In the last few years, moving your business and money into the global economy has become easier than ever before.

That’s why banks and fintechs are shifting their focus and investments into finding more efficient technologies to move money from one country to another. Historically, cross-border payments were slow, complex, inefficient, costly, and time-consuming.

International payments often involve several different banks, with non-transparent banking fees and overly complex local taxation rules that encourage global companies to avoid those transactions by all means.

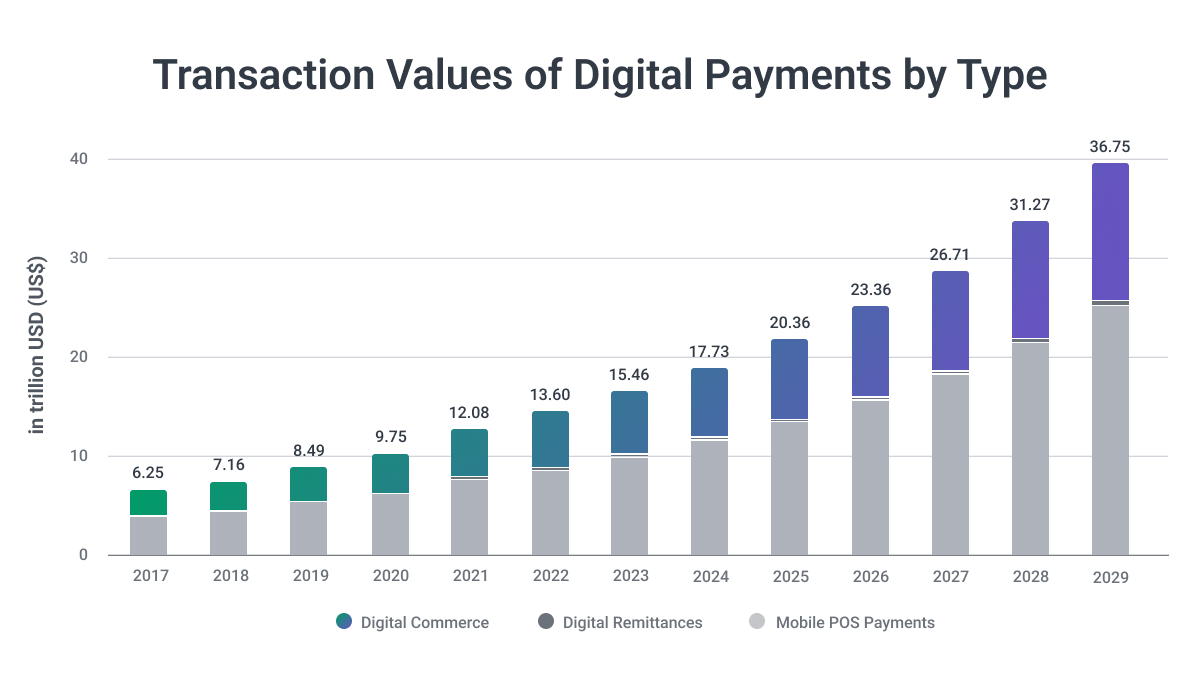

Payments Industry Overview

Today, the banking landscape has shifted significantly. The whole financial industry is moving towards digitized solutions that enable companies to move money across countries and continents with much less friction. Banking is now cheaper, available 24/7, and the process has become much more transparent.

Another big change we see on the market is that, according to PYMNTS latest article, 63% of Americans are now using digital wallets for cross-border payments. Most of them are millenials and Gen X, but boomers and Gen Z are close.

