In response to the growing demand for faster and more convenient payment options, the Federal Reserve has successfully launched FedNow, a modernization effort aimed at transforming the U.S. payment system.

Since its July 2023 launch, FedNow continues to transform the landscape of financial transactions, particularly within the fintech industry. As the real-time payment system matures in 2026, this guide examines the latest developments in FedNow's expansion, its implications for fintech innovation, and the evolving future of instant payments in the U.S.

Drawing on expert insights, we discuss the system's current impact and explore how fintechs can strategically leverage FedNow to maintain their competitive edge in this dynamic market.

Real-Time Payments vs ACH

In July 2023, FedNow shifted the U.S. away from decades of relying on the Automated Clearing House (ACH) system. Today's financial transactions demand immediacy that outpaces ACH's capabilities, despite its longtime effectiveness. FedNow delivers instant transaction processing, moving beyond same-day settlement to real-time completion.

What does ACH look like in comparison? ACH operates as a batch processing system that facilitates electronic transactions between bank accounts—direct deposit of paychecks, bill payments, and other transfers. However, ACH transactions typically take one or two business days to complete, creating delays and inconvenience for customers who need to make or receive payments quickly.

What are Real-Time Payments?

Real-time payments revolutionize money transfer by making funds available immediately; a stark contrast to ACH's one-to-two-day settlement. FedNow brings the U.S. in line with global standards, operating 24/7/365 to ensure transactions process seamlessly, securely, and instantly.

Real-time payment (RTP) rails are the networks that enable digital money to move instantly between parties, regardless of bank or location. FedNow now processes domestic U.S. payments around the clock with immediate settlement and instant fund availability.

The U.S. joined this movement relatively late. Japan pioneered RTP systems in the 1970s, followed by the UK, India, and China in the 2000s. Now, approximately 80 countries operate real-time payment systems.

North America is catching up: Canada's Real-Time Rail (RTR) entered its testing phase in fall 2025, with plans to launch a 24/7/365 instant payment system using ISO 20022 messaging—positioning Canada alongside the U.S. in modernizing regional payment infrastructure.

What are the Benefits of Real-Time Payments?

