Is finance moving towards a more digitized future? Most definitely, according Card Forum 2021. Traditional ways of dealing with money, like checks and plastic cards, are slowly being replaced by technology-based products and services. With new partnerships on the horizon, banks are joining forces with fintech companies like Zelle to address all clients’ needs.

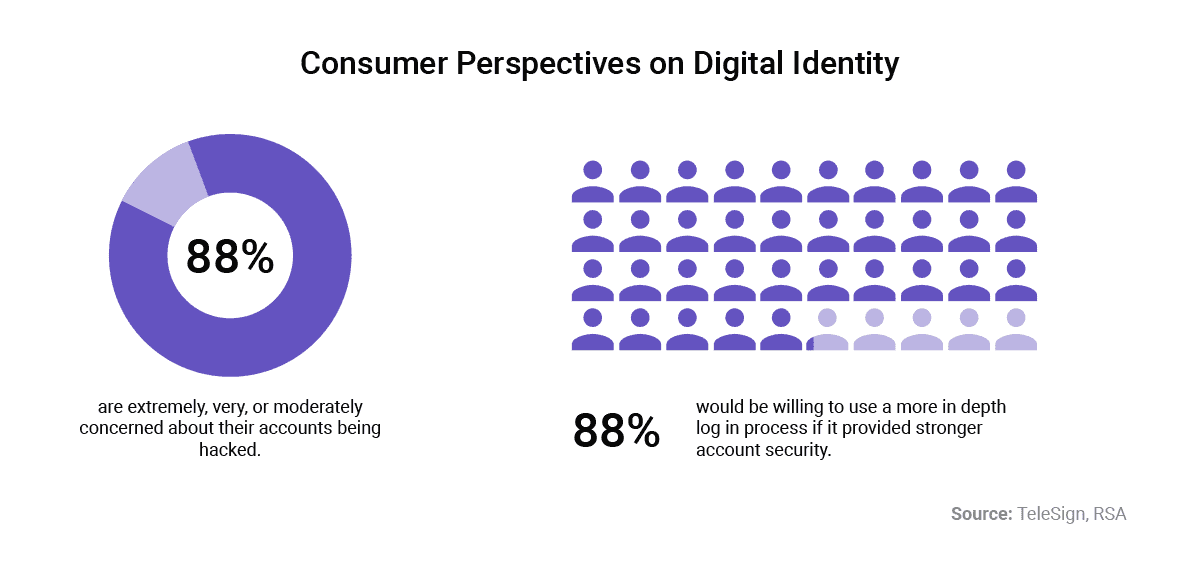

Two other hot topics were digital adoption and digital identities, as it’s becoming clear that bank customers feel secure only when they understand the technology they’re using.

While the pandemic left its mark on all segments of the economy, financial institutions have managed to stay afloat and modernize and can now support both tech-savvy and older customers to manage their money securely.

Let’s walk through some of the insights we gained from Card Forum 2021: the customer-centric approach to services, new leadership skills for bank executives, issues with digital IDs, relations with fintechs, and all those things that are keeping industry leaders more engaged than ever.

Where the Industry Is Heading

Conference participants noted that the entire industry is rapidly moving towards leveraging technology to offer better services. The pandemic has pushed many towards digital transformation and developing new products and services.

Digital-Only Banks and Services

The relationship between customers and banks has changed dramatically, and we are seeing increased numbers of new, digitally-native services that no longer need bricks and mortar branches. Cross-channel communication used to be just one of the ways to communicate among banks, but today,

