Payment Service Providers (PSPs) and banks play a crucial role in facilitating the movement of funds between different individuals, businesses, and financial institutions. These services provide a secure and efficient means of transferring money domestically and internationally. Just a few years ago, cross-border bank transfers were tedious and sometimes even took a few weeks to process. But with new technology trends emerging, moving money has become much easier in many ways.

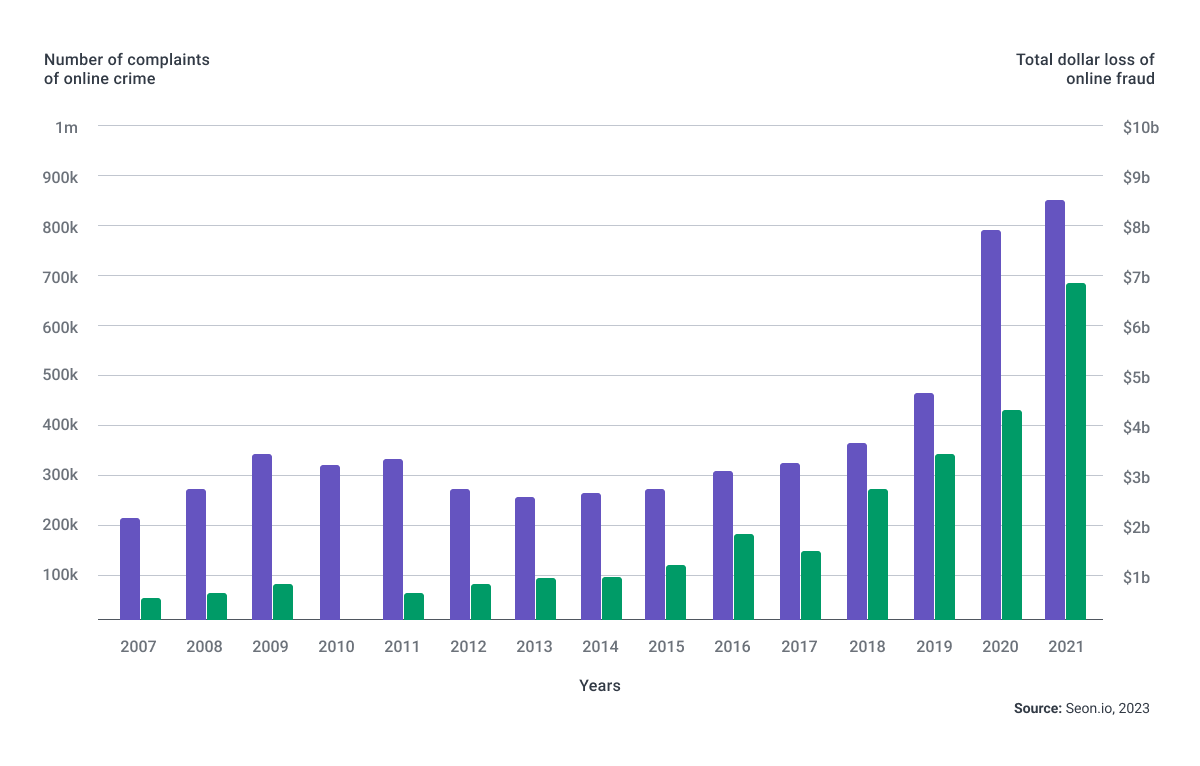

Today, cross-border payments are becoming widely accessible worldwide. Money transfers to low and middle-income countries are growing reaching $626 billion in 2022, despite the pandemic and global recession. However, this does come with a challenge. In 2023, 84% of all financial institutions with high revenues were targets of major payment fraud, with total losses equalling nearly $1.6 billion worldwide, according to LexisNexis.

With payment fraud on the rise, PSPs should turn to new tech to help them protect their users and their money. Technology will be PSPs' best hope will be to avoid government intervention, as the perceived shortcomings in the control of digital payment platforms could result in heightened regulations in the future. This is because there is a widely acknowledged trend in the industry where financial institutions typically respond to new regulations instead of proactively anticipating and adjusting to them in advance.

In this guide, we will share how important it is to use new technologies to battle fraudulent behavior and prevent money laundering schemes. Adapt quick and enhance both your payment security and your edge on the competition.

The Role of Money Remittance Services in the World’s Economy

It has become clear that remittances are becoming a lifeline for many people in developing countries. With global payments revenues reaching a staggering $1.9 trillion in 2020, it is evident that the movement of money across borders is a significant driver of economic activity.

However, along with the legitimate flow of funds, the issue of money laundering looms large. The UN Office on Drugs and Crime emphasizes the challenges in estimating the scale of money laundering, and the amounts involved are enormous and quickly growing. Money laundering comprises 5% of global GDP, equating to an astonishing $800 billion to nearly $2 trillion annually.

