Banks are taking a new approach to using their APIs to maximize their potential power and value. We are currently witnessing a change in the behavior of CIOs and CTOs of financial institutions who are becoming increasingly interested in taking advantage of application programming interfaces (APIs). They see APIs as a significant opportunity to expand the pool of their services and serve the new digitally-advanced generation of users.

APIs have the ability to connect a variety of devices, data, and applications that serve banks and financial institutions. Nearly all banks have realized the immense power of APIs and their role in modernizing complex legacy systems. According to MarketsandMarkets, the global API management market will reach $5.1 billion by 2023, growing by nearly five times compared to 2018, at an average annual rate of 33%. By 2028, Adroit Market Research predicts that the global API market will surpass $21 billion.

When it comes to API development, many banks turn to third-party technology providers if they lack the technical ability or experience in API integration. Here’s what Ana Botin, executive chairman of Santander, said for the Fintech Takes newsletter:

“Regulation now favors tech companies that intermediate financial services over banks. This is especially true for the rules on data, which powers payments. Large tech companies are becoming lending platforms without having to comply with most banking regulations. Their role, although still relatively small overall, is growing.“

In this article, we want to explore the benefits and types of APIs in fintech and how much of an influence they’ll have on banking.

The Benefits of Using APIs in Fintech

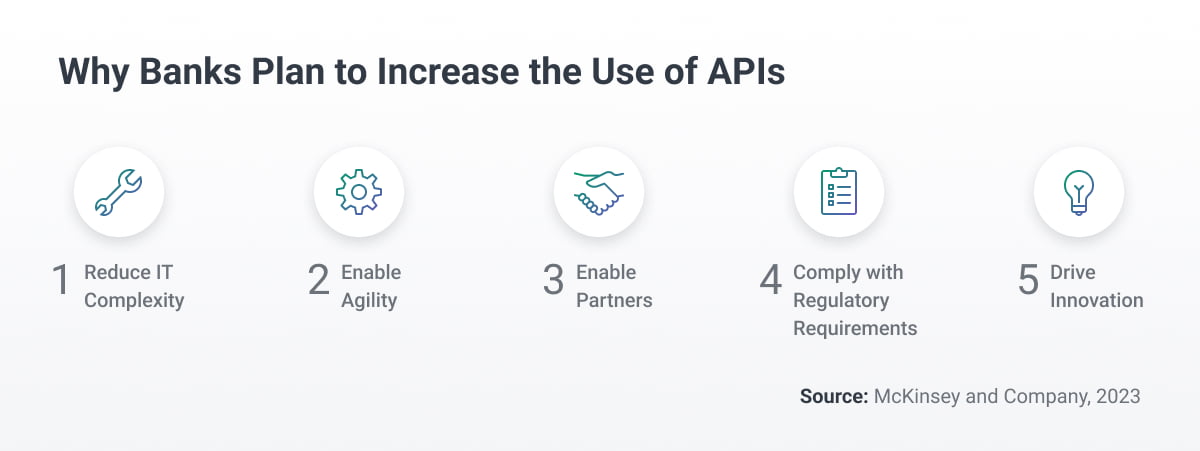

Many banks initially adopted APIs to comply with regulations, such as Europe’s Payment Service Directive (PSD2). PSD2 was created with the aim of making electronic payment services more secure and the European finance sector ready for open banking. As a part of the PSD2, European banks need to disclose their APIs to fintechs and other banks so other institutions can access their customer data. Similar regulations also exist in Mexico and Brazil, among other countries.

