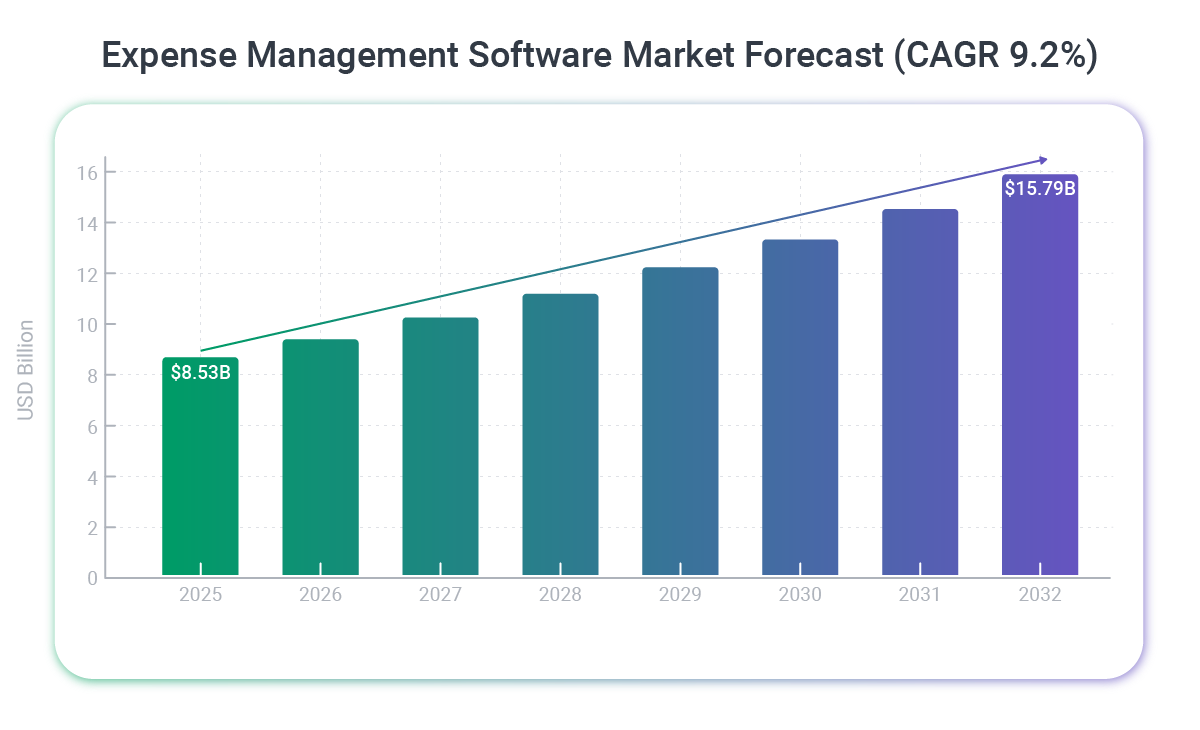

The global expense management market continues its rapid expansion. According to Research & Markets, demand for expense management solutions hit $8.53B in 2025, and is expected to reach $15.79 billion by 2032, reflecting the increasing adoption of advanced automation and compliance capabilities across industries.

For expense management providers, this incredible growth represents both opportunity and pressure. While there are openings in the market, your clients' needs are evolving faster than ever, and buyer expectations are rising in tandem.

For expense management providers to stay competitive in 2026, you’ll need to understand both what your clients are struggling with and where the market is heading. These aren't separate conversations.

For this comprehensive forecast, we interviewed professionals from expense management platforms. We combined their perspectives with implementation data from our extensive project portfolio to identify the trends that will define competitive positioning in 2026.

At Softjourn, we've spent over 15 years partnering with industry leaders in expense management, from established platforms to emerging innovators. Through dozens of successful projects spanning mobile app development, AI automation and rule creation, cloud migrations, and advanced analytics solutions, we've gained unique insights into where this industry is headed.

First, we will explore trends that expense management professionals predict for 2026, and then we will outline five major challenges affecting the industry to address in the coming year. Let’s start with trends.

The Trends Shaping 2026

Trend 1: AI is the Expectation, Not a Differentiator

If you're still positioning AI as a future capability or pilot feature, you may have already lost. In 2025, finance teams crossed an inflection point. They stopped asking "Can we trust AI?" and started asking "How fast can we scale it?"

