Web 3.0 is a buzzword that is often associated with blockchain and NFT technology. Web 3.0 may have the power to create new business models and opportunities for companies in the fintech industry. However, to properly implement this technology, we must separate hype from fact, and understand how Web 3.0 can be best utilized.

While the volatility of cryptocurrency and NFTs may grab headlines, there are more significant developments in the world of Web 3.0 and fintech. The pandemic has caused a shift toward online banking, further boosting the already popular mobile fintech sector.

With an estimated $179 billion in revenue expected in 2022, there is intense competition among the over 25,000 fintech startups to get a piece of the pie.1 Implementing innovative technology, like Web 3.0 might be the key to setting your fintech apart from the thousands of others and attracting unbanked populations.

The Basics of Web 3.0

At its most simple, Web 3.0 is the latest iteration of the web that is decentralized and based on interconnected networks, like public blockchains, cryptocurrencies, and NFTs to transfer power back to users. This will allow people to transfer data, money, and value to each other directly.

The growing range of applications in financial services is indicative of the value that Web 3.0 can generate. Before the recent market downturn, more than $250 billion was actively put to use in smart contracts, yielding autonomous returns for its depositors.2

One of the most prominent assets of Web 3.0 is non-fungible tokens (NFTs), which have managed to make a significant impact on several industries in a short time period. In fact, the NFT market surpassed US $40 billion in 2021.3

Other core components of Web 3.0 include:

Decentralization – Rather than an internet controlled and owned by centralized entities, ownership gets distributed amongst its builders and users.

Permissionless – With Web 3.0 access should never be an issue since the public would have equal access to participate.

Native payments – Web 3.0 uses cryptocurrency for spending and sending money online instead of relying on banks and payment processors.

Trustless – Web 3.0 will use incentives and economic mechanisms and not rely on third parties for development or investments.

Web 3.0 in Fintech: Decentralized Finance (DeFi)

A powerful Web 3.0 disruptor is decentralized finance, or DeFi – an umbrella term for financial services powered by blockchain infrastructure. With DeFi, consumers can do most of the things that banks normally support, like earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more. The biggest difference is that no third party would be involved and paperwork would become a thing of the past.

DeFi's potential for growth was contingent on a solution to the oracle problem - the inability of blockchains to access external data needed for complex applications. With the launch of oracle networks like Chainlink, which aggregates and feeds financial data from real-world sources onto blockchains, DeFi finally has the means to expand.

Once blockchain developers have access to data through oracle networks, they can build new DeFi applications, driving adoption. Newer blockchains like Avalanche have also seen an increase in adoption after implementing oracle networks.

A major dynamic driving the rise of DeFi is young people at the beginning of their financial journeys, in exploring non-traditional financial offerings. In 2021, 51% of Gen Z and 49% of Millennials identified a fintech, rather than a bank, as their most-trusted financial brand.1

An additional driver for the growth of Web 3.0 is a desire for more transparent, fairer relationships between individuals and platforms, where users would have ownership of their data, content, and finances.

DeFi allows depositors to earn interest on their funds without entrusting them to a bank or unregulated platform. Instead, depositors hold their funds in a non-custodial wallet on the blockchain. Smart contracts escrow these funds and only disburse them when pre-established conditions are met. Borrowers can only receive funds from the smart contract after posting collateral.

DeFi has been gaining popularity due to its reduction of human error through smart contracts, access to markets at any time, and elimination of intermediaries. DeFi turns money into a programmable and interoperable protocol, similar to how earlier versions of the web digitized information and content.

The DeFi Market

DeFi is increasingly positioned for rapid growth. While it is a relatively recent trend, the amount of value locked up in DeFi protocols has grown to more than $200 billion, with trading volumes reaching almost $100 billion per month.4

Venture capital firms are increasingly interested in DeFi, as the past few months have seen a rise in DeFi unicorns such as Anchorage (asset custody and governance), Fireblocks (embeddable APIs for token storage and digital asset operations), and Lukka (back-office platform for DeFi auditing).5

The DeFi ecosystem itself is rapidly expanding both in terms of diversification of blockchain infrastructures as well as the emergence of new layers similar to features of centralized finance, such as payments, marketplaces, and lending.

