The rise of the gig economy has revolutionized the way we work, providing millions of people with opportunities for flexible employment and supplemental income.

According to Statista, nearly 80 million Americans were gig workers in 2024, and this number is projected to surpass 86 million by 2027, comprising more than half of the U.S. workforce.

While the gig economy offers flexibility, autonomy, and freedom, it also presents unique financial challenges that traditional financial institutions have struggled to address.

Fintech companies are stepping in to fill this gap, offering innovative solutions designed to meet the specific needs of gig workers. From alternative credit models to personalized banking tools, fintech is shaping the future of financial services for this growing workforce.

Understanding the Gig Economy

The gig economy refers to a labor market dominated by freelance work, short-term contracts, and independent contractors instead of full-time employees.

It covers a broad spectrum of jobs, ranging from high-paying roles like consultants and attorneys to more common roles such as ride-share drivers, delivery workers, and freelance designers.

While the flexibility of gig work appeals to many, there are substantial financial risks involved, including inconsistent income, lack of access to traditional financial services, and complicated tax obligations.

Addressing these challenges is where fintech companies are stepping up, offering gig workers new opportunities to achieve financial security.

The Financial Challenges Facing Gig Workers

- Irregular Income and Financial Instability

Gig workers typically do not have the predictable, steady income that comes with traditional employment. This irregular cash flow can make budgeting difficult, leading to financial instability and limited access to credit or loans from traditional banks. Many gig workers live paycheck to paycheck, making it hard to build savings or plan for the future. - Limited Access to Financial Services

Traditional financial institutions often view gig workers as high-risk customers because of their irregular income and lack of a stable employment history. This makes it difficult for gig workers to access loans, mortgages, or even basic financial services like credit cards. Without a steady paycheck, they are often denied essential financial products that salaried employees can easily obtain. - High Taxes and Complex Financial Management

Gig workers are responsible for managing their own taxes, which can be more complicated than the tax filing process for traditional employees. Many freelancers need to track multiple income streams, estimate quarterly taxes, and navigate complex self-employment tax rules. Without proper financial tools, managing taxes can become overwhelming and costly. - Lack of Benefits

Unlike full-time employees, gig workers do not typically have access to employer-provided benefits like health insurance, retirement plans, or paid leave. They are forced to cover these expenses out of pocket, adding to their financial burden.

Fintech’s Role in Solving Gig Workers’ Challenges

Fintech companies are uniquely positioned to address the financial challenges faced by gig workers by offering more flexible, accessible, and tailored solutions that meet their specific needs.

1. Alternative Credit Assessment Models

One of the primary challenges gig workers face is obtaining loans or credit due to their irregular income. Fintech companies are addressing this by developing alternative credit assessment models that use non-traditional data, such as:

- Payment histories from gig platforms (e.g., Uber, Upwork, DoorDash)

- Social media presence

- Telecommunications data

- Rental and utility payments

These alternative data points provide a more comprehensive picture of a gig worker’s financial health, allowing fintech companies to assess creditworthiness more accurately.

For example, Tala and KarmaLife have developed credit systems that assess credit risk using gig workers’ transactional histories and platform data, enabling them to access lines of credit that would otherwise be unavailable through traditional financial institutions.

2. Income Smoothing and Cash Flow Management

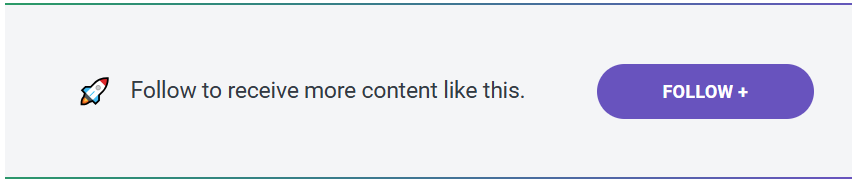

Managing irregular income is a top concern for gig workers, and fintechs have developed various solutions to help with cash flow management.

For example, Earned Wage Access (EWA) platforms allow gig workers to access a portion of their earned wages before payday, reducing the financial strain between pay periods.

Additionally, budgeting apps and tools that automatically reconcile transactions from multiple platforms can help gig workers manage their irregular income streams more effectively. Solutions offer integrated tools for invoicing, expense tracking, and tax planning, helping gig workers maintain control over their finances.