David Stifter, Founder and CEO of PredictAP, witnessed this shift firsthand:

"What surprised me most was the speed of adoption," he explains. "After years of talk about digital transformation, 2025 was the year we saw finance teams truly embrace AI—not as a pilot project, but as a core operating model. That's a massive inflection point for the industry and a clear signal that AI-driven expense management has crossed the maturity threshold."

With buyers now expecting 95%+ categorization accuracy and 70% of finance teams considering real-time expense visibility a top priority, predictive spend insights have become baseline features. Leading platforms are already achieving these benchmarks and are significantly cutting reconciliation time by using AI.

Justin Smith, CEO of Contractor+, describes what buyers expect AI to deliver:

"Today, we're seeing AI read receipts automatically, detect patterns, flag policy violations in real time, and even predict future spending behavior. This shift doesn't just reduce administrative work—it creates a more intelligent financial ecosystem where decisions are faster, compliance is tighter, and employees spend less time on paperwork and more time on meaningful work."

He believes the next wave will make expense management almost invisible, with systems that automate approvals, detect fraud before it happens, and integrate seamlessly with every operational workflow.

Omar Qari, Head of Corporate Strategy and Business Development at Emburse, notes that "the smart expense management players will differentiate themselves with increased automation as well as AI and machine learning capabilities, which will give them the competitive edge in today's turbulent market."

But AI's maturity is also raising new policy questions. Christopher Juneau, Head of SAP Concur Product Marketing, points out that, “the emphasis will remain on automating manual processes, leveraging AI-infused services to drive efficiency and deliver safeguards. In a few short years, the concept of an “expense report” may be obsolete altogether, replaced by agentic AI with the autonomy to audit, reconcile, and reimburse automatically in the background, so employees can focus their time on delivering greater strategic value to their organizations.”

Meanwhile, user adoption is evolving cautiously. Jen Moyse, Senior Director of Product at TripIt, observes that "AI will be seen as a 'handy assistant' used to source recommendations, pinpoint trends, and identify expense anomalies, but users will not yet be comfortable with AI booking travel or submitting an expense report for them." She views this as an opportunity for providers to build trust and strengthen AI offerings before users and employers are ready for full automation.

What this means for your roadmap: AI needs to be production-ready and deeply integrated, not a beta feature. Focus on intelligent decision-making (context-aware approvals, fraud prediction), not just data processing. Build trust through transparency by showing users why AI made specific decisions.

