London has always been a nexus for the innovative fintech scene. As the second biggest fintech ecosystem globally, London has the highest concentration of fintech companies and professionals.

That’s why, each year, Fintech Week London gathers many of the most prominent names and biggest decision-makers in the industry all in one place. These industry players include experts from investment firms, leading fintech, banks, neobanks, regulatory bodies, and media companies that are deeply connected with the fintech market.

The UK has more than 2500 fintech companies that can be grouped into several specialties: Banking, RegTech, InsurTech, Lending, Payments, WealthTech, Accounting, Auditing, and Cash Flow Management.

Conference Topics

Open Banking and Banking-as-a-Service

This session explored the momentum and future potential of open banking in the UK and beyond. As open banking reaches its 4-year milestone in the UK, industry experts explained what Banking as a Service is and how embedded finance can enable the customer journey.

Digital Sovereignty and Digital ID

In a world that is growing ever more digital and data-orientated, its of the utmost importance to understand cybersecurity, privacy, and fraud prevention in the quest for digital sovereignty. How can digital identity and biometrics keep you, your customers, and your businesses secure? All that and more are explained.

Big Tech and Big Banks

With so many mergers, acquisitions, and partnerships taking place, the “co-opetition” between big tech and big banks has never been more relevant as the fintech industry comes of age. The rise of neobanks and the potential for new fintech communities have pushed tech giants and big banks to work to keep up.

Trending in Fintech

From Buy Now Pay Later to Web 3.0, the hottest trends in fintech were analyzed to level up the fintech industry.

Crypto

Fintech Week London dove into the world of cryptocurrency to explore payments and NFTs, as well as analyze the arguments for the Central Bank Digital Currencies (CBDC) and the opportunities and challenges it would bring.

Fintech for the Future

The advancements in climate and ethical finance happen in an ESG-focused world, so it is essential to understand the need for further change. With the potential to make a brighter future with tech and finance, it's important to ask the question: what does real transformation look like?

Embedded Finance: The Future Is Here, Just Not Evenly Distributed

As a part of the first topic, Leda Glyptis, from 10x Future a company that develops some of the most powerful cloud native banking platforms, started her lecture by explaining how people in fintech tend to quickly move from one trend to another at a too-frequent pace. While embedded finance has been considered a trend, it has actually existed for some time and has become a part of everyday life.

Embedded finance offers more potential for decision-making for the customer, as they can choose their providers, instead of being forced to use a certain one. Glyptis explained how customers could choose to use services with benefits they choose for themself, like better user experience or smaller fees.

The second topic Glyptis focused on was a change of paradigm in the financial system. Even though the banks had more than a decade to prepare and learn to use new technologies, their understanding of new tools as well as regulations had to mature so the banks could completely digitize their services.

The tech she speaks of includes API first environment, BaaS, and platform economics. These business and tech aspects banks a lot of time to prepare and develop. The idea of banking-as-a-service is expanding and showing people that it’s possible to use different services. The biggest question now is how banks can pivot the existing infrastructure toward new services.

Centralization vs. Decentralization in Crypto

Rita Liu, the CEO of UK-based digital wallet Mode, discussed crypto adoption, regulations and whether decentralization is really possible. Mode is a digital wallet that connects merchants and users of cryptocurrencies.

Liu began her lecture by focusing on the polarization that exists around the concept of crypto. She adds that even though the world of crypto seems decentralized, actually only 18% of cryptocurrencies have decentralized their business and all of its aspects.

She posited that when it comes to crypto, it's all about the power of merchants and customers. However, what both merchants and customers care about most is security, control, privacy, and usability. That’s why decentralization is not always the best and right answer when it comes to crypto, as true decentralization comes with a lot of challenges that conflict with what is most important to merchants and customers.

What is Self-Sovereign Identity and Why Should Everyone Know About It?

All participants of the Digital Sovereignty Roundtable addressed the biggest question: What is self-sovereign identity? There’s a sway in the industry; 70% of people want to own their identity and decide exactly which pieces of information they want to share. While the roundtable discussion concluded that people should make all decisions about their data, it's still not clear how to make this happen beyond agreeing on the theory.

