Many businesses can become interested in building their own payment gateway: merchants wanting to reduce payment service fees, startups looking into offering a gateway in an underserved region, or online companies who started out with a white label service that is now presenting them with technical limitations instead of support.

However, too many do not fully understand the size and scope of building a payment gateway from scratch. There are many misconceptions about the steps involved with creating and running your own payment gateway.

In this article, we’ll answer many questions to give you the full picture of what is necessary to build your own payment gateway solution from scratch.

Payment Gateway Market Overview

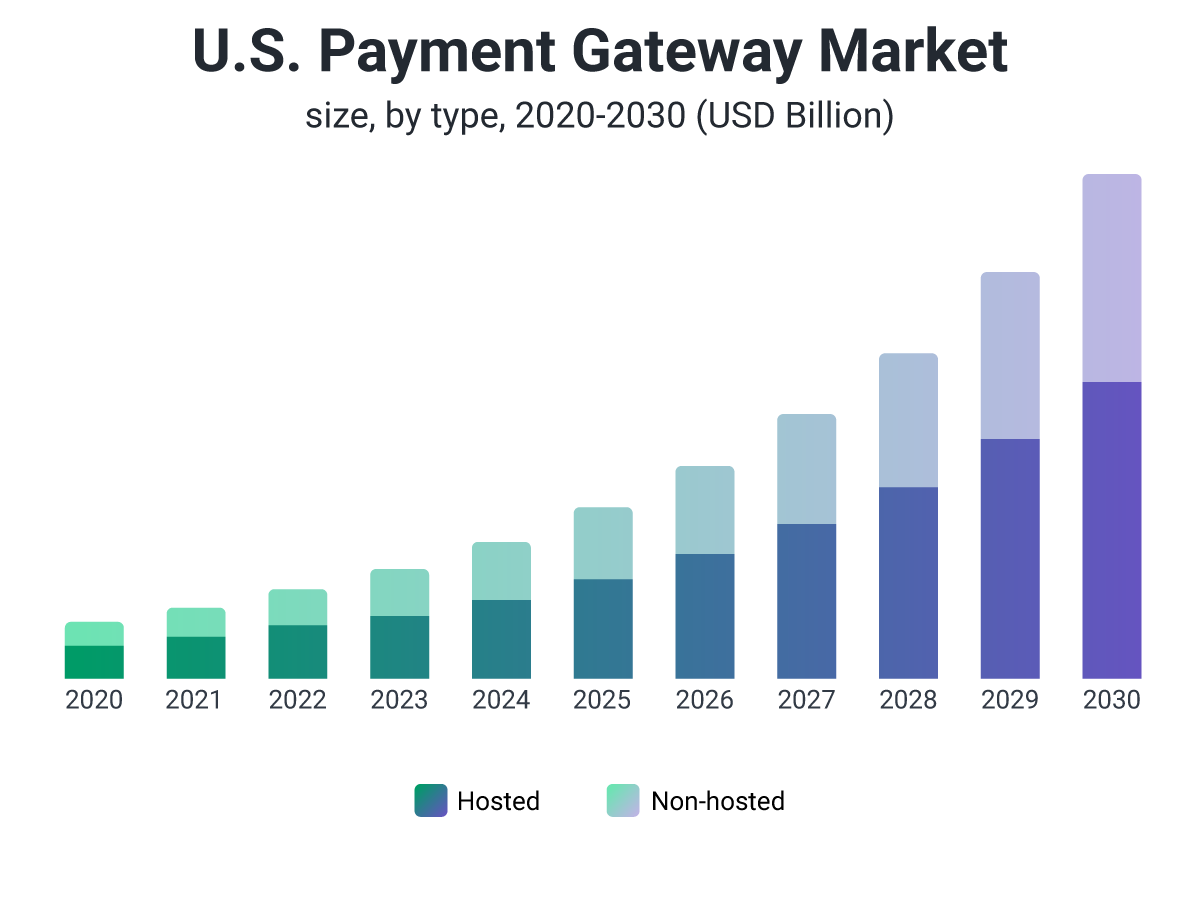

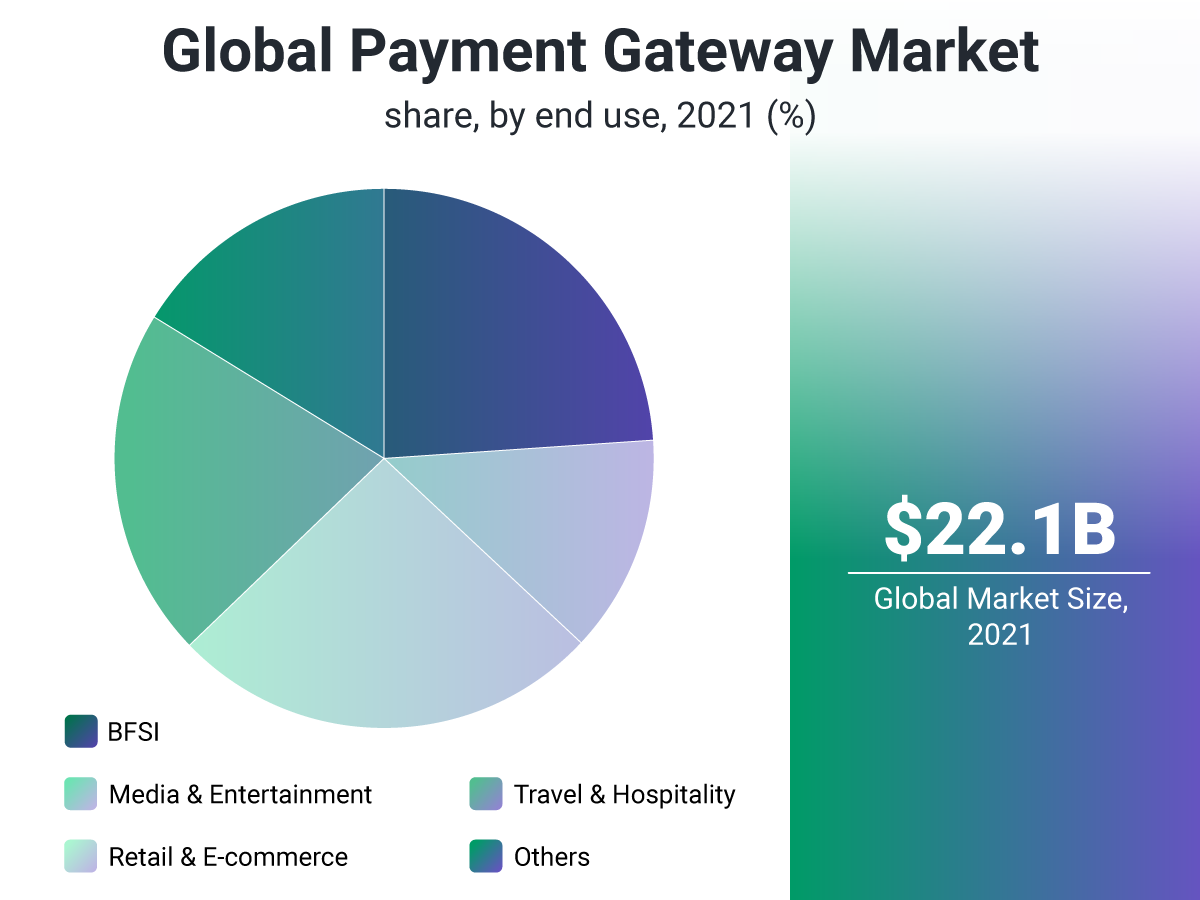

The rise in mobile payments, easy access to the internet, and growing e-commerce sales have contributed to the enormous growth of the payment gateway market. In 2021, the global payment gateway market size was valued at $22.09 billion USD, and is expected to expand at a compound annual growth rate (CAGR) of 22.1% from 2022 to 20301.

Payment gateways like Amazon Pay, Apple Pay, Samsung Pay, and Android Pay have made the process of bill payments and online purchases even more easy and convenient. The shift in merchant and consumer preference for digital payments and money transfers has influenced various companies to expand their payment systems and will continue to propel the growth of payment gateways in the upcoming future.

Payment Gateways Industry Trends

There has been a rise in the adoption of payment gateway solutions across various industries, especially in utility bill payments, online gaming, OTT platforms, and online pharmacies and grocery stores.

Many businesses are attempting to keep up with the competition by quickly digitizing and incorporating efficient payment solutions. With online payment gateway markets garnering significant traction worldwide, there is no better time to figure out the right payment gateway solution for your business.

What is a Payment Gateway?

A payment gateway is a technology used to process and authorize electronic transactions, typically for online or card-not-present transactions. It acts as a bridge between a merchant's website and the financial institution that processes the transaction.

Customers submit their payment information into a retailer's website when they make purchases there. The payment gateway then delivers this information securely, encrypts it, and sends it to the acquiring bank (the bank that processes the transaction on behalf of the merchant). The acquiring bank subsequently forwards the transaction to the relevant card issuer (like Visa or Mastercard) for authorization.

Once the card issuer has authorized the transaction, the payment gateway sends the response back to the merchant's website, and the transaction is completed. The payment gateway also sends the transaction information to the acquiring bank, which then deposits the funds into the merchant's account.

