Data-driven companies are 23 times more likely to successfully acquire new customers, and these data-focused organizations are also six times more likely to retain existing customers. In today's rapidly evolving financial landscape, managing data effectively is crucial for staying competitive.

Advanced data management solutions can help financial institutions streamline their operations, ensure compliance, and enhance decision-making.

This article delves into various aspects of data management in financial services, including its importance, best practices, and the impact of robust data governance frameworks.

What is Data Management in Financial Services?

Definition of Data Management

Data management in financial services involves the systematic organization, storage, and utilization of data to drive decision-making and operational efficiency. This includes everything from collecting financial information to ensuring that data is accurate and accessible.

Effective data management is crucial for financial institutions as it helps mitigate risks, enhance customer satisfaction, and comply with regulatory requirements.

Key Components of Data Management for Financial Services

Key components of data management for financial services include data integration, data quality, and data governance:

- Data integration involves consolidating data from multiple sources to provide a unified view.

- Data quality ensures that the data is accurate, complete, and timely, which is essential for making informed decisions.

- Data governance involves establishing policies and procedures to manage data assets effectively and ensure compliance with regulations.

Another critical component is the use of data management platforms that offer advanced analytics and reporting capabilities. These platforms enable financial institutions to gain insights from their data, identify trends, and make data-driven decisions.

Additionally, data protection measures are essential to safeguard sensitive financial information and maintain customer trust.

By focusing on these key components, financial services organizations can build a robust data management framework that supports their strategic objectives.

Why is Effective Data Governance Crucial in Financial Services?

Data Management Impact on Financial Institutions

Data management is a critical pillar for financial institutions aiming to stay competitive and compliant.

Effective data management ensures that financial institutions can accurately process, store, and retrieve essential information, leading to better decision-making, risk mitigation, and operational efficiency.

Poor data management, on the other hand, can result in inaccurate information, regulatory non-compliance, and heightened operational risks.

By implementing advanced data management strategies, including data governance, financial institutions can ensure the accuracy, security, and accessibility of their data.

This fosters improved customer satisfaction, reduces costs associated with manual processes, and provides a competitive edge in a rapidly evolving market.

Leveraging data analytics for insights into customer behavior and market trends allows institutions to make data-driven decisions, enabling them to scale effectively and offer more tailored products and services.

Understanding Data Governance

Data governance refers to the framework of policies, procedures, and standards that ensure the effective management of an organization's data assets.

In the financial services industry, data governance is crucial for maintaining data quality, ensuring compliance with regulations, and protecting sensitive financial information.

It involves defining roles and responsibilities, establishing data stewardship practices, and implementing data governance tools to manage data throughout its lifecycle.

Effective data governance enables financial institutions to manage their data assets proactively and strategically. It ensures that data is accurate, consistent, and reliable, which is essential for making informed business decisions.

Additionally, strong data governance helps financial institutions comply with regulatory requirements and avoid costly penalties.

By establishing a robust data governance framework, financial services organizations can enhance data quality, reduce risks, and improve overall operational efficiency.

Benefits of Strong Data Governance Frameworks

Strong data governance frameworks offer numerous benefits to financial institutions.

- They enhance data quality by ensuring that data is accurate, complete, and consistent. This leads to better decision-making and improved operational efficiency.

- Robust data governance frameworks help financial institutions comply with regulatory requirements, reducing the risk of penalties and reputational damage.

- Strong data governance frameworks enable financial institutions to protect sensitive customer data and maintain customer trust.

- They facilitate data integration by providing a unified view of data from multiple sources, which is essential for gaining insights and making data-driven decisions.

- Strong data governance frameworks help financial institutions achieve their strategic objectives, enhance operational efficiency, and maintain a competitive edge in the financial services industry.

How to Implement a Data Governance Framework

Steps to Develop an Effective Data Governance Framework

Implementing an effective data governance framework involves several key steps.

- Financial services organizations should define roles and responsibilities for data governance. This includes appointing data stewards and establishing data governance committees.

- Organizations should develop data governance policies and procedures to ensure data quality and compliance with regulatory requirements.

- Financial services organizations should invest in data governance tools and technologies to support their data governance initiatives. This includes data management platforms that offer data quality assessment, data cleansing, and data governance features.

- Organizations should also provide training and support to employees to promote data stewardship and ensure data accuracy.

