Fintech companies heavily rely on technology to deliver innovative financial solutions to their customers. Cloud computing services play a crucial role in enabling fintech companies to scale their operations, handle large volumes of data, and ensure the high availability and reliability of their services.

By leveraging the right cloud infrastructure, fintech firms can focus on their core competencies and rapidly develop and deploy new applications without the need for significant upfront investments in hardware and infrastructure.

The fintech industry continues to grow, with the number of users of fintech services expected to amount to 4.8 billion by 2028. The average spend per employee in the Public Cloud market worldwide is projected to reach US $260 in 2025, indicating that choosing the right cloud services provider is crucial for the bottom line for many fintech companies.

Gartner predicts that 90% of organizations will adopt a hybrid cloud approach by 2027, signifying that cloud expertise will be necessary to deliver on their digital strategies.

This guide aims to provide a comprehensive overview of the key factors fintech companies should consider when selecting a cloud services provider, ensuring they make an informed decision that aligns with their unique requirements and business goals.

Identifying Your Fintech's Unique Needs

To begin the assessment process, fintech companies should consider the following key factors:

- Data Storage: Determine the amount and type of data your fintech application will need to store, as well as the required data retention periods and backup strategies.

- Processing Power: Assess the computational resources needed to run your fintech application efficiently, taking into account peak traffic periods and potential future growth.

- Regulatory Compliance: Identify the specific regulatory requirements your fintech must adhere to, such as GDPR, PCI DSS, or HIPAA, and ensure the chosen cloud provider can meet these standards.

- Scalability: Evaluate your fintech's potential for growth and ensure the selected cloud provider can accommodate increasing user bases and transaction volumes without compromising performance.

- Security: Prioritize the security of your fintech application and customer data, considering factors such as data encryption, access controls, and multi-factor authentication.

How to Choose A Cloud Provider - Step-by-Step

Selecting the right cloud provider is a critical decision that can have a long-lasting impact on your fintech organization.

Here's a step-by-step guide to help you choose the best cloud provider for your needs:

- Assess your requirements: Clearly define your business objectives, technical requirements, and compliance needs. Ensure the provider complies with relevant financial regulations and industry standards, such as PCI DSS, SOC, and ISO 27001.

- Consider scalability and performance: When it comes to the provider's ability to scale resources on demand to handle peak traffic and a growing user base, consider the provider's global presence and data center availability in the regions where your target market is located.

- Analyze costs: Compare pricing models, including pay-as-you-go and reserved instances, and estimate the total cost of ownership. Compare the provider's pricing models and assess the total cost of ownership, including data transfer, storage, and compute costs.

- Evaluate the provider's cost optimization tools and features, such as reserved instances and auto-scaling, to manage costs effectively. Consider the provider's pricing for fintech-specific services and any additional compliance or security features fees.

- Evaluate support and SLAs: Review the provider's support offerings, response times, and service level agreements (SLAs) to ensure reliable assistance when needed.

- Assess data location and sovereignty: Consider the geographic location of data centers and ensure compliance with data sovereignty regulations. Ensure the provider complies with data sovereignty and residency regulations in the regions of your fintech application.

- Investigate migration and integration options: Evaluate the ease of migrating and integrating existing workloads with other systems and tools. Assess the provider's integration capabilities with your existing systems and third-party services. Lastly, consider the provider's ecosystem of partners and pre-built integrations relevant to fintech applications.

- Fintech-Specific Services: Evaluate the provider's offerings specific to fintech applications, such as payment processing, fraud detection, and regulatory compliance solutions. Assess the provider's integration capabilities with financial systems, such as core banking platforms and payment gateways.

When choosing a cloud service provider for your application, our experts focus on several key factors to consider to ensure the best fit for your specific needs.

How to Get the Right Cloud for Your Specific Software?

When selecting a cloud provider, it's essential to consider the specific requirements of your software application. Different types of software may have varying needs in terms of scalability, performance, security, and integration capabilities, and that’s where our DevOps consulting services come in handy.

Here are some key factors we take into consideration based on your software type:

For Web Applications:

- Scalability: Ensure the cloud provider offers auto-scaling capabilities to handle varying traffic loads.

- Load balancing: Look for built-in load balancing features to distribute traffic evenly across multiple instances.

- Content Delivery Network (CDN): Consider providers with integrated CDN services for faster content delivery.

For Mobile Applications:

- Backend-as-a-Service (BaaS): Evaluate providers that offer BaaS solutions for simplified backend development and management.