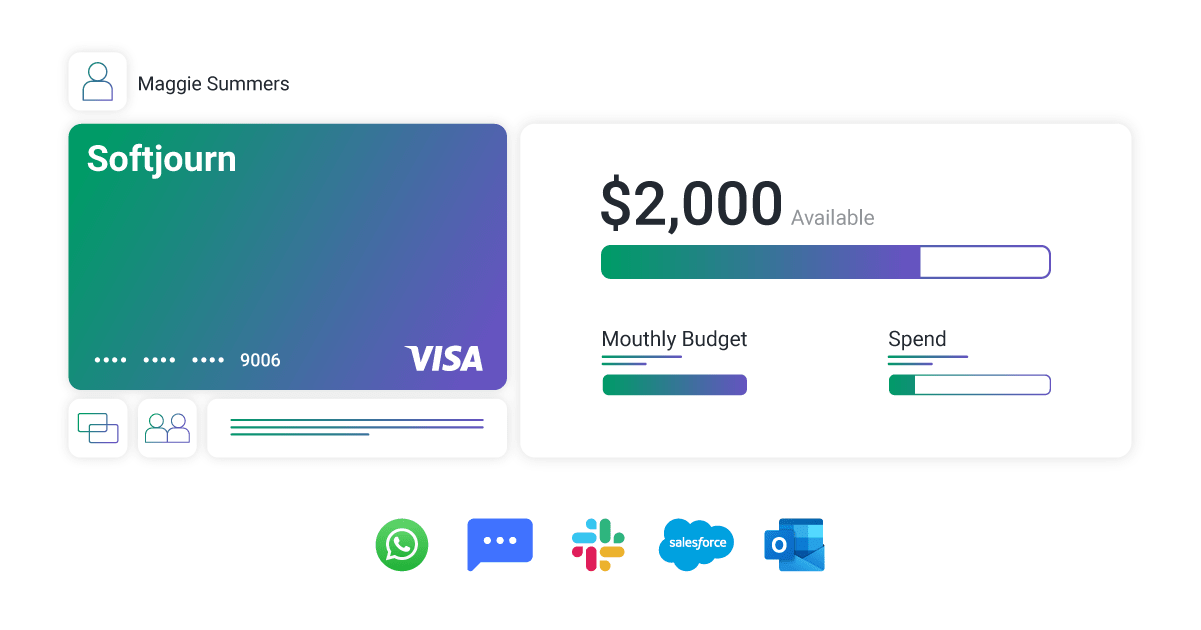

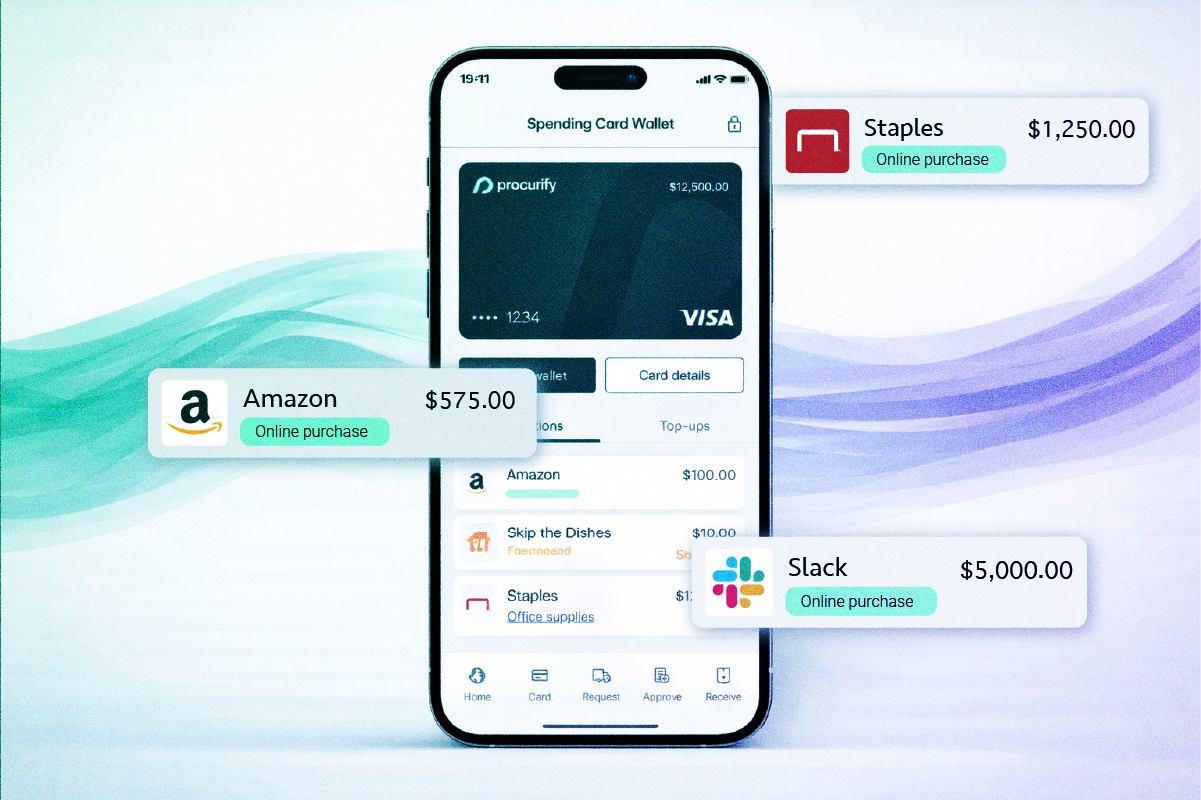

Trend 2: Validate-Before-Spend May Replace Review-After-Reimbursement

The fundamental expense management model may be shifting from reactive to proactive. Rather than reviewing and reimbursing after the fact, some platforms are moving toward validation at the point of transaction.

Kacey Flygare, General Manager and Global Business Head of SAP Concur, predicts that “Pre-spend controls, such as virtual cards and dynamic card controls, will be gamechangers in how organizations control spend, lower risk, and reduce the burden of cash outlay for business expenses.”

