Fintech companies have surged over the past decade, driven by a demand for reliable client service, modern, user-friendly interfaces, and innovative tools and features that traditional institutions often lack.

Fintech: The Driving Force Behind Banking Development

BaaS can help fintech companies quickly and easily expand their services, and can also benefit banks by providing them with a new source of revenue and a way to reach new customers. We expect BaaS to become increasingly popular as more fintech companies look for ways to offer their customers a wider range of financial services.

In 2026, Necessity Will Drive Banking Innovation

As fintech companies have grown in popularity, so too have the expectations of customers to have access to banking apps with the latest features. With mobile banking now used by over half of the U.S. population, and the overall number of digital banking users projected to reach 79% by 2029, integrating mobile services is clearly essential for banks to stay competitive.

For millennials, now the largest segment of the workforce, digital banking has become essential. With 85% of people aged 25-34 and 68% of Gen Z relying on digital banking, BaaS enables banks to address growing demands for convenience and speed while evolving with the shifting financial landscape.

However, most banks and financial institutions don't have sufficient resources to implement new technologies to compete against highly-innovative fintech companies. On the other hand, fintech companies don't necessarily want to have the full responsibilities that come with being a bank, such as adhering to strict compliance regulations.

The big secret - none of these fintech companies are becoming banks or plan to become banks. And most banks don't have big plans to digitize to the level of top fintech apps.

Instead, fintech companies are utilizing brick-and-mortar banks, which behind the scenes, offer the regulatory sponsorship and banking technologies needed to provide these products. This collective product offering is known as Banking as a Service, often shortened to BaaS.

The Growth and Significance of Banking as a Service

The financial services industry has been disrupted by digital neobanks and fintechs that have gained significant traction by delivering user-friendly, adaptable services.

However, many financial services capabilities, such as issuing payment cards and holding deposits, require the involvement of a licensed bank. As a result, banks have turned to Banking as a Service (BaaS) to partner with new entrants and adapt to the digital banking boom.

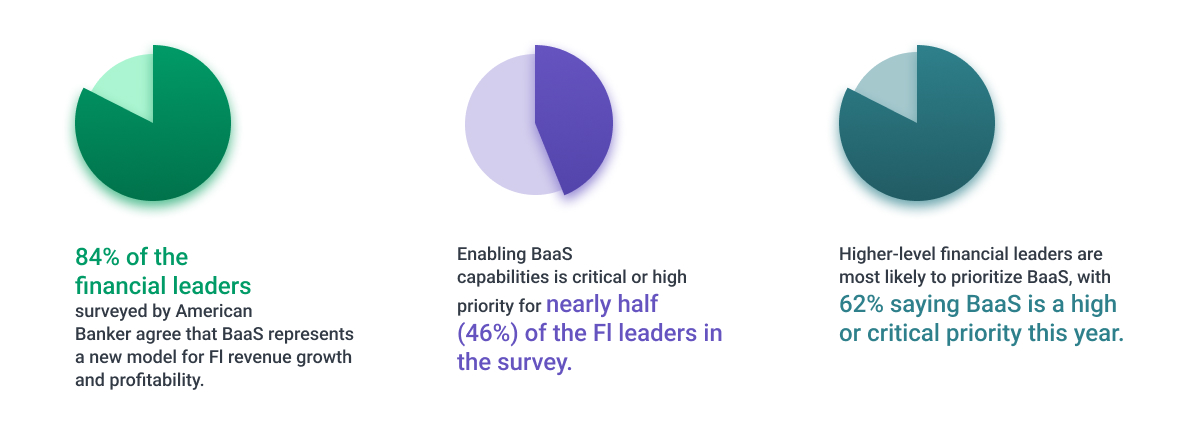

With 84% of financial leaders viewing BaaS as a new model for revenue growth and 62% prioritizing it as critical this year, enabling BaaS capabilities is key for banks to stay competitive.

