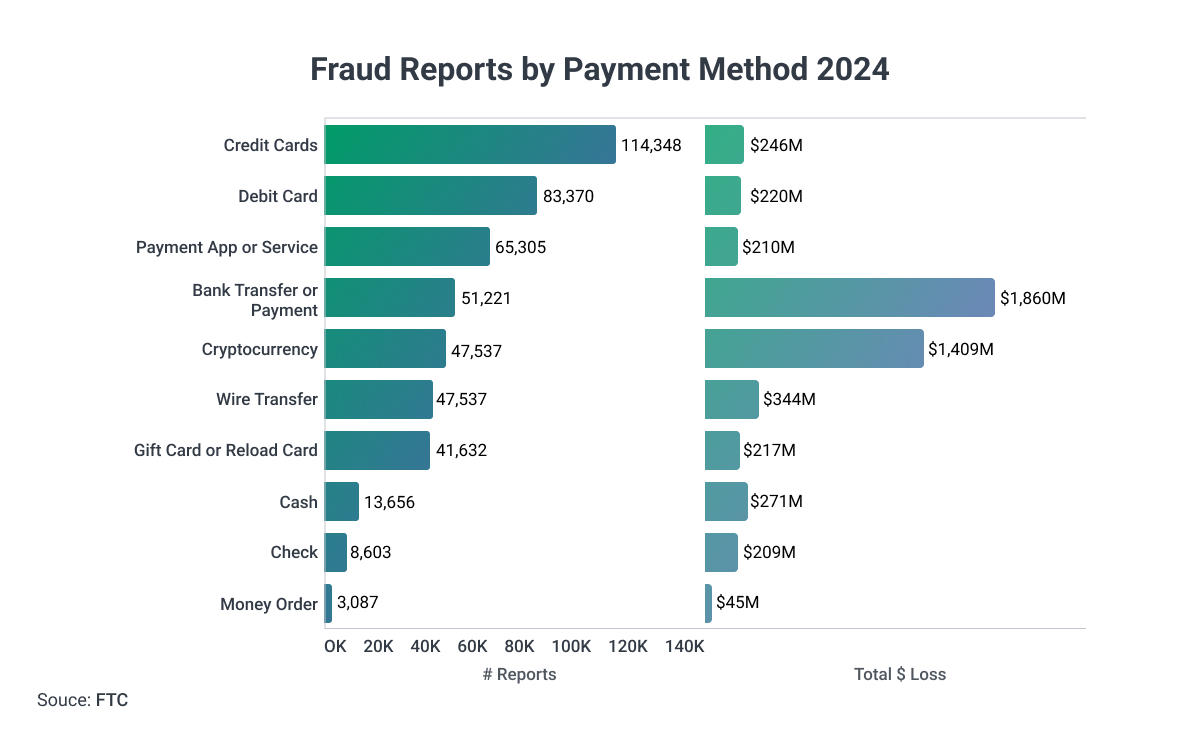

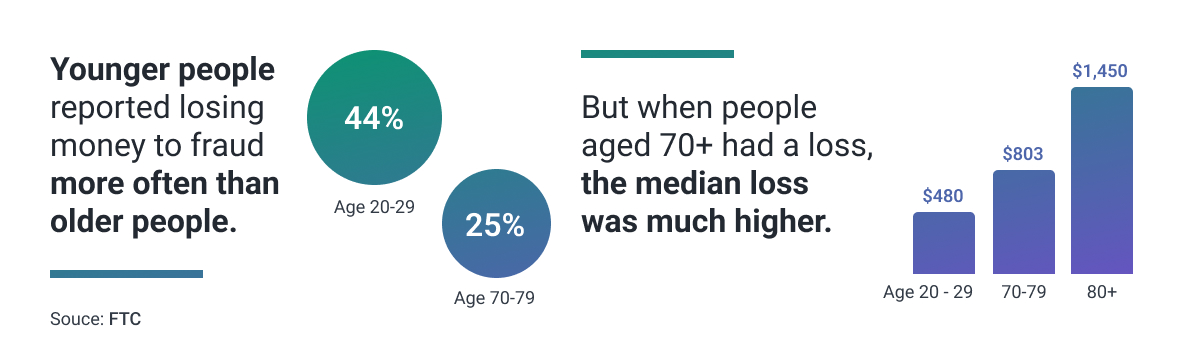

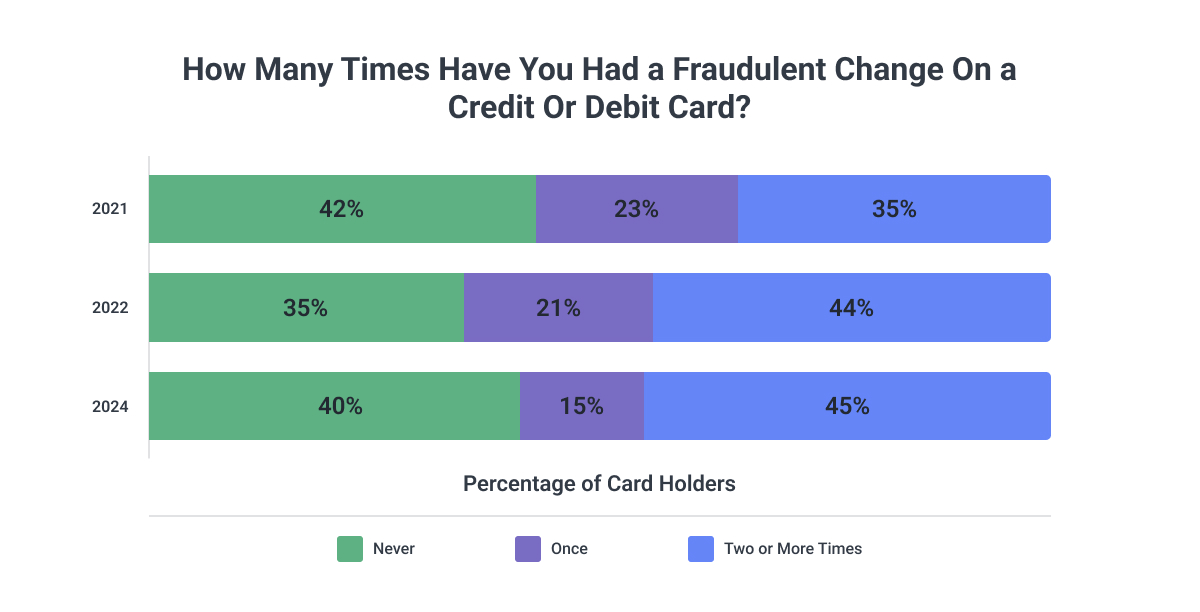

In the first half of 2024, credit cards were the leading payment method exploited by online scammers.1 The Federal Trade Commission reported over 552,000 cases of identity theft, marking a sharp rise from previous years and underscoring the growing prevalence of fraud.

With credit cards widely accepted and used for everything from everyday purchases to online subscriptions, non-cash transactions now dominate, with U.S. e-commerce sales reaching approximately $1.119 trillion in 2023—a 7.6% increase from 2022’s $1.040 trillion.

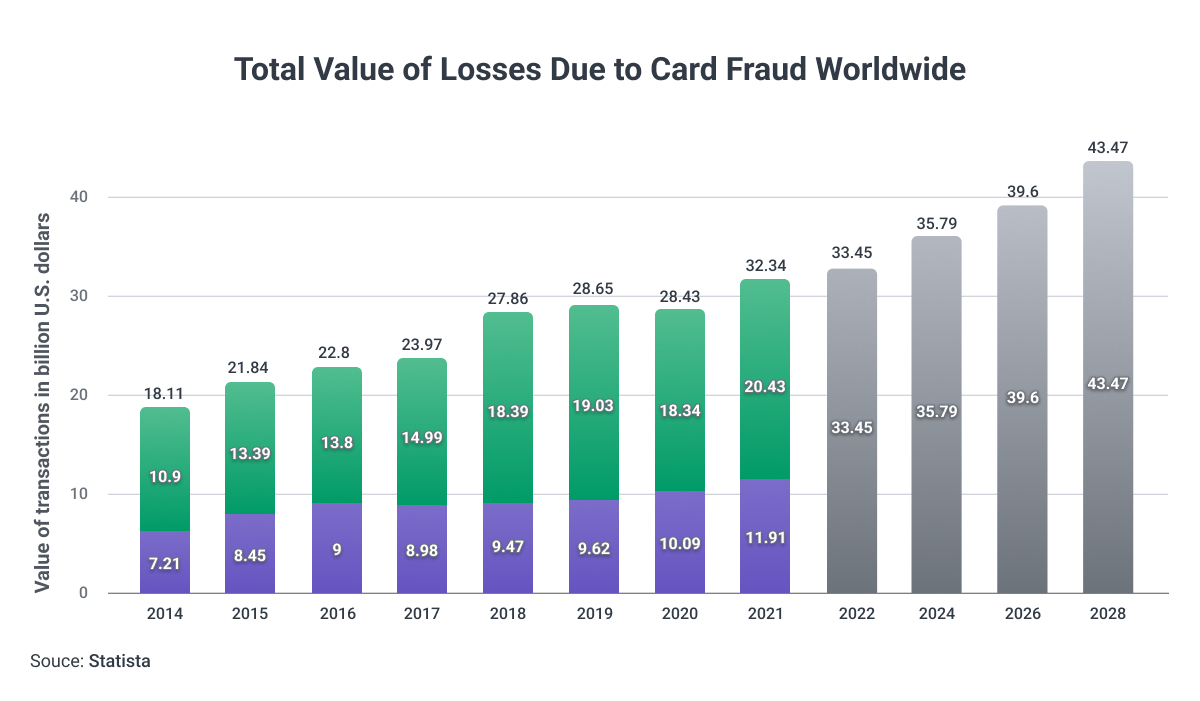

As more people move toward online payments, fraud has evolved into an increasingly significant threat. For banks and financial institutions, detecting fraud versus one-off errors has become a crucial challenge.

In fact, in 2023, nearly 60% of financial institutions reported losing over $500,000 to fraud, while a quarter lost more than $1 million. Furthermore, credit card fraud alone accounted for 40% of all identity theft reports, with cases involving unauthorized account openings on the rise.

With an increasing reliance on digital payments, businesses and consumers alike need stronger fraud prevention tools and awareness to navigate this high-risk landscape effectively.

In this article, we will share the approaches and tech solutions that banks, neobanks, and other financial institutions can use to both detect and prevent fraud.