This shift is being driven by global Continuous Transaction Controls (CTC) and e-invoicing mandates. Adam Tahir, CPA and Founder and CEO of Bizora, predicts a significant change:

"By 2026, I believe expense management will shift from 'review after reimbursement' to 'validate before spend,' driven by the global spread of continuous transaction controls (CTC) and e-invoicing mandates. The same systems governments use to verify invoices in real time will begin operating inside corporate expense flows. An employee's card authorization, merchant data, tax or VAT rates, and policy rules will be evaluated before the transaction by embedded AI policy guardians."

What makes this approach different is the tax-native design. Tahir describes systems that ingest structured receipt data, like PEPPOL or e-invoice fields, verify tax jurisdiction and rate logic by merchant category and location, and flag permanent establishment or use-tax exposure at authorization time. Programmable corporate wallets could enforce per diem, carbon, and supplier-sanctions rules at the point of spend, while AI agents resolve anomalies by messaging travelers within minutes instead of weeks.

David Barrett, CEO of Expensify, frames the conversational element philosophically: "In the end, we believe payments and chat are fundamentally the same thing; every payment is a structured chat to resolve some kind of debt tension between two people." This approach turns delayed administrative tasks into immediate, resolution-focused conversations.

The potential business impact is significant. Companies piloting this approach are closing books faster, recovering more VAT, and facing fewer audit adjustments.

What this means for your roadmap: As CTC mandates spread globally, platforms serving multinational clients may need PEPPOL integration, programmable wallet capabilities, and real-time tax jurisdiction verification. This addresses the international compliance challenges. Whether this becomes baseline or remains specialized will depend on how quickly CTC adoption accelerates in your target markets.

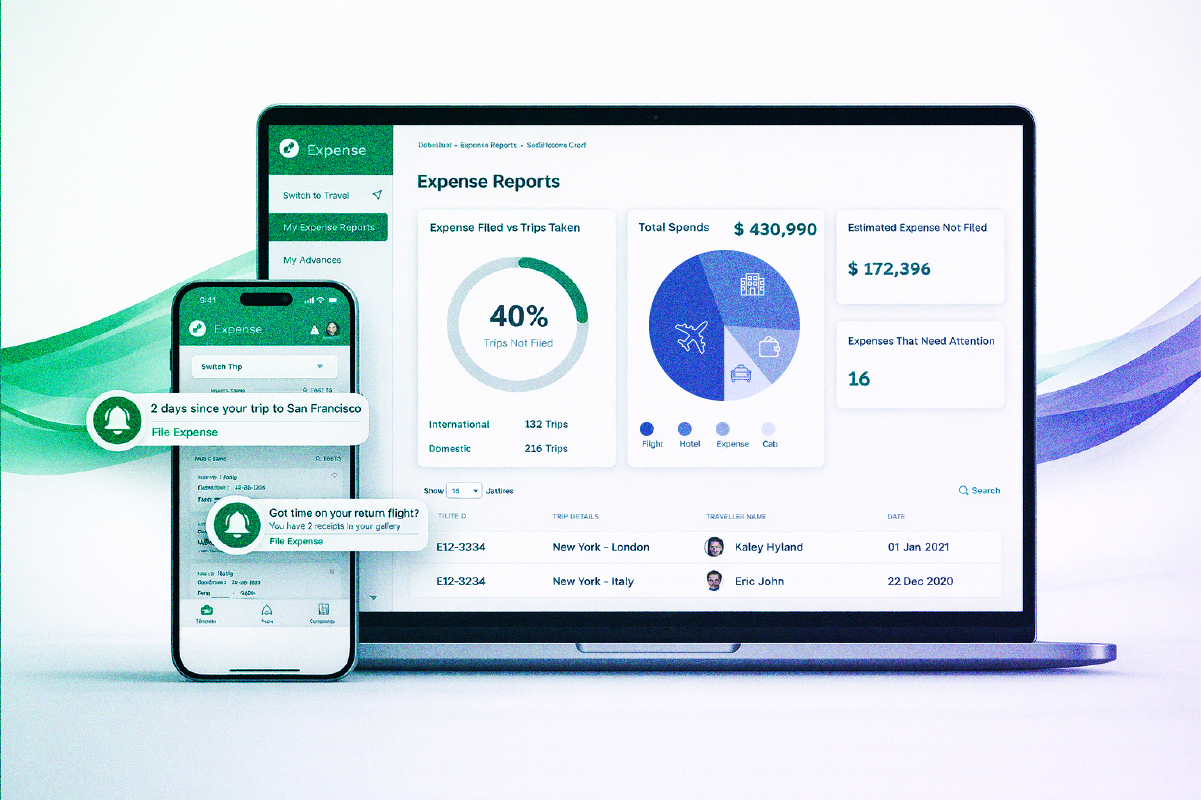

Trend 3: Expense Data is a Strategic Asset, Not Just a Cost Center

Your clients are no longer asking "How do we track spend?" They're asking, "How do we unlock value from every transaction?" This represents a fundamental shift in how expense data is perceived and used within organizations.

