Now, providing seamless and secure online payment options is essential for business success.

However, integrating a payment gateway presents numerous challenges. For instance, nearly 18% of U.S. online shoppers have abandoned 1 an order due to a "too long or complicated checkout process". Additionally, eCommerce companies are projected to lose $48 2 billion annually to fraud, with 40% of these attacks 2 originating in the United States. Compounding these issues, according to Verizon, only 43.4% of organizations maintain full compliance with PCI DSS standards, leaving many vulnerable to data breaches and associated penalties.

Whether you're a startup selecting your first provider or an enterprise aiming to optimize for scalability and performance, this guide will demystify the complexities of payment gateway integration, providing step-by-step strategies to ensure your payment systems are efficient, secure, and future-ready.

While many businesses focus solely on basic setup processes, a truly optimized payment system requires strategic planning, technical expertise, and awareness of often-overlooked considerations.

This comprehensive guide covers everything from fundamental concepts to advanced implementation strategies, helping business owners and developers create payment systems that enhance customer experience, improve operational efficiency, and drive revenue growth.

Understanding Online Payment Gateways

Before exploring integration methods and strategies, it is essential to understand what payment gateways are and how they operate within the e-commerce ecosystem. This foundational knowledge will help you make more informed decisions throughout the implementation process.

Definition and Purpose

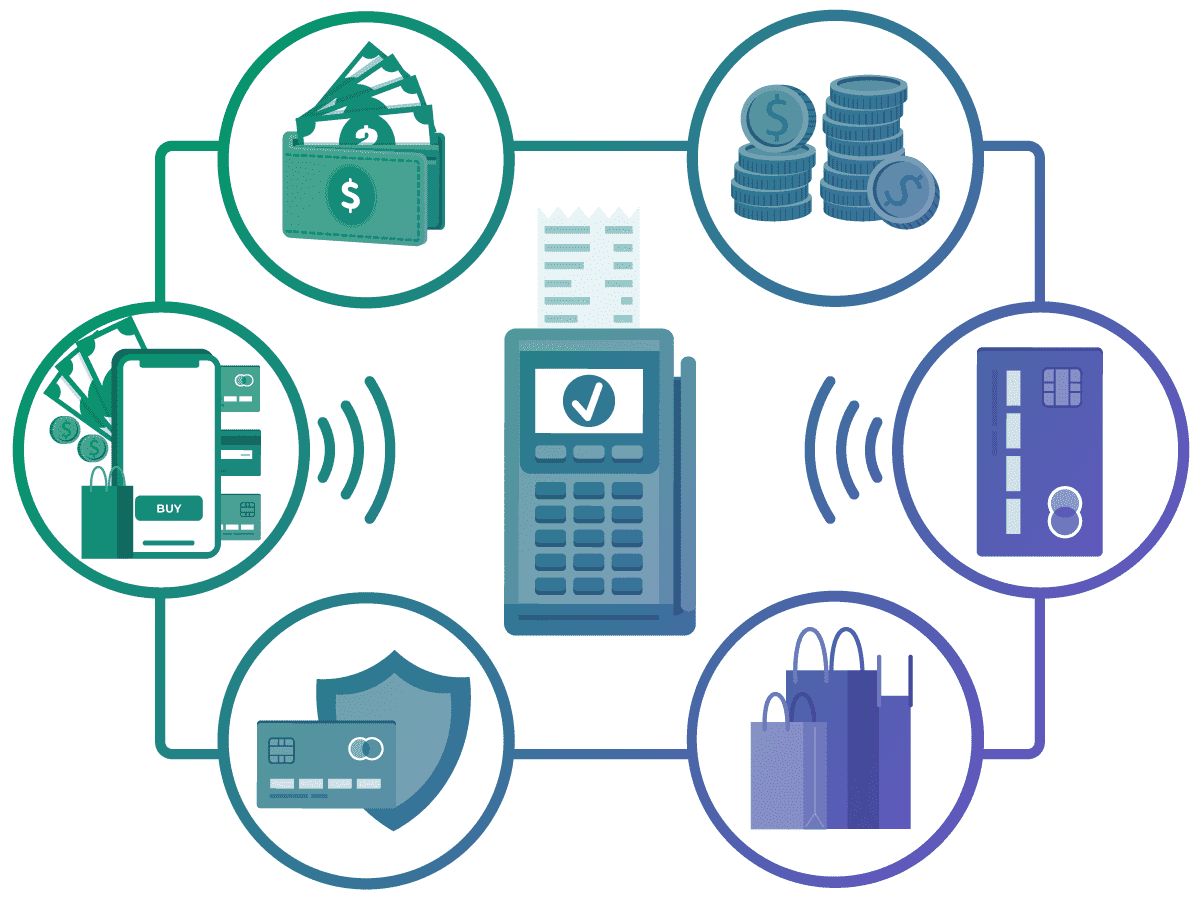

A payment gateway is a technology that facilitates the secure transfer of information between a payment portal (like a website or mobile app) and the bank that processes the transaction. It is the critical bridge between the customer and the merchant, ensuring that sensitive payment data is transmitted securely.

The primary purpose is to authorize and process payments, allowing businesses to accept various forms of payment, including credit cards, debit cards, and digital wallets. By integrating a payment gateway, businesses can:

- Streamline online payment processes

- Enhance customer experience

- Protect sensitive data through encryption

- Comply with security standards like PCI DSS

- Access valuable transaction analytics

- Build customer trust through secure processing

Payment gateways also offer advanced security features, such as encryption and fraud detection tools, which protect both the merchant and the customer from potential threats while ensuring regulatory compliance.