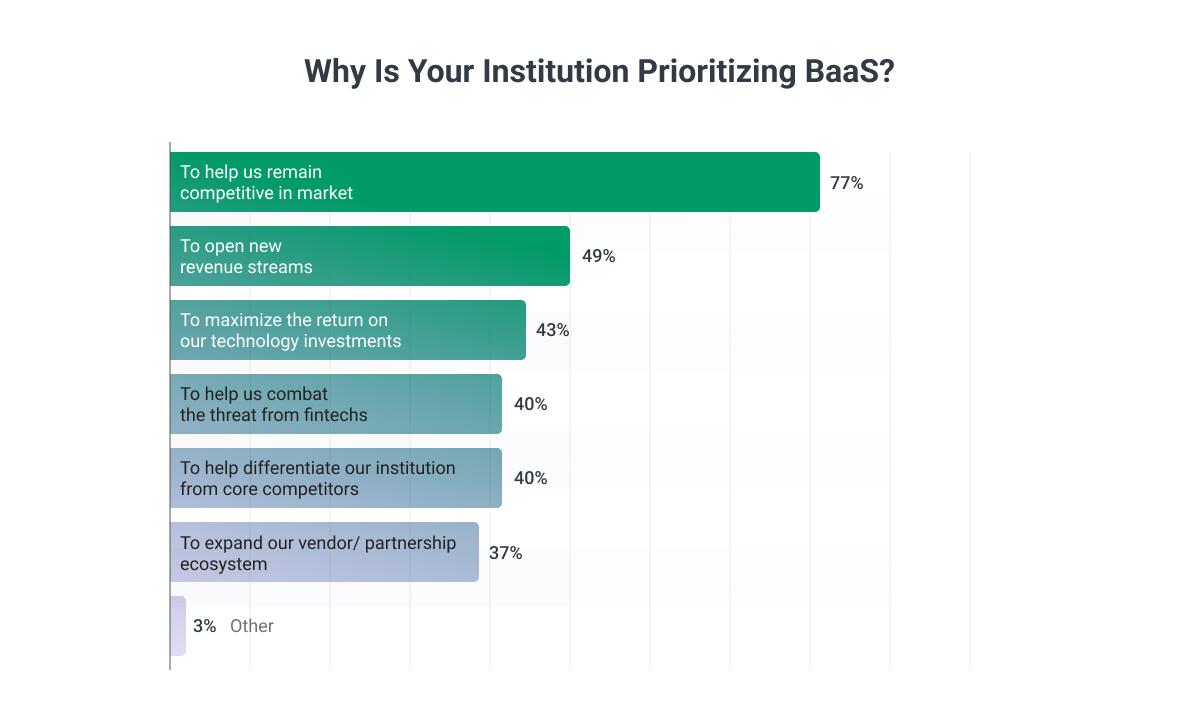

BaaS allows banks to remain competitive, meet customer demands for convenience and speed, and adapt to the changing financial services industry.

