Updated: 6/7/2022

The US and Europe banking systems are the birthplaces of financial innovation. At least it has been like that so far as the US has the world’s largest and most complex banking system, so it makes sense for many ideas to start here.

However, in the past few years, there has been a drastic change to this pattern; there has been a significant amount of financial services ideas flowing from the east to the west.

Without the fragmentation and huge investment in the legacy infrastructure of the US banking system, it’s been easier for smaller countries and geographic regions to deal more nimbly with financial services. Perhaps due to less complex laws, innovative services have sprung up and revolutionized financial services in many countries.

There are some examples of this with the adoption of EMV chip cards and contactless payments and, more recently, with faster payments. Most recently, a financial service trend that emerged in the east is becoming widely popular and utilized in the west - open banking. In Europe, open banking is now mandatory under the EU’s Second Payment Services Directive (PSD2).

PSD2 In a New Context

Innovations like cloud-based computing and digital payments are lifting customer expectations for security and convenience. Since faster payments are becoming a norm, upgrades in infrastructure are bringing out new services like e-wallets, faster remittance services, digital cards, and a variety of services.

The Payment Services Directive 2 (PSD2) is a new European directive that requires all EU-based banks to grant access to customer transaction accounts for both retail and corporate users. Sharing account and customer transaction data via open APIs applies to all payment service providers (PSPs) like banks, payment institutions, and third-party providers (TTPs) and directly relates to all types of electronic payments.

The PSD2 directive applies to 28 member states of the EU as well as the European Economic Area. By introducing this new regulative, banks will have to foster an open market where banks cannot impose additional fees on providers of these services.

Generally, PSD2 requires:

- Third-party authentication (e.g. OAuth)

- Third-party access to Payments (Transaction Requests)

- Third-party access to Account information (Balances and Transaction history)

- Fees Transparency (Static Financial Product and fees information)

- Fees Transparency (Real-time charges transparency during Transaction Requests)

- Fine-grained entitlements (Customer selected Views on accounts).

The architecture of PSD2 regulation consists of issues related to incident reporting, safety, pricing, and many others. The directive actually gives national governments a way to craft a list of precise legal requirements around three central topics: transparency, security, and access to account information.