With emerging technologies like machine learning (ML) and artificial intelligence (AI), it has become possible to successfully prevent fraud from happening and alert cardholders to act before fraudsters manage to remove a greater amount of money from their credit or debit cards.

What is Credit Card Fraud?

Credit card fraud, defined as the criminal use of another person’s credentials or credit standing, is one of the most pervasive types of financial fraud and identity theft today. In 2023, consumers reported losses exceeding $10 billion due to fraud, reflecting a 14% rise from the previous year. The Federal Trade Commission (FTC) received 416,582 reports of credit card fraud alone, making up 40% of all identity theft cases.

The predominant form of credit card fraud is new account fraud, where criminals use stolen personal data to open new accounts in the victim’s name. New account fraud makes up roughly 90% of all credit card fraud, although existing account fraud is on the rise.

Advances in card security, such as chip technology, have reduced the incidence of existing account fraud—fraudulent use of an active card. Yet, the threats of data breaches and identity theft continue to fuel new account fraud, which often goes unnoticed, leading to undetected accounts and hidden charges.

Credit card fraud typically falls into two categories: card-present fraud and card-not-present fraud:

- Card-Present Fraud

- This occurs when the physical card is used for unauthorized purchases, often through theft, robbery, or duplication. Criminals may also use card skimmers at ATMs or gas stations, capturing card data for duplication and illicit transactions.

