Estimated reading time: 6 minutes, 10 seconds

What will post-pandemic banking look like?

The financial industry has, historically, not been open to innovation and digitization (in an informal survey, the textile industry ranked higher than the financial industry when it came to innovation!1). Yet those who invested in innovation reported that they were better prepared to weather a drastic event like the novel coronavirus.2

Digitization in banking and other services has been transforming the financial industry for years, albeit in slow increments. Digitally native banking services and fintechs drive this transformation. It has moved transactions away from physical locations and into mobile devices. It has also armed financial service providers with advanced analytics to supply personalized services.

Rather than focusing on when digitization in banking will occur (because that’s a forgone conclusion), there’s a better question to ask. How do we make sure post-pandemic banking keeps the human aspect needed to stay empathetic to consumers’ unique needs?

Shaping Post-Pandemic Banking

The Human Touch

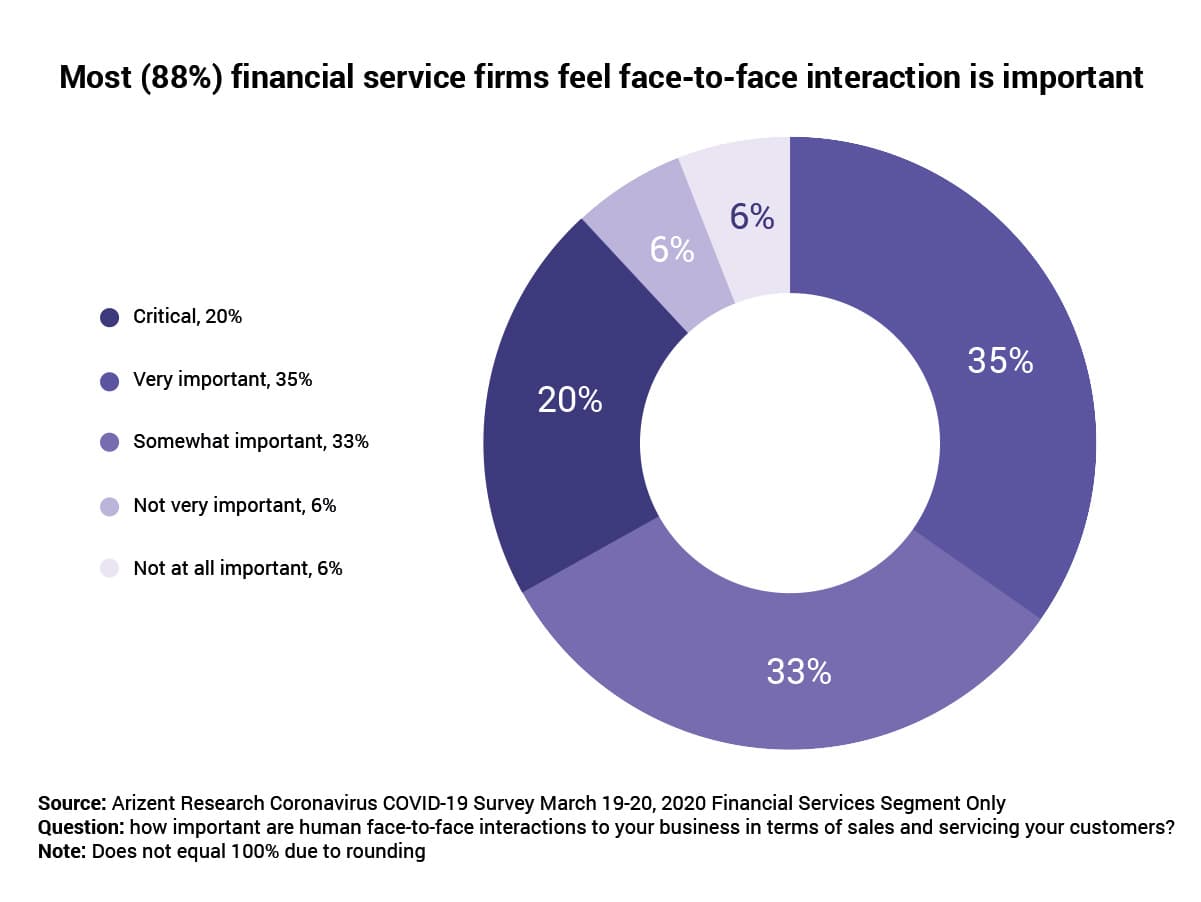

A recent survey found that 88% of financial institutions feel human interaction is important to sales and servicing.3 Unfortunately, this type of interaction was prohibited as countries, cities, and businesses shuttered to help prevent the spread of the pandemic. As social distancing measures are enforced, human interaction in business processes may continue to be difficult.

