In an era dominated by rapid technological advances, the intersection of financial technology and cloud computing has emerged as a powerhouse of innovation and efficiency.

This article delves into the pivotal statistics and trends of 2026, shedding light on the evolving landscape of FinOps and its impact on the fintech sector.

What is FinOps?

Central to this convergence is the discipline of Financial Operations, or FinOps, a strategic approach to managing cloud costs and investments. As cloud computing becomes central to digital transformation, adopting FinOps is essential for organizations aiming to control their cloud spend and enhance operational efficiencies.

The Rise of Cloud Computing

Cloud Economy and Adoption

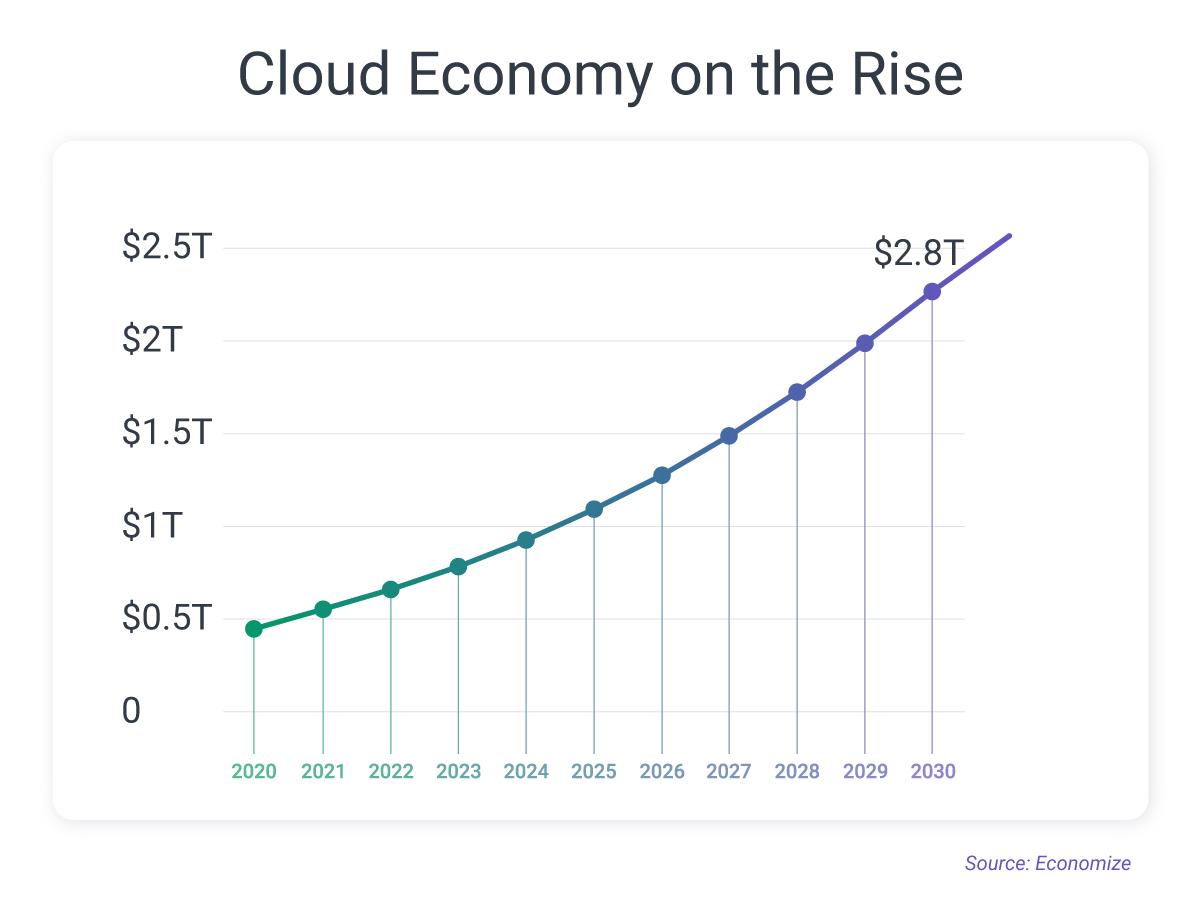

The digital landscape is witnessing a significant pivot towards cloud technologies, with Gartner forecasting the global cloud market to reach $723B in 2025 and potentially $2-2.4T by 2030.

This shift highlights the accelerating pace of digital transformation. New projections show the global cloud computing market rising from $912B in 2025 to USD $5,150B by 2034. Precedence Research estimates a strong CAGR of 21.20 percent during that period, reinforcing the cloud’s position as one of the fastest-growing areas of enterprise technology.

Venture Capital Trends in Cloud Cost Management

Cloud investment is accelerating. Flexera reports that in 2025, 33 percent of organizations spend more than USD 12 million per year on public cloud services, up from 29 percent the year before. Much of this growth is tied to AI adoption, as 72 percent of companies are now leveraging generative AI services, further increasing demand for cloud capacity.

This focus on cost efficiency mirrors broader market momentum. Recent forecasts show the cloud cost management software sector expanding at a CAGR of 18.99 percent between 2025 and 2035, highlighting the increasing need for tools that give organizations greater visibility and control over their cloud expenditures.

The Cloud Shift Phenomenon

New IDC projections highlight the accelerating shift toward cloud services. Global spending on public cloud is expected to hit USD 805 billion in 2024 and is on track to double by 2028. Even as year-over-year increases level out slightly, the market is set to sustain a robust five-year CAGR of 19.4 percent, underscoring the continued momentum behind cloud adoption.

However, cloud budget overruns remain a widespread issue, with 72% of global companies exceeding their allocated budgets in the last fiscal year. As public cloud spending is expected to surpass $1 trillion globally by 2026, the pressure to improve cloud cost management and optimization (CCMO) strategies has never been greater.

Despite these challenges, organizations are beginning to adopt CCMO strategies earlier in the cloud lifecycle, with 65% of leaders prioritizing cost management at earlier development stages.

