The digital payments market has experienced remarkable growth, surpassing even the car manufacturing sector, and it is projected to reach a staggering value of $193 billion by 2029.

Introduction

This impressive expansion, with an annual growth rate of approximately 10 percent, can be attributed to a combination of technological advancements and shifting consumer expectations and spending patterns.

In today's rapidly evolving financial landscape, the payment card market is witnessing a significant transformation. Traditional payment card solutions are being challenged by disruptive technologies and innovative business models.

In order to thrive in this competitive environment, companies need to embrace disruption and become disruptors themselves. This article aims to provide insights and guidance on how to be a disruptor in the payment card market, driving innovation and staying ahead of the curve.

The Importance of Being a Disruptor in a Competitive Market

Disruptors in this industry aim to create new value propositions, redefine customer experiences, and reshape the market landscape. They often challenge established players by offering enhanced features, improved convenience, and cost-effective solutions that cater to the evolving needs and preferences of consumers.

Being a disruptor in the payment card market holds immense significance in a highly competitive landscape. Traditional payment card providers face the risk of becoming stagnant, losing market share, and falling behind the technological curve.

Disruptors, on the other hand, have the opportunity to differentiate themselves, capture new market segments, and create sustainable competitive advantages. By embracing disruption, companies can foster innovation, drive industry-wide progress, and position themselves as leaders in the evolving payment ecosystem.

Overview of the Payment Card Market Landscape

The payment card market is a dynamic and multifaceted industry that involves various stakeholders, including financial institutions, payment processors, technology providers, and consumers.

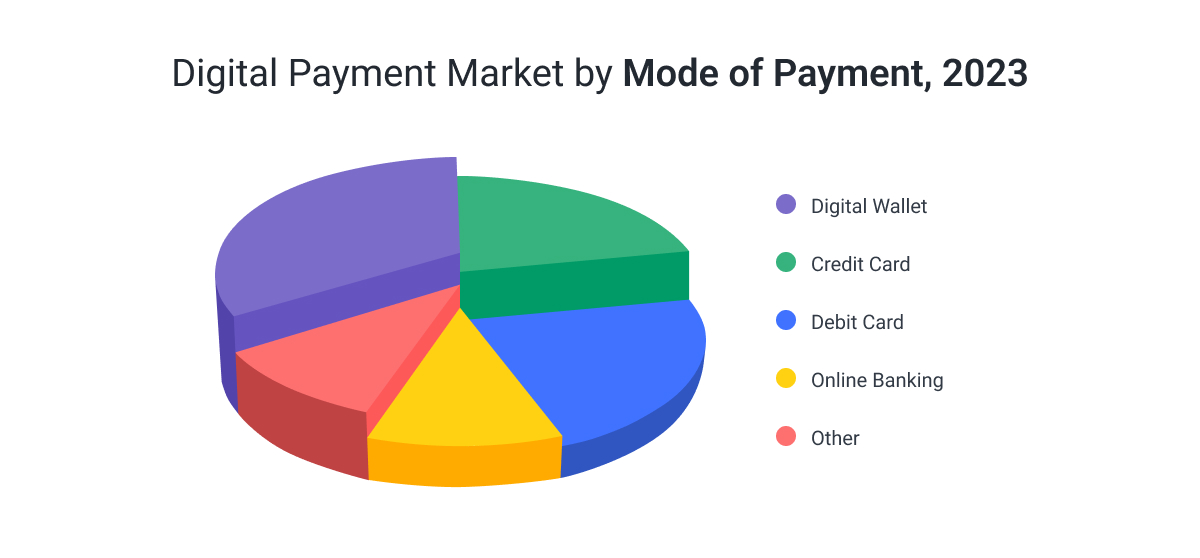

It encompasses a wide range of payment methods such as credit cards, debit cards, prepaid cards, mobile wallets, contactless cards, money transfer apps, and remittance apps.

This market has been witnessing significant growth, with the credit card market projected to reach $1.4 trillion by 2030 at a CAGR of 8.7% from 2025 to 2034. The global money transfer services market is also expected to increase from $36.35 billion in 2024 to approximately $79.18 billion by 2029.

