In recent years, the payments industry has witnessed a notable emergence of Variable Recurring Payments (VRPs). This growing trend has captured the attention of consumers, merchants, and financial institutions alike, as it introduces a new paradigm in recurring transactions. We will dive deeper into the realm of VRPs, examining their impact, benefits, and implications for both consumers and businesses.

What does Recurring Payment Mean?

A recurring payment refers to a type of financial transaction where a predetermined amount of money is automatically deducted from an individual's account at regular intervals. It is a convenient and automated method commonly used for subscriptions, memberships, utility bills, and other ongoing services.

Once authorized by the customer, the recurring payment system executes the transactions without requiring manual intervention for each payment. This arrangement ensures that payments are made on time and eliminates the need for individuals to remember or initiate recurring transactions manually.

Recurring payments provide stability and predictability for both consumers and businesses, streamlining the payment process and promoting convenience in managing financial obligations.

Besides the described fixed recurring payments, there are also irregular or variable payments, which means the amount charged is subject to change based on the customers' usage of the product or service. For example, electricity and other utility bills change month by month based on consumption.

What are Variable Recurring Payments?

Variable Recurring Payments (VRPs) are an innovative method of payment that has the potential to revolutionize regular transactions.

Emerging from the European Union's second payment services directive (PSD2), VRPs work by allowing customers to securely connect authorized payment providers to their bank accounts. This connection enables the providers to make ongoing payments on behalf of the customers, introducing flexibility, transparency, and security.

What are the Other Types of Recurring Payments?

Before the emergence of Variable Recurring Payments (VRPs), several types of recurring payment methods were commonly used.

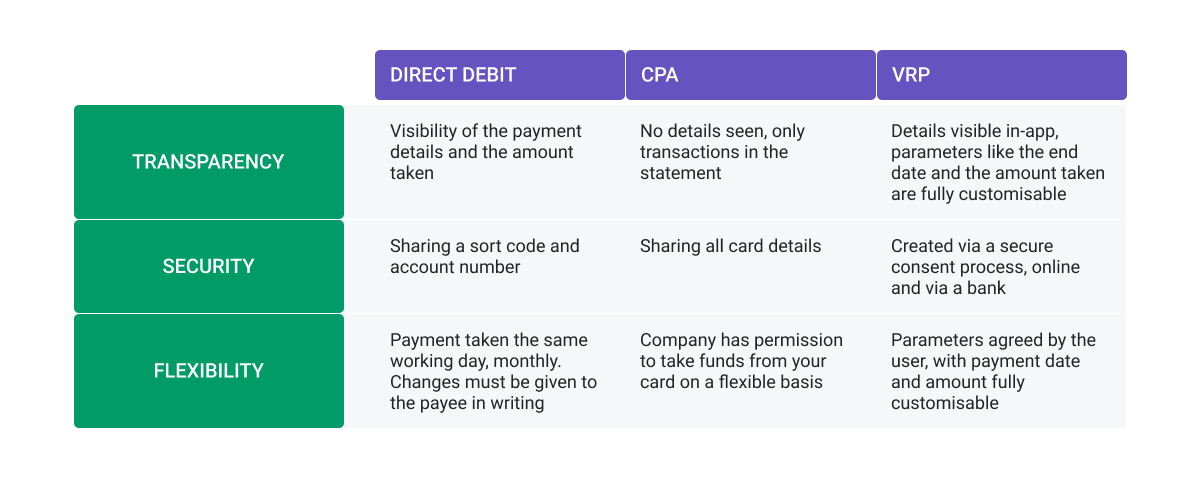

One prevalent method was direct debit, where individuals authorized a merchant or service provider to automatically withdraw funds from their bank accounts at regular intervals. Direct debit offered convenience and reliability, as payments were initiated without the need for customer intervention.

Another popular option was continuous payment authority (CPA), often used for subscription-based services. With CPA, individuals granted permission to a merchant or vendor to charge their credit or debit cards periodically.

