In today's business landscape, securing and maintaining relationships with large enterprise clients is a key strategy for driving revenue growth. However, as these clients grow in size and complexity, so do the challenges associated with processing their payments.

With the global digital payments market reaching $17.7 trillion this year according to Statista's research, it's more important than ever for companies to understand where payments are heading in 2026.

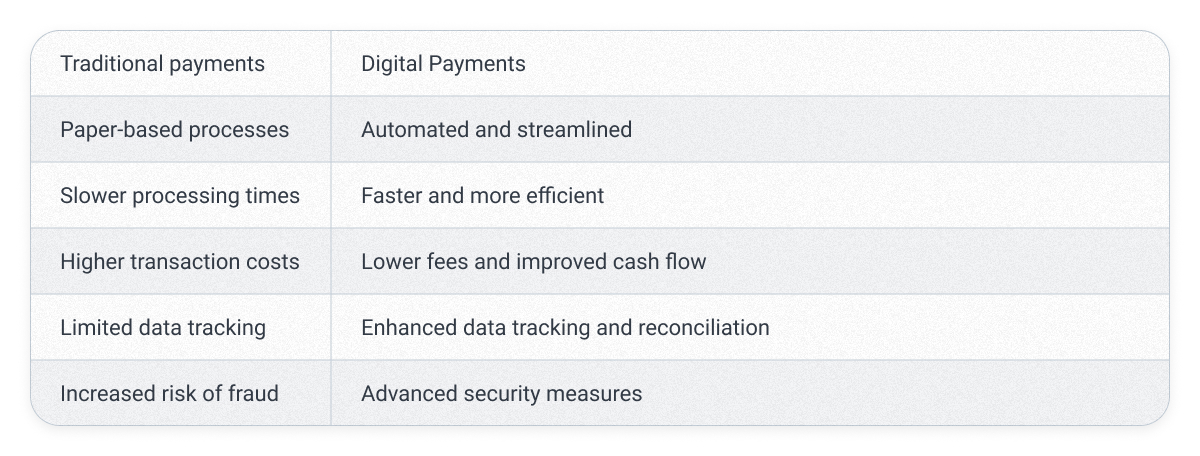

B2B transactions often involve substantial sums of money and require navigating intricate approval processes, leading to delays and inefficiencies when relying on traditional payment methods like paper checks.

In 2026, the landscape of digital B2B payments continues to evolve rapidly, presenting both opportunities and challenges for businesses looking to streamline their financial operations.

We will take an in-depth look at the current state of digital B2B payments, exploring key developments, popular payment methods, and strategies for successful implementation.

By gaining a comprehensive understanding of the digital B2B payments ecosystem, businesses can position themselves to build stronger client relationships, improve cash flow, and unlock new opportunities for growth in 2026 and beyond.

The Current State of Digital B2B Payments

The adoption of digital B2B payments has been steadily rising in recent years, as more businesses recognize the numerous advantages they offer over traditional payment methods.

In 2025, mobile B2B payments were more present and integrated into daily business operations as they are the most efficient way to send money. A Mastercard study estimates that virtual cards can deliver $0.5 to $14 in cost savings per transaction for banks. And according to the Payments Association, only 2% of transactions are made using virtual cards.

Focusing on adopting digital mobile payments will be a strategic focus for both SMEs and large corporations, as all of them recognize the need for agility. The U.S. proximity mobile payment transaction value is expected to reach $1.2 trillion by 2028.

Benefits of Digital B2B Payments

Embracing digital B2B payments offers a wide range of benefits for businesses, including:

