Graph technology is not a new concept. Graph theory, the mathematical foundation of graph technology, has existed for centuries. However, the application of graph technology in the context of fraud prevention and detection is a newer idea that has gained significant attention and traction in recent years.

Traditionally, fraud detection systems have relied on relational databases and rule-based approaches. Now, as fraudsters have become more sophisticated and their methods have evolved, companies are seeking more advanced techniques to detect and prevent fraud effectively. Graph technology offers a unique approach by enabling the representation and analysis of complex relationships and connections in data.

The use of graph technology for fraud prevention has gained prominence, particularly with the emergence of graph databases and graph analytics platforms. These technologies provide powerful tools for modeling, querying, and analyzing data as interconnected graphs, allowing banks and financial institutions to uncover hidden patterns, identify suspicious relationships, and detect problematic activities more accurately and efficiently.

While graph technology for fraud prevention may not be entirely new, its adoption and application in this specific domain have been advancing rapidly, driven by the need for more sophisticated financial fraud detection and prevention techniques. As financial institutions continue to leverage graph technology's capabilities, it is expected to evolve further and play a crucial role in combating fraud in various industries.

In this article, we will focus on the value of graph technology for fraud prevention and how fintech companies can benefit from it.

Understanding Graph Technology

Graph technology is a powerful framework for modeling and analyzing complex relationships and connections in data. At its core, it consists of two fundamental concepts: nodes and edges. By combining nodes and edges, a graph structure is formed, often referred to as a graph database. Graph databases allow for the representation and storage of complex data relationships in a way that is efficient for querying and analysis.

Nodes represent entities or objects in a dataset. Each node typically contains properties or attributes that describe the characteristics of the entity it represents. For example, in a social network graph, nodes can represent users, and their properties can include attributes such as name, age, location, and interests.

Edges represent the relationships or connections between nodes. They define how nodes are related to each other. Edges can be directed (indicating a one-way relationship) or undirected (indicating a bi-directional relationship). For instance, in a social network graph, edges can represent friendships or connections between users.

Graph databases vs. traditional relational databases

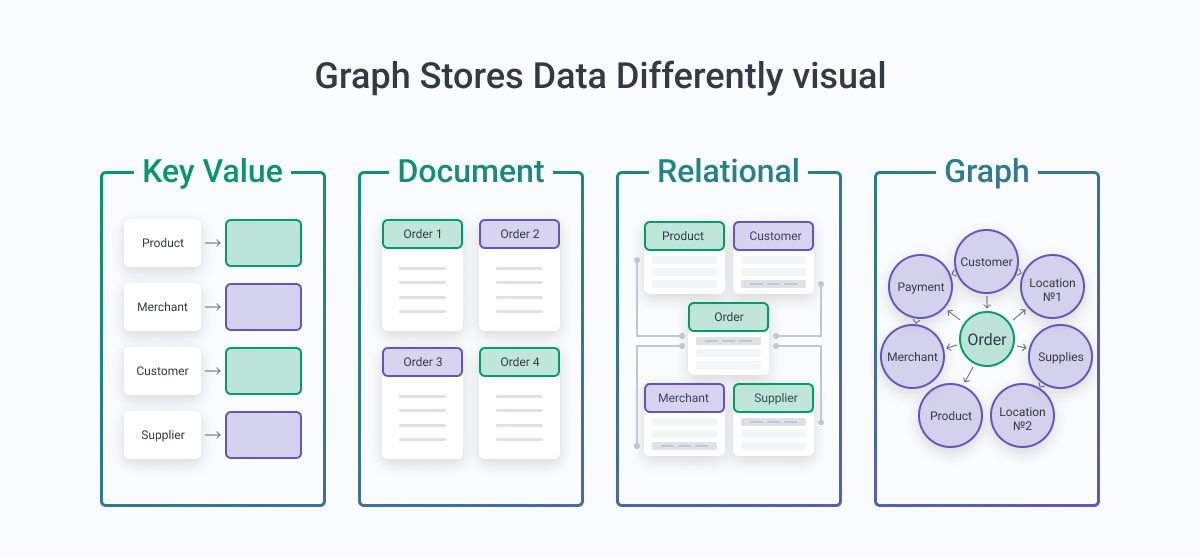

Graph databases differ from traditional relational databases in how they store and represent data. While relational databases organize data into tables with predefined schemas and use SQL for querying, graph databases store data as interconnected nodes and edges.