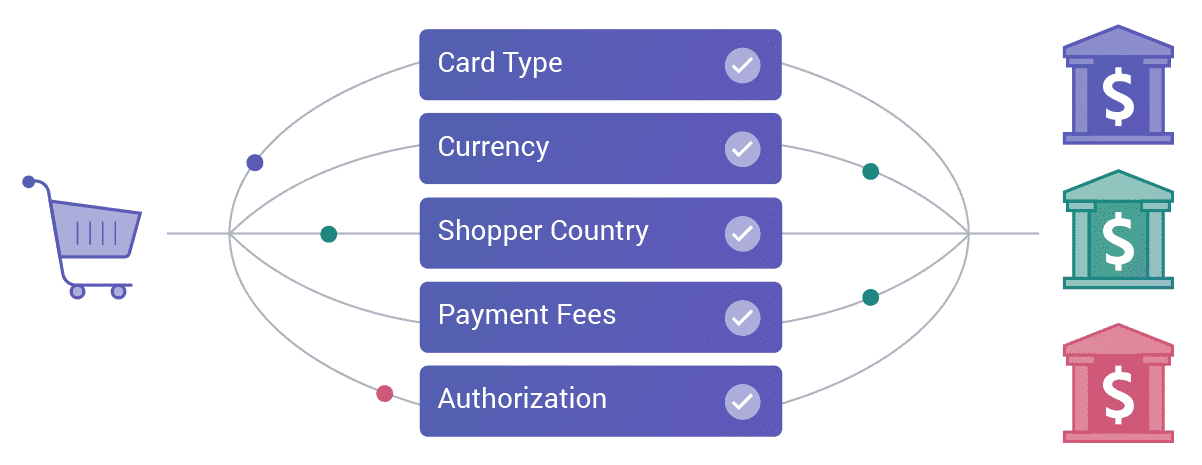

Payment Processing Flow Explained

Now that we understand what a gateway is and its purpose, let's examine how it works. Understanding the transaction flow is crucial for implementing an effective integration and troubleshooting any issues that may arise during processing.

The processing of payment involves several steps:

- Information Entry: The customer enters their payment information on the merchant's website

- Encryption: This information is encrypted and sent to the payment gateway

- Authorization Request: The gateway forwards the information to the payment processor

- Processor Communication: The processor communicates with the customer's bank to verify the transaction

- Approval: If approved, confirmation is sent back through the gateway to the merchant

- Completion: The transaction is completed, and funds are scheduled for transfer

This entire process typically takes only a few seconds, creating a seamless experience for customers. Additionally, payment gateways facilitate various payment methods and currencies, enabling businesses to serve global audiences more effectively. The availability of multiple payment options increases conversion rates, as customers are more likely to complete purchases when their preferred payment method is available.

Legal and Compliance Considerations

While technical implementation often dominates discussions, the legal and regulatory aspects are equally critical for sustainable operations. Failing to consider these factors can result in significant penalties and business disruptions.

Payment gateway integration extends beyond technical setup; it involves navigating complex legal and compliance landscapes. This includes:

- Adhering to various regional regulations

- Understanding cross-border transaction laws

- Ensuring compliance with PCI DSS and other security standards

- Managing data privacy requirements (GDPR, CCPA, etc.)

- Maintaining proper documentation for regulatory audits

Failure to address these issues can result in legal complications and substantial fines. Working with legal experts or payment processors who understand these requirements is essential for businesses operating across multiple jurisdictions.

Online Payment Gateway Integration

With a solid understanding of what payment gateways are and their legal implications, let's explore the practical aspects of integration. This section covers the various methods of implementing payment gateways and the crucial security considerations that must be addressed during the process.

Before we start: Overview of PCI DSS

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is critical when considering online payment gateway integration. This set of security standards protects card information during and after financial transactions.

It's important to understand that PCI DSS compliance responsibility is shared between the payment gateway provider and the business implementing the gateway. The exact division of responsibilities depends on the integration method chosen:

- Hosted solutions: The payment gateway provider shoulders most of the compliance burden, as it handles the payment data directly. However, businesses are still responsible for securing their own systems and ensuring safe data transfer to the provider.

- Direct Post and Integrated solutions: Businesses bear significantly more compliance responsibility as customer payment data passes through their systems before reaching the payment gateway.

- Tokenization-based solutions: These offer a middle ground, where sensitive data is replaced with non-sensitive tokens, reducing the merchant's compliance scope while maintaining control of the checkout experience.

Regardless of the method chosen, it also involves implementing security measures such as:

- Encryption of sensitive data

- Firewall implementation and maintenance

- Secure access controls and authentication

- Regular security testing and monitoring

- Vulnerability management programs

- Staff training on security protocols

Organizations must remain vigilant and proactive in updating their security protocols, conducting regular audits, and monitoring for unauthorized access attempts to maintain secure payment as cyber threats evolve.

Integration Methods Comparison

When implementing payment processing, you have several integration approaches to choose from, each with distinct advantages and considerations. The right method depends on your business needs, technical resources, and security requirements. Let's examine each integration option, starting with one of the most common approaches: hosted gateway integration.

Hosted Payment Gateway Integration: Accept Payments via Secure Third-Party Payment Processing

Hosted gateway integration provides enhanced security and compliance by redirecting customers to the payment provider's secure environment to complete transactions. This approach delivers:

Advantages:

- Simplified PCI compliance (provider handles sensitive data)

- Reduced security burden for merchants

- Typically easier to implement

- Often includes fraud detection services

Disadvantages:

- Less control over the checkout experience

- Customers leave the merchant's website during payment

- Potential for cart abandonment during redirect

To mitigate user experience issues, many businesses customize hosted pages to maintain their branding. For example, PayPal enables merchants to customize their payment page by adding their logo, color scheme, and navigation elements, thereby creating a more cohesive experience. Some hosted gateways also offer features such as tokenization (secure storage of payment information), one-click payments, and saved payment methods, all designed to enhance convenience and facilitate repeat purchases.

When evaluating hosted gateway options, assess both the security benefits and user experience trade-offs to determine the best fit for your business model and customer expectations.

How to Integrate

Integrating a hosted payment gateway follows a straightforward implementation process:

- Account setup: Create a merchant account with your chosen payment provider

- Obtain credentials: Access your API keys and integration documentation

- Frontend implementation: Add the payment button or form that triggers the secure redirect

- Backend configuration: Set up webhook notifications to track transaction statuses

Most providers offer ready-to-use and easy-to-implement software development kits (SDKs) for popular programming languages, thereby reducing development time. Always complete thorough testing in sandbox mode before transitioning to the production environment.