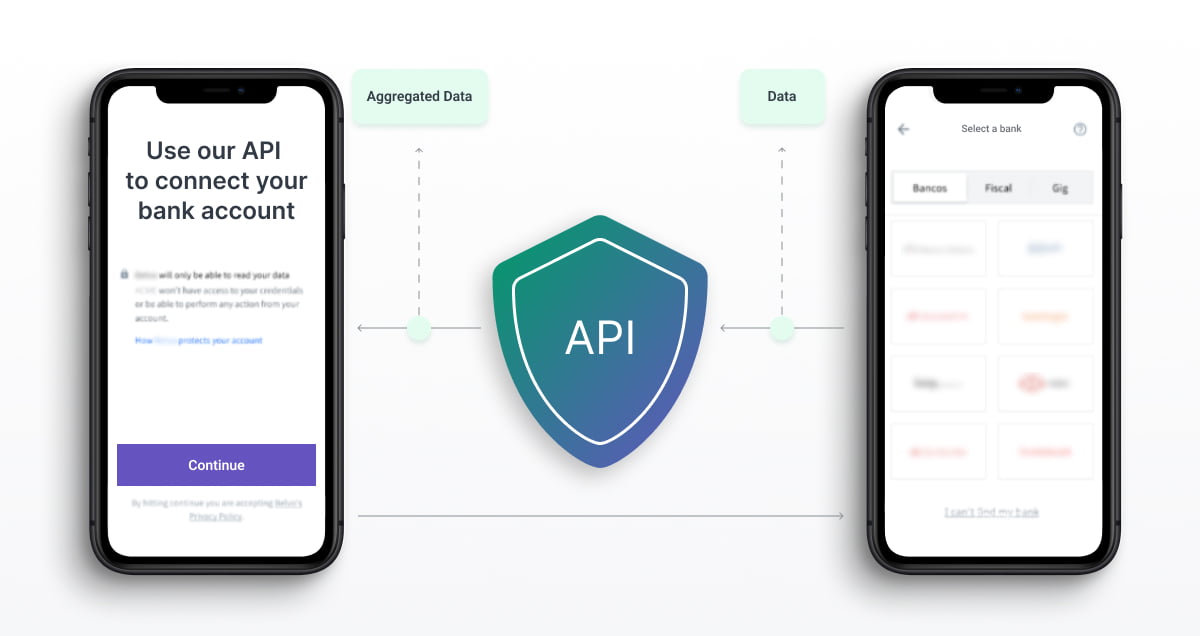

The Second Payments Directive (PSD2) integrates open banking and APIs with a large finance industry landscape. It allows third parties to access customer bank data based on customer approval. That way, companies outside of banks can offer services using baking data and ecosystems.

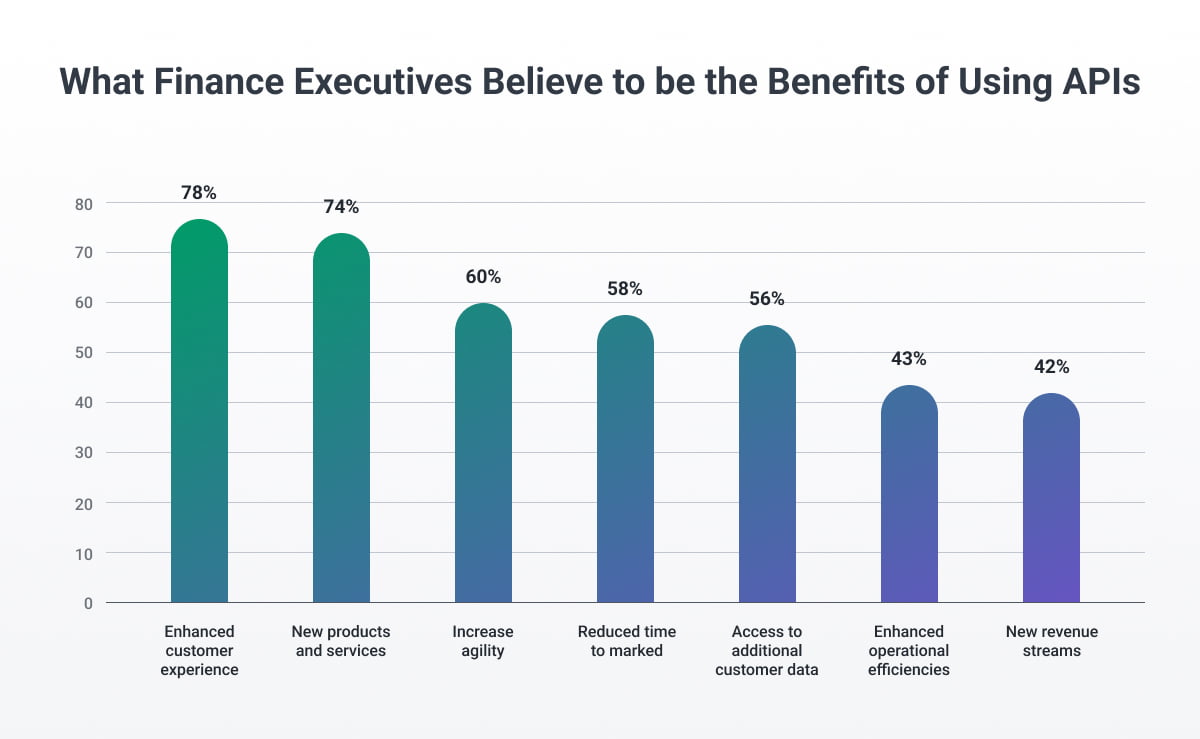

One of the greatest benefits of using APIs in banking is the ability to speed up IT infrastructure integration while reducing costs. According to Capgemini, other top benefits of using APIs include enhanced customer experiences, the opportunity to create new products and services, and increased agility.

