Softjourn recently developed prototype functionality, which we call our Cryptocurrency Banking Service, to demonstrate how Softjourn can support financial institutions that recognize the market potential of enabling customers to buy and sell cryptocurrencies from within traditional bank accounts.

The prototype, which is powered by our own “Token” cryptocurrency, uses smart contracts and is built on Quorum, an enterprise-focused version of the Ethereum, which itself is a business-focused adaptation of blockchain technology. We’ve used Quorum in multiple blockchain-based applications and recognize its suitability for high-speed, high throughput processing of private transactions within a permissioned group of known participants.

In our opinion the Quorum distributed ledger and smart contract platform is the best technology to build multicurrency wallets for use in financial transacting and bank accounts. The private blockchain configuration, along with the platform’s speed and convenience, provide the fundamental tools to support a high-volume environment.

In the first stage of our prototype development, the Cryptocurrency Banking Service has limited functionality and handles only the Softjourn Token cryptocurrency. Even in this limited release, however, it demonstrates Softjourn’s experience and familiarity with blockchain-based financial applications and how we can support financial institutions and others to extend traditional banking to incorporate cryptocurrencies. Our solution architecture includes a mobile app, API and server. In the future, we are planning to include support for popular cryptocurrencies such as Bitcoin and Ethereum.

Background

Cryptocurrencies in 2018 have taken an odd turn as consumers and even institutional investors have hit the pause button, seemingly asking, “What’s going on here?” The question is no longer “How high will bitcoin go?”, but “Where’s the bottom?” The most popular cryptocurrencies—such as bitcoin, Ethereum and Litecoin—have lost half of their value or more since the beginning of the year.

As the global financial landscape continues to evolve, cryptocurrency is carving out a significant niche within traditional banking. Digital currencies, once a novelty, are now transforming into mainstream financial assets. This transition has paved the way for cryptocurrency banking services, where the decentralized world of crypto meets the regulated realm of conventional banking.

Advantages of Cryptocurrency Banking Services:

-

Security: Leveraging advanced cryptographic techniques ensures that transactions and digital wallets are secure. Many services also offer insured custodial solutions, providing added assurance to users.

-

Convenience: Users can now manage both their fiat and crypto assets from a single platform. Whether it's converting cryptocurrency to fiat, making online payments, or transferring funds, cryptocurrency banking services simplify the process.

-

Global Transactions: With the inherent borderless nature of cryptocurrencies, international transactions become swift, transparent, and often less expensive.

-

Accessibility: Cryptocurrency banking services can cater to the unbanked or underbanked populations, granting them access to the global financial ecosystem.

-

Regulatory Compliance: By merging with traditional banking structures, many cryptocurrency banking platforms are aligning with regional and global regulations, ensuring users' trust and broader adoption.

The Road Ahead:

While the momentum is strong, cryptocurrency banking services are not without challenges. Regulatory ambiguities, market volatility, and scalability issues must be addressed for sustained growth. However, with continuous technological advancements and evolving regulatory frameworks, cryptocurrency banking services are undoubtedly poised to redefine the future of finance.

But, rather than viewing the retreat in cryptocurrency value as a sign that the day of cryptocurrencies is over, at Softjourn we believe that cryptocurrency is taking a small timeout—giving regulators, markets, institutional investors, businesses and consumers a breather to prepare for what’s next.

Although our crystal ball isn’t big enough to predict how or when cryptocurrencies will enter the financial mainstream, we do know that at the end of this journey, cryptocurrencies—and, particularly, the distributed ledger technology that supports them—will be an important and permanent part of the financial services landscape.

And, this means that every financial institution that intends to be a long-term player must develop its cryptocurrency strategy and begin a hands-on relationship with blockchain technology.

Customers will demand their participation in offering cryptocurrency services, and sheer economics and the need for stronger security will demand financial institutions’ participation in blockchain.

With our Cryptocurrency Banking Service prototype, Softjourn is paving the way for financial institutions to begin their journey into incorporating cryptocurrency services within their capabilities and gaining firsthand experience with blockchain technology and a blockchain-based platform.

The Need

Ironically, while blockchain and other forms of distributed ledger technology are generating massive investment and adoption worldwide (See figures 1 and 2), cryptocurrencies (which the blockchain was invented to support) are floundering in terms of their acceptance to purchase mainstream goods and services. One of the chief issues is cryptocurrencies are largely illiquid. They’re accepted as payment by relatively few mainstream retailers, even in ecommerce environments, and selling cryptocurrencies is slow and expensive because they operate in a heavily skewed supply-side market.

More active participation by financial institutions could increase liquidity in cryptocurrency markets and help cryptocurrencies become more mainstream as they fulfill their original mission as currencies rather than the speculative investments they’ve become. And, financial institution participation in cryptocurrencies has the potential to draw assets back into the banking system that currently exists outside it, giving financial institutions additional deposits under their control and improving capitalization.

Santander, RBC, JP Morgan, Citibank, BNY Mellon, American Express, Visa, MasterCard, and Goldman Sachs among others are all conducting multiple blockchain-related efforts and have internal working groups or dedicated professionals focusing on blockchain technology…

As CoinDesk author Noelle Acheson astutely wrote in October 2017, when the PoCs and pilots in financial services combined, we see abundant R&D that points to pervasive adoption in the future.1

Financial institutions are well-suited to play a role in cryptocurrency because—after all the hype is cleared away—supporting cryptocurrencies is similar to foreign exchange services, which many financial institutions do routinely—albeit, today, largely without the benefit of the blockchain. It isn’t far-fetched to anticipate the day when a financial institution’s customers—particularly its high-wealth customers—would pursue a personal finance diversification strategy of holding their assets in multiple currencies, such as euros, dollars, pounds, bitcoin and Ethereum and buying/selling those assets as world events, valuations and their own needs change. Many individuals are doing so today but with a key difference—their cryptocurrency assets and buying/selling those assets reside outside the banking system.

