Your customers are ready to buy on mobile, but your business might not be ready to serve them.

Daily frustrations plague mobile commerce, including checkout processes that crash mid-purchase, payment systems that reject legitimate transactions, security breaches that erode customer trust overnight, and apps that are so slow that customers abandon their carts before they finish loading. These aren't edge cases - they're the reality for most mobile commerce operations.

The Mobile Commerce Challenge: Why 70% of Businesses Struggle

Consider the pain points keeping business leaders awake at night: A single security vulnerability can expose millions of customer records, regulatory fines can reach 4% of annual revenue, and every second of loading delay costs 7% of potential conversions. Meanwhile, competitors with superior mobile experiences capture market share while your technical team struggles with integration challenges that seemed simple on paper.

The statistics tell a sobering story: mobile commerce is expected to generate $534 billion in sales by 2025, representing 44% of all e-commerce transactions, according to Statista's Global E-commerce Report. Yet, businesses launching mobile commerce initiatives face a complex landscape of options and challenges that can determine success or failure within a matter of months.

With nearly two decades of experience in financial software development, Softjourn has successfully navigated the technical complexities of mobile commerce for over 200 clients across the finance, media, and event ticketing industries. Our track record includes building payment processing systems that handle over 100 million monthly transactions, developing secure mobile banking applications for major European financial institutions, and creating commerce platforms that have processed billions of transactions.

Our expertise spans the complete mobile commerce ecosystem: from PCI DSS-compliant payment processing and fraud detection systems to AR-enabled shopping experiences and cross-platform mobile applications. We've addressed the three critical issues outlined in this article for clients ranging from fintech startups to Fortune 500 enterprises, providing us with unique insight into what actually works versus what merely sounds good in theory.

Understanding the distinct types of mobile commerce and addressing three critical implementation issues will position your business to capture this massive market opportunity while avoiding costly mistakes that plague 70% of mobile commerce launches.

Types Of Mobile Commerce Transforming How Customers Buy

Mobile commerce encompasses six distinct categories, each requiring different technical approaches and customer strategies. Choosing the right type for your business model determines your technical requirements, development costs, and market positioning.

Mobile Shopping Drives The Largest Revenue Share

Mobile shopping represents the foundational layer of mobile commerce, generating the highest transaction volumes across industries. You can implement mobile shopping through three primary channels: native mobile apps, mobile-optimized websites, or progressive web apps (PWAs).

Example applications: Amazon Mobile, Target app, Walmart app, eBay Mobile, Shopify Mobile, Best Buy app

Native mobile apps, such as Amazon and Target, provide the richest user experience, featuring functionalities like push notifications, offline browsing, and device-specific optimizations. These apps require separate development for iOS and Android but deliver the highest conversion rates, typically 3x higher than mobile websites, according to Adobe's Digital Economy Index.

Mobile-optimized websites offer broader accessibility without requiring app downloads. They load quickly on all devices and offer essential shopping features, including product catalogs, shopping carts, and streamlined checkout processes. PWAs bridge the gap between websites and native apps, delivering app-like experiences through web browsers with offline functionality and the ability to be installed on the home screen.

Softjourn Case Study: BabyQuip Mobile Shopping Success

The Need: BabyQuip, a baby equipment rental service for traveling families, required an intuitive mobile interface to streamline its rental process and enhance the user experience for busy parents managing complex travel logistics.

The Solution: Softjourn created a mobile-friendly platform with integrated payment processing, an intuitive user interface design, and secure transaction handling. We updated their technology stack from PHP 5.6 to PHP 7.3, using CakePHP 3.4, implemented the HTTPS protocol with Stripe payment integration, and optimized the system for mobile devices.

The Benefits: BabyQuip completed over 100,000 reservations, demonstrating how proper mobile shopping implementation directly drives business results. The platform achieved faster payment processing, enhanced security, and a mobile-friendly design that made ordering baby gear as simple as booking a hotel room.

Mobile Banking And Financial Services Expand Beyond Payments

Financial mobile commerce extends far beyond basic payment processing to encompass a comprehensive range of financial services. Mobile banking apps now handle 85% of routine banking transactions according to the Federal Reserve's Economic Data, while digital wallets like Apple Pay and Google Pay process over $1 trillion annually.

