Payment processors were hard hit between March and April of this year, as “closed” signs were hung in global economies to stymie the spread of COVID-19. As lockdowns are lifted and countries begin to reopen after flattening curves, transaction volume is rising.

Although we are beginning to see some recovery, this is just the beginning of the “new normal.” The pandemic still looms large. A true return to “before” may only come from a vaccine or cure. By then, new behaviors will be strongly instilled in consumers, merchants, and processors alike.

As we enter a new phase, what can payment processors do to safeguard their customers and their cash flow? We look back at the past few months to see what challenges and opportunities arose as a result of current events.

The Pandemic’s Impact on Payment Processing

Industries and Channels Hardest Hit

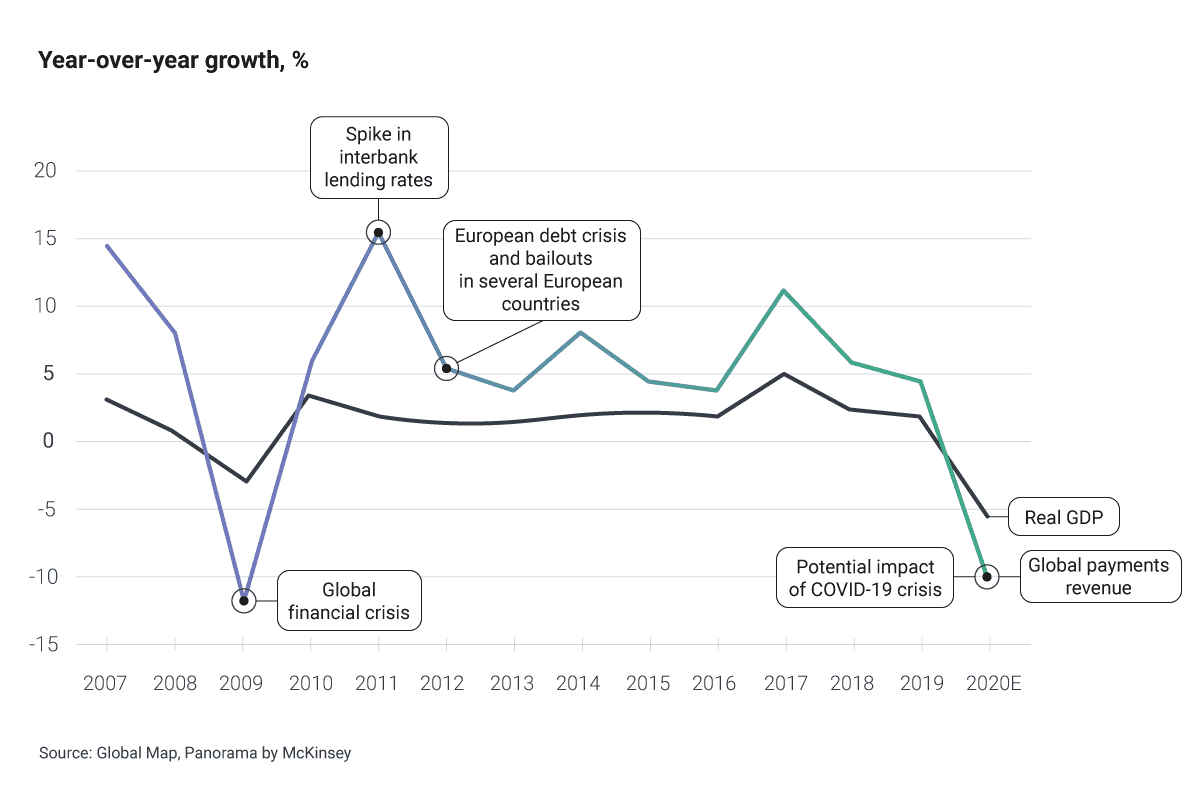

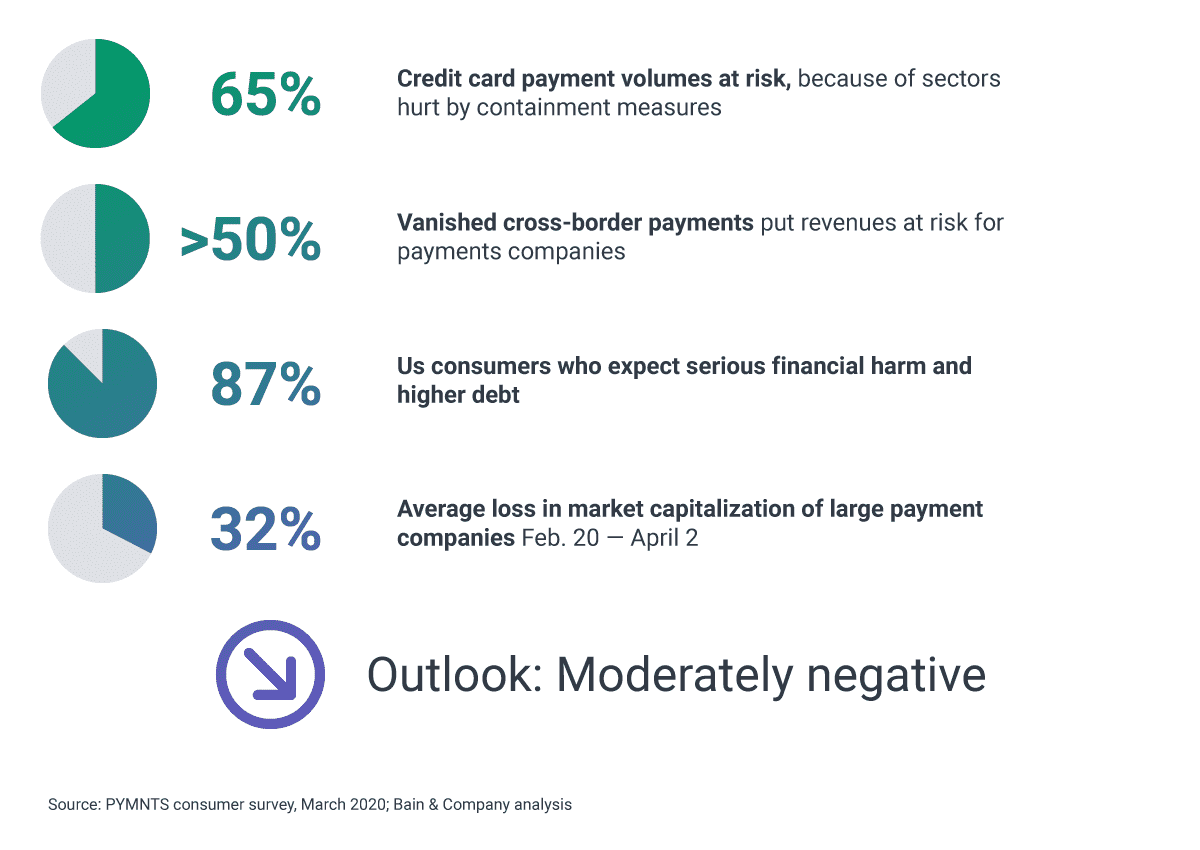

As the world screeched to a halt to slow the spread of the virus, payments likewise slowed. McKinsey predicts a global GDP decline of 8-10%, almost on par with the impact of the 2008-09 global financial crisis.1 However, investors were already driving the share prices of payments companies into a sharp decline, far below actual profit impact.

UPI reported fewer than a billion transactions processed in April, the first time in a seven-month period.2 Cross-border transactions were especially affected as borders closed and lockdowns kept consumers in place. According to Bain & Co., payments companies focused on that channel could expect a 30% drop in revenue.3

In a similar vein as cross-border transactions, card present transactions took a dip, particularly in industries related to travel and tourism. Shift4 Payments reported that hotel transactions dropped from 186 million at the beginning of March to just 8 million by the end of the month.4 The airline industry lost 96% of traffic in a year over year comparison, a low that hasn’t been seen since 1974.5 Tickets for live events declined 90% year over year in March, though they have begun to see some recovery thanks to virtual events.6

Chargebacks were also a major issue for merchants and processors alike. What had made up 0.05% of transactions had ballooned to 40% as consumers demanded refunds and initiated disputes.7 PayPal and Square implemented holdbacks of up to 30% to protect themselves from such demands and drew ire from their merchant clients.

Changes in Consumer Behavior

Despite the abounding negative effects of the pandemic, there were some optimistic notes. Digital payment channels proliferated, growing as much as 30%.8 Even with essential businesses like grocery stores open, consumers turned to digital channels and delivery services to protect themselves from potential infection. Many payments companies are now grappling with the swift change to online and digital channels.

The blueprint, if not the infrastructure, for greater digital payment channel adoption was present as the pandemic unfolded. Mobile order-ahead and delivery services in restaurant and grocery channels are two of the biggest drivers of the acceptance of digital payments. New account openings on food service websites increased from 7.5% growth in January to 36% by the end of March.9 Two in five consumers are using order-ahead services on their phones frequently.

The shift to digital purchasing may continue past lockdown, permanently moving purchases traditionally made in-store to online. UPI reported in June that transaction volume is on the rise as a result of utility and shopping payments completed through contactless means. Google Pay reported seeing a return to pre-lock down levels, although full economic recovery is still some time away.