BaaS Benefits for Fintechs

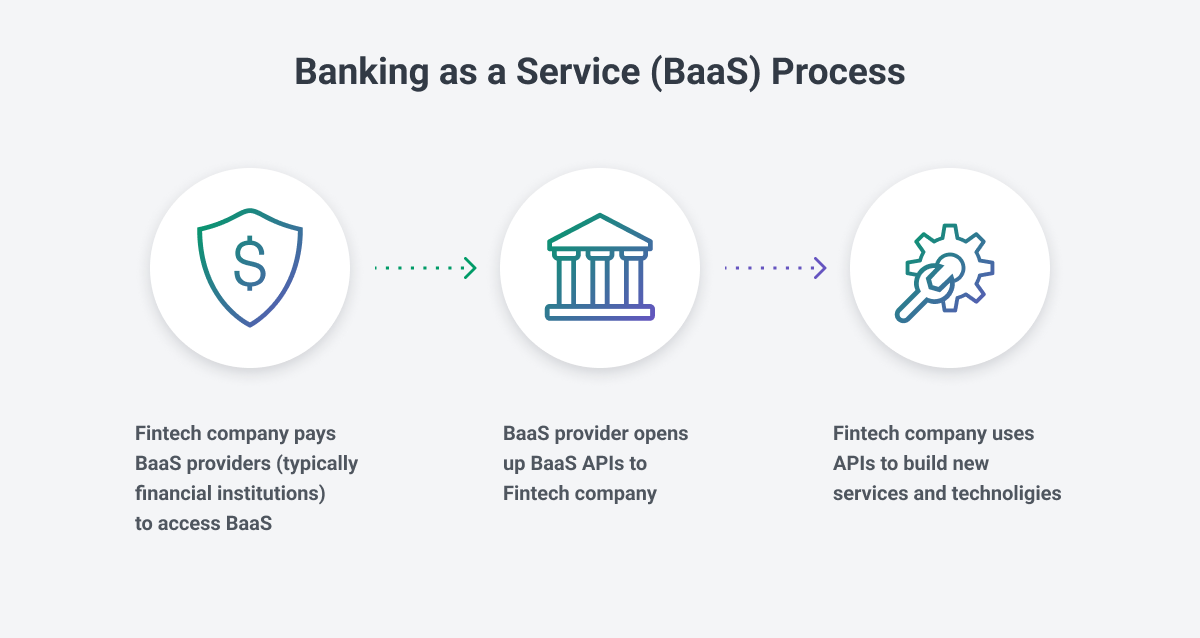

In simple terms, Banking as a Service (BaaS) is a partnership model in which a licensed bank grants a non-bank or fintech partner access to its regulated infrastructure and core systems via APIs in exchange for a fee.

The fintech company then uses this access to offer banking services to their customers through their own user interface and platform, a process also known as "white-label banking." This enables non-banks to expand their financial service offerings, such as holding deposits or providing payment cards, through collaboration with licensed banks.

Partnering with a licensed bank through BaaS allows non-banks to offer better customer experiences more efficiently and quickly, without the need to become a licensed bank or build core banking systems themselves.

This enables non-banks to integrate banking functionality with their own platform's capabilities to create a more comprehensive, seamless offering for users.

BaaS Benefits for Banks

Banking as a Service (BaaS) offers numerous benefits for fully licensed financial institutions, both in the short and long term, and provides a pathway for banks to remain relevant in a rapidly evolving financial industry.

New Revenue Streams

One of the primary benefits of BaaS is the creation of new revenue streams through API-based access to core banking products and services, sold to other businesses and non-bank partners on a recurring or per-service basis. This model can also generate revenue through set-up charges or revenue-sharing agreements.

Customer Acquisition and Retention

Another advantage of BaaS is the ability for financial institutions to acquire and retain customers more efficiently and effectively. By partnering with non-bank brands that have large and dedicated customer bases, banks can reach new potential customers at a lower cost than acquiring them directly.

BaaS also allows banks to deliver customized, easily accessible services that meet the expectations of modern customers, increasing customer satisfaction and loyalty, which leads to better retention rates.

Access to Modern Technology

BaaS also enables banks to modernize their technological capabilities, allowing them to streamline development, lower infrastructure costs, and improve data security.

By building and delivering banking products using leaner, more flexible, and more powerful API-based tech systems, banks can break down internal product silos, increase interoperability, improve organizational efficiency, and obtain a more holistic view of financial lives of their customers.

Relevance in the Market

Perhaps most importantly, BaaS offers banks an opportunity to fundamentally reshape their value proposition and role within the financial services ecosystem. Banks that embrace BaaS can remain competitive and relevant as the industry transforms over the coming years, whereas those that hesitate risk losing market share and new customers, as well as facing obsolescence.

The Relationship Between APIs, Open Banking, and BaaS

In BaaS, financial organizations integrate entire services into their apps to have access to all allowed bank services, such as mobile bank accounts, debit cards, loans, and payments.

Open banking is a more general concept that involves different banks and allows opening their data and services to third-party developers through APIs. In open banking, financial institutions can access customers' data and their accounts, and trigger allowed payments via API. But they do not integrate the entire banking service into their app.

Open banking enables consumers to develop and maintain a large network of financial relationships, creating pushback for banks to change their business models.