Direct Post Method: On-Site Payment Collection

The Direct Post Method enhances customer experience by allowing shoppers to enter payment details directly on your website, while securely transmitting data to the payment gateway. This approach:

Advantages:

- Delivers a seamless, uninterrupted checkout experience

- Keeps customers on your website throughout the entire process

- Offers complete control over checkout design and functionality

- Increases conversion rates by reducing checkout friction

Disadvantages to Consider:

- Requires stricter PCI compliance adherence

- Demands more robust security infrastructure

- Places greater data protection responsibility on your business

Businesses implementing this method must employ robust security measures, including encryption (protecting data in transit) and tokenization (replacing card data with secure tokens), to protect customer information and prevent data breaches. Regular software updates and security system maintenance are crucial for protecting against vulnerabilities.

How to Integrate

Implementing Direct Post integration involves these essential steps:

- Security preparation: Ensure your site meets PCI DSS compliance requirements

- API configuration: Register developer credentials and access integration keys

- Form implementation: Create a secure payment form using the provider's SDK

- Server setup: Configure your backend to process payment responses securely

Most gateways offer client-side encryption libraries that secure sensitive data before it is transmitted from the customer's browser. Always implement comprehensive error handling and test thoroughly across multiple payment scenarios before launching.

Non-Hosted (Integrated) Method

The Non-Hosted or Integrated Method embeds payment processing directly within the merchant's website, providing:

Advantages:

- Complete control over the user experience

- Seamless brand consistency throughout checkout

- Potential for higher conversion rates

- Ability to customize every aspect of the payment flow

Disadvantages to Consider:

- Full PCI compliance responsibility falls on the merchant

- Requires significant security expertise

- Higher development and maintenance costs

- Greater liability in case of breaches

This approach requires investing in advanced fraud detection systems and employing machine learning algorithms to analyze transaction patterns for unusual activity. Multi-factor authentication adds an extra layer of security that significantly reduces the risk of fraud.

How to Integrate

Implementing a Non-Hosted payment solution requires these comprehensive steps:

- Compliance certification: Complete full PCI DSS certification for your environment

- Security infrastructure: Implement encryption, tokenization, and network segmentation

- Gateway connection: Establish direct API integration with your payment processor

- Payment logic: Develop custom integration or custom payment processing code within your application, adding code to your website

- Fraud protection: Configure advanced fraud detection systems and transaction monitoring

Most major payment processors provide detailed API documentation and developer support for this integration method. Due to its complexity, consider allocating dedicated security resources and establishing a regular security audit schedule to maintain compliance and protect sensitive data.

.jpg)

Selecting a Payment Gateway Provider: Strategic Decision Framework

Choosing the right payment gateway provider can have a direct impact on your operational costs, customer experience, checkout page design, and business flexibility. This decision requires careful evaluation of multiple factors beyond basic transaction fees.

The market offers numerous providers with varying features, pricing models, and specializations. Consider these key factors when evaluating potential partners:

Analyzing Pricing Structures

Understanding the complete fee structure helps you calculate the true cost of payment processing:

- Transaction fees: Percentage or flat-fee per transaction

- Monthly fees: Fixed recurring charges

- Setup fees: One-time implementation costs

- Chargeback fees: Costs for disputed transactions

- Currency conversion fees: Charges for international payments

- Additional service fees: Costs for features like recurring billing

Compare providers based on your specific business model and transaction volume. Many gateways offer tiered pricing, which creates more favorable rates as your transaction volume increases.

Evaluating Limits

Payment processors impose various limitations that affect your operations:

- Maximum transaction amounts: Upper limits on single purchases

- Daily/monthly processing caps: Total transaction volume restrictions

- Minimum processing requirements: Required monthly transaction volumes

- High-volume discount thresholds: Transaction levels that trigger better rates

Select a provider with flexible limits for high-volume businesses or those projecting significant growth. Ask specifically about adjusting these thresholds during seasonal peaks or promotional campaigns.

Reviewing Merchant Account Options

Payment gateways typically work with merchant accounts that settle funds to your bank:

- Dedicated merchant accounts: Individual accounts for your business

- Aggregated accounts: Shared accounts managed by the provider

- International merchant accounts: Accounts for cross-border processing

- High-risk merchant accounts: Specialized accounts for certain industries

Some providers bundle gateway services with merchant accounts, while others require a separate setup. Consider how quickly funds are deposited into your bank account and the quality of customer support when evaluating these options.

Confirming Support for Different Types of Payment

Modern customers expect multiple payment options:

- Credit/debit cards: Major credit card networks (Visa, Mastercard, American Express)

- Digital wallets: PayPal, Apple Pay, Google Pay

- Alternative payment methods: Bank transfers, direct debits

- Buy-now-pay-later options: Affirm, Klarna, Afterpay

- Cryptocurrency: Bitcoin and other digital currencies

- Regional payment methods: Alipay, iDEAL, Boleto

Offer payment methods that your customers already use to increase conversion rates. For international businesses, local payment options dramatically improve acceptance in specific regions.

Assessing Mobile Payment Capabilities

With mobile commerce growing rapidly, evaluate these mobile features:

- Mobile-optimized checkout page: Responsive design for all screen sizes

- Mobile wallet integration: One-tap payment options

- Native app support: SDKs for iOS and Android development

- QR code payments: Contactless transaction options

- Biometric authentication: Fingerprint and facial recognition security

Test the mobile checkout experience yourself to ensure smooth transactions across devices. Strong mobile security features build customer trust while protecting sensitive data.

Checking Product Type Compatibility

Match your payment gateway to your specific business model:

- Digital goods: Instant delivery and microtransaction support

- Subscription services: Automated recurring billing with retry logic

- High-ticket items: Installment payment and financing options

- Service businesses: Appointment booking and deposit handling

- B2B commerce: Invoice generation and purchase order processing

Verify that your chosen provider supports your specific offering without workarounds. Features like automated subscription management significantly reduce administrative overhead and improve customer retention.

How to Select the Right Provider

Follow this structured process to find your ideal payment gateway:

- Define your requirements: Document your specific needs for payment methods, currencies, and integration approach

- Create provider shortlist: Research 3-5 providers that align with your technical and business requirements

- Request complete pricing: Obtain detailed quotes including all fees for your projected transaction volume

- Test technical compatibility: Access sandbox environments to evaluate developer documentation and support quality

- Speak with references: Contact similar businesses using these providers to learn about reliability issues

- Negotiate contract terms: Discuss volume discounts, contract length, and service level agreements

Create a weighted scorecard that prioritizes factors most important to your business model. Allocate sufficient time for technical evaluation - changing providers later can disrupt operations and increase costs.