Recovery has been sharper for credit cards than debit, though the latter is growing. A sizable chunk of those transactions have taken place online, even with retail locations being open for business. The focus of this spend has been in industries such as entertainment and education. Spend on segments such as airlines, fuel, movies, and dining continue to be low because consumers are still traveling less and many businesses in those industries are closed.

What Can Payment Processors Do Now?

Structural changes are happening: the transition to digital payments has been accelerated. Bain & Company estimates that post-pandemic, the acceleration will increase between 5-10% by 2025.10 While the question of how long-lasting this behavior will be is still to be answered, in the short term there are a few actions payment processors can take in order to safeguard their business and their clients.

The following are three actions payment processors can implement. The degree and form of the action will vary between organizations, as they should be dictated by the needs of an organization’s audience and business processes. However, the sooner these actions are put into place, the more likely processors will be ready for future tumult caused by the pandemic.

1. Earn Customer Trust

Even before the pandemic, customer service, better reporting, and a speedy setup were all highly ranked as reasons why small businesses changed payment processors. Now more than ever, supplying excellent service is an absolute must. Being communicative will help to reassure customers that you are present and listening. Understanding specific problems will also provide a personalized touch that can secure more business in the long term.

One service offering processors can offer their merchant clients is helping them build a web storefront with signatureless pickup and delivery options. Add-ons like chatbots, a wide variety of contactless payment types, and biometrics like voice ordering may appeal to different industries and targeted demographics.

Another choice to offer deferred payments for credit cards, waived subscription fees, or free trials to merchants in financial distress. Despite growing business challenges, now is a time for processors to show empathy toward merchants.

2. Go on the Offensive to Gain Market Share

Payment processors can advertise services aimed at helping merchant customers in these difficult times.

Fast enrollment for online or card-on-file transactions is one idea. Another is offering instant issuance of prepaid cards that work for both online and physical shopping, which targets both younger and underbanked consumers. Tap-to-pay cards and mobile wallets both offer contactless payment options that serve social distancing measures. Mobile wallets can be further augmented with instant digital issuance and push provisioning, putting payment methods into the hands of consumers quickly and easily.

Processors can offer merchants instant, easy ecommerce and card not present services, especially those where online commerce and delivery services have been underserved. Pay by link or pay later solutions may prove popular.

Providers should also consider investing in value-add services, especially when included in a powerful mobile application.

3. Review Credit Assessments

Standard creditworthiness metrics may no longer capture the increasingly volatile economic conditions. Payment providers should assess and upgrade their credit risk assessment tools.

Investing in a fraud detection model is a smart decision, especially in areas that are witnessing a sharp rise in online transactions due to the pandemic. Artificial intelligence, such as machine learning, can help identify questionable transactions amid a sea of rising digital purchases.

It’s also worth evaluating supply chain finance and working capital solutions that help distressed merchants, such as cash advances related to point of sale volumes.

Conclusion

The above are just three actions payment processors should take during the pandemic. The exact plan organizations should take will vary due to a number of factors. It’s too soon to know when the pandemic will end, or the depth and duration of the current economic downturn. What is clear, though, is that payment systems have entered a new phase of digital innovation.

Carefully planning moves in the above listed actions can raise the odds for payment processors. The pressure is on to be one of the payments providers that survives through this digital shift, instead of becoming obsolete.

If you’re interested in discussing any of the above topics, or what solutions would work for your specific needs, contact Softjourn today. We have more than 10 years of experience working with Fintech and Cards & Payments companies, which includes payment processors, banks, transaction acquirers, and prepaid card service providers.

1Bruno, P.; Chaudhur, R.; Denecker, O.; Lundberg, T.; Niederkorn, M. (n.d.) How payments can adjust to the coronavirus pandemic--and help the world adapt.

2Upadhyay, H., Mittal, A., Mittal, H. U., Tyagi, H. U., & Harsh Upadhyay (2020, May 01). Lockdown effect: UPI records over 20% fall in transaction in April.

3Gringoli, V., Williams, G., Ott, J., & Olsen, T. (2020, April 29). The Covid-19 Tipping Point for Digital Payments.

4COVID-19: The Impact of a Pandemic on the Payments Industry. (n.d.).

5(TEGNA), A. D. (2020, June 11). 96% drop in US airline travel recorded in April.

6Bary, E. (2020, May 12). Eventbrite stock slides toward worst day in a year amid collapse in ticket sales.

7Rudegeair, P., & Andriotis, A. (2020, June 15). Hit by Coronavirus-and a 30% Holdback by the Payment Processor.

8Jackson, D. (2020, May 13). Analysis: Transactions Drop as Consumers Go Into 'Savings Mode' & Digital Payments Soar.

9COVID-19: The Impact of a Pandemic on the Payments Industry. (n.d.).

10Gringoli, V., Williams, G., Ott, J., & Olsen, T. (2020, April 29). The Covid-19 Tipping Point for Digital Payments.