For the latter, more than $200 billion in loans was disbursed last year from the largest Web 3.0 lending platforms. Cumulative bad debt is currently roughly $1 million, despite significant volatility.2

While deposits and loans were some of the first fintech use cases for DeFi, other avenues have emerged, such as swaps, compliance, and P2P lending. In 2022 and beyond, DeFi and fintech will continue to converge even more, creating more innovation and competition in the banking sphere.

Benefits of DeFi

DeFi has the potential to be a major disruptor in the banking and fintech industries. Even during market turmoil, Web 3.0 lending platforms have continued to operate, with no deposits lost or frozen, and withdrawals continuing to occur.2 Some of the greatest advantages of DeFi are that:

- Eliminates the fees that banks and other financial companies charge for using their services.

- Users’ money is held in a secure digital wallet instead of a bank.

- Anyone with an internet connection can use DeFi without requesting approval.

- Transfers take minutes or even seconds.

- Leveraging blockchain infrastructure, it can offer open, decentralized database and compute layers.

- Credit scoring, identity verification, fraud prevention, and other financial functions will be reconfigured, resulting in multiple benefits for consumers.

- The ability for individuals and businesses to transact with entities across the globe––free from interference by central parties.

- Banks can benefit highly from these technologies for payments, clearance and settlement systems, fundraising, securities, loans and credit, trade finance, customer KYC, and fraud prevention.

- The potential for pricing-power compression (i.e. lower fees) due to the open-source nature of the protocols and automation.

- Credit risk is minimized because of over-collateralization requirements and automatic liquidations.

Challenges of DeFi

DeFi can offer solutions to challenging features of traditional finance such as counterparty risk, high transaction fees, long settlement times, the large share of value captured by intermediaries, system opacity, and a lack of interoperability.

However, much like cryptocurrency, DeFi likely has an uphill battle to climb with many potential users. Many people are understandably hesitant to put their money where “anyone with an internet connection” can gain access. Convincing consumers that Web 3.0 is a safe place to keep their money will be a massive challenge for DeFi advocates and business owners.

DeFi newcomers face the challenges and risks typical of a nascent industry and must navigate in a market filled with cautious customers and market speculation. If Web 3.0 can overcome the following obstacles, it may be able to become a fully established technology.

- Barriers to Regulations. A principal challenge for Web 3.0 is regulatory scrutiny and outlooks. There is a lack of clarity and legal consistency in how these assets, services, and governance models are classified. For example, smart contracts are not yet legally enforceable. This limits the potential for institutional adoption, especially by heavily regulated entities.

- Technology is too Complicated. The user experience in the Web 3.0 ecosystem is not yet ready for mainstream adoption. Interfaces are often poorly designed, and the underlying technology is too complicated for a seamless user experience.

- Insufficient Consumer Protection. Security is also a concern, as fraud and scams are still common in the sector. Know-your-customer and anti-money laundering procedures are often lacking. While Web 3.0 ultimately aims to prioritize the user value proposition, consumer protection is currently insufficient.

- High Knowledge Barriers. Users engaged in Web 3.0 may not fully understand the risks of decentralized technology and expect the same protections as with centralized, regulated entities. There is a need for products that reduce the high knowledge barriers to entry, particularly for unbanked individuals who may benefit the most from DeFi.

- Inadequate Data Privacy. The technology itself may not be ready for mainstream adoption. Data privacy is lackingin the current system. While wallets are initially anonymous, existing tools are improving at identifying wallet owners based on transaction history. Once anonymity is lost, all transactions can potentially be viewed by anyone. While this public nature can be beneficial, users will likely need access to on-demand privacy for the technology to become more widely used.

- High Costs. Transaction costs are also a factor, making some DeFi protocols too expensive to usecurrently. For example, fees paid to complete and record a transaction on the Ethereum blockchain (‘gas fees’) may be too high for some users. Although there are cheaper and faster alternatives, they do not typically have the same level of resilience or operational uptime needed for mainstream adoption.

- Untested Smart-Contracts. With weekly reoccurring exploits of weaknesses in new code or "logic hacks", smart-contract resilience is still unproven. Additionally, the accuracy of oracles, which are information feeds used in decision-making by smart contracts, is still a work in progress.