- Increased efficiency and streamlined processes

- Reduced transaction costs and improved cash flow management

- Enhanced security and fraud prevention measures

- Improved data tracking and reconciliation capabilities

- Faster payment processing times and quicker access to funds

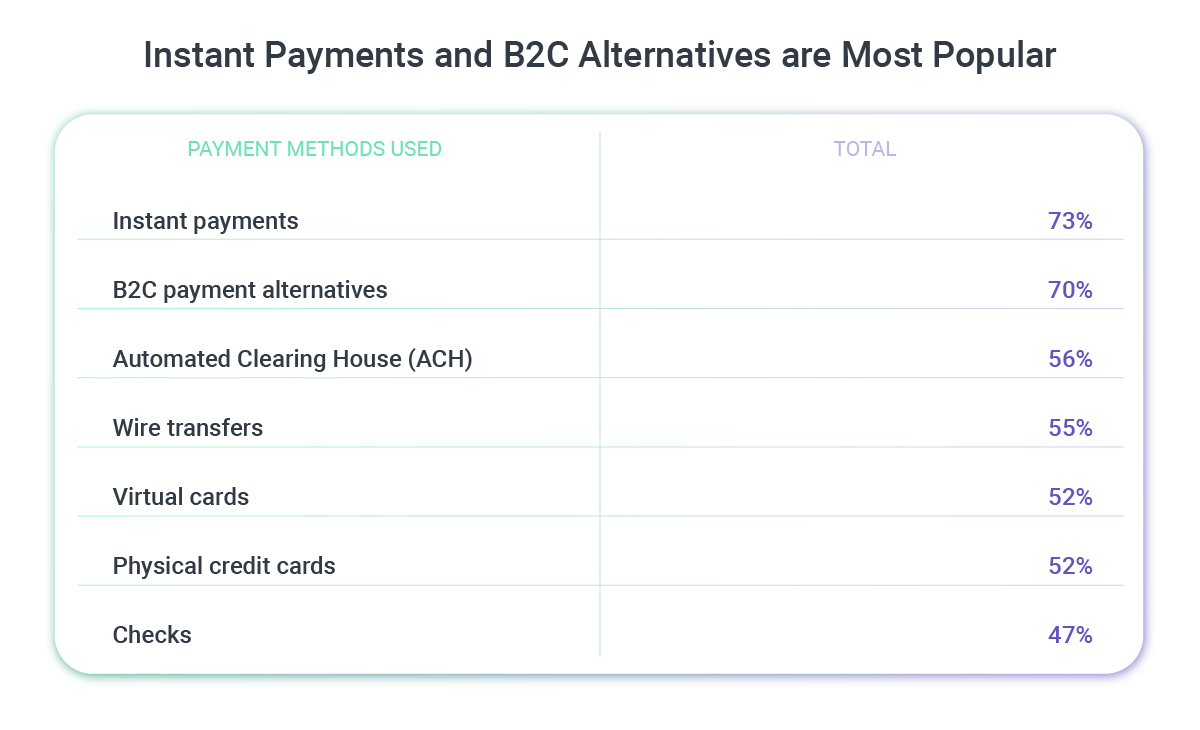

Popular Digital B2B Payment Methods

As digital B2B payments continue gaining traction, several payment methods have emerged as popular business choices. Let's take a closer look at some of the most widely used options:

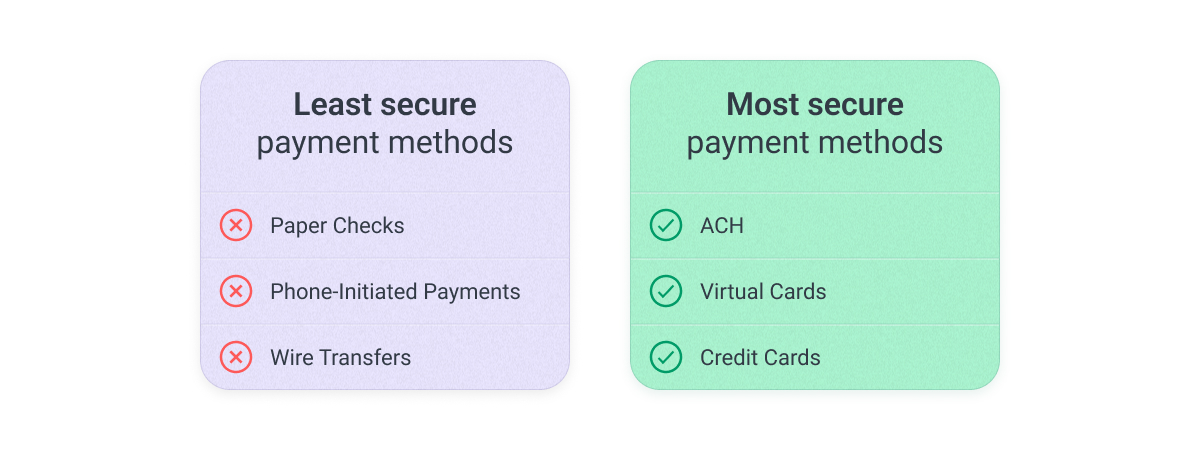

1. ACH Transfers

Automated Clearing House (ACH) transfers have become a staple in the world of digital B2B payments, offering a cost-effective and efficient way to process transactions. Setting up and processing ACH payments typically involves the following steps:

- Obtaining the necessary banking information from the payee

- Setting up the payment within your company's financial system

- Initiating the transfer through your bank or payment provider

- Waiting for the funds to clear and be deposited into the payee's account

2. Wire Transfers

Although wire transfers are one of the least common B2B payment methods, they account for a significant portion of B2B payment volume due to their frequent use in high-value, international transactions.

Managed through systems like Fedwire, CHIPS, or RTP, wire transfers provide immediate access to funds once they reach the receiving account, making them a popular real-time payment option. However, it's crucial to recognize that wire transfers are also among the least secure B2B payment methods.