David Stifter of PredictAP describes the shift: "Invoice processing isn't a back-office task—it's a strategic data source. Every invoice tells a story about vendor performance, budget discipline, and operational efficiency. Once you stop viewing expense management as a cost center and start treating it as a data asset, the entire value proposition changes."

Justin Smith of Contractor+ was surprised by how quickly this transformation occurred. "What we didn't expect was how deeply expense data would start driving decision-making at the board level," he explains. The shift wasn't just technological. It was cultural. Teams stopped asking how to track spend and began asking how to unlock value from every transaction.

What this means for your roadmap: Position your platform as business intelligence infrastructure, not just expense tracking. This means building advanced analytics and dashboards that reveal spending patterns rather than just totals, vendor performance scoring and optimization recommendations, and predictive alerts for consolidation opportunities, duplicate spend, and waste patterns. Integration with forecasting tools, like Elasticsearch or PowerBI, is increasingly important so expense data feeds directly into strategic planning. If your platform only reports what was spent, you're competing on commoditized features. If it reveals why it was spent and how to optimize it, you're selling strategic value.

Trend 4: Reliability Wins Over VC-Backed Hype

Your buyers are becoming more sophisticated and have higher expectations than ever before. Every week, another expense management vendor enters the market with aggressive pricing and flashy demos. But the evaluation criteria have changed. Buyers are now asking: "Can you sustain service, compliance, and integration at scale long after the funding runs out?"

Marcel Syriani, COO of DATABASICS, observes this market shift directly. "New vendors backed by fresh investment capital are flooding the market. They are racing for market share with aggressive pricing and quick demos. But long after the excitement fades, the real test begins: Can they sustain service, compliance, and integration at scale?"

The question, as Syriani puts it, isn't how fast the technology is moving. "It's whether the market is valuing what truly endures: Reliability, integrity, and experience," he says.

Security and infrastructure have become top priorities. Christopher Juneau of SAP Concur points out that "the risks associated with security and privacy incidents will only continue to grow, which means companies are looking for technologies that deliver greater value to customers with lower risk." It's a balancing act to move fast without disregarding security and privacy when architecting solutions.

This creates an expectations gap. Buyers want innovation at the pace of consumer apps, but with the reliability of enterprise infrastructure.

As Justin Smith, CEO of Contractor+ notes, buyers now have elevated expectations: "The companies winning today aren't just managing expenses. They're forecasting behavior, optimizing vendor relationships, and eliminating waste before it happens."

What this means for your positioning: Lead with proof rather than promises. Case studies, uptime metrics, customer retention rates, and years in business matter more than feature lists.

Emphasize security infrastructure investments, SOC 2 compliance, and privacy architecture. Show integration depth and breadth, not just that you have an API, but that you maintain dozens of enterprise integrations. Use transparent pricing that demonstrates sustainability rather than land-and-expand tactics. Market to the skeptical, experienced buyer who has been burned by vendors that couldn't scale. Compete on features that work at enterprise scale, not just newest features.

Trend 5: Verticalization is Ending the One-Size-Fits-All Era

In the past, most companies would use the same expense management platform, no matter their industry. Now, we’ve found that media companies need different workflows than construction firms, and generic platforms struggle to keep everyone satisfied. The industry is seeing a shift toward specialization.

Talia Mashiach, CEO, Founder and Product Architect of Eved, describes the evolution:

"Expense management is evolving from broad, one-size-fits-all platforms to industry-specific solutions that deeply understand the nuances of each sector. For years, many expense management tools tried to serve every industry, but the reality is that each vertical, especially media and entertainment, has its own unique workflows, approval structures, and compliance requirements."

The challenge for generic platforms is prioritization. "Industry-specific tools can prioritize the exact features and workflows that matter most to their users, releasing updates and automations that directly address their realities," Mashiach explains. "Generic tools simply can't do that because they have to serve too many competing needs."