Some of the features of a payment gateway include fraud detection and prevention, recurring billing, and support for various types of payments, including credit and debit cards, e-checks, and alternative payment methods such as digital wallets and bank transfers.

Overall, the payment gateway is an essential component of e-commerce and online transactions, ensuring the secure and convenient exchange of payment information between merchants and customers.

Payment Gateways vs. Payment Processors: Decoding the Digital Payment Ecosystem

In the world of electronic payments, two crucial components form the backbone of every transaction: payment gateways and payment processors. While often conflated, these elements play distinct roles in the intricate dance of digital commerce.

Payment Gateway: The Digital Doorkeeper

A payment gateway is the front-line soldier in the e-commerce battlefield. It's a sophisticated piece of software that acts as a secure bridge between a merchant's website and the vast financial network. Here's what it does:

- Encryption Fortress: It armors sensitive customer data with state-of-the-art encryption protocols.

- Data Relay: Safely ferries encrypted payment information to the acquiring bank.

- Authorization Liaison: Communicates with card issuers to get transaction approvals.

- Merchant Notifier: Reports transaction status back to the merchant's site in real-time.

- Settlement Initiator: Kicks off the settlement process by sending approved transaction data to the acquiring bank.

Payment Processor: The Financial Conductor

If the payment gateway is the doorkeeper, the payment processor is the backstage maestro orchestrating the financial performance. As a financial institution, it:

- Transaction Routing: Directs payment data through the labyrinth of financial networks.

- Authorization Management: Interfaces with card issuers to secure transaction approvals.

- Fund Settlement: Ensures money flows from customer accounts to merchant coffers.

- Dispute Resolution: Handles the nitty-gritty of chargebacks when necessary.

- Compliance Guardian: Keeps transactions in line with industry regulations and security standards.

The Symbiotic Relationship

While distinct, payment gateways and processors often work in tandem, sometimes offered by the same provider. This integration can streamline operations, but it's not a one-size-fits-all solution. Merchants have the flexibility to mix and match:

- All-in-One Solutions: Some providers offer both gateway and processing services, providing a seamless end-to-end solution.

- À la Carte Approach: Other businesses opt for separate gateway and processor providers, allowing for more customization and potentially better rates.

- Bank-Provided Services: Acquiring banks may offer their own gateway and processing solutions, which can simplify account management for merchants.

Understanding this ecosystem is crucial for developers entering the fintech space. Whether integrating existing solutions or building your own, the interplay between gateways and processors forms the foundation of secure, efficient digital transactions.

As you explore this landscape, consider investigating some of the leading third-party payment processors. These innovative players have reshaped the transaction landscape, offering developers powerful APIs and robust SDKs to create seamless payment experiences in our increasingly digital world.

Where Do I Start?

You might think you need to speak with developers or fintech consultants when thinking about building a payment gateway. After all, it is a digital solution for accepting credit card payments.

However, this belief is misguided; the first thing you will need to do is build business relationships with either a payment processor or an acquiring bank.

How to Create a Payment Gateway?

Constructing a payment gateway requires a combination of technical sophistication and methodical planning. Here's an in-depth guide on how to develop a payment gateway:

- Research & Planning: Dive into the needs of your target market by understanding regional regulations (e.g., GDPR in Europe, Dodd-Frank in the US), prevalent payment methods, and potential user requirements. Consider KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

- Create Your Payment Gateway Infrastructure:

- Backend Infrastructure: Establish a robust server infrastructure, ensuring it can manage high traffic loads and maintain optimal uptime. Consider cloud-based solutions (AWS, Google Cloud, or Azure) for their scalability and redundancy benefits. Implement auto-scaling and load balancing for high availability.

- Database Management: Strategize a secure database system to store transaction records, user data, and other vital information. Consider a combination of relational (e.g., PostgreSQL) and NoSQL (e.g., MongoDB) databases. Implement database sharding and caching mechanisms (e.g., Redis) for improved performance.

- API Development: Create RESTful APIs with clear documentation (use tools like Swagger) that enable easy integration of your payment gateway into merchant platforms. Implement versioning to ensure backward compatibility.

- Choose a Payment Processor: A payment processor facilitates the transaction between the merchant and the issuing bank. Selecting a reliable and versatile payment processor is essential for the overall effectiveness of your gateway. Evaluate factors like transaction fees, settlement speed, supported payment methods, and the processor's reputation in the market. Consider integrating with multiple processors for redundancy.

- Selecting a Processing Method: Decide between direct processing (which involves the direct handling of sensitive data and compliance with stringent regulations) or using hosted payment gateways (wherein a third party oversees the payment process).