Challenges in Implementing Data Governance

Implementing data governance in financial services can be challenging due to various factors.

One of the primary challenges is the complexity of managing large volumes of data from multiple sources. This requires robust data integration and data management solutions to ensure data accuracy and consistency.

Another challenge is that financial institutions must navigate complex regulatory requirements and ensure compliance with data protection laws.

Next, it can be difficult to gain buy-in from stakeholders and establish a culture of data governance within the organization. This involves defining roles and responsibilities, providing training, and promoting data stewardship practices.

Finally, financial institutions must invest in advanced data governance tools and technologies to support their data governance initiatives.

Despite these challenges, effective data governance is essential for maintaining data quality, ensuring compliance, and protecting sensitive financial information.

Maintaining and Updating the Framework

Maintaining and updating the data governance framework is crucial for its long-term success.

Financial services organizations should conduct regular reviews of their data governance policies and procedures to ensure they remain relevant and effective.

This includes updating data quality standards, data protection measures, and compliance requirements as needed. Organizations should also monitor the performance of their data governance initiatives and make adjustments as necessary.

Additionally, financial services organizations should provide ongoing training and support to employees to promote data stewardship and ensure data accuracy.

This involves keeping employees informed about changes to data governance policies and providing resources to help them manage data effectively.

How to Improve Data Quality in Financial Services

Identifying and Mitigating Poor Data

Improving data quality in financial services begins with identifying and mitigating poor data.

Poor data can result from various factors, including data entry errors, outdated information, and data integration issues.

Financial institutions must implement data quality assessment tools to identify inaccuracies and inconsistencies in their data. This involves regularly auditing data sources, validating data accuracy, and addressing any identified issues promptly.

Mitigating poor data also involves implementing data cleansing processes to remove duplicates, correct errors, and update outdated information.

Financial institutions should establish data quality standards and guidelines to ensure consistency across the organization.

By identifying and mitigating poor data, financial institutions can enhance data accuracy, improve decision-making, and reduce operational risks.

Best Practices for Ensuring Data Accuracy

Ensuring data accuracy in financial services is critical to informed decision-making and risk management. Financial institutions should adopt data governance frameworks that define clear roles, responsibilities, and data quality standards, ensuring consistency and accuracy across the organization.

Regular data audits and data quality assessment tools can identify inaccuracies, while data cleansing processes help address issues like duplicates and outdated information.

Investing in advanced data management software that provides automated data validation, error detection, and continuous monitoring further ensures that high-quality, accurate data is consistently available for decision-making.

Ongoing training for employees to promote data stewardship ensures long-term data accuracy throughout the organization.

Tools and Technologies for Data Quality Management

Advanced tools and technologies play a crucial role in data quality management for financial services. Data governance tools help establish and enforce data quality standards and guidelines.

These platforms and tools enable financial institutions to consolidate data from multiple sources, identify inaccuracies, and ensure data consistency.

Other technologies, such as artificial intelligence and machine learning, can enhance data quality management by automating data cleansing and validation processes.

These technologies can identify patterns and anomalies in data, enabling financial institutions to address issues proactively.

How Does Data Management Enable Risk Management in Finance?

Role of Data in Risk Management

Data plays a crucial role in risk management for financial services. Accurate and timely data enables financial institutions to identify, assess, and mitigate risks effectively. This includes analyzing market data, customer data, and financial information to identify potential risks and develop strategies to address them.

Robust data management practices ensure that financial institutions have access to reliable data, which is essential for effective risk management.

Integrating Data Management with Risk Management Strategies

Integrating data management with risk management strategies is essential for financial institutions. This involves establishing data governance frameworks to ensure data accuracy and consistency.

Additionally, financial institutions should implement advanced data management platforms that offer risk management features, such as data analytics and reporting capabilities. These platforms enable financial institutions to gain insights into risk patterns and develop proactive risk management strategies.

Financial institutions should also conduct regular data audits to identify and address any inaccuracies or inconsistencies, ensuring that the data used for risk management is reliable and accurate.

Examples of Risk Management Solutions

Several risk management solutions leverage advanced data management practices to enhance risk mitigation.

Predictive Analytics Tools

Financial institutions can use predictive analytics tools to identify potential risks and develop proactive strategies to address them. These tools analyze historical data and identify patterns that may indicate future risks.