Here's how they compare:

- Data Modeling: Relational databases require predefined schemas that enforce rigid structure and predefined relationships between tables. In contrast, graph databases allow for flexible data modeling, where relationships and connections can be established on the fly without altering the schema.

- Querying: Relational databases use SQL for querying structured data using join operations. Graph databases use graph query languages, such as Cypher or Gremlin, which are designed specifically for traversing and querying graph structures. These languages make it easier to express complex relationship-based queries.

- Performance: In graph databases, traversing relationships between nodes is highly efficient due to their native graph storage and indexing structures. This makes graph databases well-suited for handling complex queries that involve traversing numerous connections. Relational databases can encounter performance issues when dealing with highly connected data.

- Relationship Focus: Graph databases excel at representing and querying relationship-centric data, where the connections between entities are of primary importance. Relational databases, on the other hand, are better suited for structured data with fixed relationships between entities.

What’s important to mention is that graph databases will make AI/ML tools much more accurate and fast. They will allow financial institutions to have smarter data, quickly start searchers across different datasets, and create intuitive models and queries.

Benefits of using graph technology for fraud prevention

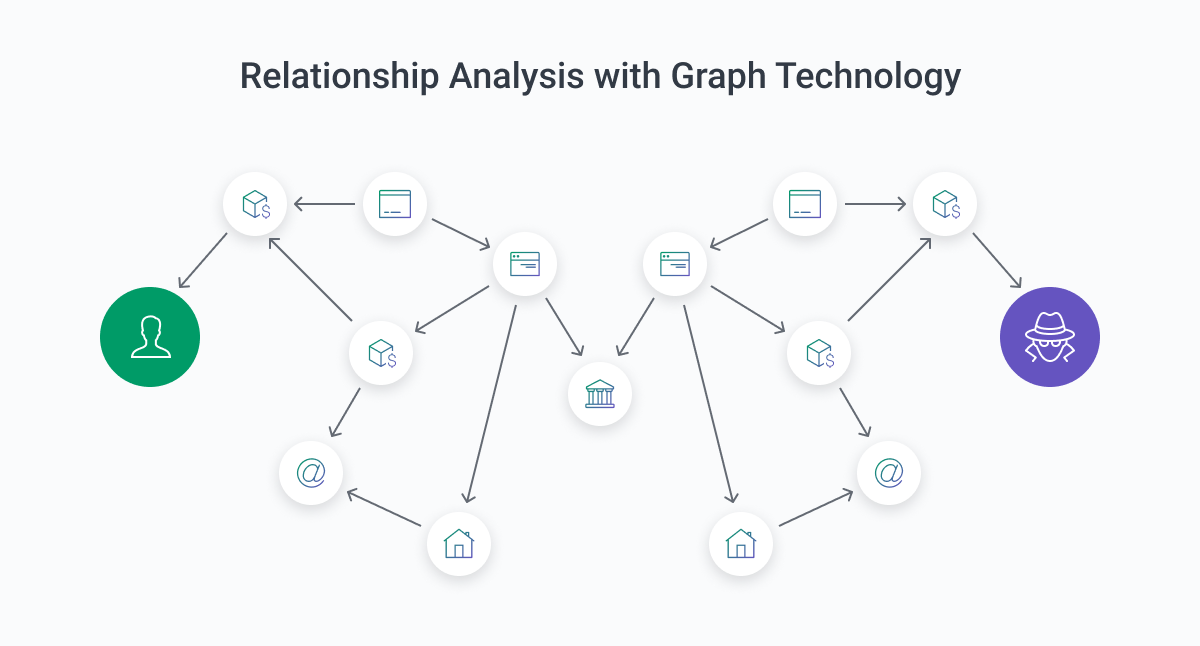

- Relationship Analysis: Graph databases excel at analyzing complex relationships and connections. By representing fraud-related data as a graph, businesses can uncover hidden patterns, identify suspicious entities, and detect fraud rings or networks that might be difficult to detect using traditional methods.

