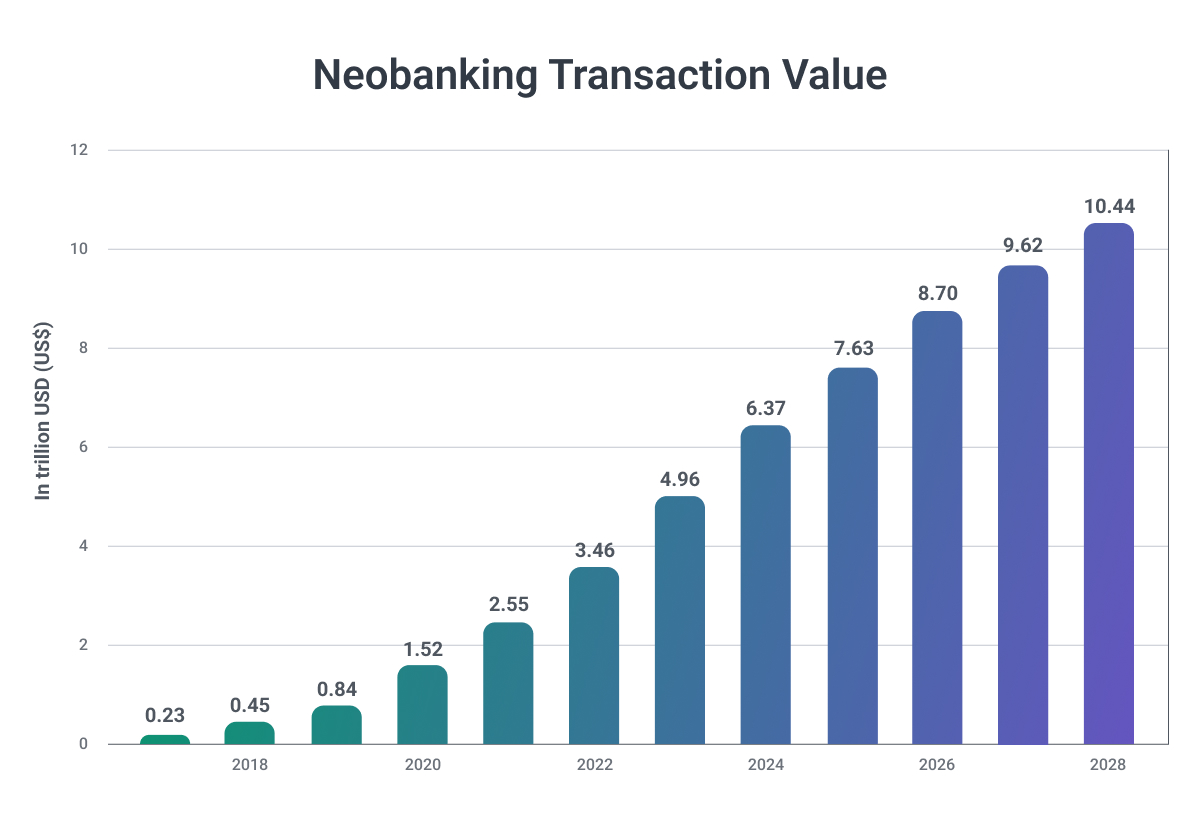

The digital banking revolution continues to accelerate faster than before. As we start to move through 2026, neobanking has evolved from a disruptive challenger to an established economic pillar in the global financial system.

The overview of 2026 looks quite different from just two years ago as neobanks have grown from a handful of mobile-first startups to big financial systems that continue to offer convenience to hundreds of millions of users worldwide.

According to the Mordor Intelligence report, the global payments market reached 3.12 trillion in 2025 and is projected to reach 5.34 trillion by 2030, with an 11.29% CAGR. What's even more important is that what is fueling this growth are mobile-first transactions.

Competition in the fintech world continues to increase, with tech giants and large banks launching their own digital banking options, such as Amazon Lending and the Apple Card, issued by Goldman Sachs.

What specific functionalities set successful neobanks apart from traditional banks? How do these features enhance user experience and financial management? Let's explore the key attributes that define leading neobanks and how they are revolutionizing banking services in today's digital age.

