Artificial intelligence (AI) and machine learning (ML) are no longer emerging technologies in banking; they are foundational tools reshaping how financial institutions operate, compete, and connect with customers.

As the digital demands on banks continue to grow in 2026, so does the pressure to deliver smarter, faster, and more secure services. AI and ML technologies offer a scalable path forward, enabling banks to evolve beyond traditional services and meet the expectations of today’s digital-first customers.

In this article, we’ll explore the most impactful AI and ML applications in banking, the challenges institutions face in implementing them, and best practices for integrating these technologies while staying compliant.

If you're looking for a broader view of how modern fintech solutions are built, check out The Complete Guide to Fintech Software Development.

Why AI/ML Matters in Banking Today

Traditional banking systems, built for stability and compliance, often struggle to adapt to rapidly changing customer expectations and threat landscapes.

AI fills that gap with tools that continuously learn, improve, and personalize over time. It helps banks shift from reactive service models to proactive, data-driven ecosystems.

According to recent industry reports, 77% of banks worldwide said they were investing in data analytics and AI-driven insights, while 54% already experimenting with or implementing AI-driven solutions.

These initiatives aim to reduce fraud, increase operational efficiency, and deliver personalized products that keep customers engaged.

Beyond cost savings and efficiency, AI gives banks a competitive edge in five key areas:

- Real-time decision-making: AI can process data faster than humans, identifying risks or opportunities in seconds.

- Enhanced personalization: ML algorithms tailor financial services based on user behavior, improving engagement and satisfaction.

- Stronger risk management: Predictive models help assess credit risk, detect fraud, and automate compliance.

- Operational efficiency: AI automates routine tasks, freeing staff for higher-value work.

- Scalable innovation: AI enables rapid testing and deployment of new features and services.

As we move deeper into this AI-powered era of banking, financial institutions that prioritize smart implementation will be better positioned to lead.

Top Applications of AI and ML in Banking

AI and machine learning are driving innovation across nearly every facet of banking.

Each of these applications demonstrates how AI is improving existing banking services and redefining what’s possible.

Here are the key areas where these technologies are delivering the most impact:

1. Fraud Detection and Risk Management

AI excels at recognizing anomalies in vast datasets. Machine learning models are trained on historical transaction patterns to detect unusual activity, flagging potential fraud in real time.

These systems continuously adapt to new threat vectors, often identifying risks faster and more accurately than rule-based approaches.

Use case example:

Banks use AI to monitor transactions for behavioral red flags, such as unusual login times or rapid fund transfers, helping prevent unauthorized activity before it escalates.

2. Personalized Customer Experiences

AI enables banks to offer tailored financial products based on a customer’s behavior, preferences, and financial history. From budgeting advice to credit offers, personalization increases relevance and customer retention.

Use case example:

Robo-advisors use ML to recommend investment portfolios based on a user’s goals, risk tolerance, and past activity — often outperforming one-size-fits-all models.

3. Process Automation and Operational Efficiency

AI automates time-consuming, manual tasks like document verification, loan underwriting, and customer onboarding. Natural language processing (NLP) tools extract insights from unstructured documents, while robotic process automation (RPA) handles rule-based workflows.

Use case example:

An expense management reporting process that once took days can now be completed in minutes with AI-powered data extraction and approval logic.

4. Conversational Banking and Virtual Assistants

Chatbots and AI-powered assistants provide 24/7 customer service, handling common queries, guiding users through transactions, and even helping with fraud disputes. These tools reduce call center load and improve response time.

Use case example:

An in-app virtual assistant can help users freeze cards, check balances, or schedule transfers using natural language.

5. Algorithmic Trading and Investment Analysis

ML algorithms are used to identify market trends, execute trades at optimal times, and model future performance based on diverse data sources. These systems continuously learn from new data to refine their strategies.

Use case example:

An investment firm can deploy AI-powered trading bots that analyze real-time news sentiment, social media trends, and historical price movements to execute high-frequency trades.

Challenges of Implementing AI in Banking

While AI offers clear advantages, banks face several barriers when attempting to implement these technologies effectively.

From technical limitations to regulatory hurdles, success requires more than just selecting the right tools. It demands thoughtful integration and long-term planning.

Regulatory and Compliance Constraints

Financial institutions operate in one of the most highly regulated industries. AI systems must comply with regulations like GDPR, CCPA, PCI DSS, and local banking rules, which often require transparency, auditability, and strict data handling practices.