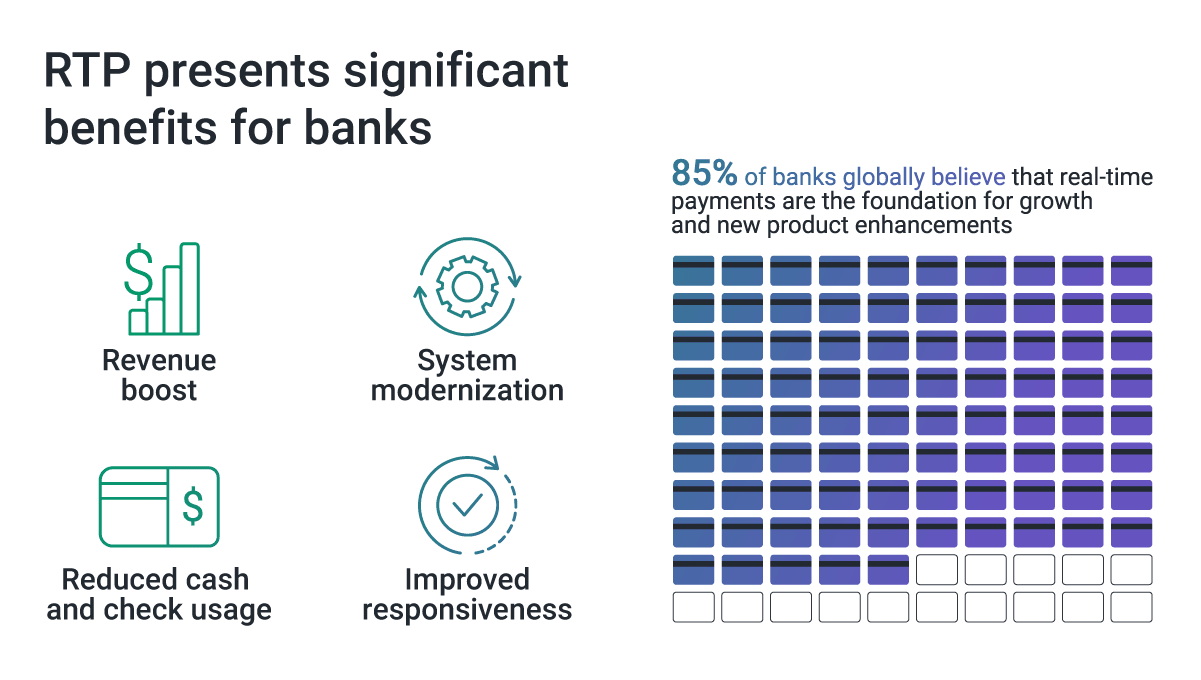

RTPs process payments within seconds: customers initiate a purchase and funds clear and settle immediately. Banks must maintain 24/7 backend systems to enable this speed while protecting against fraud.

Modern payment rails offer significant advantages over legacy systems. They enable two-way communication between payer and payee (unlike ACH's one-way flow), improving transparency and reducing errors. Their streamlined, open architecture lowers setup and operating costs while making payment-related business processes more efficient.

What is FedNow?

FedNow is the Federal Reserve's real-time payment system that enables direct, instant transactions between financial institutions of any size. Operating 24/7/365 with enterprise-grade security, FedNow serves as critical infrastructure for modern U.S. banking.

Unlike The Clearing House's RTP network, FedNow operates through the Federal Reserve's FedLine network, providing payment and information services to thousands of financial institutions. This includes secure electronic messaging and IP-based solutions that ensure broad accessibility across the banking system.

Nick Stanescu, FedNow's chief executive, noted in a 2025 PYMNTS interview that "Consumers and businesses want fast, convenient payments, and that demand is driving the growth."

How Does FedNow Work?

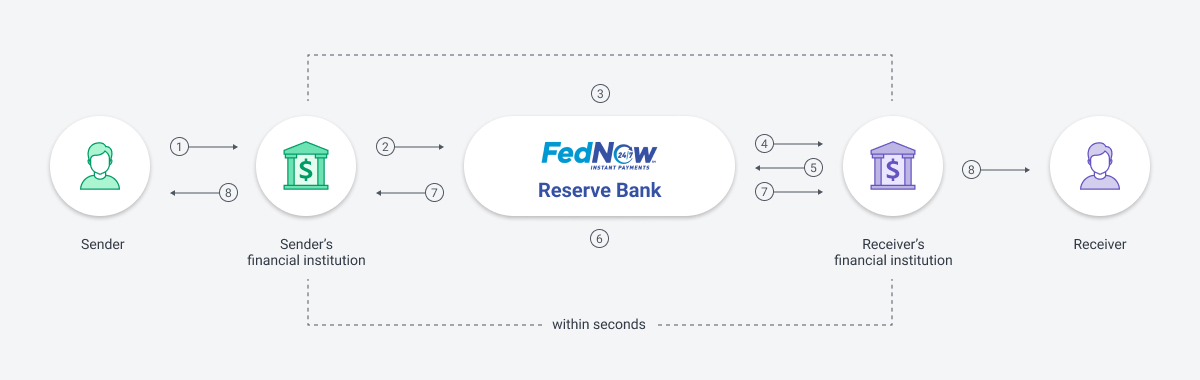

For end users, FedNow feels familiar. Customers log in to their bank accounts and initiate payments just as they always have. Financial institutions continue to provide the same security measures, payment screening, and account management, and the front-end experience remains unchanged.

The transformation happens behind the scenes. When a customer initiates a payment, FedNow acts as the intermediary between sending and receiving financial institutions. The system validates payment messages, debits the sender's account, and credits the receiver's account - all within seconds.