- Push notifications: Assess the provider's capabilities for sending push notifications to mobile devices.

- Mobile analytics: Consider providers with robust mobile analytics tools for app performance and user behavior insights.

For Data-Intensive Applications:

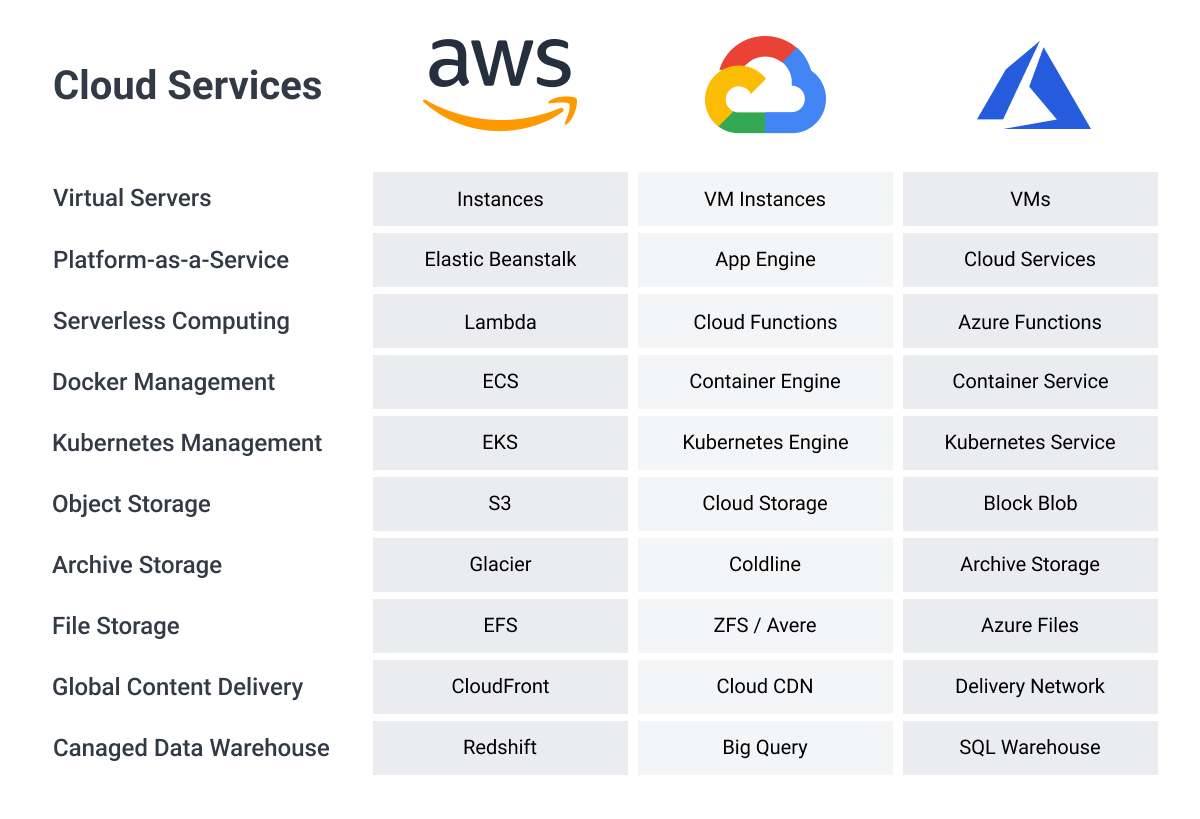

- Big data processing: Look for providers with big data services like Hadoop, Spark, or dedicated big data platforms.

- Data warehousing: Evaluate the provider's offerings for data warehousing and analytics, such as Amazon Redshift or Google BigQuery.

- Data storage: Assess the provider's storage options, including object storage and database services, based on your data volume and access patterns.

For Artificial Intelligence and Machine Learning:

- GPU instances: Consider providers that offer GPU-optimized instances for accelerated AI and ML workloads.

- Pre-trained models: Look for providers with pre-trained AI models and APIs for tasks like image recognition, natural language processing, and predictive analytics.

- ML frameworks: Evaluate the provider's support for popular ML frameworks like TensorFlow, PyTorch, or Scikit-learn.

For Microservices and Containerization:

- Kubernetes support: Assess the provider's managed Kubernetes offerings for container orchestration and management.

- Serverless computing: Consider providers with serverless platforms like AWS Lambda or Google Cloud Functions for event-driven architectures.

- Container registries: Look for providers with secure and scalable container registry services for storing and managing container images.