- Card-Not-Present Fraud

- In these cases, criminals use the card details (number, name, CVV) without the physical card. Often, this is combined with account takeover techniques, where fraudsters impersonate the cardholder to update contact information with the issuer, allowing them to bypass authentication and approve purchases undetected.

Both types of fraud illustrate the critical need for enhanced security measures and vigilant monitoring to combat evolving threats in credit card fraud.

How to Detect Credit Card Fraud?

Credit card fraud detection is vital for ensuring financial security in the digital era. Its primary goal is to quickly identify unauthorized or suspicious activity to minimize losses and protect customers.

Banks, card issuers, and financial institutions are deploying a range of policies, tools, and strategies to combat identity fraud and halt fraudulent transactions effectively.

Since the adoption of EMV chip technology by Mastercard, Visa, and Europay in 2015, credit card fraud has shifted predominantly toward card-not-present fraud. The EMV microchip offers enhanced security compared to traditional magnetic strips, as it’s difficult for skimmers to extract data or create a cloned card. This shift has led fraudsters to focus on online and remote transactions, where the physical card is not required.

To counter this, financial institutions are increasingly using advanced technologies like artificial intelligence and machine learning to analyze vast amounts of data, detect user behavior patterns, and flag suspicious transactions in real time.

These solutions leverage data analytics, predictive modeling, and decision-making algorithms to create timely fraud alerts, allowing institutions to respond swiftly and warn cardholders about unusual activity.

Together, these innovations are transforming fraud detection, making digital transactions safer for consumers and businesses alike.

How to Prevent Fraud?

Tokenization

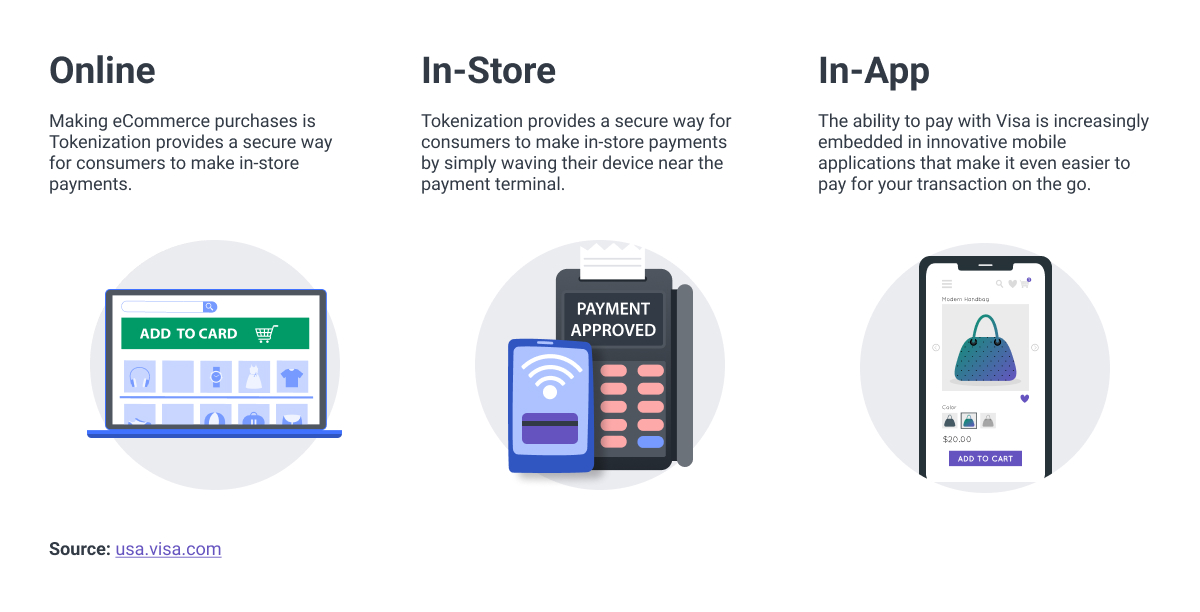

Preventing credit card fraud is a top priority for financial institutions, and a key strategy is devaluing sensitive information to make it less exploitable if compromised.