FedNow operates using the ISO 20022 messaging standard and works alongside other real-time payment systems like The Clearing House's RTP network. Currently, the service processes domestic U.S. payments only.

What is ISO 20022?

ISO 20022 is a globally recognized payment messaging standard that offers richer and more structured data during the payment process. Compared to other standards, ISO 20022 allows for about 10 times more data to be sent per payment. This additional data may include information about the payment's purpose, source, and ultimate beneficiary. This enhances the payment system's data structure, creating a common language and model for payment data worldwide.

However, building a new real-time product that meets all these requirements is complex, as it involves modernizing legacy systems. The US adoption of ISO 20022 has brought more focus on messaging and data for real-time payments within an international financial framework.

Launch Date and Early Adoption

Since launching in July 2023, FedNow has attracted hundreds of financial institutions, with participation continuing to grow. This momentum demonstrates the system's impact on payment processing.

Who Can Use FedNow?

FedNow serves both individuals and businesses of all sizes. The Federal Reserve caps individual transactions at $10 million - a dramatic increase from the $25,000 launch limit. This rapid escalation (reaching $500,000 within the first year, $1 million by mid-2025, and $10 million by November 2025) reflects growing confidence in the system's security and increasing demand for high-value use cases.

What are the Benefits of FedNow Payments?

FedNow delivers operational improvements across the payment ecosystem:

For financial institutions: Streamlined compliance processes, reduced transaction costs, and infrastructure for innovative services.

For merchants: Elimination of chargeback risks and immediate payment receipt, removing settlement delays.

For employees and consumers: Instant wage access and immediate fund availability, particularly valuable for underbanked communities that lack financial cushions for payment processing delays.

The system's real-time processing creates opportunities for fintech innovation, enabling more responsive, user-centric financial products.

Growth and Milestones of FedNow

FedNow has achieved substantial participation. By the end of 2025, approximately 1,500 financial institutions have joined the FedNow network, a faster adoption rate than The Clearing House's RTP network achieved in its early years. The network includes a wide range of institution sizes in all 50 states, from those with less than $500 million in assets to those with over $3 trillion.

Nick Stanescu, chief FedNow executive, said in an interview with PYMNTS that adoption has risen sharply. “We started with 35 institutions and now have more than 1,500,” he said. “Consumers and businesses want fast, convenient payments,” he said, and that demand is driving the growth.

As of 2026, FedNow continues expanding toward the Federal Reserve's goal of connecting roughly 8,000 of the nation's 10,000 banks and credit unions.

This growth trajectory exceeds initial projections, establishing FedNow as a major force in real-time payments. The Federal Reserve acknowledges that reaching universal adoption across all U.S. financial institutions will take time, similar to FedACH's gradual rollout in the 1970s and 1980s.1

Notably, some major U.S. banks—including Bank of America and Citigroup—have not yet joined the network, illustrating the challenges of achieving complete market penetration. However, PNC joined FedNow in October 2025, and Capital One followed by year-end. These additions signal growing momentum among major institutions that previously held back.

Mark Gould, the Federal Reserve’s chief payments executive, said, “For (FedNow) to fully reach its potential, we need every financial institution connected. We need businesses of all shapes and sizes to think about the opportunities that instant payments present and ultimately transform how payments are made.”

Challenges & Opportunities

FedNow's evolution demonstrates how initial barriers can transform into competitive advantages. When the system launched, its $25,000 transaction limit significantly restricted business use cases, particularly for corporate payments. Recognizing this constraint, the Federal Reserve increased the limit to $500,000 within the first year, and by 2026, it stands at $10 million—a threshold that accommodates most business-to-business transactions and opens the door for broader institutional participation.

This dramatic increase addresses one of FedNow's primary adoption barriers, making the system viable for corporate treasury operations, large vendor payments, and commercial real estate transactions. Financial institutions that previously hesitated due to transaction size limitations now have compelling reasons to join the network.