Example applications: Chase Mobile, Bank of America app, Venmo, PayPal, Cash App, Zelle, Robinhood, Coinbase, Mint

Peer-to-peer payment platforms like Venmo and Zelle have transformed personal finance interactions, processing $490 billion in transactions last year according to Early Warning Services data. Cryptocurrency mobile platforms enable digital asset trading, while mobile insurance and investment apps democratize financial services previously requiring desktop interfaces.

The integration between financial services and commerce creates seamless purchasing experiences. When customers store payment methods in mobile wallets, checkout friction drops dramatically, increasing conversion rates by 23% on average, according to Baymard Institute research.

Softjourn Case Study: Card Tent eWallet Platform

The Need: Card Tent required a comprehensive eWallet platform that would marry corporate payments and rewards while providing flexibility to add multiple payout options from different vendors. They wanted to give clients a configurable platform tailored to specific business needs.

The Solution: Softjourn developed a complete eWallet web application with API integrations supporting multiple payout options including bank transfers, P2P payments, virtual prepaid cards, reloadable Visa cards, eGift cards, and cash at Western Union. We created clear user flows, comprehensive API documentation, and a scalable architecture.

The Benefits: The platform provided clients with a unified payment system that reduced operational complexity while expanding payout options. Card Tent gained a competitive advantage with their own branded interface rather than relying on vendor thin clients, resulting in improved customer experience and business growth.

Location-Based Commerce Leverages Mobility Advantages

Location-based commerce uniquely leverages mobile devices' inherent mobility, creating opportunities that are impossible with desktop commerce. GPS-enabled shopping apps connect customers with nearby businesses, while geofencing technology triggers promotional offers when customers enter specific geographic areas.

Example applications: Uber, DoorDash, Grubhub, Foursquare Swarm, Yelp, Google Maps shopping, Starbucks Store Locator, Target Store Mode

Ride-sharing services like Uber and delivery platforms like DoorDash exemplify location-based commerce, generating $127 billion in combined revenue by connecting mobile users with location-specific services according to McKinsey's State of Mobility report. Local business discovery apps help customers find restaurants, services, and retailers within their immediate vicinity, often including real-time inventory and availability information.

Proximity marketing uses Bluetooth beacons and Wi-Fi networks to deliver targeted offers based on precise location data. Retailers implementing beacon technology report 20% increases in in-store conversion rates when mobile offers align with physical presence, according to Proxbook's Proximity Marketing Report.

Mobile Entertainment And Content Commerce: Monetize Digital Consumption

Digital content represents the fastest-growing segment of mobile commerce, driven by app stores, streaming services, and subscription models. App stores alone generated $133 billion in 2024 according to Sensor Tower's State of Mobile report, with mobile gaming accounting for 67% of these transactions through in-app purchases and premium game downloads.

Example applications: Apple App Store, Google Play Store, Netflix, Spotify, Disney+, Fortnite, Candy Crush Saga, Amazon Kindle, Audible, YouTube Premium

Streaming service subscriptions via mobile devices now exceed desktop subscriptions 3:1, as customers prefer managing entertainment services through mobile apps according to Conviva's Streaming State report. Mobile gaming's in-app purchase model has proven particularly lucrative, with successful games generating over $ 10,000 daily revenue per thousand active users, according to GameAnalytics data.

Subscription-based services thrive on mobile platforms because recurring payments integrate seamlessly with device-stored payment methods. The mobile subscription economy is growing at a rate of 435% annually, according to Zuora's Subscription Economy Index, which spans everything from news publications to fitness apps.

Softjourn Case Study: JellyTelly Mobile Streaming Platform

The Need: JellyTelly, a faith-based streaming platform, required native iOS and Android applications to make its educational and entertainment content accessible to a broader mobile audience while providing safe, meaningful entertainment for children.

The Solution: Softjourn developed native mobile applications using cutting-edge technologies to deliver video content, games, and interactive learning experiences. The applications provided seamless streaming capabilities with intuitive interfaces optimized for both children and parents.

The Benefits: JellyTelly successfully expanded their reach to mobile audiences, providing families with a trusted alternative to mainstream streaming services. The mobile apps enabled secure content delivery with parental controls and educational features that aligned with the platform's values.