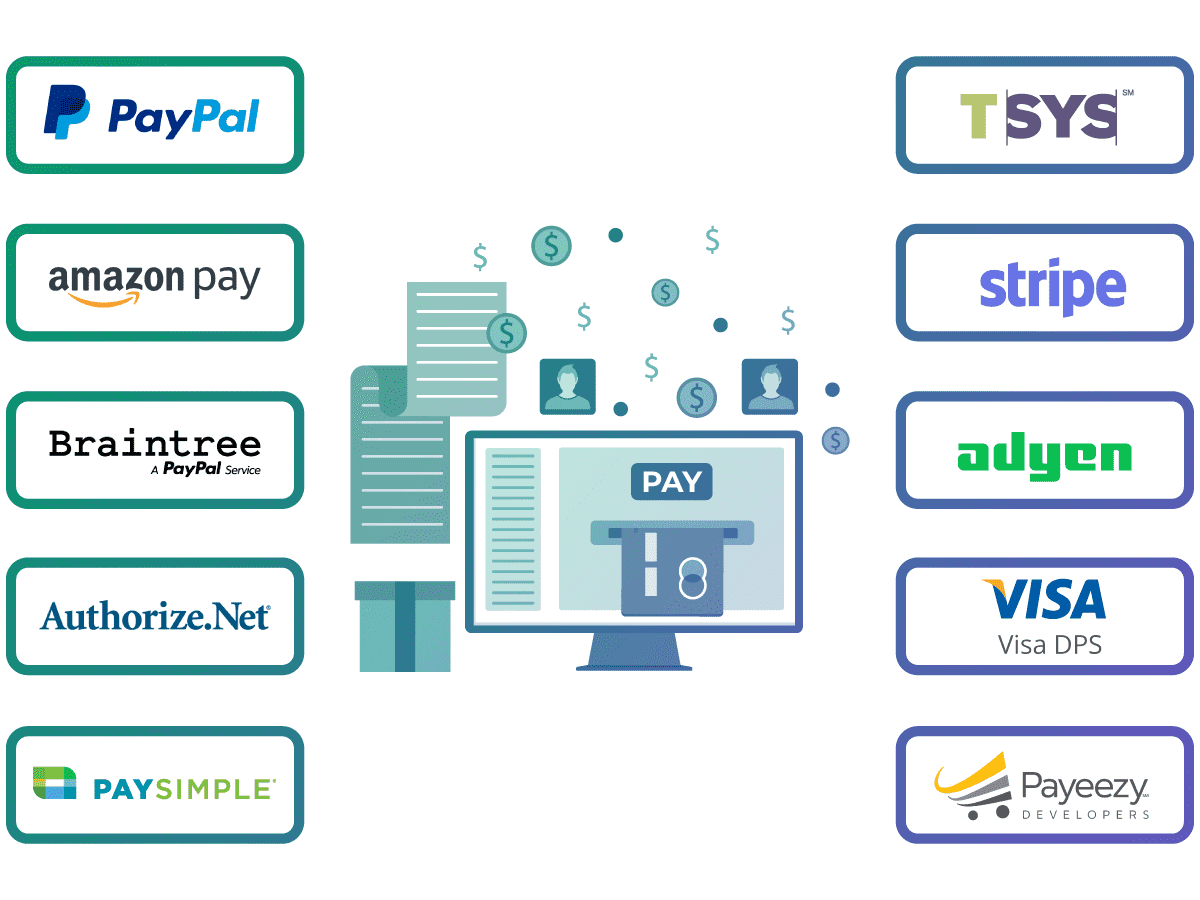

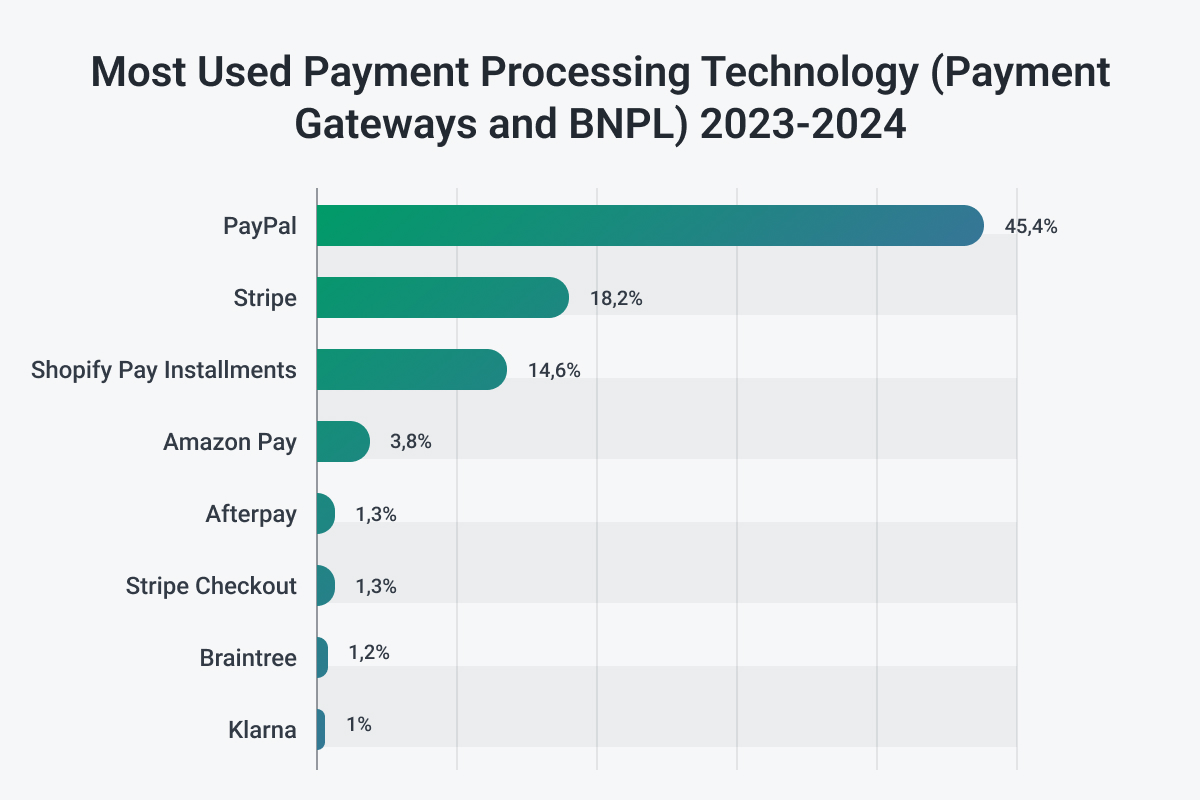

Overview of Popular Payment Gateways

The payment gateway market includes numerous providers, each with distinct strengths, limitations, and specializations. Understanding the unique characteristics of major players will help you identify which solution best aligns with your business requirements.

