Changes in domestic retail payments are the main force driving the finance industry forward. The current payment system in the US is about 40 years old and a new model has become necessary to adapt to the changing technology and trends in the industry.

As more types of payment infrastructures are brought to market, banks and fintechs are forced to restructure their current business models to adopt payment types that are currently in high demand from users.

Adaptability to changing customer needs is crucial in the banking and fintech industry. During COVID-19, we witnessed the fall of banks and fintechs who were too late in offering instant payments, online banking services, or easy access to different card types.

In Europe, the payment system is a patchwork of payment infrastructures that work well enough domestically, but are inconsistent in the EU as a whole. However, facilitating the exchange of payment types to the international market and expanding beyond a single currency is a complex and demanding task for banks.

Despite these challenges, many financial institutions are working on building a cross-border payment system that would serve users as conveniently as current domestic ones. This is only made possible by bridging closed loops of multiple banking and currency systems.

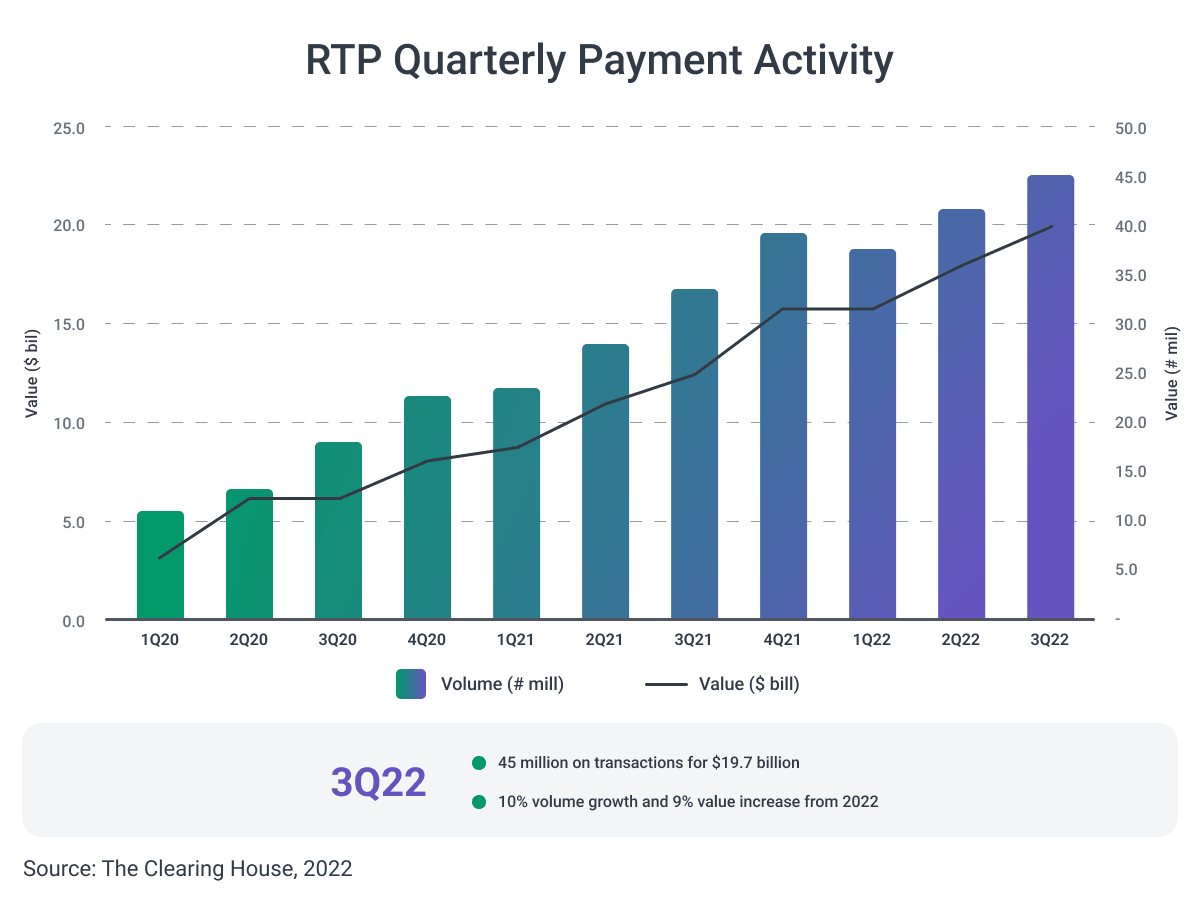

Real-time payments (RTP) are the future of payments since they are characterized as “open-loop” and many key players in the banking industry are very committed to developing the system to support it. For example, The Clearing House launched its RTP Network in 2017, and the Federal Reserve Bank is developing an RTP solution set for 2023.

