From traditional players to innovative tech disruptors, the prepaid landscape is becoming increasingly competitive, offering immense opportunities for growth.

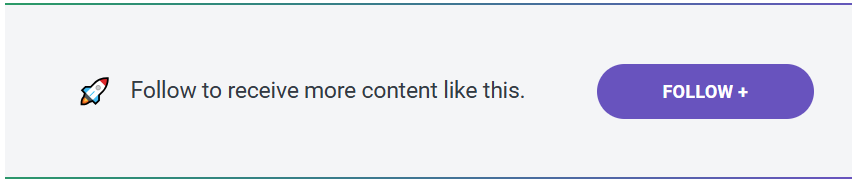

The global prepaid card market is projected to surpass $10.6 billion by 2034, driven by embedded finance, payroll cards, and digital wallet adoption. This growth isn’t just a trend, it’s a transformation. From enabling faster gig-economy payouts to supporting embedded finance and digital gifting, prepaid cards are evolving into essential fintech infrastructure.

At Softjourn, we bring deep experience in the prepaid and expense management space. That’s why we keep a close eye on the trends reshaping this industry—so our clients are always ahead of what’s next.

In this article, we break down the top prepaid card trends you need to know about this year and what they mean for fintechs, platforms, and issuers alike.

Prepaid Card Industry Quick Overview

The prepaid card industry is a dynamic and rapidly evolving market shaped by fintech innovation, regulatory shifts and embedded finance trends. With the prepaid card and digital wallet market set to surpass $3 trillion in 2029, it's clear that the market is stable and growing.

However, the market is undergoing big changes and evolving consumer behaviours. In countries like Brazil and South Korea, prepaid solutions are becoming embedded in mobile payments and banking applications.

Major players like Visa, Mastercard, American Express, Green Dot, and Netspend continue to dominate the prepaid card market, but tech-forward companies such as PayPal, Venmo, Square, Google and Apple are significantly reshaping the competitive landscape.

All these companies are increasing market competition by offering innovative prepaid solutions that integrate with e-commerce platforms, mobile wallets, and contactless payment systems.

Innovations like payroll cards and reloadable prepaid cards are driving growth, particularly in industries like hospitality and construction, where they provide secure payment solutions for migrant and low-income workers.

The shift toward digital wallets is another key trend. Young generations, especially Gen Z and millennials, are adopting digital wallets at high rates, with 79% of Gen Z and 75% of millennials using them to store payment instruments, event tickets, and personal identification.2 The convenience and security offered by prepaid cards make them a vital part of this ecosystem.

Changes in the Market - The Effect of US Tarrifs

The prepaid card market has expanded quickly in recent years, rising from $25.26 billion in 2024 to an expected $28.75 billion in 2025, reflecting a strong CAGR of 13.8%. This earlier growth was driven by shifts in regulation, changing consumer habits, economic conditions, financial inclusion programs, and a growing number of industry partnerships. Looking ahead, the market is projected to continue its rapid climb, reaching $46.91 billion by 2029 with a CAGR of 13%.

Future growth is expected to come from evolving regulations, ongoing financial inclusion efforts, more digital-forward consumers, and deeper strategic collaborations.

Key trends shaping the next phase include:

- stronger security features

- sustainability initiatives

- broader accessibility

- tighter regulatory compliance

- integration with digital wallets

The slight downward adjustment of the long-term forecast—now 13%, 0.1% lower than earlier estimates—comes largely from increased U.S. tariffs. These duties raise the cost of essential components like EMV chips and card-personalization hardware, which are primarily imported from France and Taiwan.

Higher costs ripple across the industry, affecting both U.S. providers and global players through reciprocal tariffs and slower international trade. Still, overall demand remains strong. Prepaid cards are becoming a preferred alternative to traditional bank cards, largely due to their budgeting benefits and ability to help users avoid debt.

A 2024 survey by Recharge found that one in five UK adults now use prepaid cards—more than double since the cost-of-living crisis began—with many relying on them for better financial control.