Recognizing the importance of innovation and disruption, companies can position themselves as leaders in shaping the future of financial transactions. In the following sections, we will dive into the strategies and steps required to become a disruptor in this competitive payment card market.

Understand the Market

Current Trends and Emerging Technologies

To become a disruptor in the payment card market, it is crucial to stay informed about the latest trends and emerging technologies. Conduct thorough research to identify advancements that have the potential to reshape the industry.

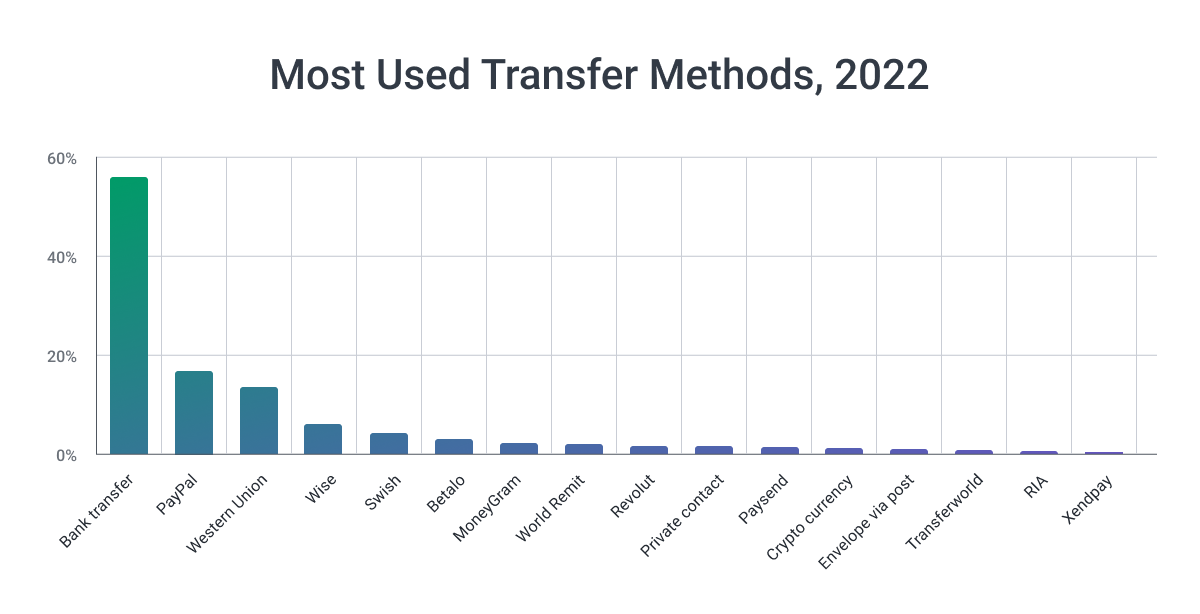

Some of the top payment developments we've been keeping our eye on in 2026 are in areas such as mobile payments, blockchain, biometric authentication, and artificial intelligence. Since the pandemic, we've witnessed a growing trend of contactless payments, an increasing preference for secure payment options, and a desire for faster, cheaper, and safer international money transfers.

Understanding these trends will provide valuable insights into the direction the market is heading and the opportunities that exist for disruption.

Trends in the payment cards industry in 2026 include:

- hyper-personalized payment experiences based on purchase history and user behavior;

- account-to-account (A2A) payments reducing transaction costs by up to 30%;

- real-time payment infrastructure (FedNow, RTP, SEPA Instant) enabling instant settlements;

- Variable Recurring Payments (VRPs) for automated subscription management;

- digital wallets as default payment interface for Gen Z and Millennials;

- biometric authentication (fingerprint, facial recognition, behavioral patterns) replacing passwords;

- AI-powered fraud detection analyzing transactions in real-time;

- BNPL embedded directly in checkout flows across e-commerce and retail;

- post-quantum cryptography preparation to defend against future threats;

- homomorphic encryption enabling computation on encrypted data;

- tokenized asset payments for cross-border settlements;

- Earned Wage Access (EWA) platforms for gig economy instant payouts;

- contextual and embedded payments invisible within user experiences;

- multi-modal authentication combining physiological and behavioral biometrics;

- payment orchestration platforms intelligently routing across multiple rails;

- digital identity integration (driver's licenses, credentials) within wallets.