It is a business imperative for financial institutions to explore cryptocurrency and become familiar with blockchain as a business service if the banking system is not sufficient to support customers’ need to buy/sell cryptocurrencies. This might happen through hands-on implementation and experimentation. It’s clear that within the next three to 10 years, the blockchain will have a profound effect on all business operations but particularly on those involving financial services. Already, there are hundreds of patents issued and applied for involving financial services operations.

We believe this timeout respite, referenced above, works to the benefit of financial institutions. Before 2018, cryptocurrency mania was so intense that it was challenging for financial institutions to reflect thoughtfully on their role in the cryptocurrency and blockchain universe. With the benefit of time, financial institutions can now be strategic in identifying the role they will play in the emergence of cryptocurrencies and in pursuing opportunities to gain hands-on experience with blockchain technologies.

The Solution

Softjourn’s Cryptocurrency Banking Service provides both customer-focused functionality at the intersection of banking and cryptocurrency and a hands-on experience for financial institutions to become comfortable and conversant in blockchain technology.

Our prototype draws on the following resources:

- Quorum is an enterprise-focused version of Ethereum created by JP Morgan Chase.

- Privat24 Banking System, created by one of the oldest and largest banks in Ukraine, serves as our payments gateway.

- Smart contracts are the trading contract and representation of user accounts that include information about users’ account balances and trading history within the blockchain.

- Our own cryptocurrency, which we call “Token,” powers the service.

Quorum manages much of its secure message transfers through a system called Constellation. Constellation is a general-purpose mechanism that is not necessarily blockchain-specific. It involves encrypting specific messages in communication with an enclave, a store of previous transactions, authenticity, and authentications. Much of the cryptographically-heavy work is done within the enclave and the communication relay between it. Constellation, and the architecture it supports, is one of the reasons for Quorum’s superior speed.2

How It Works

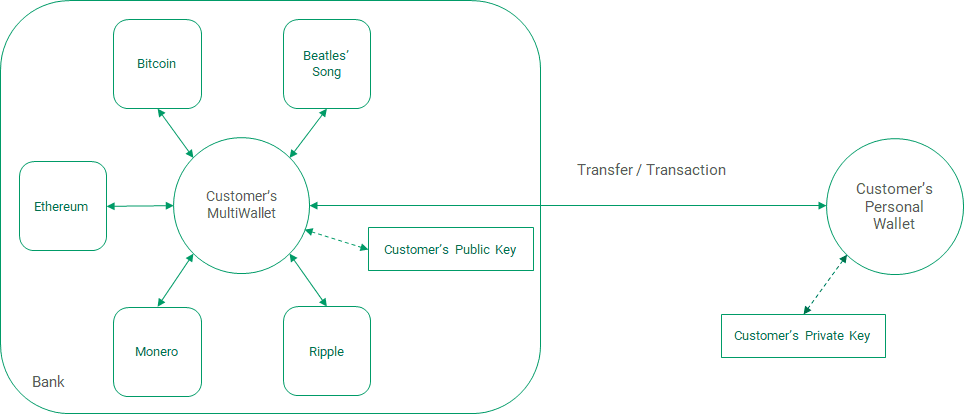

The main participants in the Cryptocurrency Banking Service are customers—platform users who buy and sell Tokens and also view their account status and transaction history—and banks—platform users that issue Tokens, set the Token exchange rate, and view the bank account status, all user accountsand transaction history. Figure 3 presents the main relationships in the system.

Creating a New User Account

The process has two steps:

- The customer manually creates an account in the Privat24 Banking System.

- The customer creates an account in our system, and during this process needs to provide the Privat24 Banking System credentials.

Our system uses these credentials to create a smart contract that holds information about Token balance and all blockchain transactions.

Transaction Processing

The primary platform actions related to transaction processing are buying and selling Tokens.

The “buy” process is described below. The “sell” process is the same but with the customer and bank assuming opposite roles from the buy process.

- The system checks if the desired value in Tokens is available and creates a transaction in the blockchain that holds them if they are available or cancels the transaction if they are not.

- Once the Tokens are held, the system uses the Privat24 online banking system to transfer money from the customer’s account to the bank account if action is “buy” or vice versa if action is “sell.” The amount of money transferred is the computed result of the number of Tokens and the exchange rate.

- Once the transaction is successful in the Privat24 online banking system, the system credits the Tokens to the customer’s balance.

- If the transaction is not successful in Privat24, the system credits the Tokens back to the bank balance.

There are actions that can be processed only by the bank: “set rate” and “emit coins.” The “set rate” action is used to manually set the exchange rate, and the “emit coins” action is used to add new coins to the bank’s account. Note: Currently, there is no limitation on exchange rates or the number of coins that can be issued.

Conclusion: Pioneering with Crypto Banking App Development

The rise of cryptocurrency banking services has given birth to a surge in crypto banking app development. This arena is an amalgamation of cutting-edge cryptography, seamless user experience, and robust financial tools tailored for the digital age. Crypto banking apps are redefining mobile finance by offering features like instant crypto-to-fiat conversions, peer-to-peer transfers, real-time transaction tracking, and secure digital wallets, all accessible with a tap on a smartphone.

As more people embrace the convenience of mobile banking and the potential of cryptocurrencies, there's a growing demand for apps that can bridge the two worlds seamlessly. This has paved the way for developers and financial institutions to collaborate, ensuring these apps not only provide robust functionality but also adhere to stringent security standards and regulatory guidelines. By investing in crypto banking app development, businesses can tap into a burgeoning market, foster customer loyalty, and stay at the forefront of the financial technology revolution.