by 2035, highlighting the rising demand for integrated financial solutions across industries.

Consumer Adoption Patterns

Younger consumers, particularly Millennials and Gen Z, are driving adoption. Over 30 million Millennials and 25 million Gen Z consumers in the United States utilized BNPL services in 2024, with Gen Z usage increasing by 10% even as overall adoption experienced a 10% decline across other demographics.

When looking at all installment options combined (BNPL, credit card installments, and other pay-later methods), 45% of Gen Z and 42% of millennials used some form of installment payment during this period, demonstrating the broad appeal of pay-later options among younger consumers.

However, BNPL is expanding beyond younger cohorts as 28.9% of Gen X consumers are expected to use the payment method in 2026.

Income also shapes behavior significantly: nearly half of BNPL households earn less than $50,000 per year, though 70% of households under $50,000 still avoided installments entirely. A separate PYMNTS study, "Cash Flow Shortages Drive Consumers' BNPL Usage," found that cash-short consumers are 3.5 times more likely to rely on BNPL to navigate periods between paychecks.

Together, these insights highlight BNPL's evolution from alternative credit to mainstream budgeting mechanism, particularly for younger adults already predisposed to digital payments and installment tools.

Business Adoption and Impact

What distinguishes BNPL is its appeal across diverse consumer segments, extending beyond millennials and Gen Z to encompass a significant portion of shoppers. During the 2024 holiday shopping season, U.S. shoppers spent $16.6 billion using BNPL plans, with BNPL volume increasing 14% year-over-year.

Companies have recognized the significance of BNPL in driving sales and enhancing customer engagement. From retail to e-commerce, businesses leverage BNPL to augment basket sizes, close sales, and cater to consumer preferences for flexible payment structures. BNPL providers continue to innovate, diversify their offerings, and extend their services into brick-and-mortar commerce. Seamless digital wallet integration is becoming the norm, with major platforms embedding BNPL directly into checkout flows.

Innovation in Risk Management

As the industry flourishes, so inevitably do the risks, ranging from fraud to late payments. To address these issues, international leaders such as Klarna, Afterpay, PayPal, and Affirm are using artificial intelligence and big data to minimize losses while personalizing services and increasing sales.

Affirm has introduced dynamic payment schedules in the U.S., while Riverty in Germany uses AI-driven tools to predict user behavior and optimize repayment plans. Afterpay uses big data and AI to ensure a smooth user experience and improved risk management. PayPal's BNPL solution, Pay in 4, incorporates sophisticated fraud prevention technology and machine learning models to assess creditworthiness quickly, and Sezzle uses machine learning for customer risk assessment and to offer tailored financing options.

These firms demonstrate how innovative technologies, including machine learning, AI, and predictive analytics, are making services faster, more secure, and more personalized for consumers.

Competitive Landscape

The market's competitive landscape witnesses a multitude of players vying for market share. Dedicated BNPL providers, banks, tech giants like Apple, and other financial institutions have entered the fray, intensifying competition and spurring innovations within the BNPL space. The appeal of BNPL lies in its convenience and accessibility, enabling immediate access to purchases while deferring payments over subsequent weeks or months.

Regulatory Divergence: EU vs. U.S.

2025 marked a pivotal phase in BNPL's regulatory trajectory, with diverging approaches between the EU and the U.S. creating a complex compliance landscape for global providers.

European Regulatory Tightening:

The EU's revised Consumer Credit Directive (CCD2), set for full implementation by late 2026, introduces stricter regulations for BNPL services. BNPL providers must comply with local APR caps, conduct creditworthiness checks, and clearly communicate loan terms and risks. The directive will pressure BNPL firms to adapt their pricing and business models to meet compliance across multiple countries. While these rules aim to boost consumer protection and reduce debt, they may also limit access to BNPL and raise operational costs.

U.S. Regulatory Pause:

In contrast, the U.S. Consumer Financial Protection Bureau announced in May 2025 that it will not prioritize enforcement of its Buy Now, Pay Later rule under Regulation Z. Instead, the agency is shifting focus to more urgent consumer protection issues, particularly those affecting servicemembers, veterans, and small businesses. The Bureau is also considering rescinding the BNPL rule entirely.

This regulatory divergence creates strategic complexity for global BNPL providers, who must navigate tightening European requirements while the U.S. maintains a lighter-touch approach. As companies and consumers continue to embrace BNPL's flexibility and accessibility, its role in reshaping payment behaviors remains pivotal for 2026 and beyond.

Action Item

NPL has evolved from an alternative payment method to a mainstream expectation, with nearly 40% of consumers using installment options by late 2025.

