Any business that spends money—on travel, software, meals, or mileage—needs a way to track, manage, and control those expenses. That’s what expense management is all about.

But there's more to it than receipts and spreadsheets. Modern expense management solutions help businesses save time, enforce policy, and get real-time visibility into spend. And when it comes to T&E—short for travel and expense—things get even more complex.

Whether you're a finance leader, operations manager, or building tools for these teams, understanding how expense management works (and where it's headed) is critical.

What Is Expense Management?

Expense management is the process of tracking, approving, reimbursing, and reporting on business-related expenses. This includes everything from employee travel costs to client lunches to SaaS subscriptions.

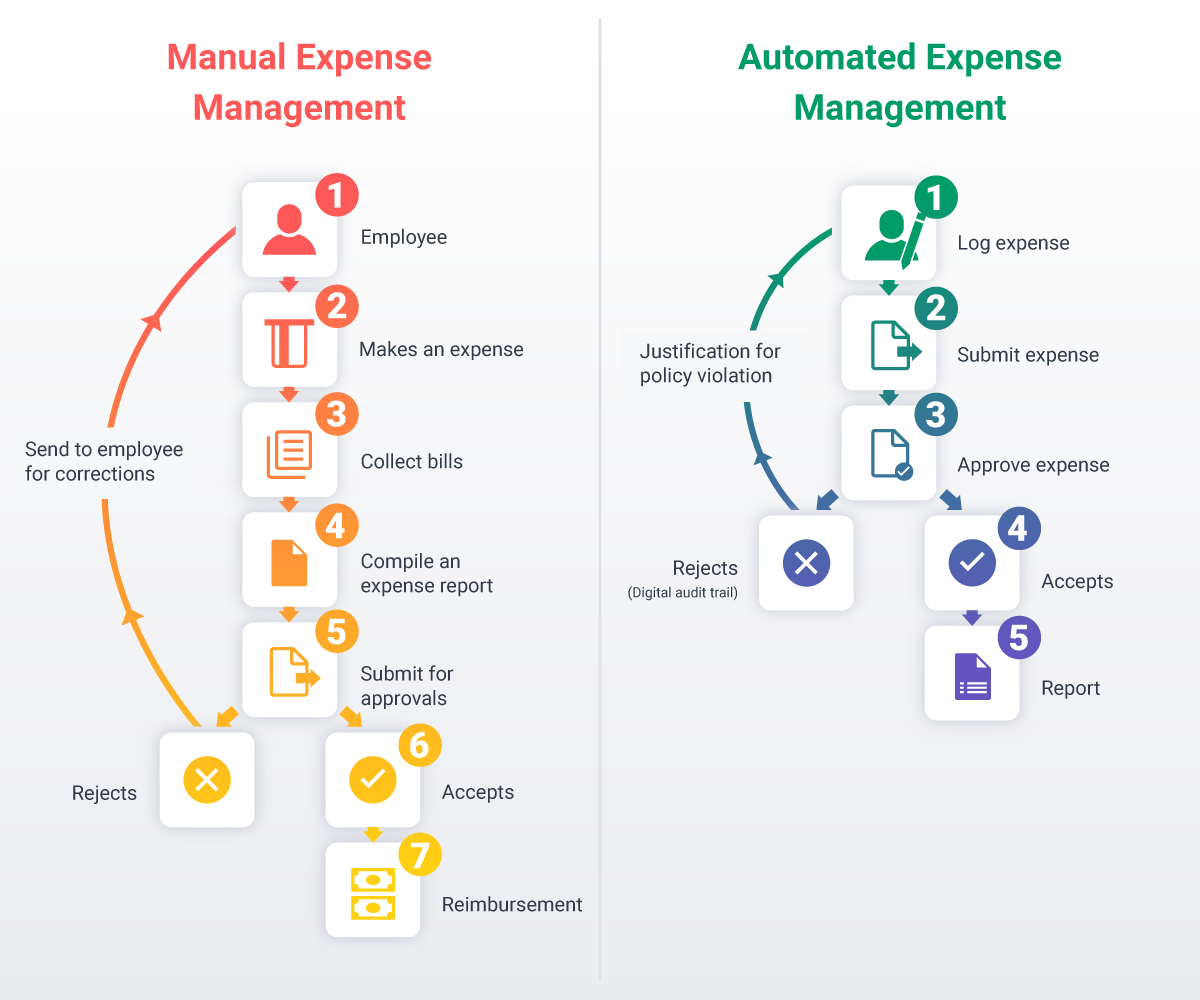

It covers the full lifecycle of a business expense:

- A purchase is made

- A receipt is submitted

- A manager approves it

- Finance reimburses it (or reconciles a company card)

- The expense is logged for accounting and tax purposes

Companies used to manage this with spreadsheets and paper receipts. Today, automated expense management tools allow for faster processing, better controls, and smarter decision-making.

What Does T&E Mean?

T&E stands for Travel and Expense—a category of expenses that typically makes up the largest portion of variable spending for many companies.

T&E includes:

- Airfare and lodging

- Meals and per diems

- Mileage and ground transportation

- Conference fees or client entertainment

Because T&E spending often happens outside the office and is driven by employees, it's harder to control without the right systems. That’s why T&E management is often a core focus for finance teams.

Why Traditional Expense Management Falls Short

For many companies, expense management still means spreadsheets, email threads, and paper receipts. That might work for a five-person startup, but once you have multiple teams, locations, and spend categories, the cracks start to show—fast.

Manual processes slow everything down. Employees waste time tracking receipts, managers get bogged down in approvals, and finance teams spend days chasing missing data. On top of that, there’s limited visibility. By the time leadership sees a report, the spending has already happened—and fixing issues after the fact becomes damage control.

Common pain points with traditional methods include:

- Policy violations that go unnoticed until it's too late

- Delayed reimbursements, which frustrate employees and hurt morale

- Higher risk of fraud, whether it’s accidental misuse or intentional abuse

- Duplicate or incomplete data that leads to accounting errors

- Lack of visibility across departments or geographies

These aren’t just operational annoyances—they’re risks to your bottom line and employee experience. In a time where speed and accuracy matter, old-school expense management holds businesses back.

How Modern Tools Are Changing Expense Management

Modern businesses can’t afford to manage expenses the way they did ten years ago. The combination of hybrid work, rising employee expectations, and pressure to cut costs has forced companies to upgrade from outdated, manual processes. That’s where automated expense management tools come in.

These platforms don’t just digitize receipts—they streamline the entire workflow. From mobile apps that scan and categorize expenses automatically, to real-time dashboards that track spend by department, they reduce admin time, enforce company policy, and give finance teams the visibility they need to make smart decisions.

Some key features include:

1. Mobile Receipt Capture

Mobile receipt capture with OCR (optical character recognition) to reduce data entry errors

How We Did It: We helped our client introduce biometric authentication and photo-based receipt validation - cutting down on fraudulent submissions and strengthening their audit trail without adding extra admin burden.

2. Corporate Cards

Corporate card integration that syncs transactions in real-time and flags mismatches

How We Did It: Softjourn helped a client address this by introducing validation and data consistency checks using automation scripts. The result was a noticeable drop in expense report errors and cleaner records for audits.

3. Automated Approval

Automated approval workflows that follow policy logic (e.g., auto-approve under $50, escalate over $500)

How We Did It: One of our clients faced constant frustration from employees waiting on manual reimbursement processes. Human error and bottlenecks were common. We implemented an auto-approval workflow where expense rules could be customized down to the department, date, and transaction type. Managers can now set automatic approvals under certain conditions—saving hours per week and reducing friction for employees.

4. Policy enforcement

Built-in policy enforcement that notifies employees of violations before submission

How We Did It: A Softjourn client used custom rule-building functionality to automatically alert users before submitting non-compliant expenses. This shifted compliance from reactive to proactive and reduced violations.

5. Real-time Analytics

Real-time dashboards and analytics that help finance teams spot trends, outliers, and compliance issues

How We Did It: Softjourn integrated Power BI for a client to provide department-level spend dashboards. This business intelligence solution gave leadership real-time views across regions and departments, replacing outdated monthly reports and eliminating blind spots.

These tools are no longer “nice to have”—they’re becoming standard infrastructure for any company that wants to control spending and scale efficiently.

.jpg)

Spend Management vs Expense Management: What's the Difference?