Neobank Market Overview

Neobanks have experienced remarkable growth over the past decade. User adoption has skyrocketed as well, with projections reaching 850 million users by 2030, according to Juniper Research. With rapid smartphone adoption, supportive open banking rules, and an increase in the customer demand for intuitive digital banking apps, leading neobanks like Nubank and Chime are showing how digital-first models can work for hundreds of millions of customers.

At the beginning of 2026, the market concentration is moderate, as only a handful of banks control a substantial customer base. Nubank, based in Brazil, surpassed 110 million users thanks to its real-time rails and transparency. Klarna and Revolut work with more than 135 million clients. Webank, Wise, Chime, Monz and N26 are among the 10 top valued neobanks in the world.

EU-based Neobanks are Targeting Gen Z Users

Millennials and Gen Z make up 78% of the global neobank user base in 2025, with over 62% of neobank users aged 18 to 35, but the real prize isn't just their numbers. It's their lifetime value.

Unlike previous generations who built decades-long relationships with legacy banks, Gen Z is establishing their first financial accounts with neobanks, creating loyalty patterns that could last 50+ years. This demographic doesn't just tolerate digital banking; they expect it as the baseline, rejecting physical branches, hidden fees, and clunky interfaces that traditional banks still defend.

The stakes explain why European neobank giants are now betting billions on a high-risk American expansion strategy.

Revolut is Going to the US Market

Revolut is raising $2 billion at a massive $75 billion valuation, with a substantial portion earmarked for conquering the US market, the world's largest banking economy, where Chime already commands 9.1 million active users. The British fintech giant isn't just introducing products; it's fighting for new users against American big banks.

The weapon of choice? High-yield savings accounts, AI-powered financial assistants rolling out in 2025, and commission-free trading all bundled into a single app experience that JPMorgan Chase and Bank of America's legacy systems can't match without cannibalizing their existing fee structures.

The company's strategy reveals something critical: they're not just selling banking services they're selling an entire financial operating system that includes everything from cryptocurrency trading to phone plans to mortgage products, positioning themselves as the only app Gen Z needs to manage their entire financial life.

While Revolut plays global chess, Monzo has achieved something many thought impossible: 48% revenue growth to £1.2 billion with 12.2 million customers while maintaining profitability. Their secret? Obsessive focus on what Gen Z actually does with money.

New Budgeting Tools from Monzo

Monzo pioneered instant spending notifications and shared tabs for splitting bills, with user-friendly budgeting tools, built-in savings pots, and a transparent fee structure, making it especially popular with millennials and Gen Z customers. These aren't gimmicks, they're solutions to genuine behavioral patterns. Gen Z splits expenses constantly (think group dinners, shared rent, concert tickets), switches between saving goals rapidly (emergency fund, travel, new tech), and demands granular control over every dollar.

Monzo's product roadmap reads like a Gen Z wish list: digital SIM card services for constant travelers, advanced anti-fraud features including "trusted contact" verification systems where friends can approve suspicious transactions, and salary sorting features that automatically allocate paychecks across multiple financial goals. With fresh capital secured, they're now ready to scale these innovations internationally.

The Economics of Winning a Customer

The competition for Gen Z isn't just about winning customers; it's about capturing the formative financial experiences that shape lifelong banking behaviors. When a 22-year-old gets their first real paycheck deposited into Revolut or Monzo instead of Wells Fargo, they're not just choosing a bank, they're choosing an entire financial philosophy: transparency over opacity, features over branches, community over institutions.

35% of neobank users in 2026 identify freelancing or gig work as their primary income source, reflecting the demand for non-traditional banking solutions as Gen Z's non-traditional work patterns grow. Traditional banks built products for employees with steady paychecks; neobanks built products for people with irregular income, multiple revenue streams, and global mobility.

Conquering the US Market

What neither Revolut nor Monzo publicly emphasizes is their Achilles' heel: many European companies, including London-based Checkout.com and OakNorth, are already taking tentative steps into the U.S. market. Will they be able to crack America? This'll be a point of fascination for tech watchers in the coming years. The U.S. is served by established consumer banking giants, including JPMorgan Chase, Bank of America, Wells Fargo and Citigroup, all with deep regulatory relationships, lobbying power, and home-field advantage.

