Did you know that over 70% of Americans have at least one credit card? With so many options available, it’s important to choose the right one based on your spending habits, financial goals, and credit profile.

Whether you’re looking to build credit, earn rewards, or save on interest, there's a credit card designed for you. Below, we break down the main types of credit cards and their benefits to help you make the best decision.

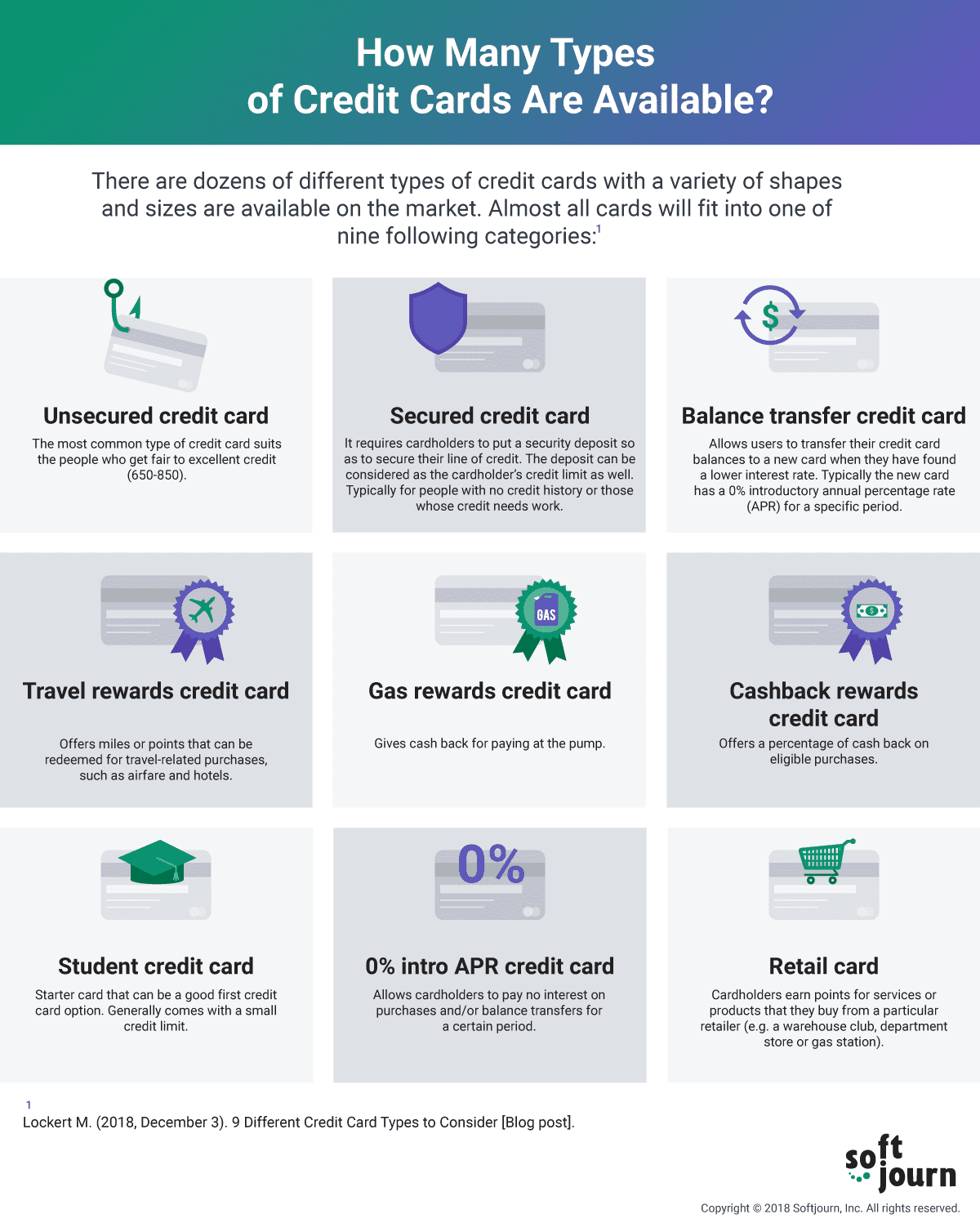

Unsecured Credit Cards

✅ Best for: People with fair to excellent credit (650-850)

✅ Key benefit: No security deposit required

Unsecured credit cards are the most common type. Unlike secured credit cards, they don’t require a deposit. Your credit limit is determined by your creditworthiness, and responsible usage can help build your credit score.

