Hyper-personalization has become integral not only for banks but for everyone offering services in the finance industry. Banks are now focusing on the customer experience to offer their users tailor-made services that make a difference.

New age consumers are already used to hyper-personalized approaches in other aspects of their lives. Offering a unique selling point to millions of users is something that helped giant companies grow and expand, and while some banks have already started using this approach, others are struggling to adopt technology to analyze vast amounts of data.

We can define hyper-personalization in banking as a unique approach that offers tailor-made products to clients. Driven by behavioral science and artificial intelligence (AI), product recommendations that are aligned by the data collected on the individual’s transaction history, shopping habits, location, and so on go directly to a client. AI uses all the customer data to generate comprehensive profiles that banks can later use to make product offers that cater to the individual’s changing needs.

The future success of every bank will largely depend on maintaining a delicate balance between technology-based services and the integrity of data protection.

The Power of Technology-Based Banking

Banks have entered a new era. Today, behavioral analytics are being joined with AI and smart routing systems to provide every customer with the services they need through personalized recommendations. To unlock the power of customer data, banks will have to aggregate it on clouds across different departments and sections. With true customer profiles that reflect their financial capacity, spending habits and location, banks can offer individually tailored solutions.

As digital banking becomes "imperative"1 banks will have to invest more in data management and personalization to maximize their digital transformation. For example, digital customer profiles can help a bank system determine what kind of card to offer individuals or when the right time is to suggest a loan.

Hyper-personalization in banking makes it possible to serve thousands of unique clients, while providing specialized services to each and every one of them more easily than ever before.

Growing Expectations

The digital transformation of the banking sector was inevitable, but adoption has been slower than in other industries. Since the COVID pandemic, however, banks have been rapidly making efforts to improve their customer experience and offer hyper-personalized services.