Striking a balance between control and privacy is very important, and grows more important every day; it's reasonably very hard for people to trust technology partners and platforms as they are quickly taking up a lot of personal data.

Self-sovereignty identity (SSI) is only possible it's frictionless and easy to implement. Identity creates trust, and when people move around the world, no matter where they go, they want to have their data safe but still accessible.

Big Tech and Banks

Is big tech an opportunity or competition for big banks? This topic was first broached around 2014 in the light of super apps appearing in Asian markets that quickly transformed the way they purchase goods, order online, and control their finance. Banks and big tech companies worked together to create a system that millions of people can use.

Banks understand that there are things they must improve on, notably tech advancements, and big tech companies also have their own issues to solve, especially in the realm of finance. Due to this, banks are some of the biggest clients of tech companies, and tech companies are some of the largest clients of banks! It is speculated that these overlapping parties will converge and work together towards increased digitalization.

Co-creating solutions is already happening as big banks are investing in data analytics by pairing up with big tech companies. Banks have to use the best technology to deliver financial services. Just because banks are increasing their focus on technology, doesn’t necessarily mean that banks will try to beat or become tech companies. Banks will still have their own services to offer, and vice versa, so we predict that neither will step on each other’s toes.

“Banking is What We do, and Technology is How we do it”

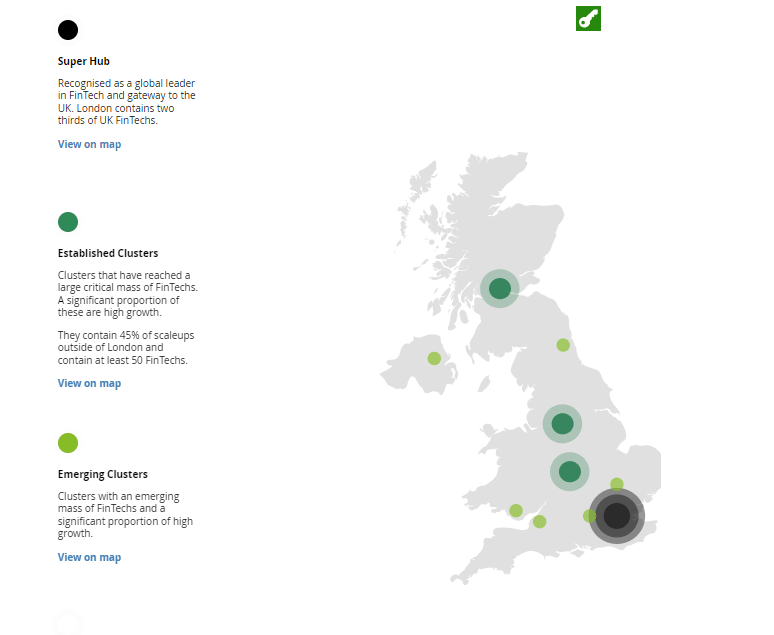

After London Fintech Week, we clearly saw what trends are on the rise for banking and tech, and where there is space for growth in the fintech landscape. The UK’s high-growth clusters and assets play a big role in supporting economic growth and recovery, so learning lessons straight from a fintech hotspot was enlightening.

We love sharing the insights we learn from conferences, because we enjoy hearing from those who attended and those who weren’t able to, in particular, what their thoughts were on the topics shared. Attending conferences is one of the ways Softjourn stays ahead of the curve and brings the latest technical solutions closer to our clients.

Understanding the technology that is driving fintech is no longer about simply acknowledging trends, but understanding how and when it’s necessary to implement them. If you are looking for a partner to help you follow the fast pace of the financial industry with a deep understanding of the tech needed to make improvements happen - contact us.

Fintech startups and banks choose to work with us because we have been developing financial apps for more than a decade, yet always advancing our consulting knowledge and skillsets to reflect the best technologies present. We are here to help you digitalize your services, and create mobile and web applications to provide their clients with easy and frictionless journeys.