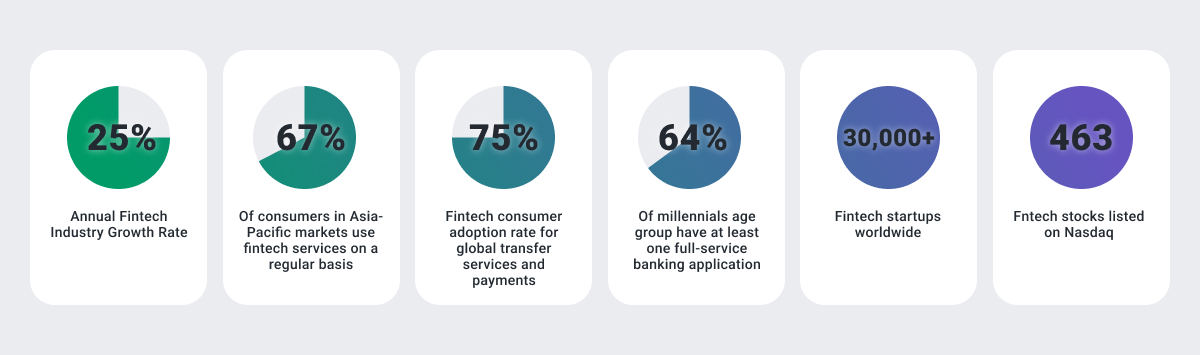

The fintech industry stands at an inflection point. After years of explosive growth fueled by innovation, the sector is maturing, and with that maturity comes a sharper focus on fundamentals over flashy features.

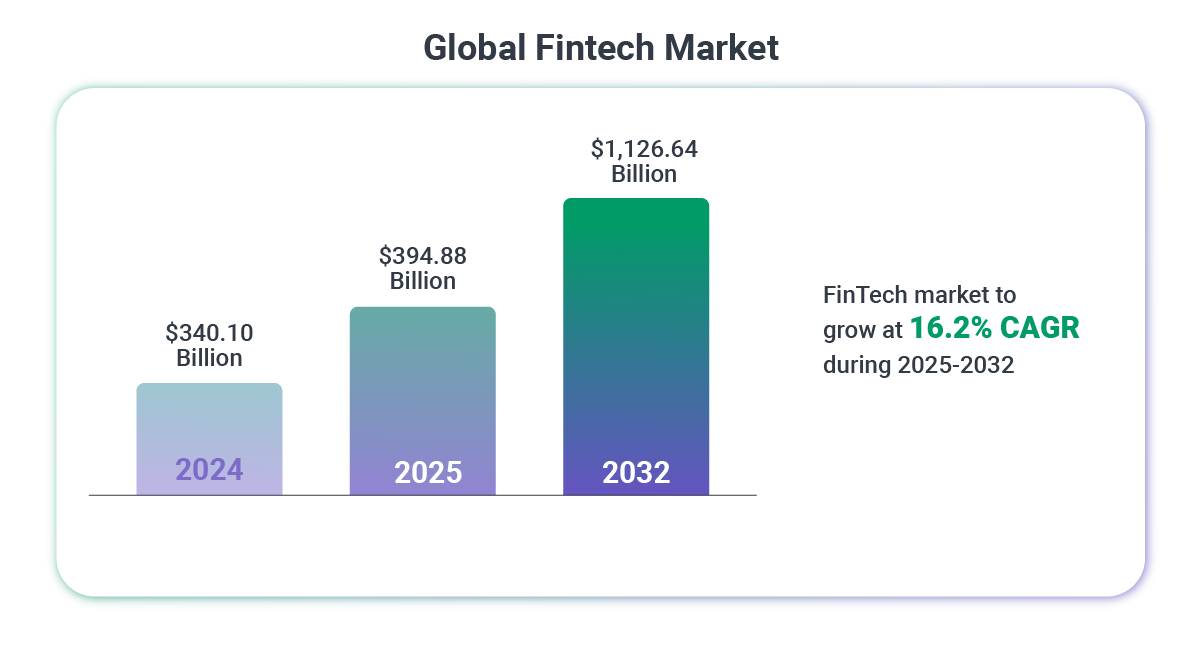

The global fintech market is projected to reach $394.88 billion in 2025 and climb to $1.12 trillion by 2032, representing a 16.2% CAGR. But beneath these impressive numbers lies a more nuanced reality: investors are demanding quality over quantity, regulators are catching up with innovation, and customers expect seamless experiences backed by unshakeable trust.