- Ensuring Security: Prioritize encryption, such as Secure Socket Layer (SSL), and implement end-to-end encryption using TLS 1.3. To safeguard sensitive information, maintain alignment with the Payment Card Industry Data Security Standard (PCI DSS). Use tokenization to protect sensitive card data and implement rate limiting and DDoS protection.

- Integration with Banks and Card Networks: Foster partnerships with banks and card networks like Visa and Mastercard. This often involves setting up a dedicated merchant account and meeting the bank's specific criteria.

- Developing the Interface: Design an intuitive interface that caters to merchants and customers, emphasizing transparency and user-friendliness. Consider implementing a microservices architecture for scalability and maintainability.

- Testing: Undertake rigorous testing for a variety of transaction scenarios to ensure system resilience and reliability. Implement comprehensive unit and integration tests (use frameworks like Jest or Mocha). Conduct regular penetration testing and security audits. Perform stress testing to ensure the system can handle peak loads. Learn more about different types of testing in software development.

- Fraud Detection: Embed a sophisticated fraud detection mechanism, incorporating machine learning models for real-time fraud detection. Use features like IP geolocation, transaction velocity, and amount patterns. Consider integrating with third-party fraud detection services for additional layers of security.

- Reporting Tools: Incorporate tools that empower merchants with insights through transaction details, summaries, and other relevant metrics. Implement distributed tracing (e.g., Jaeger, Zipkin) for transaction flow visibility.

- Ongoing Maintenance and Updates: Update the payment gateway to address emerging security threats, introduce new payment integrations, and refine the user experience while adhering to evolving industry standards. Implement a CI/CD pipeline (e.g., GitLab CI or GitHub Actions) for automated testing and deployment.

- Customer Support: Roll out a proficient support mechanism to assist both merchants and end-users with any concerns or queries related to the gateway.

- Scalability and Performance Optimization: Implement caching strategies for frequently accessed data. Use database read replicas to distribute query load. Optimize database queries and indexes for faster transaction processing.

- Future-Proofing: Design the system to be agnostic to the payment method. Consider blockchain integration for certain types of transactions. Stay updated with emerging standards (e.g., Fast IDentity Online - FIDO2).

Building a payment gateway is a delicate balance between ensuring robust security measures and delivering an optimal, user-friendly experience, all while strictly abiding by local and international financial norms and regulations. It requires a meld of technical sophistication and systematic planning. By focusing on scalable architecture, robust security measures, and adherence to regulatory standards, you can create a payment gateway that not only meets current needs but is also prepared for future innovations in the fintech space.

Remember, the landscape of digital payments is ever-evolving. Regular updates, continuous learning, and adaptation to new technologies and regulations are crucial for maintaining a competitive and secure payment gateway.

Why do I need a payment processor?

If you wish to offer a payment gateway as a service, you need something to connect it to. This something is the payment processor. A payment processor, sometimes called a merchant service, moves the transaction through the payment network. Sometimes an acquiring bank can be a payment processor.

The processor you choose to partner with will provide you with technical information to integrate your gateway with their system. Depending on the payment types you wish to be able to accept, you may need to partner and integrate with several processors.

Why Do I Need an Acquiring Bank?

If you are a merchant that wishes to have their own payment gateway, you’ll need a payment processor and an acquiring bank. Merchants already need a merchant account to accept digital payments, which are provided by acquiring banks.

An acquiring partner is a bank or financial institution (FI) that processes credit or debit card payments on behalf of a merchant. The acquiring bank you choose will assume risk for your business, and as such, will require certain financial commitments due to chargebacks, refunds, ACH returns, and potential fraud.

An acquiring bank is not the same as a commercial bank, which offers checking and savings accounts. A commercial bank may have an acquiring division, but not all commercial banks can underwrite merchant accounts. Make sure the financial institution you wish to partner with can set you up with a merchant account.

1. Customer initiates a digital purchase. 2. The merchant transmits the cardholder information to the payment gateway. 3. The payment gateway encrypts the cardholder information and transmits it to the payment processor. 4. The payment processor verifies the cardholder information and transmits it to the card network. 5. The card network transmits the information to the issuing bank. 6-9. Depending on the amount of funds in the cardholder’s account, an approved or declined message is transmitted back along the payment network. 10. If the payment is approved, funds are transmitted to the merchant’s account at their acquiring bank.

What Technical Specifications Will I Need?

Your payment processor of choice will provide the specifications necessary to integrate your payment gateway with their system and the overall payment network. If you plan to accept many different payment types, you may need to get additional specifications from other acquirers or processors.

These technical specifications will inform what technology you can or should use to build your payment gateway.

What if I Want to Sell in Multiple Geographic Locations?

You will need a relationship with a processor that operates in all of the locations. This can mean a partnership with a specific processor that operates in multiple locations, or partnerships with multiple processors.