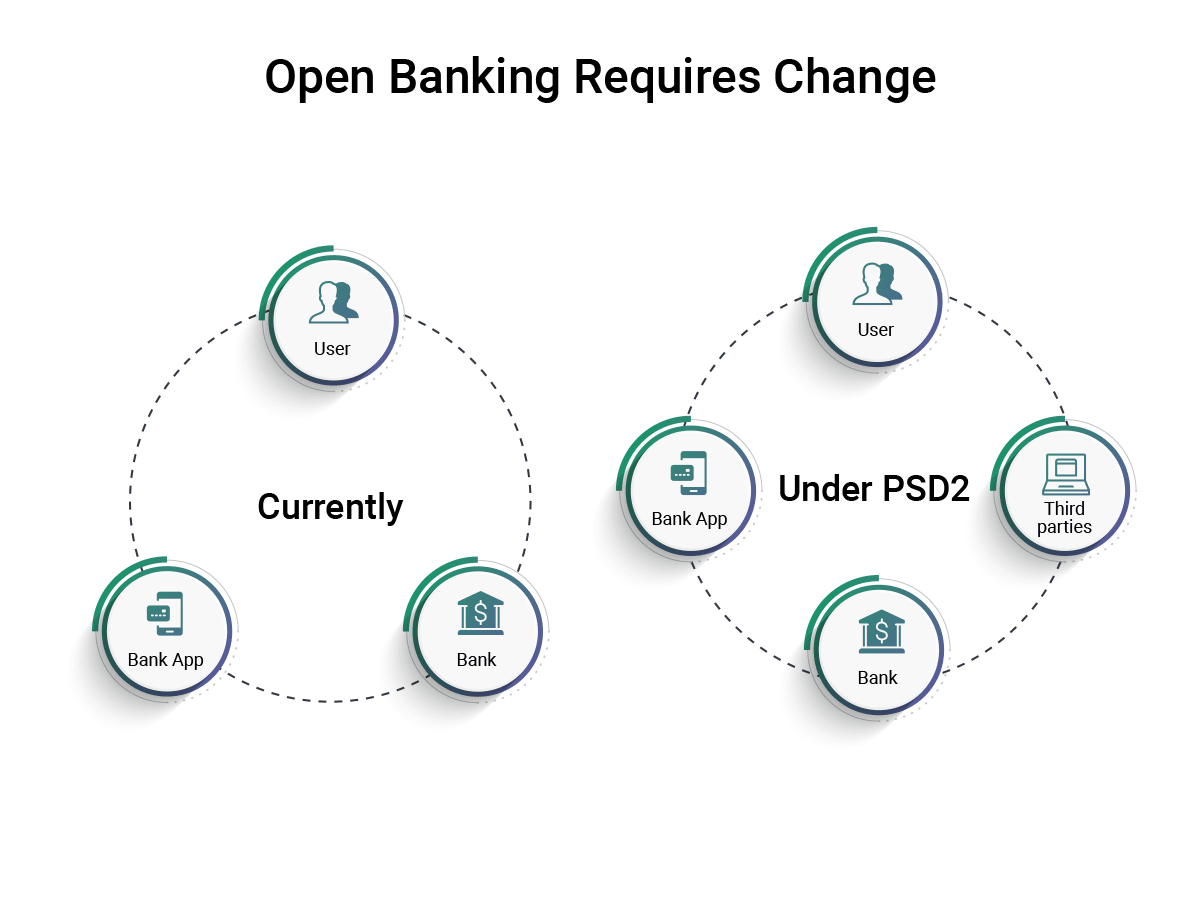

Why Open Banking Requires Change

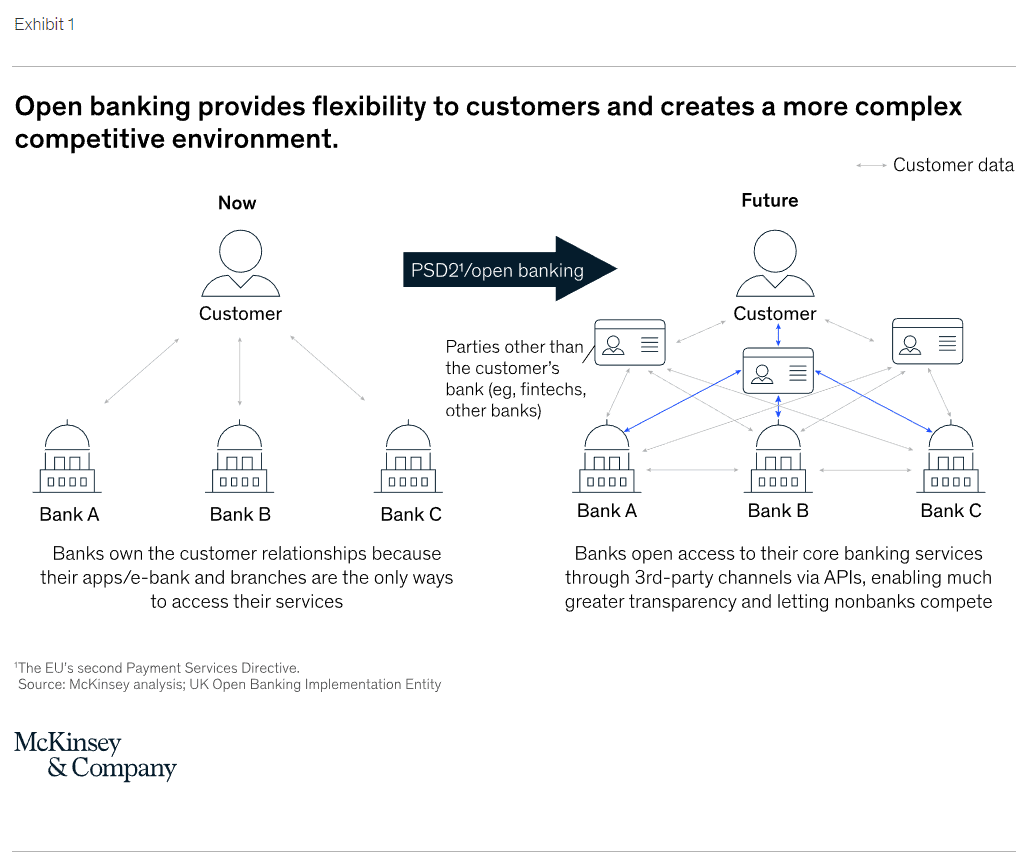

Open banking can be defined in many ways. It allows customers’ account information at traditional banks to be accessible via APIs to third-party providers (TPP), which can be nonbanks (such as fintech, tech companies, or credit agencies) or even traditional or challenger banks.

Once a customer authorizes a TPP to access their bank account, the TPP interacts with the account-holding bank through APIs the bank provides to obtain the information required to deliver services.

Open banking standards are based on financial institutions which make their data available to qualified, but unrelated third parties. Financial institutions have traditionally built fortresses around their data since unauthorized access could violate privacy laws and have serious direct financial consequences, along with harder-to-measure indirect consequences resulting from loss of reputation and trust.