The Top Cloud Providers in 2026

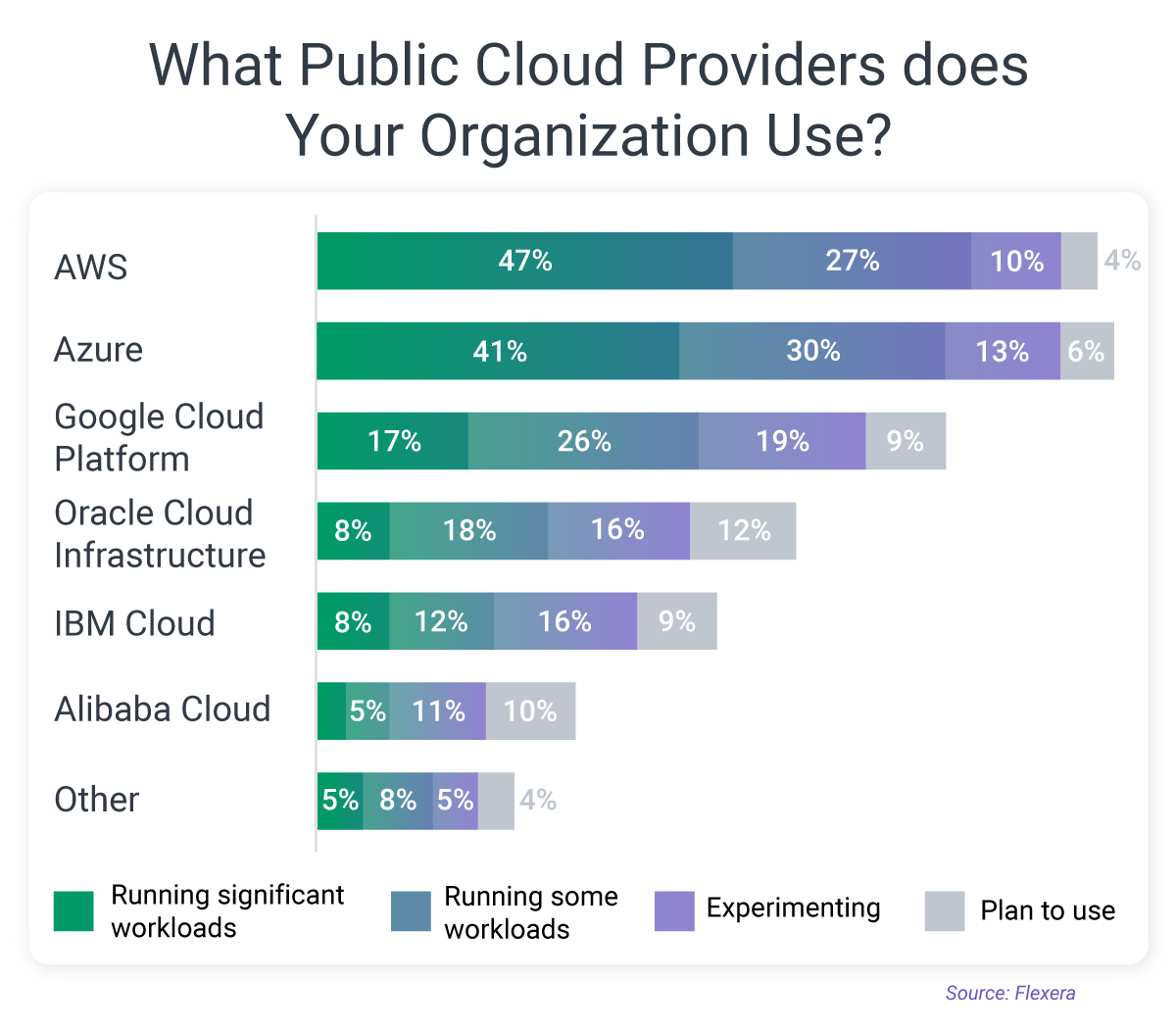

The market dominance of Amazon Web Services, Microsoft Azure, and Google Cloud highlights the confidence and reliance businesses place on these platforms for cloud services. Their comprehensive offerings and global infrastructure make them the preferred choice for organizations looking to leverage cloud computing to drive business growth and innovation.

Top Cloud Services and FinOps Tools

The top public cloud services used by organizations are data warehouses, DBaaS (relational), and push notifications. Many companies are experimenting with machine learning, Disaster recovery as a service, Edge services, IoT, and Serverless.

{f3208542}

The State of Cloud in Organizations in 2025

Accelerated Migration to Cloud

The cloud's ascendancy has been further accelerated by growth of remote work, which has compelled organizations to rethink their operational models and adapt to a new business and social reality.

Michael Warrilow, Gartner's research vice president, underscores the urgency of this transition, warning that technology and service providers who lag in adapting to the cloud shift risk obsolescence or relegation to low-growth markets.

Emerging Trends in Cloud Computing

With over half of all workloads and data now residing in the public cloud, a notable 65% of companies are reprioritizing their IT strategies to focus on cloud technologies, highlighting the shift towards cloud-centric operations.3

If your company doesn't have a roadmap for the cloud, we recommend utilizing cloud strategy and planning consulting to get expert recommendations tailored to your business's cloud needs.