The European neobanks' ultimate success may depend less on superior technology and more on whether U.S. regulators will grant banking licenses that allow them to compete on equal footing with domestic players. Until then, they're essentially playing banking theater, offering most of the features through partner banks while watching American competitors like Chime build unassailable moats with actual U.S. charters.

Gen Z will determine the future of banking, but the battle for their loyalty is far from decided. The neobanks that win won't just be the most innovative, they'll be the ones that best navigate the treacherous intersection of regulation, localization, and genuine customer obsession.

Key Market Drivers

There are several fundamental forces that are propelling the neobanking market forward, and those are:

- Customer experience gap: More than 80% of neobank users are actively using multiple features that their banking app is offering, including the digital wallet for daily financial transactions. These engagement rates are quite high compared to traditional banks.

- Cost efficiency: Neobanks operate on significantly lower cost structures, which later enables them to offer lower fees and more competitive rates overall.

- Regulation: With PSD2 and PSD3, open banking initiatives are creating more favorable conditions for neobanks to expand into different markets safely.

- Digital-first mindset: Digital adoption accelerated after the COVID-19 pandemic, driven by increased digital literacy across generations of users.

Pillar Features for Neobanks

With no physical branches and innovative digital solutions, neobanks offer a fresh approach to banking services. As neobanks focus so much of their resources on developing a fintech app, getting new features is their key to attracting new users. However, as the market grows, we can see what the essentials are.

Today, we want to dive into the most essential features of neobanks this year, exploring how they're reshaping the financial services landscape and why they're important for Gen Z as core users and all the other ones.

Based on current industry trends and developments, here are the key neobank capabilities to keep an eye on in 2026:

Feature-Packed Mobile Banking Apps

Mobile apps are the core platform for neobanks, replacing the need for physical bank branches. Customers can conduct all critical banking functions directly through the provider's smartphone app, supported across iOS and Android devices.

Users can complete new account openings entirely digitally through the mobile app flow. Streamlined identity verification, funding, and debit card/account activation can occur within minutes instead of days. Ongoing account management for deposits, transfers, and payments is also facilitated seamlessly.

Neobanks allow depositing paper checks simply by capturing photos through the smartphone camera within their app. Advanced image processing verifies check details.

Transaction histories and balance details are viewable in real time through users' mobile apps. Advanced analytics also automatically categorizes spending by areas like dining, entertainment, and travel and provides custom insights into cash flow trends that users can act on.

Peer-to-peer (P2P) and Acount-to-Account (A2A) transfers to other users are instantly facilitated to account numbers/emails/phone numbers for easy sharing of funds. Remittance payments are also fast and simplified, as most of the world's currencies are available on almost every platform. One-time or recurring bill payments can be scheduled to merchants, and everything stays digital.

By concentrating full financial functionality within intuitive and highly-rated mobile apps, neobanks have appealed strongly to digitally inclined demographics who manage personal finances primarily from their smartphones.

Action step: If your mobile app needs advanced payment processing solutions so your users can easily send and receive payments, our teams have the experience and knowledge to consult and develop cutting-edge payment gateways and custom payment apps or help with PCI DSS compliance.

Automated Budgeting Tools for Micro and Macro Savings

Better in-app and web budget templates, spend tracking, subscription management, and savings goals help customers manage finances.

To deepen its presence in the US market, Revolut launched a high-yield savings account to attract more users who want to manage their savings digitally. Monzo focused on creatin of "Savings Jars" feature that allows micro-savings and better financial control in real time.

To appeal to younger users, neobanking apps focus on providing the best real-time spending tracking in customized categories (dining, travel, bills, etc.) and merchant-level details to identify top expenses and show expense analytics.

Custom Budgeting Template. Users can set up periodic budgets for common categories like food, entertainment, or car expenses based on usual spending. Budget caps trigger alerts once reached, along with advice to reallocate excess funds to savings goals.

Automated Savings Rules. Set predefined rules to automatically transfer set amounts to separate savings accounts or "pockets" after receiving direct deposits or when making certain purchases. Makes building an emergency fund or splitting bills to joint account holders an effortless habit.