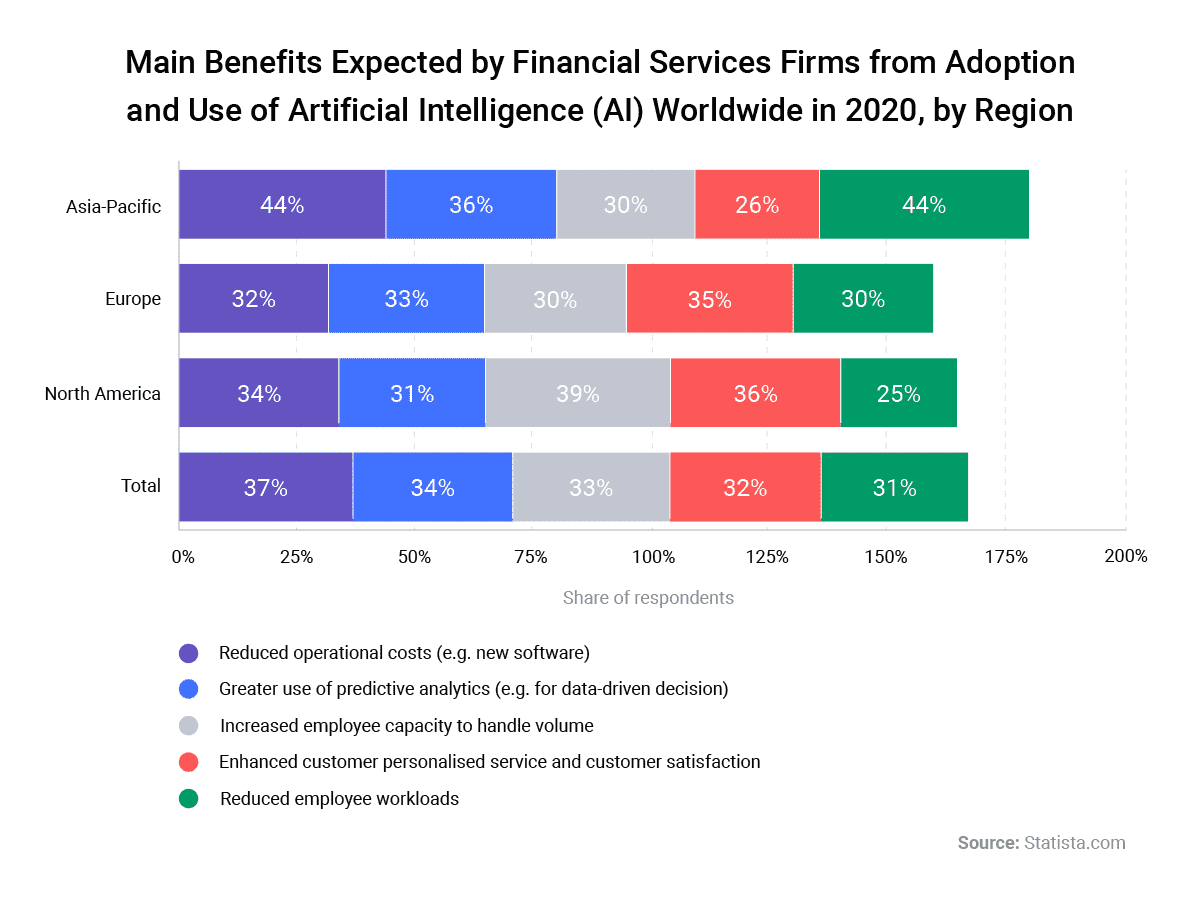

AI is helping banks offer the best services by using more data. Since there are reservations about how this will affect the banking workforce, everyone confirmed that people remain the biggest value for any bank.

“Few would argue that AI technologies are increasingly integral to the world that we live in,” noted Onfido’s Geoff Quintiere. “And that banks need to deploy this technology at scale to remain relevant. McKenzie estimated that AI technologies could deliver more than one trillion dollars in additional value each year.”

Driving Loyalty Through Referrals and Rewards

Money is a sensitive topic for every customer, even as people slowly become more accustomed to managing their money from the comfort of their homes. For millennials, the stakes are going to be higher, as this cohort expects a personalized approach. That’s why it’s so important to communicate everything that brings them value.

That’s where referral programs come into play, with monetary rewards or points. Referral marketing is taking place everywhere today, and companies are relying on it to support their growth. Since customers value personalization, relevant offers and their financial value matter a lot. With co-branded cards, it will soon become possible to collect points for every transaction in hotels, purchases for travel, and even rent payments.

Banks are offering clients access digital wallets like Google Pay, Samsung Pay, Apple Pay and others to eliminate unnecessary friction and to build trust. Customers can thus store their loyalty and co-branded cards and use them with ease. With the complex payment system in the US, tech providers offer customers a new option for bypassing such complications and moving their money securely.

BNPL as a Market Disruptor

One panel tackled investing trends and payments technology, with a lot of buzz about what BNPL is and whether it could be a major market disruptor. As it’s a combination of payment and lending, for most participants, it will be interesting to see how BNPL performs.

“BNPL is definitely a trend,” said Wells Fargo’s Crista Phillips. “I think it's an important one to watch. I do think we continue to see that space being highlighted and serving the needs of our customers in a very big way.”

Brian Tate noted the importance in regulating BNPL and giving it a sense of direction and control. As small and medium banks rely heavily on overdrafts as a source of income, services like Earned Wage Access (EWA) and Buy Now, Pay Later (BNPL) should have a strong impact on their business model.

Open Banking/Payment Rails

Before open banking, the payments ecosystem was strongly dominated by cards and wallets. With APIs, the system functions differently today, as they have unlocked the option of A2A payments and have removed countless barriers. “Open banking rails are going to be very important in the future,” stated Anthemis’s Farhan Lalji.

The general consensus was that today’s banking landscape offers plenty of growth opportunities and that open banking could be a disruptor for card issuers.

