"Since 2010 Softjourn team has been maintaining the processing system which is a core of our business; they’ve done a great job so far! We value the knowledge transfer process as well as excellent development skills."

UPC: Improving Payment Processing with Server Maintenance

ABOUT THE CLIENT:

The Challenge

Shopping online is quickly becoming the largest global channel for retail, albeit at different speeds in different countries. But it’s estimated that by 2040, 95% of purchases will be facilitated by e-commerce.

UPC created the eCommerce Connect system in 2005 to serve the growing need of supporting merchants’ ability to accept online payments via banking cards.

UPC quickly realized that their software needed to be updated as server performance directly impacts customer experience, and payment service providers need to quickly process orders to satisfy not just their merchants, but the merchants’ customers.

Ukrainian Processing Center (UPC) is one of the largest processing centers in Central and Eastern Europe, and has been operating since 1997. On average, UPC processes 100 million transactions a month made with payment types such as online, ATMs, and POS. In order to serve the growing needs of online merchants, they built a payment gateway to help process online orders. Over time, they needed assistance with ongoing maintenance.

To keep UPC’s customers happy with the system and keep maintenance costs down, UPC collaborated with Softjourn to migrate and update the processes associated with e-commerce Connect.

The Solution

Of course, to enable the online acceptance of any type of bank card or digital payment, a merchant needs a payment processor. There are many varied services available globally, but what if the most popular and widely accepted processors, like PayPal, don’t work in your country? This is why localized payment methods are becoming increasingly important, especially as cross-border commerce continues to rise.