3. Digital Banking and Financial Management Tools

To meet the banking needs of gig workers, fintech companies are offering specialized digital banking solutions. These include business checking accounts with features tailored to freelancers, such as automated tax filing, invoicing, and expense management. Fintech platforms that offer banking services designed specifically for freelancers, include features like automatic expense categorization, tax withholding, and real-time financial reporting.

Some platforms even provide access to financial services for underbanked gig workers, offering microloans, savings accounts, and payment processing services through a digital interface.

4. Insurance and Benefits Solutions

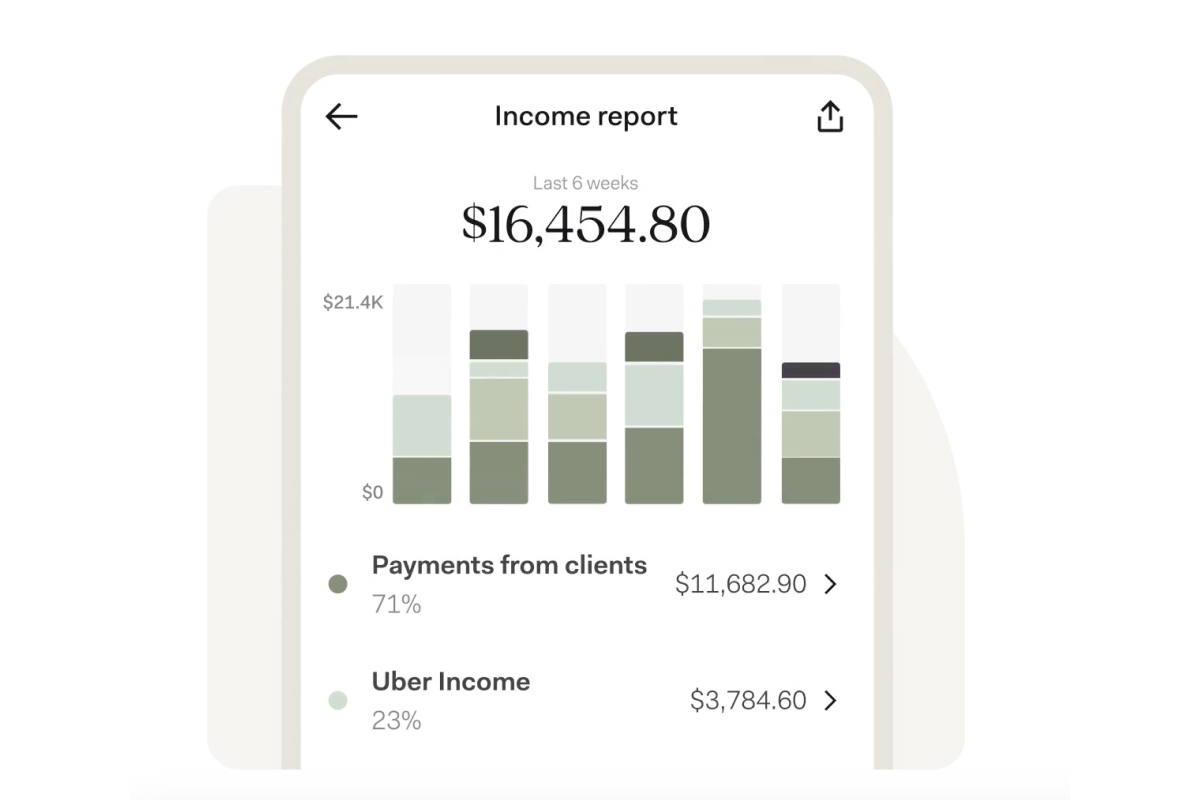

Access to affordable insurance is one of the biggest challenges facing gig workers, particularly in regions where employer-provided health insurance is the norm. In response, fintech companies are offering micro-insurance products that are tailored to the needs of gig workers.

Fintechs are also helping gig workers access retirement savings solutions. Platforms like PensionBee in the UK offer personalized pension plans designed for freelancers, allowing them to save for retirement at their own pace without the need for employer contributions.