The technology behind open banking utilizes APIs, and through open banking, APIs have been used to connect banks with third-party providers, allowing the creation of Banking-as-a-Service functionality. BaaS connects fintech companies to banking systems through APIs, helping them create better financial products.

Open banking offers financial institutions a chance to increase revenue streams by expanding their customer base.

According to research from Global Market Insights, the open banking market size was valued at $31 billion in 2024 and is estimated to register a CAGR of over 24.9% between 2024 & 2028. The growth of digital banking and the increased usage of online platforms for payment transactions are major drivers in the market.

Cybersecurity Threats for Banking as a Service

While BaaS is promising for fintech companies and banks, it does bring concerns about potential security threats. Sergiy Fitsak, Payments Expert at Softjourn, notes some of the most notable examples of security threats and issues when using BaaS:

- Data breaches - "BaaS platforms can be a target for hackers who want to steal sensitive data."

- SSL-based attacks - "SSL protocol and implementation flaws are also a significant threat to BaaS users."

- Misconfigurations - "As BaaS environments operate in the public cloud, organizations must consider cloud applications' unique cyber threats.

Cloud misconfigurations can be one such threat as they may leave sensitive data exposed to unauthorized access. Not to mention the human factor that can cause misconfigurations."

Social engineering and vulnerability attacks are also becoming increasingly frequent, with threat actors exploiting gaps in software or hardware that have not been updated with the latest patches.

Additionally, recent evidence shows that smaller community banks are equally susceptible to cyberattacks as larger ones. Therefore, the demand for improved cybersecurity will continue to rise significantly.

All of these factors prove that it's more important than ever for banks to maintain strong security measures and invest in fraud prevention and detection tools to respond quickly to security breaches. Otherwise, they may put themselves at risk of a data breach, which - according to the 2024 IBM Cost of a Data Breach Report - is $4.88 million on average in the financial services industry.