Pain Points and Challenges Faced by Customers

Disruptors excel at addressing pain points and challenges faced by customers. Conduct extensive market research and engage with potential customers to identify their frustrations and unmet needs when it comes to payment card solutions.

Common pain points may include high transaction fees, limited acceptance, security concerns, complex user experiences, transfer fees, and a lack of personalized features.

By identifying these pain points, disruptors can tailor their solutions to solve real problems and offer a superior customer experience.

Analyze Existing Payment Card Solutions and Their Limitations

To disrupt the market, it is essential to understand the strengths and weaknesses of existing payment card solutions. Analyze the offerings provided by traditional card networks, financial institutions, and fintech companies.

Evaluate their features, pricing models, security measures, and user experiences. Identify the limitations and areas where improvement is needed. This analysis will enable disruptors to identify gaps in the market and develop innovative solutions that address these shortcomings, differentiating themselves from existing players.

Innovative Product Development

Identify Gaps in the Market and Unmet Customer Needs

To be a disruptor in the payment card market, it is crucial to identify gaps in the market and understand unmet customer needs. Recognize the preferences and demands of the Millennial and Gen Z demographics, who are driving digital innovation and embracing smart device payments and virtual cards.

These more tech-savvy generations seek tailored financial products that offer seamless and intuitive experiences through their smartphones.

Customer-Centric Approach

To meet the evolving needs of the modern payment landscape, it's important to create customer-centric offerings and align your product development with market trends and customer expectations.

To adopt a customer-centric approach, segment your target audience and gain a deep understanding of their preferences and behaviors. Recognize the unique needs and expectations of different customer groups, such as the Millennial and Gen Z demographics, and tailor your payment card features and experiences accordingly.

We recommend you do this by emphasizing a mobile-first approach, considering the widespread ownership of smartphones and the increasing reliance on mobile platforms for various transactions. Take inspiration from successful examples like Amazon or Stripe, ensuring that your payment card platform provides clarity, transparency, and a user-friendly experience.

Not only does the convenience of digital transactions attract younger generations, but as an age group deeply concerned with environmental issues, Gen Z and Millennials will often find themselves seeking out alternatives that negate environmental damage, and digital solutions help in the reduction of plastic waste.

ABI Research reveals that the annual production of banking cards utilizes plastic equivalent to that found in 80 Boeing 747 planes. Additionally, the carbon footprint generated from this production is comparable to the emissions resulting from 300,000 passengers traveling from New York to Sydney.

No matter which types of solutions you'd like to develop, we advise that you engage with your target audience and users through surveys, focus groups, or user testing sessions to gather valuable input. By understanding their pain points, desires, and suggestions, you can better improve the user experience and address their specific needs effectively.

Explore New Technologies and Payment Card Features

Exploring new technologies and payment card features is essential. With the rise of alternative payment cards and the increased adoption of digital payments, it is vital to leverage technological innovation to provide customers with a wider range of choices. Consider incorporating features that align with the preferences and expectations of the target audience, such as mobile-first experiences, intuitive navigation, and transparency in transfer fees.

Develop a Unique Value Proposition

Create a payment card that addresses the needs of the unbanked and underserved populations, particularly among younger and lower-income households. Focus on affordability, security, and convenience, offering services that cater to their financial requirements.

Additionally, consider the gig economy and the role of payment cards in facilitating timely payments for contract workers. Offering innovative solutions at an affordable price point will unlock opportunities in this evolving market.