3. Commercial Credit Cards

Commercial credit cards remain a highly popular payment method for buyers, even in B2B transactions, despite the associated processing fees. For suppliers, however, accepting credit card payments can be one of the most expensive options.

Most businesses recognize that the potential loss of business from not accepting credit cards far outweighs the short-term cost savings.

Companies can take steps to reduce these costs, such as implementing credit card surcharging or utilizing credit card processing technology designed to limit the cost passed along to businesses.

These tools can streamline and automate credit card payments, reduce manual processes, accelerate cash flow, drive more revenue, and enable critical team members to focus on strategic activities rather than payment processing.

4. Digital Wallets and Digital Payment Services

Digital wallets and digital payment services, such as PayPal, Venmo, Apple Pay, Dwolla, Skrill and Google Pay, enable buyers to pay for goods or services through digital devices.

These platforms electronically transfer funds between accounts, typically avoiding direct access to bank accounts, although the accounts are linked.

Some consumers prefer digital wallets and online payment services due to additional features like the ability to add notes to transactions and enhanced tracking capabilities. The convenience of managing transactions from a mobile device is also a significant draw.

5. Virtual Credit Cards

Virtual credit cards have gained popularity in recent years as a secure and convenient alternative to traditional corporate credit cards. They have rapidly gained popularity among both sellers and buyers for B2B payments.

These digitally-generated 16-digit numbers can be used in place of physical credit cards, offering enhanced security through tokenization and spend controls.

Virtual credit cards are typically single-use, and controls can be implemented to limit their use based on factors such as purchase type, validity period, and maximum dollar amount. Finance leaders are quick to recognize the numerous additional benefits of using virtual credit cards as B2B payment methods, including:

A Mastercard study estimates that virtual cards can deliver $0.5 to $14 in cost savings per transaction for banks. According to the Payments Association, only 2% of transactions are made with virtual cards.

These digital payment solutions offer several key benefits, such as:

- Single-use card numbers for enhanced security

- Improved expense tracking and reconciliation

- Easier integration with existing accounting systems

- Greater control over spending limits and employee access

6. Blockchain-Based Payment Solutions

Blockchain technology has the potential to revolutionize the way businesses process B2B payments, offering a range of advantages over traditional methods.

In just a decade, the cryptocurrency landscape has experienced exponential growth and continued to evolve.

As of September 2025, over 37 million unique cryptocurrencies have been created, and we’re on track to reach 100 million by the end of the year. According to data from CoinMarketCap and other crypto tracking platforms, 10,000+ cryptocurrencies existed as of September 2025.

A new study by the National Cryptocurrency Association (NCA) has revealed that 55 million US adults, or 21% of the population, now use cryptocurrency. The survey highlights how digital assets are being adopted across different age groups, income levels, and industries.

Ownership remains highest among younger users Gen Z and millenials, with 67% of holders under 45. The study also found significant adoption among older Americans, with 15% of users over 55.

Statista projections suggest that international business-to-business (B2B) blockchain transactions could surpass $1.7 billion by 2025, and by the end of next year, the number of B2B cross-border transactions conducted on blockchain technology is expected to hit 745 million.

Blockchain technology is rapidly transforming cross-border B2B payments, moving from experimental pilot projects to mainstream adoption.

In 2025, 71% of global financial institutions are either testing or deploying blockchain solutions for international transactions, with 56% of banks and financial institutions reporting active participation in cross-border blockchain payment initiatives, a significant increase from 47% in 2024.

This accelerating adoption reflects the growing recognition that blockchain addresses fundamental inefficiencies in traditional cross-border payment infrastructure. The global market value of cross-border blockchain transactions is projected to surpass $4.5 trillion by the end of 2025, representing a 35% increase from 2024 and signaling that blockchain has crossed the threshold from innovation to essential infrastructure for international B2B commerce.