For businesses, the strategic question is no longer whether to offer BNPL, but how to implement it effectively amid diverging global regulations.

If You're Implementing BNPL in 2026:

Choose your compliance path: EU merchants must begin CCD2 preparation now—creditworthiness checks, APR caps, and transparent terms become mandatory by late 2026. U.S. merchants have regulatory flexibility but should monitor CFPB policy shifts.

Decide on partner or build: Partner with established providers (Affirm, Klarna, PayPal) for faster deployment, or build proprietary solutions for greater control over user experience and data ownership.

Implement AI-powered risk management: Manual underwriting cannot compete with real-time machine learning for fraud detection and dynamic payment scheduling. This is no longer optional infrastructure.

Design for seamless integration: BNPL must be embedded directly in checkout flows, not treated as a secondary payment option. Friction at checkout kills conversion.

Business benefits include: Higher conversion rates and Average Order Value, reduced cart abandonment, deeper customer insights through payment behavior data, increased repeat purchases, and lower chargeback risk compared to traditional credit.

Softjourn has developed BNPL solutions for clients across brick-and-mortar, m-commerce, and e-commerce environments. During our collaboration with UPC, we created a flexible BNPL solution that reduced chargeback risk, offered multiple installment plans at checkout, and provided payment options tailored to diverse customer budgets.

Whether you're building a new BNPL capability or modernizing an existing one to meet 2026 compliance requirements, we can help you navigate the technical and regulatory complexity.

7. Biometric Payments Merge Security with Seamless User Experience

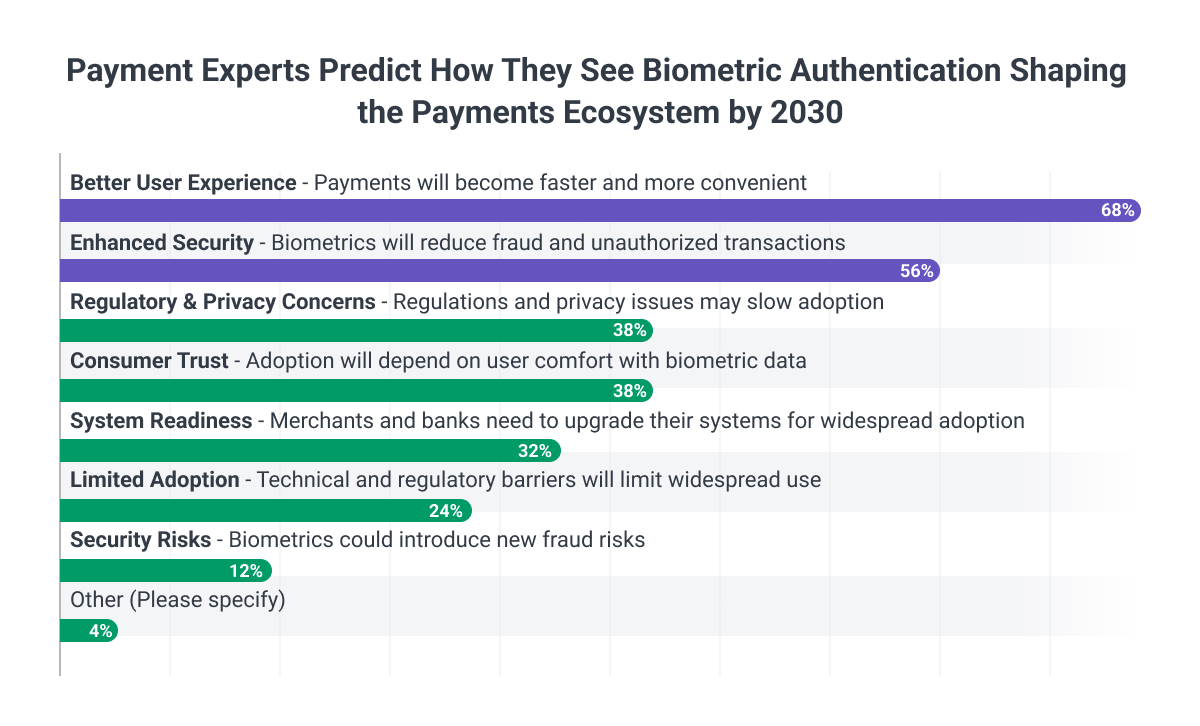

Biometric authentication has evolved from novelty to payment infrastructure necessity. As passwords and PINs prove increasingly vulnerable to fraud, biometric payments are redefining secure and frictionless transactions.

The biometric payments market is projected to reach $5.8 trillion by 2026, driven by rising fraud sophistication and consumer demand for passwordless experiences. Fingerprint, facial recognition, voice authentication, and behavioral biometrics are no longer premium features; instead, they're baseline expectations for digital wallets and payment apps.