However, a significant structural challenge remains: FedNow and The Clearing House's RTP network operate as separate, non-interoperable systems. This fragmentation creates complexity for businesses and financial institutions that must choose between networks or integrate with both, potentially slowing the unified real-time payment ecosystem the U.S. needs to compete globally.

Despite this limitation, FedNow's strengths position it well for high-growth payment segments. The system excels in scenarios requiring immediate, irrevocable settlement—digital wallets, instant payroll, earned wage access, and consumer-to-business payments. For B2B transactions, real-time settlement delivers tangible working capital advantages, reducing the cash flow gaps that tie up corporate resources.

As FedNow's transaction capabilities expand and more institutions join the network, use cases continue to evolve beyond early adopter applications. The combination of higher limits, growing participation, and maturing infrastructure creates opportunities for innovative payment products that weren't feasible at launch.

Pricing and Fee Structure

In 2025, the Federal Reserve introduced significant pricing changes to accelerate FedNow adoption. The service now excludes fees for "on-us" transactions—payments sent and received within the same financial institution.

While maintaining the $0.045 fee for credit transfers, the Fed offered a discount for the first 2,500 monthly transactions and eliminated the $25 annual participation fee. These adjustments particularly benefit smaller institutions testing the platform and encourage higher transaction volumes among early adopters.

As of late 2025, the Federal Reserve has not yet announced FedNow's fee structure for 2026. However, given the strategic importance of expanding network participation, similar incentive-based pricing may continue.

For institutions evaluating FedNow implementation in 2026, monitoring the Fed's pricing announcements will be essential to accurate ROI calculations. Current participants should factor potential fee changes into their annual budgets and growth projections.

Multi-Rail Strategy Becomes Industry Standard

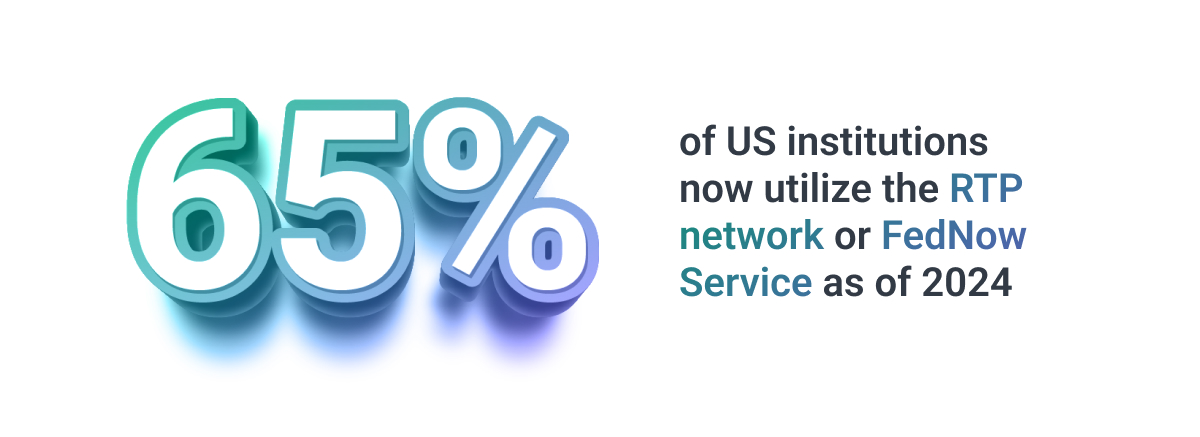

A significant shift has emerged in how financial institutions approach instant payments: 58% of U.S. banks that enable instant payments now use both the RTP network and FedNow Service. This multi-rail approach, once seen as a barrier to adoption, has become standard practice for ensuring network resilience and broader reach.

While 93% of banks report positive impacts from instant payments, only 62% are currently connected to real-time payment networks—though this number continues to rise. The multi-rail strategy addresses a key challenge: FedNow and RTP remain separate, non-interoperable systems, so institutions connecting to both can serve more customers and counterparties.