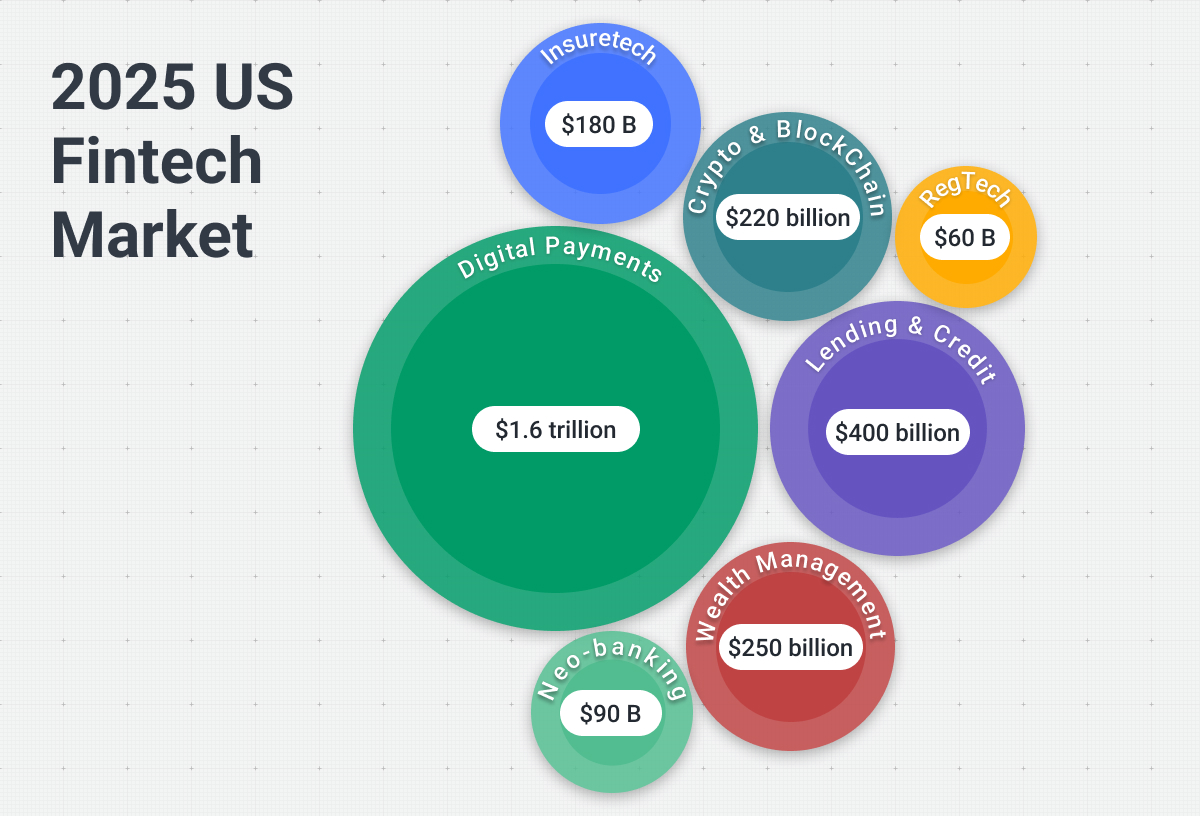

Digital payments now account for 66% of e-commerce value globally, with mobile commerce capturing 57% of all online transactions. Real-time payment infrastructure is expanding rapidly, embedded finance is moving beyond payments into lending and insurance, and AI has evolved from experimental technology to operational necessity.

Yet not all trends deserve equal attention. As Maurina Venturelli, Head of GTM at OpStart, observes from her work with over 100 startups:

"AI-powered financial forecasting tools are overhyped. Every pitch deck now has 'AI-driven insights,' but most are just glorified trend lines with better UI. I watched three portfolio companies spend $30K+ on AI forecasting platforms last year, only to revert to spreadsheets because the models couldn't account for their actual business reality. Startups don't have enough clean historical data to train them properly, and their businesses change too fast for backward-looking algorithms to matter."

The distinction between AI hype and operational reality defines the fintech landscape of 2026. Companies that focus on genuine value creation, transparent decision-making, and measurable business impact will pull ahead. Those chasing trends without understanding fundamentals will struggle.

With years of experience developing innovative financial solutions for the industry, Softjourn stays ahead of the latest trends shaping the future of financial technology. We've helped fintech companies navigate the evolving landscape with custom software solutions, from payments and expense management to sustainable finance.

In this article, we explore the fintech trends that will genuinely impact your business in 2026, and what they mean for leaders building the next generation of financial services.

1. AI Moving From Assistive to Autonomous

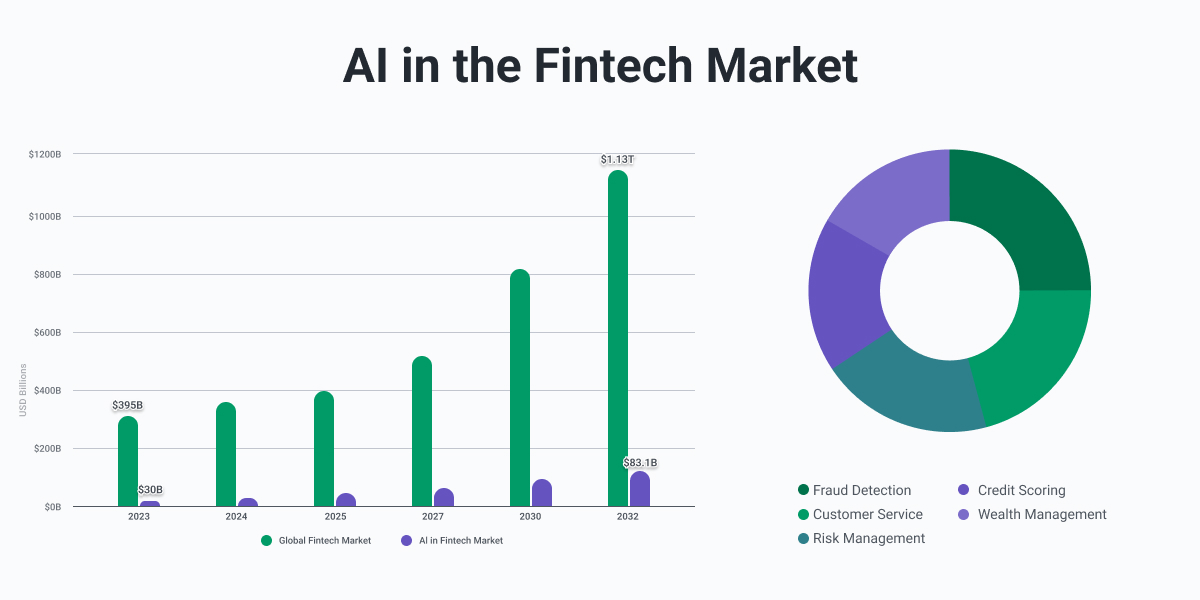

Artificial intelligence in fintech has crossed a critical threshold. After years of hype, AI is finally delivering measurable operational value, moving from reactive assistance to proactive decision-making. The global AI in fintech market is projected to reach $30 billion in 2025, growing at 22.6% CAGR, with 85% of financial institutions now using AI for core operations.

The shift is profound. AI is no longer just processing transactions or flagging anomalies. It's anticipating needs, executing decisions, and fundamentally restructuring financial workflows.

Ciaran Burke, COO and Co-Founder of Swoop Funding, sees this transformation firsthand:

"AI is finally moving from noise to utility. The next 12 to 18 months will be less about shiny demos and more about real deployment. We're already seeing AI compress what used to be multi-step funding journeys into one conversation: reading a business's financials, interpreting documents, and surfacing eligible funding in seconds. The reshaping isn't theoretical anymore. It's operational. Banks, lenders, and fintechs that embed AI into underwriting, customer engagement, and internal decision-making will widen the gap on cost and speed. Those that don't will look painfully manual by comparison."

Peter Connor, Co-Founder of BulletHQ, illustrates this evolution with a concrete example from his company's rebuild of their accounts product:

"We are currently going through a full rebuild of our accounts product and moving away from reconciliation. Instead, we will auto-reconcile; we're going to use AI to absorb all the bad data, because accounting is traditionally messy and needs clean data, something accountants historically handled. A major change is using AI to fetch data and make accounts proactive. For example, if you are doing your end-of-year return and you select that you have a second property [which allows you to deduct expenses for maintenance or upgrades], once you connect your bank account, we will actively seek and categorize all items relevant to that. Once it’s confirmed you have a second property, those transactions will be automatically categorized as tax-deductible. We apply the same logic to medical expenses and similar categories."

The competitive implications extend beyond individual features. Gentry Davies, Co-Founder and CEO of Crew, sees AI creating new market dynamics:

"Newer entrants [to fintech] should benefit most from this AI platform shift since it will let them differentiate really clearly from established offerings. Personalization and accessibility will be major themes with the fintechs who win."