Source: The Clearing House, 2022

RTPs make payments frictionless for customers since they are initiated, cleared, and settled within seconds of a purchase. To make payments in real-time, the bank's backend system must be available 24/7, keeping both users and the bank secure and protected from fraud. RTPs ensure that customers will have speed in payments, instant settlements, and easy access to their money, any time they need it.

Building Real-Time Payment Rails for the Future

Real-time payments are not an entirely new concept. In the 1970s, Japan was one of the first to develop an RTP system, and countries such as the UK, India, and China, followed in the 2000s. There are an estimated 54 countries that have already set up real-time payment systems.

RTP rails are networks or platforms that allow digital money to move from one person to another regardless of the method, currency, or country. They allow domestic US payments to be processed 24/7 and all year round with immediate settlement and instant funds availability. From 2022, RTP transactions are allowed to be up to 1 million dollars in value.

Rails can be different in terms of payment types they support, speed, technology, and the part of the world where they are in use. The most popular rails today are offered by major credit card providers (e.g. Mastercard and Visa), SWIFT, SEPA, and Automated Clearing House (ACH).

Building payment rails will support better end-to-end communication, and it will be a significant change compared to one-way communication (payer to payee). Their lean and open architecture will simplify the setup and operating costs and will make business processes and communication around payments much more efficient.

Disrupting The Worldwide Financial Market

Real-time payments are one of the most convenient ways for businesses needing fast transactions and constant access to account funds. While real-time payments (RTP) and automated clearing house (ACH) payments are different types of account-to-account transfers, each of them uses separate payment rails and is controlled by different entities.

Here are some of the factors that are driving the adoption of RTP:

- Optimization and flexibility to adjust to being used by different payment systems