Organizations Embrace Hybrid and Multi-Cloud

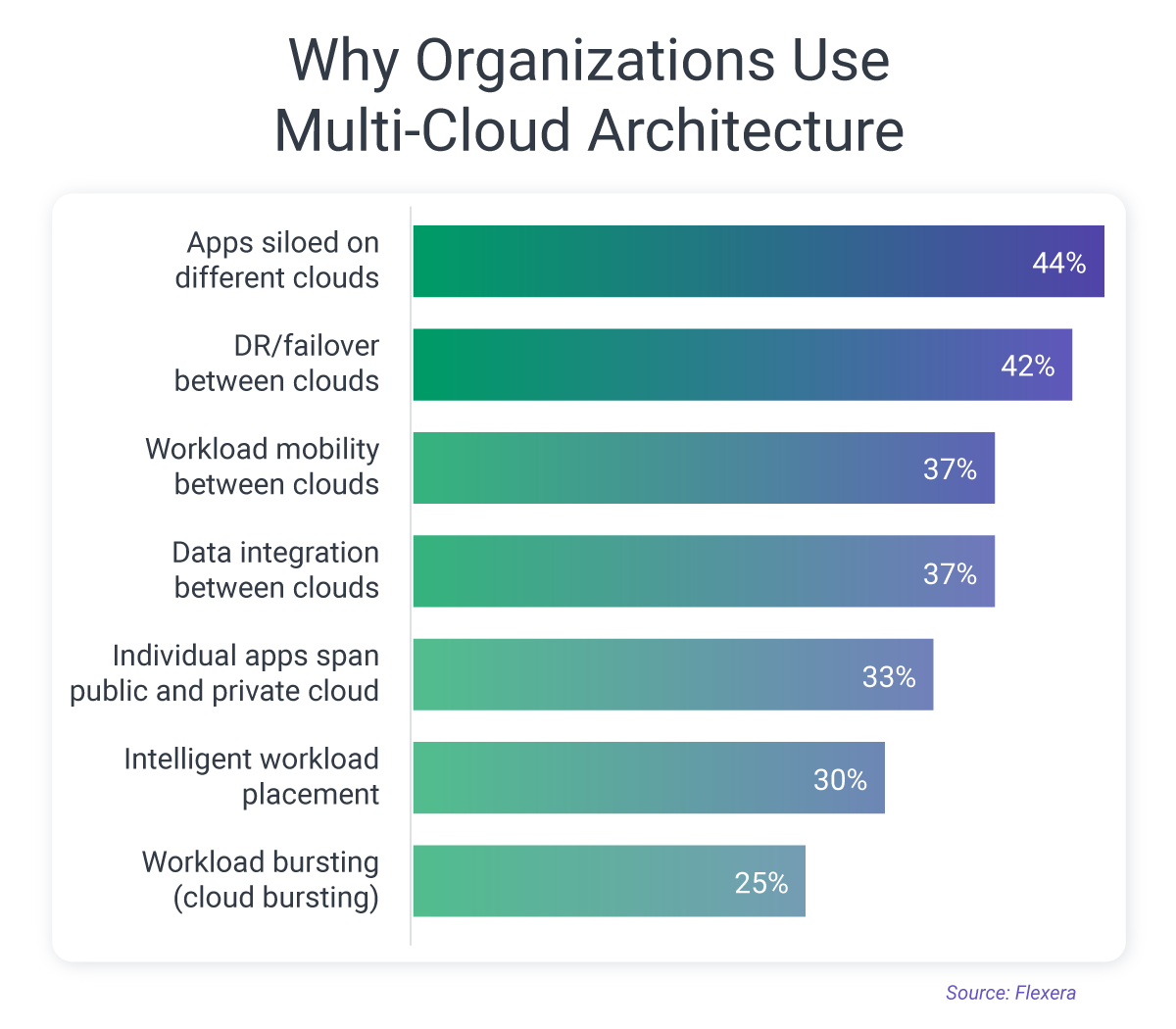

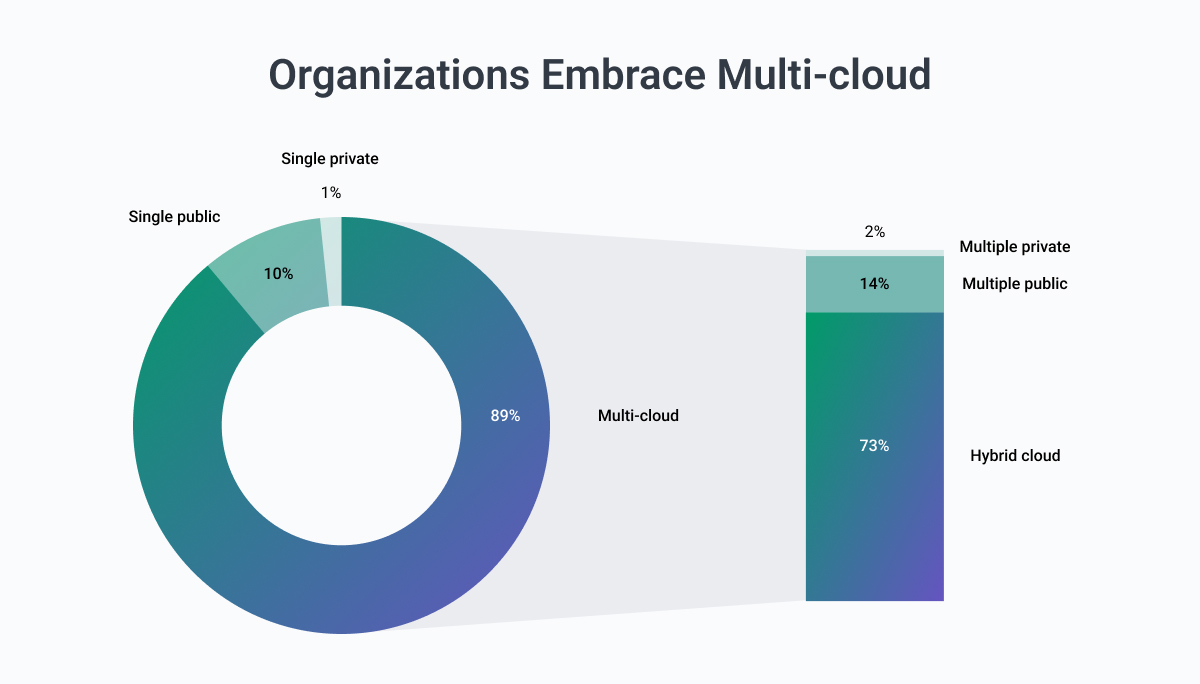

The majority of organizations choose to blend public and private clouds, with 87% using multi-cloud infrastructure.

According to Flexera State of the Cloud Report, the top reasons for multi-cloud architectures are apps siloed on different clouds, failover between clouds, workload mobility between clouds, and data integration between clouds.

