One positive side-effect of the pandemic has been an explosion in e-commerce. Not only have online sales grown, but also the number of individuals making online purchases has skyrocketed. Still, between any order and delivery lies a critical step: online payment. Payment failures can come from both the merchant and the customer end, and that’s why it’s not always easy to locate the source of the problem.

Payment failures also make fraud more difficult to detect. A study1 by ClearSale found that more than $400 billion could be lost due to fraud by the end of 2025. While only 50% of businesses prioritize payment strategies, they are also the ones that are growing the most. These businesses are concerned with protecting their customers with a secure transaction approval process and high approval rates.

Regulation is one of the best ways to protect both consumers and merchants. That is why the financial industry has Payment Card Industry Data Security Standard (PCI DSS)

How Payment Orchestration Works

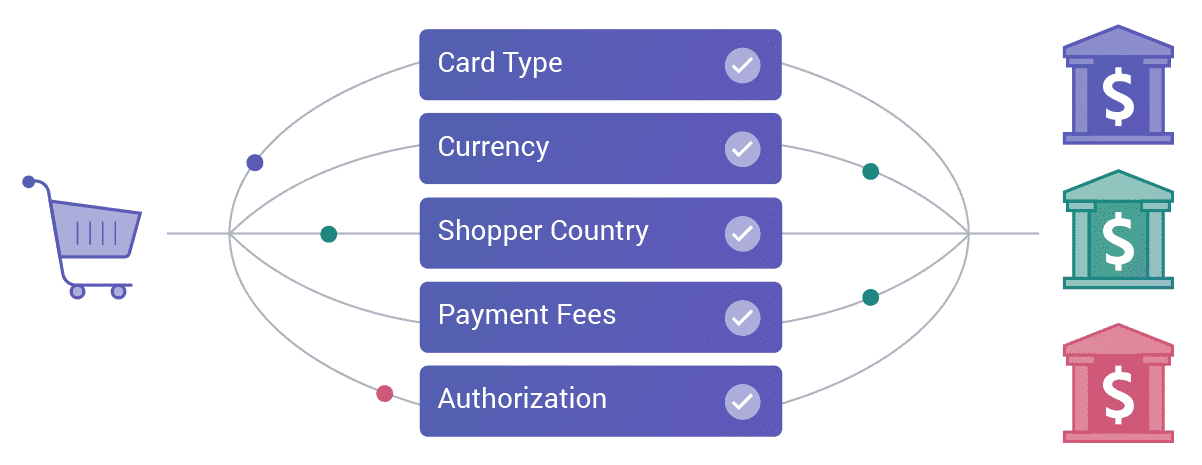

Payment orchestration connects all the tools necessary to increase the conversion of transactions.

Some of the biggest advantages of using payment orchestration are optimizing payment flow and removing unnecessary complications from the payment process. Since payment gateways can vary according to their location, type and brand, it’s important to include all those factors to achieve the highest acceptance rate.

Payment orchestration funnels transactions through the gateway most likely to approve the payment, increasing approval ratings and lowering fees.

Payment orchestration automates managing individual payment gateways and other banking processes. That way, IT experts can focus on different aspects of business processes. Once the focus shifts to the end-consumer experience, you will see improved ROI on a transaction basis.

Using payment orchestration, card issuers, payment processors and, ultimately, merchants can significantly reduce the number of declined transactions. The payment orchestration platform can aggregate data to present merchants with real-time analysis and translation data. What’s more, with improved payment gateways, merchants can ultimately decrease their transaction fees and significantly improve service quality—to everyone’s benefit.

What Are Cascading Payments?

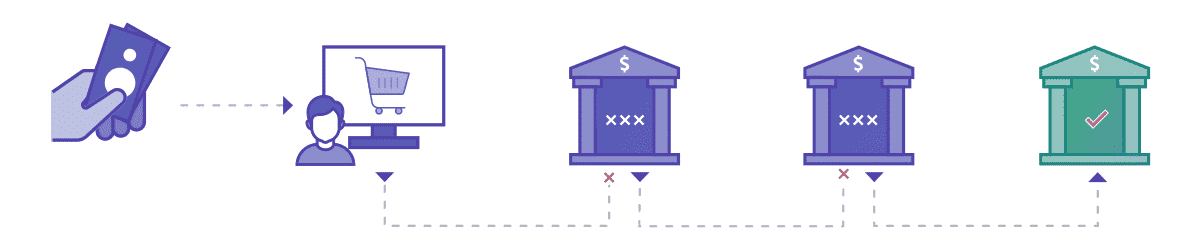

A cascading payments feature allows merchants to configure transaction distribution and redirect it towards the right partner. Transactions from certain parts of the world can be redirected to specific acquiring partners to provide better approval ratios and increase profit.