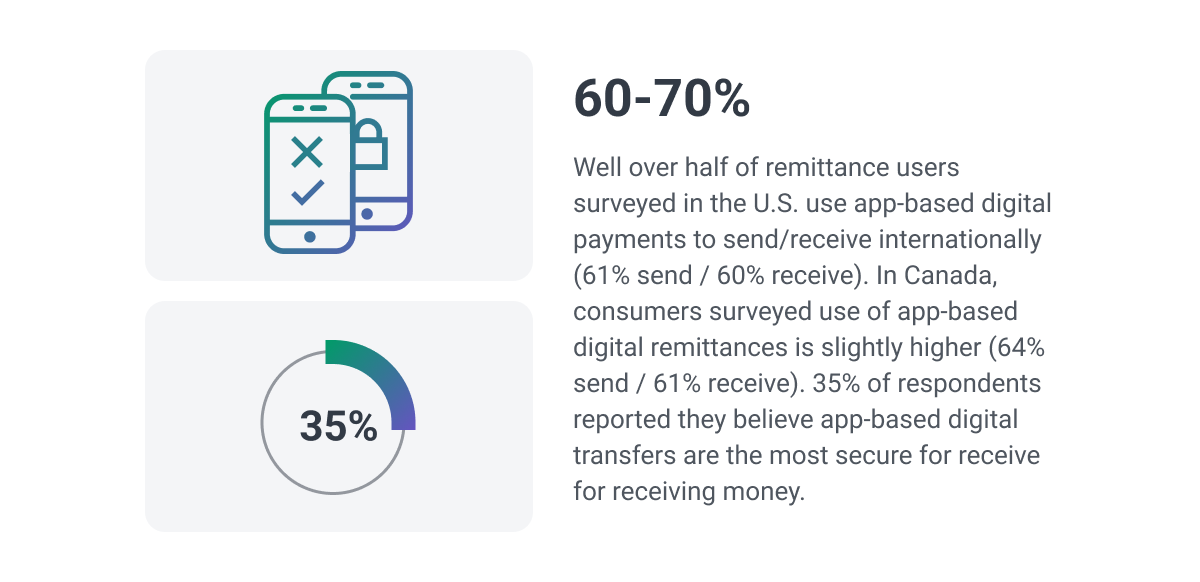

For example, with the growing trend of people sending money abroad, developing remittance features or a money transfer app might be a great way to set your business apart. According to Visa’s Money Travels: Digital Remittances Adoption Report, 63% of Americans send money abroad at least once a year, while 57% of respondents receive remittances from overseas. Similarly, in Canada, 64% of respondents send money abroad at least once a year, while 52% receive remittances.

The survey also found that 30% of U.S. consumers and 28% of Canadian consumers intend to use digital remittances more frequently in the future.

Monitor and Adapt

To thrive as a disruptor in the payment card market, we advise clients to embrace a mindset of monitoring, adapting, and continuous improvement. Stay vigilant by closely monitoring market trends and keeping a watchful eye on your competitors' activities. This will enable you to identify emerging patterns, anticipate shifts in customer preferences, and proactively respond to market dynamics.

Additionally, collecting and analyzing customer feedback is invaluable for ongoing improvement. Listen attentively to your customers, gather their insights, and use that feedback to refine and enhance your payment card offering. By actively adapting to the evolving needs and expectations of your target audience, you can stay ahead of the competition and maintain a competitive edge.

Collaborate with Partners

By forging strategic partnerships and leveraging the expertise and resources of technology providers and financial institutions, you can enhance your payment card solution and position yourself as a disruptor in the market.

Collaboration allows you to leverage complementary strengths, expand your customer base, and offer innovative features that differentiate your offering from competitors. Here are a few collaborative strategies we recommend.

Identify Potential Strategic Partnerships in the Industry

To improve your odds of becoming a disruptor in the payment card market, it is crucial to identify potential strategic partnerships within the industry. Look for opportunities to collaborate with established players, innovative startups, or niche service providers that can complement your offering and expand your market reach. Seek partnerships that align with your goals and target customer segments, creating synergies and shared value.

Create Mutually Beneficial Relationships to Enhance Your Offerings

Establish clear communication channels, align on strategic objectives, and work collaboratively to deliver value to customers. Explore joint marketing initiatives, co-development opportunities, and shared resources to maximize the impact of each potential partnership.