Data and Cloud Migration Approaches

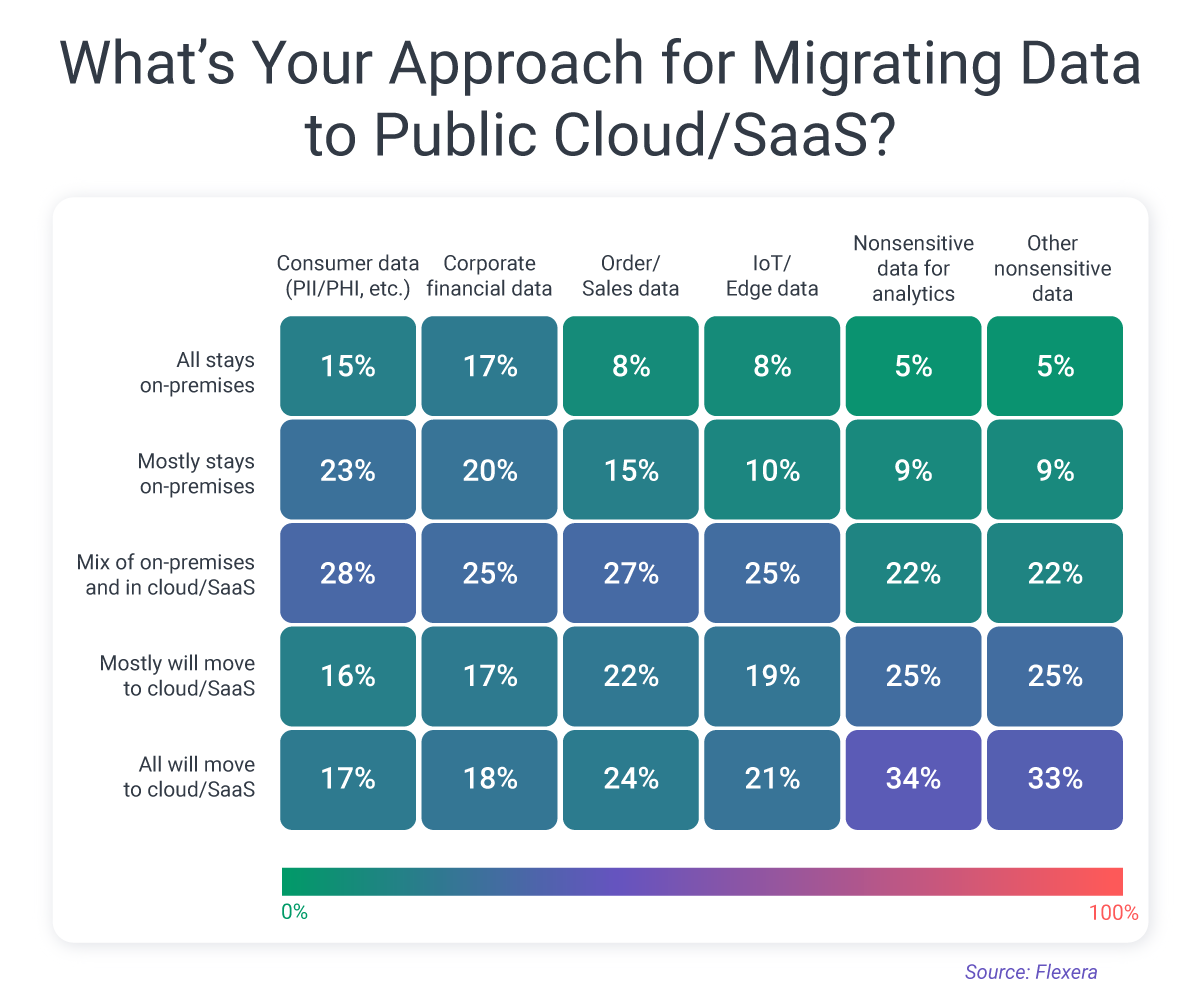

When it comes to storing data on-premise versus on the cloud, many companies store non-sensitive data, orders, and sales data, as well as IoT/data on the public or hybrid cloud, while keeping consumer and corporate financial data on stay on-premise. Expert cloud implementation services can help you create the perfect plan for multi-cloud, hybrid, or single cloud use.

Top Cloud Challenges for Businesses

Cost Management Concerns

When asked about the top cloud challenges they are facing this year, both enterprises and SMBs mention managing cloud spend, lack of resources and expertise, and security, with SMBs also identifying compliance as a major challenge.

In a similar study by Flexera, a significant 82% of respondents identified cost management as their primary concern with cloud computing, underscoring the importance of efficient financial oversight.