AI is accelerating this trend. As AI becomes more embedded in financial systems, Mashiach predicts that "companies will demand solutions that move fast, adapt instantly, and mirror their workflow, not force them to adapt to the software. The future of expense management belongs to platforms that are built for how each industry truly works."

What this means for your strategy: The key is avoiding the trap of trying to be everything to everyone. That means, if you're staying horizontal, success depends on emphasizing customization depth and building a strong partner ecosystem. In the meantime, study industries where expense workflows are most distinct and consider whether specialization makes sense for your roadmap.

The platforms succeeding with generic approaches are those that acknowledge competing demands upfront and offer flexible solutions that don't require every stakeholder to sacrifice their priorities.

Otherwise, consider going vertical by picking two to three industries and building deep, specific workflows, or you can build for vertical partners by creating a modular architecture that lets industry specialists extend your platform.

Solving Your Clients' Biggest Struggles

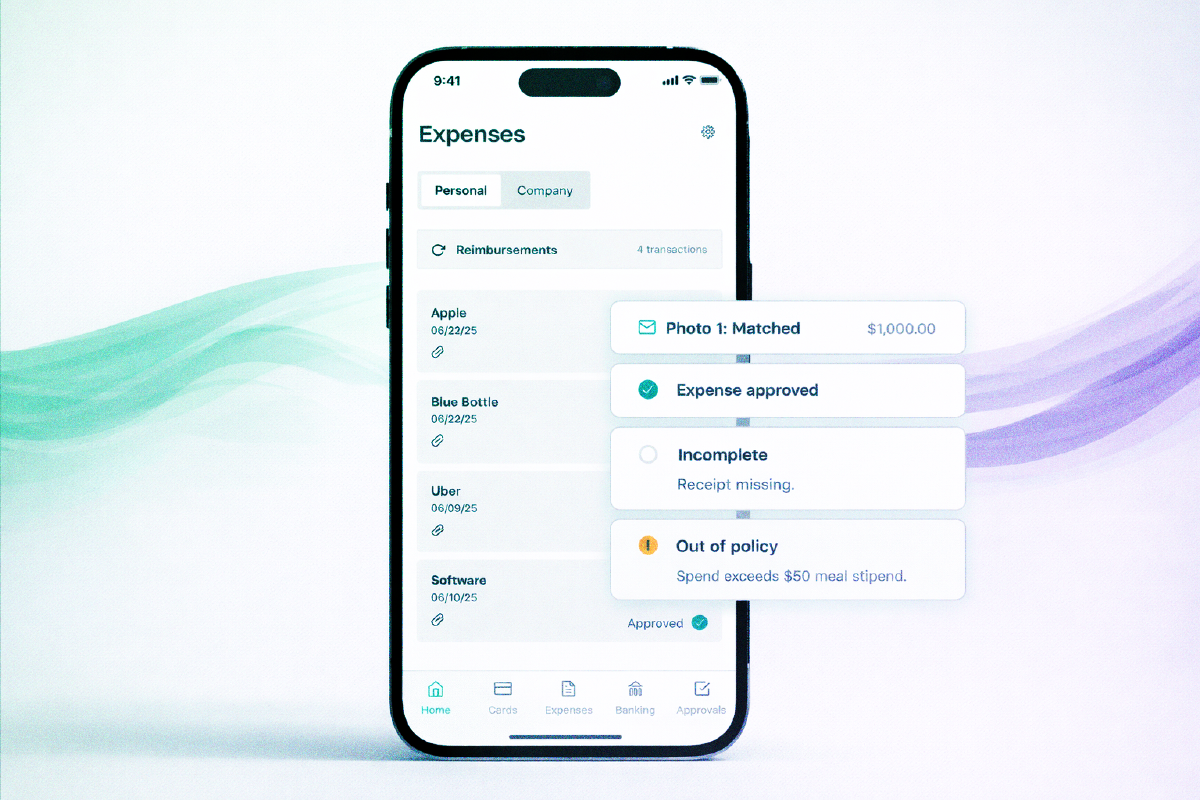

Challenge 1: The "Last Mile Problem" - Automation Exists, But The Intelligence Gaps Remain

While AI has become a baseline expectation (see Trend 1), there's a critical gap between having AI capabilities and deploying them effectively. Your clients have invested in automation tools. They've implemented OCR for receipt scanning, integrated credit card feeds, and set up approval workflows.