Local regulations for the region or regions in which you wish to do business will also influence the choice of technology for your payment gateway. We have received requests to help create gateways to operate in, for example, Latin America and Malaysia; local laws and standards can make growth difficult for other popular payment providers like PayPal, which seems to leave a gap for other providers.

However, obstacles for larger companies are obstacles for a reason; they are not always so easily addressed by others. Here's what you need to consider as wellr:

- Multi-Currency Support:

- Implement real-time currency conversion

- Support local currencies for each target market

- Consider using third-party services for up-to-date exchange rates

- Regional Payment Methods

- Research and integrate popular local payment methods:

- Europe: SEPA, iDEAL, Giropay

- China: Alipay, WeChat Pay

- India: UPI, Paytm

- Latin America: Boleto, Oxxo

- Partner with local payment service providers if necessary

- Regulatory Compliance • Understand and adhere to regional financial regulations:

- Europe: GDPR, PSD2

- US: Dodd-Frank Act, state-specific laws

- China: Cybersecurity Law

- Implement region-specific data protection measures

- Consider seeking legal counsel for complex regulatory landscapes

- Tax Handling

- Integrate with tax calculation services for accurate local tax rates

- Implement systems to handle VAT, GST, and other region-specific taxes

- Ensure proper tax reporting for each jurisdiction.

How Much Does It Cost to Build a Payment Gateway?

Our ballpark estimation for creating a payment gateway minimum viable product (MVP) is between $200K and $250K. Of course, this is dependent on the functionality you wish to incorporate into your gateway. The MVP described here would at least get you set up to accept credit and debit card payments.

How Long Does It Take to Build a Payment Gateway?

It can take years to build a payment gateway from scratch. A faster solution is to license a white label product, which can be up and running in just a few months. Many white label products can be customized to your company’s needs.

It can also take months or years for processors or acquirers to decide to integrate with your payment gateway, making it viable for market use.

We estimate that it will take up to six months to build an MVP payment gateway from scratch. This estimate will likely fluctuate depending on the specifics of your request.

Won’t I Save Money in the Long Term if I Build My Own Gateway?

Maybe, if your processing volume is large enough. Many wrongly assume that if they host a payment gateway solution of their own that they can eliminate credit card processing fees that they are paying to their processor.

Fees for card network usage and/or processing will always be required by providers like Visa and Mastercard.

Interchange and settlement costs can only be eliminated with direct integrations with card network providers. This level of integration really only makes sense if your company processes very large transaction volumes, such as into the billions.

Surcharges can be reduced through owning your own payment gateway, but this is again dependent on whether your transaction volume offsets the cost of building and operating a payment gateway.

Owning and operating your own payment gateway also comes with the additional cost of paying for servers and gateway product maintenance.

It is only worth taking an open source product in-house or developing your own if eliminating some of the third-party gateway-related fees offsets the annual price of gateway maintenance, PCI DSS audit, certifications, and other myriad costs.

Don’t Forget About Security and Compliance.

Partnering with a processor and getting technical specifications for integration are just the tip of the iceberg. Merchants look for secure payment gateways to boost customer confidence. Secure payment gateways with fraud detection mechanisms can help avoid chargebacks and other problems resulting from fraudulent purchases.

The payment industry is evolving rapidly, with technological advances and changing consumer preferences driving a shift toward digital and mobile payment solutions. As payment gateways play a critical role in facilitating online transactions, ensuring the security and protection of sensitive data is paramount. This section will discuss the essential security standards and compliance requirements for building a payment gateway from scratch, providing insights into the various measures that can help secure and safeguard payment data.

Topics covered will include Payment Card Industry Data Security Standard (PCI DSS), encryption methods, Secure Sockets Layer (SSL) and Transport Layer Security (TLS), Two-Factor Authentication (2FA) and Multi-Factor Authentication (MFA), EMV, EMV 3-D Secure, tokenization, and peer-to-peer encryption (P2PE). By adhering to these security standards and implementing robust security measures, payment gateways can provide a safe and secure environment for online transactions, fostering trust among users and merchants alike.

Over the next sections, we’ll discuss other concepts that can have an impact on your ability to build and operate your own payment gateway.

Payment Card Industry Data Security Standard (PCI DSS)

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all businesses that accept, process, store, or transmit credit card information maintain a secure environment. Established in 2006 by major card brands, including Visa, Mastercard, American Express, Discover, and JCB, PCI DSS aims to minimize the risk of data breaches and protect cardholder information.