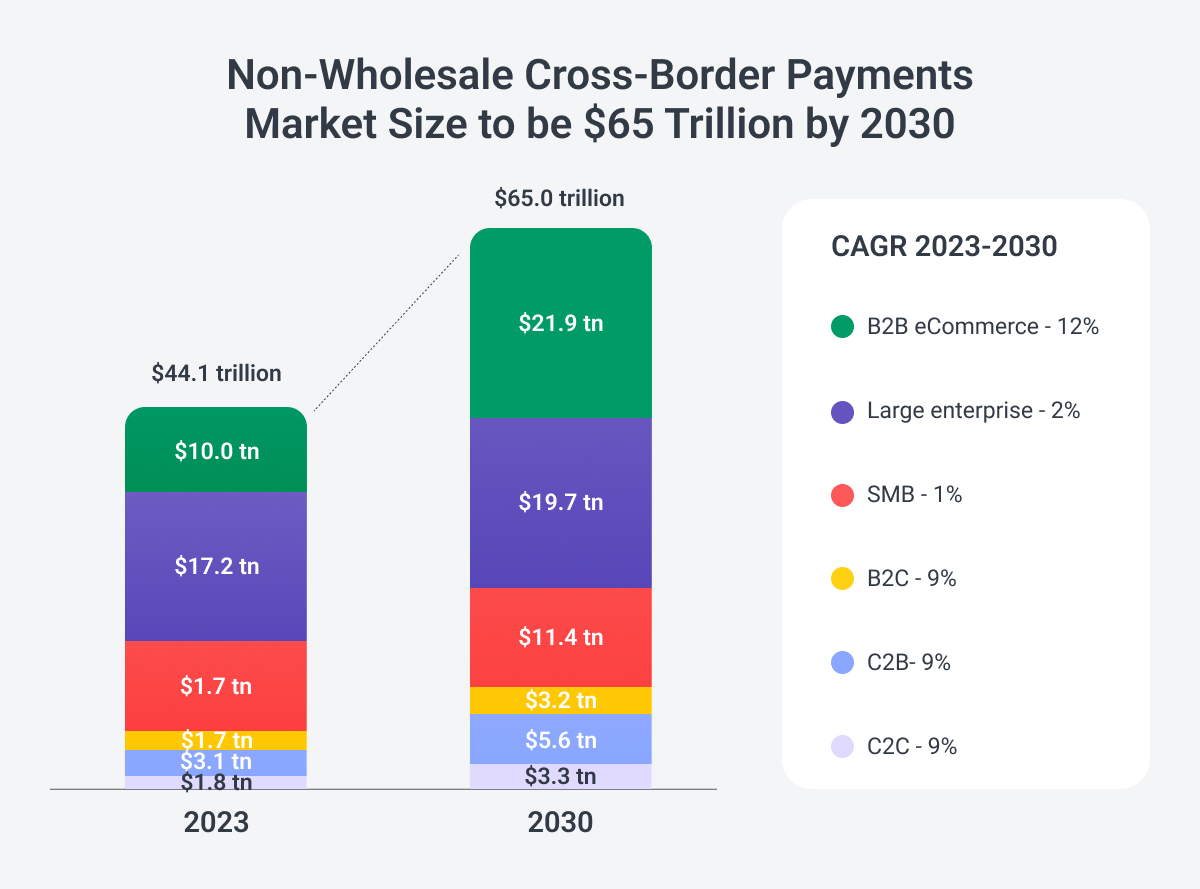

A recent study by Juniper Research projects that the value of B2B payments will increase by 40% by 2028, rising from $89 trillion in 2024. This growth is attributed to the adoption of digital payment systems in developing markets.