- Flexibility to adapt to new technological solutions in the digital age

- Offers faster financial services for businesses and individuals

- Reduced risk of fraud and better security

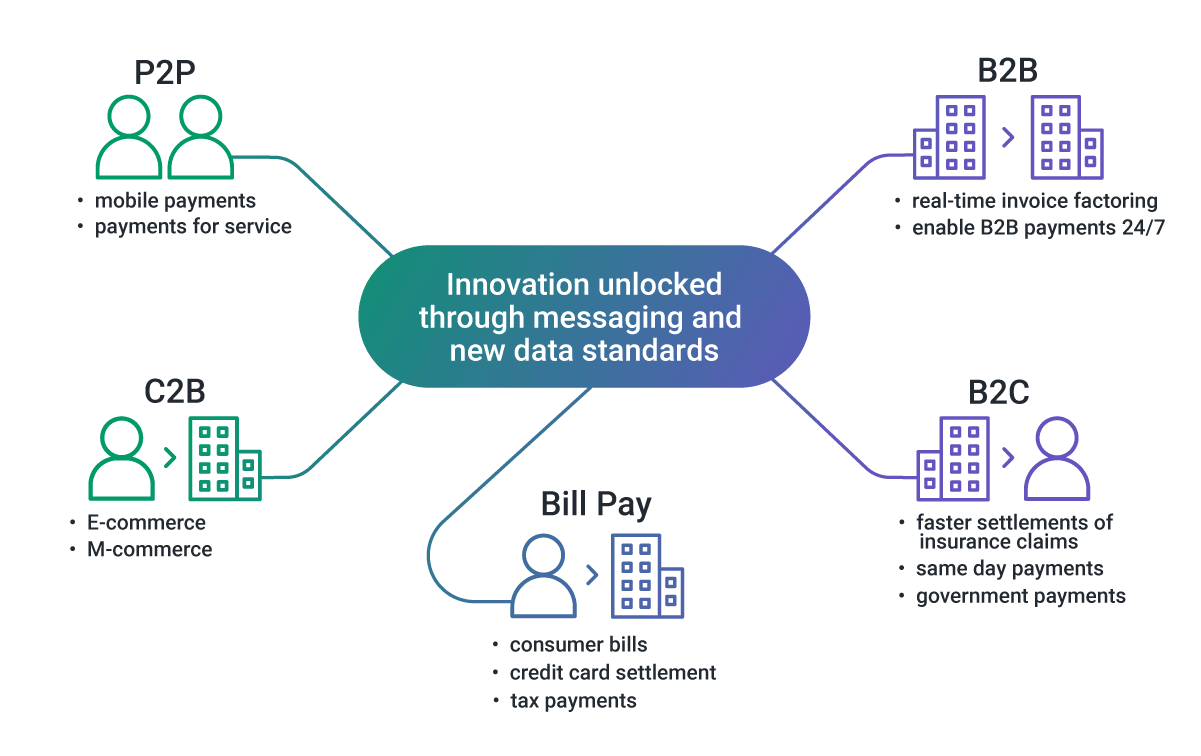

The Clearing House and its RTP network deliver efficient payment systems for several use cases including B2B, P2P real-time transactions, Payroll, Request to pay (R2P), and more. As of this year, up to 72% of the world has or will have real-time payment infrastructure. Many big players, such as J.P. Morgan, are investing heavily in RTP as they want to lead the way in the adoption of this system.

RTP is also now growing to include:

- New partnerships to expand the network

- More data to messaging

- Better connection with mobile wallets and other non-banking structures

- A strong focus on addressing the needs of a diverse-customer base

Roadblocks for Development of Real-Time Payments

While RTP is gaining traction in individual countries, RTP systems are still facing many issues internationally. These challenges include the complexity of using different data formats, implementing various compliance checks, and experiencing limitations with operating hours across time zones. Unfortunately, it's not easy to find one solution that multiple financial institutions across various countries all agree on.

Legacy Technology

Legacy technology can be a big blocker to making major worthwhile improvements in international payment systems. Transactions from one country to another are more complex compared to domestic payments, and it will take time for international banks to develop shared regulations and infrastructure.

Cross-Border Transactions

For banking systems to better facilitate cross-border transactions they must adopt real-time monitoring, a higher capacity for data processing, and lessen their dependence on batch processing.

These changes must be made quickly for banks to stay competitive because customer expectations are rising as they are searching for customer-friendly, fast, and secure systems.

New Standards for Real-Time Payments

ISO 20022 is an open global payment messaging standard that provides significantly richer and better-structured data during the payment process. It means more data (around 10 times more) about each payment can be sent. This could include information about the purpose of the payment, the original source, and the ultimate beneficiary. This enhanced data system will also create a common language and model for payment data across the globe.

However, building a new real-time product that meets all of these requirements can be quite complex. The design and implementation of RTP rails must take into account robust legacy systems that have to be digitalized to meet the new ISO 20022 standard.

After the US adopted the open global standard ISO 20022, more focus has been brought to messaging and data pertaining to RTPs. With the introduction of ISO 20022, new messaging types are now supported inside an international financial framework that enables real-time payments.

What is Request-for-Payment (RfP)?

RTP brings robust messaging capabilities that are superior compared to previous payment methods. Once the data is gathered on different types of transactions, there are a number of data points that can serve to improve inefficiencies and create room for innovation.