Secured Credit Cards

✅ Best for: People with no credit history or those rebuilding credit

✅ Key benefit: Requires a refundable deposit as collateral

Secured credit cards require a deposit (typically $200-$500) that acts as your credit limit. These cards are designed to help you establish or repair credit, as payments are reported to credit bureaus.

Balance Transfer Credit Cards

✅ Best for: Those with high-interest credit card debt

✅ Key benefit: 0% intro APR on balance transfers

Balance transfer credit cards allow you to move existing credit card debt to a new card with a lower interest rate. Many offer 0% APR for a promotional period (e.g., 12-18 months), making it easier to pay off debt faster.

Travel Rewards Credit Cards

✅ Best for: Frequent travelers

✅ Key benefit: Earn miles or points redeemable for flights, hotels, and more

Travel credit cards let you earn points or miles for every dollar spent, which can be redeemed for travel expenses. Some even offer free checked bags, airport lounge access, and travel insurance.

Gas Rewards Credit Cards

✅ Best for: Commuters and frequent drivers

✅ Key benefit: Cashback or discounts on gas purchases

Gas rewards credit cards reward you for fueling up by offering cashback or discounts at gas stations.

Cashback Rewards Credit Cards

✅ Best for: Everyday spenders

✅ Key benefit: Earn cashback on purchases

Cashback credit cards let you earn a percentage of your spending back in cash rewards. Some cards offer flat-rate cashback, while others provide higher cashback in specific categories like groceries, dining, or travel.

Student Credit Cards

✅ Best for: College students building credit

✅ Key benefit: Lower credit limits, no security deposit required

Student credit cards are designed for young adults with little to no credit history. They often include rewards, educational tools, and forgiveness for first-time late payments.

0% Intro APR Credit Cards

✅ Best for: Large purchases and avoiding interest

✅ Key benefit: 0% APR on purchases and/or balance transfers for a limited time

These cards allow cardholders to make interest-free purchases for a promotional period, usually 12-21 months. Ideal for big purchases like appliances or medical expenses.

Retail & Store Credit Cards

✅ Best for: Loyal shoppers at specific retailers

✅ Key benefit: Higher rewards and special financing at select stores

Retail credit cards offer exclusive discounts, cashback, and perks when shopping at certain brands. Some allow financing on large purchases with 0% interest if paid within a set period.

Business Credit Cards

✅ Best for: Entrepreneurs, freelancers, and small business owners

✅ Key benefit: Higher limits, expense tracking, and rewards on business expenses

Business credit cards help separate personal and business finances while offering higher credit limits, employee cards, and cashback on business-related purchases.

Comparison Table: Which Credit Card is Right for You?

| Credit Card Type | Best For | Key Benefits |

|---|---|---|

| Unsecured Credit Card | Everyday spending | No deposit required |

| Secured Credit Card | Building/rebuilding credit | Requires a deposit, easy approval |

| Balance Transfer Card | Paying off debt | 0% intro APR for balance transfers |

| Travel Rewards Card | Frequent travelers | Earn miles/points for travel |

| Gas Rewards Card | Drivers, commuters | Cashback on fuel |

| Cashback Card | Everyday spending | Earn cashback on purchases |

| Student Credit Card | College students | Good for first-time credit users |

| 0% Intro APR Card | Big purchases, avoiding interest | 0% interest for a limited time |

| Retail Store Card | Brand-loyal shoppers | Exclusive perks at specific stores |

| Business Credit Card | Entrepreneurs, businesses | Rewards & tools for business expenses |

Final Thoughts

Choosing the right credit card depends on your financial habits and goals. Whether you’re looking to build credit, earn rewards, or save on interest, there’s a card that fits your needs.