Key Requirements For Payment Gateways

To comply with PCI DSS, payment gateways must adhere to its 12 high-level requirements, further divided into more specific sub-requirements. The key areas of focus include:

1. Building and maintaining a secure network

- Installing and maintaining a firewall configuration to protect cardholder data

- Ensuring proper password protection and not using vendor-supplied defaults for system passwords and security parameters

2. Protecting cardholder data

- Encrypting transmission of cardholder data across open, public networks

- Protecting stored cardholder data

3. Maintaining a vulnerability management program

- Using and regularly updating anti-virus software or programs

- Developing and maintaining secure systems and applications

4. Implementing strong access control measures

- Restricting access to cardholder data by business need-to-know

- Assigning a unique ID to each person with computer access

- Restricting physical access to cardholder data

5. Regularly monitoring and testing networks

- Tracking and monitoring all access to network resources and cardholder data

- Regularly testing security systems and processes

6. Maintaining an information security policy

- Establishing, publishing, maintaining, and disseminating a comprehensive information security policy

Benefits And Consequences Of Non-compliance

Complying with PCI DSS helps businesses maintain a secure environment for processing credit card transactions and fosters consumer trust. Non-compliance, on the other hand, can lead to severe consequences, such as data breaches, reputational damage, financial penalties, and the potential loss of the ability to process credit card payments. Therefore, payment gateways must prioritize PCI DSS compliance to protect sensitive cardholder data and minimize the risk of security incidents.

General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR) is a comprehensive data protection law implemented by the European Union (EU) in May 2018. The regulation aims to strengthen individuals' data privacy rights and harmonize data protection rules across EU member states. GDPR has extraterritorial scope, meaning it applies to any organization worldwide that processes the personal data of individuals within the EU.

Key Requirements For Payment Gateways

Payment gateways that process the personal data of individuals within the EU must comply with GDPR's fundamental principles and requirements. Some of these include:

- Lawfulness, fairness, and transparency: Payment gateways must process personal data lawfully, fairly, and transparently, clearly communicating the purpose and legal basis for data processing.

- Data minimization: Payment gateways should only collect and process the minimum personal data necessary to fulfill their purpose.

- Accuracy: Payment gateways must ensure that personal data is accurate and, where necessary, up-to-date, providing individuals the right to rectify inaccurate information.

- Storage limitation: Payment gateways should only store personal data for as long as necessary to fulfill the purpose for which it was collected.

- Security: Payment gateways must implement appropriate technical and organizational measures to ensure the safety of personal data, including protection against unauthorized or unlawful processing and accidental loss, destruction, or damage.

- Accountability: Payment gateways must demonstrate compliance with GDPR by maintaining records of processing activities, conducting data protection impact assessments, and appointing a data protection officer when necessary.

How GDPR Affects Payment Gateways Outside The EU

As GDPR has extraterritorial reach, payment gateways outside the EU must still comply with the regulation if they process the personal data of individuals within the EU. Non-compliance with GDPR can result in hefty fines of up to €20 million or 4% of the company's annual global turnover, whichever is higher. Additionally, non-compliant payment gateways risk damaging their reputation and losing the trust of customers who value data privacy. Therefore, payment gateways must understand and adhere to GDPR requirements to protect personal data and maintain a trustworthy relationship with customers.

California Consumer Privacy Act (CCPA)

The California Consumer Privacy Act (CCPA) is a comprehensive data privacy law enacted in California in June 2018, which went into effect on January 1, 2020. The CCPA grants California residents new rights concerning the collection, use, and sharing of their personal information by businesses. While the CCPA primarily applies to companies operating in California, its impact reaches beyond the state's borders, affecting companies that process the personal information of California residents.

Key Requirements For Payment Gateways

Payment gateways that process the personal information of California residents must comply with CCPA's key provisions, which include:

1. Transparency: Payment gateways must inform consumers about the categories of personal information they collect, the purpose for which it is used, and any third parties with whom they share the information.

2. Consumer rights: Payment gateways must respect the following rights of consumers:

- The right to know about the personal information collected, used, shared, or sold

- The right to delete personal information held by businesses

- The right to opt out of the sale of their personal information

- The right to non-discrimination for exercising their CCPA rights

3. Opt-out mechanisms: Payment gateways must provide a clear and conspicuous "Do Not Sell My Personal Information" link on their website or mobile app, allowing consumers to opt out of the sale of their personal information.

4. Verification of consumer requests: Payment gateways must establish a process to verify the identity of consumers who submit requests to exercise their rights under CCPA.

4. Data security: Payment gateways must implement reasonable security measures to protect personal information from unauthorized access, disclosure, or destruction.

How CCPA Affects Payment Gateways Outside California

CCPA's reach extends beyond California, affecting any payment gateway that processes the personal information of California residents, regardless of the company's location. Non-compliance with CCPA can result in civil penalties of up to $7,500 per intentional violation and $2,500 per unintentional violation, as well as potential lawsuits and reputational damage. To mitigate these risks, payment gateways must understand and adhere to CCPA requirements, ensuring high data privacy for their customers and maintaining consumer trust.