5. Tax Optimization and Filing Assistance

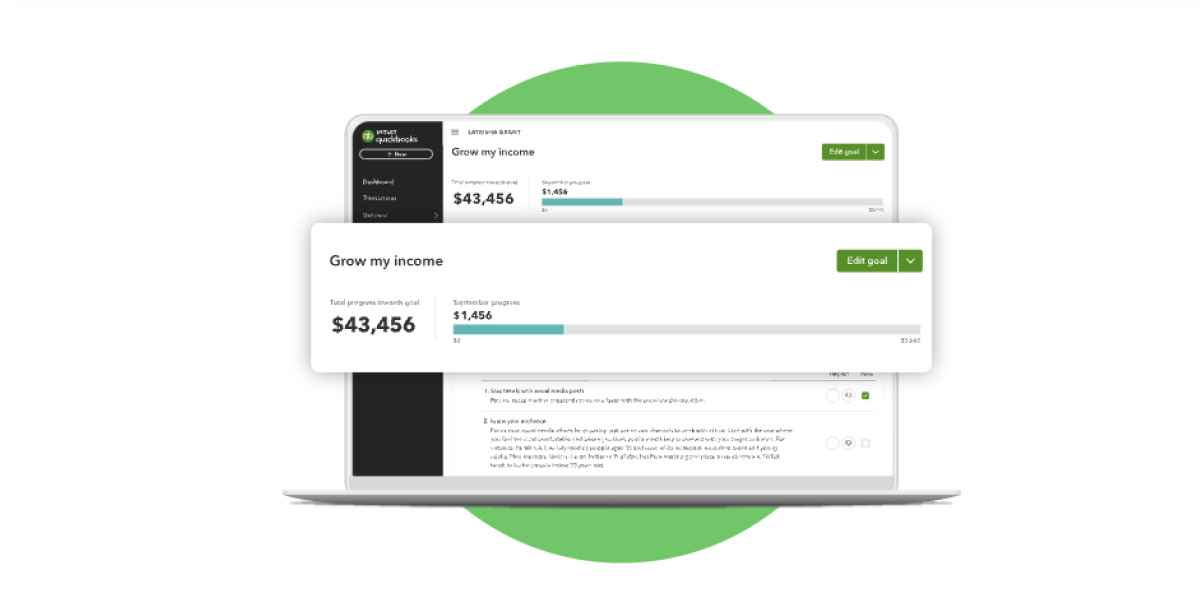

Handling taxes is another significant pain point for gig workers, and fintech companies are developing tools to make this process simpler. Platforms like QuickBooks Self-Employed offer features that allow freelancers to automatically track income, estimate taxes, and prepare for quarterly tax filings.

Other solutions, such as Keeper Tax, specialize in identifying potential tax deductions for gig workers by analyzing their financial transactions.