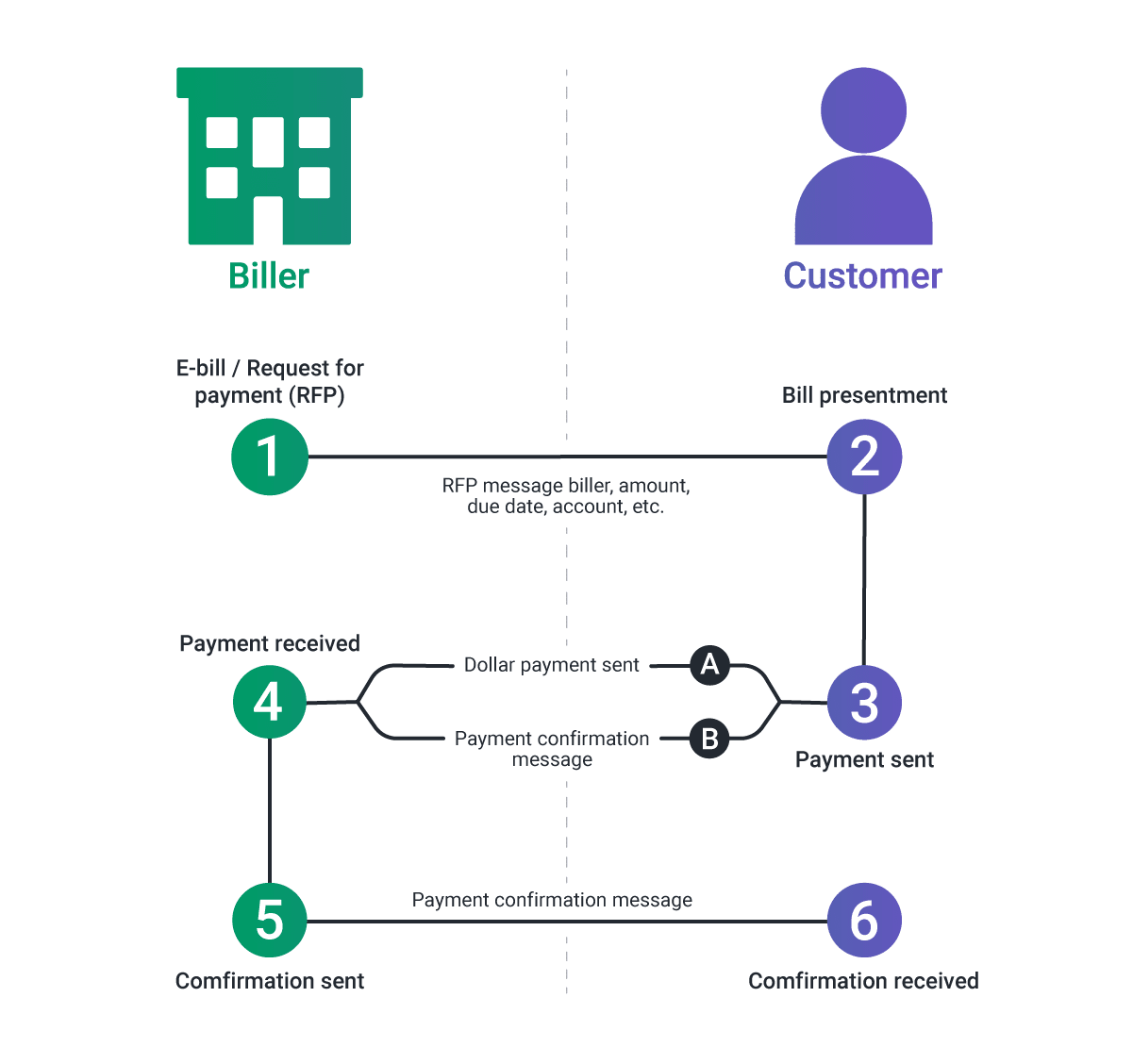

RTP allows billers to send Request for Payment (RfP) messages that function as invoices native to RTP payment rails. The RTP system allows both parties to send multiple types of messages and alerts within one payment process. Messages can be segmented into three separate categories:

- Messages with explanations - These messages are sent to the participants of the RTP system and are not related to a specific payment.

- Payment-related messages - These messages can be a Request for Payment, a Request for Information, a Payment Acknowledgment, or a Request for the return of funds.

- Payment messages - This message is one containing information from a financial institution with instructions for sending money.