This represents a fundamental shift: traditional AI tools wait for user input, while autonomous AI anticipates needs based on context, taking action before being asked. The implications extend across fintech: credit scoring models now update in real time based on behavioral data, fraud detection systems learn and adapt faster than criminals can evolve tactics, and customer service has moved from chatbots answering questions to AI agents resolving complex multi-step processes independently.

The financial services firms leading in 2026 aren't those with the most AI features. They're the ones that have embedded AI so deeply into operations that it's invisible to users while transforming the backend completely. The technology has matured from experimental to essential infrastructure.

2. Predictive Analytics & Intelligent Data Utilization

The next battleground in fintech isn't merely collecting data. Nearly every platform is sitting on mountains of transactional, behavioral, and operational information. The competitive advantage now lies in what companies do with that data: transforming historical patterns into forward-looking intelligence that drives decisions.

Predictive analytics has quietly become one of the most undervalued capabilities in financial services. While headlines focus on flashier innovations, companies leveraging time-series forecasting and pattern recognition are delivering measurable ROI that traditional approaches can't match.

John Readman, Founder of ASK BOSCO, an AI platform handling millions in ad spend decisions, makes the case for the most underhyped fintech trend:

"Predictive budget allocation using time-series forecasting. This sounds boring, but it's where the actual money is. When we onboarded Visualsoft's 300+ clients, we found agencies were wasting 50% of their time on manual reporting and still getting forecasts wrong 30 to 40% of the time. The financial services firms we work with are just starting to wake up to this, but most are still stuck in spreadsheet hell."

The evolution Readman describes extends beyond company spend. Predictive models are reshaping cash flow management, credit risk assessment, customer lifetime value calculations, and liquidity forecasting. Financial institutions using advanced analytics can anticipate market movements, identify emerging fraud patterns before they scale, and optimize capital allocation with precision that was impossible even two years ago.

Andrew Alex, CEO of Spendbase, applies this intelligence to a specific pain point:

"The most underhyped trend is spend visibility for businesses. As companies face tighter budgets, having clear, real-time insight into SaaS, cloud, and card spending isn't just about saving money; it's about enabling smarter, faster decisions. That's where we'll see real transformation in the next wave of fintech."

But analytics alone isn't enough. As Ciaran Burke of Swoop Funding notes:

"Turning insight into action is the challenge. Everyone's sitting on data from open banking, accounting, credit, and transactions, but most fintechs still treat AI as an analysis tool, not an execution layer. The challenge now is connecting the dots so the system doesn't just tell you what to do, but actually does it. We're building toward a funding ecosystem where AI can identify a funding gap, pre-qualify a borrower, assemble the right documents, and submit to the right lender autonomously. Whoever cracks that loop at scale will define the next wave of fintech."

This distinction matters. Descriptive analytics tells you what happened, and predictive analytics tells you what might happen. But prescriptive analytics, which combines prediction with automated execution, closes the loop entirely. The fintechs winning in 2026 are those that have moved beyond dashboards and reports to systems that make intelligent decisions and act on them automatically.

The data gold rush is over, and the intelligence execution race has begun.

3. Embedded Finance Matures Beyond Payments

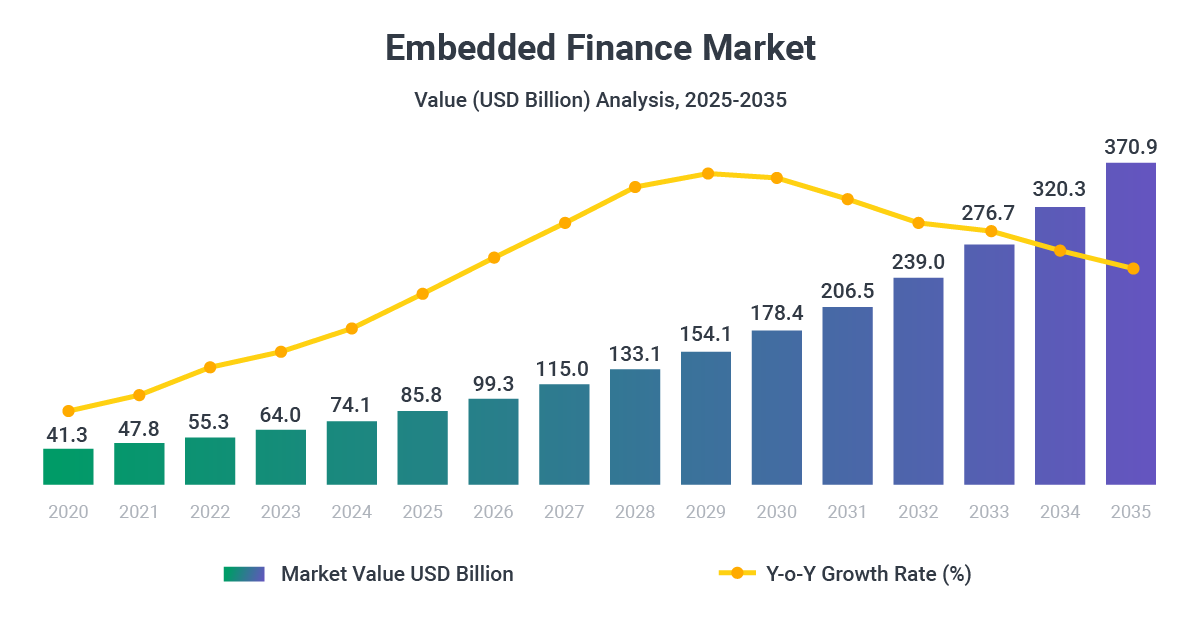

Embedded finance has evolved from a buzzword to business-critical infrastructure. The market is projected to reach $85.8 billion in 2025 and grow to $370.9 billion by 2035, representing a 15.8% CAGR. But the real story isn't the market size. It's how embedded finance is expanding beyond simple payment buttons into comprehensive financial ecosystems built directly into non-financial platforms.

Early embedded finance focused on transactions: adding a "Pay Now" button to an e-commerce site or enabling ride-hailing apps to process payments. The next phase integrates lending, insurance, investment products, and banking services so seamlessly that users barely recognize they're interacting with financial infrastructure.

Consider a SaaS accounting platform that now offers business loans based on real-time cash flow data it already processes. Or an e-commerce marketplace that provides seller financing, payment processing, working capital advances, and fraud protection as built-in features. These aren't partnerships with external financial institutions, but native financial capabilities that make the core platform stickier and more valuable.

Daniel Kroytor, CEO of TailoredPay, sees embedded finance as one of the most underestimated trends: "Adding finance tools such as payments, lending, or insurance to existing SaaS apps makes things easier for businesses as they can do everything in one platform without switching vendors."

This convenience factor translates directly to competitive advantage. Platforms offering embedded financial services reduce customer churn, increase average revenue per user, and capture data that further improves their core product.