Using cascading payments can have a positive impact on revenue due to more approved transactions and lower transaction fees.

Smart routing solutions can rank for multiple destinations to determine which one will perform best. After analyzing failed transactions, smart routing ranks all possible alternatives to identify new potential pathways. Once there’s a new pathway with increased chances of approval, our solution reroutes the transaction.

With fewer failed transactions, you also ensure a more positive customer experience. They won’t have to struggle with purchase declines, nor will they have to input their payment details several times before the transaction goes through.

Setting up cascading payments will increase your transaction approval rate and gateway downtime. Cascading payment works like an insurance policy that ensures all your losing transactions will find the right gateway.

Failing Payments: How to Eliminate Them

Failed transactions are one of the biggest challenges merchants face in terms of payment, as more than 65% don’t receive any data to explain when or why the payments were declined. And with more than 31% of merchants saying that payment issues are preventing them from entering new markets, it is clear that failing payments are one of the most troubling issues in e-commerce.

At times, a single glitch in the payment process generates errors and leads to an unsuccessful purchase. Unsuccessful transactions raise problems for merchants and customers alike, as they can compromise the security of data. Ultimately, they also waste valuable time and money, which discourages customers from returning to the same website.

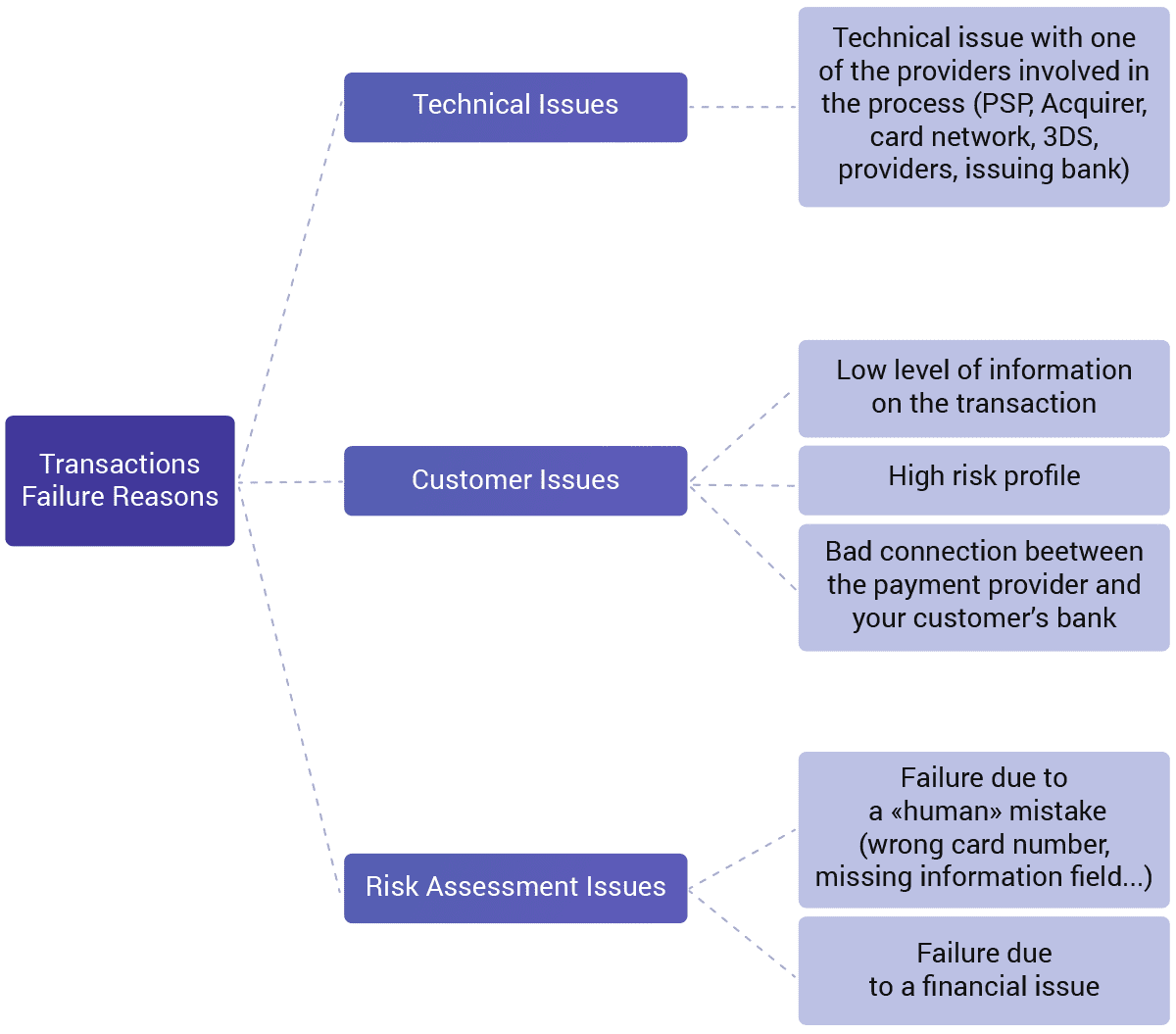

Payments fail due to one of the three reasons: financial problems, technical bugs, and risk assessment. Financial problems usually have something to do with card limits, insufficient funds to cover the transaction, or problems with the card itself.

Payments can fail due to three main reasons: technical, financial, or risk assessment.

Technical problems are slightly more complicated, as they cover various situations, from bad internet connections to transactions flagged as fraudulent. As it’s often hard to determine what exactly happened and why a transaction was declined, merchants opt for payment orchestration to help them mitigate the risks.

Optimizing Transactions Using Orchestration

When merchants rely on a single PSP/acquirer, the vendor controls their transaction flow. That might not be the best solution, as it increases the risk of payment refusals.