Examples of DeFi & Web 3.0 in the Fintech Industry

It is not surprising that DeFi and Web 3.0 fundraising has declined in a year marked by an impending recession, crypto scandals, and the unpopularity of the Metaverse, despite Zuckerberg’s attempts to help it gain traction.

However, investment continues to flow into DeFi, NFTs, and metaverse startups. While Q3 showed a 24% drop from the previous quarter, it’s up several million dollars more than what was invested in the decentralized sector during the same period last year.6

As we reach the final month of the year, here are a few examples of DeFi and Web 3.0 companies that are on the rise:

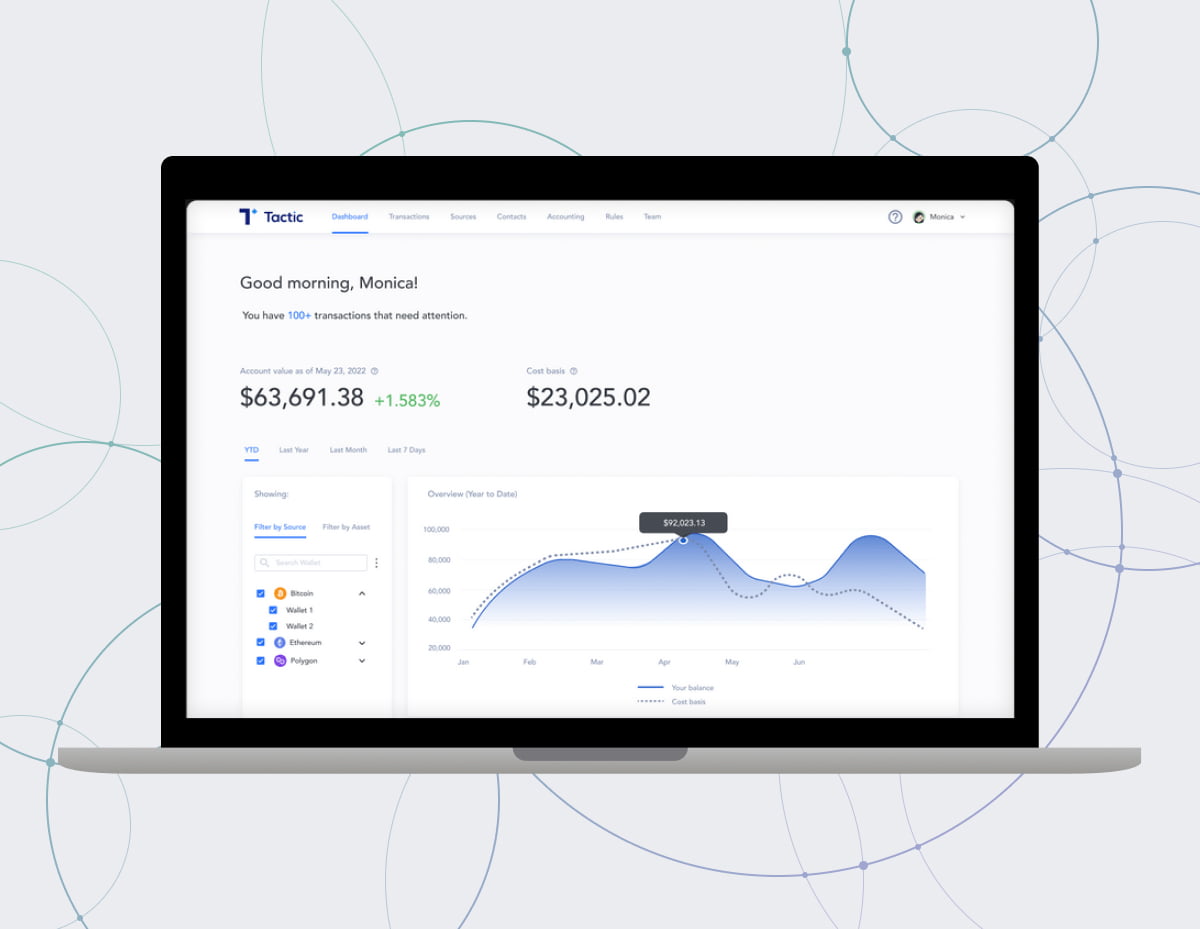

Tactic recently raised $11 million in funding to continue its mission of simplifying financial operations for businesses in Web 3.0.7 Tactic claims the funds will help it assist enterprises in navigating the evolving regulatory landscape for financial compliance.