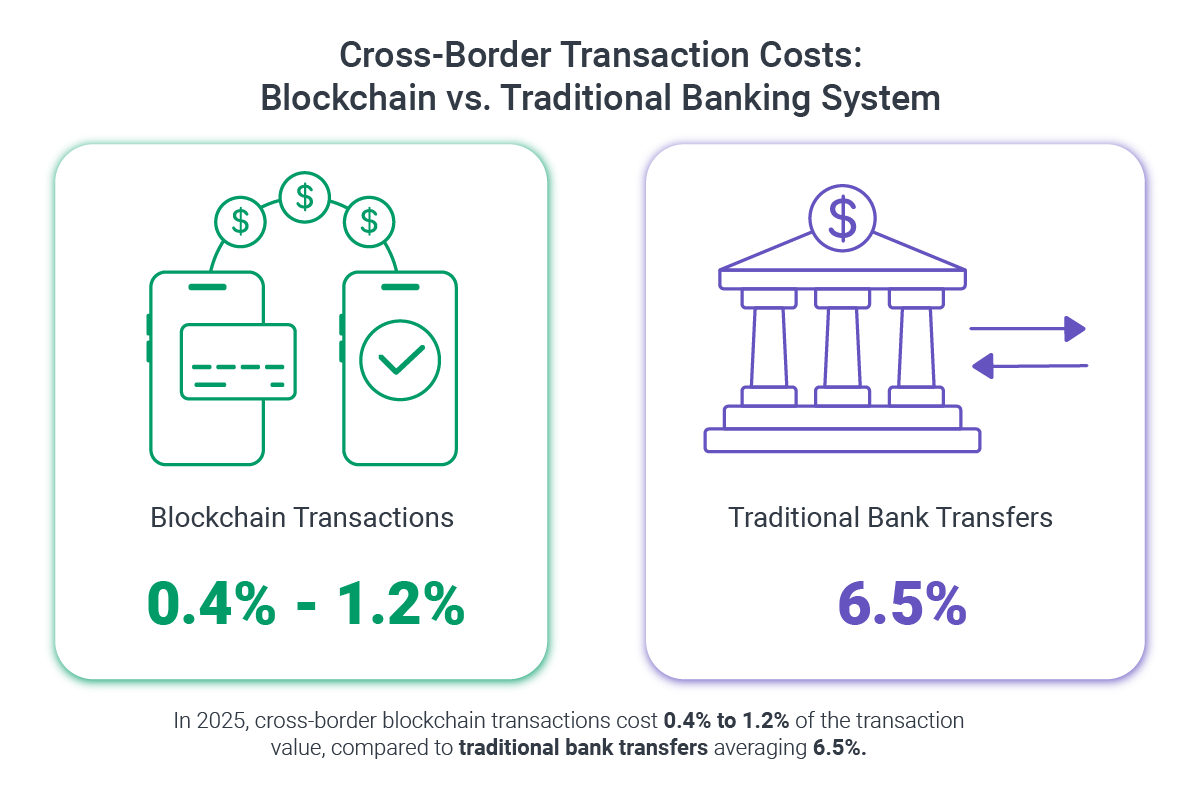

The business case for blockchain-based cross-border payments is compelling, particularly for companies managing substantial international transaction volumes. On average, blockchain reduces cross-border transaction fees by up to 70% compared to traditional wire transfers, transforming the economics of international supplier payments, multi-currency operations, and global payroll processing.

Beyond cost reduction, blockchain delivers faster settlement times, often hours instead of days, while providing enhanced transparency and traceability throughout the payment lifecycle.

According to an OECD report, 95% of cross-border blockchain payment projects in 2025 focus on improving speed, security, and cost-efficiency, addressing the three most critical pain points that have plagued international B2B payments for decades.

For businesses operating across multiple jurisdictions, these improvements translate directly into better cash flow management, reduced forex exposure, and stronger supplier relationships. Institutional and regulatory support is accelerating blockchain's path to ubiquity in cross-border payments.

The G20 countries have endorsed a common framework for enhancing cross-border blockchain payment adoption, targeting full integration by 2027, a clear signal that international coordination is prioritizing this technology for global financial infrastructure modernization. This high-level governmental backing provides the regulatory clarity and standardization that financial institutions need to invest confidently in blockchain solutions.

As interoperability standards mature and more central banks explore digital currency integration with blockchain rails, businesses should prepare for a payment landscape where blockchain-based cross-border transactions become the default rather than the alternative.