Challenges When Migrating to the Cloud

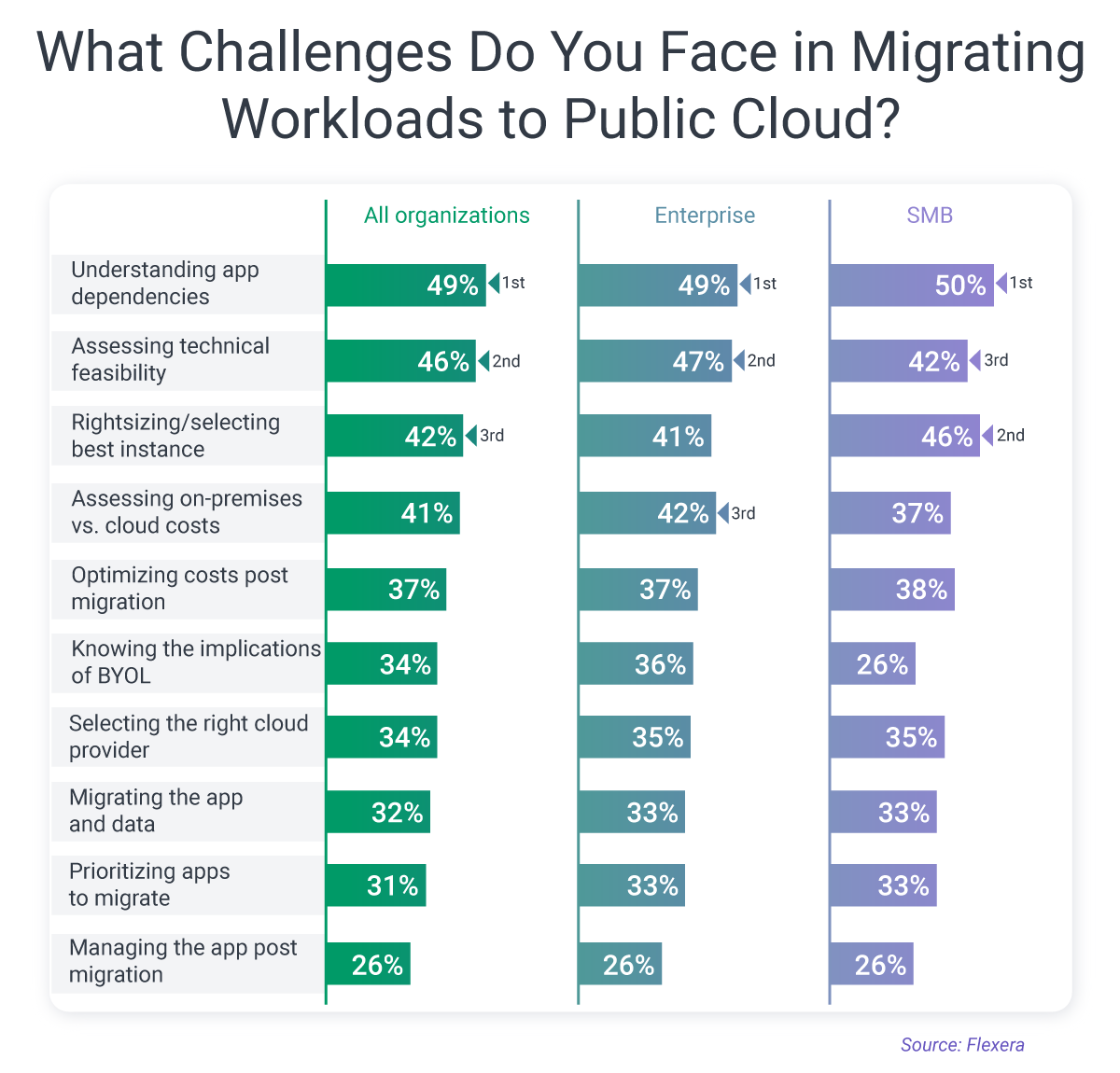

Some of the greatest challenges both enterprises and SMBs face in migrating to the cloud are understanding app dependencies, assessing technical feasibility, selecting best instance, and assessing on-premise versus cloud costs.

Other cloud migration challenges include optimizing costs post-migration, knowing the implications of BYOL, and selecting the right cloud provider.

How Much Does the Cloud Cost: Spending Reports

Public Cloud Spending Trends

Global end-user spending on public cloud services is projected to reach $723.4 billion in 2025, up from $595.7 billion in 2024, reflecting the continued expansion of cloud adoption, according to Gartner.

This 21.5% growth is fueled by the growing demand for distributed, hybrid, cloud-native, and multicloud environments supported by cross-cloud frameworks.

By 2027, Gartner forecasts that 90% of organizations will embrace a hybrid cloud strategy, emphasizing its importance in modern IT infrastructure. Additionally, addressing data synchronization across hybrid cloud environments is expected to be the most pressing challenge for organizations deploying generative AI technologies over the next year.

What are Companies Spending on the Cloud?

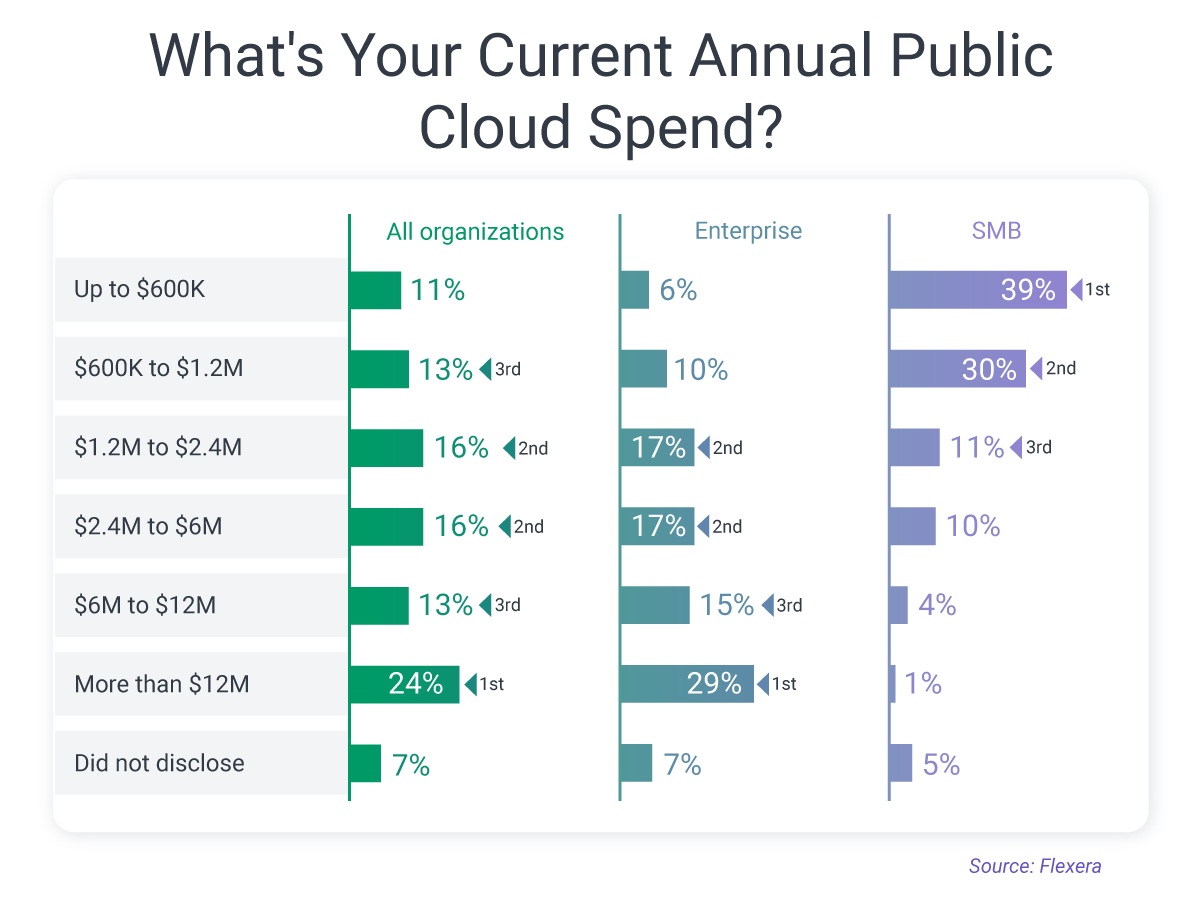

Nearly a quarter of businesses spend over $12M on public cloud per year, with the vast majority of enterprises spending at least $1.2M annually.

The majority (60%) of companies understand that cloud costs are increasing, and over half of companies said public cloud increased their IT spend in the past three years.

Budget Wastage in Cloud Spending

Despite the growing sophistication in cloud management, a significant portion of cloud budgets—up to a third—goes to waste, according to Flexera. This statistic highlights the critical need for more effective cloud cost management strategies, where FinOps plays an essential role.