Subscription Management: Neobanks lets users track, cancel, or optimize recurring subscriptions and bills from their account dashboard to stop unwanted charges.

Overall, these robust tools integrated with banking make it simpler for consumers to take control of cash flow, save more automatically, gain financial insights, and build sound money management habits. The automation and seamless user experiences allow for consistent money management versus more manual budgeting.

AI-Powered Banking

Today, predictive analytics and conversational AI are powering smarter customer service, more personalized credit offers, and more automation when it comes to savings. Using emerging technologies like AI and ML contributes to better data management by adding rules.

FDIC-Insured Accounts & Customer Protection

Today's leading neobanks deliver a compelling value proposition that traditional financial institutions struggle to match, seamlessly blending consumer-centric features with enterprise-grade regulatory compliance.

Neobank checking, savings, cash management, and money market accounts come standard with FDIC insurance protections safeguarding up to $250,000 per individual account. This matches traditional brick-and-mortar guarantees while covering customers in financial insolvency cases.

To ensure transparency, neobanks prominently display FDIC signage within their mobile apps, with some offering real-time insurance calculation tools that highlight available coverage based on current balances.

On the transaction side, neobanks issue both virtual debit cards for online use and physical debit cards for in-store purchases, enabling true omni-channel spend access.

These Visa or Mastercard-branded cards support contactless tap payments via digital wallets, real-time purchase notifications, and integrated rewards programs. Security features include instant digital freezing capabilities and rapid card re-issuance through the app, putting control directly in customers' hands.

KYC/KYB automation has evolved beyond basic digital onboarding. Regulators now demand deeper verification for both individuals and businesses, requiring sophisticated identity verification frameworks that balance friction with security.

AML and transaction-monitoring tools that detect suspicious activity in real time are non-negotiable. These systems work silently in the background, protecting both customers and institutions while enabling the instant transactions users expect.

Licensing pressure continues to intensify globally. From MAS in Singapore to MiCA in Europe, startups need clear licensing pathways to scale across borders. The days of regulatory arbitrage are over; sustainable growth requires proactive compliance strategies from day one.

The winning formula? Neobanks that can deliver frictionless customer experiences while maintaining bulletproof compliance infrastructure. By blending modern digital banking practices with rich card functionality comparable to top issuers, neobanks furnish reliable payment utilities that customers expect alongside account management conveniences.

AI as Operational Backbone for Neobanks

Artificial intelligence is rapidly becoming the operational backbone of blockchain-enabled fintech, transforming three critical functions simultaneously.

AI-powered fraud detection and risk models now identify anomalies in blockchain transactions faster than human analysts ever could, providing real-time protection across decentralized networks.

On the compliance front, AI-driven KYC verification systems are solving fintech's perpetual tension between user experience and regulatory requirements, reducing onboarding friction while maintaining regulator-friendly standards through automated identity verification and continuous monitoring.

Perhaps most transformatively, predictive finance capabilities are emerging as AI integrates with blockchain-based lending and trading platforms, delivering tailored investment insights that leverage both on-chain data patterns and traditional financial indicators.

This AI-blockchain convergence isn't just about efficiency gains; it's fundamentally redefining how fintech platforms detect risk, verify trust, and generate alpha in increasingly complex digital asset ecosystems.

Many neobanks have adopted AI-powered chatbots to handle basic and repetitive inquiries like checking account balances, transaction status, and modifying personal details/contact info. The bots answer instantly without wait times through on-site messaging and in-app chat windows. For advanced issues that require further troubleshooting or specialized knowledge, the bots' qualification algorithms seamlessly route those cases to live agents.

In urgent situations like lost card replacement or temporary account freezes while traveling, neobanks furnish 24/7 toll-free contact numbers that allow real-time issue reporting/remediation over phone call conversations. Coupled with digital self-service tools, users feel fully covered at all times.

By merging automated bots and dedicated live bank representatives that are accessible anytime, neobank support models have achieved new standards of responsiveness and problem resolution speed that customers have embraced.

New and Popular Features

1. AI-Powered Fraud Detection & Real-Time Risk Management

AI-driven fraud detection models now identify anomalies in blockchain and traditional transactions faster than human analysts, providing real-time protection across decentralized and centralized networks.