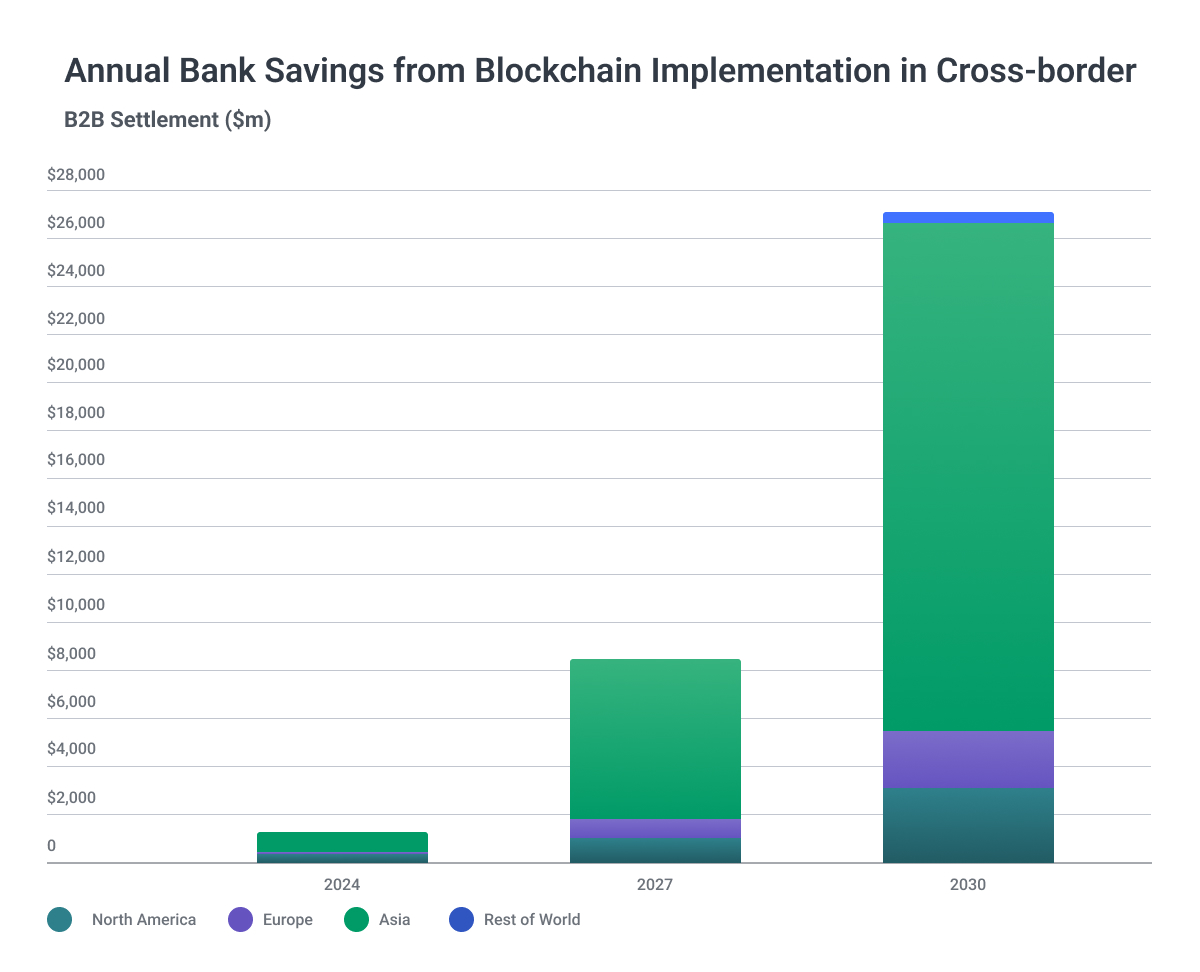

A Juniper Research study predicts blockchain deployments will save banks over $27 billion in cross-border settlement costs by 2030, reducing transaction expenses by 11%. Additionally, integrating blockchain can cut compliance costs by up to 50% through automation of identity and anti-money laundering checks, while streamlining payment processing, reconciliation, and treasury operations.

Some of the key benefits of blockchain-based payment solutions include:

- Faster and more secure transactions

- Reduced transaction fees and intermediary costs

- Increased transparency and traceability of payments

- Smart contract capabilities for automated payment processing

2026 Mega Trends in Digital B2B Payments

To successfully adopt digital B2B payment solutions, businesses must carefully consider their options and develop a strategic implementation plan. As digital B2B payments continue to evolve, several emerging trends and innovations are poised to shape the future of this dynamic field.

While the payment methods described above form the foundation of modern B2B payments, several transformative trends are fundamentally reshaping the landscape in 2026.

These aren't incremental improvements; they represent paradigm shifts in how businesses approach payment operations, infrastructure, and strategy. Understanding and adapting to these mega-trends will separate market leaders in the years ahead.

Some of the most promising developments include:

1. AI-Powered Payment Intelligence Reshaping B2B Landscape

Artificial intelligence is no longer just automating B2B payments; it's fundamentally reimagining how businesses make financial decisions. In 2026, we're witnessing the rise of "agentic AI" in payments: autonomous systems that don't just process transactions but actively manage entire payment workflows with minimal human intervention.

Traditional payment automation relied on rigid, rule-based systems that required constant human oversight. Today's AI-powered payment systems leverage machine learning and large language models to reason, adapt, and make intelligent decisions independently.

According to recent Forrester analysis, approximately one-third of B2B payment workflows will use autonomous AI agents by the end of 2026, streamlining complex processes and driving unprecedented efficiency gains.

For B2B payments, this means AI can process an invoice from ingestion through payment without human interaction, creating true end-to-end workflows. Autonomous payment systems can intelligently handle invoice matching, validate payment data, identify discrepancies, trigger appropriate workflows, and ensure compliance, all while learning and improving from each transaction.