The Benefits of Using Real-Time Payments

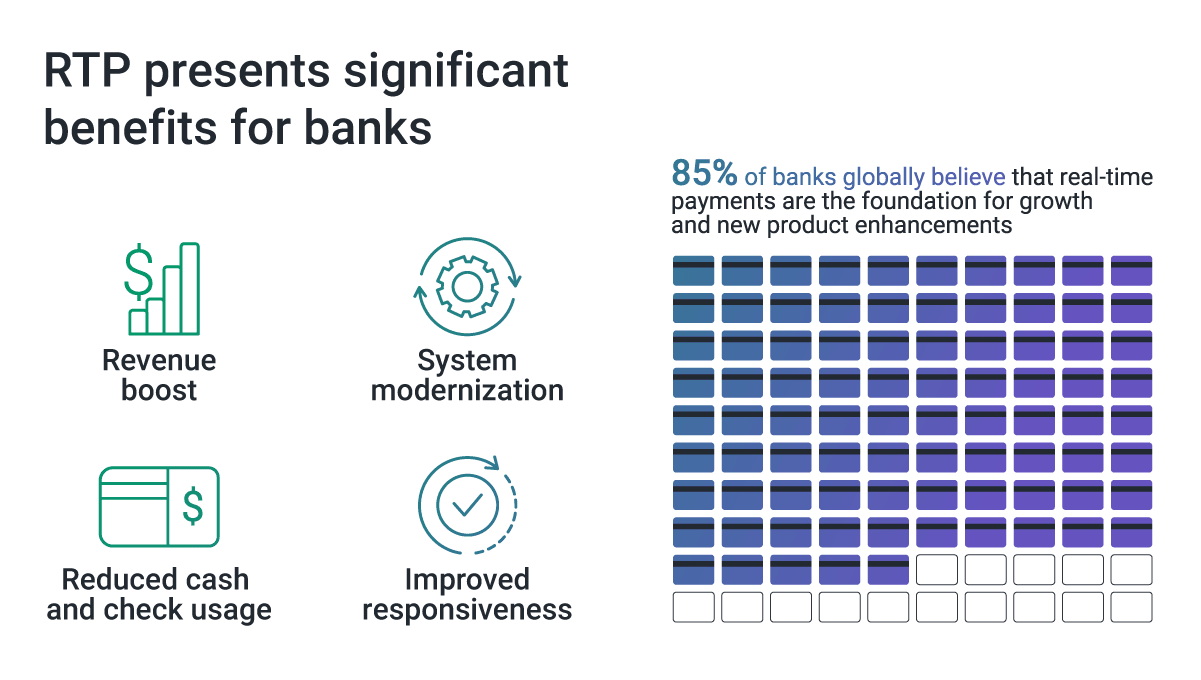

RTPs bring a lot of obvious as well as less apparent benefits to the table for both individuals and financial institutions. In the P2P environment, most benefits are connected with meeting the need for real-time services in multiple aspects of people’s everyday lives. As Gen Z and Millennials choose their banks, we will see demand grow for faster and more convenient services well suited for generations comfortable with technology.

Other benefits we will see with the growth of RTP systems include:

1. Improved Cash Flow Control

Rapid payment and settlements, cash flow efficiency, and process optimization are some of the key reasons why customers enjoy using RTP. With a steady cash flow, businesses can rely on always having a good view of their finances and making transfers easily, without unnecessary friction. For companies that need to meet short or long-term financial goals, real-time payments enable that there’s always enough cash to pay all the bills and salaries. Payments can be sent at any time of the year or day and all payment settlements are final and irrevocable. As the payment status is immediately updated for both sender and the receiver, everyone knows whether a transaction went through successfully.

2. Speed and Transparency

Transaction messages help both senders and receivers as notifications show who the transfer is intended for, who is receiving it, the transfer status, and other information important to the payer and payee.

3. Simplified Processes

When vendors send their payments, there is often a waiting period to see whether the transfer will be cleared. With RTPs, all parties are informed when payments are processed, allowing everyone to feel confident that they have all the necessary information. Payments are processed 24/7 all year round, settlement is immediate, and funds are instantly available to the receiving party.

P2P and RTP

Recently, peer-to-peer (P2P) payments have been rising rapidly in popularity, with a number of applications and services like Venmo, PayPal, and Zelle replacing in-person payments. During the COVID-19 pandemic, the use of services that offer P2P soared as the market gained incredible momentum and a large number of new users.

While RTP networks are used often for businesses, governments, and other institutions, they are also largely designed to meet the needs of customers in the P2P segment. With the increase in P2P payments, services are quickly connecting with real-time payment rails to meet customers' demands for greater speed and convenience.

For example, a large payment service, Zelle, has recently integrated with RTP rail from The Clearing House, meaning that any financial institution integrated into the RTP network can frictionlessly accept and settle transactions from Zelle.

Are RTPs Better than ACH Payments?

For most businesses with access to either RTP or ACH for a transaction, it is often better to go with RTP. Generally, same-day ACH and RTP are priced similarly, and the benefits of faster processing outweigh any small differences in price.

Businesses are also using RTPs to solve problems with rejected checks and returned ACH payments. RTP might be the best way for banks to reduce the usage of checks and deliver a more modern and frictionless experience to their customers.

However, some transactions are not eligible for real-time payments. To use RTPs, both your bank and the other party's bank must be opted-in as participating institutions in the RTP system. Furthermore, many large businesses might be limited by the current $1M transaction limit, making both RTP and same-day ACH payments impractical for some B2B use cases.

Additionally, the business should consider how urgently they need transactions to be settled before deciding which payment type to use. If you need a payment completed quickly and outside of business hours, RTP is hands-down the best choice. If a payment is not time-sensitive, then the cost savings of next-day or regularly processed ACH are likely more reasonable methods.

Conclusion

According to The Clearing House, 70% of US businesses are planning to start using RTP in the next two years. Of course, RTP is just a part of a wider payment strategy that aims to make transactions faster, safer, and more available to more users than ever before.

Are you looking to upgrade your payment system? Softjourn has expert fintech consultants and deep expertise in creating innovative technical solutions. Please contact us today to find out more.