Social Commerce Integrates Shopping With Social Interaction

Social commerce transforms social media platforms into direct sales channels, with Instagram Shopping and Facebook Marketplace processing billions in transactions according to Meta's Business Report. This integration enables customers to discover, research, and purchase products directly from their preferred social platforms.

Example applications: Instagram Shopping, Facebook Marketplace, TikTok Shop, Pinterest Product Pins, Snapchat Ads, WhatsApp Business, WeChat Pay, YouTube Shopping

Influencer-driven commerce leverages social proof and personal recommendations to drive purchasing decisions. Brands partnering with influencers see 6.5x higher conversion rates compared to traditional mobile advertising according to Influencer Marketing Hub's State of Influencer Marketing, particularly when influencers demonstrate products through video content.

User-generated content integration allows customers to share product experiences, creating authentic social proof that influences other buyers. Reviews, photos, and videos from real customers provide the trust signals necessary for mobile purchasing decisions.

Softjourn Case Study: SnappyTV Social Media Integration

The Need: SnappyTV(acquired by Twitter) sought to enhance its entertainment platform by developing second-screen functionality that would revive the social aspect of watching TV in a digital environment, enabling users to share and interact with live content.

The Solution: Softjourn developed social media video platform features that enabled users to join friends for private showings, incorporating engagement features such as chats and screen interactions. The platform made live streams and TV broadcasts social, mobile, and viral.

The Benefits: SnappyTV successfully created an interactive entertainment experience that combined live content with social engagement, demonstrating how mobile commerce can extend beyond traditional transactions to create new forms of digital social interaction.

Augmented Reality Commerce Bridges Digital And Physical Experiences

AR commerce addresses the primary limitation of mobile shopping: the inability to physically examine products before purchase. Virtual try-on experiences for clothing, accessories, and cosmetics reduce return rates by 40% while increasing customer confidence in mobile purchases according to Shopify's Future of Commerce report.

Example applications: IKEA Place, Sephora Virtual Artist, Nike Fit, Warby Parker Virtual Try-On, Amazon AR View, L'Oréal ModiFace, Ray-Ban Virtual Try-On

Furniture retailers like IKEA utilize AR apps to enable customers to visualize products in their actual living spaces before making a purchase. This technology solves spatial reasoning challenges that previously required showroom visits, enabling complex purchases through mobile devices.

Interactive shopping experiences through AR create engaging product demonstrations that traditional mobile commerce cannot match. Customers spend 75% more time engaging with AR-enabled product pages according to Vertebrae's AR Commerce Report, leading to higher conversion rates and larger average order values.

The 3 Critical Issues That Determine Mobile Commerce Success

Three fundamental challenges determine whether mobile commerce initiatives succeed or fail. Addressing these issues requires strategic planning, technical expertise, and ongoing optimization based on customer behavior data.

Security And Privacy Concerns Threaten Customer Trust And Business Viability

Mobile devices create unique security vulnerabilities that criminals actively exploit to steal payment information and personal data. Unlike desktop computers with robust security software, mobile devices often lack comprehensive protection, making them attractive targets for fraud attempts.

Data breaches cost mobile commerce businesses an average of $4.35 million per incident, according to IBM's Cost of a Data Breach Report. However, the damage to trust often proves more expensive than direct financial losses. Customers abandon mobile commerce platforms permanently after security incidents, with 67% never returning to compromised services according to PwC's Global Consumer Insights Survey.

Regulatory compliance requirements, such as GDPR and CCPA, impose additional security obligations, with violations carrying penalties of up to 4% of annual revenue. These regulations require explicit consent for data collection and processing, transparent privacy policies, and robust data protection measures.

You must implement multi-factor authentication, combining something customers know (passwords), something they have (devices), and something they are (biometrics). End-to-end encryption protects data transmission between devices and servers, while tokenization replaces sensitive payment data with non-sensitive tokens.

Biometric authentication options like fingerprint, voice and facial recognition provide security without friction, increasing customer adoption rates. Regular security audits identify vulnerabilities before criminals can exploit them, while transparent privacy policies build customer trust through clear explanations of data usage.