The Strategic Transformation of Cross-Border and Instant Payments

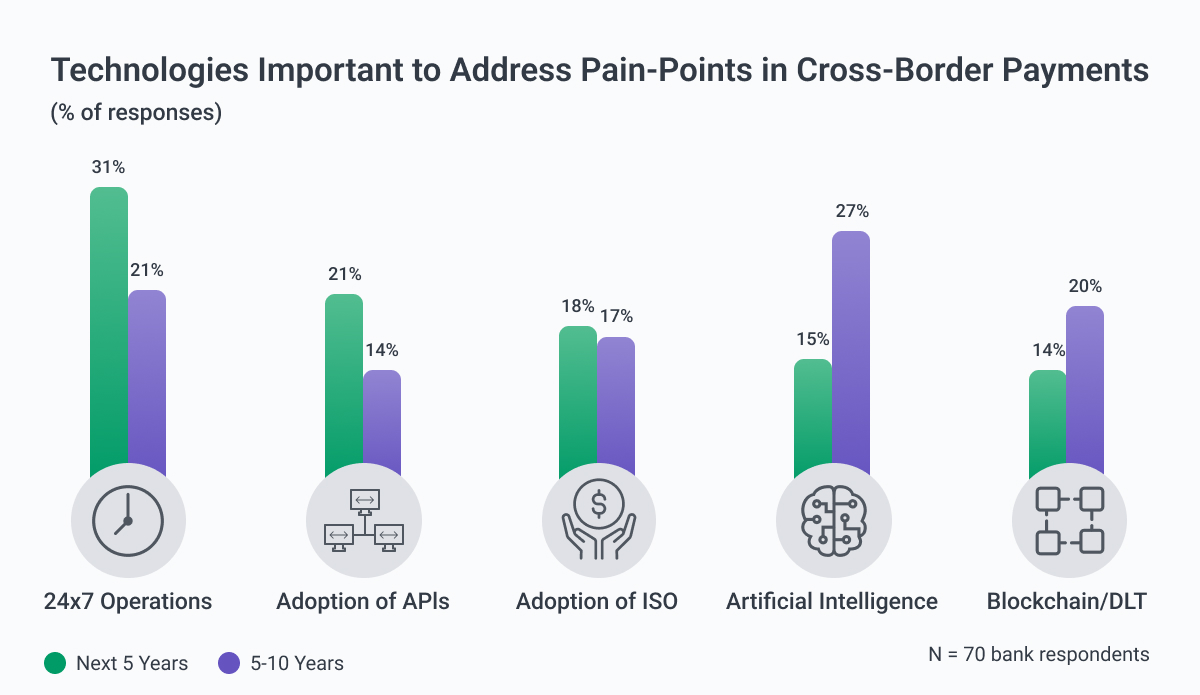

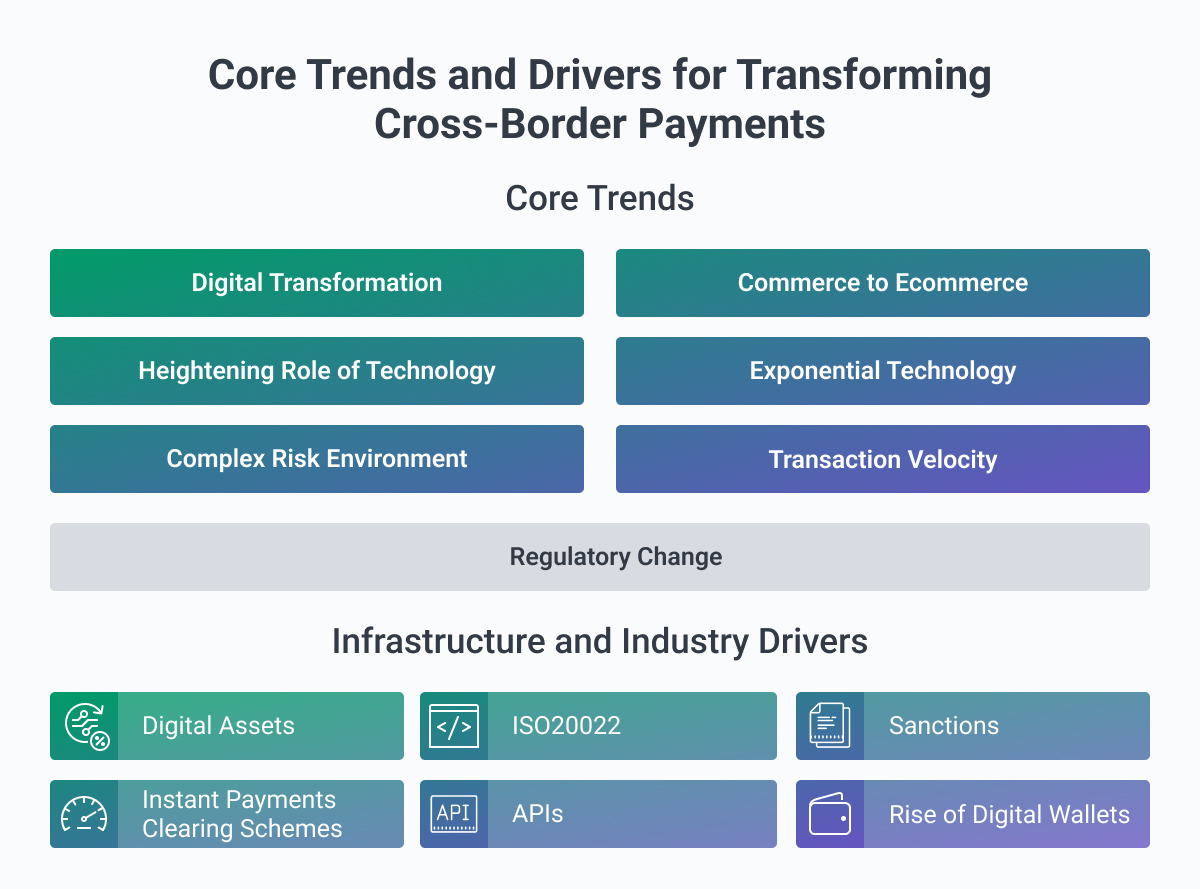

Cross-border payments are undergoing their most significant transformation in decades, driven by what JP Morgan identifies as four fundamental forces of change:

- Faster payments infrastructure

- Platform modernization

- Emerging payment corridors

- Enhanced cybersecurity frameworks

These trends are reshaping not just how money moves internationally, but how global trade and investments flow across borders. The shift represents a strategic inflection point, cross-border payments are no longer merely operational plumbing but strategic capabilities that directly impact competitive positioning, working capital efficiency, and market access.

As businesses expand globally and supply chains become increasingly complex, the ability to move money quickly, securely, and cost-effectively across borders has emerged as a critical differentiator in B2B commerce.

The evolution toward always-on, instant payment infrastructure is accelerating globally, with North America leading a multi-rail revolution that's fundamentally changing payment expectations. In the United States, 58% of financial institutions now connect to both The Clearing House's RTP network and the Federal Reserve's FedNow Service, recognizing that a multi-rail strategy provides the resilience, flexibility, and redundancy that modern businesses demand.

This dual-rail approach ensures that payments can flow 24/7/365 even when one network experiences issues, delivering the "always-on" reliability that 90% of consumers and businesses now prioritize for instant disbursements.

The satisfaction metrics validate this approach, 94% of users report high satisfaction with instant payment experiences, reflecting the tangible value of eliminating settlement delays and enabling real-time financial operations.

FedNow and RTP Transaction Limits

Transaction capabilities are scaling dramatically to accommodate enterprise-level payment volumes. FedNow recently doubled its transaction limit from $500,000 to $1 million, while RTP handles transactions up to $10 million—firmly positioning real-time payments as viable alternatives to traditional wire transfers for substantial B2B transactions.

The Clearing House has further enhanced RTP's enterprise capabilities by launching "on-behalf-of" (OBO) payment functionality, which supports complex use cases like payroll processing, real estate settlements, and B2B disbursements with increased control and transparency.

These developments signal a fundamental shift from "faster payments" to "bigger and more flexible payments," with real-time rails now threatening the decades-long dominance of wire transfers for high-value transactions.

Canada is witnessing similar traction, with Interac gaining momentum in payroll, lending, and insurance disbursements, while the country's new Real-Time Rail system enters testing this fall, promising 24/7/365 instant irrevocable payments with full ISO 20022 messaging support.

A2A's Explosive Growth

The convergence of real-time infrastructure and account-to-account (A2A) payment adoption is creating explosive growth in direct bank-to-bank transfers. Global A2A payment volume is projected to rise from $1.7 trillion in 2024 to $5.7 trillion by 2029, representing 230% growth driven by regulatory mandates, technological maturation, and surging demand for card alternatives.

This trajectory reflects businesses' recognition that A2A payments, when combined with real-time settlement rails, deliver the optimal combination of low cost (often 90% less than card fees), instant availability, and rich transaction data. However, significant technical barriers remain.

While 92% of banks recognize the strategic value of interoperability between payment networks and are actively considering implementation, only 2% have successfully deployed interoperable systems.