Secure Sockets Layer (SSL) and Transport Layer Security (TLS)

Secure Sockets Layer (SSL) and Transport Layer Security (TLS) are cryptographic protocols designed to communicate securely over a computer network. SSL, the predecessor of TLS, was developed by Netscape in the mid-1990s. TLS was introduced as an upgrade to SSL in 1999 and is now the more widely used protocol. SSL and TLS use encryption to protect sensitive data during transmission, ensuring the privacy and integrity of information exchanged between a user's browser and a website or application.

Importance of SSL/TLS Encryption

SSL/TLS encryption is essential for payment gateways to safeguard sensitive data during online transactions, such as credit card information and personally identifiable information (PII). Implementing SSL/TLS encryption:

- Ensures data privacy: SSL/TLS encryption prevents unauthorized parties from intercepting or reading the sensitive information transmitted between the user's browser and the payment gateway.

- Provides data integrity: SSL/TLS encryption guarantees that the transmitted data has not been tampered with or altered during transmission, ensuring its accuracy and reliability.

- Establishes trust: SSL/TLS encryption is often accompanied by an SSL certificate, which verifies the identity of the website or application. This certificate is visible to users as a padlock icon or a green address bar in their browser, indicating that the website is secure and trustworthy.

Key Considerations For Implementation

Payment gateways should consider the following factors when implementing SSL/TLS encryption:

- SSL/TLS version: Use the most recent version of TLS (currently TLS 1.3) to benefit from the latest security improvements and features.

- Certificate authority: Obtain an SSL certificate from a reputable certificate authority (CA) to ensure its authenticity and credibility.

- Cipher suites: Choose strong cipher suites that provide robust encryption and support forward secrecy, preventing data decryption even if the encryption key is compromised in the future.

- Regular updates: Monitor and update the SSL/TLS configurations to address new vulnerabilities and adhere to evolving security standards.

By implementing SSL/TLS encryption, payment gateways can provide a secure environment for online transactions, protecting sensitive data from unauthorized access and fostering trust among their users.

Two-Factor Authentication (2FA) and Multi-Factor Authentication (MFA)

Two-Factor Authentication (2FA) and Multi-Factor Authentication (MFA) are security mechanisms that require users to provide two or more independent factors to verify their identity during the authentication process. These factors generally fall into three categories:

- Something the user knows (e.g., password).

- Something the user has (e.g., mobile device).

- Something the user is (e.g., biometric data).

By implementing 2FA or MFA, payment gateways can add an extra layer of security, making it more difficult for unauthorized users to access sensitive data and systems.

Common 2FA and MFA Methods For Payment Gateways

Payment gateways can implement various 2FA and MFA methods to enhance their security, including:

- SMS-based authentication: Sending a one-time password (OTP) to the user's registered mobile number, which they must enter to complete the authentication process.

- Authenticator apps: Using applications like Google Authenticator or Authy to generate time-based OTPs, which users enter during the authentication process.

- Hardware tokens: Provide users with a physical device, such as a USB key, that generates OTPs or must be inserted into a computer to complete the authentication process.

- Biometric authentication: Utilizing the user's unique biometric data, such as fingerprints, facial recognition, or voice recognition, to verify their identity.

- Push notifications: Send a notification to the user's registered mobile device, which they must approve to complete the authentication process.

Key Considerations For Implementation

When implementing 2FA or MFA for a payment gateway, businesses should consider the following factors:

- User experience: Strive to balance security and user experience, ensuring that the authentication process is manageable and manageable for users.

- Flexibility: Offer multiple authentication methods to accommodate user preferences and device capabilities while providing fallback options in case the primary method is unavailable.

- Integration: Ensure that the chosen 2FA or MFA solution integrates seamlessly with the payment gateway's existing systems, applications, and infrastructure.

- Regulatory compliance: Verify that the selected 2FA or MFA solution meets relevant regulatory requirements or industry standards, such as PCI DSS, GDPR, or CCPA.

By incorporating 2FA or MFA into their security measures, payment gateways can significantly reduce the risk of unauthorized access and enhance the security of their systems and sensitive data.

EMV

EMV (Europay, Mastercard, and Visa) is a global standard for credit and debit card processing aiming to enhance card-present transactions' security. EMV technology uses an embedded microprocessor chip in payment cards to securely store and process cardholder data, replacing the less secure magnetic stripe technology. In the 1990s, EMV became the predominant standard for card-present transactions worldwide, offering increased protection against card fraud.