PCI DSS compliance ensures payment data handling meets industry standards, reducing liability and building merchant processor relationships. Regular app security updates patch newly discovered vulnerabilities, maintaining protection against evolving threats.

Softjourn Case Study: UPC Cloud Migration Security

The Need: The Ukrainian Processing Center (UPC), which processes over 100 million monthly transactions, needed to migrate its Open Banking platform to AWS while maintaining PCI DSS compliance and meeting new Ukrainian banking legislation requirements.

The Solution: Softjourn implemented a phased migration strategy using serverless AWS architecture with comprehensive security measures, including IAM roles, environment isolation, and Infrastructure as Code through Terraform. We ensured PCI DSS compliance throughout the migration process using only native AWS services.

The Benefits: UPC achieved enhanced security and compliance while gaining improved performance, scalability, and cost efficiency.

Read the full UPC migration case study →

User Experience And Technical Performance Determine Conversion Success

Mobile devices present unique user experience challenges that don't exist in desktop commerce. Screen size limitations, varying device capabilities, and network connectivity issues can frustrate customers and lead to abandoned purchases at any stage of the transaction.

Device fragmentation across iOS and Android platforms complicates development, with thousands of different screen sizes, processing capabilities, and operating system versions requiring accommodation. Apps must perform consistently across this diverse hardware landscape while maintaining visual appeal and functionality.

Network connectivity varies dramatically based on location, carrier, and device capabilities. Your mobile commerce platform must function reliably on slow 3G connections while leveraging high-speed 5G networks where available. Customers abandon purchases when loading times exceed 3 seconds according to Google's PageSpeed Insights research, making performance optimization critical.

Page load speed optimization requires minimizing file sizes, compressing images, and implementing progressive loading techniques that display content as it becomes available. Content delivery networks (CDNs) reduce loading times by serving content from geographically distributed servers closest to customers.

Touch-friendly interface elements must accommodate different finger sizes and motor skills while providing clear visual feedback for interactions. Buttons require a minimum 44-pixel touch target according to Apple's Human Interface Guidelines, while interactive elements need sufficient spacing to prevent accidental taps.

Simplified checkout processes reduce abandonment by minimizing required information and steps. Guest checkout options allow purchases without account creation, while auto-fill capabilities reduce typing on mobile keyboards. One-touch payment solutions like Apple Pay and Google Pay can reduce checkout to a single interaction.

Offline functionality enables customers to browse products and prepare purchases even without internet connectivity. When connections resume, apps can synchronize cart contents and complete transactions, preventing lost sales from network interruptions.