The infrastructure complexity required to enable seamless cross-network payments, including shared protocols, unified fraud prevention, and synchronized liquidity management, creates substantial implementation challenges.

Solving this interoperability gap is critical, as connected networks would further reduce costs, enhance fraud prevention through shared intelligence, and provide businesses with truly frictionless access to multiple payment rails through a single integration.

The strategic imperative for businesses is clear: real-time, always-on payment infrastructure is moving from competitive advantage to baseline requirement. The combination of expanding transaction limits, multi-rail redundancy, and explosive A2A growth means that within 12-24 months, instant settlement will be the expected standard rather than a premium service.

For B2B organizations, this transformation demands immediate strategic planning, evaluating current payment infrastructure, identifying use cases where instant settlement delivers maximum value, and building multi-rail capabilities that position the business to leverage real-time payments as they reach full maturity.

The businesses that establish these capabilities now will capture significant advantages in cash flow management, supplier relationships, and operational efficiency, while those that delay will find themselves at a growing competitive disadvantage as partners and customers increasingly expect instant, always-on payment experiences as the default.

Instant payments are set to transform B2B transactions, facilitating cost-effective and secure cross-border trade. By 2028, instant payments are expected to account for 42% of cross-border payments, reaching $16 trillion, up from just 17% in 2024, at $5 trillion.

New Global Payments Language

The centerpiece of the adoption of cross-border digital payments is ISO 20022, a universal standard for instant payments messaging, which will encourage third-party providers to develop value-added services. These innovations, enabled by modern systems supporting detailed remittance data, will drive efficiencies such as automated accounting, attracting businesses to adopt modern payment infrastructures1.

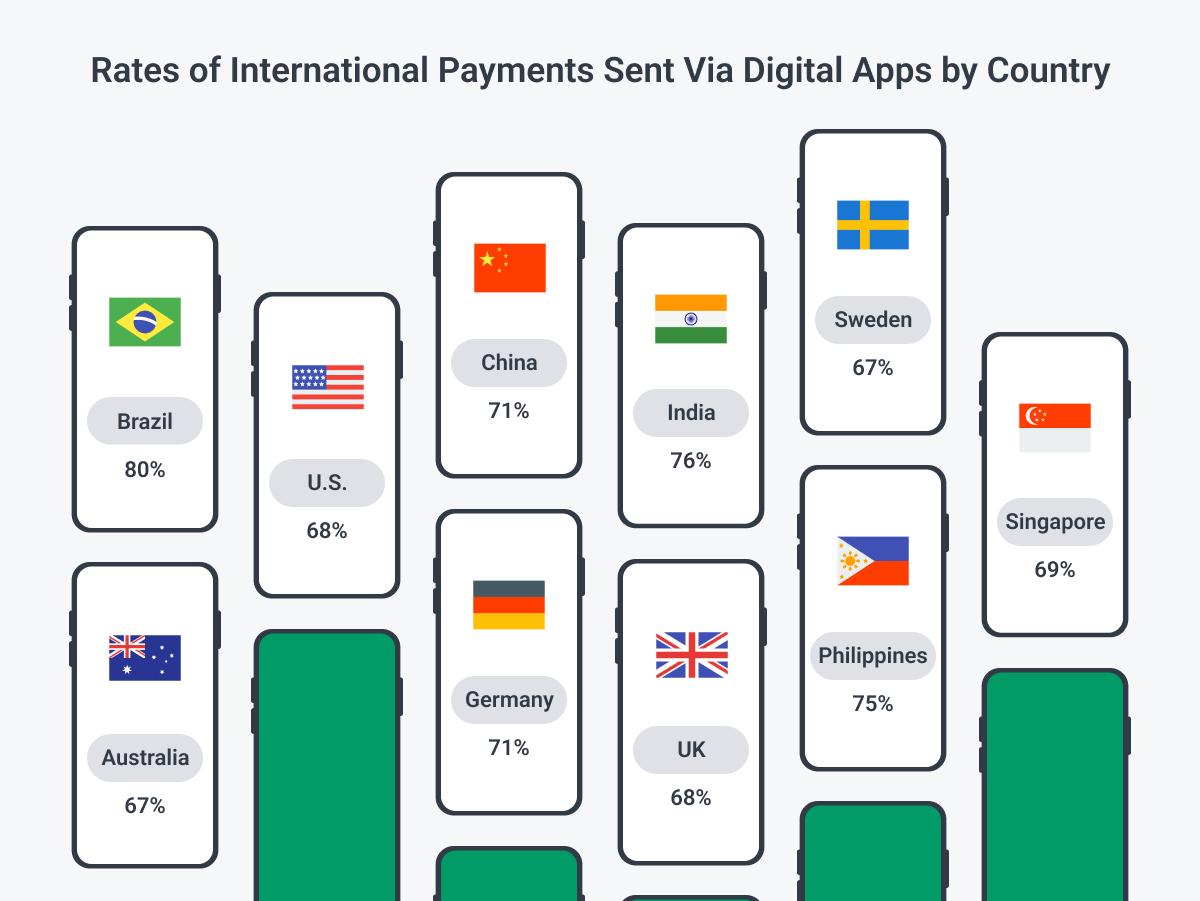

Another significant change in the financial sector is the higher set of expectations related to the quality and convenience of financial services. Entrepreneurs, SMEs, and corporations expect the same levels of transparency and service quality regarding both domestic and international payments.