The growth of electronic payments contributes to the expansion of remittances, particularly in North America, Europe, and Asia. Electronic payments are outpacing the GDP growth rates in these regions, with Asia experiencing even more rapid expansion. This trend reflects the increasing adoption of digital financial services and the convenience they offer for international transactions.

Remittances are vital not only for the individuals and families receiving them but also for the economies of many countries. In developing African nations, remittances often serve as a lifeline, providing much-needed household income and supporting basic needs such as education, healthcare, and housing.

Furthermore, transferred money can contribute to overall economic growth by boosting consumer spending, fostering entrepreneurship, and encouraging investment in productive sectors.

However, the biggest problem in combating fraud is that governments and international organizations must collaborate to implement robust anti-money laundering measures and enhance transparency in cross-border transactions. And these processes are complex to implement.

The Many Faces of Money Transfer Fraud

Money travels much faster than it used to. That’s why cybercriminals use a variety of loopholes in different banking systems to retrieve the required data to steal someone else's money. They can gain access to client information and therefore their funds by taking advantage of the differences in jurisdictions, rules, and regulations worldwide.

Bank Fraud and Money Transfer Fraud

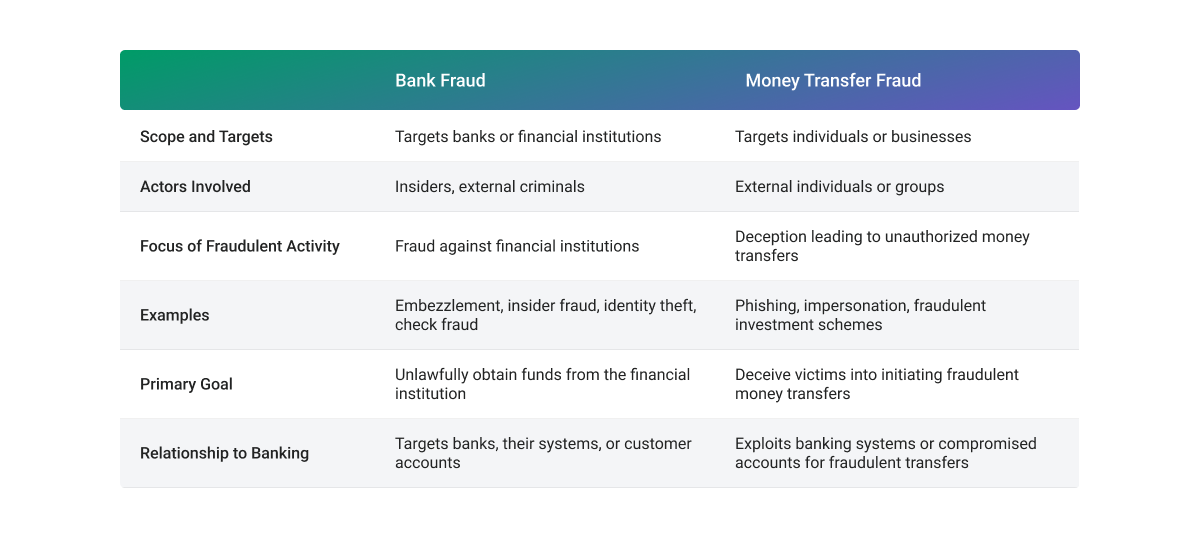

The first distinction we must make is between bank and money transfer fraud. Banks are a part of the money transferring system, but nowadays, many PSPs offer money transfer and remittance services that don’t have the same robust security systems that banks have. The transfers are faster, but they come at a greater risk of fraud as the onboarding process is often simplified at the expense of security.

That’s why money transfer and remittance fraud focuses on individual transfers. Using the loopholes in the security systems, cybercriminals can use various methods to access confidential information and use them to move funds.

Standard Types of Fraud

Money transfer fraud and fraud can occur through various methods and techniques. Here are some common ways in which fraud can happen on an individual level:

Phishing

Phishing involves sending fraudulent emails, text messages, or phone calls that appear to be from legitimate financial institutions. The messages often request sensitive information, such as account numbers or login credentials, under the pretense of a security update or urgent notification. If individuals unknowingly provide their information, fraudsters can use it to gain unauthorized access to their accounts.

Insider Fraud

Insider fraud involves employees or insiders within a bank or financial institution who misuse their position and access to sensitive information to carry out fraudulent activities. This can include embezzling funds, manipulating accounts, or providing unauthorized access to confidential information.