While both direct debit and CPA facilitated recurring payments, they had limitations in terms of flexibility, as changes or cancellations required a multi-step process and were subject to the terms and conditions set by the merchants.

These traditional recurring payment methods laid the foundation for VRPs, which introduced greater control and transparency for consumers in managing their ongoing financial commitments.

How are VRPs Different from Other Recurring Payments?

Traditional recurring payment methods such as direct debit and continuous payment authority (CPA) require authentication for every transaction, creating unnecessary friction.

VRPs address this issue by allowing customers to modify their transactions directly from their mobile banking apps, eliminating the need for multiple authentication steps.

With VRPs, customers have control over parameters like payment frequency, maximum amount, and permission end date, and they can cancel payments or revoke access to third-party providers at any time. By combining the advantages of direct debit and open banking payments, VRPs offer enhanced security, instant processing, and irrevocability.

Unlike one-off open banking payments that require individual validation, VRPs rely on a validated mandate to initiate a series of open banking payments at the defined frequency until the end of the mandate. This innovative payment method streamlines the payment process for consumers and provides them with greater control and convenience.

How VRPs are Transforming the Payments Industry

In the UK, the Competition and Markets Authority (CMA) mandated nine banks, known as the CMA9, to implement a VRP open banking API. This move aims to facilitate fund sweeping from a customer's current account to other accounts, making it easier for individuals to manage their finances effectively.

VRPs are poised to bring additional innovations to the realm of variable recurring payments, potentially transforming how consumers pay their bills and how merchants secure their payments.

What is Sweeping?

The sweeping process, facilitated by Variable Recurring Payments (VRPs), revolutionizes money management by enabling automated fund transfers between linked bank accounts. With sweeping, customers can effortlessly move funds from their current account to savings or loan accounts, optimizing their financial resources.

What are the Benefits of Sweeping?

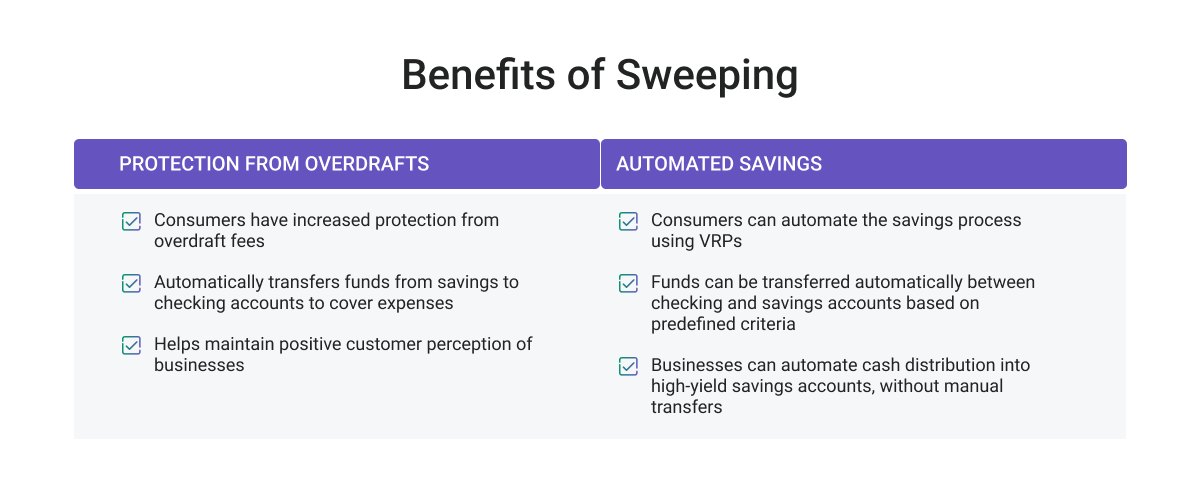

Sweeping offers more than simple transfers. Through VRPs, third-party payment providers can establish parameters for effective money management.