Yet finance teams are still manually validating transactions, matching invoices to purchase orders, and resolving exceptions. The automation moves data efficiently, but it can't make the contextual decisions that require human judgment–at least not yet.

In fact, Capture Expense found that out of 371,000 claims, only 2.6% of them were approved immediately, showing the very real issue of approval bottlenecks. The reason why? Teams are way too busy chasing additional context, interpreting intent, and manually reviewing claims instead of catching mistakes early.

This gap between workflow automation and intelligent decision-making is what David Stifter, Founder and CEO of PredictAP, calls the "last mile problem":

"Most companies are still wrestling with fragmented processes and incomplete data. Even with automation tools in place, there's often a 'last mile' problem where human intervention is still required to validate, match, or approve transactions. That manual friction adds cost, delays insight, and limits scalability. The solution is closing that last mile by automating not just the workflow, but the decision-making layer that makes it intelligent."

The challenge is particularly acute because each new automation capability raises expectations. As Marcel Syriani, COO of DATABASICS, observes, "Expense reporting isn't new. But the technology behind it keeps evolving faster than ever. AI, OCR, travel booking integrations, and credit card automation – each wave promises to make expense management simpler. And yet, the reality is more complex."

He also mentioned that “customers want more automation, more accuracy, and more control, but they're not always willing to pay more” for these capabilities.

The winners will be those who can close the last mile gap—turning "automated data movement" into "automated intelligent decisioning"—while keeping implementation complexity and costs low enough for mid-market adoption. This requires investing heavily in training AI models on expense-specific context, building robust exception-handling logic, and creating systems that learn from human corrections to continuously improve accuracy.

Challenge 2: The Documentation Crisis - When Missing Receipts Cost Clients Six Figures

Your clients face a documentation crisis that's costing them six figures in lost deductions and failed deals. The problem isn't that receipts go missing—it's that most platforms capture the transaction but not the business purpose or supporting documents at the point of purchase. This creates downstream problems that are expensive and embarrassing.

Max Emma, CEO and Chief Bookkeeping Officer of BooXkeeping, has seen this financial impact across thousands of small and medium businesses. "I've watched businesses lose $15K-40k in valid tax deductions because they had transactions in their accounting software but zero supporting documentation," he explains. "One client claimed major equipment purchases to lower their tax bill, but when they tried selling the company, buyers walked away during due diligence because they couldn't prove those expenses were real. The deal fell apart over missing paperwork, not actual financial problems."

The root cause is that most expense systems capture the transaction but not the business purpose or supporting documents at the point of purchase. Employees swipe cards, managers approve amounts in the system, but nobody photographs the itemized receipt or notes who attended that business dinner. Six months later, when someone asks what a specific charge was for, nobody remembers, and the deduction is lost.

Buyers need systems that enforce documentation capture at the point of purchase, not as an afterthought during reconciliation. The platform that can implement "no documentation equals no categorization" without destroying user experience will win the enterprise market.

This means building mandatory receipt capture workflows that feel natural, not punitive. Consider mobile-first capture with AI-powered field extraction, automatic reminders when documentation is missing, and workflow blocks that prevent expense approval without attachments.

Challenge 3: Data Quality Chaos - When Clients Can't Trust Their Own Reports

Your clients are making business decisions based on financial reports they can't trust. The culprit? Inconsistent expense categorization by employees. One person codes office supplies as "Materials," another uses "General Expenses," and someone else picks whatever appears first in the dropdown.

The scale of this problem is staggering. Max Emma of BooXkeeping, reports that across thousands of clients, "40% of their expense reports required manual reclassification before we could even close their monthly books. That's hours of work that shouldn't exist." But the real cost isn't just the reconciliation time. It's that business owners can't make informed decisions when their reports are fundamentally unreliable.

Emma describes a typical scenario: "When Q1 shows office supply costs doubled, but nothing actually changed except how people coded receipts, you can't make real decisions. I had one client almost cancel a vendor contract because their reports showed marketing spend was 'out of control,' but it turned out sales team lunches were being coded as ‘marketing’ instead of ‘meals and entertainment’."

Interestingly, some of the most effective solutions are low-tech. Expense management operations that built visual cheat sheets (pictures of common purchases) next to correct categories saw cleanup time drop by 60%. Sometimes the simplest solution wins.