The continued expansion of e-commerce is another major growth engine. Prepaid cards are widely used for online shopping, and rising digital sales are boosting adoption. To strengthen their market presence, leading companies are launching new and innovative products. Examples include Giverly’s Neokred card, which turns purchases into charitable contributions, and the State Bank of India’s RuPay NCMC card, designed for seamless transport payments across multiple systems.

Major players in the sector include Walmart, JPMorgan Chase, American Express, Visa, PayPal, Mastercard, Green Dot, Western Union, and numerous specialized fintech firms. The Asia-Pacific region led the global market in 2025, followed by Western Europe.

The market spans open-loop cards—usable across multiple merchants—and closed-loop cards tied to specific retailers. These products serve a wide range of applications, from consumer spending to payroll distribution and government benefits.

Overall, the prepaid card market represents revenues earned from storing, processing, and handling prepaid transactions, including associated service fees. As trade tensions and tariff policies continue to evolve, upcoming market reports will reflect updated forecasts and strategic guidance for organizations navigating this fast-changing environment.

Gig Workers Prefer Prepaid Card Payments

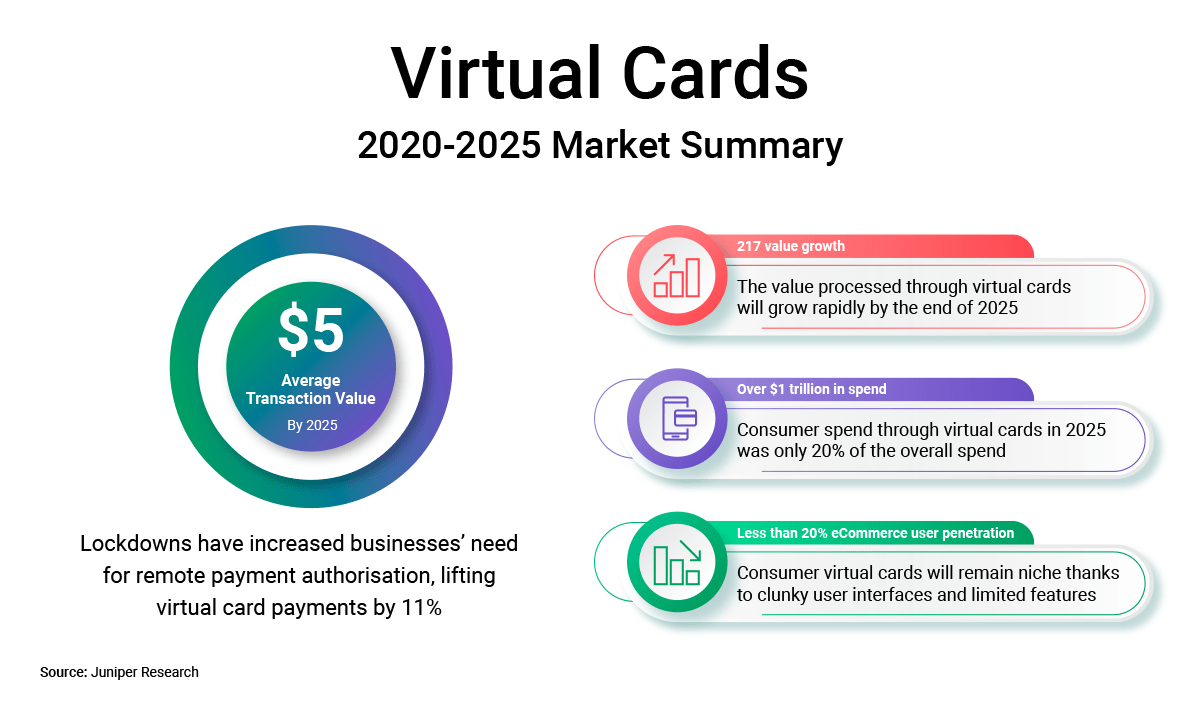

The gig economy—currently valued at $556.7 billion and projected to triple by 2032- is one of the key drivers of prepaid card adoption.3 With 59 million Americans engaged in gig work, timely payment is a top priority for independent workers.4

According to recent surveys, 84% of gig workers would take on more assignments if they were paid faster.5

Prepaid cards offer an ideal solution for companies to address this need, enabling real-time payments that bypass the delays of traditional payment systems. This flexibility attracts gig workers and fosters stronger relationships between freelancers and companies.