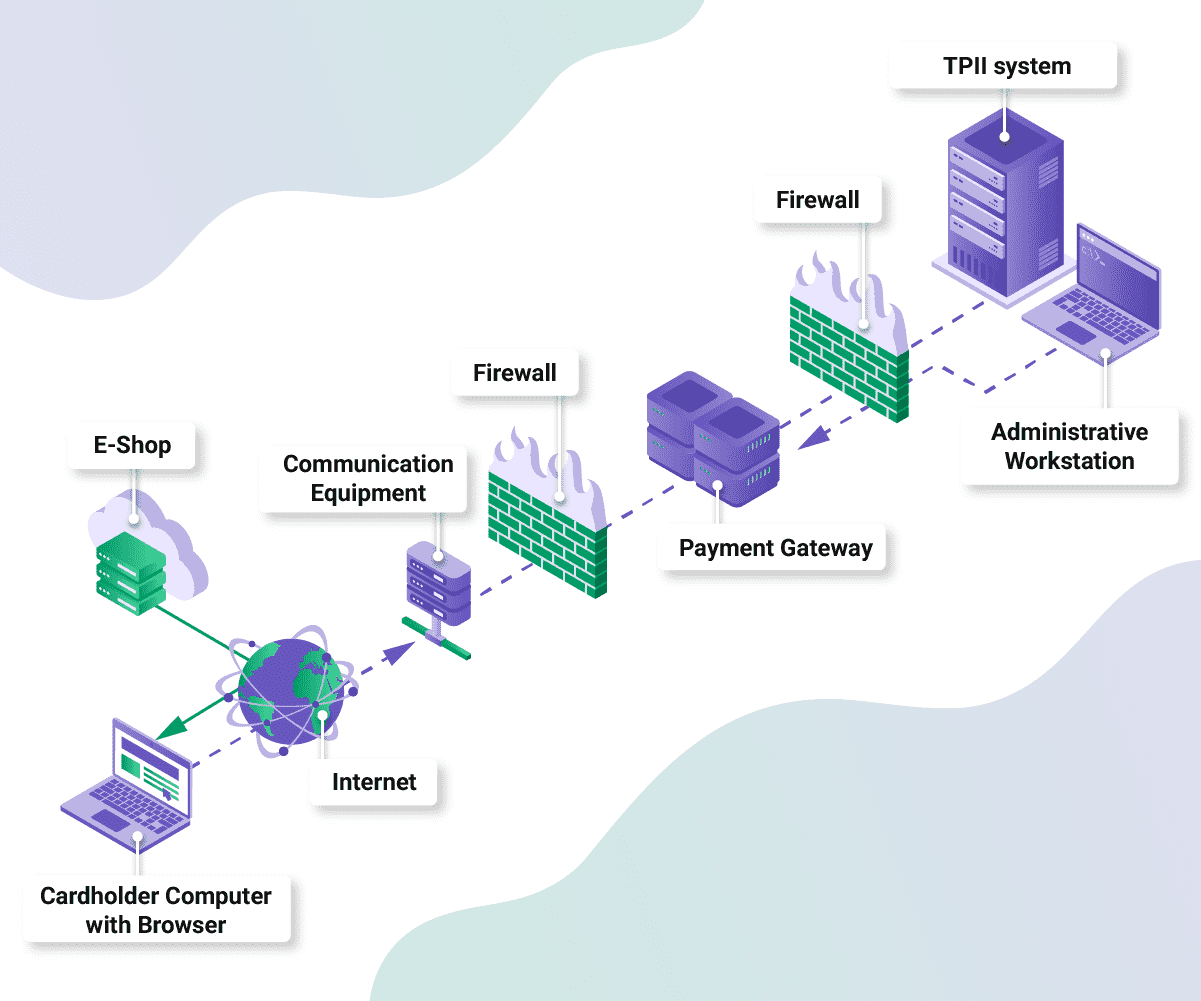

Ukrainian Processing Center (UPC) is one of the largest processing centers in Central and Eastern Europe, and has been operating since 1997. On average, UPC processes 100 million transactions a month made with payment types such as online, ATMs, and POS. In order to serve the growing needs of online merchants, they built a payment gateway to help process online orders. Over time, they needed assistance with ongoing maintenance. payment processing, especially when it comes to technology that enables a quick and accurate transaction. We have also worked with UPC on their Authentic, a transaction and card processing system that transmits authorization validation data among issuers, acquirers, and ATMs.