CEO, Ann Jaskiw, founded Tactic after realizing that founders in Web 3.0 were managing their accounting with spreadsheets. Existing accounting and expense management software providers were not built to handle crypto transactions. Tactic's product helps CFOs and heads of finance answer the question "Where did the money go?" at the end of a quarter.

After talking to hundreds of companies, Tactic found that decentralized finance (DeFi) transactions were the most challenging. For example, a single interaction with a smart contract can generate hundreds of nested transactions, which all need to be accounted for. Tactic has partnered with accounting firms to help interpret accounting guidelines for DeFi-specific activities such as staking, NFT minting, and airdrops.

Tactic’s Platform

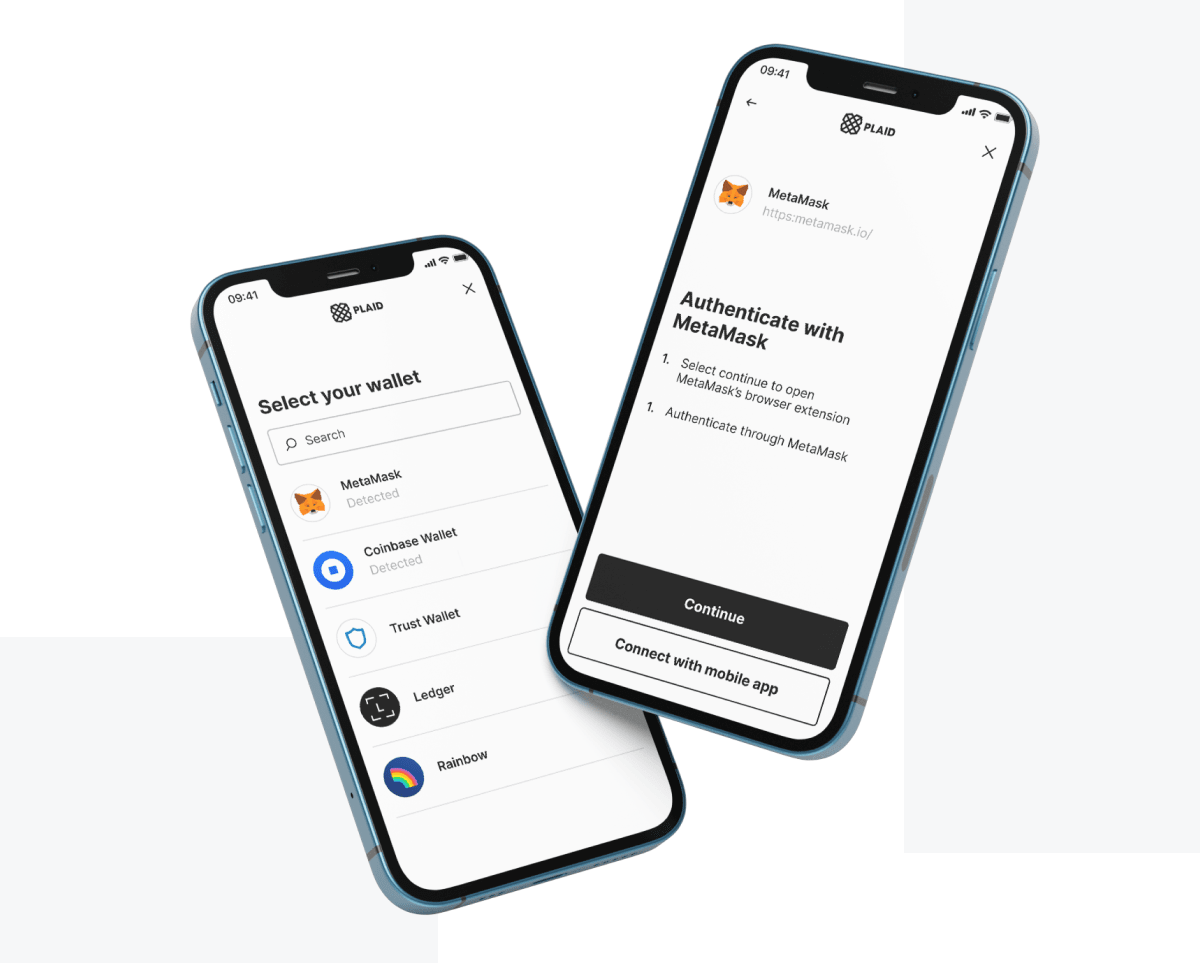

A leading Fintech company, Plaid, has jumped into Web 3.0 with the introduction of technology that streamlines the integration of decentralized apps (dApps) and