It’s not unusual to believe that speaking with someone face to face is important, especially when it comes to financial matters. Reasons for meeting in person range from missing subtext usually found in body language, misunderstandings in written text, or discomfort and lack of familiarity with technology.

But personalization comes in many forms, and customers have unique needs. Some of them are looking to complete errands quickly. Most of the world owns a mobile device, and tech literacy is climbing every day as many daily activities are automated.

Digitizing otherwise tedious services, like onboarding, help speed customers to the resolution they want. This is no longer a differentiator, but a baseline expectation. By doing this, companies can allocate resources for human touchpoints to areas that need it more.

Why Digital Banking is the Future

Because of a black swan event, we find ourselves forced to rely more on technology. We are experiencing the biggest use case for how technology can support human interaction.

Social media and blogging have sustained community building. Friends are staying in touch with telecommunications software like Zoom and Google Meets. Families can get needed groceries or medication with ecommerce, mcommerce, and online payment options.

Technology cannot replace human interaction, but it can support and enable it. Especially in demanding situations like the one we find ourselves in now. The current crisis cannot have made the importance of digitization in banking more clear.

It is because of technology that someone in California can connect instantly with a friend in South Korea. It is due to technology that someone can start a business with the push of a button. Generations now prefer texting and create new communication to imply subtle expressions usually conveyed by facial tics or hand gestures.

Technology is a tool, and one that should be added to processes with intelligence and care. Digital banking is a necessary evolution moving forward.

Consumers and Post-Pandemic Banking

How Consumer Behavior is Impacted

Typically, consumer behavior is slow to change. Yet the current climate has created a swift transformation, forcing consumers to quickly adopt new processes.

Eighty-three percent of American shoppers say their in-store shopping behavior has changed since the coronavirus hit. Since January, ecommerce platforms have seen an 80% increase in demand.4

Most consumers are finding that, now more than ever, it’s easier to take their business to a competitor when they find their incumbent financial service doesn’t match their preferences.5

Due to globalization, consumers are being introduced to a wider number of options for all kinds of services. While they often stay with a particular company out of familiarity, they are slowly understanding they have an incredible power of choice.

This is just as true for financial services. Consumers are increasingly using online means to pay bills and access other financial services and prefer to call rather than walk into a physical branch location.6

As new processes are adopted, especially ones that make finishing a task easier and faster, it’s difficult to go back to the way things were before.

What Consumers Want from Digital Banking

Consumers want ease of access. They’re used to finding information, connecting with others, and making purchases anywhere, at any time, right from their mobile devices. This leads them to ask, why can’t my bank afford me the same quality of interaction?

This isn’t to say that human interaction is unnecessary; customers still want personalization. Humans are needed to solve human problems and meet human needs.

Consumers expect companies to understand their needs and expectations.7 Depending on scale, a local bank can supply that level of understanding for their customers by meeting them face to face.

But so much more can be done with that manually collected information. For example, a CRM integrated with an AI program can estimate better terms, recommend more services, or suggest a brand new product. Machine learning can keep financial services on par with rising fraud issues.

All of these tools can remove human error, resolve redundant processes, and empower employees to do work that computers can’t, such as deep analysis and creative application. Banks that successfully adopt digital technologies can see a 40% increase in profit from a combination of increased revenues and lower operational costs.8

Customers know that easier and faster delivery is possible when technology complements the process. Marrying human touch to tech creates a business that is empathetic to its customers’ needs, and grants the organization agility.

As businesses shift to remote operations, technology is an expectation and a need. We must think on how to make sure the human part isn’t lost in post-pandemic banking.