Your platform will need intelligent defaults, visual guidance, and AI-powered suggestions built into the submission flow, not just the reconciliation backend. The platforms that prevent miscategorization at the point of entry (rather than fixing it later) will differentiate on data quality.

Consider implementing context-aware category suggestions based on merchant type, visual guides that show common expense examples, and soft validation that flags unusual categorizations before they're submitted. Your goal should be to make the correct choice the easiest choice, not just the available choice.

Challenge 4: International Compliance Web - Beyond Currency Conversion

While you may already provide currency exchange and conversions on your expense management platform, your clients expanding globally face a bigger problem: simple expense reimbursements that trigger corporate tax liabilities in foreign jurisdictions.

The concept of Permanent Establishment (PE) has turned expense management into a compliance minefield. Olivier Wagner, Founder and CEO of 1040 Abroad, explains the stakes:

"Businesses are permitting employees more and more to work at any location, and this has resulted in a spider web of foreign compliance requirements, which have a direct effect on the expense reporting and your overall corporate tax profile. A mere reimbursement of a co-working space charge or a casual international temporary living cost can theoretically cause the organization to become permanently established in a new nation resulting in unforeseen corporate taxes and employer social security funds."

Legacy systems weren't built to track employee time across dozens of tax jurisdictions simultaneously. Tax advisors are seeing cases where employees trigger local payroll withholding requirements after just 60 to 90 days in treaty countries. Most platforms can't connect these dots or alert payroll and tax departments to the risk.

Beyond compliance, there are immediate financial impacts. Banks hide fees in exchange rates, and reconciling expenses across country teams becomes a major time sink. Wagner's assessment is stark: expense management is "becoming a gatekeeper to international corporate compliance."

If you serve multinational clients, you need capabilities that flag PE risk based on location and time-in-country data, integrate with tax regulation databases, and provide transparent FX rates. This is a deal requirement for any company with remote employees working across borders.

Challenge 5: Competing Stakeholder Demands - The Impossible Balancing Act

Your buyers aren't just finance teams anymore. HR, Procurement, IT, and Operations are all becoming stakeholders with their own requirements, and they often want fundamentally different things from your platform.

Justin Smith, CEO of Contractor+, captures the core tension: "Finance wants accuracy, employees want simplicity, and operations want speed, yet the systems in place rarely deliver all three." The challenge is compounded by expanding stakeholder circles. Alan Tyson, CEO of DATABASICS, notes that "HR, Procurement, and IT will emerge as greater stakeholders in the employee expense management process."

Victor Domingos, CFO of SAP Concur, observes that companies are navigating this complexity in the context of broader organizational priorities: "Companies will most likely try to do that without compromising on compliance and sustainability. That is where finance again plays a critical role in having the best possible supplier landscape to guide investments in technology that prioritize compliance and environmental, social, and governance (ESG) considerations."

Meanwhile, employee expectations continue rising—driven partly by generational shifts in decision-making. Charlie Sultan, President of Concur Travel, points out that "with more and more millennials making up not just corporate travelers, but also serving in decision-making roles, I expect that companies that built a culture around employee travel flexibility will continue to offer those benefits."

Meanwhile, employee expectations continue rising. As Smith notes, "Employees now expect consumer-grade experience and zero friction, and finance leaders expect live insights rather than monthly reports." Generic platforms that try to be everything to everyone can't prioritize features fast enough to keep all stakeholders satisfied.

Expense management platforms can no longer optimize for a single buyer persona. Today's solutions must simultaneously satisfy finance teams demanding accuracy and real-time insights, employees expecting consumer-grade experiences with zero friction, operations requiring speed, and emerging stakeholders in HR, Procurement, and IT who each bring distinct requirements.

The winners will be those who build modular, configurable architectures that allow different stakeholder groups to get what they need without forcing trade-offs on others.

Final Word

The expense management platforms winning in 2026 won't be those with the longest feature lists. They'll be the ones that solve real client pain points with capabilities that work reliably at enterprise scale or within their ideal vertical.

Ready to Build?

At Softjourn, we've spent over 15 years helping expense management platforms develop the capabilities outlined in this report. Whether you need AI automation, real-time validation infrastructure, advanced analytics, or vertical-specific workflows, our team has the expertise to turn strategic vision into production-ready features. Contact us to discuss your 2026 roadmap.