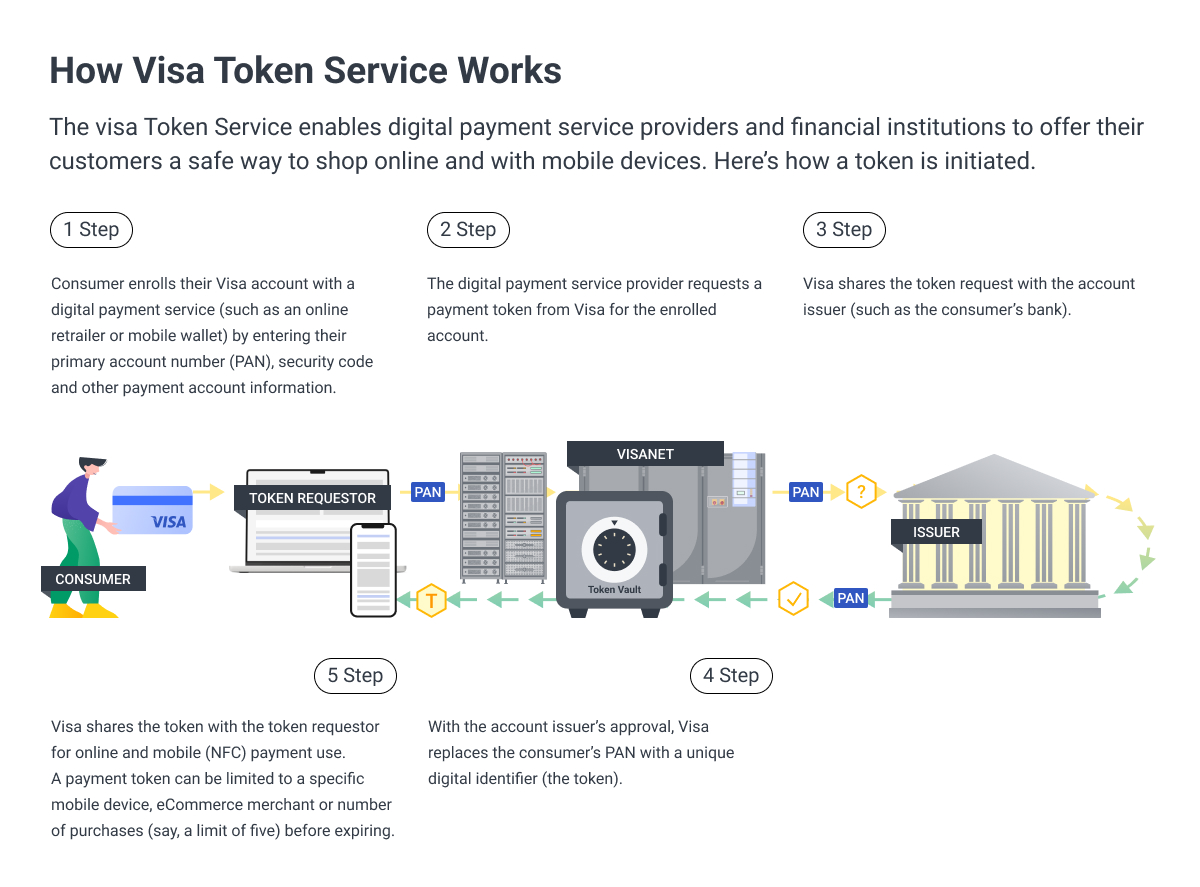

Tokenization is one of the most effective methods for this purpose. It involves replacing credit card numbers with randomly generated tokens that cannot be traced back to the original information. This means that during transactions, no actual credit card details are exposed, yet payment processors can still complete the transaction securely without revealing the consumer’s account number.

Here’s how tokenization works: when a consumer submits their payment information, such as the primary account number and security code, to a business, the business sends a request to the payment network to generate a unique token.

The network then sends this tokenized information to the bank, enabling the transaction to proceed safely. By using tokenization, businesses protect sensitive data and greatly reduce the risk of credit card fraud.

Rule-Based Systems

Another effective method for preventing fraud is employing rule-based systems that analyze patterns within vast amounts of transactional data to identify anomalies.

These rules help pinpoint when and why typical transaction patterns are disrupted, allowing financial institutions to catch and address suspicious activity swiftly.

The more data the system processes, the more accurate and efficient it becomes at detecting unusual behavior, ultimately enhancing fraud prevention efforts.

Encryption

Encryption protects sensitive information during transmission, ensuring that data is secure from interception or misuse. By encrypting cardholder details, financial institutions add a crucial layer of security throughout the transaction process, reducing the risk of data breaches.

Multi-Factor Authentication (MFA)

MFA requires multiple forms of verification, such as passwords, biometric data, or SMS codes, to access accounts. This added layer of security makes it significantly harder for unauthorized users to gain access, reducing the chances of fraud.

Behavioral Analytics

Using behavioral analytics powered by artificial intelligence, financial institutions can analyze a customer’s typical behavior and detect deviations. For instance, spending patterns that don’t align with a customer’s usual behavior can trigger alerts, allowing for early fraud detection.

Real-Time Fraud Detection with Machine Learning

Machine learning algorithms analyze large amounts of transactional data in real-time to identify patterns of potential fraud. As the system “learns” from new data, it improves its ability to accurately detect suspicious activities, preventing fraud before it occurs.

Geolocation Tracking and IP Address Monitoring

By monitoring the location and IP address of transactions, financial institutions can quickly detect unusual or distant transactions that deviate from the customer’s typical spending locations, helping to catch potential fraud early.

Device Fingerprinting

Device fingerprinting identifies specific devices associated with a customer’s account. If a transaction is attempted from an unrecognized device, additional verification steps are triggered, adding another layer of fraud prevention.

Step-Up Authentication

For cases where potential fraud is suspected, step-up authentication methods—like document verification, biometric checks, or live photo ID tests—are used to confirm the user’s identity. This prevents fraudulent transactions by ensuring that the account owner is the one authorizing the payment.

The Biggest Fraud Challenges for Institutions

Financial institutions are intensifying efforts to detect and prevent attempted fraud, particularly as online transactions become the primary target for fraudsters. Given the rapid shift to digital payments, fraud prevention and detection must go hand-in-hand, with both processes aiming to reduce fraudulent activity as much as possible using advanced technologies and methodologies.