Similarly, a recent Harness report estimates that enterprises will waste about 21 percent of their cloud infrastructure budgets in 2025, totaling roughly $44.5 billion in unused or underused resources. The study notes that cloud spending has become one of the largest line items for software companies, surpassed only by payroll.

Embracing FinOps for Cloud Cost Management

The Critical Role of FinOps

As cloud adoption skyrockets, managing the associated costs becomes a paramount challenge for organizations. In this landscape, 89% of industry stakeholders identify FinOps as the key to reigning in cloud cost complexity.

FinOps is Top Priority for Businesses

Research from Wakefield and S&P Global reinforces this viewpoint, revealing that FinOps has ascended to the same level of importance as established IT disciplines, like DevOps and SecOps, among developers, engineers, and C-suite executives.

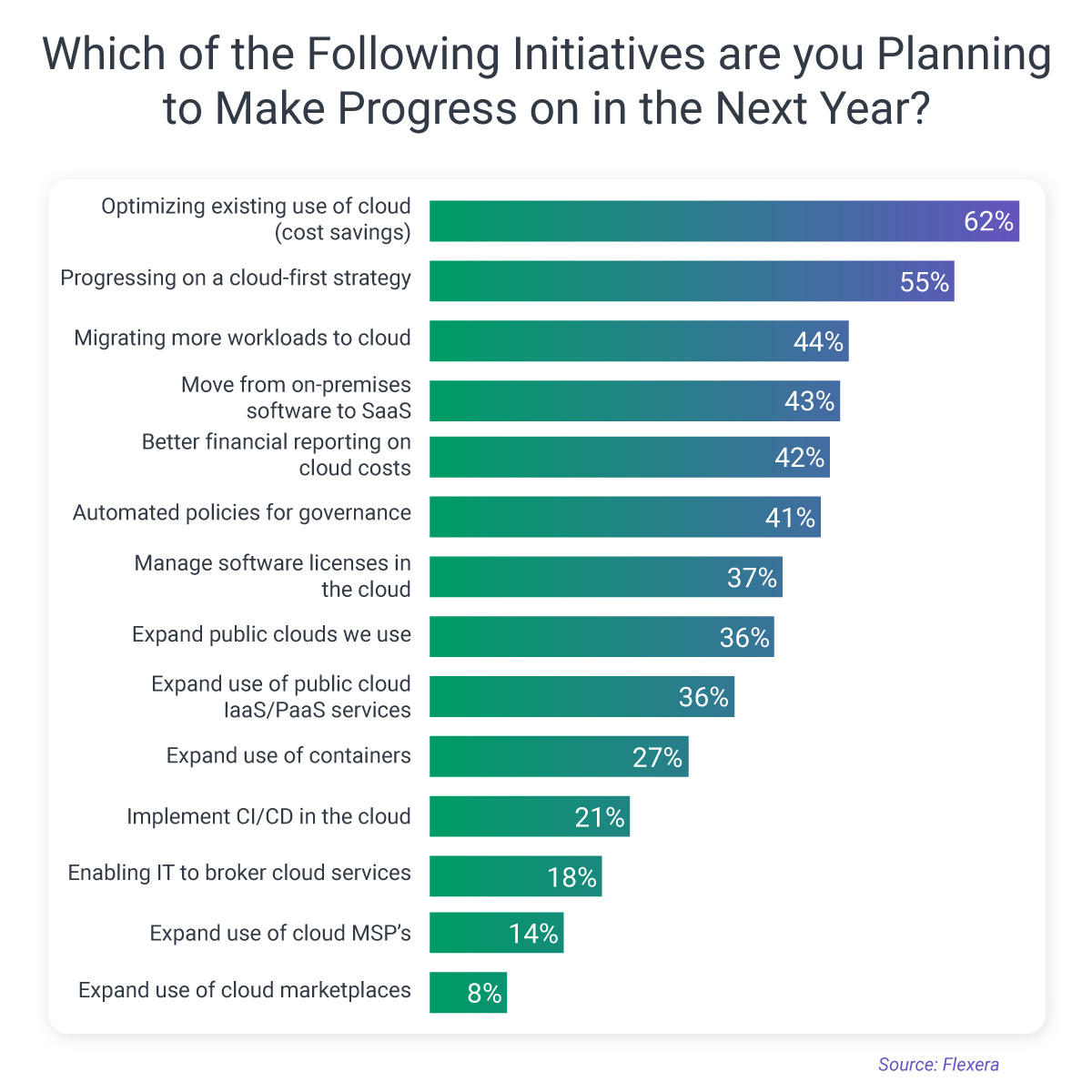

Cloud optimization, also called FinOps, is the top priority for businesses next year, followed by initiatives to have a cloud-first strategy.

Efficiency Through FinOps

The latest FinOps Foundation findings illustrate just how critical cloud cost management has become for large enterprises. Among surveyed organizations, 31 percent spend more than $50 million annually on public cloud, and another 20 percent spend over $100 million. More than 20 organizations report cloud budgets exceeding $1 billion per year.

These figures mirror the scale of the teams involved: 41 percent of respondents come from companies with more than 20,000 employees, and 15 percent represent organizations of over 100,000 employees. This concentration of large-scale cloud users underscores why FinOps is increasingly central to modern IT and financial strategy.

Understanding FinOps Hiring

How Many Companies Have a FinOps Team

While writing this report, we’ve seen a variety of projections of how many companies currently have FinOps teams. This has ranged from 82% of organizations [FinOps Foundation], to just 9% of companies, depending on the source [Wakefield Research].

We would take a guess that the number is somewhere between these, but it is still a nascent practice for most companies. We assume that many of these companies have used DevOps implementation services or cloud implementation services that assist them in applying cloud cost optimization practices, even if they don't call it "FinOps".