The coexistence of FedNow and The Clearing House's RTP network has created a competitive dynamic that benefits the industry. Jim Colassano, Senior Vice President of RTP product management at The Clearing House, noted that the two systems "will learn to differentiate our services such that we can gain competitive advantages... This will be healthy for the industry."

What Does FedNow Mean for Fintechs?

FedNow presents both immediate opportunities and ongoing limitations for fintech companies. Currently, fintechs must access the network through partner banks rather than connecting directly, a structure that adds complexity but hasn't prevented innovation.

Real-time settlement enables compelling use cases across the fintech ecosystem: instant supplier payments, same-day mortgage processing, immediate contractor payouts, faster bill payment services, and enhanced digital wallet functionality. Companies like Stripe, Wise, and emerging payment platforms can leverage FedNow through banking partnerships to deliver faster, more cost-effective services to their customers.

Consumer expectations are driving this urgency. Recent Federal Reserve research shows that 78% of consumers now choose faster payments as their preferred option, with 60% considering instant payment availability important when selecting a financial institution.

Business demand mirrors this trend: 66% of firms report they're likely to use instant payments if offered by their primary financial institution, and those already using instant payments show 10% higher satisfaction with their banks.

The Financial Technology Association (FTA) continues advocating for direct fintech access to FedNow, arguing that "broader entity access" would accelerate innovation and competition. While the Federal Reserve has not announced plans to expand access beyond depository institutions, the growing fintech influence on payment infrastructure keeps this possibility in ongoing discussion.

For now, the most practical path forward involves fintechs building technology layers on top of partner bank infrastructure. This "overlay" approach (where fintechs provide the user experience and product innovation while banks handle the FedNow connection) has proven effective for early adopters.

API-driven integration strategies, increasingly supported by participating banks, enable fintechs to access real-time payment capabilities without direct Fed membership.

Ready to Implement FedNow?

As real-time payments become table stakes for competitive fintech offerings, the question shifts from "should we integrate FedNow?" to "how quickly can we execute?"

Softjourn's payment infrastructure team helps fintech companies navigate FedNow integration—from partner bank selection and technical architecture through compliance and go-to-market strategy.

With nearly two decades of experience in payment systems modernization, we provide practical guidance tailored to your specific use cases and infrastructure. Contact our team to discuss your FedNow implementation roadmap.

How is Fraud Handled with Instant Payments?

The instant nature of FedNow transactions does not inherently increase fraud risk. On the contrary, it leverages advanced security measures to safeguard against unauthorized transactions, emphasizing the importance of user education and system integrity.

Instant payments and fraud are often discussed together, with the assumption that faster payments lead to more fraud.

This concern often overshadows a surprising reality: 91% of businesses currently use paper checks, which experience the highest fraud rates of any payment method according to the 2025 Association for Financial Professionals Payments Fraud and Control Survey.

FedNow participants have reported seeing minimal fraud on the network to date, with the system's built-in security measures and real-time validation providing stronger protection than traditional payment rails.

Additionally, Jim Colassano, the Senior Vice President of RTP product management at The Clearing House, said instant payments can be inherently safer than direct debit transitions when there are 'push' transactions.

While some people worry about the potential irreversibility of instant payments, the transactions are actually processed through secure bank rails, which are among the most secure payment channels in the world.

With real-time payments changing the game, banks must educate customers to think of instant payments like cash payments and act accordingly. To ensure even greater safety, some fintech companies are developing standard APIs to help financial institutions integrate with fraud providers.

Ultimately, banks and networks have an obligation to protect their clients, which includes educating them and providing additional layers of security.

Adoption Insights and Market Response

The integration of FedNow into the banking ecosystem not only heralds a new era of financial transactions but also reflects evolving expectations among businesses and consumers alike.

The post-launch period has been marked by a significant embrace of FedNow by the banking community. With over 1,500 financial institutions, including major players like Chase and Wells Fargo, now connected to FedNow, the system has established a significant presence across all 50 states and D.C. This growth, while impressive, still represents only a fraction of the nearly 10,000 banks and credit unions in the U.S., highlighting the vast potential for further expansion.