Growing Prepaid Card Adoption Among Millennials and Gen Z

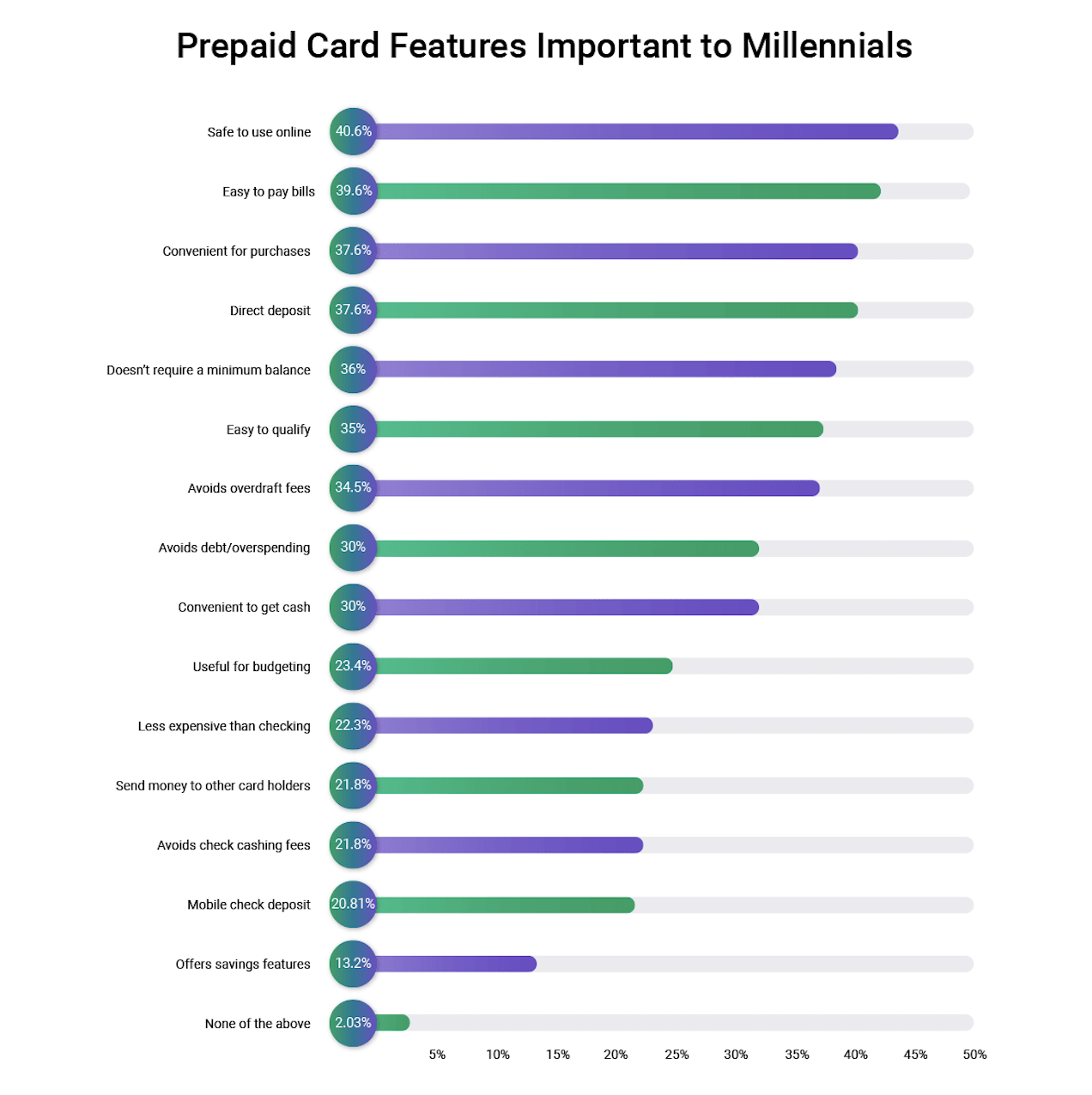

Millennials and Gen Z—digital natives who value convenience and security—are driving the adoption of prepaid cards.

For millennials, prepaid cards offer a seamless way to shop online and withdraw cash without the risks associated with traditional checking accounts, such as overdraft fees and minimum balance requirements.

Companies like Venmo and Square have responded by launching prepaid debit cards that integrate with their platforms, making transactions effortless and secure.