Key applications that are transforming B2B payments:

- Intelligent Payment Routing:

- Predictive Cash Flow Management:

- Advanced Fraud Detection:

- Automated Reconciliation:

The business impact of AI adoption is compelling, as they are predicted to save businesses 2.6 billion dollars annually by 2026. If we look beyond cost savings, B2B payment solutions are projected to grow, as companies that still rely on manual payment processes lag behind those that have adopted AI.

2. Embedded Finance and Payment Orchestration: The New Competitive Advantage

Embedded Finance Explosion

Embedded B2B payments are projected to handle $16 trillion in transactions by 2030, representing approximately 10.4% of the total $150 trillion global B2B payments market. More immediately, embedded B2B payments are expected to reach $2.6 trillion in 2026, growing at a compound annual rate of 25%.

This isn't just about convenience, it's about fundamentally reimagining business workflows. Rather than leaving their ERP system, procurement platform, or accounting software to process a payment, users can now complete transactions without disruption.

For example, a SaaS billing system might enable suppliers to receive payment immediately after an invoice is approved, or a procurement platform could offer credit and early payment options built directly into its interface.

Payment Orchestration

Payment orchestration sits above gateways, acquirers, banks, and alternative payment methods to coordinate payment flows, routing logic, reconciliation, reporting, and fraud mitigation. The payment orchestration market is projected to grow at nearly 25% annually through 2034, reflecting its critical role in modern payment infrastructure.

For B2B businesses, orchestration solves a fundamental problem: the fragmentation of payment methods, currencies, and rails across global operations. Instead of building separate integrations for ACH, wire transfers, virtual cards, digital wallets, and open banking, businesses can access all payment methods through a single API.

Here are some of the key benefits of using payment orchestration:

- Smart Routing: Orchestration platforms automatically select the most suitable payment provider based on transaction location, cost, success rate, or settlement speed. Advanced routing can double payment success rates and significantly reduce processing costs as critical advantages for businesses handling large, high-value B2B transactions.

- Unified Multi-Rail Approach: Businesses can seamlessly support cards, open banking, wallets, account-to-account payments, and virtual accounts from one interface. This ensures compliance across multiple regions while supporting local payment preferences.

- Rapid Market Entry: Companies utilizing orchestration can add new payment methods, providers, or markets without changing their core systems. This dramatically accelerates time-to-market and reduces technical debt.

- Embedded Payments on B2B Platforms: The embedded payments market in e-commerce is projected to reach $291 billion by 2026, with B2B embedded payments platforms growing at 20% annually during the same period. Research from Centime and PYMNTS shows that 65% of executives are exploring embedded payment monetization strategies, recognizing that payments can transform from cost centers into profit contributors.

Embedded finance creates new business models beyond traditional software licensing. Mid-market B2B platforms can command 2-5% commissions on embedded payment volumes. For embedded ACH payments alone, platforms are expected to capture approximately $4 billion in net revenues from value-added services by the end of 2026.

Virtual cards, dynamic discounting, and cross-sold financial services are helping companies turn accounts payable into revenue generators rather than pure cost centers. When payments are streamlined, finance teams can refocus on strategic work like scenario modeling, forecasting, and vendor negotiation.

3. Real-Time Payments and FedNow: From Emerging to Essential

Real-time payments are crossing a critical threshold in 2026: moving from innovative capability to business necessity. With the Federal Reserve's FedNow service now operating alongside The Clearing House's RTP network, instant 24/7/365 settlement is finally becoming mainstream in the United States, and it's fundamentally changing B2B payment expectations.

The Transformation Is Accelerating

By late 2025, approximately 1,500 financial institutions had joined the FedNow network. This number significantly exceeded initial projections and outpaced RTP's early adoption curve.

The Federal Reserve's goal is to connect roughly 8,000 of the nation's 10,000 banks and credit unions, creating true ubiquity for instant payments. As of 2026, 58% of U.S. financial institutions that enable instant payments now offer both RTP and FedNow, recognizing that a multi-rail strategy provides the flexibility and redundancy businesses demand.

The numbers tell a compelling story: 96% of manufacturers expect real-time payments to replace traditional checks for outgoing payments, while 87% foresee the same shift for receiving payments.

Total real-time transaction volume is expected to reach $8.9 billion by 2026—quadrupling the approximately $1.8 billion processed in 2022. Globally, real-time payments are projected to grow at a 33.5% compound annual rate through 2028.

Why B2B businesses can't ignore this shift:

- Working Capital Liberation: Real-time settlement eliminates the cash flow gaps that tie up corporate resources. Instead of waiting 2-3 days for ACH settlement or days for checks to clear, businesses can access funds instantly.