Online Banking Fraud

As more banking transactions occur online, criminals have adapted their tactics to exploit vulnerabilities in online banking systems. This can involve malware or phishing attacks that compromise login credentials, fraudulent fund transfers, or unauthorized account access.

New Types of Fraud Emerging

APP Scam

APP scam, also known as an Authorized Push Payment scam, refers to a type of fraud where individuals are tricked into authorizing the transfer of funds from their bank accounts to accounts controlled by criminals. This scam typically involves sophisticated social engineering techniques and manipulative tactics to deceive victims into believing they are making legitimate payments or investments.

In an APP scam, fraudsters often pose as trusted entities, such as banks, government agencies, or businesses, and use various methods to gain victims' trust and convince them to initiate the payment. This can be done through phone calls, emails, or text messages that appear genuine and urgent. The scammers exploit the victim's trust, emotions, or sense of urgency to coerce them into transferring money.

Once the victim authorizes the payment, the funds are quickly moved to multiple accounts or laundered through various channels, making it difficult to trace or recover. When the victim realizes they have been scammed, the fraudsters typically disappear, and the chances of retrieving the money become slim.

B2B Fraud

B2B fraud, or business-to-business fraud, refers to fraudulent activities or deceptive practices that target businesses engaged in commercial transactions with other companies. It involves various fraudulent schemes that exploit the vulnerabilities of small, medium, or even large systems within B2B relationships for financial gain.

In B2B fraud, the criminals typically present themselves as legitimate businesses, suppliers, vendors, or service providers to deceive their business victims. They may employ various tactics to carry out fraud, such as false invoicing, non-delivery of goods or services, identity theft, conspiracy, or manipulation of financial documents. The most common types of B2B fraud are merchant fraud, triangulation fraud, and transaction laundering.

Merchant fraud involves setting up a shop as a merchant and deceiving their targets. It starts with obtaining merchant accounts and registering with PSPs. The concept behind it is to either sell rip-off products they never deliver. Merchant fraud is a big concern for payment processors and fintechs.

Triangulation fraud is sometimes considered a type of merchant fraud as the merchant presents themself as a legitimate shop owner. However, they are selling items they don’t have and are ordering them from someone else. This can happen for companies and individuals, who discover it only when they see the unauthorized purchase.

Transaction laundering is a type of fraud when a merchant uses another merchant's service that seems legit. The transaction appears legitimate, but the merchant lies about what they sell. All transactions are fraudulent, and this type of fraud particularly affects payment processors and acquirer banks.

There are so many ways to mask fraudulent behavior as a company that it would be impossible to name all of them. Many of these fraud types started during the pandemic as non-existent businesses that offered “relief funds”, showing how quickly fraudsters adjust to current events.

Can Regulations Help Prevent Fraud?

In the United States, the current regulatory focus is on licensed money transmitters. Still, PSPs shouldn’t assume that similar standards will not be applied to other providers in these areas.

Since financial institutions in Europe and other jurisdictions often do business using US dollars, nearly all of them would be affected by some of the measures rolled out in the US. As more fraud and money laundering incidents surface, the United States and other jurisdictions will likely strengthen compliance expectations for payment providers.

Within the European Union, proposed enhancements to PSD2 are expected to have a stronger focus on fraud, financial crime, and customer security. Technical requirements for customer identity and authentication are likely to be strengthened, and payer protection through advanced chargeback procedures is expected to be included as well.

How Can Businesses Detect & Prevent Bank Transfer and Remittance Fraud?

New technologies allow businesses to gain better control over transactions to ensure that money transfers are going from and to the right place.

KYC Due Diligence

Any financial entity or business in the finance domain should verify customer identity using digital KYC solutions while onboarding. Additionally, companies must perform KYC due diligence at regular intervals and rate customers based on the risk level they pose. Institutions can rely on an end-to-end identity verification platform that seamlessly onboards and verifies customer identity using AI to compare identities against government records.

AML Checks

Businesses must perform AML or anti-money laundering checks to reduce their exposure to money launderers. AML can help with name recognition and screening as its often performed as a part of customer due diligence processes to ensure all transactitons are in compliance with the latest regulation.

Advanced Monitoring

Businesses must opt for real-time and cross-channel transaction monitoring solutions. These solutions help detect mule accounts, unusual transaction volumes, transactions that are inconsistent with customer profiles, and customers with a past SAR/STR-marked history.

Watch List Screening

Smart screening solutions must be in place to screen clients against internal lists, sanction lists, remitters, or beneficiary lists. This screening helps spot potential defaulters before they can scam more people.

Advanced ML Tools

A machine learning model can help create a genuine transaction profile for every customer. This type of model can easily detect and report abnormal patterns against customers' peer groups and past transactions. ML is particularly efficient when it comes to battling false positives and helping to detect problematic transactions.