self-custody crypto wallets. Plaid is launching a new crypto-native product, Wallet Onboard, that will support an array of digital wallets. Plaid is also partnering with multiple DeFi startups.8

The Head of Plaid’s UK operations, Keith Grose, has said that Wallet Onboard will extend the ease of development of their legacy product into the Web 3.0 ecosystem.9

Plaid is hoping to offer a smart contract check to verify the program the customer is accessing is legitimate, to boost users’ confidence when navigating Web 3.0.

An example of Plaid’s Wallet Onboard feature.

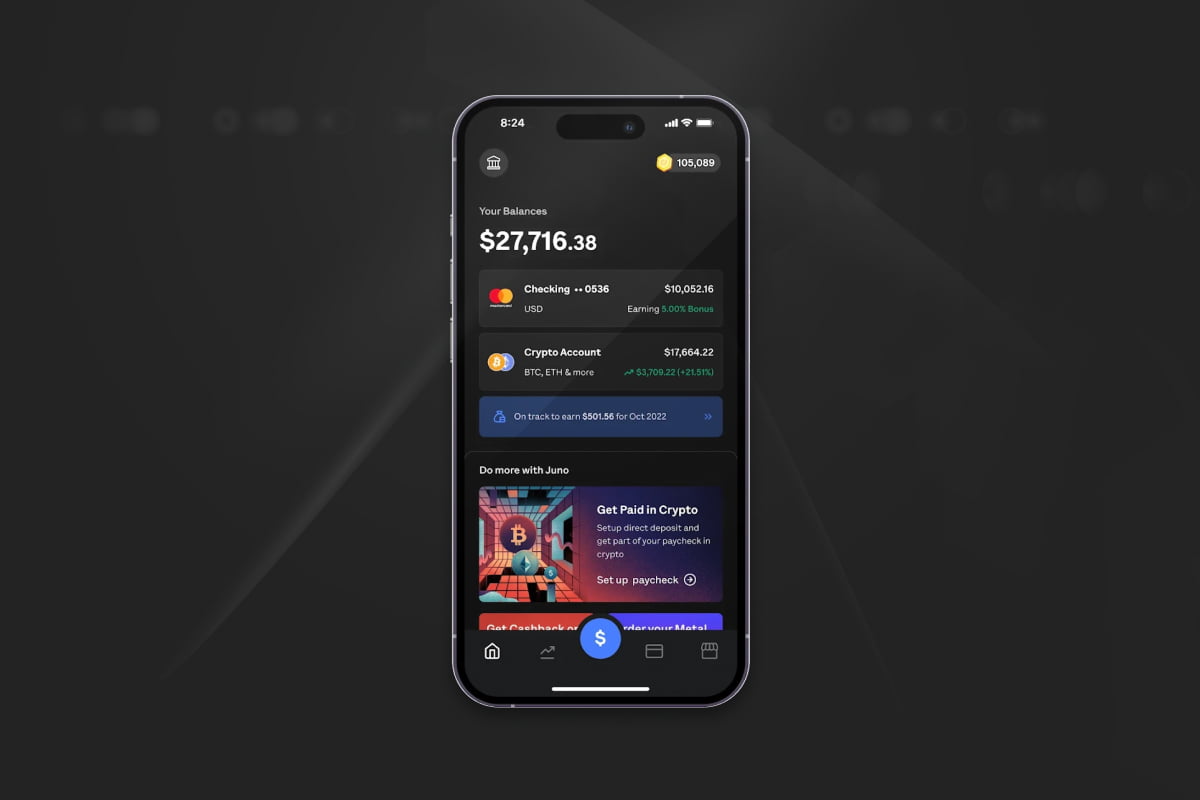

Several projects, including Juno, Dharma, and Outlet, are launching DeFi neobanks. Their goal is to provide users with a high-yield account for savings that competes with cash accounts of fintech start-ups like Wealthfront and neobanks like Monzo. This is enabled by providing a simple alternate banking interface that seamlessly blends crypto and traditional finance.