Risk Monitoring Systems

Financial institutions can implement automated risk monitoring systems that continuously monitor data for anomalies and potential risks.

Data Visualization Tools

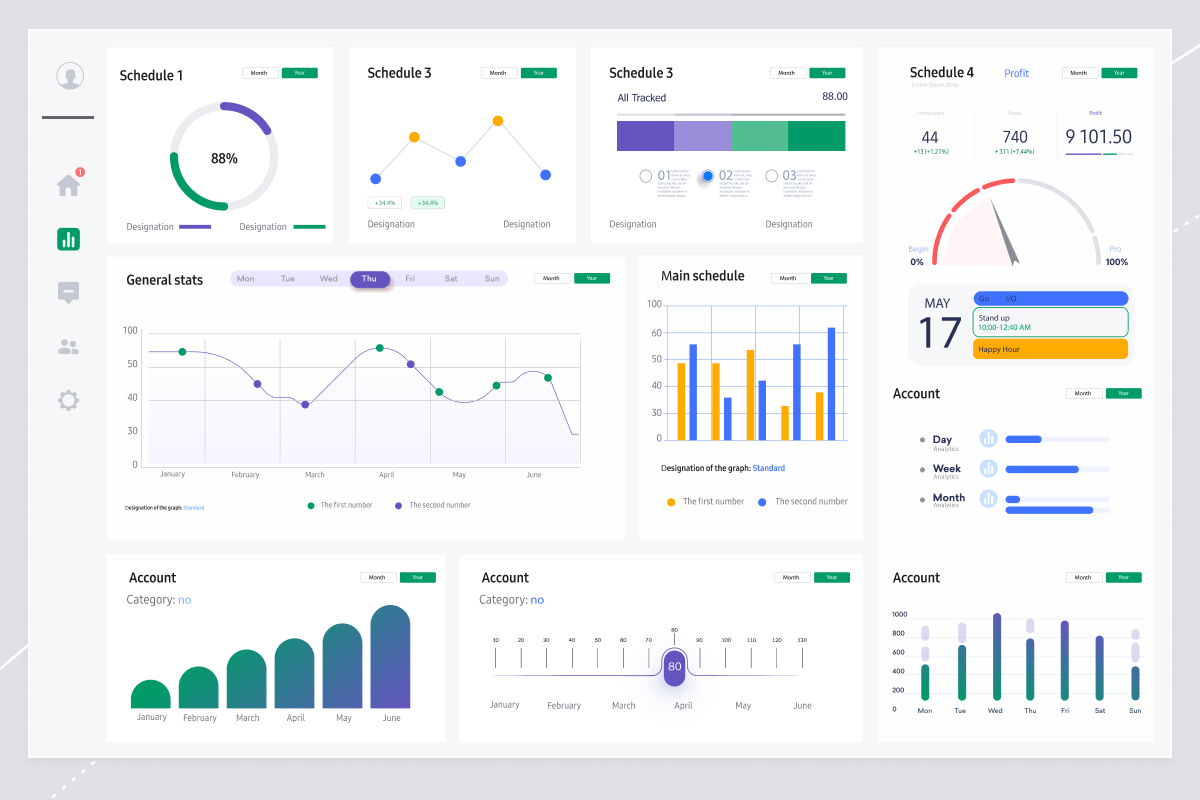

Another example is the use of data visualization tools to gain insights into risk patterns and trends. These tools provide interactive dashboards that enable financial institutions to visualize data and identify potential risks quickly.

Data Management Solutions for Financial Services

Top Data Management Platforms

Several top data management platforms are designed specifically for financial services. These platforms offer a range of features, including data integration, data cleansing, and advanced analytics.

Some of the leading data management platforms for financial services include Informatica, IBM Infosphere, and Oracle Data Management. These platforms provide robust data management solutions that enhance data quality, ensure compliance, and support data-driven decision-making.

These platforms offer scalability and flexibility, enabling financial institutions to manage large volumes of data effectively. They also provide advanced security features to protect sensitive financial information and maintain customer trust.

Features to Look for in Data Management Software

When selecting data management software for financial services, financial institutions should look for several key features:

- The software should offer robust data integration capabilities to consolidate data from multiple sources.

- The software should provide advanced data quality assessment and data cleansing features to identify and address inaccuracies.

- Data management software should offer advanced analytics and reporting capabilities to gain insights from data and support data-driven decision-making.