Many machine learning models, especially black-box models, present challenges when it comes to explainability and regulatory approval.

Data Quality and Accessibility

AI systems are only as good as the data they’re trained on. Banks often struggle with fragmented data sources, inconsistent formats, or legacy systems that weren’t built for AI-readiness. Cleaning, standardizing, and integrating datasets is a major undertaking, but a necessary one.

Legacy Infrastructure Integration

Outdated core banking systems and siloed architectures can limit the ability to deploy AI models in production. Banks must modernize infrastructure, ensure real-time data availability, and design flexible APIs for AI-driven services to function effectively.

Talent and Expertise Gaps

AI and ML projects require specialized skills in data science, MLOps, model governance, and financial domain knowledge. Many institutions face a shortage of qualified professionals or lack internal expertise to scale initiatives sustainably.

Customer Trust and Transparency

AI must be deployed in ways that build customer trust. Decisions made by machine learning models (such as loan denials or fraud flags) must be explainable to both customers and regulators. Institutions that fail to offer transparency risk losing user confidence and facing scrutiny.

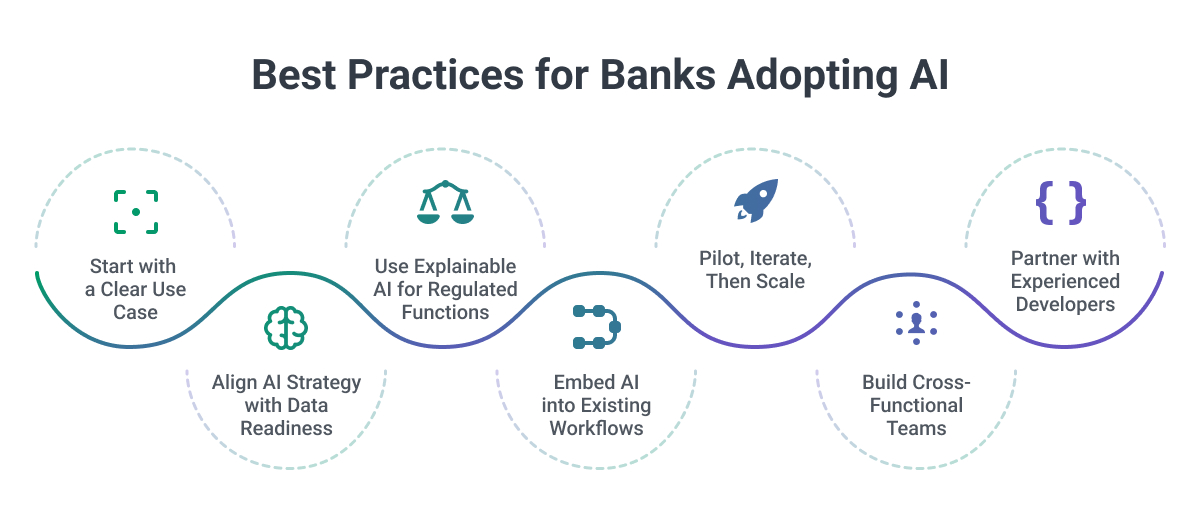

Best Practices for Banks Adopting AI

Successfully integrating AI into banking operations requires more than technical capability. Iit calls for a strategic approach that balances innovation, risk management, and long-term maintainability.

These best practices can help financial institutions maximize the value of AI while minimizing potential setbacks:

- Start with a Clear, Targeted Use Case

Rather than launching large-scale AI programs from the start, focus on a specific business problem, such as fraud detection, customer service automation, or risk scoring. Clear goals help measure ROI and reduce risk.

- Align AI Strategy with Data Readiness

Before model development, ensure data is well-governed, accessible, and clean. Invest in building unified data lakes or real-time data pipelines, and establish strong data ownership policies.

- Use Explainable AI (XAI) for Regulated Functions

When applying AI to credit scoring, compliance monitoring, or customer approvals, prioritize models that can provide transparency and traceability. Tools like SHAP or LIME can help make ML models interpretable for both regulators and internal teams.

- Embed AI into Existing Workflows, Not Just Tech Stacks

AI should enhance existing systems and processes, not disrupt them. Use APIs, microservices, and event-driven architecture to integrate AI-driven insights into familiar tools, like core banking systems or mobile apps.

- Pilot, Iterate, Then Scale

Test models in a controlled environment before rolling them out broadly. Use feedback from internal users and customers to improve the model and ensure it performs as expected in real-world conditions.