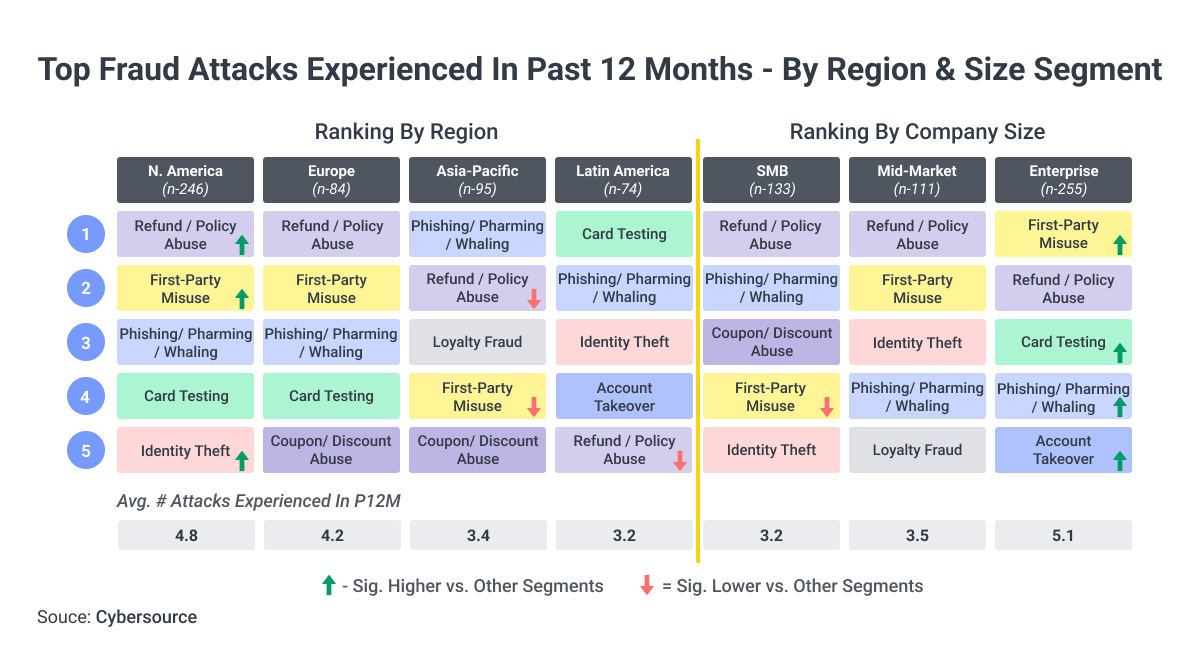

With most transactions now happening online, fraudsters have evolved their tactics to exploit digital vulnerabilities, necessitating a more comprehensive approach to fraud categorization. Financial institutions and networks generally categorize fraudulent behavior into four main types:

-

E-commerce and Remote Payments Fraud

This type of fraud includes unauthorized transactions where the cardholder is not present, making it common in online shopping. With the growth of digital payments, e-commerce fraud has surged, often involving techniques like card-not-present (CNP) fraud, phishing, and credential stuffing. Preventing this type of fraud is particularly challenging because it doesn’t require physical access to the card, relying instead on compromised card details. -

Counterfeit Fraud

Counterfeit fraud occurs when fraudsters create a duplicate version of a legitimate card, often using data stolen from skimming devices. Although EMV chip technology has significantly reduced counterfeit fraud in regions that have adopted it, some fraudsters continue to exploit magnetic stripe data in regions or networks where chip technology isn’t mandatory. This type of fraud underscores the need for ongoing security upgrades in payment systems worldwide. -

Lost and Stolen Cards

This form of fraud involves unauthorized transactions made with a lost or stolen card. Although cardholders are encouraged to report lost or stolen cards immediately, some transactions may still slip through before the card is blocked. This type of fraud highlights the need for fast-acting fraud detection tools, such as geolocation tracking and step-up authentication, which can help prevent unauthorized use of a card once it’s been reported missing. -

Account Takeovers and Other Types of Fraud

Account takeover fraud occurs when a fraudster gains control of a customer’s account, often by stealing login credentials through phishing, social engineering, or data breaches. Once inside, they can make unauthorized purchases, transfer funds, or change account details to avoid detection.

Other types of fraud in this category may include synthetic identity fraud (where fraudsters create fake identities) and friendly fraud (where legitimate cardholders claim unauthorized transactions for personal gain). Account takeovers are challenging to prevent because they often involve sophisticated social engineering tactics.

Challenges in Detecting and Preventing Fraud

Despite advancements in technology, several challenges persist in combating fraud effectively:

- Balancing Security and User Experience: While strict security measures can prevent fraud, they may also hinder the user experience. Excessive security prompts or authentication steps can frustrate legitimate users, leading to customer dissatisfaction and even attrition.

- Keeping Up with Evolving Tactics: Fraudsters constantly adapt to new security measures, finding ways around even the most advanced defenses. Financial institutions need to stay ahead by continuously updating their systems, which requires significant time, resources, and investment in innovation.

- Managing False Positives: Fraud detection systems must balance accuracy with sensitivity. Overly strict systems can flag legitimate transactions as fraudulent, leading to “false positives.” These instances not only inconvenience customers but also create additional work for customer support teams.

- Data Privacy and Security Regulations: Adhering to data privacy regulations (such as GDPR or CCPA) while managing sensitive information for fraud prevention adds complexity. Institutions must ensure that their fraud detection processes are compliant, which can limit data sharing or use of customer information in fraud detection.

- Complexity of Cross-Border Transactions: Cross-border transactions present unique challenges, as they are often more difficult to authenticate due to differences in regulations, payment standards, and currency. These transactions can also attract fraudsters, given the complexities involved.

- Real-Time Detection Needs: Today’s fraud landscape requires real-time detection to prevent losses from rapidly occurring online transactions. Implementing real-time analysis on high transaction volumes is technically challenging and requires sophisticated machine learning and AI tools.

Addressing these challenges requires a holistic, multi-layered approach to fraud prevention that includes advanced technology, regulatory compliance, and a deep understanding of fraud patterns.

Tools for Fraud Prevention and Detection

Technologies and strategies for combating fraud are crafted to address all four primary types of fraud. To combat fraud, 3 out of 4 banks and fintechs are planning to invest in an Identity Risk Solution in the next 12 months. Below are some of the most common and advanced tools used to fight credit card fraud.