They want payments to be transferred instantly, regardless of the time zone, bank, or country. And financial institutions are fighting hard to develop solutions that will enable them to do their business internationally.

What Are Cross-Border Payments & How Do They Work?

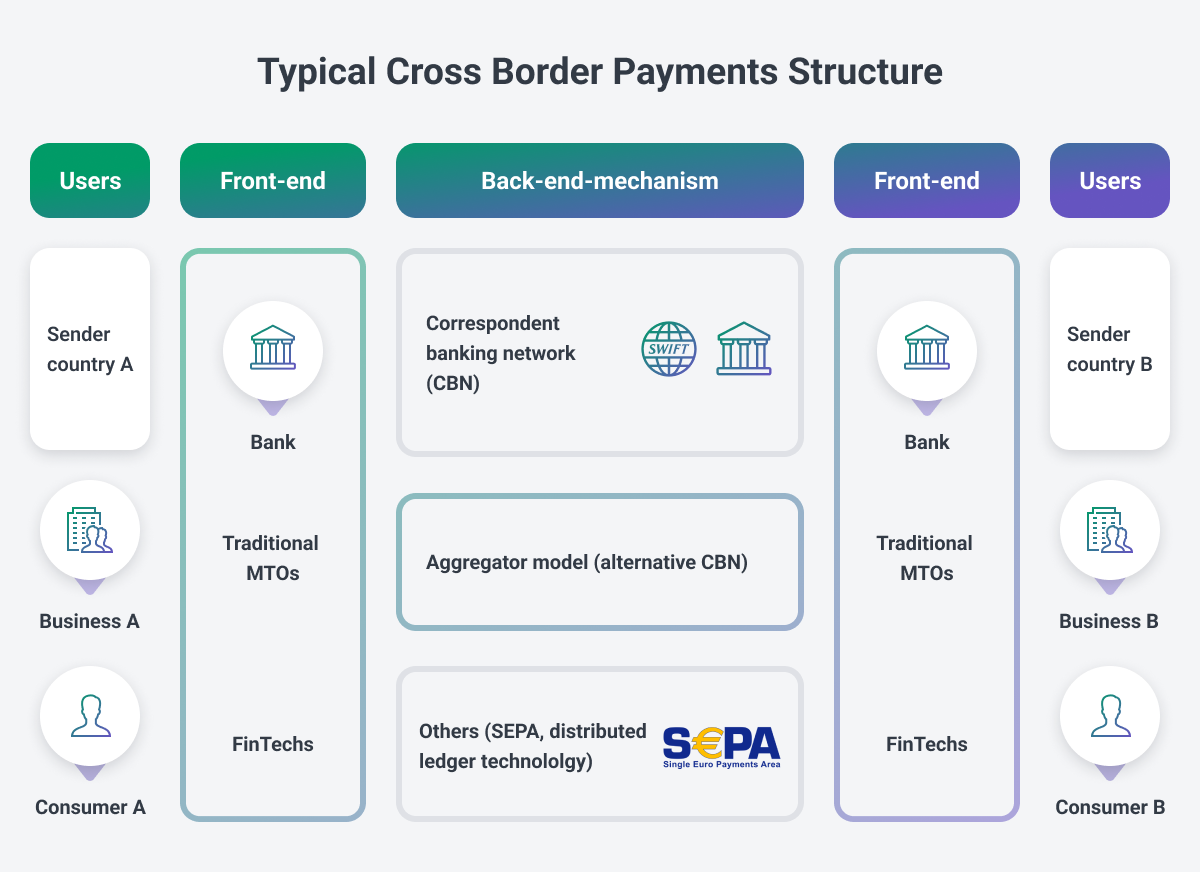

Cross-border payments can be defined as transactions where money goes from one country to another. Nowadays, money can be moved through bank transfers, alternative payment methods, card payments, and mobile payments. Once a payment goes through complex processes and approvals, it can then reach its destination and become available.

A report by the Committee on Payments and Market Infrastructures previously highlighted significant disparities in payment processing times, emphasizing the need for standardization in fintech. While cross-border payments have become more accessible globally, regional variations in processing speed persist.

Recent data from Swift indicates that these gaps are narrowing, with 90% of cross-border payments on its network now reaching the destination bank within an hour. However, regions like Sub-Saharan Africa still face challenges, particularly in the final beneficiary leg of payments.

Continued adoption of standardized messaging protocols like ISO 20022 and investments in regional infrastructure will be critical to achieving faster and more equitable cross-border payment processing worldwide.

Main Types of Cross-Border Payments

There are two main types of cross-border payments: wholesale and retail.

Wholesale Cross-Border Payments

Wholesale cross-border payments occur between financial institutions and involve large-scale transactions such as lending, borrowing, foreign exchange, and commodities trading. These payments are critical for banks, governments, and large corporations engaged in international trade, investment flows, and managing liquidity. Wholesale payments are used for large imports, exports, and general trading activities.

Key examples include:

- Bank Transfers (SWIFT). Transfers using the SWIFT network between banks for interbank lending, borrowing, and large trade settlements.

- International Wire Transfers. Transfers through networks like Western Union or MoneyGram for international financial operations.

- Correspondent Banking. Financial institutions working with foreign banks (correspondents) to facilitate cross-border transactions.

- Foreign Exchange (FX). Large-scale currency exchanges between financial institutions and corporations to manage international business operations.

