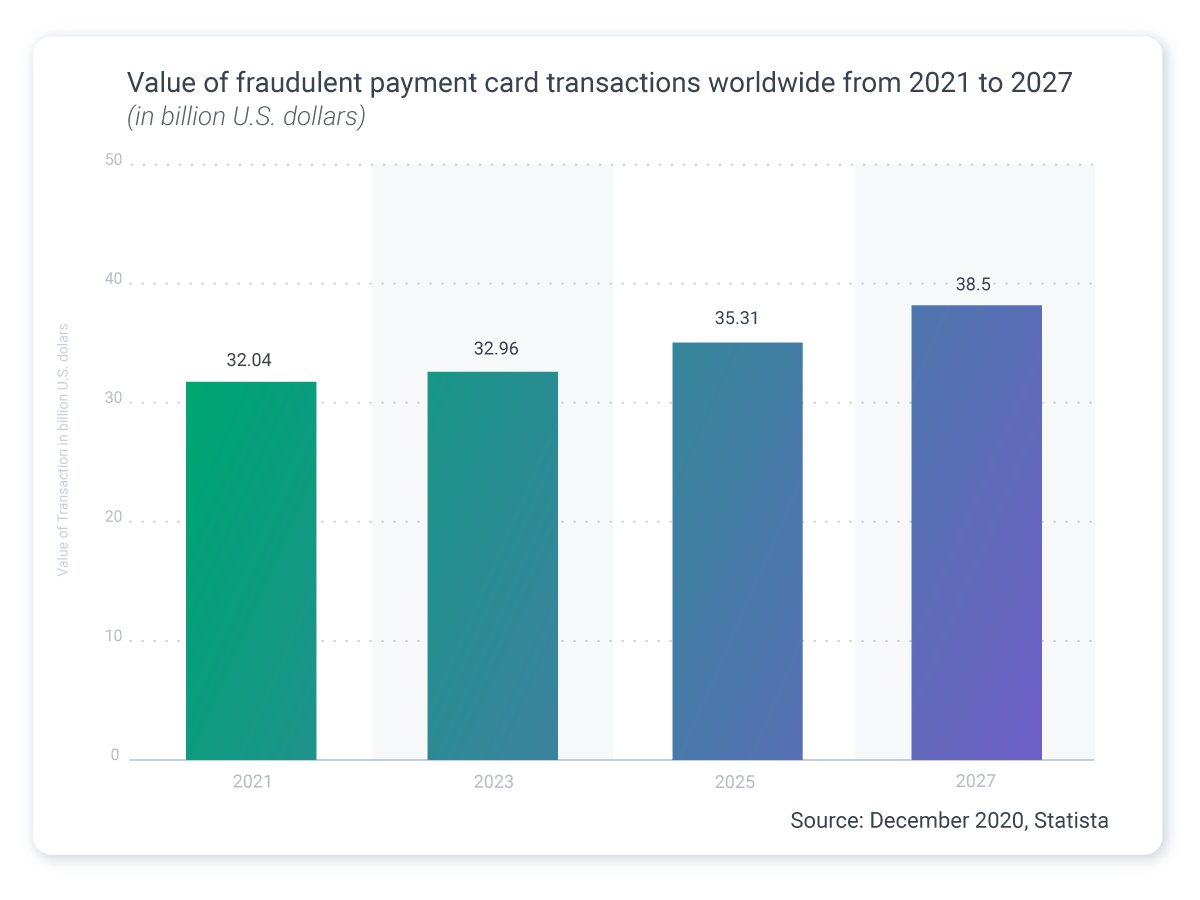

Global fraud losses continue to surge. Juniper Research expects payment fraud to exceed 340 billion dollars cumulatively between 2023 and 2027, with annual fraud losses still rising into 2028. Fraud growth is driven by real-time payments adoption, synthetic identity fraud, and increasingly sophisticated AI-driven attacks.

Proactive fraud prevention now takes center stage for financial institutions as they seek the best solutions to reduce fraud and enhance their clients' overall security.

Today, nearly every consumer interacts with ML-driven systems across banking, e-commerce, and digital payments. Financial institutions use this technology for adaptive risk scoring, anomaly detection, behavioral biometrics, transaction monitoring, and synthetic identity detection across billions of transactions.