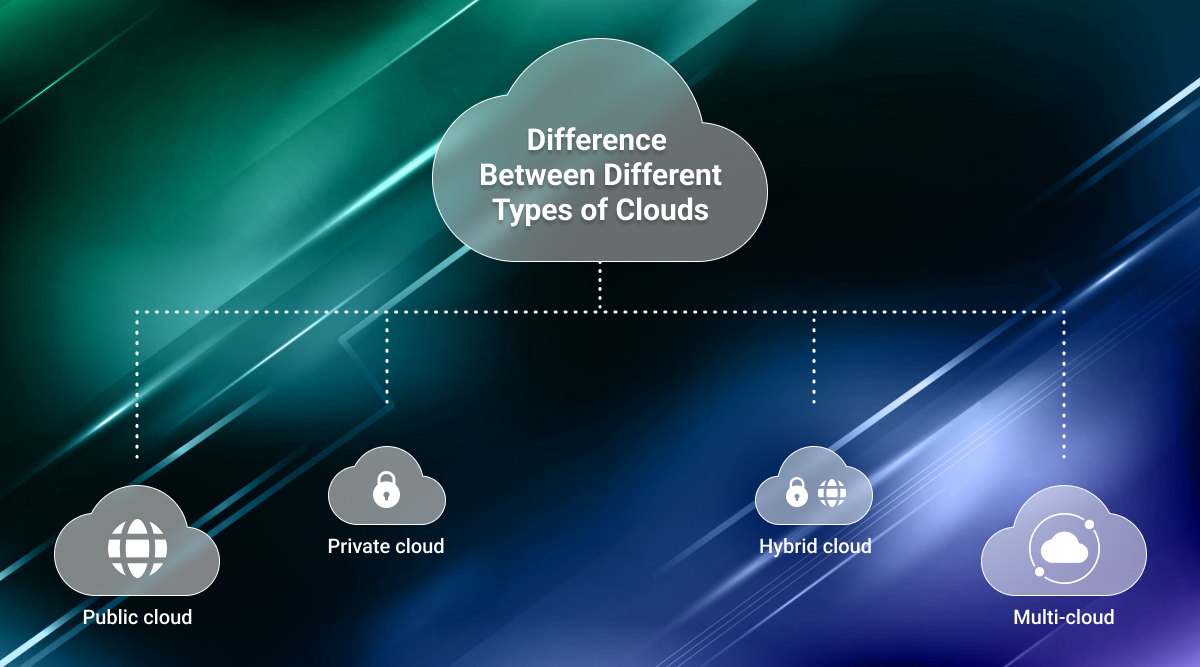

Different Types of Cloud Infrastructure

Cloud computing services come in different forms, each with its own characteristics and benefits:

Public Cloud: Shared computing resources provided by third-party providers, offering scalability and cost-effectiveness.

Private Cloud: Dedicated computing resources exclusively used by a single organization, providing enhanced control and security.

Hybrid Cloud: Combination of public and private clouds, allowing workloads to move between the two based on specific requirements.

Multi-Cloud: Utilizing multiple cloud providers to distribute workloads and avoid vendor lock-in.

Key Factors to Consider When Choosing a Cloud Provider

When evaluating potential cloud services providers, fintech companies should focus on several critical factors that can significantly impact the success of their applications and overall business.

![visual_75]()

Security and Compliance

In the fintech industry, security and compliance are paramount.

Fintech companies handle sensitive customer data and must adhere to strict regulatory requirements to maintain trust and avoid costly penalties. When choosing a cloud provider, fintech firms should look for those that offer robust security features and have a proven track record of meeting industry standards.

Encryption: Ensure the provider offers data encryption both at rest and in transit to protect sensitive information from unauthorized access.

Access Controls: Look for providers that offer granular access controls, allowing fintech companies to manage user permissions and restrict access to sensitive data.

Compliance Certifications: Choose a provider that holds relevant compliance certifications, such as ISO 27001, SOC 2, and PCI DSS, demonstrating their commitment to security and privacy.

Scalability and Performance

Fintech applications often experience rapid growth and fluctuating demand, making scalability and performance critical considerations when selecting a cloud provider.

The chosen provider should be able to accommodate increasing user bases and transaction volumes without compromising the application's speed and reliability.

Auto-scaling: Look for providers that offer auto-scaling capabilities, allowing your fintech application to automatically adjust its resources based on demand, ensuring optimal performance and cost-efficiency.