What Skills Should FinOps Teams Have

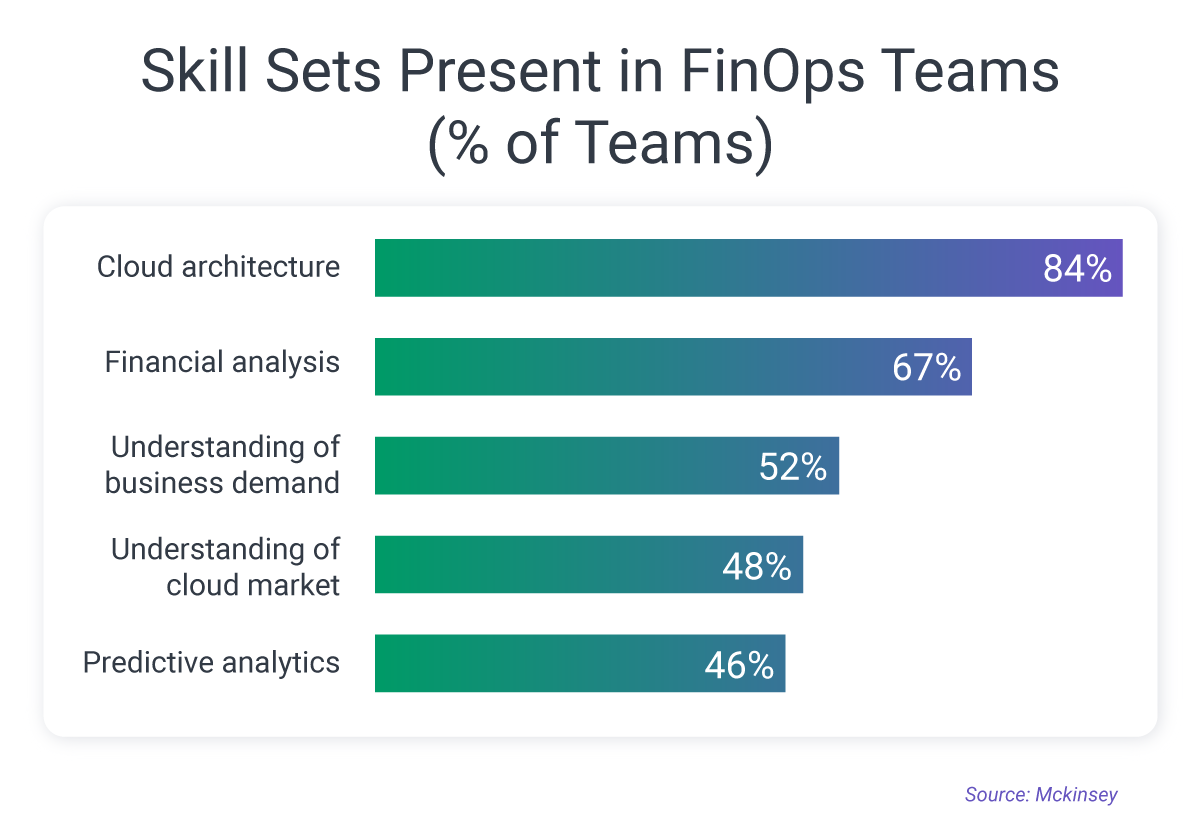

Common skill sets FinOps teams have are expertise in cloud architecture, financial analysis, and understanding of business demand, with fewer teams having an understanding of the cloud market and predictive analytics.

How Much are FinOps Salaries?

When it comes to FinOps salaries, businesses can expect to pay between $50-$300K for FinOps specialists, depending on their level of experience.

If your cloud cost optimization projects are a priority, we recommend utilizing FinOps consulting services to help you quickly address priority items or check on cloud spend, without having to hire a full-time FinOps engineer or team. Often, experienced DevOps engineers can also help with cost-optimization projects for the cloud.

How to Implement FinOps

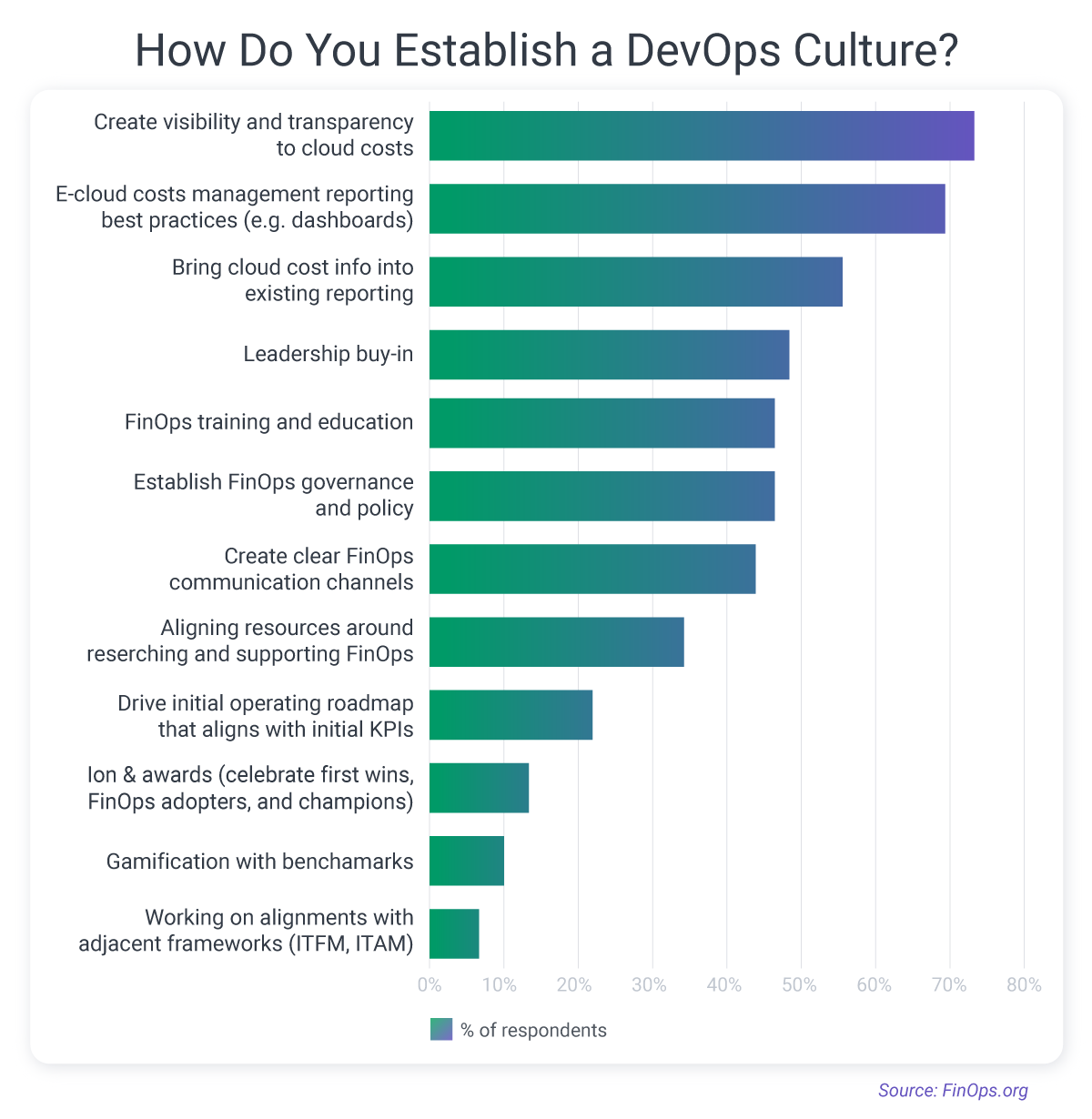

Beyond hiring a FinOps team, to establish a FinOps culture, the majority of companies say they try to create visibility and transparency to cloud costs, use cloud cost management reporting best practices, and bring cloud cost data into existing reporting.