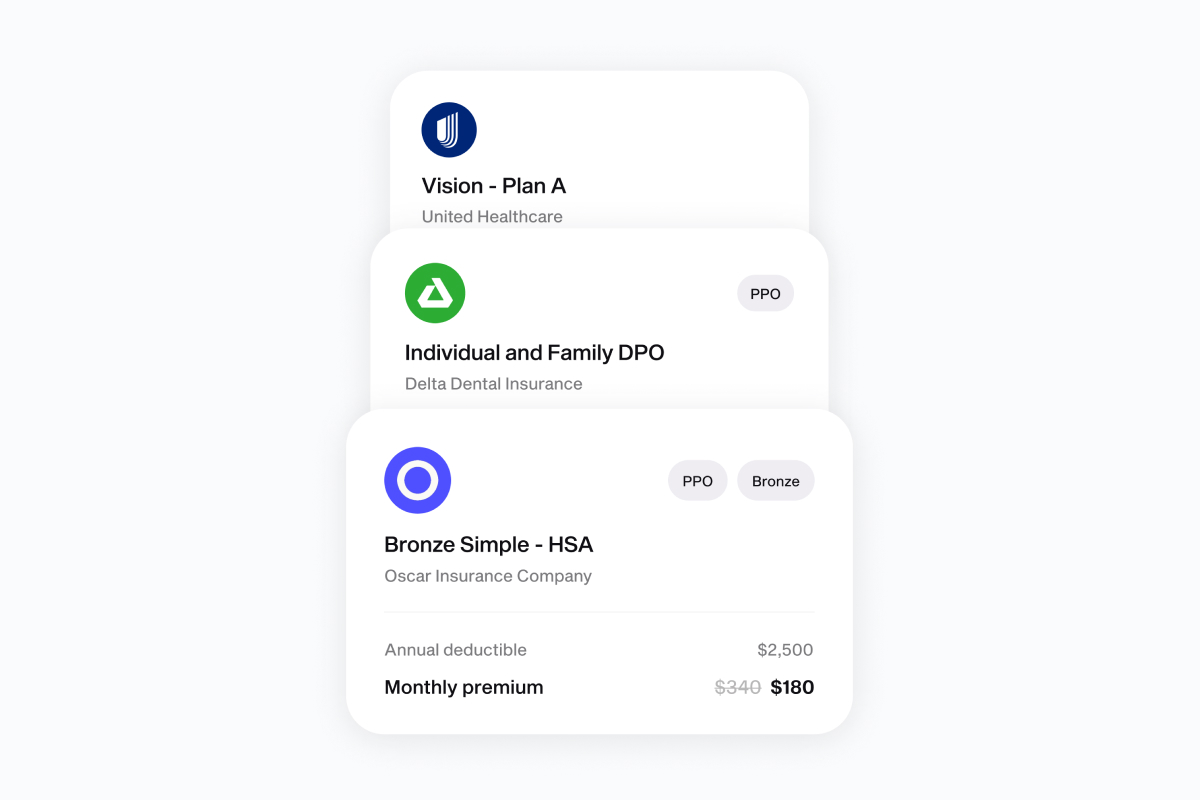

6. Open Banking and Financial Aggregation

Open banking initiatives are transforming the financial landscape by allowing fintechs to aggregate financial data from multiple accounts and services into a single platform. This is particularly useful for gig workers who often have income streams from multiple sources.

By consolidating financial data, fintech platforms can provide gig workers with a clearer picture of their overall financial health, helping them make more informed decisions about budgeting, saving, and investing.

In the UK and EU, open banking is already making it easier for gig workers to access financial products like mortgages, loans, and insurance by providing a more holistic view of their income and spending habits.

Notable Fintech Companies Leading the Way

Fintech startups and established companies alike are developing solutions to address these pain points and empower gig workers to take control of their financial lives:

- Affordable benefits: Companies such as Stride Health and Catch are making healthcare and retirement benefits more accessible and affordable for independent workers.

- Tax automation: Services like Keeper Tax and QuickBooks Self-Employed simplify tax prep for gig workers by automatically tracking income and expenses, estimating quarterly taxes, and more.

- Alternative credit scoring: Fintechs like Portify and Argyle are leveraging data points like payment history and reviews on work platforms (e.g. Uber, TaskRabbit) to help assess the creditworthiness of gig workers.

- Instant lines of credit: KarmaLife offers gig workers instant lines of credit through a mobile app, providing liquidity and financial support with minimal paperwork. They are also exploring micro-insurance solutions.

- Earned wage access: Paymenow allows gig workers to access a portion of their earned wages before payday, enhancing financial flexibility and reducing reliance on payday loans.

- Micro-insurance: The fintech, Turaco provides affordable health and life insurance to gig workers, offering coverage with premiums as low as $2 per month.

- Business banking: Found, a U.S.-based platform, offers gig workers business checking accounts integrated with invoicing, tax management, and bookkeeping features to simplify financial management.

- Income smoothing: Apps like Even and Steady help freelancers automatically save a portion of their income during high-earning periods to cover expenses during leaner times.

Conclusion

The gig economy is here to stay, and as it continues to grow, so does the need for financial services tailored to the unique challenges gig workers face.

Traditional financial institutions have struggled to serve this demographic, but fintech companies are stepping in with innovative solutions that promote financial inclusion, stability, and empowerment.

From alternative credit assessments to income smoothing tools, fintech is revolutionizing the way gig workers manage their finances. Fintech companies are not only filling the gaps left by traditional banks but are also paving the way for a more inclusive and equitable financial system for the growing gig workforce.

Want to create a breakthrough fintech product to support gig economy workers? Partner with Softjourn to develop innovative solutions and bring your vision to life. Contact us today to get started!