How can financial institutions take advantage of the incredible efficiency of ML to help protect their client’s transactions and reduce overall fraud?

We will focus on answering this question, using evidence of ML's success thus far in preventing fraud in the finance industry.

What is Fraud Detection and Why Does It Create Problems?

Digital banking, mobile payments, and instant transfers have raised consumer expectations for speed and convenience. They have also created a larger attack surface as financial institutions now process billions of transactions at any time of day, across multiple channels, devices, and payment rails.

At the same time, fraud methods have advanced rapidly. Attackers now use automated bots, deepfakes, phishing kits powered by generative AI, and large-scale credential theft. Cybercrime already costs the global economy 10.5 trillion dollars, with further growth expected in 2026 and 2027.

The scale of this activity means financial institutions cannot rely on human-driven review processes but require trained models to spot fraudulent behaviour in real time.

Traditional fraud detection systems often depend on fixed rules. While rules have value, they struggle with new fraud patterns, create high false positive rates, and require constant manual tuning. ML models improve on this by learning from both historical behavior and live transaction patterns, allowing them to detect subtle anomalies and emerging threats as they appear.

However, there’s a solution that works much better than rule-based systems - ML and AI. The ability of machines, using ML algorithms, to learn from past data patterns and spot anomalies has become necessary, especially in financial software.

Where Financial Fraud Happens

There are a few specific areas where we find that financial detection software can be most helpful in successfully detecting fraud and raising red flags for companies.

Financial institutions face fraud across many channels. The most common and fast-growing areas include:

1. Digital Wallet and Device-Level Fraud

Digital wallets have become one of the biggest points for fraud. This happened because the use of digital wallets has grown as consumers increasingly store payment credentials in their phones. Attackers use SIM swapping, jailbroken devices, app-level injection attacks, and stolen biometrics. ML strengthens defense through behavioral biometrics, continuous authentication, and device intelligence analysis.

2. Card-Not-Present (CNP) and Digital Payments Fraud

CNP fraud remains one of the largest categories of payment fraud, particularly in e-commerce. Fraudsters exploit stolen card data, device spoofing, compromised accounts, and automated scripts that test card details at scale. ML models help detect suspicious behavior by analyzing purchase velocity, device fingerprints, location anomalies, and behavioral signals.

3. Account Takeover and Identity Fraud

Attackers use phishing kits, deepfake audio, synthetic identities, and credential theft to gain access to legitimate customer accounts. ML evaluates login behavior, device reputation, biometric indicators, and unusual navigation patterns that point to an account takeover attempt.

4. ATM Fraud and Cash-Out Schemes

While classic skimming still occurs, modern ATM fraud involves malware-driven jackpotting, PIN harvesting, and coordinated cash-out events. ML supports detection by analyzing withdrawal patterns, machine-level anomalies, and transaction clustering across networks.

5. POS and Merchant Fraud

Fraud within merchant environments includes refund fraud, loyalty program abuse, chargeback schemes, and terminal manipulation. ML models can identify inconsistencies in user activity, unusual refund behavior, and high-risk merchant transactions.

6. Phishing and Social Engineering

Generative AI tools have increased the volume and realism of phishing messages. ML-powered email security platforms now scan billions of messages each day and block suspicious content based on linguistic patterns, sender reputation, and malicious link detection. Google and Microsoft report that their systems block more than 99 percent of spam, phishing, and malware before it reaches users.

New Types of Fraud

Generative AI Is Reshaping Financial Fraud

Generative AI has significantly altered the fraud landscape between 2024 and 2026. Fraudsters now use AI models to generate realistic text, audio, and images at scale, making scams more convincing and harder to detect.

Deepfake audio is increasingly used to impersonate executives, bank representatives, or customer support agents. Voice cloning attacks can bypass traditional verification processes, particularly in call centers.

AI-generated phishing campaigns dynamically adjust tone, language, and brand cues, improving success rates. Synthetic identities created with generative models are also being used to defeat weak onboarding and KYC processes.