Customers have the flexibility to set maximum spending limits in their current accounts, with any excess funds automatically redirected to accounts with higher interest rates or investment portfolios. This automated process empowers individuals to optimize their financial goals and yields.

Moreover, sweeping serves as a preventive measure against overdrafts. Triggers can be set to "parachute" funds from other accounts, maintaining a positive balance in the current account and safeguarding against potential financial shortfalls.

By leveraging VRPs and the sweeping process, individuals can streamline their money movements, reduce manual efforts, and enjoy greater control over their financial well-being. The convenience and automation offered by sweeping through VRPs make it an invaluable tool in modern personal finance management.

VRPs Use Cases

As it stands today, VRPs have only been released in the UK, which is typically 12-18 months ahead of the EU. This gap is slowly closing as the rest of Europe catches up and implements the technology, but for the moment, the UK is the reigning champion in open banking innovation.

The first use case addressed using VRP was sweeping, which was released in July 2022 across the nine largest banks in the UK. Also called ‘me-to-me’ payments, sweeping allows the automatic transfer of money between two accounts that belong to the same person.

Opportunities for Non-Sweeping Variable Recurring Payments

While the CMA9 banks are not required to offer non-sweeping VRPs, there are significant opportunities for businesses and consumers to benefit from these payment services. Non-sweeping VRPs can assist in various ways, including:

Managing Regular Bills: Non-sweeping VRPs can streamline the process of managing regular bills, such as utility payments. By automating these payments, businesses and consumers can ensure timely and hassle-free bill settlements.

Subscription Service Management: Non-sweeping VRPs offer a convenient solution for managing subscription services. Customers can easily set up recurring payments for services like streaming platforms or membership subscriptions, ensuring uninterrupted access while providing businesses with a reliable payment method.

Simplifying Tax Payments: Non-sweeping VRPs can assist businesses in handling tax obligations more efficiently. By setting aside funds for taxes and VAT at the point of invoice collection, these payment services can simplify the process and help businesses meet their tax responsibilities accurately and on time.

Indemnity Claim Reduction: Direct Debit indemnity claims can be a source of headaches for businesses. Non-sweeping VRPs offer an alternative method that eliminates the complexities associated with indemnity claims. By leveraging these payment services, businesses can mitigate risks and streamline their payment processes.

Although not mandated, non-sweeping VRPs present promising opportunities for businesses and consumers to enhance financial management, simplify payments, and improve overall efficiency in various aspects of their financial transactions.

Benefits of VRPs for Merchants

Enhanced Fraud Protection and Payment Success: With Variable Recurring Payments (VRPs), there is required strong customer authentication (SCA), significantly reducing the risk of fraud and minimizing the occurrence of failed payments. This secure payment method ensures a lower risk of fraudulent transactions, providing merchants with peace of mind.

Cost Savings: VRPs utilize open banking payments, bypassing traditional card schemes like Visa and Mastercard that impose high interchange fees. By leveraging open banking technology, merchants can enjoy reduced costs associated with payment processing, contributing to improved profitability.

Efficient and Irrevocable Payments: Open banking payments used in VRPs offer account-to-account transactions that are irrevocable and cannot be contested. This means that merchants receive payments directly into their accounts, eliminating disputes and ensuring a seamless payment experience.

Benefits of VRPs for Consumers:

Enhanced Security: VRPs utilize open banking technology, which enforces strong authentication protocols and eliminates the need for consumers to enter sensitive card or account numbers. This heightened security feature protects consumers from fraudulent activities and safeguards their financial information.

Optimized User Experience: VRPs offer a fast, convenient, and user-friendly payment experience. Consumers have complete control over their recurring payments, enabling them to easily manage their financial commitments without the hassle of manual payment processes.

Effective Financial Management: Through sweeping, consumers can effortlessly save money at advantageous rates and protect themselves from overdraft fees. VRPs provide consumers with the flexibility to automate savings and effectively manage their finances, promoting sound financial practices. By using VRPs, many consumers can reduce late payments and collection time.