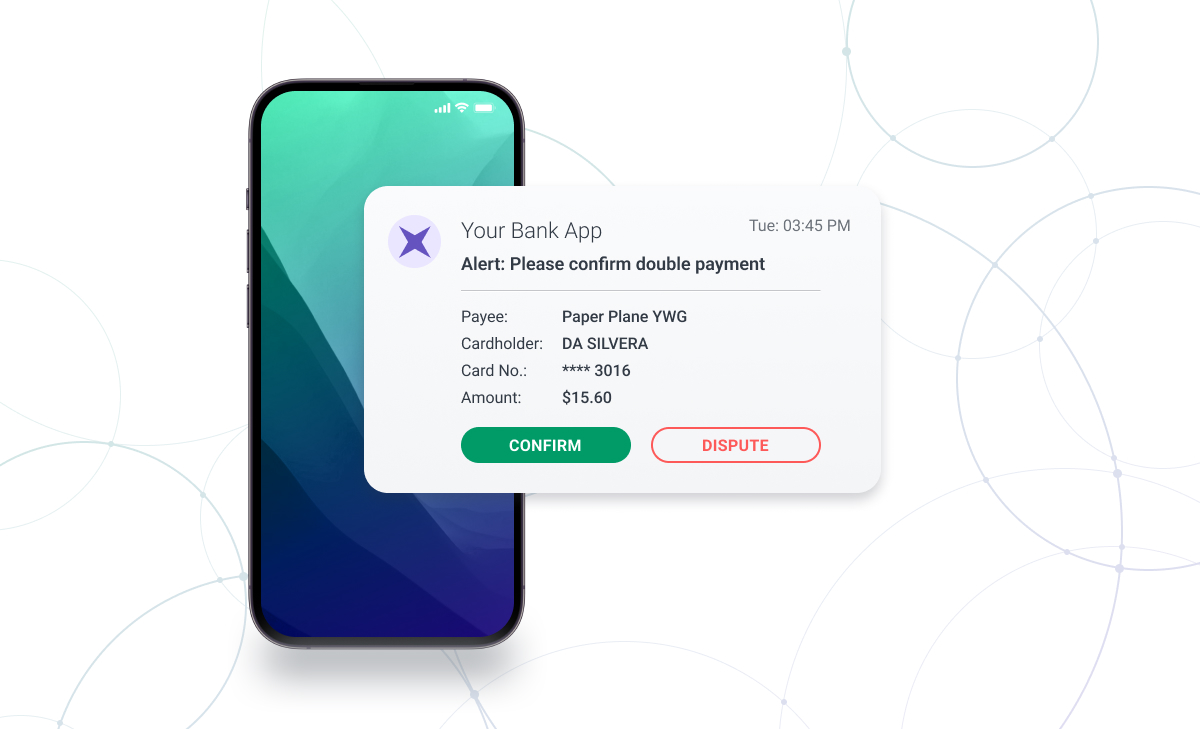

Consumer Transaction Alerts

Consumer transaction alerts play a crucial role in stopping fraudulent activities before they affect the cardholder. These alerts are typically sent via SMS, email, or banking apps, and they notify the cardholder each time a transaction occurs. Alerts can be customized based on user preferences, such as only sending notifications for high-value transactions, ensuring that consumers are immediately informed of any suspicious activity.

- SMS Text Alerts: Banks like BNY Mellon have enabled SMS alerts for account events, such as profile updates and transactions. This tool not only helps to identify fraud in real-time but also gives consumers confidence in monitoring their own accounts.

Call Center-Based Multi-Factor Authentication (MFA)

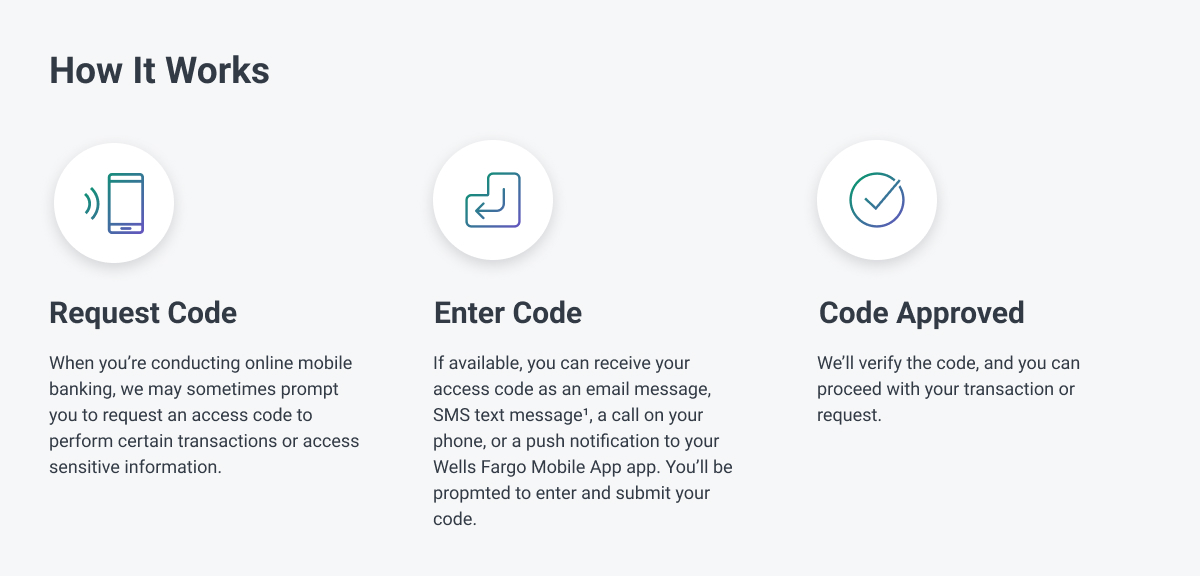

To enhance security in phone-based transactions, call centers are adopting MFA techniques. Agents can issue a temporary token to the caller’s mobile device and ask for verification during the call. This real-time authentication step provides added security for fraud-sensitive transactions, ensuring that the caller is the legitimate account holder.

Dynamic Passcodes

Dynamic passcodes provide an additional layer of security by generating a one-time code for each transaction. Sent via SMS, email, or the banking app, this code verifies the cardholder’s identity and meets the requirements of the PSD2 Directive. Dynamic codes are particularly effective for preventing online fraud, as they ensure the transaction is authorized by the cardholder.

Real-Time Data Enrichment Tools

Data enrichment tools enhance existing KYC data by pulling additional information from open-source databases, digital services, and social networks. This enriched data allows banks to gain a comprehensive view of the customer, enabling them to flag potential risks, identify high-value clients, and assess transaction risk levels more accurately.