To counter these threats, financial institutions are deploying ML systems that analyze voice characteristics, detect media manipulation artifacts, identify linguistic anomalies, and validate identity using multiple data signals rather than static documents alone. Multimodal analysis that combines behavioral, biometric, and contextual data is becoming essential for banks and digital banks to ensure the safety of their clients.

The Rise of Real-Time Payments Fraud

Real-time payment systems have transformed how money moves, but they have also introduced new fraud risks. Once a real-time payment is authorized, funds are typically irrevocable, leaving little opportunity for recovery.

Payment rails such as FedNow, RTP, SEPA Instant, and PIX have shortened fraud detection windows from hours to seconds. Authorized push payment fraud has become one of the fastest-growing threats, where users are manipulated into sending funds themselves. Mule account networks are often used to rapidly disperse stolen funds across multiple accounts.

Financial institutions are responding with real-time ML risk scoring before payment release, behavioral analysis at the moment of authorization, and graph-based detection to identify mule activity.

Behavioral Biometrics as a Core Fraud Defense

Behavioral biometrics has become one of the most widely adopted fraud prevention tools in 2025 and 2026. Instead of relying solely on what a user knows or possesses, behavioral biometrics focuses on how a user interacts with systems.

Signals such as typing cadence, swipe behavior, mouse movement, navigation patterns, and hesitation signatures are continuously analyzed in the background. These patterns are extremely difficult to replicate, even when credentials are compromised.

Behavioral biometrics is especially effective in detecting account takeovers, social engineering attempts, and bot-driven attacks. Because it operates passively and continuously, it improves security without adding friction to the customer experience.

Graph-Based Fraud Detection and Network Analysis

Fraud rarely occurs in isolation. Organized fraud often involves networks of accounts, devices, merchants, and intermediaries. Graph-based machine learning detects these relationships by analyzing connections rather than individual transactions.

Graph models identify suspicious clusters, repeated device usage across accounts, shared infrastructure, and coordinated behavior patterns. This approach is particularly effective for detecting mule networks, fraud rings, and collusive merchant activity.

By understanding how entities interact within a network, graph-based detection reveals fraud patterns that traditional transaction-level models miss. It has become a critical layer in modern fraud prevention architectures.

AI Explainability and Trust in Fraud Decisions

Fraud detection models must be explainable so risk teams, compliance officers, and regulators can understand why a transaction was approved or declined.

Explainable AI provides transparency into decision drivers, feature importance, and risk factors influencing outcomes. This enables faster investigations, clearer dispute resolution, and defensible regulatory reporting.

Techniques such as feature attribution, decision path visualization, and counterfactual explanations help institutions balance advanced detection with accountability. Explainability is also critical for maintaining internal trust in AI systems and ensuring responsible use of ML.

Why Is ML So Effective for Fraud Detection?

Machine learning models excel because they adapt. Once trained on historical and live transaction data, a model learns to recognize patterns of normal behavior for each customer, account, device, and merchant. It then evaluates new events in real time and assigns a risk score. This allows financial institutions to stop suspicious transactions instantly without adding unnecessary friction for legitimate customers.

ML delivers several key advantages:

- Real-Time Pattern Recognition. ML monitors thousands of data points for every transaction, identifying subtle indicators of fraud that humans or rule engines often overlook.

- Reduced False Positives. By understanding individual behavior patterns over time, ML is more accurate than static rules, which reduces unnecessary transaction declines and improves customer satisfaction.

- Adaptive Risk Scoring. Fraud patterns change rapidly. ML models continuously learn from new data, allowing them to detect new types of attacks without months of manual rule updates.

- Improved Operational Efficiency. ML reduces the workload on fraud analysts by filtering low-risk activity and highlighting only the most suspicious cases.

- Stronger Protection Against Emerging Threats. Modern fraud includes mule account networks, social engineering, and synthetic identities. ML supports detection through graph analysis, clustering techniques, and behavioral modeling.

