"Softjourn is very good at the management piece and has a lot of strong knowledge in the financial area. As well Softjourn shows a lot of experience in multiple programming languages and in combining them into one product."

PEX: Xamarin Builds Speed and Functionality Into Expense Management App

ABOUT THE CLIENT:

SERVICES USED:

SERVICES USED:

The Challenge

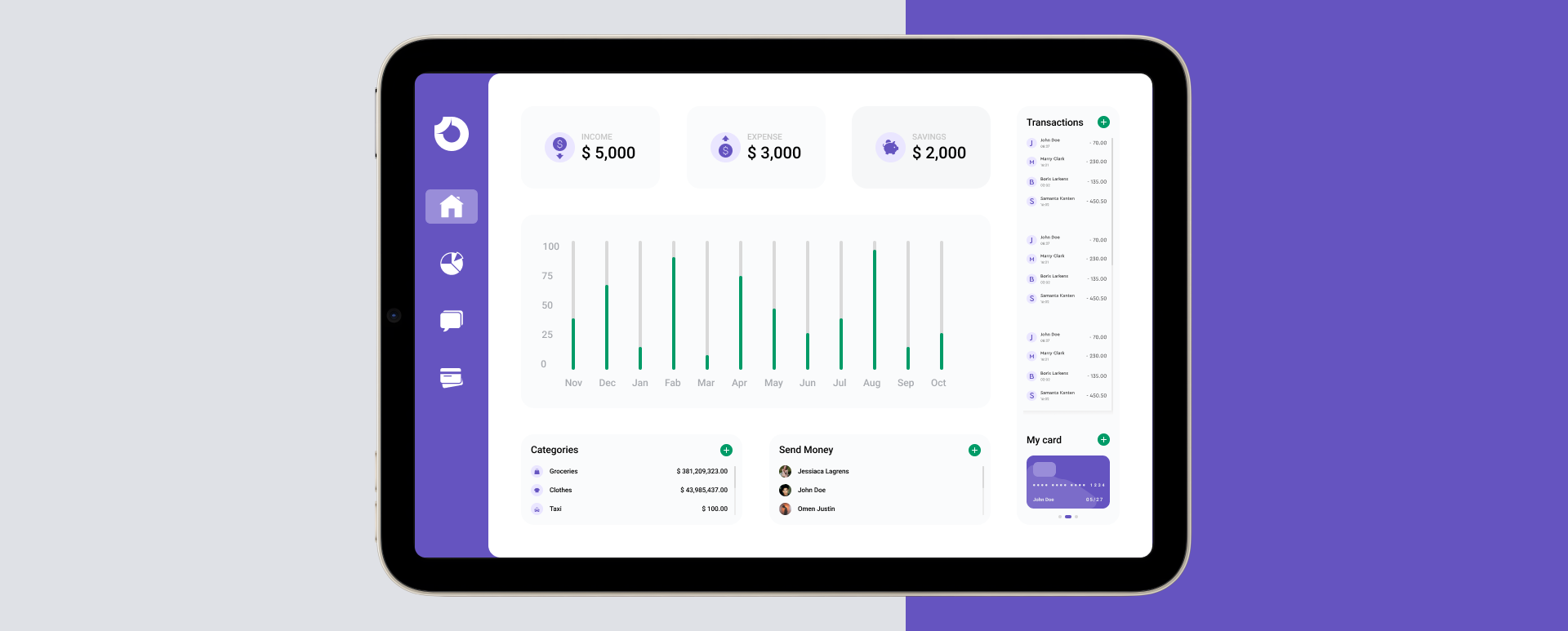

PEX wanted to develop a user‑friendly application interface for phones and tablets that allowed companies to make use of prepaid cards to track employee spending better.