For example, a project management tool that offers invoice financing understands cash flow patterns, or a logistics platform providing cargo insurance sees risk profiles across thousands of shipments. That operational data becomes a moat that pure-play financial institutions can't replicate.

The shift is particularly pronounced in B2B software. Companies using platforms like Shopify, Toast, or Mindbody increasingly expect financial services to be native features, not third-party integrations. The friction of switching between tools, reconciling data across systems, and managing multiple vendor relationships creates opportunities for platforms that can embed everything seamlessly.

The partnership dynamics are shifting as well. Luc Gueriane, CEO of Moorwand, observes a notable change: "In the past year, I've seen relationships between banks and fintechs get stronger. No longer can only outsiders come up with new ideas; institutions can too. This means that fintechs need to adapt quickly."

Technical infrastructure has finally caught up to the vision. Modern API frameworks, regulatory clarity around Banking-as-a-Service partnerships, and modular compliance tools have made it feasible for non-financial companies to offer sophisticated financial products without becoming banks themselves. The question is no longer whether to embed finance, but how quickly platforms can integrate capabilities before competitors do.

4. Real-Time Payments & Cross-Border Infrastructure

The infrastructure powering global payments is undergoing a fundamental restructuring. Real-time payment systems have become baseline expectations, and the companies providing access to these rails are democratizing capabilities that were previously available only to the largest institutions.

The Cross-Border Infrastructure Revolution

Cross-border spending is projected to grow from $194.6 trillion in 2024 to $320 trillion by 2032.

We’re seeing cross-border payment infrastructure growing around the world: the U.S. FedNow Service is expanding, increasing its network transaction limit from $1 million to $10 million in November 2025; SEPA Instant payments in Europe now enable settlement in under 10 seconds, 24/7; Brazil's Pix system recorded 239.9 million transactions on a single Black Friday; and India's UPI processed approximately 170 billion transactions in 2024, valued at nearly $2.9 trillion.

But the market size only tells part of the story. Part of the transformation is happening in access and cost structure.

Peter Connor, Co-Founder of BulletHQ, experienced this shift directly:

"We were looking to automate the sending of a €1 payment to customers when they onboard onto our product. To execute this, we were going to have to onboard a banking rails platform at a minimum cost of €10,000 with a minimum spend of about €2,000 per month. After looking around, we found that Revolut had an API, and for €35 a month, we could send that €1 payment. That was a whole section of the industry removed simply by the opening of that API."

This massive cost reduction isn't an isolated example. It represents a broader trend where large platforms are opening infrastructure APIs that bypass traditional payment processors. The barriers to building payment functionality into applications have collapsed. What required enterprise banking relationships and six-figure minimum commitments two years ago now costs less than most SaaS subscriptions.

The shift extends beyond traditional payment rails. David Kemmerer, Co-Founder and CEO of CoinLedger, points to another infrastructure evolution in how quickly tokenized assets found use. “A year ago,” he says, “tokenization was more theoretical. Now, property, payroll, and invoices are tokenized to move money across borders faster and cheaper. The rate at which regulators are adapting to this instead of resisting it is also fascinating."

Tokenization enables fractional settlements, reduces currency conversion friction, and provides audit trails that traditional wire transfers can't match. For companies managing international contractor payments, supplier invoices, or cross-border treasury operations, tokenized transfers can cut settlement times from days to minutes while reducing costs.

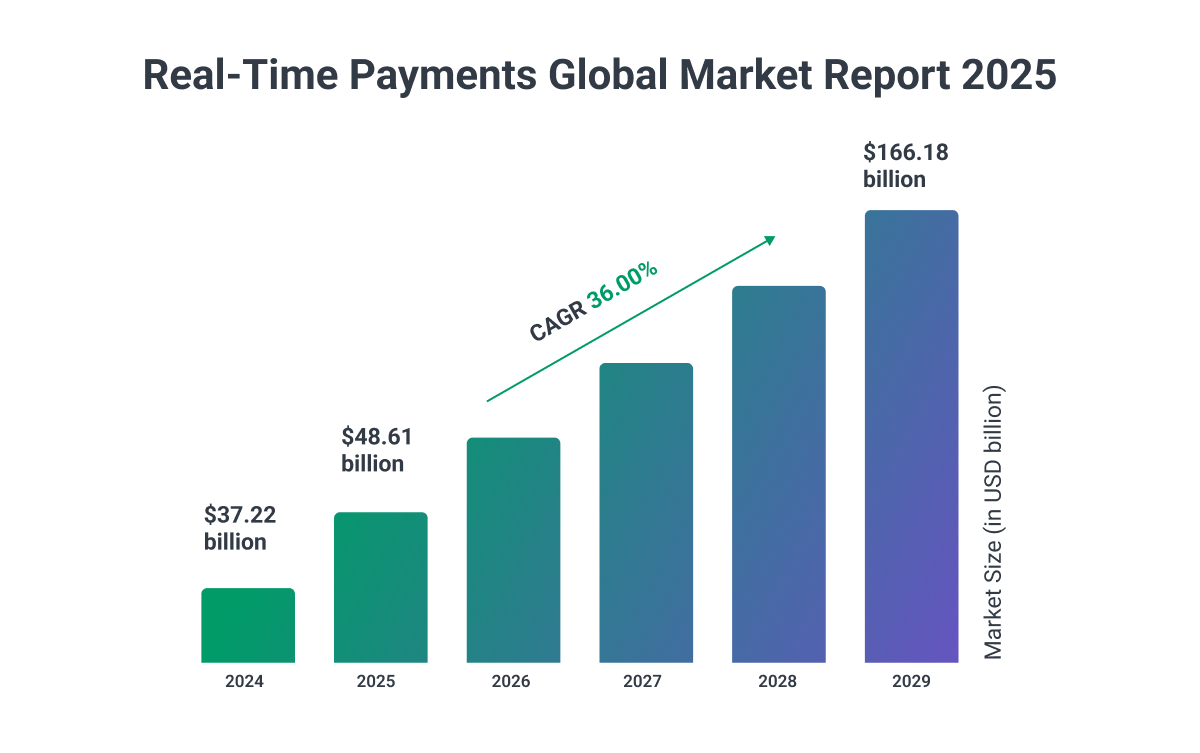

Real-Time Payments

Real-time payments aren't just faster transactions. They're enabling entirely new business models: instant supplier financing based on invoice verification, dynamic pricing that adjusts to market conditions in seconds, and treasury management that optimizes liquidity across multiple accounts and currencies continuously. Companies that treat real-time infrastructure as a feature rather than a foundation will find themselves at a structural disadvantage as customer expectations continue to accelerate.