Compliance

Businesses must comply with all necessary regulations to prevent money laundering or fraud. Entities such as banks and other financial organizations must comply with BSA regulations, AML laws, KYC regulations, data protection laws, and consumer protection. Any PSP should establish compliance programs and due diligence procedures so they can report any fraudulent behavior to authorities.

Entity Link Analysis Tool

Entity Link Analysis Tools are impactful in preventing remittance fraud. These tools help uncover hidden relationships between parties, analyze transaction patterns, and detect mule account schemes, thus detecting potential money laundering strategies before they occur.

Risk Orchestration

Many global businesses are turning to risk orchestration to effectively meet and manage compliance and customer demands in the digital economy. Risk orchestration helps organizations balance evolving compliance and fraud requirements with the operational realities of digital acceleration. It enables optimal customer outcomes while realizing cost and productivity advantages at the enterprise level.

Managing the Risks of Fraud

The fight against fraud is not a walk in the park, but there are increasingly innovative ways to ensure the risks are more manageable. While most banks already have robust security systems in place, they often need to play catch up to make the necessary changes.

On the other hand, PSPs, neobanks, digital-only banks, remittance providers, and other fintechs have a greater ability to experiment with new technologies like AI and ML to find the best solutions for battling cybercrime.

Strategies for Protection and Prevention

The continuous evolution of compliance should focus on leveraging a well-rounded strategy for protection that includes collaboration between different departments, regular risk assessments, implementation of fraud-preventing technology, continuous improvement, and staff and consumer education to successfully combat fraud in all types of transactions.

To combat bank fraud, financial institutions implement multiple layers of security measures. These may include encryption technologies, multi-factor authentication, KYC, fraud detection systems, and transaction monitoring. Additionally, customers are advised to remain vigilant, regularly monitor their accounts, and promptly report any suspicious activity to their banks.

Awareness, education, and caution are crucial in mitigating the risk of falling victim to such scams. It is important to verify the authenticity of any payment requests, double-check contact information, and be wary of unexpected or high-pressure demands for money transfers.

Here are some strategies we recommend for battling money transfer and remittance fraud:

Decide which risk you are willing to accept

Financial organizations and payment providers must determine which risks they are ready to accept and which risks pose too big of a threat and must be combatted ASAP.

For instance, when addressing anti-money laundering (AML) and know-your-customer (KYC) concerns, PSPs should consider a streamlined customer experience as a significant advantage to their payment business model, since it can provide efficient onboarding, verification, and transaction processing.

Explore new approaches

It’s not the worst idea for PSPs to question the effectiveness of traditional banks' control environments and frameworks. PSPs have the ability to be more innovative and develop creative and high-tech solutions as long as they meet regulatory requirements. This may entail balancing compliance and flexibility, enabling PSPs to explore new approaches that enhance security without sacrificing user convenience.

Better to be safe than sorry

As we mentioned, many traditional financial institutions react rather than anticipate fraud risks. On the other hand, PSPs are in a unique position where they can go beyond reactive measures and proactively combat financial fraud. To do this, PSPs need to anticipate risks and embed protective measures into the design of their core services and products.

Adaptability comes first

A proactive approach involves constantly updating and adapting your strategies to address evolving fraud methods. Unlike banks, PSPs have the freedom and capacity to review their procedures more often and figure out which approaches work best.

For example, PSPs can swiftly adjust their regular and ad hoc software releases to counter emerging fraud tactics with new technologies. By embracing this strategy, PSPs can design advanced mechanisms that effectively counter financial crime by ensuring they are one step ahead of fraudsters.

Remittance providers and PSPs can enhance their ability to combat financial fraud by establishing a proportionate control framework tailored to their business model, challenging conventional control environments to drive innovation, and remaining proactive in countering emerging fraud threats. This aggressive stance will enable them to develop next-generation mechanisms that protect their customers and contribute to a safer financial ecosystem.

Conclusion

In the realm of fast money transfers and remittances, understanding the techniques employed by fraudsters is crucial. Implementing multi-layered security measures, conducting regular risk assessments, and adopting advanced monitoring technologies can help detect and prevent fraudulent activities and create systems to fight crime.

PSPs have a great opportunity to try out different approaches to combatting fraud. One of the top ways we recommend to do this is by embracing advanced technologies like ML and AI to ensure your KYC processes can quickly identify fraudsters before they engage in criminal activity. By joining forces with a software development partner that understands payment security and money transfer technology, you will have a far easier time protecting your clients and business from fraud.

Overall, combating fraud, ensuring compliance, and protecting the interests of individuals, businesses, and the financial system requires a holistic approach encompassing proactively implementing technological advancements and robust processes. Contact us today to get started!