Advancing Cybersecurity in BaaS with AI and Zero-Trust Architecture

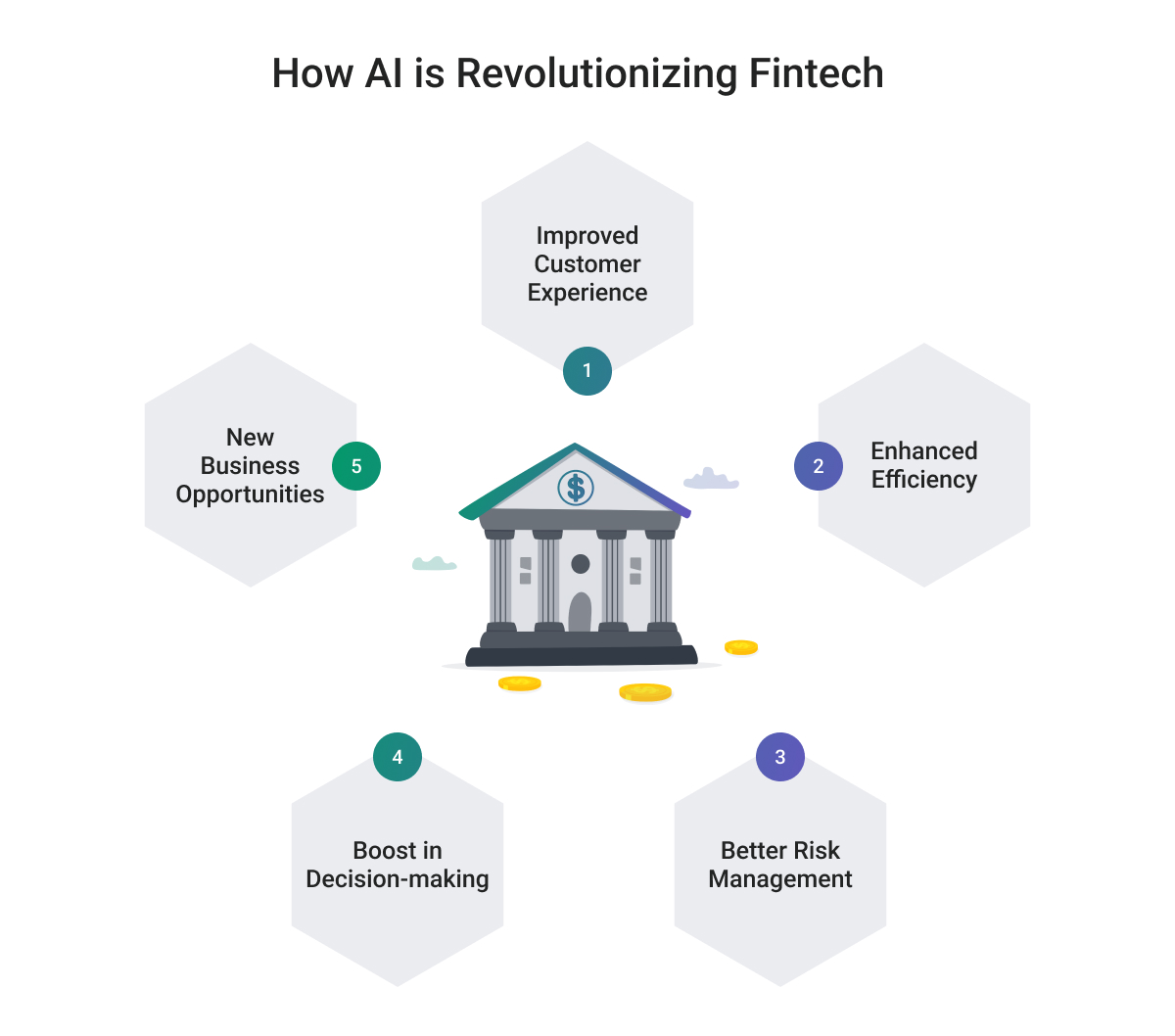

As BaaS adoption grows, cybersecurity innovations are critical to protecting sensitive data and transactions. Artificial intelligence (AI) and machine learning (ML) are advancing fraud detection by identifying anomalies in real-time, enabling faster responses to emerging threats.

For example, AI-powered behavioral analytics can flag unusual account activity based on deviations from typical patterns, helping prevent account takeovers and unauthorized transactions.

Zero-trust architecture is another key trend, emphasizing "never trust, always verify" principles to secure access at every layer of interaction. This approach mitigates risks associated with lateral movement within systems, reducing the potential impact of breaches.

Additionally, financial institutions are beginning to prepare for quantum computing’s future impact on encryption methods, investing in quantum-safe cryptography to future-proof their systems. These developments ensure that BaaS platforms can offer robust security to match their scalability and innovation.

--

Softjourn offers modern security offerings to ensure your company is as protected as it can be. Our team has over 20 years of experience in developing secure payment systems that protect your customers' sensitive financial data. From online payment gateways to mobile payment apps, we have the expertise to deliver cutting-edge solutions that meet the highest security standards.

Banks Can Leverage Fintech Security Measures to Fight Fraud

While banks may face increasingly high amounts of security threats, by partnering with fintech companies, they may have access to the latest security measures for safeguarding digital wallets, exchanges, and other online accounts.

By collaborating with fintech companies, banks can leverage technologies such as two-factor authentication (2FA), 3D Secure, tokenization, artificial intelligence (AI), and machine learning (ML) to enhance app security, automate fraud detection, and ensure identity protection.

New Trends in Mergers and Acquisitions

The trend of mergers and acquisitions (M&A) in the community banking sector has been primarily driven by the need to keep up with larger financial service providers and their vast resources.

In 2022, J.P. Morgan acquired Renovite Technologies to strengthen its cloud-native capabilities, enhancing its ability to support embedded finance solutions. Building on this, the 2024 acquisition of WePay integrated advanced APIs and risk management tools into J.P. Morgan’s platform, enabling seamless BaaS offerings for SMBs. These acquisitions underscore the role of M&A in expanding BaaS capabilities and driving innovation.1

What's interesting is that BaaS is leading this trend, and we're seeing not only banks merging with other banks but also fintech companies acquiring banks. For instance, in 2024, UK fintech Pockit acquired mobile banking services provider, Monese, with the goal of building a fintech platform tailored to serve financially underserved and lower-middle-income consumers across the UK and Europe.