Elisa Tavilla, Director of Debit Payments at Javelin Strategy & Research, states, “There’s still a ways to go in getting the system to be ubiquitous and broadly adopted, similar to what we have with ACH today. I think broad uptake will be a gradual process.”

Participants in FedNow span an impressive spectrum, from smaller institutions to those with assets in the trillions. This diversity not only demonstrates FedNow's broad applicability but also its potential to revolutionize various facets of the financial sector.

Since going live in July 2023, FedNow has experienced a strong growth trajectory. The growth is reflected in transaction volumes: FedNow processed 2.1 million payments in Q2 2025, up 62% from the previous quarter, with an average payment exceeding $115,000. This resulted in an average daily value of $2.7 billion—an increase of more than 400% year over year.

Nevertheless, FedNow remains significantly smaller than RTP in absolute volume. RTP processed 1.18 million payments per day in Q2—roughly equivalent to FedNow's entire quarterly volume in just two days. Not to mention that RTP has a total daily value of $481 billion.

However, FedNow's growth trajectory remains strong. With the transaction limit now at $10 million and major banks continuing to join, the gap between the two networks is expected to narrow as use cases expand and network effects strengthen.

Global Lessons and Government-Driven Adoption

Brazil's PIX system offers instructive lessons for FedNow's expansion. Since launching in 2020, PIX has become the fastest-growing national RTP system, processing twice as many real-time transactions per capita as India's Unified Payments Interface.

PIX's success stems from three key decisions: mandatory participation for institutions with 500,000+ users, direct fintech access from day one, and government-mandated use for emergency benefit payments.

FedNow's approach differs—participation remains voluntary and fintech access is limited to bank partnerships—but the power of government adoption is now being realized.

In September 2025, the U.S. Treasury expanded its use of FedNow to include instant disaster relief disbursements through FEMA. CB&S Bank in Alabama became the first institution to receive an instant disaster relief payment, demonstrating the system's readiness for high-stakes government use cases.

Mark Gould, the Federal Reserve's chief payments executive, called it "a game-changer for individuals and businesses," especially in disaster or emergency situations where speed really matters to the recipient.

If expanded to other government disbursements like Social Security, tax refunds, or benefit payments, FedNow could achieve the widespread adoption that government mandates delivered for Brazil's PIX.

Market and User Feedback

The response from the early adopters of FedNow underscores the system's immediate impact, particularly in facilitating B2C transactions. Use cases such as earned wage access, loan funding, and insurance payouts have proven the value of instant payments, offering both businesses and consumers a new level of financial agility and satisfaction.

On the other hand, financial institutions still appear to be wary of the potential risks associated with instant payments, such as fraud and the disruption of traditional revenue streams. Addressing these concerns remains a pivotal challenge for FedNow's broader acceptance, especially in unlocking the potential of B2B transactions.

The Unexplored Potential in B2B Payments

B2B payments represent a significant untapped opportunity for FedNow. The ability to execute instant payments provides businesses with unprecedented control over their financial operations, enhancing the efficiency of vendor payments and invoicing processes. This shift could redefine the competitive landscape, offering a compelling alternative to conventional payment methods.

As FedNow continues to evolve, a strategic focus on overcoming institutional hesitations and broadening its application scope will be crucial. The system's expansion will depend on reinforcing its security framework and demonstrating the tangible benefits of instant payments, particularly to the business sector.

Now's the Time to Strategize for FedNow

FedNow’s journey from its launch to 2026 marks a significant advancement in the quest for a more efficient and secure payment system in the U.S. With growing participation and its potential to revolutionize both B2C and B2B payments, FedNow is poised to play a central role in the future of finance.

As we look to the future, now is the time for fintechs to strategize and integrate FedNow or real-time payments into their operations. The opportunities presented by real-time payments are vast, and those who act now will be best positioned to lead in this evolving industry. Don’t hesitate to reach out and get started!