The economics are driving rapid adoption. Account-to-account (A2A) payments can reduce processing costs by up to 30% compared to traditional card-based systems, with global A2A value forecast to reach $3.8 trillion by 2030. Among merchants already accepting real-time payments, 80% reported increased customer usage over the past year, signaling a fundamental shift in payment preferences.

But infrastructure improvements mean little if user expectations aren't met. Gary Jain, CEO of The Ledger Labs, highlights the expectation shift:

"The biggest shift has been the move toward real-time data accessibility. Clients no longer want to wait until month-end to understand cash flow or expenses. They expect instant visibility. We've integrated multiple financial data APIs to deliver live dashboards that combine accounting, payment, and operational data. This has redefined client expectations for financial transparency."

Richard Dalder, Business Development Manager at Tradervue, emphasizes the broader transformation:

"The growth of digital payment platforms that offer integrated services through software systems does not get enough attention. These systems make payments easier and safer for businesses and customers. They support multiple ways to pay, manage transactions well, and help smaller businesses reach more customers. As these platforms become more common, they make financial operations smoother and open new opportunities."

5. Trust, Transparency & Explainability

As financial services become increasingly automated, a counterintuitive challenge has emerged: the smarter the algorithms become, the more customers demand to understand how they work. Trust isn't built on sophistication but on transparency.

While 90% of financial institutions are now using AI to combat fraud, 92% report that fraudsters are also using generative AI. This technological arms race has created a paradox.

The same tools that protect customers can feel opaque and alienating when they make decisions that users don't understand. A loan or credit card rejection delivered by an algorithm with no explanation erodes trust faster than a slower manual process with clear reasoning.

David Kemmerer of CoinLedger has seen this dynamic play out directly in his business:

"The biggest challenge remains trust. Everyone is out here building smarter algorithms while customers continue to demand trust. They want to know how their data is used and how decisions are made. Thus, the fintech companies that will do well in the next years will be those that are transparent enough to explain everything to customers. Our customers, for example, are more interested in learning how we calculate their gains. They are less interested in the final number. We made the calculation traceable and easy to understand, and our support tickets dropped by 37%. Transparency is the new area of competition, and features don't matter as much."

A major reduction in support tickets represents more than operational efficiency. It reflects customers who understand the system well enough to trust it without constant verification. In an industry where switching costs have never been lower, trust becomes a primary mechanism for retention.

The challenge intensifies in regulated lending and credit decisions. Christopher Ledwidge, Co-Founder and Executive Vice President at theLender.com, frames the issue clearly:

"Explainability and trust are now the true obstacles. Both regulators and consumers will want transparency in the process used to determine results as AI becomes more integrated into financial decision-making. 'Why was this borrower approved and that one declined?' is no longer a technical question; it's a reputational one. Fintechs that can combine automation with clear accountability will lead the next phase of growth."

Regulatory pressure is building around model explainability. As AI becomes central to credit scoring, fraud detection, and automated decision-making, regulators are starting to demand clear audit trails showing how models reach their conclusions. Fintechs that can't explain their algorithms may face compliance risks that extend beyond individual transactions to systemic operational approval.

The practical implications are significant. Companies must invest in data governance frameworks, ethical AI documentation, and customer-facing explanations that translate complex models into plain language. This isn't about dumbing down the technology. It's about respecting that customers have a right to understand systems making consequential decisions about their financial lives.

Survey data reinforces the stakes: 84% of consumers would switch banks if their previous institution was linked to financial crime, and 87% would actively warn family and friends against using that institution. Trust, once lost, spreads as a negative signal far faster than positive features attract new customers.

The top fintechs in 2026 won't necessarily have the most sophisticated algorithms. They'll be the companies that can explain their sophistication in ways that build confidence rather than confusion.