Data security has always been an important topic, but with the emergence of open banking, the issue has come to a head.

If open banking API is enshrined in a law or regulation, then financial institutions will be required to provide would-be competitors with the raw materials to build products and services which would help these institutions to compete against them using their own data,

In an age where data is the new oil, it would be difficult for financial institutions—even those not currently fully utilizing the value of that data—to share an asset that would benefit competing third parties.

How Open Banking Works

Financial institutions in Europe, including the UK, may have had concerns initially about open banking, but, with the adoption of PSD2—which, among other things, requires financial institutions to open their data to third parties—they had no choice but to comply. The social forces advocating for more transparency and competition in financial services prevailed over financial institutions’ concerns.

Let’s take a focused look at open banking in the UK, because it has taken PSD2 to a new level by requiring financial institutions to not only open their data to third parties but to do so in a standardized format.

The UK took this extra step with the support of its Competition and Markets Authority, with the goals of promoting financial services innovation, making financial services more transparent, and increasing financial services competition by opening account access to nonbanks.

As a practical matter, open banking in the UK and Ireland requires that the nine largest banks—Allied Irish Bank, Bank of Ireland, Barclays, Danske, HSBC, Lloyds, Nationwide, RBS, and Santander—must share aggregated customer data online in a secure, standardized form with authorized third parties that can use it to build new products with the banks’ data.

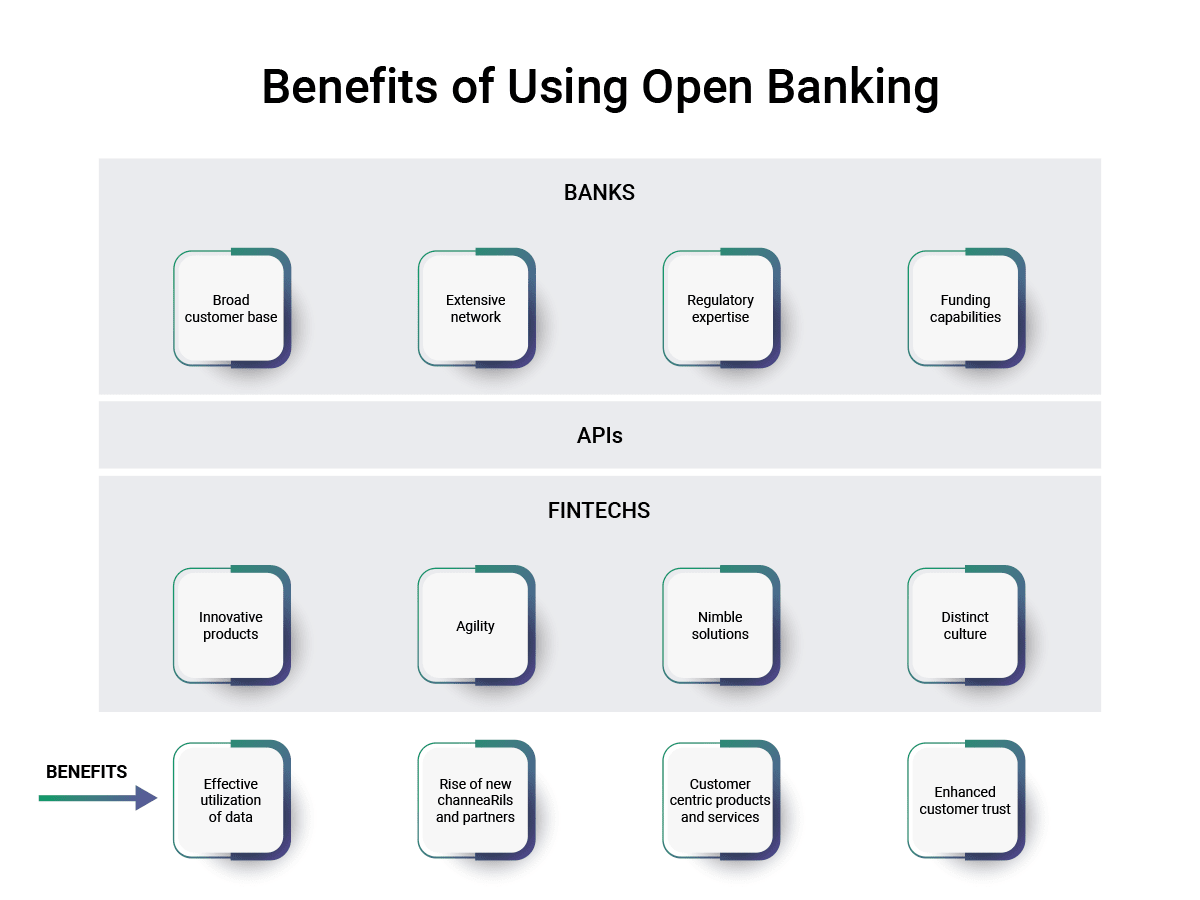

Benefits of Using Open Banking

While open banking may give concern to some financial institutions, it also comes with consumer and company benefits:

- The ability to connect the data from multiple accounts

- Reshaping consumer experience and competitive landscape of the banking industry

- Consumers gain a better understanding of their personal finance

- Companies can use open banking to streamline their business costs

Impact on the Market and Potential Risks

Open banking standards open up a variety of benefits to small businesses and it creates potentially better relationships between customers and financial institutions as clients get more access to funding. However, with open banking there can be some potential risks, including:

- Data breaches

- Insider threats

- Risks to financial services

- Open banking APIs can be risky due to third party information providers

Will Open Banking Come to the US?

Will open banking come to the US? Perhaps, but the more important question is whether open banking will come to the US by means of regulation?

While we don’t have a crystal ball, we can be reasonably certain that even though US regulators admire the goals of the UK’s Competition and Markets Authority, they don’t currently have the appetite to bite off what would be an extremely large and difficult process to implement open banking via regulation.

It is more likely that open banking will be left in the hands of the private sector, with only soft encouragement from regulators. Even under a more pro-regulation US administration, it would be challenging to implement open banking by regulation because of the mere size and complexity of the US banking system.

Still, if the pendulum someday swings back to the extremely proactive days of the US, like those when the Consumer Financial Protection Bureau was run under Richard Cordray, what will happen is anyone’s guess. There is always the chance that activist consumer groups would take on open banking as a cause, and encourage a legislative approach.

The Importance of Collaboration

We also should acknowledge that open banking is emerging in the US without legislation or regulatory fiat. Today more than ever, we hear less about fintechs putting financial institutions out of business, and more about financial institutions and fintechs working together.

Both financial institutions and fintechs have strengths they bring to the table: financial institutions bring their trustworthiness, experience operating in a regulated environment, existing customer base, and capital; and fintechs bring their fearlessness and innovative spirit, as well as their deep understanding of the mobile-first or mobile-only customer’s needs.

Many US financial institutions are opening up their data to third parties via APIs and pursuing business arrangements with fintechs, which achieves pretty much the same goal as open banking in the UK, but without regulation. .

An important factor to consider is that in most US communities, there are small banks or credit unions that deliver services equal to biggest banks. By partnering with fintechs or other third parties, small banks may be able to overcome their minimal resources and small geographic footprints with mobile and online capabilities.

Even in areas without the presence of physical banks, such as rural communities, there are a multitude of online-only financial institutions that can serve anyone with a mobile phone or an internet connection.

Fragmentation, which often presents huge challenges for the US banking system, might actually work in its favor when it comes to a voluntary approach to open banking vs. a regulated approach.

What Should US Financial Institutions Be Doing?

With or without regulation, US financial institutions should be taking open banking extremely seriously right now.

They should incorporate open banking concepts into their strategies in order to use their tech resources to compete effectively against the competition, by offering compelling products and services that meet their customers’ needs and deliver exceptional user experiences.

How To Prepare for Open Banking Implementation

Open banking—particularly when it’s approached on a voluntary basis—can be an opportunity for those who are strategic in their thinking. When moving forward with open banking, we recommend that institutions prepare themselves in the following ways:

- Introduce services to the consumer and SME markets that accurately reflect the needs of those markets and their preferred channels of interaction.

- Expand the accessibility of financial services, especially to disenfranchised and underserved groups.

- Price fairly and be transparent with all fees as well as terms and conditions.

- Modernize legacy systems to enable faster and more agile financial services development.

- Work with fintechs to establish mutually beneficial relationships that support financial services innovation.

- Use valuable in-house consumer data to create or co-create new solutions to financial services challenges.

Conclusion

The adoption of new technologies and the dramatic turn toward online channels since the pandemic appears to have accelerated the development of digital banking worldwide.

Consumers that spend more time online are much more comfortable with using digital payments and fintech apps as well as other non-traditional financial services, due to their convenience and flexibility.

In 2020, the number of users of open banking-based apps grew so much in the UK and the US, that now almost one in two users have some kind of fintech app on their smartphone. Open banking APIs give new power to non-banks to position themselves as financial services providers and gives consumers a better banking experience.

The shift to open banking standards has already begun, so financial institutions should consider jumping on board before they get left in the dust.