Why behavioral biometrics?

Physical biometrics, which includes fingerprint, hand geometry, iris scan, retina, and vein scanners, as well as facial recognition, is steadily gaining popularity as a way to unlock smartphones or access sensitive apps. It’s also becoming popular as a way to verify payments, because it secures data without inconveniencing consumers.

But is it secure enough? Researchers from New York University and Michigan State University have proved that it is possible to generate fake fingerprint using neural networks1.

In addition to physical biometrics, behavioral biometrics, including vocal behavior analysis, signature dynamics analysis, and analyzing keystroke patterns, also needs to be taken into account to make the authentication process even more secure2.

How can you protect your customers?

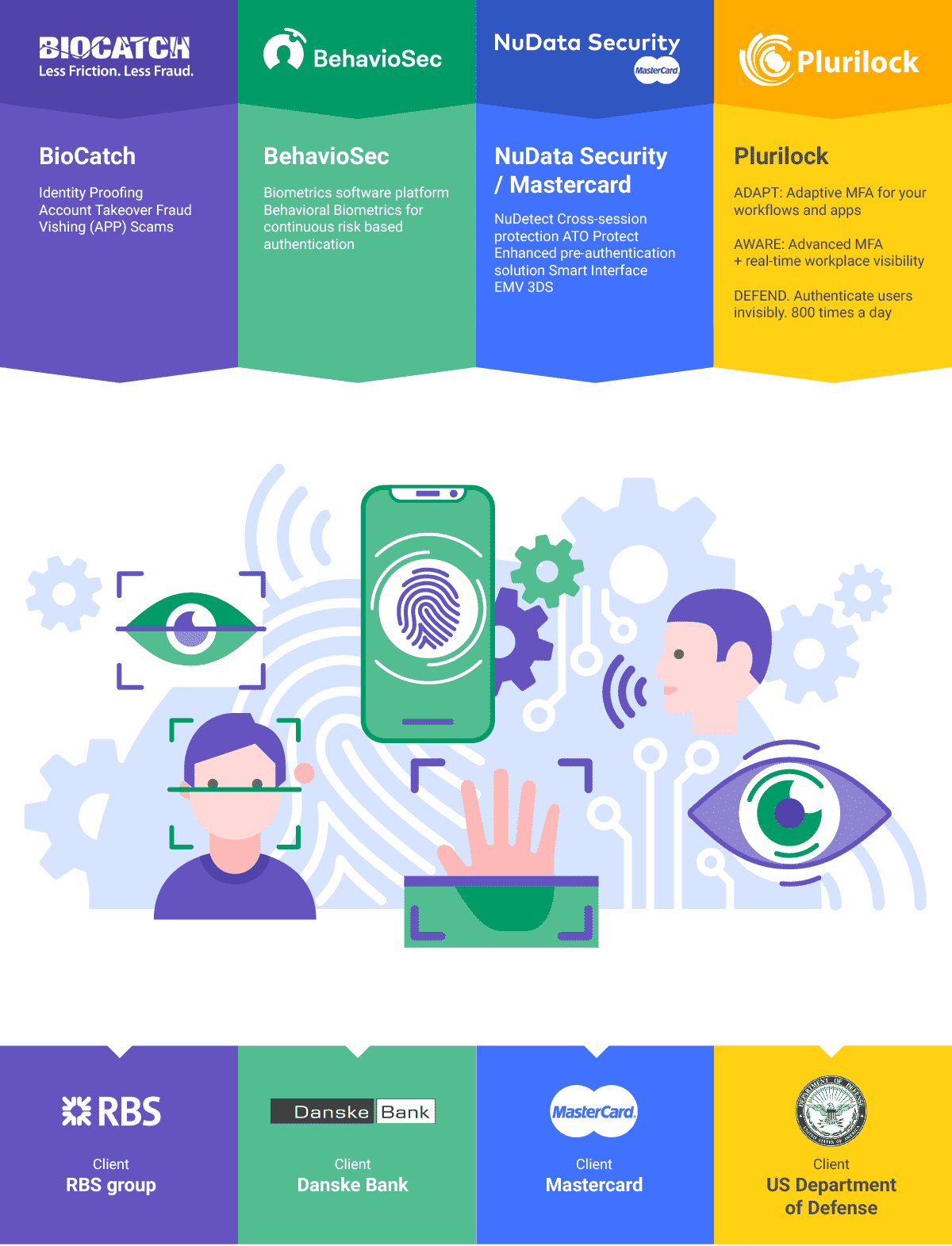

Banks have to face the risk of fake biometrics if hackers use neural networks and AI based solutions to imitate the biometric identity of their customers. We’ve analyzed tools for capturing behavioral biometrics, for the financial industry, provided by 4 different vendors. These tools can significantly decrease the risk of fraud.