It's clear that technology is the driving force behind consolidation in the banking industry. To remain competitive and independent, community banks must consider their strategic technology plans.

The Rise of BaaS for Credit and Debit Card Services

In the fintech industry, an interesting phenomenon has emerged where neobanks and non-financial companies are providing credit card services.

Previously, cards were only issued by banks, such as national brands like Amex, Bank of America, or Chase, or smaller regional banks and credit unions. Today, neobanks like Cash App, Chime, or Varo are issuing cards. In reality, the cards themselves are actually provided by small regional banks, not the neobank or Fintech company whose name is on the card.

Other non-bank startups are also providing branded cards, a good example being Brex and Ramp, which provide corporate cards, and DoorDash and Instacart, which offer tech-enabled prepaid cards to their drivers.

These companies use the Banking as a Service (BaaS) model, partnering with a financial institution and an issuer processor, who provide the regulatory and technical infrastructure as a service, allowing any company to issue debit or credit cards.

Will Real-Time Payments Finally be Within Reach for Fintechs?

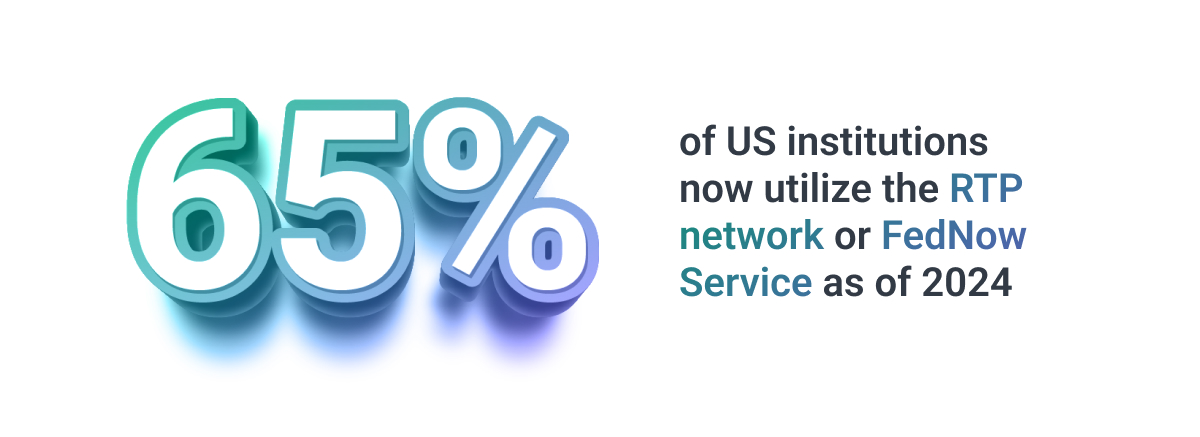

The adoption of real-time payment (RTP) networks continues to expand rapidly, with more than 60% of US companies now utilizing the RTP network or FedNow Service as of 2024. FedNow, launched by the Federal Reserve in mid-2023, provides instant payment capabilities to financial institutions of all sizes, broadening access to real-time transactions across the country.

Globally, new players such as Wise and Payoneer are integrating RTP capabilities into their cross-border payments platforms, making instant transactions more accessible for SMEs and individual users.

Additionally, blockchain-based solutions like RippleNet are gaining traction, enabling secure, real-time international settlements. These advancements are expected to drive the affordability and ubiquity of RTP systems, fostering more efficient and seamless payment experiences for businesses and consumers alike.

Embedded Finance Set to Grow in 2026

As businesses recognize the value of embedded finance in creating new revenue streams and boosting customer satisfaction, the market for this seamless integration of embedded finance is set to exceed $250 billion over the next five years.