Beyond enhancing visibility within their company, businesses can also establish a FinOps culture through leadership buy-in, FinOps training, policies, and more.

FinOps in The Fintech Landscape: A Cloud-Driven Future

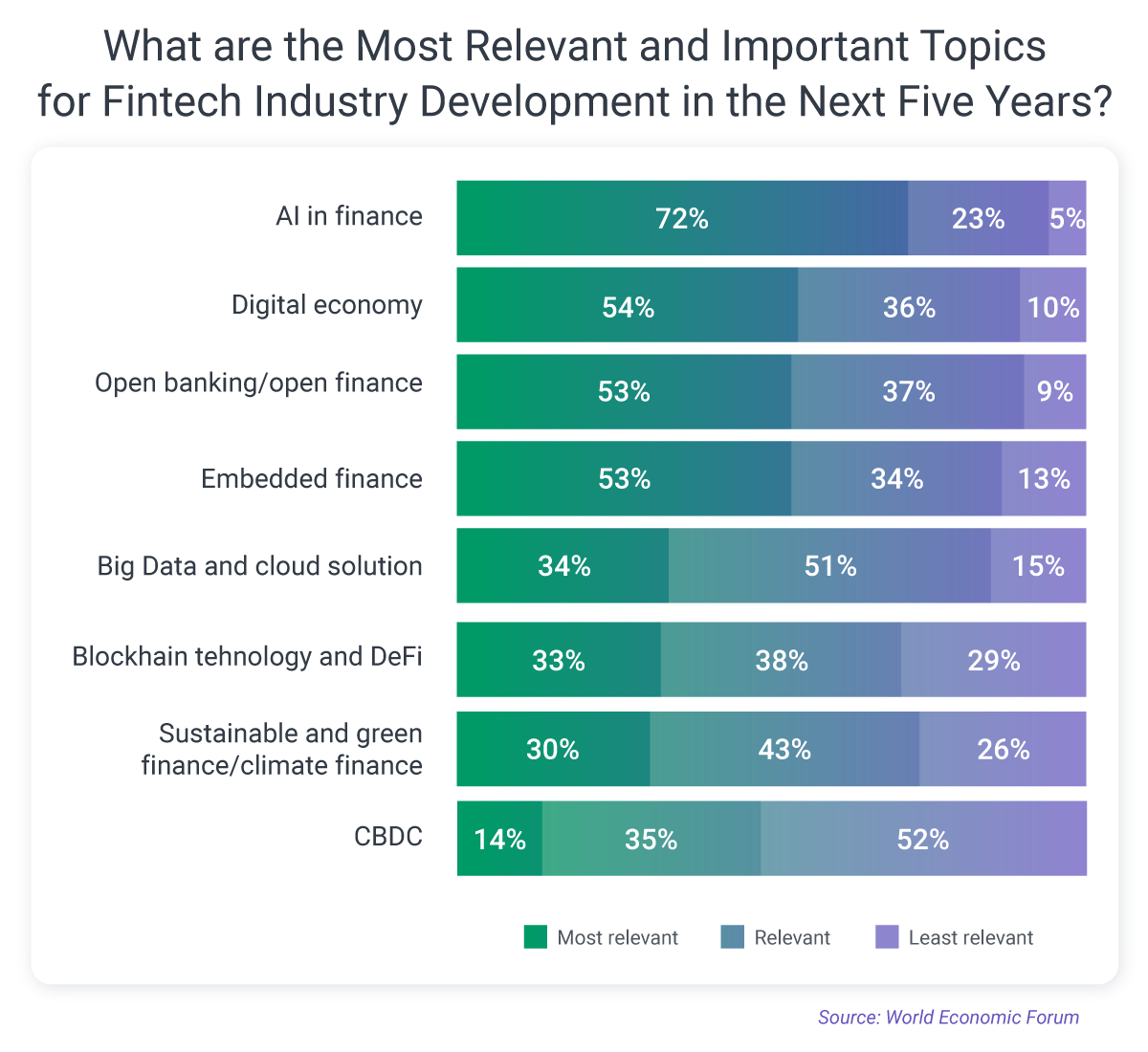

According to the World Economic Forum, Cloud Solutions were ranked as the 5th most important topic in the Fintech industry in 2025, beaten only by AI/ML, regional interoperability, Open Banking, and embedded finance.

Similarly, the Economist also reported a significant shift towards cloud computing in the banking sector, with over half of the survey respondents agreeing that banks will completely migrate to the public cloud, abandoning private data centers within the next five years.

.png)

The CVP of financial services at Microsoft, Bill Borden, explained that cloud technology has shown that banks can take advantage of scale while not having to build on-premise technology on their own, giving them more space for agility and flexibility while adhering to regulatory-controlled environments.

Looking Forward: The Next Frontier in FinOps

It's clear that FinOps and cloud computing are not merely fleeting trends but foundational elements shaping the future of technology and business operations. With the necessity for cloud computing on the rise and the increasing complexity of cloud cost management, the adoption of FinOps becomes not just beneficial but essential.

If your organization is on the path to cloud optimization and seeking to harness the strategic benefits of FinOps, now is the time to act. Consider engaging with a FinOps consulting company that can provide the insights, strategies, and support needed to navigate the complexities of cloud cost management.

With the right expertise, your organization can not only avoid the pitfalls of unmanaged cloud spending but also achieve significant efficiency gains, laying the groundwork for sustainable growth and success in the cloud era.