Conclusion

What post-pandemic banking will look like depends on many factors: the audience served, the companies and services trying to reach them, and the needs met.

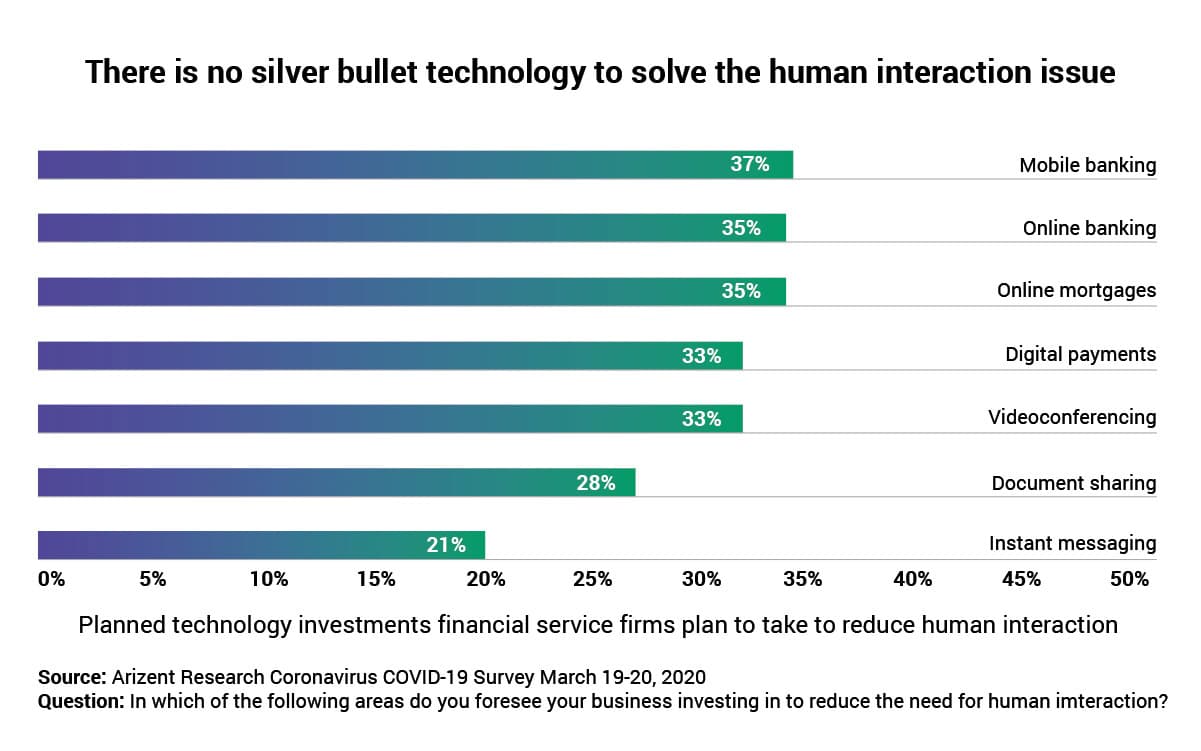

There’s a lot of technology out there to help grow digital banking solutions. The one thing we know for certain is that tech will continue to help financial services weather this current crisis. Hopefully, it can also better prepare them for emergencies in the future.

If you are a financial services company looking for a technology services partner to help chart a course into post-pandemic banking, Softjourn is here to help. We are a global technology services partner with more than a decade of experience working with fintech and cards & payments companies.

Our 200+ employees skillfully evaluate, identify, and plan innovative, creative solutions. We become a trusted partner by proactively collaborating on all design, build out, and deployment. Contact us to give life to your ideas!

1 Mawad, M., & Neuman, J. (2020, June 02). Banking is less innovative than the textile industry.

2,3,6 Moeser, M. (2020, March 26). Subscriber exclusive: How the payments industry is responding to coronavirus.

4 A Look at Changing Consumer Behavior Trends. (n.d.).

5, 7 What Are Customer Expectations (and How Have They Changed)? (n.d.).

8 Mangla, R.; Singh, R.; Trehan, K.; Williams, M. (n.d.). How digital collaboration helps banks serve customers better.