- Real-Time Detection: Graph technology allows for real-time fraud detection. As new transactions or events occur, they can be immediately analyzed within the graph database, taking into account the relationships and connections between entities. This enables proactive identification and prevention of fraudulent activities as they happen.

- Link Analysis: Graph technology enables link analysis, which is crucial for understanding how entities are connected and identifying suspicious relationships, and pinpointing potential fraudsters.

- Collaborative Intelligence: Graph technology facilitates collaboration and information sharing among different entities involved in fraud prevention. Multiple organizations, such as banks, law enforcement agencies, and financial regulators, can securely share information and work together to identify and prevent fraud using a graph-based approach.

- Scalability: Graph databases are designed to handle large-scale, highly connected data. As fraud datasets grow in size and complexity, graph technology can scale to accommodate the increasing data volume while maintaining high-performance querying and analysis capabilities.

Identifying Fraud Patterns

Connect and analyze complex data relationships

Graph technology provides a powerful framework for connecting and analyzing complex data relationships. By representing data as nodes and edges, banks can capture the intricate connections between different users and companies and gain a deeper understanding of their data. Graph databases enable efficient querying and traversal of these relationships, allowing for advanced analysis and insight generation.

Whether it's analyzing social networks, customer behavior, or supply chain dynamics, graph technology empowers everyone to uncover valuable insights by leveraging the power of interconnected data relationships and improving their ML and AI tools.

One of the key strengths of graph technology in fraud prevention is its ability to uncover hidden connections and patterns within fraud networks.

Graph algorithms, such as community detection and centrality analysis, can reveal clusters of suspicious entities and identify key nodes that play a significant role in fraudulent activities. This holistic view of fraud networks enables financial institutions to identify previously undetectable patterns and expose hidden relationships.

Improve Real-Time Fraud Monitoring

Leveraging graph technology for real-time fraud monitoring

By continuously ingesting transactional data into a graph database, banks, fintechs, and financial institutions can leverage graph algorithms and real-time analytics to identify suspicious patterns, anomalies, and potential fraud indicators in real-time. The ability to analyze and respond to fraudulent activities as soon as they happen enhances the effectiveness of fraud prevention efforts, enabling auditors to take immediate action and minimize financial losses.

Establishing a fraud detection pipeline

To achieve real-time fraud monitoring, organizations can establish a fraud detection pipeline. This involves preprocessing and enriching data, building and maintaining an extensive graph database, as well as applying graph algorithms to identify suspicious patterns and relationships.

By incorporating these algorithms into the fraud detection pipeline, it becomes possible to continuously analyze data streams while activating and generating real-time alerts for further investigation and action.

Enhancing fraud detection accuracy

The adoption of graph technology in real-time fraud monitoring has proven to enhance both the accuracy and speed of fraud detection processes. This technology brings contextual understanding to a new level. Contextual awareness is crucial in detection as it enables the analysis of not just individual transactions or events but also the interconnections between them.