This section provides insights into five popular payment gateways, highlighting their key features, advantages, and potential limitations:

Features of Stripe

Stripe is known for its developer-friendly API and comprehensive feature set:

- Extensive API Documentation: Well-documented resources for developers

- Multiple Currency Support: Processing in 135+ currencies

- Subscription Billing: Robust recurring payment handling

- Customizable Checkout: Highly flexible frontend options

- Fraud Prevention: Machine learning-based detection systems

- Mobile SDKs: Native support for iOS and Android

- Global Reach: International payment processing capabilities

Stripe's flexibility and scalability make it a suitable choice for businesses of all sizes, from startups to established enterprises. Its seamless integration with various e-commerce platforms and mobile applications enhances the overall user experience.

Business Considerations:

- No monthly fees, 2.9% + $0.30 per successful transaction (US rates)

- Higher transaction costs but lower development and maintenance overhead

- Particularly strong for businesses with complex payment needs

- Built-in compliance with regulations like SCA, PSD2, and GDPR

- Direct bank reconciliation tools and accounting software integrations

Integration Resources:

- Stripe Developer Documentation

- API Reference

- Stripe Elements - Pre-built UI components

- GitHub Code Examples

- Integration Checklist

Benefits of PayPal

PayPal is one of the most recognized payment gateways globally:

- Brand Recognition: Trusted by consumers worldwide

- Express Checkout: One-click payment options

- Buyer Protection: Enhanced security for customers

- Multi-Currency Support: International payment processing

- No Monthly Fees: Transaction-based pricing model

- Mobile Optimization: Streamlined mobile checkout experience

- Extensive Integration Options: Compatible with most platforms

PayPal's mobile app allows users to manage transactions on the go. The platform supports various payment methods, ensuring customers have multiple purchase options.

Business Considerations:

- Transaction-based pricing: 2.9% + $0.30 per transaction (US rates)

- No development capabilities needed for basic hosted checkout

- Particularly valuable for businesses with international customers

- Multiple integration options from basic buttons to advanced custom flows

- Ability to handle complex currency conversion scenarios

Integration Resources:

- PayPal Developer Portal

- PayPal Checkout Integration

- Braintree Integration Guide

- API Reference

- Developer Community

Insights into Amazon Pay

Amazon Pay leverages Amazon's established user base:

- Trusted Brand Association: Leverages Amazon's reputation

- Streamlined Checkout: Access to saved payment methods

- Mobile-Optimized: Responsive design across devices

- Alexa Integration: Voice commerce capabilities

- Fraud Protection: Advanced security measures

- Global Presence: International payment processing

- Easy Integration: Simple implementation process

With Amazon Pay, businesses can enhance the shopping experience by allowing customers to access their saved payment methods and shipping addresses, streamlining the checkout process and potentially increasing conversion rates.

Integration Resources:

- Amazon Pay Developer Central

- Integration Guide

- Button Placement Guidelines

- SDK References

- Checkout Simulator

Business Considerations:

- 2.9% + $0.30 per transaction for domestic payments (US rates)

- Higher rates for cross-border transactions

- Works best for businesses with products/services that align with Amazon's customer base

- Handles address verification automatically through Amazon accounts

- Advanced fraud protection leveraging Amazon's risk assessment technology

Understanding Authorize.net

Authorize.net is a well-established payment gateway with comprehensive features:

- Fraud Detection Tools: Advanced security measures

- Recurring Billing: Subscription management capabilities

- Customer Information Manager: Securely store payment details

- Mobile Point-of-Sale: In-person payment options

- Virtual Terminal: Process payments without a website

- eCheck Processing: Direct bank account payments

- Detailed Reporting: Transaction analytics and insights

Authorize.net's ability to handle transactions in multiple currencies and its support for mobile payments enhance its versatility for businesses with diverse customer bases. Its suite of tools for managing subscriptions and invoicing is particularly valuable for service-based businesses.

Business Considerations:

- Monthly gateway fee ($25) plus per-transaction fees (typically 2.9% + $0.30)

- Often requires a separate merchant account setup

- Strong choice for businesses with omnichannel (online/in-person) needs

- Advanced reporting and reconciliation features

- Specialized fraud management tools for high-risk industries

Integration Resources:

- Authorize.Net Developer Center

- Integration Methods Overview

- Accept.js Integration

- API Reference Guide

- Testing Guide

Exploring 2Checkout (Verifone)

2Checkout (now Verifone) offers global payment processing solutions:

- Global Payment Support: 200+ markets worldwide

- Multi-Currency Processing: 100+ currencies supported

- Localized Checkout: 30+ languages available

- Subscription Management: Recurring billing capabilities

- Digital Product Support: Specialized tools for digital goods

- Tax Management: Automated sales tax calculation

- Extensive Reporting: Detailed analytics tools

2Checkout's focus on global commerce makes it ideal for businesses expanding internationally. Its comprehensive fraud protection measures ensure secure transactions, while its localized payment options enhance the shopping experience for customers worldwide.