Retail Cross-Border Payments

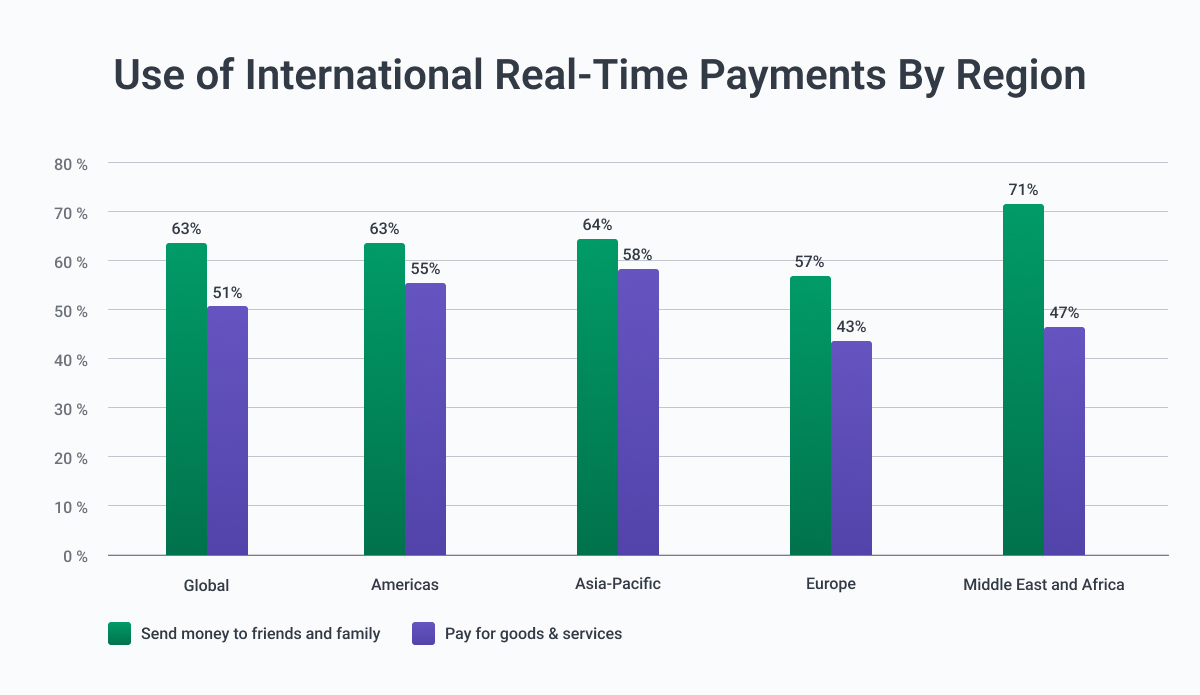

Retail cross-border payments are more common and involve transactions between individuals and businesses. These include remittances (money sent by individuals to family members abroad) and online purchases made by consumers or small businesses. Retail payments cover everyday transactions and are essential for the global e-commerce market.

According to GlobalData’s Financial Services Consumer Survey, approximately 63% of global consumers utilize international real-time payment services to transfer money to family and friends, while 51% use them exclusively for purchasing goods and services.

Key examples include:

-

eWallets. Platforms like PayPal, Alipay, and Skrill allow fast, convenient cross-border payments for consumers and small businesses.

-

Card Payments. Transactions using credit or debit cards via global networks such as Visa and MasterCard for online shopping or travel-related expenses.

-

Mobile Payments. Mobile apps like WeChat Pay or Venmo offer cross-border payment capabilities, often for remittances or small business transactions.

-

Cryptocurrency Payments. Digital currencies like Bitcoin and Ethereum provide an alternative for cross-border payments, enabling fast, low-cost transfers without intermediaries.

-

Fintech Payment Platforms. Companies like TransferWise (Wise) and Revolut facilitate cross-border transactions at lower fees compared to traditional banking options.

-

Money Orders. Traditional methods through postal services or specialized companies for small, person-to-person international transfers, though slower than digital options.

Pain Points and Challenges in Cross-Border Payments

Strong competition has created both opportunities and challenges in fintech. We see banks, neobanks, payment processors, and non-traditional financial players adding new solutions to make the cross-border flow easier.

However, cross-border payments come with a host of challenges that make them slow, costly, and often frustrating for both individuals and businesses.

Lack of Transparency and Visibility

Sending money internationally can feel like shipping a package without tracking information. Once a payment is initiated, there’s little visibility into its journey until it reaches the recipient, often days later. This lack of transparency creates uncertainty and undermines trust, particularly when funds are delayed or fail to arrive altogether.

High Fees and Inefficiencies

The traditional cross-border payment process relies on correspondent banks and clearing houses, introducing inefficiencies that lead to high fees and slow settlement times.

Consumer cross-border payments often incur bank fees averaging over 11%, making smaller transactions disproportionately expensive.

Businesses face similar challenges, with B2B payment fees averaging 1.5% and delays stretching up to several weeks. Nearly 59% of Citibank’s corporate clients cite slow processing speeds as a key pain point.4

These inefficiencies are exacerbated by the reliance on legacy technology, which often lacks modern tools like real-time monitoring, automation, and AI/ML capabilities. These outdated systems make payments slower and more cumbersome, leaving users without the speed and functionality that newer technologies can offer.

Complex Chains of Responsibility

To enable money to move internationally, banks frequently depend on third-party providers (TPPs) and lengthy authentication processes. This reliance on multiple intermediaries introduces additional friction, often resulting in significant delays as money moves through various parties before reaching its destination.