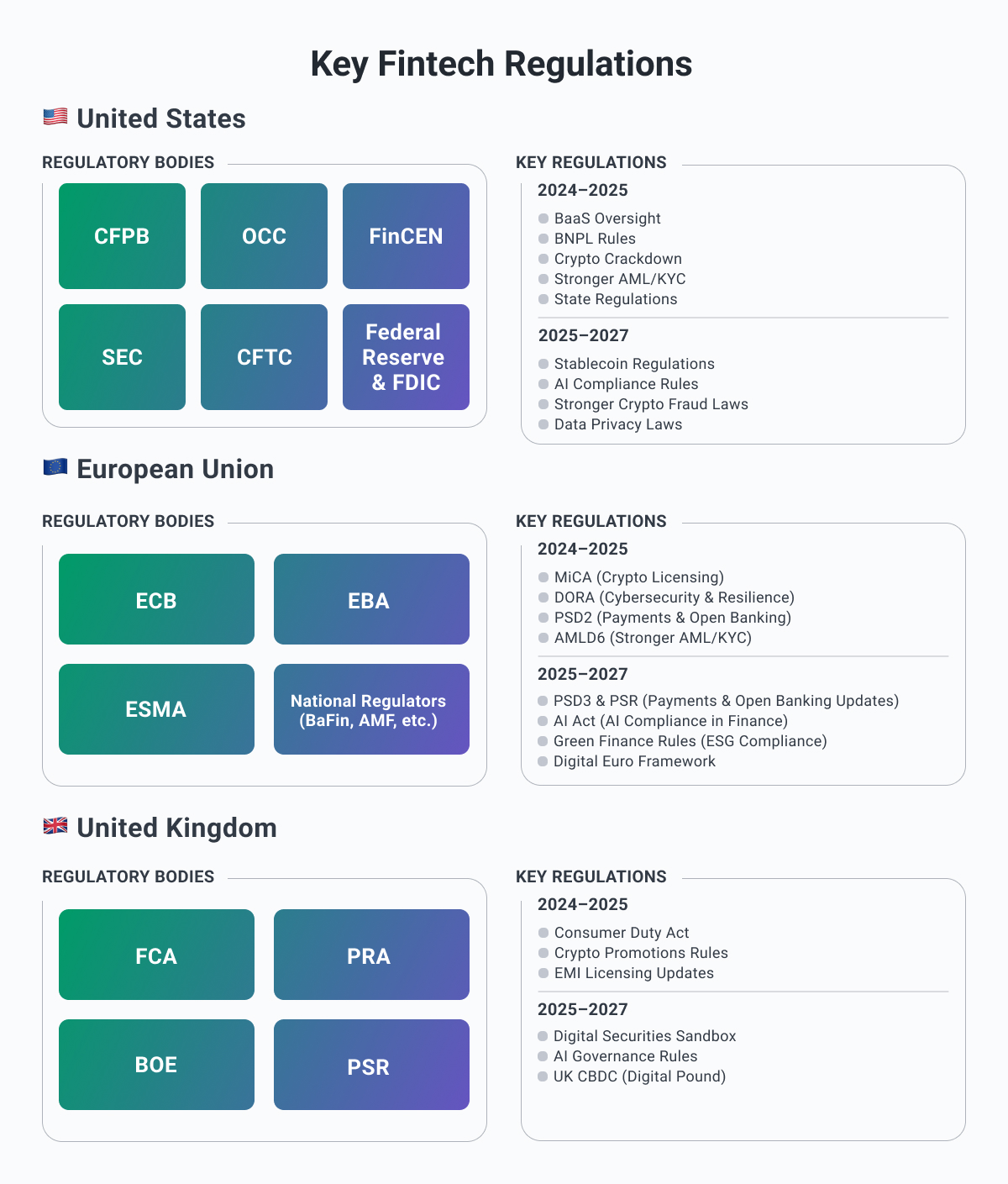

6. Regulatory Evolution & Compliance as Competitive Advantage

The relationship between fintech innovation and regulation is undergoing a fundamental shift. Rather than the traditional cat-and-mouse dynamic where regulators chase innovation years after it emerges, regulatory bodies are increasingly working alongside technology development. This convergence creates opportunities for companies that view compliance as a strategic differentiator rather than an operational burden.

Henry Magun, Founder and CEO of Hansa, has observed this evolution directly:

"One of the most striking developments this year has been the pace at which regulators have gained comfort with AI in financial services. Regulatory bodies that once took years to review new technologies are now approving AI-driven products for production use, signaling a new phase of trust and agility. Parallel progress on open banking and AI governance frameworks has accelerated responsible innovation across the industry."

This regulatory momentum creates a window of opportunity. Companies that engage early with emerging frameworks can help shape standards rather than scrambling to comply after they're finalized. Those building transparent, auditable systems from the ground up will find regulatory approval significantly faster than competitors retrofitting compliance onto existing architectures.

But new requirements are coming that many companies aren't prepared for. Gary Jain of The Ledger Labs flags a critical shift:

"One regulatory shift that's not getting enough attention is the coming AI model transparency and auditability requirement. As AI becomes central to credit scoring, fraud detection, and automated decision-making, regulators are starting to demand clear audit trails showing how these models reach their conclusions. Fintechs that can't explain their algorithms may face compliance risks. Preparing now means investing in data governance frameworks and ethical AI documentation, not just automation."

The practical implications extend beyond documentation. Companies need systems that can demonstrate model behavior across millions of decisions, prove the absence of bias, and show exactly which data inputs drove specific outcomes. This level of explainability doesn't happen by accident and it requires architectural decisions made early in product development.

Regional differences add complexity: The EU's Digital Operational Resilience Act (DORA) imposes comprehensive cybersecurity and operational resilience requirements; the US is moving toward stricter AML/CFT frameworks and enhanced consumer data protection for open banking APIs; and the UK's approach to AI governance emphasizes explainability and fairness in automated decision-making. Companies operating across jurisdictions must navigate overlapping but not identical frameworks.

Yet this complexity creates competitive moats. Smaller competitors struggle with the resource investment required for multi-jurisdiction compliance. Companies that crack scalable compliance infrastructure can enter new markets faster, form banking partnerships more easily, and command customer trust that competitors can't match.

The mindset shift matters most. Viewing compliance as a cost center leads to minimum viable compliance. Instead, view it as a competitive advantage leads to systems that make compliance easier, faster, and more transparent than competitors can achieve. Companies that build regulatory readiness into their core architecture from day one will move faster, scale more efficiently, and earn trust that competitors struggle to replicate.

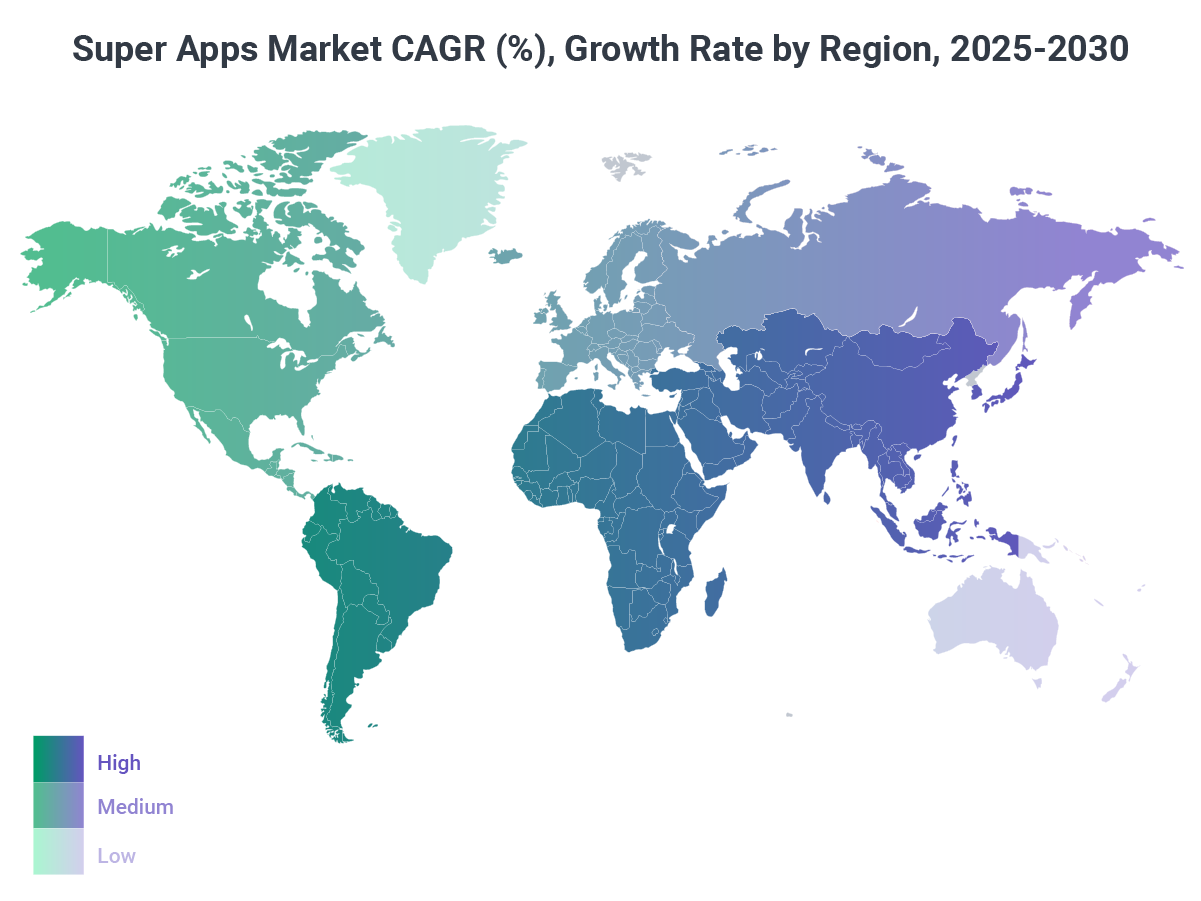

7. Super Apps Evolution

The super app model continues its global expansion, with the market valued at $127.1 billion in 2025 and forecast to reach $861.9 billion by 2035, advancing at a 21.1% CAGR. These platforms have moved beyond proof of concept to become essential infrastructure in users' daily lives, aggregating financial services, commerce, communication, and lifestyle features within unified ecosystems.