Machine learning (ML) enhances fraud detection precision compared to conventional methods, enabling neobanks to protect customers from sophisticated scams while maintaining frictionless user experiences.

Real-World Implementation:

- Monzo deployed industry-first anti-fraud features, including "known locations" (geofencing for large transactions), "trusted contact" verification requiring a designated family member to approve suspicious transfers, and secret QR code authentication.

- Nubank leverages AI-powered automation and personalization to help customers manage finances more efficiently while detecting fraudulent patterns.

- More neobanks now use AI-driven predictive analytics for cash flow projections and risk assessment.

2. Predictive Finance & Personalized Wealth Management

AI integration with blockchain-based and traditional financial platforms now delivers tailored investment insights, democratizing sophisticated financial planning previously reserved for high-net-worth individuals. These systems leverage both on-chain data patterns and traditional financial indicators to generate actionable intelligence.

Democratization in Action:

- Nubank building features that democratize "AI private banking" services for everyday users, making high-level financial services available to everybody.

- Revolut's AI-powered assistant is launching gradually in 2025 to adapt to customer needs, guide smarter money habits, and provide enhanced financial decision-making support.

- Using predictive finance, neobanks enable customers to project cash flow and expenses more precisely through AI, ensuring proper alignment between budget and revenue cycles.

3. Beyond Banking: Super-App Expansion

Leading neobanks are shedding their single-purpose origins to become comprehensive financial ecosystems.

Mortgage & Lending Expansion: Revolut is launching digital mortgages in Lithuania, Ireland, and France with rapid approval, conditional approvals, and final offers within one business day. Spain is expected to join Revolut's mortgage rollout in 2026, and Chime launched Instant Loans in March 2025, three-month installment loans up to $500 with fixed rates, no credit checks, and building credit through on-time repayments.

.png)

Physical-Digital Hybrid Models: Revolut is deploying branded ATMs in Spain that feature facial recognition technology, cash and card dispensing, and future cash deposit capabilities. Also, Revolut Business is introducing the first European business credit product and Revolut Kiosk for restaurant/store operations with biometric payment exploration.

4. Telecommunications Integration in Neobanks

By integrating mobile services, neobanks aim to increase user engagement and loyalty, creating a more comprehensive ecosystem that encourages customers to consolidate their financial and connectivity needs within a single platform.

Neobanks are "virtual," with technology playing a big role in their offerings, often with only online support and account access. They are marketed as having lower overheads, which gives them greater agility and the ability to offer lower prices.

The shift in mindset is largely due to the emergence of eSIMs. With embedded SIM cards, service providers can remotely provision connectivity services to smartphones, making it easier for financial service providers to embed connectivity services within their portfolio.

Neobanks bring several competitive advantages:

- existing customer relationships with tens of millions of customers (lower acquisition costs),

- digital-first infrastructure built without legacy systems, and

- data-driven personalization through advanced analytics capabilities.

Users already trust these platforms with their money, adding mobile service feels like a natural extension rather than a risky leap. The same principles that made neobank fees transparent apply to mobile plans—no surprise charges, no hidden terms.

.jpg)

What Comes Next

The question today is no longer related to whether the neobanks will succeed, but what choices they'll have to make to go through the inevitable consolidation of the market.

Going through every innovation we mentioned- from Nubank's AI-powered democratization of private banking to Revlut's one-business-day mortgage approvals, a clear pattern is revealed.

The winners in this market battle are not just building better banks; they're building financial systems that make traditional banking seem slow. The advancements of neobanks are based on three pillars: technical excellence through AI, revenue diversification with eSIMs, and a long-term generational strategy.

These features, along with core capabilities such as integrated budgeting templates, real-time purchase alerts, fraud prevention measures, and automated subscription management, underscore why digital banking continues to attract new users every day.

Banking is no longer just about finance, it's about creating seameless experiences that fit the fast-paced life of modern life. The change is here, and the banks you used in 2020 will bear minimal resemblance to the ones we will see in 2030.

The future of neobanking lies in its ability to adapt and innovate. If you're ready to develop or enhance your financial system with cutting-edge features, our team of experts is here to support you.

Contact us today to explore how we can help you stay ahead in the digital banking revolution.