Credit Rating is the ability of a person on fulfiling their financial commitment, based on previous dealings with credit, loans or any similar products. Any missing or late payments could lower their credit rating and if they would like to apply for a loan or credit card, their credit rating will be assessed. The worse their credit rating is, the less opportunity they have to take out the product, and vice versa.

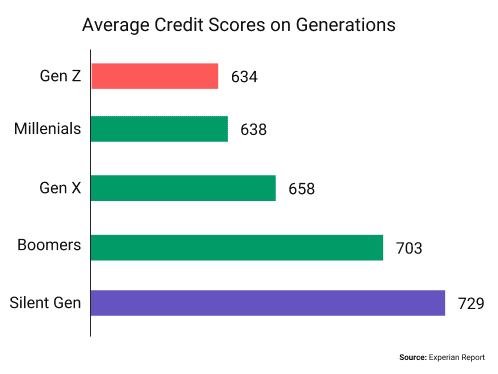

Average credit score on Generations1

As what declared in 2017 Experian State of Credit report, Gen Z (born after 1996)'s average credit score is much lower than the oldest generation - Silent Gen (born after 1946): Gen Z's score is 634 and Silent Gen's score is 729. Followed them, Boomers (1947-1966)' score is 703, Gen X's (1967-1987) score is 658 while Millenials (1982-1995) reached 638. Such the statistics unsurprisingly result from the fact that the older cardholders are, the maturer their credit score history gets.