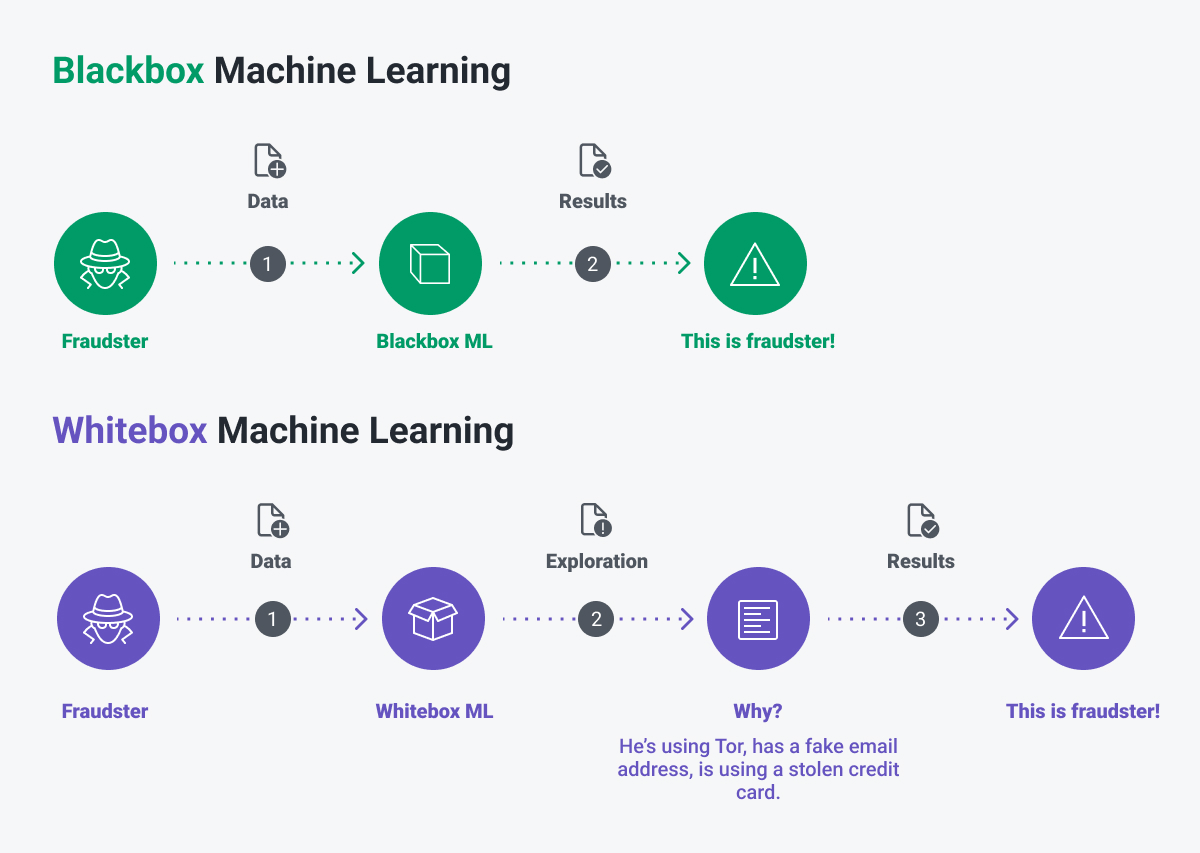

Machine Learning (ML) for Fraud Detection

ML is essential in modern fraud prevention, as it can analyze vast amounts of data to detect patterns and identify anomalies. By learning user behaviors, ML systems can quickly flag unusual activity, such as transactions from new locations or abnormal purchase times. Additionally, ML models like black box systems are popular for generating real-time fraud risk scores, leveraging technologies like deep learning and neural networks.

- Black Box vs. White Box Machine Learning: Black box ML models (the predominant type post-2021) are highly effective for fraud detection as they utilize complex algorithms and big data to recognize fraud patterns. White box models are less common but offer transparency, allowing users to understand how fraud predictions are made—useful in highly regulated environments.

Know Your Customer (KYC) Protocols

KYC remains foundational for identity verification, helping financial institutions meet compliance standards and prevent fraud. This process includes multiple verification steps, such as ID checks, biometric scans, and document verification, ensuring that customers are who they claim to be. In India, for example, banks use e-KYC, which leverages government-verified applications to streamline and secure identity verification.

Geolocation and IP Monitoring

These tools track the location and IP address associated with each transaction, allowing banks to identify potentially suspicious activities. For example, if a transaction is initiated from a different country than usual, the system can flag it and initiate additional security checks, helping to prevent unauthorized activity.

Behavioral Biometrics

Behavioral biometrics analyzes unique user behaviors, such as typing speed, device orientation, and even how a person swipes or taps on their mobile device. By monitoring these behaviors, financial institutions can add an extra layer of fraud prevention, identifying when someone other than the account holder is trying to gain access.

Challenges in Implementing Fraud Detection Tools

Even with these advanced tools, financial institutions face challenges in effectively implementing fraud prevention strategies:

- Balancing Usability and Security: Too many security steps can frustrate legitimate users, potentially leading to a poor user experience or even customer loss.

- False Positives: Sophisticated systems can sometimes flag legitimate transactions as fraudulent, resulting in customer inconvenience and increased call center volumes.

- Data Privacy and Compliance: Data enrichment and behavioral analysis tools require access to sensitive information, which must be managed carefully to comply with privacy laws.

These fraud detection and prevention tools, while powerful, must be continuously refined to keep up with evolving fraud tactics and ensure a seamless experience for customers. Financial institutions adopting a layered approach to security are better positioned to protect themselves and their clients from increasingly sophisticated fraud threats.

New Technologies for Fraud Detection

Voice Biometrics

Many financial institutions have introduced biometrics and artificial intelligence (AI) to passively authenticate callers based on their voiceprint. The technology compares a caller’s voice characteristics—vocal range, talking speed, speech patterns, and so on—against a verified, previously enrolled voice sample.