Business Considerations:

- Tiered pricing model based on volume (starts at 3.5% + $0.35)

- All-in-one solution with merchant account included

- Particularly valuable for businesses selling globally

- Specialized tools for subscription and digital goods businesses

- Comprehensive tax compliance management for global sales

Integration Resources:

- Verifone Commerce Developer Portal

- Integration Methods Overview

- Inline Checkout Integration

- API Documentation

- Testing Environment Guide

Gateway Documentation & Support

Each gateway provides specific resources to streamline implementation:

- Official Documentation Libraries:

- SDK & Code Libraries:

- Testing Resources:

Community Resources & Forums

Leverage collective knowledge from developer communities:

- Stack Overflow Payment Processing Tags

- Stripe Developer Discord Community

- PayPal Developer Forums

- Merchant Risk Council - Industry best practices

- Payment Processing Industry Group on LinkedIn

Security Implementation Guides

Essential resources for secure payment implementation:

- PCI Security Standards Council Implementation Guides

- OWASP Payment Processing Guidelines

- Card Network Security Requirements

Payment Gateway Selection Decision Matrix

Use this decision matrix to evaluate potential payment gateway providers based on your specific business requirements. Rate each factor on a scale of 1-5 based on importance to your business, then score each gateway accordingly.

| Selection Factor | Weight (1-5) | Gateway A Score | Gateway B Score | Gateway C Score |

|---|---|---|---|---|

| Transaction Fees | ||||

| Fixed per-transaction fee | ||||

| Percentage-based fee | ||||

| Monthly minimums | ||||

| Volume discount thresholds | ||||

| Technical Integration | ||||

| API documentation quality | ||||

| SDK availability for your platform | ||||

| Webhook reliability | ||||

| Sandbox testing environment | ||||

| Payment Methods | ||||

| Credit/debit card coverage | ||||

| Digital wallet support | ||||

| Alternative payment methods | ||||

| Local payment options | ||||

| Security & Compliance | ||||

| PCI compliance assistance | ||||

| Fraud protection features | ||||

| Data breach protection | ||||

| Regulatory compliance tools | ||||

| Business Considerations | ||||

| Contract flexibility | ||||

| Settlement time | ||||

| Customer support quality | ||||

| Reputation and stability | ||||

| Total Score |

How to Use This Matrix:

- Assign weights to each factor based on your business priorities

- Research each gateway and score them from 1-5 on each factor

- Multiply each score by the weight

- Sum the weighted scores for each gateway

- The highest total score indicates the best match for your requirements

Example Priority Profiles:

- High-Volume Enterprise: Prioritize competitive transaction fees, advanced fraud tools, and API reliability

- Global E-commerce: Emphasize multi-currency support, regional payment methods, and cross-border compliance

- Subscription Business: Focus on recurring billing features, card updater capabilities, and retry logic

- Mobile-First Business: Prioritize mobile SDK quality, digital wallet integration, and biometric authentication

Hidden Cost Factors in Payment Gateway Integration

While the upfront costs of payment gateway integration—like setup fees and transaction charges—are obvious, many businesses fail to account for ongoing expenses that can significantly impact the total cost of ownership. Understanding these hidden costs is essential for accurate budgeting and avoiding unexpected financial burdens.

When budgeting for payment gateway integration, several significant cost factors are often overlooked:

Maintenance and Upgrades

Ongoing maintenance and regular upgrades incur significant costs over time:

- API updates and compatibility changes

- Security protocol updates

- Feature enhancements and bug fixes

- Testing and validation requirements

- Development resources for implementation

Payment gateways frequently update their APIs and security protocols, requiring businesses to allocate resources for continuous integration, testing, and deployment. Failing to keep up with these changes leads to compatibility issues and security vulnerabilities, potentially resulting in higher long-term costs.

Customer Support and Dispute Management

Handling customer queries and disputes related to payment issues requires dedicated resources:

- Customer support team staffing costs

- Training for payment-specific support scenarios

- Chargeback management processes

- Dispute resolution procedures

- Documentation and evidence collection systems

Providing effective and timely support is crucial for maintaining customer satisfaction and trust but adds to operational costs. Specialized tools for tracking and managing payment disputes can reduce the burden but represent an additional investment.

Fraud Prevention and Security Measures

Investing in advanced fraud detection and prevention tools is essential but often under-budgeted:

- Fraud detection software subscription costs

- Security audit expenses

- PCI DSS compliance maintenance

- Staff training on security protocols

- Insurance for potential data breaches

While basic security measures might be accounted for, implementing sophisticated fraud prevention systems, conducting regular security audits, and maintaining compliance can be substantial ongoing expenses. However, the financial impact of fraud incidents can far exceed prevention costs if proper measures aren't in place.

How to Integrate a Payment Gateway: Development Team Skills Required

The success of your payment gateway implementation depends directly on the expertise of your software development team. Even with perfect planning, integration projects fail when teams lack the specialized knowledge required for financial systems. Assess your resources against these essential skill areas before beginning your integration journey.

Aligning with Your Technology Stack

The specific technical skills needed for your payment gateway integration will fundamentally depend on your existing technology stack:

- Platform compatibility: Ensure developers are proficient in the programming languages that power your current application (PHP for WordPress sites, Ruby on Rails applications, JavaScript for MERN/MEAN stacks)

- Framework expertise: Specialized knowledge in your specific framework (Laravel, Django, React, Angular) accelerates integration and reduces errors

- Existing infrastructure: Developer familiarity with your current hosting environment, CI/CD pipelines, and development workflows minimizes integration friction

- Legacy system knowledge: For established systems, understanding existing architecture constraints and data models is critical for successful payment integration

Select a gateway that provides robust SDKs and libraries tailored to your specific tech stack, simplifying implementation and reducing development time.