- 24/7/365 Availability: Unlike traditional payment rails that close on weekends and holidays, FedNow and RTP operate continuously. This means invoice settlements, contractor payments, and supplier disbursements can happen immediately, regardless of when the transaction is initiated.

- Enhanced Transaction Capabilities: FedNow's transaction limit has increased to $1 million per payment as of July 2025, while RTP now supports transactions up to $10 million. These higher limits unlock real-time payments for substantial B2B transactions, including corporate disbursements, real estate settlements, and high-value supplier payments.

- Rich Data and ISO 20022: Real-time payment rails use the ISO 20022 messaging standard, enabling much richer transaction data than legacy systems.

- Request for Payment (RfP): Both FedNow and RTP support Request for Payment functionality, which could revolutionize B2B invoicing. Rather than mailing invoices and manually processing payments, businesses can initiate electronic payment requests.

The Multi-Rail Reality

Rather than choosing between payment rails, sophisticated businesses are adopting a strategic, multi-rail approach. The distinct capabilities of each network create complementary use cases:

- RTP's $10 million limit makes it ideal for large B2B transactions and corporate treasury operations

- FedNow's broader bank participation provides wider coverage, especially for smaller financial institutions

- Both networks ensure redundancy and business continuity

Financial institutions are helping clients navigate this complexity by offering unified platforms that intelligently route transactions based on transaction size, recipient capabilities, and urgency requirements.

Overcoming Adoption Barriers

Despite momentum, challenges remain. Infrastructure investments are needed to integrate real-time rails with existing financial systems. Legal frameworks must evolve, for instance, state "Good Funds" laws in real estate often don't explicitly recognize irrevocable real-time payments as permitted methods.

Consumer and business education is critical. Many still don't understand how real-time payments differ from same-day ACH or how to mitigate fraud risks in irrevocable, instant transactions. Financial institutions must implement robust authentication and fraud prevention while educating users that real-time payments are final.

The 2026 Imperative

Real-time payments will be table stakes for B2B businesses within the next 12-24 months. Companies that embrace FedNow and RTP now will gain competitive advantages in cash flow management, supplier relationships, and operational efficiency. Those who delay risk being left behind as business partners and customers increasingly expect instant settlement as the default, not the exception.

4. Open Banking and Account-to-Account Payments: The Card Network Alternative

Open banking is driving one of the most significant shifts in B2B payment infrastructure: the rise of account-to-account (A2A) payments. By enabling direct bank-to-bank transfers without card networks or intermediaries, A2A payments promise dramatically lower costs, enhanced data richness, and instant settlement, fundamentally challenging the decades-long dominance of commercial credit cards in B2B transactions.

The Global Momentum

Globally, A2A transactions are projected to reach 186 billion by 2029, representing 209% growth from current levels. In e-commerce specifically, A2A payment value was approximately $525 billion in 2022 and is forecasted to reach $850 billion by the end of 2026.

While A2A currently represents a relatively small percentage of total payment volume, growth rates are extraordinarysome markets are seeing month-over-month growth exceeding 20-40%.

The transformation is most advanced in markets where open banking regulations are mature. In Europe, PSD2 mandated banks to provide third-party access to customer account data (with permission), enabling seamless A2A payment experiences.

The United States Reaches a Tipping Point

The U.S. has historically lagged Europe in open banking adoption, relying instead on market-driven approaches with aggregators and voluntary API adoption. This changed dramatically in October 2024 when the Consumer Financial Protection Bureau finalized its Personal Financial Data Rights rule under Section 1033 of the Dodd-Frank Act.

The rule mandates that financial institutions share consumer-authorized financial data: transaction histories, balances, account terms with third parties at no charge and under explicit, revocable consent. Implementation is phased by institution size, with large banks beginning compliance in April 2026 and smaller institutions following through 2030.

This regulatory framework creates the infrastructure needed for A2A payments to scale in the United States. McKinsey analysis projects that A2A could handle approximately $200 billion in U.S. consumer-to-business transactions by 2026, with even larger potential in B2B payments.

Why B2B Businesses Are Embracing A2A

- Dramatic Cost Reduction: Traditional card-based transactions cost merchants 2.0-3.5% in interchange and processing fees. A2A transactions typically cost a fixed fee of $0.40-0.50 per API call, orders of magnitude less expensive for high-value B2B transactions. For a $50,000 supplier payment, the difference between a 2.5% card fee ($1,250) and a $0.50 A2A fee is transformative.

- Instant Settlement with Real-Time Rails: When combined with real-time payment infrastructure like FedNow and RTP, A2A payments settle instantly 24/7/365. This eliminates the working capital gaps that plague traditional B2B payment methods.

- Enhanced Data and Reconciliation: A2A payments leveraging ISO 20022 standards carry significantly richer transaction data than legacy card networks. This improved data quality streamlines reconciliation, reduces errors, and enhances financial forecasting.