In addition to the audio voiceprint, a conversation print process transcribes the contents of the call and compares it to callers’ typical vocabulary and syntax. Additionally, behavioral checks review the data collected on the caller’s device, geographic location, and more.

Voice biometrics can help identify fraudsters, as well as flag calls potentially made under duress. Most importantly, it automates the most annoying part of the authentication processes for shareholders, letting them access their accounts faster without wading through questions about zip codes, maiden names, or account numbers.

Enhanced Knowledge-Based Authentication (KBA)

Another new solution for fighting credit card fraud is knowledge-based authentication technology, which validates cardholder identities against outside sources. Examples of personal information used in KBA are a person’s social security number, date of birth, phone number, address, employment history, and so on.

This technology incorporates third-party data and tools from different providers and gives access to data on 400 million people from over 10,000 sources. It checks to see whether personal information like phone numbers, addresses, and other data provided by a caller appear in association with the same individual in other records. It can also combine data from multiple sources to create extremely hard-to-guess challenge questions.

Adaptive Authentication

Financial Institutions, such as BNY Mellon, have introduced AI fraud risk scoring capability, which pulls together analytics from multiple channels to provide clear guidance to agents during a call.

Anomalies such as unusual device attributes, excessive numbers of transactions, or failed voiceprints will be combined into a single risk score. A high score can trigger stepped-up authentication, a transfer to a fraud analyst, or even a failed transaction.

The risk engine is designed to make agents’ jobs easier by simplifying a wealth of data into a single real-time metric, helping to stop fraud before it happens.

Tech to Prevent Counterfeit Fraud When Using a Credit Card

Address Verification Service or AVS

Address Verification Service (AVS) is one of the most widely used fraud prevention tools in card-not-present (CNP) transactions. An AVS check compares the billing address used in the transaction with the issuing bank’s address information for the cardholder. It is a common sense check since the majority of purchases go to a customer’s address.

Geolocation

Visa pioneered geolocation technology for card transactions in 2015. Essentially, it matches a cardholder’s mobile phone location with the location of a transaction. Geolocation offers one more data point when accepting or declining a transaction and may work in conjunction with other tools.

For example, the consumer may be sent a unique passcode on her mobile to confirm that she is the one initiating the transaction. Presently, Visa has combined many of its security solutions into a suite of tools called Visa 3-D Secure 2.0, which holds the promise of stronger defenses against fraud by increasing the amount and type of data used in verifying transactions.

Account Takeover Tools

There has been a great emergence of tools to detect account takeover including biometric authentication to confirm identities, activity analytics that compares current online behavior with past established patterns, and general card verification. Card Verification Methods (called card verification value [CVV] or card verification code [CVC] for some card brands and card identification [CID] for others) are typically required in CNP transactions, where a PIN cannot be used.

Most debit or credit cards carry a three- or four-digit code, which the cardholder must enter to complete many transactions. This code is printed only on the card, and CVV/CVC verifies that the person making the transaction is in possession of the card.

Final Word

By digitizing fraud prevention capabilities using AI and other advanced technologies, banks and financial institutions can speed up their response to fraud—and in turn, help cardholders feel more comfortable making payments online and in-person.

Taking steps to protect users and their accounts means using the available anti-fraud tools and discovering new techniques and technologies to improve fraud-prevention and detection processes.

We understand the payments industry well, and our consultants can support you in enhancing your fraud prevention, detection, and payment processes for credit, debit, prepaid cards, and more. We can provide you with the anti-fraud solutions your cardholders will appreciate, helping your company comply with regulations.

Don't let payment fraud hinder your business growth! Leverage Softjourn's financial development expertise to secure your transactions and safeguard your customers' data. Contact us today to start implementing cutting-edge solutions tailored to your needs.

FAQ

What Are the Most Effective Ways to Prevent Fraud?

Preventing fraud involves a multi-layered approach:

Tokenization: Replaces sensitive card data with a unique token, protecting it during transactions.

Encryption: Secures cardholder data by encoding it, making it unusable if intercepted.

Multi-Factor Authentication (MFA): Adds extra verification steps for account access.

Behavioral Analytics and Machine Learning: Identifies anomalies in spending behavior for real-time fraud prevention.

What Are Some of the Latest Technologies for Fraud Detection?

Technologies like voice biometrics, enhanced knowledge-based authentication (KBA), and adaptive authentication are gaining traction. These tools increase security by using AI and advanced analytics to verify identities and flag risky transactions.

What Are the Biggest Fraud Challenges for Financial Institutions?

Key challenges include balancing security with user experience, managing evolving fraud tactics, dealing with false positives, adhering to data privacy regulations, and ensuring real-time detection across high transaction volumes.

What Tools Are Available for Fraud Prevention and Detection?

Institutions use a range of tools such as consumer transaction alerts, dynamic passcodes, KYC protocols, real-time data enrichment, and behavioral biometrics. These tools create a secure environment and reduce the chances of fraud.

How Do Real-Time Fraud Detection Systems Work?

Real-time systems use machine learning to monitor transactions and identify potential fraud based on patterns and behavioral data. These systems improve over time by learning from each new data point, allowing for swift response to suspicious activity.

How Does Geolocation Help Prevent Fraud?

Geolocation technology checks the cardholder's location against the transaction location. If the locations don’t match, additional verification may be required to ensure the transaction is legitimate.

What Are the Challenges of Implementing Fraud Detection Tools?

Implementing these tools requires balancing security with usability, managing false positives, ensuring data privacy compliance, and adapting to evolving fraud tactics. Institutions also face challenges with real-time detection for high transaction volumes.

How Can Financial Institutions Prevent Counterfeit Fraud?

Counterfeit fraud can be minimized with Address Verification Services (AVS), geolocation, account takeover tools, and other technologies that verify both card details and cardholder identity.

How Does Softjourn Support Fraud Prevention?

Softjourn provides expertise in implementing advanced fraud prevention and detection technologies tailored to financial institutions. Our solutions help protect sensitive data, enhance transaction security, and meet regulatory compliance needs.