Payment Processing And Integration Challenges Complicate Transaction Completion

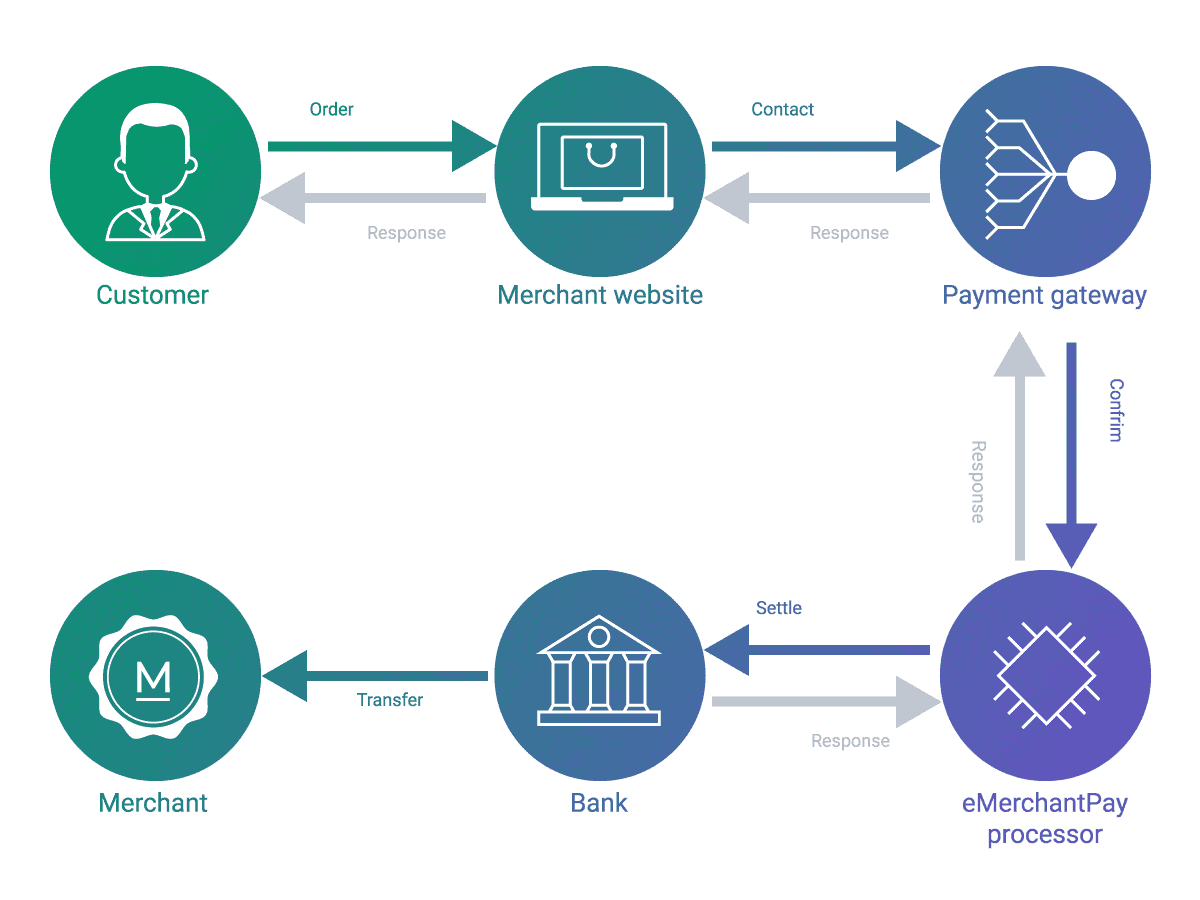

Payment processing represents the most complex technical challenge in mobile commerce, requiring integration with multiple payment gateways, fraud detection systems, and financial institutions. Each additional step in the payment process increases abandonment rates by 7% according to Baymard Institute's Checkout Usability research, making streamlined integration essential.

Customers expect multiple payment options reflecting their diverse preferences and financial situations. Credit cards, debit cards, digital wallets, buy-now-pay-later services, and bank transfers each require separate integrations with different technical requirements and fee structures.

International payment complexities multiply when serving global customers. Currency conversion, country-specific payment methods, and varying regulatory requirements create technical and compliance challenges. European customers prefer SEPA bank transfers, while Asian markets rely heavily on digital wallets and QR code payments according to Worldpay's Global Payments Report.

Transaction fees vary significantly across payment methods and can erode profit margins if not carefully managed. Credit card processing typically costs 2.9% plus $0.30 per transaction, while digital wallets range from 2.7% to 3.5% according to Payment Processing Industry Analysis. ACH bank transfers cost significantly less but take 3-5 business days to process.

Fraud detection systems must balance security with customer experience. Overly aggressive fraud prevention blocks legitimate transactions, while insufficient protection allows costly chargebacks. Machine learning algorithms analyze transaction patterns to identify suspicious activity without impacting genuine customers.

PCI DSS compliance requirements outline the procedures for handling, storing, and transmitting payment card information. Non-compliance results in fines and increased processing fees, while breaches can lead to the termination of merchant accounts entirely. Tokenization systems store encrypted payment tokens instead of actual card numbers, reducing compliance scope and security risks.

Integration with existing business systems, such as inventory management, customer relationship management, and accounting software, requires careful planning and often involves custom development. APIs must synchronize order information, update inventory levels, and trigger fulfillment processes without delays or errors.

Softjourn Case Study: Bullet Payment Integration

The Need: Bullet, an Irish accounting software company, required updates to comply with new Irish payroll regulations mandating real-time reporting to Revenue Online Service (ROS), while maintaining secure payment processing and PCI DSS compliance.

The Solution: Softjourn updated Bullet's existing system to support both direct payroll reporting and file-based ROS uploads. We implemented secure payment integration using industry-standard protocols, ensuring the platform met all regulatory requirements while maintaining a seamless user experience.