Stringent Compliance Checks

While compliance regulations are essential for preventing money laundering and financial crimes, they significantly complicate cross-border transactions. The need for extensive data and documentation slows down the process, with different countries applying inconsistent regulations that add further complexity. Some transactions require over 20 data points, creating an overly burdensome experience for consumers and businesses alike.

Data Security and Fraud Prevention

According to Endava’s Global Payments Report, data security and fraud prevention remain top concerns for cross-border payments.

Data security is especially pressing, as the rise in cyber-attacks has exposed vulnerabilities in legacy systems. Outdated code and restrictive regulations often prevent platforms from adopting advanced fraud prevention measures.

While automated tools leveraging machine learning, big data, and algorithms have improved fraud detection, they remain under scrutiny for their ability to consistently identify and block problematic transactions.

Local Taxation and Regulatory Barriers

Differing taxation systems and regulatory requirements across countries add another layer of difficulty. These barriers often result in additional fees, slower processing times, and challenges in compliance, particularly for businesses expanding into new markets.

Automatic Approvals and Fraud Detection

The introduction of automatic approval systems has streamlined cross-border payments, but they require robust fraud detection tools to ensure security. Machine learning and big data are essential for analyzing transaction patterns and optimizing payment processes, but concerns remain about whether these tools can fully eliminate fraudulent activity.

Missed Potential of ISO 20022

The adoption of ISO 20022 offers a chance to streamline cross-border payments, allowing banks to move from batch processing to near-instant settlements. However, its full potential remains untapped, as banks and businesses struggle to utilize enhanced analytics and data-sharing capabilities.

Recent updates to standardize data requirements aim to address these inefficiencies, but adoption is still uneven globally.

Innovations to Watch in Cross-Border Payments

In today’s interconnected economy, businesses increasingly operate across borders, relying on international suppliers and customers. To keep the money flowing seamlessly, companies are demanding that banks and financial institutions simplify and modernize cross-border payment processes.

The following innovations are paving the way for a more efficient and transparent future in global payments:

APIs and Real-Time FX Rates

APIs have become a cornerstone of innovation in the financial sector, transforming the way cross-border payments are managed. By integrating APIs into treasury infrastructure, businesses gain real-time visibility into foreign exchange (FX) rates, enabling smarter decision-making and better management of reconciliation processes. Beyond FX transparency, APIs also allow businesses to automate payment flows, reduce manual intervention, and improve accuracy in financial reporting—all while enhancing the speed and efficiency of transactions.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain technology is emerging as a powerful tool for cross-border payments by reducing reliance on intermediaries and improving transaction transparency. Platforms built on blockchain enable near-instantaneous payments with lower fees by bypassing traditional correspondent banking networks. Additionally, the immutable nature of blockchain ensures security and traceability, making it an attractive option for businesses looking to streamline global transactions.

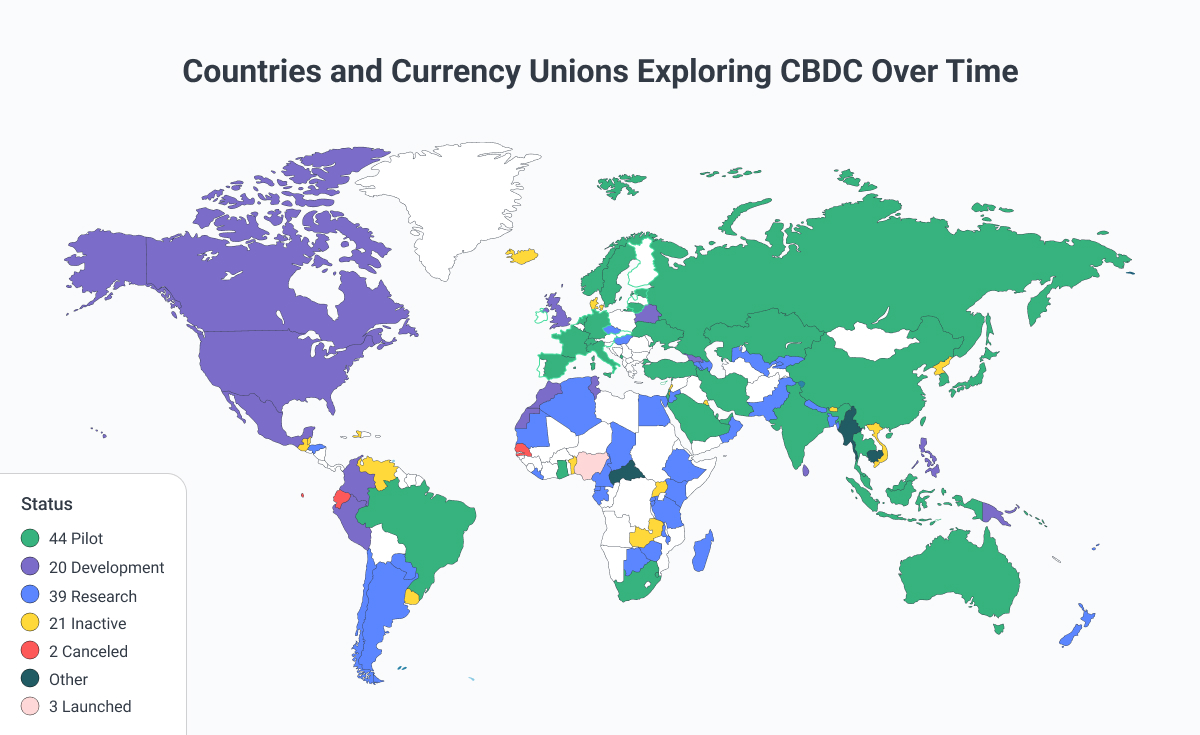

Digital Currencies and CBDCs

Digital currencies, including central bank digital currencies (CBDCs), are reshaping cross-border payments by offering faster settlement times and reducing costs. By leveraging blockchain or similar distributed systems, CBDCs enable governments and financial institutions to offer a state-backed, secure alternative to traditional cross-border payment systems. These currencies hold the potential to eliminate some inefficiencies and ensure compliance through programmable features.