- Security features are crucial to protect sensitive financial information and ensure compliance with regulatory requirements.

Case Studies from the Financial Services Industry

1. PEX: Leveraging Power BI to Save Time & Encourage Data-Driven Decision Making

Softjourn helped PEX implement a Power BI solution to analyze years of financial data in seconds, enabling faster and more informed decision-making. This solution allowed PEX to consolidate key data from multiple sources and provide actionable insights for both their team and clients. The improved data strategy enhanced scalability and helped drive future business initiatives.

2. Zero Downtime, Maximum Performance: Versapay's Smooth Database Migration

Softjourn successfully migrated Versapay's database to AWS Aurora, improving performance, scalability, and cost efficiency while ensuring zero downtime. The migration allowed Versapay to handle larger data volumes and run complex queries more efficiently. With the new database system in place, Versapay is well-positioned for future growth and operational demands.

3. Bullet: Meeting CBI Requirements with AWS-Powered Data Processing

Softjourn helped Bullet migrate to AWS, ensuring compliance with Central Bank of Ireland regulations while improving system scalability and reliability. The new AWS-powered infrastructure enhanced observability, disaster recovery, and operational resilience. Bullet’s platform now meets stringent regulatory requirements while being positioned for future growth in the competitive financial services market.

4. How Expense Management Leader Optimized Their Elasticsearch Through a Massive Upgrade

Softjourn upgraded an expense management client’s Elasticsearch system, significantly improving search speed and accuracy for large volumes of financial data. The project involved a complex version upgrade, ensuring the new system maintained user experience while offering better performance. Additionally, Softjourn developed a custom comparison tool to ensure future Elasticsearch upgrades are seamless and accurate.

Final Word

In today’s competitive financial landscape, effective data management is essential for enhancing operational efficiency, ensuring compliance, and making data-driven decisions.

By implementing advanced data governance frameworks and utilizing the right tools, financial institutions can improve data quality, mitigate risks, and safeguard customer trust.

If you're looking for expert assistance with your data migration strategy or need tailored data management consulting solutions to optimize your financial services operations, contact Softjourn today.

Let us help you build a robust and resilient data infrastructure for future success!

FAQs

Q: What are the key benefits of implementing financial services data management solutions?

A: Financial services data management solutions provide accurate data for decision-making, improve risk management, and ensure compliance with regulatory requirements. They also streamline data from different sources, ensuring that financial institutions have the right data at the right time.

Q: What role does data validation play in financial data management?

A: Data validation ensures that the financial data being used is accurate and reliable. This is crucial for maintaining the integrity of financial reports, complying with regulations, and making sound business decisions.

Q: How does financial data management help financial services improve risk management?

A: Financial data management allows financial services to have a comprehensive view of their data across the organization. This enables them to identify potential risks, monitor transactions, and implement preventive measures in a timely manner.

Q: Why is it important for financial firms to use an enterprise data warehouse?

A: An enterprise data warehouse consolidates data from different sources into a single repository, making it easier to manage and analyze. This helps financial firms to gain insights, improve decision-making, and enhance overall data governance.

Q: How can financial services use cloud data to their advantage?

A: Cloud data provides financial services with scalable, flexible, and cost-effective solutions for storing and managing data. It enables real-time data access, enhances collaboration, and supports advanced analytics and machine learning applications.

Q: What are the challenges of managing transactional data in the financial industry?

A: Managing transactional data in the financial industry involves ensuring data accuracy, preventing fraud, and complying with regulations. Financial institutions must also handle large volumes of data efficiently and integrate it with various systems and platforms.

Q: How can financial data management solutions help financial services sector achieve compliance?

A: Financial data management solutions help the financial services sector achieve compliance by providing accurate and consistent data, automating reporting processes, and ensuring adherence to regulatory standards.

Q: What impact does efficient data management have on a bank’s data strategy?

A: Efficient data management enhances a bank’s data strategy by improving data quality, enabling better analytics, and supporting strategic initiatives. It helps banks to deliver personalized services, optimize operations, and drive innovation.

Q: How can financial institutions leverage new data technologies?

A: Financial institutions can leverage new data technologies such as artificial intelligence, machine learning, and blockchain to enhance their data management capabilities. These technologies can provide deeper insights, improve security, and drive efficiencies across the financial services sector.