Load Balancing: Choose a provider that offers load balancing services to distribute traffic evenly across multiple servers, preventing bottlenecks and ensuring a seamless user experience.

Global Presence: Consider providers with a global network of data centers, enabling your fintech application to deliver low latency and high performance to users worldwide.

Key performance metrics to consider:

- Response Time: The time it takes for your fintech application to respond to user requests.

- Throughput: The number of transactions or requests your application can process within a given timeframe.

- Uptime: The percentage of time your application is available and accessible to users.

Cost and Pricing Models

Cost is a significant factor for fintech companies when choosing a cloud services provider. It is essential to understand the different pricing models offered by providers and how they align with your fintech's budget and growth projections.

Pay-as-you-go: Many cloud providers offer a pay-as-you-go model, allowing fintech companies to pay only for the resources they consume, providing flexibility and cost-efficiency.

Reserved Instances: Some providers offer the option to reserve resources for a specific period, often at a discounted rate compared to on-demand pricing.

Spot Instances: Certain providers, such as AWS, offer spot instances, which allow fintech companies to bid on unused compute capacity at significantly lower prices, suitable for non-critical or interruptible workloads.

Integration and Interoperability

Fintech applications often need to integrate with various external systems, such as payment gateways, banking APIs, and third-party services. When choosing a cloud provider, fintech companies should consider the provider's integration capabilities and the ease of interoperability with existing systems.

API Management: Look for providers that offer robust API management tools, enabling secure and seamless integration with external services.

Hybrid Cloud: The worldwide public cloud market is increasingly dominated by hybrid solutions, reflecting a growing preference for flexibility and scalability among enterprises. Consider providers that support hybrid cloud deployments, allowing fintech companies to integrate their cloud-based applications with on-premises systems.

Marketplace Ecosystem: Evaluate the provider's marketplace ecosystem, which offers pre-built integrations and tools that can accelerate development and reduce integration efforts.

Integration best practices:

- Use industry-standard protocols like REST and SOAP for seamless integration.

- Implement secure authentication and authorization mechanisms, like OAuth and API keys.

- Leverage middleware and integration platforms to simplify connectivity between disparate systems.

- Regularly monitor and test integrations to ensure data integrity and system reliability.

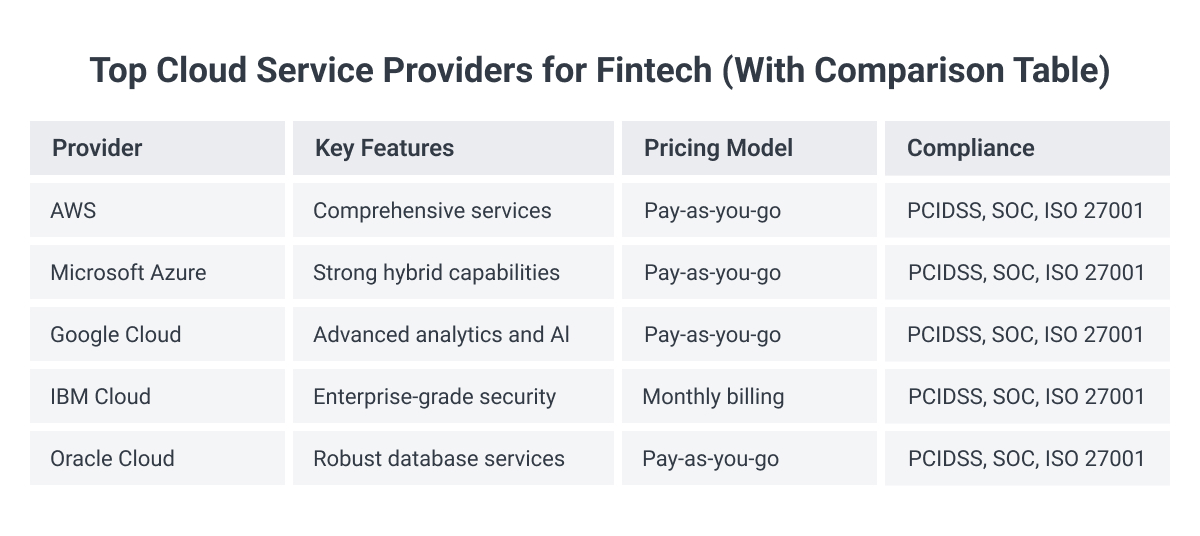

Evaluating Top Cloud Providers for Fintech

Several cloud service providers have emerged as leaders in the fintech industry, each offering a unique set of features and benefits. Let's take a closer look at three of the most prominent providers:

Amazon Web Services (AWS)

AWS is the largest cloud provider, offering a comprehensive suite of services tailored to the needs of fintech companies. With a strong focus on security and compliance, AWS provides a range of fintech-specific solutions, such as:

- AWS FinSpace: A data management and analytics service designed for financial services, enabling fintech companies to store, process, and analyze large volumes of financial data securely.