The appeal centers on friction reduction: rather than toggling between separate apps for payments, banking, investment, messaging, and commerce, users access everything through a single interface. This convenience translates directly to engagement, as super apps see significantly higher daily active user rates and session times compared to single-purpose financial apps.

Regional leaders demonstrate the model's potential: WeChat dominates China with payments, social networking, e-commerce, and financial services seamlessly integrated; Grab has evolved from Southeast Asian ride-hailing into a comprehensive platform offering food delivery, digital payments, lending, and insurance; Revolut, operating globally with over 65 million users, combines banking, currency exchange, investment, and payment solutions in one app; and LINE extends across Japan, Taiwan, and Thailand with mobile payments, e-commerce, and financial services built on its messaging foundation.

The competitive dynamics favor super apps through network effects. Each additional service makes the platform stickier. A user who starts with payments and later adds investment, lending, and insurance becomes exponentially less likely to switch providers. The data advantage compounds as well: a super app processing payments, tracking spending, facilitating investments, and managing loans, understands customer financial behavior at a depth that specialized providers cannot match.

For traditional financial institutions, super apps represent both threat and opportunity. The threat: becoming commoditized infrastructure providers as platforms own customer relationships. The opportunity: partnering with super apps to reach massive user bases without building consumer-facing technology from scratch.

The model faces challenges in certain markets. Regulatory fragmentation in the US and Europe makes it harder to bundle banking, payments, and investment under unified licenses, privacy concerns grow as single platforms accumulate comprehensive user data, and cultural preferences for specialized apps over all-in-one platforms persist in some regions.

Yet the trajectory favors expansion. Younger demographics, particularly Gen Z users who now represent substantial consumer spending power, show a strong preference for unified experiences over managing multiple financial relationships. As these users age into higher earning brackets, the platforms that captured their early financial lives will likely retain them across mortgages, investment accounts, and business banking.

The question for fintech companies becomes strategic: build the super app, power the super app, or compete against the super app? Each path requires fundamentally different capabilities and partnerships. The middle ground of being neither platform nor infrastructure is becoming increasingly more difficult.

8. Digital Wallets & the Generational Payment Shift

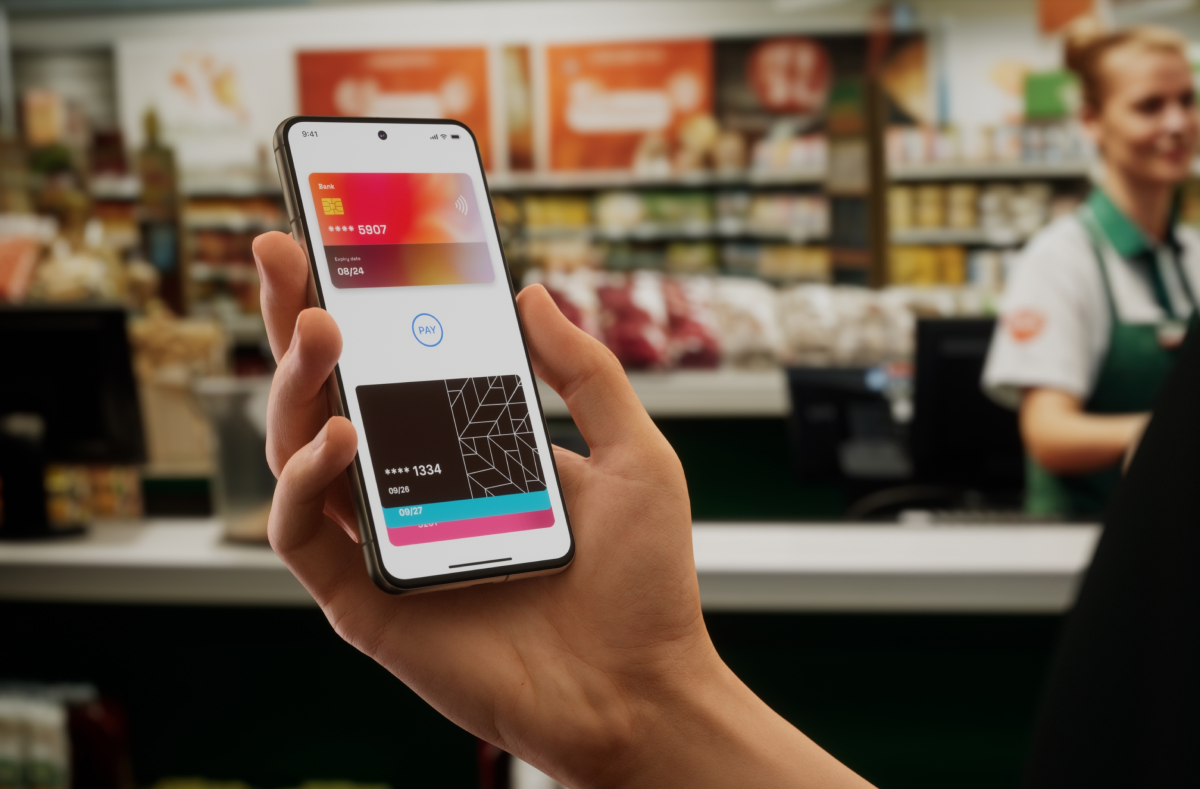

Digital wallets have crossed from emerging payment method to dominant financial interface. The numbers tell a story of accelerating adoption: digital wallet transaction value grew nearly tenfold from $1.6 trillion in 2014 to $15.7 trillion in 2024, and is projected to grow to $17 trillion by 2029. But aggregate growth obscures the more significant shift happening at the generational level.