What Businesses can use Recurring Payments?

Recurring payments are a versatile solution that can benefit a wide range of businesses across different industries. Many types of businesses can leverage recurring payments to streamline their revenue collection and provide convenience to their customers.

Subscription-based services, such as streaming platforms, software-as-a-service (SaaS) providers, and membership-based organizations, can utilize recurring payments to automate the billing process and ensure a seamless customer experience.

E-commerce businesses can implement recurring payments for subscription boxes, product subscriptions, or installment payment options, offering flexibility and convenience to their customers.

Additionally, professional service providers and membership based businesses, such as consultants, fitness studios, and maintenance services, can use recurring payments to establish ongoing billing arrangements with their clients.

By incorporating recurring payments into their business models, businesses can enhance cash flow predictability, reduce administrative burden, and foster long-term customer relationships.

Increasing the Widespread Adoption of VRPs

Expand the Scope of VRPs to Drive Adoption

The adoption of Variable Recurring Payments (VRPs) can be driven by expanding beyond sweeping funds between accounts. Currently, VRPs are limited to sweeping payments between certain types of accounts, causing confusion and hindering trust among consumers.

To unlock the transformative potential of VRPs, providers, and banks need to enable commercial VRPs outside of sweeping, reducing costs for customers and minimizing friction for businesses.

Incentivize Banks to Promote and Embrace VRPs

Incentives should be provided to banks to promote VRPs more prominently, considering the growing presence of challenger banks and fintech companies that are not obligated to offer sweeping VRPs.

While the UK's financial ecosystem has expanded since the introduction of open banking, the CMA9 banks, which are required to provide sweeping VRPs, have little motivation to feature them prominently.

Regulators, providers, and early adopters should incentivize CMA9 banks to showcase sweeping VRPs and encourage other players to voluntarily adopt VRPs, thus driving broader adoption.

Emphasize Familiarity with VRPs

Spreading awareness and helping consumers feel familiar with the idea of VRPs as an improvement upon existing payment methods can help overcome hesitations and make customers more receptive to their benefits, such as faster settlement speeds and a better user experience compared to card-on-file and direct debit payments.

Positioning VRPs as a logical progression from existing payment practices can remove potential fear factors. By highlighting the quality and enhancements VRPs bring to familiar payment processes, providers can make them accessible to customers who might otherwise be skeptical, ultimately driving greater acceptance and utilization of VRPs.

What's Next for VRPs?

We are only at the beginning of VRPs, and the possibilities for their future applications extend far beyond sweeping. VRPs hold the potential to enable transfers between accounts owned by different individuals or businesses, catering to various use cases including e-commerce and more. In the future, VRPs could coexist with or even replace other forms of recurring payments. They have the potential to streamline the payment processes for a wide range of typical recurring expenses, such as:

- Household bills (electricity, gas, etc.)

- Insurance policies

- Streaming services like Spotify or Netflix

- Transportation-hailing apps like Uber or Lyft

- Investment services

As the evolution of VRPs continues, we can expect to witness their integration into diverse sectors, enhancing convenience and efficiency in everyday financial transactions.

How VRPs Solutions Can Empower Financial Institutions

It is crucial for banks and financial institutions to recognize Variable Recurring Payments (VRPs) as an incredible opportunity to empower their customers. By embracing VRPs, banks can position themselves as key players in their customers' financial lives, going beyond being mere custodians of funds.

Looking ahead, VRPs have the potential to reshape the payments ecosystem, refocusing it on customers and their digital wallets. Financial institutions need to strategize and innovate to ensure they remain at the forefront of customers' minds. It is essential for firms to consider how they can effectively deploy VRPs and explore the opportunities they present.

If you would like to dive deeper into the details of VRPs or learn how your institution can effectively implement them, reach out to Softjourn today. Our specialists can guide you through the important initial steps and help you leverage the power of VRPs.