The Benefits: Bullet achieved regulatory compliance while maintaining business continuity, avoiding the fate of non-compliant competitors who were forced to cease operations. The updated system provided enhanced security, streamlined payroll processes, and positioned Bullet for future growth in the competitive SaaS market.

Read the full Bullet case study →

Strategic Recommendations For Mobile Commerce Success

Your mobile commerce strategy should align with customer behavior patterns and business capabilities rather than following generic best practices. Different industries and customer segments require tailored approaches based on purchasing patterns, device preferences, and technical requirements.

For Businesses Entering Mobile Commerce

Start by analyzing your target audience's mobile behavior through analytics data, surveys, and competitor research. Understanding how customers currently interact with mobile devices reveals which mobile commerce types align with their preferences and habits.

Select mobile commerce types that complement your existing business model, rather than requiring entirely new capabilities. Retailers with strong visual products benefit from AR commerce integration, while service businesses should prioritize location-based features.

Prioritize security architecture from the initial development phase rather than adding protection later. Building security into your foundation costs less and provides better protection than retrofitting existing systems with security patches.

Plan for scalability by selecting platforms and architectures that can accommodate growth without requiring complete rebuilds. Cloud-based solutions provide flexibility and cost-effectiveness for businesses with uncertain growth trajectories.

For Existing Mobile Commerce Operations

Conduct regular code audits and security assessments using third-party penetration testing and vulnerability scanning. Monthly security reviews identify weaknesses before criminals exploit them, while annual comprehensive audits ensure compliance with evolving regulations.

Implement continuous user experience optimization through A/B testing, heat mapping, and customer feedback analysis. Small improvements in checkout flow, product discovery, and payment processing compound into significant conversion increases over time.

Evaluate payment system performance quarterly, analyzing processing fees, decline rates, and customer satisfaction scores. New payment methods and technologies emerge regularly, potentially offering better rates or improved customer experiences.

Monitor performance metrics daily, tracking page load speeds, app crash rates, and transaction completion times. Performance degradation often occurs gradually, making regular monitoring essential for maintaining customer satisfaction.

Future Trends Reshaping Mobile Commerce

Emerging technologies will create new mobile commerce opportunities while potentially disrupting existing business models. Staying informed about these trends enables you to make strategic investments and avoid outdated approaches.

5G networks enable previously impossible mobile experiences through ultra-low latency and high-bandwidth connections according to Ericsson's Mobility Report. Live video commerce, real-time AR experiences, and instant payment processing become standard rather than premium features.

Voice commerce integration enables customers to make purchases through voice assistants without needing to touch their devices. This hands-free interaction model particularly benefits customers with accessibility needs and creates opportunities for voice-optimized product discovery.

Artificial intelligence and machine learning enable personalized product recommendations, dynamic pricing, and predictive inventory management. AI chatbots handle customer service inquiries while learning algorithms optimize payment routing and fraud detection.

Internet of Things (IoT) integration connects mobile commerce with smart home devices, wearables, and connected cars. Automatic reordering based on consumption patterns and location-triggered purchasing creates new revenue opportunities.

Sustainability considerations increasingly influence customer purchasing decisions, with 73% of customers willing to pay premium prices for environmentally responsible products and services, according to Nielsen's Global Sustainability Study. Mobile commerce platforms that prominently display sustainability metrics and carbon footprint information gain a competitive advantage.

Take Action On Mobile Commerce Opportunities

Mobile commerce success requires a strategic focus on security, user experience, and payment optimization, as well as selecting the right commerce types for your customer base. The businesses that thrive in mobile commerce begin with solid foundations and continuously optimize their strategies based on customer behavior data.

Begin by assessing your current mobile presence and identifying the biggest gaps between customer expectations and your current capabilities. Whether you're launching new mobile commerce initiatives or optimizing existing operations, addressing the three critical issues - security, user experience, and payment processing - provides the foundation for sustainable growth.

The mobile commerce opportunity continues expanding, but success requires more than simply building mobile apps or responsive websites. Strategic planning, technical excellence, and customer-focused optimization separate thriving mobile commerce businesses from the 70% that struggle with poor implementation and planning.