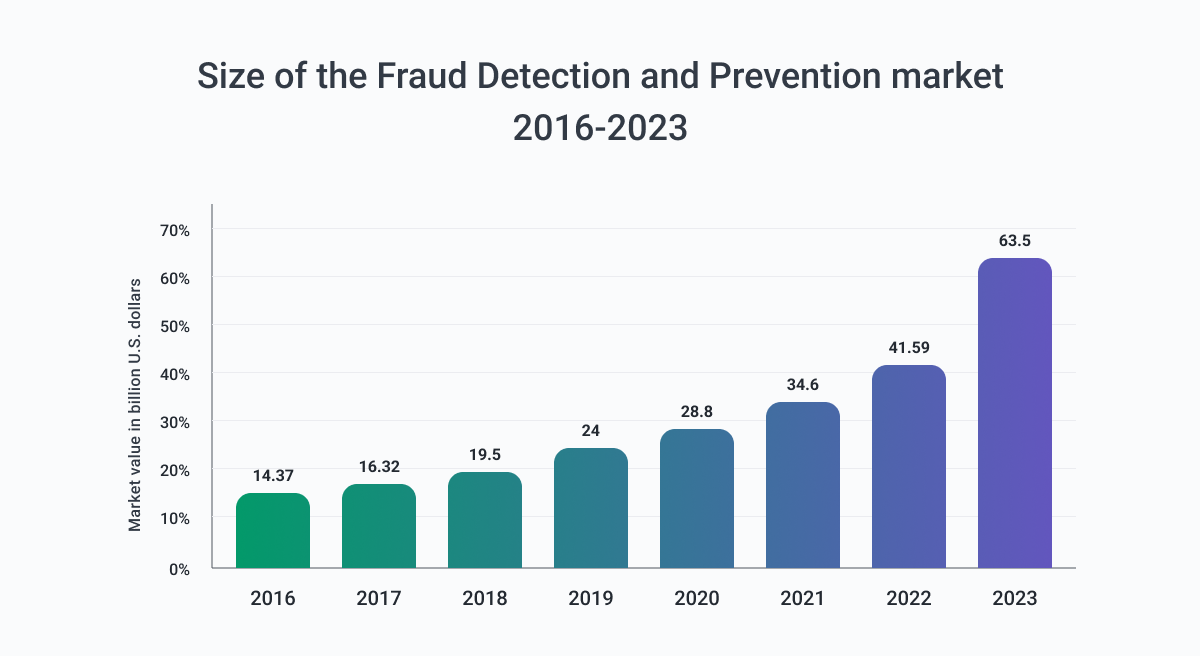

The inherent scalability and performance of graph databases enable organizations to process large volumes of data in real-time, ensuring that fraud detection and prevention efforts keep pace with the dynamic nature of fraudulent activities that increase year after year.

Challenges and Limitations of Graph Technology

While graph technology offers significant advantages in fraud prevention, there are also potential challenges and limitations to consider.

One of the first challenges is the complexity of modeling and managing large-scale graph databases. As the volume and complexity of data increase, financial institutions may need help in designing and maintaining efficient graph data models.

Additionally, ensuring data quality and accuracy is crucial, as errors or incomplete data can impact the effectiveness of fraud detection algorithms.

Another challenge is the computational complexity of specific graph algorithms, especially when dealing with massive datasets. The performance of graph-based solutions may be affected by the need for intensive computations, potentially leading to longer processing times.

Last, integrating graph technology into existing IT infrastructure and workflows can be challenging, requiring careful planning and coordination to ensure seamless integration with existing systems.

Addressing Privacy Concerns and Data Protection in Graph-Based Solutions

The use of graph technology for fraud prevention raises privacy concerns and data protection considerations. Graph databases can potentially contain sensitive and personal information about individuals, which requires robust privacy measures all around.

Banks and other providers of financial services must ensure compliance with applicable data protection regulations and implement appropriate security measures to safeguard the data stored in graph databases.

Most commonly, anonymization and pseudonymization can be employed to protect individuals' identities while still allowing for effective fraud detection. Also, access controls and encryption can be implemented to restrict unauthorized access and protect data confidentiality.

How to Maximize the Effectiveness of Graph Technology

To overcome challenges and maximize the effectiveness of graph technology in fraud prevention, organizations can use various technologies, here are a few of the most commonly used ones:

- Data Quality and Preparation. Prioritize data quality by ensuring accurate and reliable data inputs. Invest in data cleansing and enrichment techniques to enhance the accuracy of graph-based fraud detection models.

- Scalability and Performance Optimization. Optimize the performance of graph databases by employing efficient indexing techniques, hardware optimization, and parallel processing. Consider distributed graph databases for handling large-scale datasets.

- Algorithm Selection. Choose graph algorithms that are best suited for the specific fraud detection requirements. Explore optimization techniques, such as sampling or approximation, to improve the efficiency of computationally intensive algorithms.

- Integration and Interoperability. Integrate graph technology into existing IT infrastructure seamlessly to ensure compatibility and interoperability with other systems and data sources. Foster collaboration among different entities involved in fraud prevention, such as financial institutions, regulatory agencies, and law enforcement. Share knowledge, insights, and best practices to collectively enhance fraud prevention capabilities.

- Continuous Monitoring and Adaptation. Fraud patterns and techniques are constantly evolving, so it is crucial to continuously monitor and update graph-based fraud detection models. Regularly analyze and evaluate the performance of the system and make necessary adjustments to improve accuracy and effectiveness.