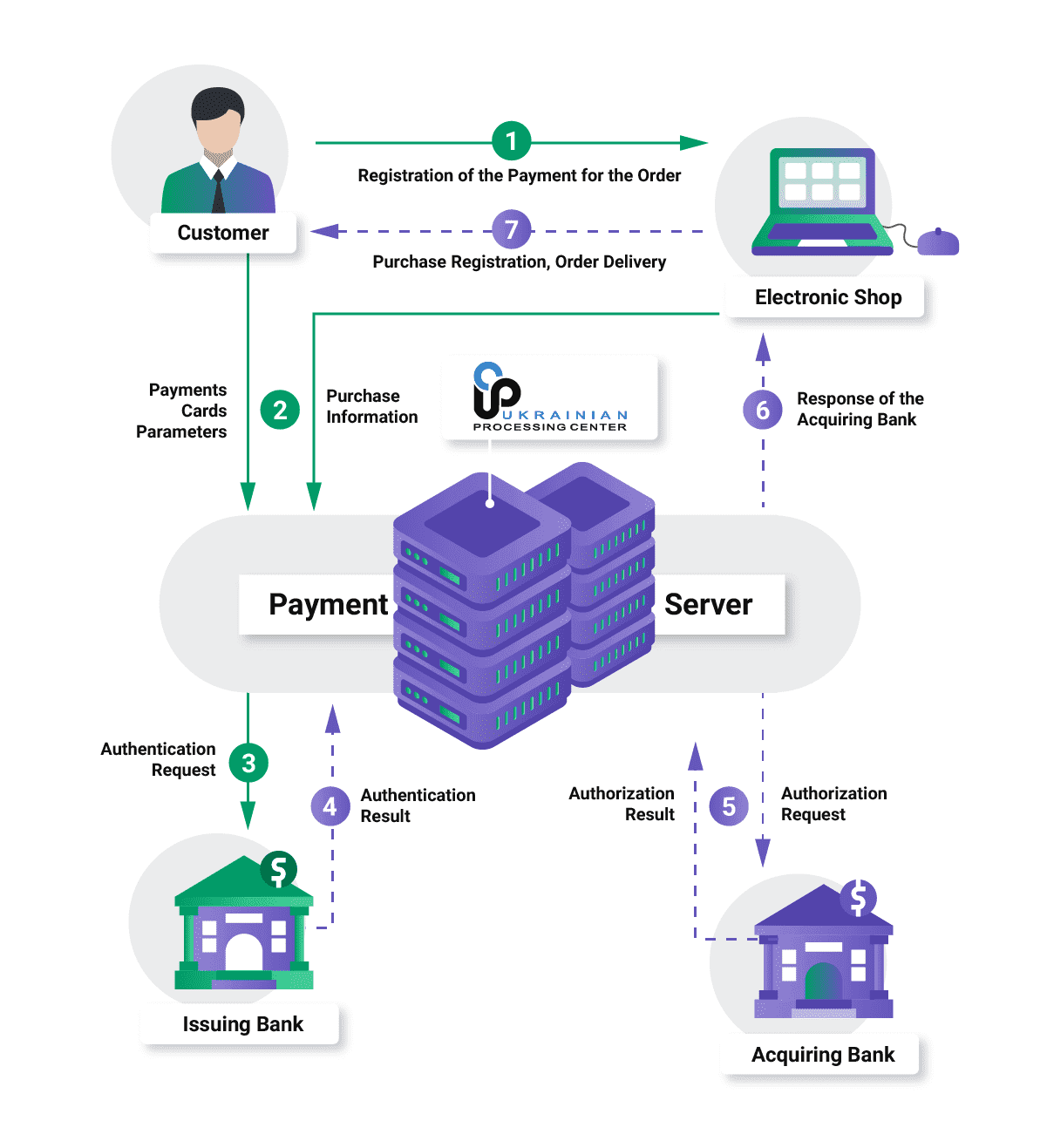

eCommerce Connect is the front end of Authentic and provides a secure checkout page. When a transaction is made, the payment gateway checks for validity, encrypts the transaction details, and saves in Authentic for payment processing.

Softjourn migrated and upgraded software related to the stability, security, and reliability of the overall system, unifying processes that were spread out over different types of software. This enhanced the processing speed of the server, ensuring that transactions were completed according to industry standards for time and swiftness.

By updating the software, UPC also ensures that ongoing and long-term maintenance of the whole processing system is easier, faster, and cheaper to complete.

Banking companies and institutions have a large task on their plate when it comes to upgrading legacy systems, but there are many impactful and long-term benefits to doing so.

After Softjourn completed the server migration and upgrade, UPC received the following benefits:

- Secure systems that adhere to regulatory requirements: Compliance with regulations was a benefit UPC was deeply invested in achieving. Since being among the first Ukrainian processing companies to earn PCI DSS compliance in 2009, UPC has maintained certification ever since. With Softjourn’s expertise, they were able to continue to ensure their transaction data, customer data, and overall systems were secure from the threat of a cyberattack.

- Easier long-term maintenance: Because technology is current, it is less tedious and time consuming to perform regular maintenance that helps machines and software function at optimal parameters. It also helps find and resolve issues that arise over the lifespan of the machines and software, keeping customer calls to help lines at a minimum.

- Better adaptability for new functionality in the future: With updated technology, new functionality is easier to add or integrate as it becomes available. This helps UPC remain at the forefront of the payments service business, because they can add new technology as it becomes needed.

- More reliability for their customers’ businesses: Optimized technology runs faster, which means processes are timely and efficient. This ensures that UPC’s customers are receiving the product they expect, and are able to create easy to use and fast payment pages for their own businesses, which enables and empowers their success.

By partnering with Softjourn to augment its in-house technical team, UPC also gets:

- Staffing to meet its exact needs. We make sure the right staff is always available to address a client’s needs. Softjourn can staff up quickly to address developing projects and staff down just as quickly when the job is completed. And clients never need to worry about human resources issues—such as staff development, wage increases and benefits—for its Softjourn staff.

- No learning curve. Our developers hit the ground running. Softjourn knows payments systems and technology, so we can get started quickly.

- Specialized skills on tap. Softjourn stands ready to provide specialized tech expertise, when needed or wanted.

- Confidence, quality and professionalism. Softjourn’s clients never deal with third-party developers who are inexperienced and don’t know the payments space. They can count on our professionalism and the quality of our work.

- On time and on budget. We are committed to delivering on time and on budget for every client assignment we undertake.

- Protection of client work products. Our work on behalf of our clients belongs exclusively to those clients and their intellectual property is protected.

Conclusion

Softjourn and UPC's collaboration continues to this day. We have several new projects with UPC in the pipeline, and continue to maintain and service their current systems for over 10 years. UPC saw that Softjourn had the skills and expertise to both find solutions for their growing needs, and to bring new ideas to life.

Softjourn is a global technology services provider with over 10 years of experience working with Cards & Payments service providers. We've built creative solutions or augmented in-house technical teams to provide support and project-specific expertise resulting in revenue-generating features.

We specialize in enabling and preserving the security of prepaid cards, developing transaction simulators to save roll-out time, and creating repeatable and strategic approaches to managing payment recovery. We help our customers—payment processors, banks, transaction acquirers, and prepaid card service providers—by leveraging our expertise to increase market share.

Interested in how new technology can enhance your business? Contact us today!

Partnership & Recognition