- Reduced Fraud Exposure: Bank-grade security including Strong Customer Authentication (SCA), tokenization, and encrypted data-sharing makes A2A payments more secure than many traditional methods. The direct bank-to-bank nature eliminates certain fraud vectors present in card-not-present transactions.

- No Credit Line Required: Unlike commercial cards, A2A payments don't require available credit, making them accessible to businesses seeking to optimize working capital without increasing leverage.

The B2B Use Cases and Adoption Challenges

Supplier Payments and Invoice Settlement: Large, recurring B2B payments are ideal for A2A. The cost savings on high-value transactions justify any implementation effort, and the instant settlement improves supplier relationships.

Subscription and Recurring Billing: B2B SaaS companies and service providers can reduce payment processing costs significantly by shifting recurring charges from cards to A2A, while improved data flow enhances subscription management.

Cross-Border Payments: Open banking-enabled A2A payments can reduce international transaction fees and improve settlement times compared to traditional correspondent banking or SWIFT transfers, particularly within regions with integrated open banking frameworks.

Bill Payments and Utilities: B2B rent, utilities, and service payments that historically relied on checks or ACH can transition to instant A2A settlement with enhanced data for reconciliation.

Despite compelling advantages, A2A faces hurdles:

Consumer and Business Habits: Particularly in credit-card-dominant markets like the United States, changing payment behavior requires education and incentives. Businesses must communicate A2A benefits while potentially offering rewards for adoption.

User Experience Friction: Requiring users to enter banking credentials or navigate between apps creates friction compared to saved card credentials. Solutions like one-click payments, digital wallet integration, and QR codes are addressing this challenge.

Network Effects and Integration: A2A requires both payer and payee to have open banking-enabled accounts and integrated systems. Building this network effect takes time, though regulatory mandates are accelerating the timeline.

The Regulatory Landscape

Beyond the U.S. CFPB rule, open banking regulation continues evolving. Europe's anticipated PSD3 framework will further strengthen open banking requirements and expand into adjacent sectors. The UK's Smart Data initiatives aim to extend open banking principles beyond financial services and Australia's Consumer Data Right is expanding from open banking to broader open finance.

ISO 20022 adoption is accelerating globally, creating better interoperability for A2A payments.

Strategic Positioning for 2026

Businesses should view A2A not as a replacement for all payment methods but as an essential component of a modern, multi-rail payment strategy. The optimal approach combines:

- Virtual cards for expense management and control

- A2A for high-value, recurring B2B transactions where cost savings are substantial

- Real-time payments via FedNow/RTP for urgent settlements

- Traditional ACH for batch processing where immediate settlement isn't critical

Early adopters of A2A capabilities will capture significant cost advantages and strengthen relationships with suppliers and customers who increasingly expect instant, low-cost payment options. By 2026's end, businesses that haven't integrated A2A capabilities into their payment infrastructure risk being at a competitive disadvantage as this payment method moves from emerging to essential.

The convergence of open banking regulation, real-time payment rails, and demand for cost-effective B2B payments is creating a perfect storm for A2A adoption. The question is no longer whether businesses will adopt A2A payments, but how quickly they can integrate them into their operations to capture the significant strategic and financial benefits.

Final Word on B2B Digital Payments

Digital B2B payments have crossed the threshold from competitive advantage to business imperative. The convergence of AI-powered intelligence, embedded finance, real-time settlement, and open banking in 2026 represents a fundamental restructuring of how businesses transact, not an incremental evolution.

The opportunity cost of inaction is substantial. Businesses leveraging modern payment infrastructure are achieving 90% cost reductions on transactions, eliminating days of settlement delays, and generating new revenue streams from payment operations. Meanwhile, organizations clinging to legacy methods face mounting disadvantages as customers, suppliers, and partners increasingly expect instant, seamless, low-cost payment experiences.

Within 12-24 months, today's innovations will become tomorrow's baseline requirements. Real-time settlement will be standard, not exceptional. Embedded payment experiences will be expected, not novel. AI-driven payment intelligence will separate efficient operations from outdated ones. The early-mover advantage available today will rapidly diminish.

Success requires a strategic, multi-rail approach that intelligently combines payment methods based on transaction context: AI for automation and intelligence, embedded finance for workflow integration, real-time rails for instant settlement, A2A payments for cost efficiency, and traditional methods where still appropriate. It requires viewing payments as strategic infrastructure, not operational overhead.

The businesses that will thrive in 2027 and beyond are those taking action in 2026. By modernizing payment infrastructure, embracing automation, and building multi-rail capabilities, companies position themselves to lead rather than follow in an increasingly digital, instant, and competitive B2B landscape. The transformation is underway and your next move determines whether you shape it or respond to it.