While the terms are often used interchangeably, there’s a key distinction:

- Expense management focuses on tracking and reimbursing employee-initiated purchases (like T&E).

- Spend management is a broader term that includes all types of company spend—vendor payments, procurement, subscriptions, and more.

Think of expense management as one piece of the larger spend management puzzle. While expense management typically focuses on employee-initiated purchases, spend management takes a broader view—one that includes procurement, vendor payments, and strategic sourcing. It’s a company-wide view of how money moves, not just a workflow for reimbursement.

Expense management is often the entry point, but many businesses evolve toward unified spend systems as they scale. Many modern platforms aim to unify both under one system, helping companies gain full control over how money moves across the business.

Our client, PEX, for example, started by managing employee expenses but expanded into broader spend controls across departments and vendors—powered by a flexible microservices architecture built with Softjourn. They now offer a full spend platform with rules for card usage, bulk job execution, and integration with accounting software.

Who Uses Expense Management Tools?

These systems aren’t just for the finance team. A good expense management solution supports everyone involved in the spend lifecycle:

- Employees submit expenses via app or card

- Managers approve (or reject) requests

- Finance and accounting audit, reimburse, and reconcile

- IT/Admins ensure systems are secure and compliant

Because so many roles touch expense systems, good UX and real-time data are no longer optional—they’re required. One platform Softjourn worked with saw a drop in support tickets after improving mobile UI and automating receipt capture.

That’s why intuitive UX, real-time data, and flexible policies matter more than ever.

Why This Matters

Expense management might seem like a back-office function, but it affects nearly every part of the business. How companies track and control spend directly impacts cash flow, compliance, employee satisfaction, and even company culture.

When employees feel confident that reimbursements will be timely and fair, they’re more likely to travel, host clients, and act in the company’s interest. When finance has real-time data, they can make smarter decisions, identify trends early, and adjust course before things go off-track.

Take a Softjourn client, for example: after introducing auto-approval rules and spend caps, within three months they saw a reduction in policy violations and an increase in expense report accuracy. That kind of operational gain adds up quickly.

If you're running a business, investing in modern travel and expense management isn't just about saving time—it’s about gaining control and visibility over how your company spends money. If you're building the tools behind these systems, your clients are counting on you to solve real problems: fragmented workflows, poor UX, policy headaches, and more.

Where Expense Management Is Headed

The next generation of expense management is smarter, faster, and more predictive. It’s not just about recording spend after it happens—it’s about preventing bad spend before it happens, and guiding employees in real-time.

Expect to see AI-powered auditing that automatically flags suspicious submissions based on behavioral patterns, not just dollar amounts. Card-linked policies will become the norm, with spend controls built directly into payment methods—meaning employees can only spend within pre-approved limits. Additionally, real-time spend alerts will allow finance teams to catch and correct issues before the end of the month.

Emerging trends also include:

- Integrations with travel booking tools to streamline T&E before the trip even starts

- Automated tax compliance for international teams (VAT/GST detection and reconciliation)

- Employee-centric UX that makes submitting an expense as easy as taking a photo or tapping a card

- Predictive spend analysis that forecasts future expenses based on past behavior

Forward-thinking platforms are already integrating features like Elasticsearch and Microsoft Power BI to turn raw data into actionable insights. One Softjourn client used Elasticsearch to upgrade their reporting infrastructure—helping their users surface historical spend patterns across departments in seconds. That kind of capability isn’t just a nice-to-have—it’s become nearly essential.

With tools like automated VAT compliance, biometric authentication, and dynamic policy controls, expense platforms are rapidly becoming essential infrastructure for scaling businesses.

Ultimately, the goal is to move from reactive to proactive spend management—where the system helps people make better decisions in the moment, not just explain what happened after the fact.

Final Thoughts

Expense management isn’t just back-office busywork. It’s a core business function that impacts your bottom line. Whether you’re trying to control employee T&E or manage company-wide spend, the right tools—and the right strategy—can make all the difference.

If you’re looking to implement or improve your expense management solution, partnering with the right experts is essential.

We know this space inside and out because we’ve helped build the tools shaping its future. If you're looking to modernize your platform or solve complex problems for your customers, we’d love to help. Contact us to get started.