The preferences of these demographics also extend to virtual prepaid cards and digital wallets, which are gaining momentum as secure, flexible payment options. By addressing their needs for speed, security, and digital integration, the prepaid card market is poised for sustained growth.

Virtual Prepaid Cards: A Boon for Security and Efficiency

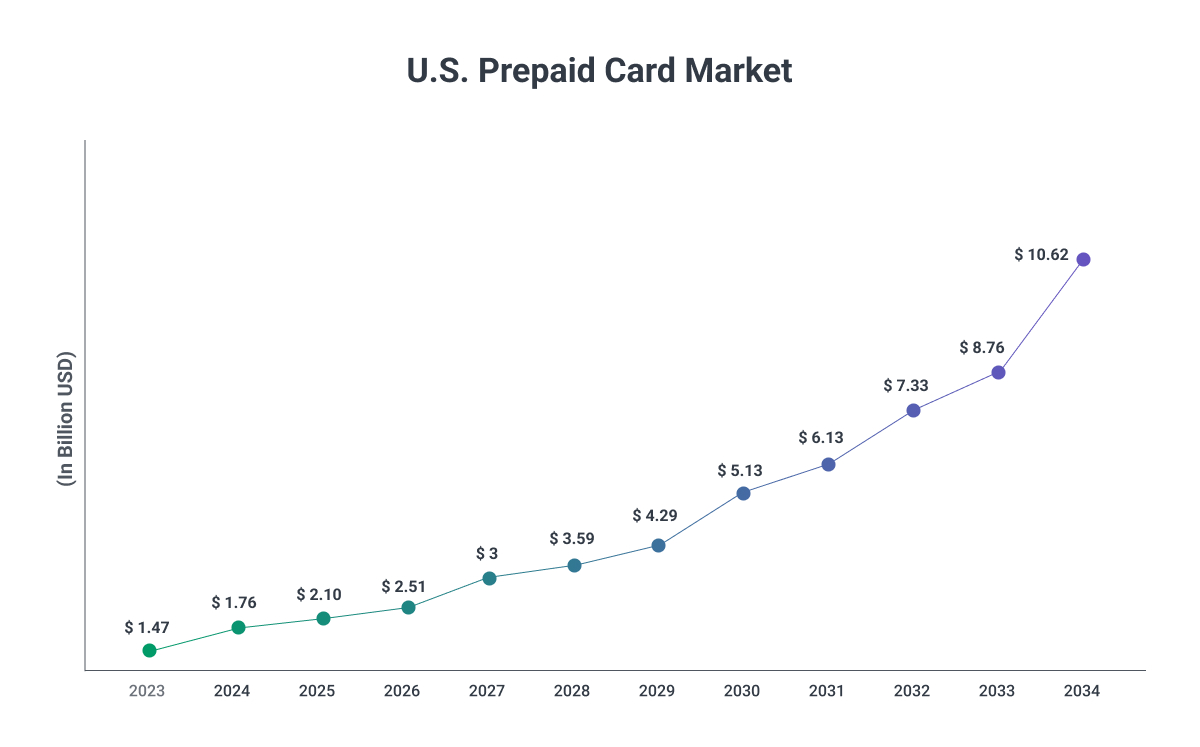

Virtual prepaid cards have seen a surge in adoption due to their enhanced security features for online transactions. With the ability to generate unique card numbers for each purchase, these cards minimize the risk of fraud and data breaches.