AI and Predictive Analytics

Artificial intelligence (AI) is revolutionizing cross-border payments by optimizing processes and enhancing fraud detection. AI-powered predictive analytics can forecast FX rate fluctuations, helping businesses lock in favorable rates for transactions. Additionally, AI improves risk assessment, streamlines compliance processes, and detects patterns of suspicious activity in real time, reducing delays and losses associated with fraud.

The Rise of Instant Payment Networks

Global initiatives like ISO 20022 and frameworks such as Project Nexus are connecting domestic instant payment systems, enabling faster and more seamless cross-border transactions. These networks reduce transaction friction and open the door to real-time, end-to-end visibility for businesses. As more countries adopt and integrate these systems, businesses can expect quicker settlements and greater transparency in their international payment processes.

Accelerating Cross-Border Payments with Instant Payment Networks

A recent Juniper Research study projects a 223% global increase in cross-border instant payment transactions by 2028, driven by the integration of national instant payment schemes. This growth will result in cross-border instant payments accounting for 29% of all global instant payment transactions, highlighting the transformative impact of reducing transaction friction.

Connecting Domestic Rails for Seamless Payments

Integrating domestic payment systems will revolutionize cross-border transactions, fostering greater trade and investment between participating nations. The study emphasizes the need for governments to support these initiatives through strategic investments and regulatory frameworks to connect their instant payment systems effectively.

Project Nexus: A Blueprint for Integration

Frameworks like Project Nexus play a pivotal role in simplifying the integration of multiple payment networks by centralizing the process rather than managing separate integrations for individual rails. Michael Greenwood, the author of Juniper Research's report on instant payments, notes, “These schemes create a positive feedback loop. As more countries connect to an instant payments network, the network’s value increases, encouraging broader participation.”

Boosting International Trade Through Innovation

As cross-border instant payment networks expand, businesses are expected to leverage these enhanced rails to facilitate international trade. Improved payment processing speed, access to value-added services like detailed transaction data, and enhanced cash flow management will drive businesses to adopt these systems, unlocking new opportunities for global commerce.

How Fintech Companies Can Adjust to Realities in Cross-Border Payments

Fintech companies must adapt to the evolving landscape of cross-border payments to remain competitive and capitalize on emerging opportunities. Here are key strategies to consider:

1. Embrace Collaboration with Banks and Payment Networks

Rather than viewing traditional banks as competitors, fintech companies can leverage partnerships to access established infrastructure and compliance expertise. By collaborating with payment networks, fintechs can expand their reach and offer customers seamless, cost-effective cross-border payment solutions.

2. Invest in Interoperability

Interoperability is critical for connecting diverse payment systems and ensuring smooth transactions across borders. Fintechs should focus on integrating with global standards like ISO 20022 and initiatives like Project Nexus to streamline cross-border transactions. This approach not only reduces friction but also opens doors to new markets.

3. Leverage Emerging Technologies

Adopting technologies like blockchain, AI, and APIs can enhance efficiency, reduce costs, and provide better customer experiences. For example, AI-powered fraud detection tools can help fintechs build trust by ensuring secure transactions, while APIs can provide real-time visibility into payment statuses and FX rates.

4. Focus on Regulatory Compliance

Navigating the complex web of international regulations is one of the biggest challenges in cross-border payments. Fintechs need to stay ahead by investing in compliance automation and partnering with experts who understand the regulatory landscape. Building transparent systems that simplify compliance for users will set fintechs apart.

5. Enhance the User Experience

Fintechs can differentiate themselves by addressing pain points like high fees, slow processing times, and lack of transparency. Providing features such as real-time transaction tracking, cost breakdowns, and simplified interfaces will enhance user satisfaction and loyalty.

6. Expand Value-Added Services

Adding features like automated reconciliation, enhanced transaction data for reporting, and predictive analytics can provide fintechs with a competitive edge. These services improve cash flow management and offer customers tools to optimize their international payment strategies.

By aligning with these strategies, fintech companies can position themselves as leaders in the cross-border payment space, driving innovation and creating value for their customers.

Final Word

The cross-border payment landscape is undergoing rapid transformation, driven by advancements in technology and evolving customer expectations.

For fintech companies, the ability to adapt and innovate will be key to thriving in this dynamic environment. By focusing on collaboration, leveraging emerging technologies, and enhancing the user experience, fintechs can overcome barriers and unlock the full potential of cross-border payments.

To navigate these shifts, fintech companies and financial institutions must prioritize collaboration with experts who can provide the technical knowledge and tools needed to adapt.

Contact us if you're looking to invest in modern infrastructure and leverage the latest advancements - both of which will be essential in staying competitive in the rapidly evolving cross-border payments landscape.