Juno provides checking accounts to crypto enthusiasts and allows them to take their paychecks in digital tokens and it has raised $18B in a new funding round as it expands its offerings to include a tokenized loyalty program.10

Juno has amassed over 75,000 customers in the U.S. who take their salaries (some in entirety, rest in portions) in crypto and invest consistently in digital assets each month.

Juno’s App

What You Should Consider Before Adopting Web 3.0

Infrastructure

Web 3.0 infrastructure must continue to evolve to become more robust—many critical services are often too centralized or too sensitive to failure. There is a need for more infrastructure related to custody and asset servicing, clearing and settlement, tokenization and issuance, risk and compliance, wallets and identity, and more that are currently insufficiently addressed by legacy players.

Banks and other financial institutions have an opportunity to partner with Web 3.0 native companies to innovate their offerings and support the maturation of the Web 3.0 infrastructure that is needed for mainstream adoption.

User Experience

For Web 3.0 to reach the general population, it must be intuitive and easy to use. Currently, it’s complicated and requires technical savvy to get users up and running.

Plaid’s Head of Operations, Keith Grose, said, “when you think about what will be needed for DeFi to take off, a lot is around the user experience and making this accessible to people who are not really deep in crypto.”11

At the BOLD Award Conference Series: Finding the value of Web 3.0, panel speakers had a general consensus that developers are building DeFi products they would use, without thinking of the end users, when really, users are the driving force behind all tech innovation.

Jeremiah Owyang, the CMO of Rally, a crypto network for social tokens, posited at the same conference, that Web 3.0 needs to become as simple to use as Web 2.0. “Web 2.0 got their users so right because it's addictive and it's so easy to use,” he said. “We don't want to teach consumers something new, we must enhance what they already do.”12

Talent Shortage & Development Challenges:

Even with the recent market downturn, the speed of innovation for Web 3.0 is unlikely to slow. Beyond application usage, both crypto-native firms and the institutions they seek to replace are rapidly hiring for Web 3-focused positions,13 signaling growing mainstream interest and adoption. Notably, blockchain companies are also drawing in a wave of professionals from organizations like big tech companies and banks.

Given the open-source nature of the technology, developers can easily develop new applications by building on established programs that have been battle-tested and proven under severe market conditions. It may be hard for even the largest organizations to compete with this scale of global developer base and innovation, and the speed could accelerate as more users and developers join.

At the BOLD Award Conference Series: Finding the value of Web 3.0, Grant Powell, the founder of Curios – an NFT Market and Smart Contract API provider – spoke about his experience with Web 3.0. He said that for those who are considering implementing Web 3.0, choosing an environment and tech stack is a big undertaking, and “that’s why an advisor or enhanced team can help you make your move”.12

When asked about the best language to use for Web 3.0 applications, he said “As long as you can do simple rest API calls, you can choose the language you'd prefer.”

Conclusion

We are currently in a downward turn of the hype cycle concerning NFTs, crypto, and Web 3.0, although the industry has plenty of room for the growth and innovation of these technologies.

For those interested in exploring how DeFi and Web 3.0 can benefit their business, it is necessary to perform ample research on the merits of implementing these technologies and to proceed with caution. Even if it succeeds, Web 3.0 will likely be a slow journey to the top. Just remember that it took almost 5 years for blockchain technology to become broadly usable!

For companies seeking to explore Web 3.0 solutions, but need a bit of guidance, Softjourn can help. We are experienced in fintech consulting and blockchain development solutions and have developers who can work with a wide range of tech stacks.

We will bring light to whether Web 3.0 solutions can benefit your business and even enhance your team to develop better solutions faster. We will help you discover and assess what technology solutions will be best for the precise goals of your business. Contact us for a free consultation to get started.