Backend Development Capabilities

- Server-side programming: Strong proficiency in at least one primary language (Java, Python, Node.js, PHP, or .NET) for creating reliable payment processing logic

- API integration experience: Demonstrated ability working with RESTful APIs and webhook implementations, ideally with prior payment gateway experience

- Secure data management: Expertise in designing database schemas that maintain referential integrity while securely storing transaction data and adhering to data retention policies

Frontend Development Skills

- Modern interface development: Mastery of HTML5, CSS3, and JavaScript frameworks for creating responsive checkout experiences

- Conversion-optimized design: Knowledge of UI/UX best practices specifically for reducing checkout abandonment rates

- Cross-platform compatibility: Ability to ensure consistent payment experiences across desktop, mobile, and tablet devices

Security and Compliance Expertise

- PCI DSS implementation: Comprehensive understanding of the Payment Card Industry Data Security Standard requirements and how they apply to your specific integration model

- Data protection techniques: Experience implementing tokenization, field-level encryption, and secure transmission protocols

- Authentication systems: Skill in implementing 3D Secure, biometric verification, and multi-factor authentication mechanisms

Testing and Quality Assurance Methodologies

- Comprehensive test strategy: Ability to develop test plans covering happy paths, edge cases, and failure scenarios for payment processing

- Load testing experience: Knowledge of simulating high transaction volumes to identify bottlenecks before they impact customers

- Security verification: Expertise in penetration testing and vulnerability scanning focused on payment systems

Project Management Considerations

- Integration timeline management: Experience creating realistic implementation schedules that account for third-party dependencies

- Documentation standards: Discipline in maintaining detailed integration records for troubleshooting and knowledge transfer

- Stakeholder communication: Ability to translate technical payment concepts for business stakeholders and decision-makers

When to Augment Your Team

Consider bringing in specialized expertise when your team lacks experience in:

- Payment industry regulations and compliance requirements

- Specific gateway API integration experience

- High-volume payment processing architecture

- International payment processing, cross-border payments, and localization

A skilled team augmentation reduces implementation time, minimizes security vulnerabilities, and creates a more reliable payment experience—ultimately improving conversion rates and reducing operational costs.

Steps to Integrate: Implementation Roadmap for Success

Once you understand the available integration methods and have selected the approach that best fits your business needs, developing a structured implementation plan becomes critical. Many integration projects fail not because of technology limitations, but due to poor planning and execution strategy.

When creating a payment gateway integration roadmap, several best practices are often overlooked but can significantly impact success:

Phased Implementation and Testing

Instead of attempting full implementation at once, break down the integration into smaller, manageable phases:

- Discovery and planning: Define requirements and select appropriate gateway(s)

- Core functionality: Implement basic payment processing

- Security infrastructure: Set up encryption, tokenization, and fraud prevention

- Secondary features: Add support for subscriptions, refunds, etc.

- Testing and optimization: Thoroughly test and refine processes

This incremental approach enables the testing and validation of each component, thereby reducing the risk of large-scale failures. Continuous integration and deployment (CI/CD) pipelines can automate testing and deployment processes for each phase.

Comprehensive User Acceptance Testing (UAT)

While basic testing is common practice, comprehensive UAT involving real users reveals usability issues and edge cases that developers might miss:

- Simulate real-world scenarios with various payment methods

- Test different currencies and transaction types

- Verify error handling and recovery processes

- Engage actual customers or diverse tester groups

- Test across multiple devices and browsers

Our development teams emphasize engaging actual customers or diverse tester groups to ensure the system meets user expectations and handles all possible scenarios smoothly.

Detailed Documentation and Knowledge Transfer

Thorough documentation is crucial, but it is often neglected when teams rush to complete an integration. Schedule dedicated time to create comprehensive guides covering:

- Setup and configuration processes

- API documentation and reference

- Process flows and system architecture

- Troubleshooting and maintenance procedures

- Security protocols and compliance requirements

- Step-by-step operational instructions

Additionally, ensure relevant teams receive structured knowledge transfer so they're well-equipped to handle the system post-implementation, reducing dependency on the initial development team.

Performance Monitoring and Analytics Setup

Setting up robust performance monitoring from the outset enables proactive issue detection and resolution:

- Implement real-time analytics dashboards

- Monitor transaction success rates

- Track response times and system performance

- Set up alerts for unusual patterns or failures

- Analyze customer behavior and abandonment points

This data enables the quick identification and resolution of performance bottlenecks, ensuring a seamless payment experience for users and providing valuable insights for ongoing improvement.

Customer Support Integration

Integrating your payment gateway with customer support systems streamlines issue resolution:

- Enable support teams to quickly access transaction details

- Create a knowledge base for common payment issues

- Implement automated workflows for routine problems

- Establish clear escalation paths for complex issues

- Set up notification systems for transaction failures

This integration allows support teams to provide prompt assistance. Automated workflows can resolve common issues without human intervention, increasing efficiency and customer satisfaction.

Fallback Mechanisms and Redundancy

Fallback mechanisms provide contingencies in case of gateway failures:

- Configure automatic switching to alternative gateways

- Implement transaction retry logic with backoff strategies

- Create clear processes for manual intervention when needed

- Set up monitoring alerts for system switching

- Test fallback scenarios regularly

Such redundancy ensures continuity in payment processing and minimizes disruptions. Developing these mechanisms saves time during outages and helps maintain uninterrupted service while resolving issues.

Customization and Localization

Customizing the payment gateway to match your brand and localizing the experience for different regions significantly impacts success:

- Support local languages and currencies

- Offer region-specific payment methods

- Adapt to cultural preferences and expectations

- Customize checkout flow for different markets

- Provide localized support options

Providing a familiar and seamless experience improves user trust and conversion rates. Research by ACI indicates that localized payment pages can increase conversion rates by up to 30% in international markets.

Troubleshooting Guide

| Problem | Possible Causes | Resolution Steps |

|---|---|---|

| Transaction Declined Without Specific Error | • Generic decline from the issuing bank • Insufficient information in the request • Gateway configuration error | 1. Check for complete request parameters 2. Verify card details format (Luhn check) 3. Test with the gateway's test card numbers. 4. Review gateway logs for detailed error codes |

| 3D Secure Authentication Failures | • Timeout during authentication • Browser compatibility issues • Incorrect implementation | 1. Verify timeout settings (minimum 5 minutes) 2. Test across multiple browsers 3. Implement proper return URL handling 4. Check for JavaScript errors during the redirect |

| Inconsistent Gateway Response Times | • Network latency • Gateway performance issues • Server resource constraints | 1. Implement asynchronous processing where possible. 2. Add performance monitoring with alerting 3. Consider connection pooling 4. Implement exponential backoff retry logic |

| Webhook Event Processing Failures | • Invalid endpoint configuration • Webhook timeout • Signature verification failure | 1. Validate endpoint is publicly accessible. 2. Ensure rapid response (under 2 seconds) 3. Verify correct signature keys 4. Implement idempotent event processing |

| Settlement Reconciliation Discrepancies | • Timing differences • Currency conversion issues • Refund/chargeback confusion | 1. Normalize timestamps across systems 2. Account for gateway processing fees 3. Implement daily reconciliation processes 4. Track transaction lifecycle with unique IDs |

Security and Fraud Prevention in Digital Payments

Security cannot be an afterthought in payment processing—it must be built into every aspect of your implementation. As payment fraud techniques become increasingly sophisticated, basic security measures are no longer sufficient to protect your business and customers.