Juniper Research projects that virtual card transactions in the B2B sector will grow from $3 trillion in 2024 to $11 trillion by 2028, making them the fastest-growing payment method in this category.6

Businesses are leveraging virtual prepaid cards to streamline operations, improve transparency, and enhance security. The rapid growth of virtual cards highlights their potential to transform payment processes for both consumers and enterprises.

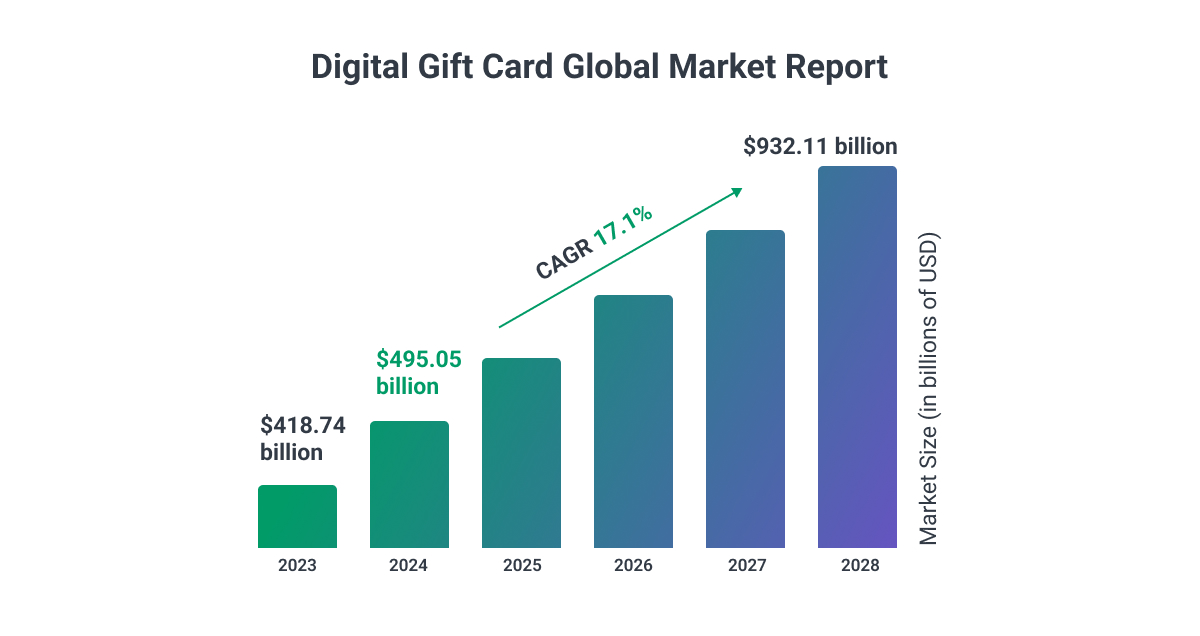

eGift Cards Witness Robust Growth

The popularity of digital gift cards has skyrocketed, driven by e-commerce and consumer demand for personalized gifting options. In North America, 52% of respondents anticipated increased gift card budgets in 2024.7

Innovative features like video uploads and live personalization, as seen with Home Depot’s eGift cards, are helping companies stand out in this competitive market.

Social media also plays a crucial role in promoting eGift cards. Platforms like TikTok and Instagram have become major hubs for product discovery, with 43% of users making purchases directly through social media.8

Influencer marketing and strategic partnerships offer significant opportunities for prepaid card providers to reach their target audiences effectively.