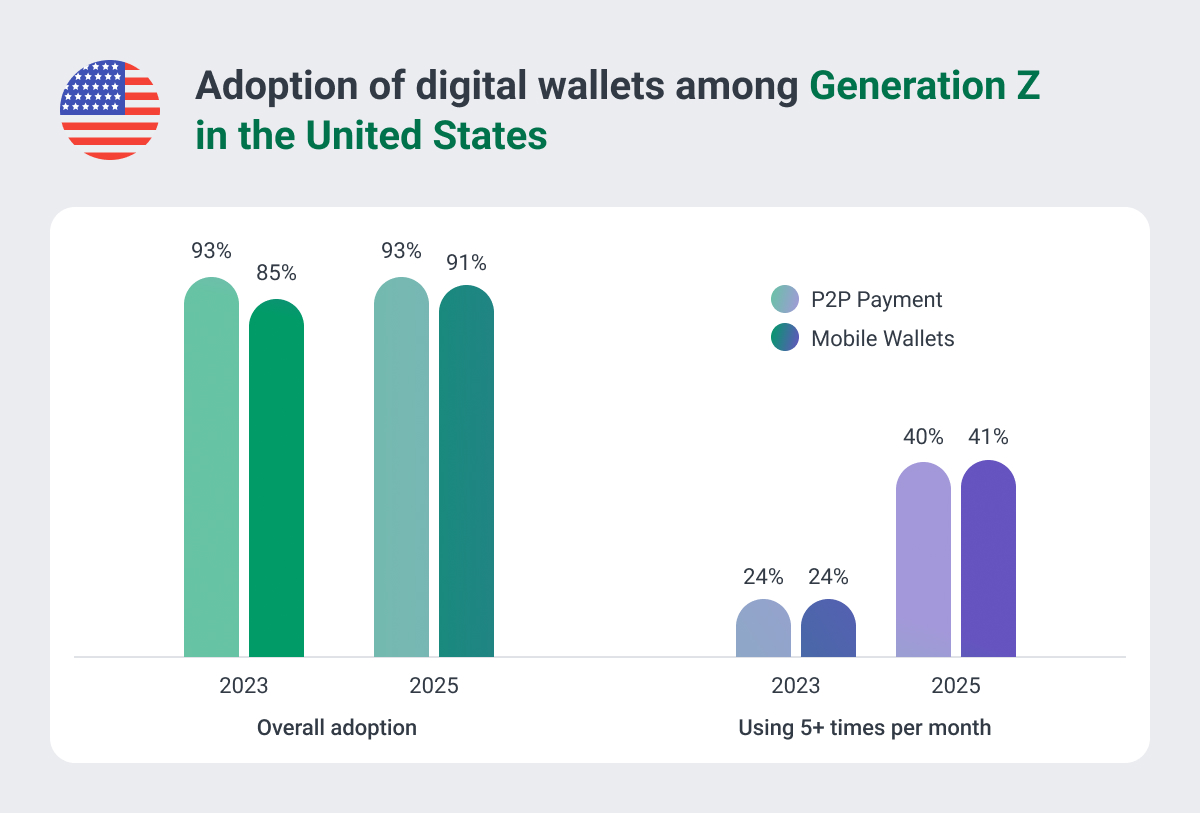

Gen Z represents the first cohort for whom digital wallets are not an alternative payment method but the default. 91% use mobile wallets, 93% use peer-to-peer payment platforms, and over 40% use each more than five times monthly. Digital wallets and cards combined account for 92% of Gen Z's preferred payment methods, while cash has fallen to a historic low of just 7%. This represents a complete inversion from payment preferences that dominated for decades.

The behavioral implications extend beyond transaction mechanics. Gen Z consumers demonstrate substantially lower tolerance for payment friction than older demographics. 81% would abandon brands over poor payment experiences, with 65% leaving after just two to three negative interactions. Payment experience has become a primary factor in brand loyalty, competing directly with product quality and price.

This generational divide forces businesses to support multiple payment rails simultaneously. Older customers still rely heavily on cards and, in some contexts, cash. Younger customers expect instant digital wallet options, QR code payments, and peer-to-peer transfers. Failing to support preferred payment methods directly impacts customer acquisition and retention, particularly as Gen Z enters peak earning and spending years.

Merchant adoption reflects these pressures. 74% of merchants added at least one new payment acceptance method in the past 13 months, with digital wallets leading new integrations. The business case extends beyond customer preference. Digital wallet transactions typically settle faster than card payments, reduce checkout friction that causes cart abandonment, and provide richer data on customer behavior.

The most successful wallet implementations share a common characteristic: invisibility. Holly Andrews, Managing Director of KIS Finance, captures this principle:

"I believe contextual and embedded payments are flying under the radar. When payments sit quietly inside the experience, whether that is an app, a car, or a lending journey, everything just flows. It builds trust and reduces friction in a way people barely notice, which is exactly the point."

This invisible integration defines wallet maturity. The functionality of digital wallets continues expanding beyond simple payments. Modern wallet apps integrate loyalty programs, stored value, buy-now-pay-later financing, cryptocurrency holdings, identity verification, and even access control for physical spaces. This evolution transforms wallets from payment tools into comprehensive financial identity platforms.

Cross-border use cases are accelerating as well; 49% of businesses are exploring digital wallets for international commerce, recognizing that wallets simplify currency conversion, reduce transaction fees, and provide faster settlement than traditional payment networks. For businesses operating across multiple countries, supporting regional wallet preferences becomes essential.

The strategic question for financial institutions centers on positioning. Some choose to become wallet providers, competing directly with Apple Pay, Google Pay, and regional leaders. Others focus on powering wallets through back-end infrastructure and issuing partnerships. The middle position of trying to redirect customers away from wallets toward proprietary apps increasingly fails as consumer behavior solidifies around established wallet platforms.

The generational payment shift accelerates with each cohort entering the market. Companies that treat digital wallets as one payment option among many will find themselves structurally disadvantaged against competitors who recognize wallets as the primary financial interface for the next generation of customers.

The Path Forward

The fintech landscape of 2026 rewards a specific kind of sophistication: systems that handle immense complexity behind the scenes while delivering experiences that feel effortless to users. The gap between these two realities defines competitive advantage.

Talia Mashiach, CEO and Founder of Eved, frames the challenge precisely:

"The next era of fintech competitiveness will hinge on invisible complexity. Compliance, global tax, and regulatory requirements are growing more intricate, but users expect an experience that feels effortless. The challenge and opportunity is to make the backend sophisticated enough to handle complexity while keeping the frontend fast, intuitive, and human. Fintech that can deliver this level of speed and agility, while keeping compliance and control running silently in the background, will define the leaders of the next generation."

What separates winners from the rest: operational AI that delivers measurable results, revenue that survives economic stress, payment infrastructure that removes friction, transparency that builds lasting trust, regulatory readiness that opens markets, and experiences so seamless that complexity becomes competitive advantage rather than operational burden.

The companies that master this balance - building sophisticated systems that feel effortless to users - will stand out the most in 2026.

Ready to Build Your Competitive Edge?

Partner with Softjourn to navigate the evolving fintech landscape. With over 20 years of experience developing solutions for banks, payment platforms, and financial services companies, we help transform complex requirements into seamless user experiences.

Whether you're building AI-driven financial products, modernizing payment infrastructure, or scaling embedded finance capabilities, our team brings the technical expertise and industry knowledge to help you succeed. Contact us to discuss your next breakthrough.