In addition, McKinsey research shows that 75% of the top 100 banks in the world have made their APIs publicly available so they can gain access to new markets while also having the ability to offer better services to their customers.

Despite the increasing digitalization of the financial industry, many banks continue to rely on older, legacy systems. These systems may be difficult to integrate with modern API-based technologies and may not be able to fully utilize their capabilities. This can be a challenge for banks that want to take advantage of all that APIs have to offer.

Guide to API Models

Modern banking leaders are changing their approach to APIs and are even creating strategies to distinguish to leverage the opportunities they bring and distinguish their banks as market leaders.

APIs are no longer seen merely as a tool but as a monetization opportunity, as they enable new businesses by engaging with third-party collaborations, giving players in the finance industry a unique chance to innovate and become more efficient.

Before making a decision to build APIs, decision-makers in finance need to have a basic understanding of their current infrastructure. One of the first things is they type of system financial institution is using (on-premise or cloud-based), which data sets they have access to, and ultimately what functionalities they want to develop. Focusing on API-first design requires significant changes to the legacy systems and depending on who will be the intended end-users of the APIs, there are three types of API models most commonly used in fintech:

- Internal APIs

- Fintech APIs

- Open (Public) APIs

Internal APIs are developed to simplify operational processes and simplify software development. They are used within an organization to allow different systems to communicate with each other easily, and improve internal processes by automating repetitive tasks.

Many banks start by developing an internal API to allow different systems to communicate with each other, without allowing it to be accessible to the public. A common example of this is the lending department of a financial institute that must check on customers’ other accounts before giving them the green light for a loan.

Fintech APIs are specifically designed for the exchange of information between financial institutions and the services that require their information. Fintech APIs are used by financial institutions to allow neobanks and other services that they have indicated as ‘preferred’, to access client financial data and securely perform transactions.

By allowing access to financial data, neobanks and third-party services can enhance their products and services or introduce new ones, based on client needs. For example, banks may use a partnering institution’s API to send data from its customers to a BNPL service, so clients can make purchases upon request.