- Amazon Managed Blockchain: A fully managed service that allows fintech companies to build and deploy blockchain networks, facilitating secure and transparent transactions.

- AWS PayMents PayMents: A set of tools and services that enable fintech companies to process payments securely, including support for PCI DSS compliance.

Microsoft Azure

Microsoft Azure is another leading cloud provider, known for its strong focus on enterprise-grade security and compliance. Azure offers a range of services that cater to the needs of fintech companies, including:

- Azure Blockchain Workbench: A tool that simplifies the development and deployment of blockchain applications, enabling fintech companies to create secure and scalable solutions.

- Azure Active Directory: A comprehensive identity and access management service that helps fintech companies secure their applications and protect sensitive data.

- Azure Cognitive Services: A set of AI-powered services that enable fintech companies to build intelligent applications, such as fraud detection and risk assessment systems.

Key benefits of Microsoft Azure for fintech:

>Seamless integration with Microsoft tools and technologies, like Office 365 and Power BI.

>Robust security features, including multi-factor authentication and data encryption.

>Comprehensive compliance offerings, meeting various industry standards and regulations.

Google Cloud Platform (GCP)

Google Cloud Platform is known for its strength in analytics, machine learning, and big data processing, making it an attractive choice for fintech companies looking to leverage these technologies.

GCP offers several services that can benefit fintech firms, such as:

- BigQuery: A fully managed, petabyte-scale data warehouse that enables fintech companies to store and analyze massive amounts of financial data.

- Cloud Machine Learning Engine: A managed service that allows fintech companies to build, train, and deploy machine learning models, enabling advanced analytics and predictive capabilities.

- Cloud DLP: A data loss prevention service that helps fintech companies protect sensitive data and ensure compliance with regulations like GDPR and PCI DSS.

Making the Final Decision

Choosing the right cloud services provider for your fintech company is a critical decision that requires careful consideration and evaluation.

By assessing your fintech's unique requirements, aligning cloud services with your business goals, and comparing the offerings of top providers, you can make an informed decision that sets your company up for long-term success.

To ensure you select the best provider for your fintech, conduct a comprehensive comparison of the top contenders based on your specific requirements. Create a matrix that evaluates each provider across key factors, such as:

- Security and compliance features

- Scalability and performance capabilities

- Cost and pricing models

- Integration and interoperability options

- Fintech-specific services and tools

Tips on How to Migrate to a New Cloud Service

- Plan and assess: Conduct a thorough assessment of your current environment and create a detailed data migration plan.

- Choose the right migration strategy: Select the appropriate migration approach, such as lift-and-shift, re-platforming, or refactoring.

- Prioritize workloads: Identify and prioritize the workloads to be migrated based on criticality and dependencies.

- Test and validate: Perform thorough testing and validation of migrated workloads to ensure functionality and performance.

- Train and communicate: Provide training to your team and communicate the migration process and timeline to all stakeholders.

- Monitor and optimize: Continuously monitor the migrated workloads and optimize for performance, cost, and security.

By understanding the basics of cloud computing services, evaluating the right cloud provider, and following best practices for migration, fintech companies can harness the power of the cloud to drive innovation, scalability, and competitive advantage in the rapidly evolving financial industry.

Before committing, consider engaging in proof of concepts (POCs) or trials with the top cloud providers on your shortlist. This hands-on experience will give you valuable insights into the provider's capabilities, performance, and ease of use, helping you make a more informed decision.

Final Word

Selecting the right cloud services provider is a critical decision for fintech companies, as it can significantly impact their ability to innovate, scale, and remain competitive in an ever-evolving industry.

By carefully evaluating your fintech's unique requirements, considering key factors such as security, scalability, and cost, and comparing the offerings of top providers like AWS, Microsoft Azure, and Google Cloud, you can make an informed decision that aligns with your business goals and sets your company up for long-term success.

Remember to conduct thorough comparisons, engage in proof of concepts or trials, and involve key stakeholders throughout the decision-making process.

Once you pass through that phase, you can ensure that your fintech company selects a cloud services provider that not only meets your current needs but also supports your future growth and success in the dynamic world of financial technology.