The Solution

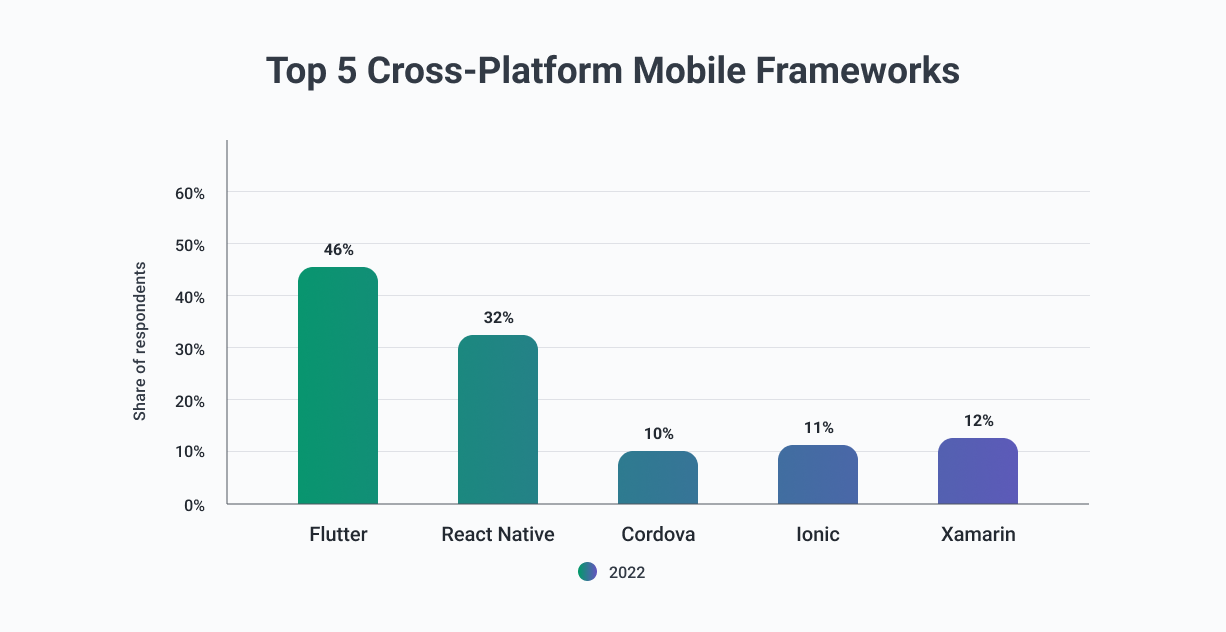

Instead of building two native apps from scratch that would require separate support and additional costs, PEX and Softjourn settled on utilizing Xamarin. It allows the development of single-sourced applications with an integrated UI layer for cross-platform functionality.

The Result

The rebuilt application using Xamarin allows PEX users, whether employees or managers, to enjoy a rapid performance from UI that looks, feels, and acts like native applications.

The Challenge

Tracking expenses in today’s world is trickier than ever, with transactions occurring with the simple swipe of a card or the push of a button.

Prepaid cards allow employers to authorize essential funds for employees to complete on-demand payments that are part of necessary business activities; for example, buying gas or purchasing necessary repair parts. Prepaid cards are not linked to bank accounts, and set specific limits on the spender.

An expense management app also allows employees to track and manage their own allocated funds by being able to check their balance and request needed funds on their own instead of waiting on hold for a call center.

PEX approached Softjourn for a solution to its UI issues, and Softjourn delivered by developing a convenient and easy-to-use app UI that empowers a company’s employees to tackle the work of managing their own expenses, all while keeping company assets safe. Our developers used Xamarin, as it allowed fast development of hybrid applications with advanced features.

The Solution

Instead of building two native apps from scratch that would require separate support and additional costs, PEX and Softjourn settled on utilizing Xamarin.

Xamarin uses C# language and .NET framework, and is paired with Microsoft Visual Studio; this means a developer has a complete solution for building, testing, and tracking an application's performance across platforms.

Apps developed with Xamarin share 90% of the code across platforms, which also meant that adding new functionality in the future would be much easier than siloing the development of separate updates for separate apps.

With Xamarin, Softjourn combined the two original apps into a single application that identified users via login credentials. In addition, Xamarin applications have performance metrics compared to the original native stacks used for Android and iOS application development, which means the UI worked effortlessly; there's no detectable difference between a Xamarin and a native app.

The Benefits

With Xamarin's native API access, it was easy for Softjourn to incorporate some additional features into the new build: biometrics such as fingerprint and facial recognition to fight fraud, and a receipt-capture option using a device's built-in camera.

Biometrics are gaining in popularity as digital fraud and concerns over data privacy rise; with Xamarin, Softjourn was able to tap into biometrics already integrated into a number of iOS and Android devices to set up a faster and simpler user authentication system for those accessing the expense reporting app.

In addition to this, Softjourn implemented a two-step verification for money transfers; this required both a fingerprint or facial scan plus a password, to better safeguard company data. This prevents a hacker from profiting off of stealing the biometric data alone. Both of these implementations ensured that PEX was abiding by the Payment Card Industry Data Security Standard (PCI DSS).

The addition of a receipt-capture option assists employees with paperwork management; rather than needing to collect and save all receipts in a separate receptacle like a folder, they can simply take a photo of the receipt and upload it directly into the app.

Conclusion

The rebuilt application using Xamarin allows PEX users, whether employees or managers, to enjoy a rapid performance from UI that looks and feels like native applications.

In addition, PEX benefits from a development environment that allows code sharing across all platforms, plus a development partner team that can leverage it to create great user experiences. If you are in need for efficient Xamarin-based solutions - contact us!

Partnership & Recognition