By adopting these strategies, regulators can overcome challenges, address privacy concerns, and maximize the effectiveness of graph technology in fraud prevention, ultimately enhancing their ability to detect and prevent scammy activities.

Companies That Use Graph Technology Today

Many companies across industries are using graph technology to prevent fraudulent behavior. We’ve compiled some of the most popular industry cases where we can see the benefits of using graph technology for fraud detection.

Airbnb, the well-known online marketplace for short-term rentals, utilizes graph technology to combat fraud within their platform. They employ graph databases to analyze user behavior, property listings, and transactional data to identify and flag suspicious activities. By mapping and analyzing the relationships between hosts, guests, and bookings, Airbnb can proactively identify and prevent fraudulent behavior.

IBM offers various fraud prevention solutions that leverage graph technology. Their graph analytics platform, IBM Graph, enables companies to analyze vast amounts of interconnected data to detect problematic patterns and identify potential risks. IBM's graph-based solutions currently support financial institutions and insurance companies to enhance their fraud scheme prevention capabilities.

Mastercard utilizes graph technology to enhance its fraud detection systems by analyzing transactional data, user behavior, and network connections to identify potential fraudulent activities in real-time. Mastercard's use of graph technology allows them to detect complex fraud schemes and protect their customers from risky transactions.

PayPal, a leading online payment platform, employs graph technology to detect and prevent financial scams worldwide. They use graph databases to analyze transactional data and identify patterns.

Amazon incorporates graph technology into complex detection systems to combat fraud across its e-commerce platform. Amazon can identify suspicious activities by analyzing customer behavior, purchase histories, and network connections, such as fake reviews, account takeovers, and fake transactions.

Many other organizations, including financial institutions, insurance companies, cybersecurity firms, and government agencies, are also using or building graph tech pipelines to improve their fraud detection capabilities and protect their users against a variety of online frauds.

Trends and Opportunities in Graph Technology Development

Graph technology continues to evolve every day. One emerging trend is the integration of graph databases with other cutting-edge technologies, such as artificial intelligence and machine learning, to enhance fraud detection capabilities. By combining the power of graph technology with advanced analytics and algorithms, companies work to uncover hidden patterns and detect sophisticated fraud schemes that traditional methods might miss.

Another trend is the application of graph technology in real-time fraud prevention. As fraudsters become more agile and adaptive, real-time monitoring and detection are essential. This real-time capability, coupled with graph algorithms and analytics, provides a proactive approach to fraud prevention, reducing the overall financial impact on companies and mitigating risks.

The Role of Artificial Intelligence and Machine Learning in Enhancing Graph-Based Fraud Prevention

Artificial intelligence (AI) and machine learning (ML) play a crucial role in enhancing graph-based fraud prevention. AI and ML techniques can be applied to graph data to identify patterns, anomalies, and predictive indicators of fraud. By leveraging AI and ML algorithms, organizations can automate the detection process, improve accuracy, and adapt to evolving fraud patterns.

ML algorithms can be trained on historical fraud data to recognize patterns and anomalies within graph structures. These algorithms can identify unusual behaviors, detect deviations from normal patterns, and generate alerts for potentially fraudulent activities. By continuously learning from new data, ML models can adapt and improve their fraud detection capabilities over time.

AI techniques, such as natural language processing and image analysis, can also enhance graph-based fraud prevention. Unstructured data, such as text-based fraud reports or images of fraudulent documents, can be processed and analyzed using AI algorithms. The extracted information can then be connected to the graph database, enriching the overall understanding of fraud networks and helping identify new patterns or trends.

As AI and ML techniques continue to advance, their synergy with graph technology holds tremendous potential for improving fraud detection accuracy and efficiency.

Conclusion

In this article, we explored the various aspects of graph technology in relation to fraud prevention, including its fundamental concepts, advantages over traditional relational databases, and real-world applications in detecting and combating financial fraud.

The future of fraud prevention with graph technology looks very promising. As financial institutions, banks, and fintechs strive to stay ahead of increasingly sophisticated fraud schemes, graph technology offers a powerful solution.