The Benefits of Using Machine Learning in Fintech Application Development

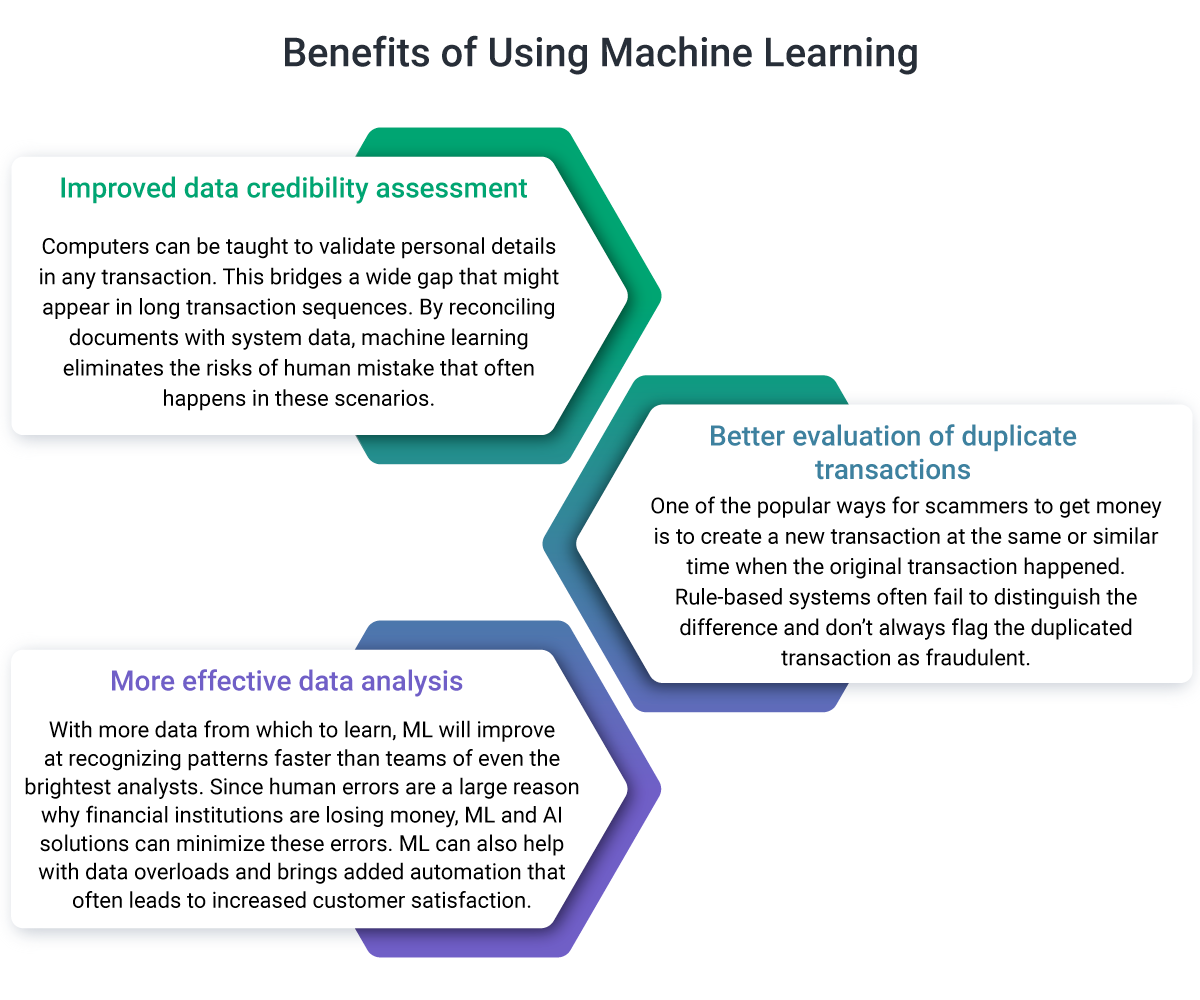

ML can be applied in several areas of the overall payment process to prevent fraud. It allows clients' account information to remain safe and lowers overall costs incurred, such as the time operators spend in call centers trying to help clients mitigate the consequences of scams. Beyond cost and resource savings, the benefits of ML include:

Improved data credibility assessment

Computers can be taught to validate personal details in any transaction. This bridges a wide gap that might appear in long transaction sequences. By reconciling documents with system data, machine learning eliminates the risks of human mistakes that often happen in these scenarios.