Beyond basic compliance with security standards, implement advanced fraud detection and prevention measures:

- Deploy machine learning algorithms to detect suspicious patterns

- Implement multi-layered authentication mechanisms

- Regularly update security protocols with emerging threats

- Conduct penetration testing to identify vulnerabilities

- Balance security with user experience to minimize friction

The cost of fraud prevention is significantly lower than the potential losses from successful attacks, making this investment essential for long-term success.

Strategic Multi-Gateway Integration

While most integration guides focus on implementing a single payment gateway, sophisticated e-commerce operations can gain significant competitive advantages through multi-gateway architecture. This advanced approach transforms payment processing from a utility into a strategic asset.

Key Benefits of Multi-Gateway Integration

- Transaction routing intelligence: Automatically direct payments to optimal processors based on transaction type, amount, currency, and customer location

- Enhanced system resilience: Maintain uninterrupted payment acceptance even during gateway outages or maintenance windows

- Dynamic load distribution: Efficiently handle traffic spikes during sales events or seasonal peaks without service degradation

- Cost optimization engine: Reduce processing fees by intelligently routing transactions through the most cost-effective gateway based on transaction characteristics

- Authorization rate improvements: Boost conversion rates by directing transactions to gateways with the highest approval rates for specific card types or geographies

Implementation Strategies

A successful multi-gateway architecture requires thoughtful implementation:

- Primary/backup configuration: The simplest approach assigns one gateway as primary with automatic failover to secondary gateways when issues occur

- Rules-based routing: Create conditional logic that directs transactions based on predefined criteria such as transaction value, card type, or customer location

- Machine learning optimization: Advanced systems can analyze historical performance data to improve routing decisions based on success patterns continuously

Technical Considerations

Implementing multiple gateways introduces additional complexity that requires planning:

- Unified reporting system: Develop consolidated reporting across all gateways to maintain clear financial visibility

- Consistent customer experience: Ensure checkout flows remain smooth regardless of which gateway processes the transaction

- Normalized response handling: Create standardized error handling to provide consistent customer messaging regardless of gateway-specific response codes

- Synchronized reconciliation: Implement robust reconciliation processes across multiple settlement accounts and payment sources

When to Consider Multi-Gateway Architecture

Multi-gateway integration delivers the most value for businesses with:

- Transaction volumes exceeding $1 million monthly

- Global customer bases across multiple regions

- High-value transactions where authorization rates significantly impact revenue

- Critical dependency on payment system uptime

- Seasonal traffic patterns requiring flexible processing capacity

While requiring more sophisticated development and maintenance, multi-gateway architectures offer substantial competitive advantages in terms of reliability, cost optimization, and approval rates, typically delivering a strong return on investment for high-volume operations.

Custom Payment Gateway Development

While third-party payment gateways meet the needs of most businesses, some organizations with specific requirements, high transaction volumes, or unique business models may benefit from building their own custom payment solution.

Custom gateways provide maximum flexibility and control but require significant investment in development resources and ongoing maintenance. Before pursuing this option, carefully evaluate whether the benefits outweigh the costs and complexities involved.

Steps to Build a Custom Gateway

For businesses with unique needs, building a custom payment gateway may be the optimal solution:

- Define Requirements:

- Identify specific features and functionalities needed

- Determine security requirements and compliance standards

- Document performance and scalability expectations

- Map integration points with existing systems

- Select Payment Processor:

- Choose processor(s) supporting required payment methods

- Evaluate fee structures and transaction limits

- Consider geographical coverage and currency support

- Assess security features and compliance assistance

- Develop the Gateway:

- Build secure API connections to processors

- Implement encryption and tokenization systems

- Create user interfaces for payment collection

- Develop admin tools for monitoring and management

- Ensure full compliance with security standards

- Test the System:

- Conduct unit and integration testing

- Perform penetration testing for security

- Complete load testing for performance

- Execute comprehensive UAT with stakeholders

- Launch and Monitor:

- Deploy in phases with controlled rollout

- Implement monitoring and alerting systems

- Establish performance benchmarks

- Create processes for ongoing maintenance

During the requirements phase, engage stakeholders from different departments to gather comprehensive needs. When selecting processors, evaluate their reputation for reliability and support quality. Throughout development, prioritize security while maintaining a smooth user experience.

Final Thoughts on Payment Gateways

Selecting and implementing the right payment gateway solution is a critical business decision that impacts revenue, customer experience, and operational efficiency. By understanding the various integration options, security requirements, provider differences, and implementation best practices outlined in this guide, businesses can make informed choices that enhance their payment processing capabilities.

Whether choosing an established provider or building a custom solution, focus on these key success factors:

- Security and compliance as non-negotiable foundations

- User experience that minimizes friction and abandonment

- Technical integration that ensures reliability and performance

- Scalability to accommodate business growth

- Support for diverse payment methods to meet customer preferences

- Cost-effectiveness based on total ownership cost, not just transaction fees

As the e-commerce landscape continues to evolve, staying informed about payment gateway trends and technologies will be essential for ongoing success. Regular reviews of your payment infrastructure can identify opportunities for optimization and ensure you're providing the best possible experience for your customers.

The right payment solution isn't just a technical implementation—it's a strategic asset that can differentiate your business in a competitive marketplace. By approaching payment gateway integration with the comprehensive understanding provided in this guide, you'll be well-positioned to create a payment system that supports business growth and enhances customer satisfaction.

Ready to elevate your online business with a secure and efficient payment gateway? Our team of experts is here to guide you through every step of the process. With over 20 years of experience in fintech consulting and custom software development, we have the expertise to tailor payment solutions that align with your unique business objectives. Contact us today for a free consultation to discuss how our payment gateway expertise can help you enhance your customer experience and drive revenue growth.