The Role of AI in Banking

Of course, there are concerns that AI will replace people working in banks, but individuals are still in the best position to add something new to the system. The real opportunities lie with people who have creative ideas and innovative approaches to existing problems.

“When we talk about technology or solutions out there, it’s not like we’re necessarily saying let’s replace an important asset, which is the people,” said UMB Bank’s Uma Wilson. “We are not trying to say that. Rather, use your assets to offer other valuable services. You don’t need someone printing checks at your office or manually signing them. That kind of thing we can automate.”

Branches will continue to exist as well as the people working in them, but with more automation, roles will be changing. Digitally native services don’t need branches, but they still need a lot of people involved in processing them.

Responding to Customer Needs with New Solutions

Clients now need new services and banks are focused on developing apps to cater to these needs. The new focus is on digital banking apps, mobile wallets, and various digital services like BNPL, P2P transactions, and loyalty and referral programs, just to name a few.

Fintech companies are increasingly getting involved in finance. Radha Suvarna, head of Enterprise Payments Strategy & Innovation at Citizens, pointed out that they are adding value to the system as they collaborate with big banks. This comes with twofold benefits for customers: staying with a bank they trust and using new services from tech providers.

Strong connections between brick-and-mortar banks and big market players like Zelle can ensure that everyone contributes to the development of the industry.

Buy now, pay later (BNPL) services are one example where fintech companies found a way to cater to banking customer needs where banks couldn’t. While it’s considered to be a new service in the US, in Asia BNPL has existed for more than a decade, so it was only a matter of time before it appeared on other markets.

“By definition, payments can scale when they’re open for multiple parties in the ecosystem,” noted Citizens’ Radha Suvarna. “This means that any type of collaborative market works on open standards when multiple stakeholders are involved.”

Co-branded Cards

As the pandemic lingers, people continue to use co-branded travel cards for different services, in order to collect points for a possible future trip. Jonathan Clarkson pointed out that what took place wasn’t expected to happen, but customers were so happy using the product that they continued using it.

Wells Fargo devised a card in collaboration with hotels.com to offer customers a new program. The co-branded cards will provide users with points whenever they travel, pay rent, or purchase in participating stores, that the holders can use for future purchases.

Focusing on Customers

Digital Verification and Fraud Reports

We live in a digital society, making verification in a remote world more complex. Banks need to find a balance between security and providing customers with the solutions they want and need. Big retail influencers like BNPL and COVID-19 are affecting activities in both offline and online environments.

“The key takeaway is that digital verification plays a vital role in safeguarding the entire payments ecosystem,’ said Geoff Quintiere, Strategic Partnerships and Alliances at Onfido. “And it’s no longer just a preference, but a necessity.”

There has been a major shift in consumer behavior compared to 2020, since both fraud detection and digital identity are in flux. There has been a major spike in fraud and losses: Accenture reported that banks are spending $1 billion a year looking for solutions to protect their payment ecosystem.

With increased cases of fraudulent behavior online, the best practices for fighting fraud include proofing strategies, upgraded authentication strategies, and active collaboration with market players to reduce risks.

There are three trends that Onfido’s Quintiere pointed out:

- Friction in the digital identification process

- Viewing digital identity verification holistically across the identity lifecycle

- The concept of portable digital identity

Client-Centered Environment

Throughout the conference, payment experts emphasized the importance of putting customers first to generate new digital products. “As product leaders and as marketers, we have to listen to our customers every day,” Wells Fargo’s Krista Phillips pointed out.

“The key is diversity and the culture of diversity,” said TD’s Barry Baird. “You need to surround yourself with your customer base. It’s really critical to be representative of customers that you have to know about. People need to have various backgrounds to support innovation and customer wants and needs.”

American Banker’s Daniel Wolfe noted that every employee is a potential consumer and having their input on new products is invaluable. “You can gain insights into a much broader spectrum of your customers just by talking to your employees,” he concluded.

Banks are focused on building trust by offering frictionless payment processes that give their customers more freedom in managing their money.

“Finance is very emotional, and so we need to make sure we are constantly listening to what people are feeling about finance, about payments, about where they’re spending and where they’re not spending,” said Krista Phillips, head of Credit Card Marketing, Products, Loyalty and Digital at Wells Fargo. “I do think it’s our responsibility to constantly listen, take those insights and bring them forward.”

What The Future Holds

COVID-19 has had a major impact on everyone involved in banking. However, this sudden change fueled the fast adoption of banking apps and mobile banking. Another major change has been new partnerships between banks and payment processors that will most likely determine the future of payments.

In this new landscape, fraudulent behavior will continue to be a problem, so now, more than ever, customers and banks need to join forces to ensure the security of transactions. “Let’s embrace technology to make our quality of life better,” concluded Uma Wilson, Director of Bank Product Management at UMB Bank.