BNPL Solutions

As payments become digitized, old payment methods are reappearing. Consumer financing goes beyond loans with high-interest rates and credit cards. Fintech platforms, FI, and payment gateways offer flexible payments as consumers shift from traditional to online shopping..

Here are some of the BNPL perks for your business:

- Higher conversion rates

- Greater Average Order Value (AOV)

- More customer insights

- Fewer abandoned carts

- More repeat business

Staying at the forefront of the financial industry is only possible through regular innovation. By developing a BNPL solution for one of our clients, we enabled them to offer BNPL to brick and mortar, m-commerce, and ecommerce merchants.

These are the results of our collaboration:

- Attractive financial product for existing and new clients

- Less risk of a chargeback

- Customer choice of number of installment payments at checkout

- Customer choice of payment method that suits their budget

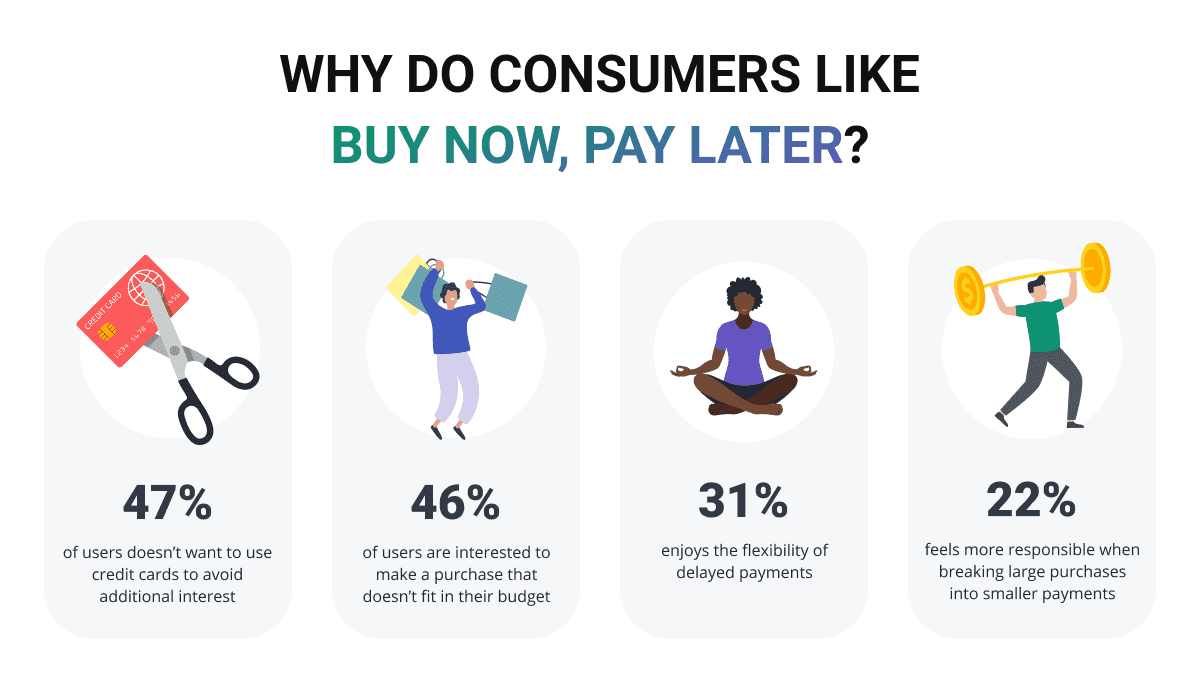

Why Consumers Choose BNPL Over Other Payment Options

1) Convenience

BNPL loans usually require an upfront deposit payment or a portion such as 25% of the purchase amount. The remaining amount is then paid off in installments over a few weeks or months.

2) Zero- or low-interest rate

BNPL arrangements don't include interest or additional fees, but they could come with a fixed repayment schedule.

3) Soft Credit Check

To prevent fraud, a soft credit check is necessary to ensure the person’s identity. No credit check or underwriting is involved in the process.

4) Easy Approval Process

One of the valued features of BNPL is the quick, easy approval process. It doesn’t affect credit ratings, and it will be invisible to other creditors.

Want to more about how our engineers can help your project?

Implementation of BNPL Solution

Split payments are a helpful solution for merchants with an average order value (AOV) of less than $1,000.

The great benefit of using split payments is that they involve just four installments that the customer must to pay over six weeks.

- Four installments

- Six-week loan period

- Suitable for smaller amounts

For purchases that have a high AOV over $1,000, installment loans offer a customized way to repay the purchase.

Installment loans allow customers to split the cost into 12 or 24 payments.

- Customized number of installments

- Multiple options

- Suitable for diverse types of purchases

- 0% APR

Our BNPL Case Studies

Engagement Models

What Services We Offer

Whether upgrading an existing code or creating a new one, the most important expertise we offer is a proven approach to mitigating risk and containing costs. Discover more about Softjourn's expert Consulting Services.

Often clients don’t know what product they need, but do know the results they want. Our job is to help define the product and develop optimal solutions to get those results. Learn more about Softjourn's Discovery Phase Services.

To compete, our clients continually need to provide new and better services. We have our own R&D Centers – started in 2008 – which uniquely positions us to do just that. Read more about Softjourn's Research and Development Services.

Our developers and illustrators are experts at UI and UX design. They will work with you to understand your needs in going from idea to prototype to deployment faster and at less cost. Explore further into Softjourn's Digital Product Design Services.

Software development has grown exponentially in recent decades. Softjourn is the solution to help you define and develop forward-thinking technology that gets real-world results. Get to know more about Softjourn's Software Engineering Services.

Our core belief is that analyzing and testing is critical because the essential role of software is so important. In the process, our Quality Assurance team helps you create superior products. Explore further into Softjourn's QA services.

Since day one, we’ve been providing application support and maintenance services to each customer on every project. It’s why we’re a proven, trusted partner and reliable asset. Get to know more about Softjourn's Application Support and Maintenance Services.

Our technology stack at Softjourn is designed to empower us to deliver world-class services to our clients. With a strong focus on innovation and efficiency, we continually adapt our expertise to stay ahead of the curve. Discover the Technologies and Frameworks we utilize, and learn how we can bring your ideas to life.