Prepaid-as-a-Service White Label Solutions on the Rise

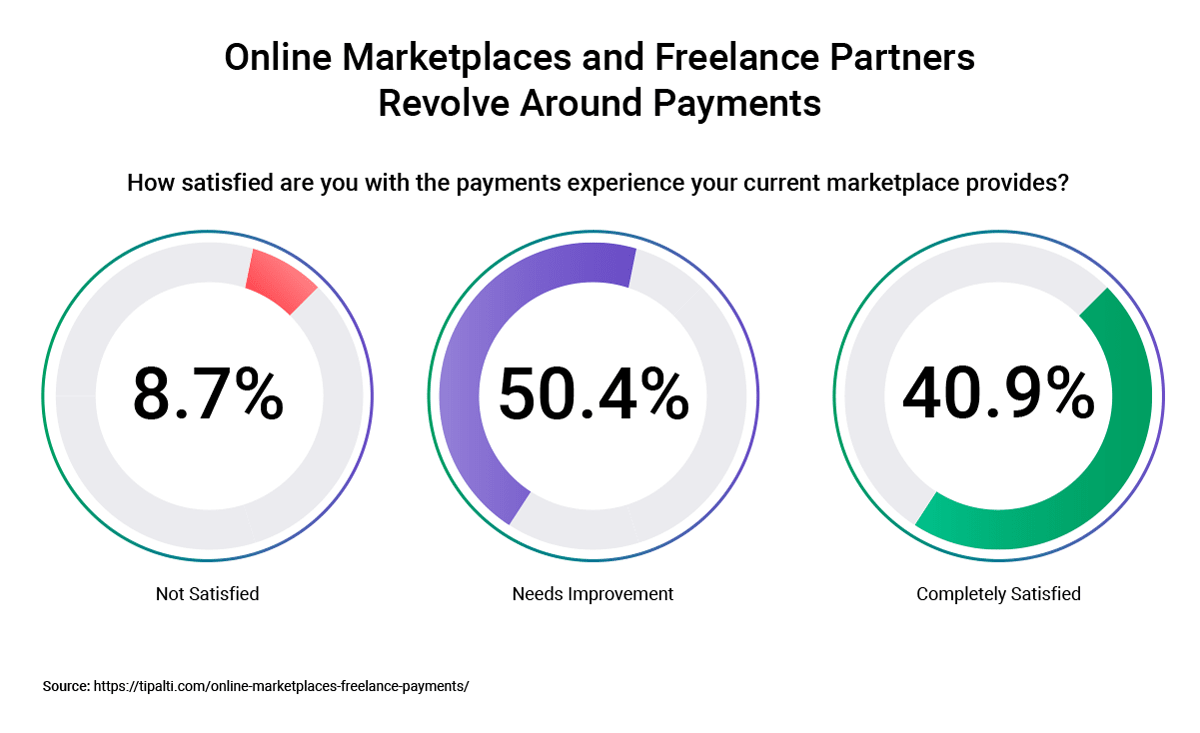

Prepaid-as-a-Service (PaaS) is reshaping the prepaid card industry by enabling companies to launch white-label prepaid card programs.

For instance, Apple’s Cash Card, powered by Green Dot, allows consumers to seamlessly collect and spend daily cashback.

PaaS providers offer robust backend systems, including administrative portals, secure encryption, and compliance with regulations like PCI DSS and PSD2. This approach not only reduces the barriers to entry but also enables businesses to provide custom-branded prepaid card solutions, opening up new revenue streams.

Final Thoughts

The prepaid card industry is evolving rapidly, driven by technological advancements, changing consumer preferences, and the growing gig economy. Whether it’s payroll cards, virtual cards, or eGift cards, prepaid solutions continue to meet the diverse needs of businesses and consumers alike.

If you’re curious about the trends shaping the prepaid card market or have ideas to share, we’d love to hear from you. Let’s explore how prepaid innovation can benefit your business and customers.