In today's highly regulated business environment, compliance with industry standards and regulations, particularly in finance, is non-negotiable.

In this article, we'll dive into how code audit services can be a cornerstone of your compliance strategy, ensuring your software adheres to the necessary financial guidelines, especially in sectors like banking, international payments, and more.

The Role of Code Audit Services in Financial Compliance

Code audit services play a pivotal role in helping organizations in the financial sector achieve and maintain compliance with a wide range of regulations and standards. Here's how they are essential:

International Payments and Transactions: With the globalization of financial markets, international payment compliance, including anti-money laundering (AML) and know your customer (KYC) regulations, is critical. Code audits ensure that your software aligns with these international requirements, minimizing the risk of regulatory breaches.

Banking Regulations: In the banking industry, numerous regulations, such as Basel III and Dodd-Frank, impose strict requirements on financial institutions. Code audits can identify areas where your software may fall short of these complex and evolving standards.

Data Security and Privacy: Financial data is highly sensitive. Compliance with data protection regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), is paramount. Code audits focus on data protection, ensuring that your software maintains the highest standards of security and minimizes the risk of data breaches.

How Code Audit Services Address Financial Compliance Challenges

Achieving financial compliance can be especially complex and demanding. Code audit services can help address these challenges effectively:

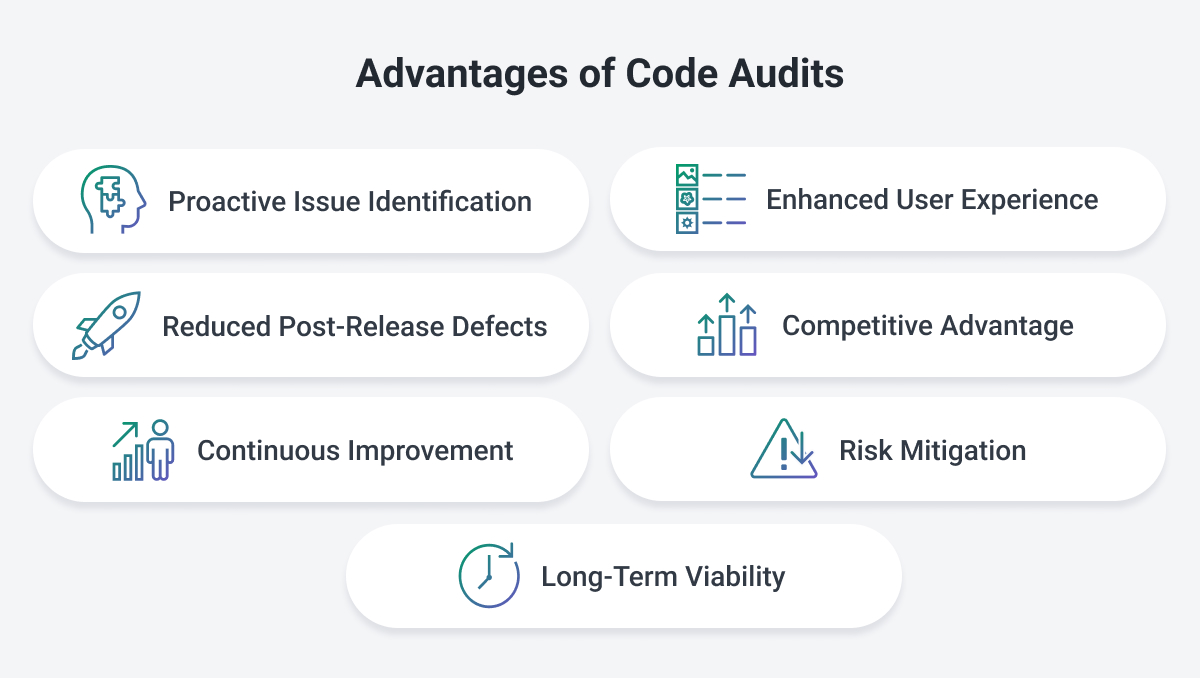

Regulatory Alignment: Code audits ensure that your software aligns with the ever-evolving financial regulations and standards, helping you stay ahead of compliance requirements.

Risk Mitigation: Compliance breaches in the financial sector can result in severe penalties and reputational damage. Technology audits help mitigate these risks by identifying and addressing compliance gaps.

Efficient Compliance Management: Keeping pace with changing financial regulations can be overwhelming. Architecture audits provide a structured and efficient approach to compliance management.

Safeguard Your Business Today

Code audit services are a vital component of financial compliance in sectors such as banking and international payments. Our Code Audit Services can help you navigate this complex landscape and avoid costly compliance breaches.