Payment orchestration layers are currently one of the best ways to provide a seamless checkout experience and accommodate all payment services, which can otherwise be time-consuming and costly. Payment orchestration also offers you a chance to easily re-route failed transactions and optimize processing rates to provide a frictionless experience to your customers.

Finding The Right Payment Orchestration Platform

When comparing payment orchestration platforms, you’ll have to consider three main factors: whether the platform is vendor agnostic, use case, and ease of use.

When analyzing each platform, one of the first things every client should know is whether they offer payment orchestration in addition to a payment gateway. If that is the case, keep in mind that preferred payment gateways can impact your ROI. Vendor-agnostic payment orchestration will work with multiple providers so your customers have a smooth checkout experience.

Before you decide which platform to use, analyze your needs and assess the value this might bring to your business. If you are receiving payments from all over the world, you need globalized payment processing. Research different offers to see where the strengths of each vendor are.

Lastly, ease of use plays a significant role in deciding which platform you should go to. Some payment orchestration solutions are low code or no-code, while others require additional resources.

Smart Payments Orchestration Benefits

Cascading payments and payment orchestration will undoubtedly play a role in mitigating both technical and customer issues and drive automation in online payment processing. Merchants will have to work on customer experience to come up with innovative offers to remain competitive.

With cascading and payments orchestration, payment processors can both mitigate and resolve the issue of false positives.

Some of the benefits of using payment orchestration include:

- Improved quality of user experience

- Increased authorization rate for merchants

- Lower transaction fees

- Less time involved

- Flexible and scalable

Conclusion

Every merchant wants to have repeat buyers who feel safe while shopping. Payment orchestration solves numerous problems and enables merchants to take control of their transitions.

By leveraging modern technology, you can prevent payment outages, reduce transaction fees, and offer frictionless checkout experiences to all your customers. Ultimately, payment orchestration allows you to be agile and have all the necessary data to scale your business, both now and in the future.

Softjourn is a global technology services provider with over 10 years of experience working with Cards & Payments service providers. We've built creative solutions or augmented in-house technical teams to provide support and project-specific expertise resulting in revenue-generating features.