Better evaluation of duplicate transactions

One of the popular ways for scammers to get money is to create a new transaction at the same or similar time when the original transaction happened. Rule-based systems often fail to distinguish between transactions and don’t always flag duplicated transactions as fraudulent.

More effective data analysis

With more data from which to learn, ML will improve at recognizing patterns faster than teams of even the brightest analysts. Since human error is a major reason financial institutions lose money, ML and AI solutions can help minimize it. ML can also help with data overload and bring added automation, often leading to increased customer satisfaction.

Fraud Detection AI and ML Models and Algorithms

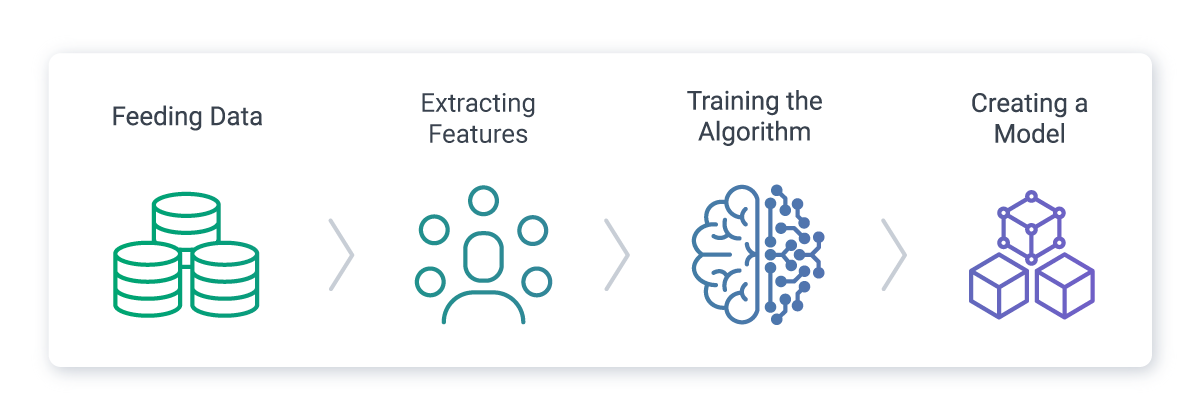

There are a handful of algorithms used to “train machines'' and the two most popular ones are supervised and unsupervised models. When an algorithm is used as a set of instructions, machines can build models by processing data to create a baseline with which they can compare new information.

Supervised learning models

A supervised model is the most common model of ML across multiple disciplines. Once machines are “fed” with enough data with tagged transaction information, they will generate spending models and compare new data with what they already have. Fraudulent and regular user behavior is labeled beforehand so the machine can understand the difference and only needs to learn from it. The more data a machine has, the easier it is for it to make accurate assumptions.

Unsupervised learning models

Unsupervised models differ from supervised ones because they work with unlabeled data, so the machine must learn to recognize fraud on its own. In some cases, it's difficult to identify which transaction is problematic, and that’s when the machine takes up assumptions based on large data sets it has learned from.

Semi-supervised learning models

Semi-supervised learning falls somewhere between supervised and unsupervised models. It manages well in situations when labeling information is not possible, making assumptions based on discovered patterns.

Reinforcement learning models

Reinforcement learning algorithms allow machines to discover behavior norms within a specific context to learn from. These systems constantly learn and look to find behavior that doesn’t fit and raise red flags when they find it.

Final Thoughts on Financial Data Fraud Prevention

Machine learning algorithms demonstrate their full potential when used for pattern identification in the finance industry. They are able to detect correlations that would be otherwise unrecognizable in vast data sets. Human analysts would need hours to discover one particular pattern that ML can analyze and learn from significantly faster.

In finance, ML can be used in various ways, from analyzing credit history, payments, and remittances, to preventing user fraud. ML and AI have the incredible ability to evaluate massive chunks of data in real-time, recognize patterns, and label transactions as fraudulent, showcasing the pivotal role of ai in fintech.

By using available data sets for ML, banks, neobanks, payment providers, and other financial institutions can build prevention systems and assist customers on a level that rule-based systems cannot. Ultimately, every bank, card issuer, or bank, aims to secure customers’ sensitive information and money as fraud can heavily influence their business’s future and reputation.