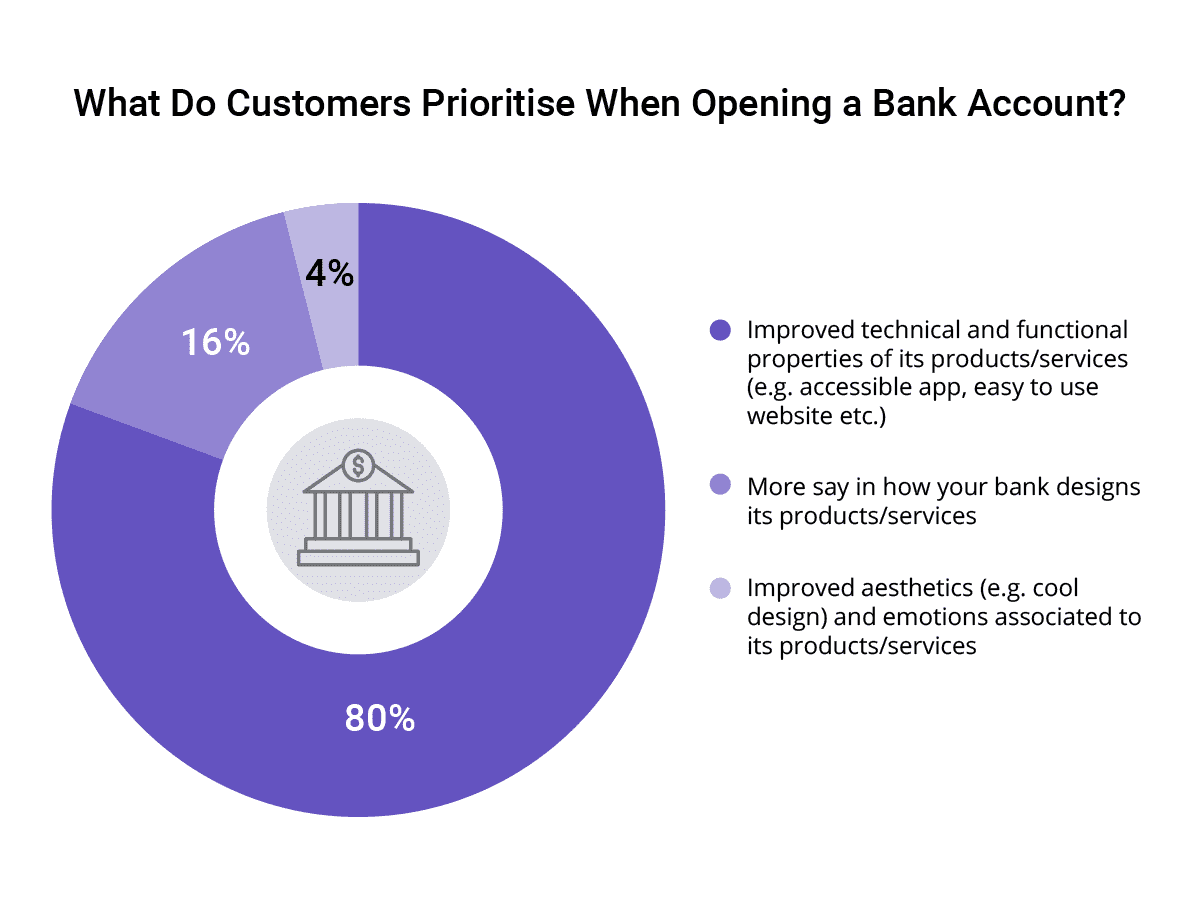

Source: The future of retail banking: The hyper-personalization imperative

Neobanks were the quickest to cater to the needs of a new generation of customers who expect a hyper-personalized approach in every kind of service that they use. What's more, neobanks noticed immense potential for attracting specific groups of clients and offering them a unique set of services, generating momentum where people with similar experiences want to be a part of a greater community.

Implementation of Hyper-Personalization in Banking

Hyper personalization gives a competitive advantage to reinforce brand visibility while offering high-quality services. An increase in IT budgets is a first step towards recognizing the problem, but it takes time to better understand how to communicate with your users to create customized offers.

- Build omnichannel experiences

- Understand customers and their needs

- Prevent customer retention

One of the best examples for using hyper-personalization in banking is Capital One, a US-based company. It sends clients notifications, assists with simple tasks, sends new offers, and helps in managing personal finance. They partnered with several retailers, and now they are using geolocation to prompt customers with purchasing offers when such individuals find themselves close to these partners.

HCBC has started using AI to predict customer behavior regarding card points redemption and offer them valuable rewards. They noticed that clients enjoyed receiving personalized awards and even opened their email notifications more often than before.

How To Come Up With a Plan

It’s fairly simple to understand what makes personalization so effective, but it’s another to actually provide impactful experiences. The biggest challenge lies in trying to learn what your customers need and how to offer it to them. Personalization is a quick way to help customers resolve relatively simple issues that otherwise make their banking experience less easy. There are several approaches you can take:

- Recommend products

- Propose offers and discounts

- Teach customers about new financial products

- Filter and remove unnecessary products

- Predict customer needs based on data

- Provide customers with clear options

Possible Use-cases of Hyper-Personalization in Banking

Financial Wellness Coaches: Guiding Customers to Success

Robo-advisory services use AI algorithms to provide personalized financial advice to customers based on their individual financial goals, risk tolerance, and investment preferences. In addition, context-based recommendations, such as real-time budgeting tips and location-based spending insights, help customers make informed financial decisions tailored to their unique circumstances.

Customized Banking: Crafting the Perfect Financial Toolkit

Banks can now offer customized loan and credit card options that cater to each customer's specific needs and financial situation. In addition, personalized investment products, such as individualized portfolios based on customer risk profiles and financial objectives, ensure customers receive tailored financial solutions that align with their goals.

Always-On Customer Support: Reinventing Service with AI

AI-powered chatbots provide personalized customer support by leveraging natural language processing and customer data to understand and address individual needs effectively. Proactive problem resolution involves identifying potential customer issues before they arise and providing swift, tailored solutions to minimize inconvenience and enhance satisfaction.