The Security-UX Balance

Traditional authentication methods are failing at scale. AI-generated deepfakes and voice cloning can now defeat single-factor facial recognition, forcing payment providers to implement multi-layered verification.

Revolut has introduced secure in-app support powered by biometric verification, while Entrust has deployed AI-powered ID verification that analyzes document authenticity and matches it against live biometric data in real-time.

The most sophisticated implementations combine physiological biometrics (fingerprints, facial features) with behavioral biometrics (typing patterns, device handling, transaction habits). These continuous authentication systems monitor user behavior throughout a session, detecting anomalies that might indicate account takeover even after initial login.

Beyond security, biometrics solve payment friction. Apple Pay and Google Wallet have demonstrated biometric payments at scale, with millions of daily transactions authenticated through Face ID or fingerprint sensors. The technology proves both secure enough for financial institutions and fast enough for retail environments, where checkout speed directly impacts conversion.

Regulatory and Privacy Challenges

Biometric data presents unique regulatory challenges. Unlike passwords, biometrics cannot be reset if compromised. This has prompted stringent data protection requirements, particularly under GDPR and state laws like Illinois' Biometric Information Privacy Act (BIPA).

Payment providers must demonstrate that biometric data is stored securely (as non-reversible mathematical templates rather than actual images), used only for stated purposes, and deleted when no longer needed. Consumer trust depends on transparent biometric data handling.

Looking Ahead

The next wave extends beyond smartphones. Wearables with embedded sensors can authenticate through cardiac signatures. Some pilots test palm vein recognition at retail checkouts, eliminating the need to carry cards or phones entirely. Voice-authenticated payments through smart speakers are gaining traction for subscription and bill payments.

As biometric payments mature in 2026, the focus shifts from proving the technology works to scaling it across diverse payment contexts while maintaining the security financial institutions require and the simplicity consumers demand.

Action Item

For implementing biometric authentication:

- Deploy multi-modal verification: Combine physiological biometrics with behavioral analysis and liveness detection to defend against AI-generated attacks.

- Build for privacy compliance: Store biometric data as non-reversible templates, document retention policies, and obtain explicit consent. GDPR and BIPA impose significant penalties for mishandling biometric data.

- Design fallback mechanisms: Biometric systems fail due to sensor issues or lighting conditions. Implement seamless backup authentication that maintains security without frustrating users.

- Test across diverse populations: Facial recognition algorithms show accuracy variations across demographics. Rigorously test with representative user populations to avoid exclusion or bias.

Softjourn has extensive experience developing secure authentication systems for financial services clients. Whether you're implementing biometric verification for the first time or upgrading existing systems to defend against AI-powered fraud, we can help you balance security, user experience, and regulatory compliance.

Strategic Considerations for 2026

As the payments industry continues its rapid evolution, businesses face a critical balancing act: managing costs in an uncertain economic environment while making strategic investments that drive long-term competitive advantage.

The global economy in 2025 demonstrated continued volatility with persistent inflation pressures, shifting interest rates, and ongoing geopolitical tensions, creating unpredictable market conditions.

For payment companies and financial institutions, the temptation to default to short-term cost-cutting can be strong. However, drastic reductions in technology investments, innovation initiatives, and talent acquisition often derail the very capabilities needed to compete in 2026 and beyond.

The most successful organizations are those that react thoughtfully rather than reactively. Strategic technology investments with proven ROI, such as real-time payment infrastructure, AI-powered fraud prevention, and biometric authentication systems, position companies to weather economic uncertainty while building foundations for sustainable growth.

Many leading payment companies, from established players like Visa and Mastercard to emerging fintechs, rely on strategic development partnerships to access specialized technical talent, accelerate time-to-market, and reduce operational costs without sacrificing quality.

By partnering with experienced fintech development teams, businesses can maintain focus on core competencies while ensuring their payment infrastructure remains competitive, secure, and compliant.

The key is making calculated investments in technology and talent that deliver measurable value, rather than cutting indiscriminately in ways that compromise future market position.

Final Word

The payments landscape in 2026 continues its relentless focus on seamless, frictionless transactions across all channels.

Real-time payment infrastructure, account-to-account transfers, biometric authentication, and AI-driven fraud prevention are no longer emerging technologies, while personalization has become a baseline expectation rather than a competitive differentiator.

The question is no longer whether to adopt these capabilities, but how quickly and effectively companies can implement them while maintaining security, compliance, and user trust.

Contact Softjourn to position yourself as a payments leader with secure, scalable solutions for real-time payments, biometric authentication, fraud prevention, and digital wallet integration.