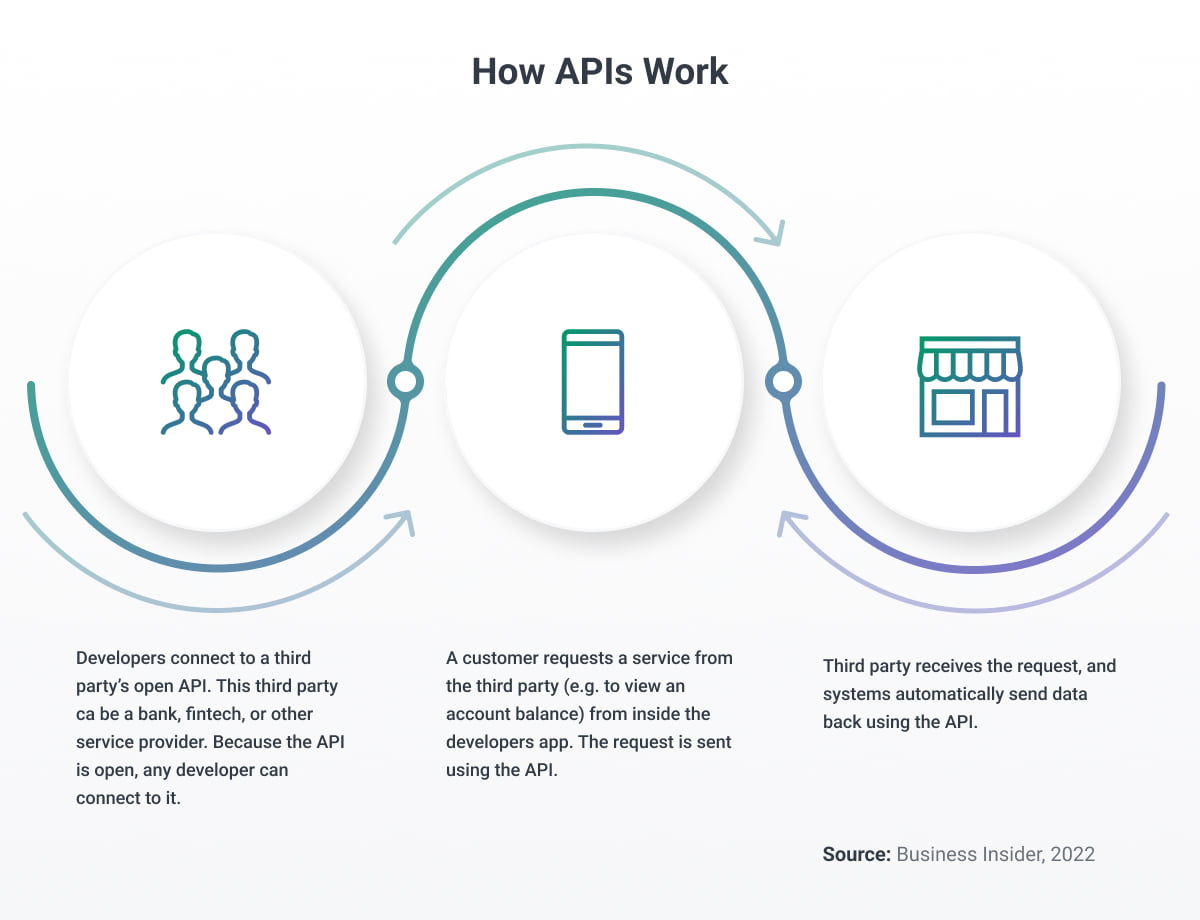

Open or Public APIs open up bank data to multiple companies, products, and services. This type of API is made public for use by developers and organizations, allowing them to access and integrate the company’s data and functionality into their own applications. The aim of open APIs is to speed up software development and commercialization of banking software.

Open APIs can be used for many different purposes. One of the most common uses is payment processing as they allow businesses to authenticate payments directly between customers and their banks. APIs prevent fraudulent behavior and ensure that payments are faster and more efficient.

The Best Approach to Using APIs for Banking

In general, banks are combining all three generic API approaches. Banks usually start off using small, internal APIs and slowly scale up towards creating an external developer portal with standards that guarantee scalability and reusability. The maturation of APIs in banking is continuing, and the versatility of banking APIs suggests that they can offer new ways for banks to expand their value.

When considering API development, there should be a great focus on the business value, as banks need to have a solid API monetization model to find success. Internal APIs add value through cost savings and shorter time to market.

Besides internal APIs, fintech and open APIs connect banks with their customers, external partners, or the general public. They provide access to valuable customer data analytics, payment processing, personalized approach to credit scores, advanced business accounting and tax management.

Are all banks great candidates for API development? Not necessarily, but for any bank wanting to get started on building their APIs, we recommend they first:

- Focus on connecting their ecosystems to deliver the best possible products and services.

- Create a clear business strategy that defines all the products they need to stay competitive.

- Prioritize the features they want to develop.

- Consult with software development experts on the right approach when developing new APIs.

The Relationship Between APIs and Open Banking

Open banking enables consumers to develop and maintain a large network of financial relationships, creating pushback for banks to change their business models. The technology behind open banking utilizes APIs, and through open banking, APIs have been used to connect banks with third-party providers, allowing the creation of Banking-as-a-Service functionality. BaaS connects fintechs to banking systems through APIs, helping them create better financial products.

Open banking offers financial institutions a chance to increase revenue streams by expanding their customer base. According to research from Polaris, the global open banking market size was valued at $16.1 billion in 2021 and is expected to grow and reach $128 billion by 2030.

Conclusion

In the past, consumers had to rely on traditional banking relationships in order to access advanced financial services. However, with the advent of APIs and new business models, this is changing. The question now is whether banks will adopt APIs to help them be competitive players in the market while providing a comprehensive solution for their customers.

It's clear that we are living in an API-driven world and that legacy banks will continue falling behind if they don’t quickly pick up new technologies that are important to their customers. APIs are a crucial part of the future of banking and fintech, and it's important for businesses to understand how they can be used to connect with other financial institutions.

If you're struggling to see how APIs can benefit your business or need help with API development, we are here to help. Take advantage of our expertise and let us assist you in leveraging the power of APIs.