Targeted Marketing: Engaging Customers with Precision

Data-driven marketing campaigns and personalized product recommendations enable banks to engage customers with relevant and timely offers that resonate with their individual preferences. In addition, personalized rewards and loyalty programs, designed based on customer behavior and engagement, further enhance customer retention and loyalty.

6 Examples of Successful Hyper-Personalization in Banking

1. Teach customers about new products: Intesa Sao Paolo

This famous Italian banking group worked on the development of a program to increase consumer receptiveness to the data collection that was necessary for the future. The program was designed to do two things: demonstrate clear value for its clients and establish boundaries on how collected data was used.

To ensure every customer understood the value of data collection, Intesa designed a messaging solution presenting all the benefits every individual would receive. Simple messages that tackled all questions and used simple language made customers more open to cooperation. Since Intesa implemented this policy, almost 80% of its customers have agreed to allow the highest level of data usage.

2. Netflix-style product recommendations: Bank of Ireland

On one occasion, the Bank of Ireland announced its intention to become the “Netflix of Banking” so their customers could have access to personalized banking services and offers.

Thanks to skilled teams of data specialists and experts, the Bank of Ireland wants to leave the one-size-fits-all approach behind and work on better tactics to serve its clients. As customer journeys are getting more complex and require the use of more devices, the Bank hired experts to analyze customer behavior in a way similar to what retailers do, to offer clients new credit cards, loans, account upgrades, and smoother mortgage onboarding.

3. Propose new offers: Bank Zachodni WBK

Poland’s third-largest bank, which operates within the Santander Group, is working hard to provide their 4.3 million customers with more personalized products. Their new project is based on using AI to gather more data about customer use of social media and activity in online communities.

This data is used to generate targeted offers to both potential and existing customers to respond to their ever-changing needs. Ultimately, the NEO Intelligence project supports customer acquisition and is helping strengthen the Bank’s relationship with its most valuable clients.

4. Predict customer needs: Royal Bank of Canada

Back in 2016, the Royal Bank of Canada had an ambitious plan to implement personalization through all its digital channels. First, it started with a new app and launched a series of initiatives to refine a personalized approach to all of its customers.

“With a single mobile app, we can personalize the experience to suit a particular consumer’s need,” says Rami Thabet, VP of Digital Products from RBC. “So, in the same app where you pay your bills, you will see Find & Save, and a very tailored investing experience.”

RBC’s digital assistant NOMI includes real-time insights, help with automated savings, budgeting, and access to information at any time. NOMI currently offers NOMI Insights, NOMI Find & Save, NOMI Budget, and Ask NOMI. In the first quarter of 2020, it had over 1.1 million users.

5. Provide consumers with a clear set of options: Daylight

A US-based neobank called Daylight has decided to develop a unique banking experience for the LGBT community and thus to meet their particular needs.

Daylight’s specific features include personalized cards, sessions with financial advisors, and access to customized loans. The bank also offers customized recommendations to members and sends notifications when individuals spend money in stores aligned with their community's values.

6. Make promotional offers: Mitto

An interesting example of a neobank with unique branding is Mitto, a Spanish fintech startup devoted to environmentalism. Mitto is transparent about its CO2 footprint and has attracted a lot of young adults, teens, and even other startups to use its financial services. The neobank also helps its clients get discounts on sustainable brands and services that align with their environmentalist lifestyle.

Following its hyper-personalized approach, Mitto shows how much CO2 every transaction generates and suggests environmental causes the customer might support.

What The Future Holds

Business Insider shared that banks invested in their IT budgets over $66 billion in 2020 with a tendency for those numbers to increase in the next five years until they reach an estimate of $83 billion in 2024.2

The surge of newly formed digital banks aimed at specific demographics or communities has provided more opportunities for consumers, as it gives them access to a much broader range of financial services.

Those banks that deliver truly personalized services will gain a significant advantage in the future and that’s why so many big names are focusing on developing a new hyper-personalized approach.

Digital banks will focus on customers and their future financial goals rather than pushing products that may not be the best fit for them. Building emotional connections with entrepreneurs, freelancers, minorities, unbanked communities, or students is an approach that builds trust. With hyper-personalization in banking, every customer can get the right message at the right time.