In 2026, we expect to see a continued ascent of embedded finance, with a particular focus on B2B eCommerce. This will lead to more startups entering the space, offering niche financial products like BNPL for businesses, merchant financing, and trade credit insurance.

Banking as a Service vs. Banking as a Platform

Banking as a Service (BaaS) and Banking as a Platform (BaaP) are two terms that are frequently used in the fintech industry, but they have distinct meanings.

Banking as a Service (BaaS) refers to a business model where banks and financial institutions offer their licenses, services, and software to third-party companies. This allows non-bank companies to provide banking-related services without needing a banking license. Examples include online marketplaces offering deposit accounts or service providers giving out personalized payment cards using BaaS solutions. These services are facilitated through APIs and webhooks.

On the other hand, Banking as a Platform (BaaP) operates in the reverse direction. Instead of non-bank businesses offering financial services, BaaP allows these businesses to provide services to banking institutions. This means that bank customers can benefit from innovative services developed by fintech companies. An example would be a bank integrating a chatbot, developed by an external fintech firm, into their app.

The article also touches upon the concept of open banking, which uses APIs to connect third parties to bank data. Unlike BaaS, which integrates banking products into company services, open banking allows third parties to tailor their products based on bank data, provided they have customer permission.

In summary, while BaaS serves non-bank business customers with integrated bank services, BaaP serves bank customers with integrated fintech services.

Platform Consolidation, Upgrades, and Cloud Adoption to Increase in Commercial Banking

As banks strive for cost efficiencies, faster response times, and scalability, they will increasingly turn to consolidation, upgrades, and cloud adoption in their commercial banking platforms.

This trend will drive banks to partner with fintech companies to leverage innovative technologies such as nCino and Loan IQ for tasks such as credit, servicing, and origination.

This is particularly evident in the US, where there has been a surge in recent years of mergers and acquisitions among banks and fintech companies, leading to a greater emphasis on modernizing their IT systems.

How Digital Banking Will Evolve in 2026: BaaS 2.0

The era of "growth at all costs" in Banking-as-a-Service (BaaS) is fading, replaced by a more compliant and commercially sustainable approach. This shift, driven by increased regulatory scrutiny, marks the evolution into BaaS 2.0—a phase focused on fostering responsible innovation and redefining how consumers interact with financial services.

To date, embedded financial services, like lending and seamless payment options, have been the dominant use cases, creating frictionless customer experiences. As BaaS matures, we can expect broader applications, such as digital wallets and integrated savings and investment tools, directly embedded into customer journeys. The ultimate goal is to create value, boost loyalty, and enhance long-term relationships.

While BaaS has been praised for its impact on conversions, its true potential lies in shaping the browsing experience. By leveraging data analytics to offer personalized financial products during the shopping journey, BaaS providers can deliver contextual solutions that deepen customer engagement and satisfaction.

The evolution into BaaS 2.0 is marked by heightened regulatory scrutiny, with frameworks like PSD3 in Europe setting the tone for more standardized and secure operations. PSD3 emphasizes consumer protection, improved security, and stronger authentication measures, creating a more transparent ecosystem for BaaS providers.

In the United States, the Office of the Comptroller of the Currency (OCC) and other regulatory bodies are tightening oversight on fintech collaborations, focusing on risk management and compliance.

Updated guidelines emphasize the need for robust data security protocols, proper vendor management, and transparent partnerships between banks and non-bank entities. These frameworks are driving the shift toward a more compliant, sustainable BaaS model that prioritizes customer trust and regulatory alignment.

Get Ahead of the BaaS Curve

As the banking industry continues to experience growth and more insights into the needs of end-users, it has become increasingly clear that BaaS solutions are the way of the near future.

With many banks looking to develop partnerships and offerings in the fintech space, it is important for businesses to work with experienced providers who understand the unique challenges and opportunities of the industry.

At Softjourn, we have the knowledge and experience needed to help our clients succeed in this fast-paced and dynamic space, offering higher rates of innovation and delivery. If you are looking to stay ahead of the curve and make the most of BaaS, we encourage you to get in touch with us and discover what financial development services we can offer you.