- Build Cross-Functional Teams

AI initiatives should include not just data scientists, but also compliance officers, software engineers, business analysts, and domain experts. This ensures that technical models solve real problems and meet industry standards.

- Partner with Experienced Fintech Developers

Working with a software partner that understands both AI and banking systems can accelerate development, reduce integration complexity, and ensure that security and compliance are built in from the beginning.

"We were encouraged because Softjourn asked the right questions and involved people with the right experience in the conversations. Softjourn is very good at the management piece and has a lot of strong knowledge in the financial area. Additionally, Softjourn shows a lot of experience in multiple programming languages and knows how to combine them into one product."

- Toffer Grant, the Founder and CEO of PEX.

AI and Compliance: Can They Coexist?

AI has the potential to enhance compliance efforts, but it can also introduce new risks if not implemented carefully.

For banks operating in highly regulated environments, the challenge is to harness AI’s benefits while staying firmly within legal and ethical boundaries.

Balancing Innovation with Regulation

Many financial regulations were not written with machine learning in mind. As a result, institutions must interpret compliance requirements through the lens of evolving technology.

This includes ensuring that AI-driven processes – such as fraud detection or loan approvals – can be audited, explained, and justified.

Key Compliance Considerations for AI in Banking

- Data Privacy: AI systems must handle personal and financial data in compliance with regulations like GDPR, CCPA, and local equivalents. This includes data minimization, consent management, and secure data handling.

- Model Explainability: Regulators often require transparency around decision-making processes, especially for high-stakes actions like credit decisions. Explainable AI techniques help satisfy these requirements.

- Bias and Fairness: AI models must be evaluated for potential bias, particularly in areas like lending or fraud detection, where unfair decisions can harm consumers or trigger legal action.

- Auditability: All AI decisions and model changes must be logged and traceable. This enables banks to prove compliance during internal reviews or external audits.

- Continuous Monitoring: Models must be retrained and evaluated regularly to ensure continued performance and regulatory alignment as conditions change.

When AI Helps with Compliance

AI can also improve compliance efforts by automating tasks like transaction monitoring, suspicious activity detection, and regulatory reporting. Machine learning can identify patterns human analysts might miss, improving both speed and accuracy.

With proper governance, AI doesn’t need to conflict with compliance, instead, it can reinforce it. The key is to embed regulatory thinking from the start, not treat it as an afterthought.

The Future of AI in Banking

The next wave of AI in banking is focused on deeper personalization, stronger automation, and more proactive service delivery. As technologies and user expectations evolve, banks that embrace continuous innovation will lead the way.

Key Trends to Watch

- Generative AI for Customer Service:

Beyond scripted chatbots, generative AI is enabling banks to deploy virtual assistants that handle complex conversations, generate customized financial content, and support multilingual interactions. - Federated Learning:

Privacy-preserving AI models will allow institutions to train algorithms across distributed datasets without moving sensitive information. This can improve fraud detection while maintaining compliance with strict data laws. - AI-Powered Financial Coaching:

Banks are beginning to act as financial wellness partners, using AI to recommend savings goals, alert users to risky behaviors, and offer just-in-time insights tailored to each customer. - AI Ops for Infrastructure Management:

Machine learning models can now monitor IT systems for anomalies, forecast performance issues, and trigger automated resolutions, helping banks reduce downtime and maintain service reliability. - Hybrid Intelligence:

Human-in-the-loop models are becoming standard for high-stakes decisions, allowing AI to surface insights while leaving final judgment to compliance officers or analysts.

Strategic Priorities for Banks Moving Forward

To stay ahead, banks should:

- Treat AI as a long-term capability, not a one-time feature

- Invest in cross-functional AI fluency across technical and business teams

- Modernize infrastructure to support real-time, secure data operations

- Continuously evaluate governance frameworks for responsible AI

Final Word

AI and machine learning are redefining how financial institutions connect with their customers, manage risk, and deliver value. As adoption grows, so does the importance of building responsible, scalable, and compliant AI systems.

Whether you're enhancing fraud detection, personalizing digital services, or automating internal workflows, success depends on careful planning and the right technology partner.

With deep expertise in both fintech and AI implementation, Softjourn helps banks and financial platforms integrate smart, secure, and future-ready solutions.

Looking to explore AI for your banking platform? Let’s talk about how we can help.

Or dive deeper into the full ecosystem of tools and strategies shaping the industry in our Complete Guide to Fintech Software Development.