We advise businesses to regularly evaluate and refine the partnership to ensure it remains aligned with the evolving needs of the payment card market and delivers sustainable growth for both parties.

Leverage Technology Providers and Financial Institutions

Partnering with experienced technology providers can be instrumental in enhancing your payment card solution. By collaborating with industry leaders, you can leverage their cutting-edge solutions, expertise, and insights to incorporate innovative features into your offering.

Softjourn has deep experience in software development and tech consultancy in the payments industry and can help you unlock the potential of your payment card solution.

We can help the following innovative features into your current or future offering:

- Cryptocurrency support: Capture the growing demand for digital currencies by enabling cryptocurrency transactions on your payment card platform or money transfer app.

- AI-based fraud detection: Enhance security measures with advanced artificial intelligence algorithms that detect and prevent fraudulent activities, ensuring the safety of your customers' transactions.

- Voice-based transactions: Stay at the forefront of technology by enabling voice-activated payments, providing a seamless and convenient experience for your users.

- Biometric authentication: Increase security by integrating biometric authentication methods like fingerprint or facial recognition, ensuring secure and frictionless transactions.

- Social media integration: Attract tech-savvy customers by integrating social media features, allowing them to easily connect their payment cards with their social accounts.

- Incorporation of financial management software: Empower your users with comprehensive financial management tools that enable them to track and manage expenses, budgets, and savings within your payment card ecosystem.

- Variable recurring payments: Simplify bill payments and subscription services by enabling seamless variable recurring payments, offering convenience and peace of mind to your users.

- International remittance: Facilitate cross-border transactions with ease, allowing users to send and receive funds internationally at competitive rates by developing a money transfer app.

- P2P cross-border transfer apps: Develop peer-to-peer payment applications that enable secure and instant money transfers across borders, meeting the needs of global customers.

- Wire transfers: Expand your payment card capabilities by incorporating reliable and efficient wire transfer functionality, catering to users who prefer traditional banking methods.

- Cloud Migration: With 40% of money transfer apps still not on the cloud, set yourself up for success by making the move to the cloud and take advantage of all the benefits cloud computing can offer for payment card systems.

Partnering with Softjourn will enable you to create an innovative payment card solution that sets you apart from the competition, drives customer satisfaction, and propels your business toward success.

Contact us today to discuss how their partnership can revolutionize your payment card offering.

Regulatory Considerations

By prioritizing regulatory considerations, including staying updated on regulations and implementing robust data security measures, you can navigate the complex regulatory landscape and position yourself as a trusted and compliant disruptor in the payment card market.

Compliance not only protects your business but also instills confidence in your customers, contributing to long-term success and sustainable growth.

Stay up to Date With Relevant Regulations

It is crucial to stay up to date with the ever-evolving landscape of regulations and compliance standards. The payment industry is highly regulated, and understanding and adhering to these regulations is essential for maintaining trust with customers and avoiding legal pitfalls.

Stay informed about regional, national, and international regulations that govern payment card transactions, including consumer protection laws, anti-money laundering (AML) regulations, and data privacy regulations.

Ensure Data Security and Privacy Measures are in Place

Data security and privacy are paramount in the payment card industry. Safeguarding customer information and transaction data is not only a legal requirement but also a crucial aspect of maintaining customer trust.

Implement robust data security measures, encryption protocols, and secure authentication processes to protect sensitive information. Consider the latest security technologies and best practices to proactively mitigate security risks and ensure the integrity of your payment card system.

Conclusion

Becoming a disruptor in the payment card industry requires a combination of innovation, customer focus, and strategic partnerships. Aspiring disruptors should take action, seize opportunities, and partner with experienced software developers to bring their ideas to life faster.

By fostering a culture of innovation and focusing on customer needs, businesses can position themselves as disruptive forces, driving positive change and redefining the payment card industry. The time to disrupt is now, so let your ideas flourish and embark on the journey of transforming the payment card landscape.