Importance of EMV

While EMV primarily applies to card-present transactions, it can also impact payment gateways by promoting the adoption of more secure payment technologies and reducing the overall risk of card fraud. Implementing EMV technology can offer several benefits to payment gateways, such as:

- Enhanced security: The microprocessor chip in EMV cards offers improved protection against card skimming, counterfeiting, and other forms of fraud compared to magnetic stripe cards.

- Global interoperability: EMV is a globally recognized standard, allowing payment gateways to support card-present transactions across different countries and regions.

- Liability shift: In many countries, the liability for fraudulent transactions has shifted from the card issuer to the party that has not adopted EMV technology, incentivizing payment gateways and merchants to implement EMV.

Key Considerations For Implementation

Payment gateways should consider the following factors when implementing EMV:

- Compliance: Ensure that the payment gateway's hardware and software are EMV-compliant, adhering to the specifications and requirements set by the EMVCo organization.

- Integration: Verify that EMV technology can be seamlessly integrated with the payment gateway's existing systems, applications, and infrastructure.

- Training: Provide training and support to merchants and staff on handling and processing EMV card transactions properly.

- Future-proofing: Consider adopting contactless EMV technology, such as NFC-enabled cards and mobile wallets, to meet consumers' evolving needs and preferences.

EMV 3-D Secure

EMV 3-D Secure (3DS) is an online authentication protocol developed by EMVCo to enhance the security of card-not-present (CNP) transactions, such as online and mobile payments. The protocol builds upon the original 3-D Secure protocol (developed by Visa in 1999) by offering improved risk-based authentication, reduced friction during the checkout process, and better support for various devices and payment channels. EMV 3DS aims to minimize the risk of fraud and chargebacks in CNP transactions while providing a seamless user experience.

Importance of EMV 3DS

Implementing EMV 3DS can offer several benefits to payment gateways:

- Enhanced security: EMV 3DS provides an additional layer of authentication for online transactions, reducing the likelihood of fraudulent transactions and chargebacks.

- Improved user experience: The risk-based authentication approach of EMV 3DS minimizes friction during the checkout process by only requiring additional verification for high-risk transactions.

- Regulatory compliance: EMV 3DS can help payment gateways comply with regulatory requirements, such as the European Union's Strong Customer Authentication (SCA) mandate under the Revised Payment Services Directive (PSD2).

Key Considerations For Implementation

Payment gateways should consider the following factors when implementing EMV 3DS:

- Compatibility: Ensure the payment gateway's existing systems and applications are compatible with the EMV 3DS protocol.

- Integration: Verify that EMV 3DS can be seamlessly integrated with the payment gateway's infrastructure, including support for mobile and other digital channels.

- Flexibility: Offer a customizable authentication experience that adapts to different merchants' and customers' specific needs and preferences.

- Monitoring and optimization: Continuously optimize the EMV 3DS implementation to balance security and user experience, adjusting risk thresholds and authentication methods as needed.

Tokenization

Tokenization is a security technology that replaces sensitive payment data, such as credit card numbers, with a unique, non-sensitive token. The original data is stored securely in a centralized token vault, and only the token is used for processing transactions. As a result, tokenization significantly reduces the risk of data breaches and unauthorized access to sensitive payment information, as the tickets are useless if intercepted or stolen.

Importance Of Tokenization

Implementing tokenization can offer several benefits to payment gateways:

- Enhanced security: Tokenization protects sensitive payment data during transmission and storage, minimizing the risk of data breaches and unauthorized access.

- Reduced scope of PCI DSS compliance: By replacing sensitive cardholder data with tokens, payment gateways can reduce their PCI DSS compliance requirements, as tokens are not considered cardholder data.

- Improved customer experience: Tokenization enables secure storage of customer payment information for future transactions, facilitating a smoother checkout process and supporting features like one-click payments and recurring billing.

Key Considerations For Implementation

Payment gateways should consider the following factors when implementing tokenization:

- Integration: Verify that tokenization technology can be seamlessly integrated with the payment gateway's existing systems, applications, and infrastructure.

- Token vault management: Implement robust security measures to protect the token vault, including encryption, access controls, and monitoring.

- Token lifecycle management: Establish policies and processes for managing the token lifecycle, including token generation, storage, expiration, and deletion.

- Compliance: Ensure the tokenization solution meets relevant industry standards and regulatory requirements, such as PCI DSS and GDPR.

Peer-to-Peer Encryption (P2PE)

Peer-to-Peer Encryption (P2PE) is a security technology that encrypts sensitive payment data at the point of capture (e.g., card reader or payment terminal). It keeps it encrypted until it reaches the payment processor or gateway. This end-to-end encryption ensures that sensitive data remains protected throughout the transaction process, significantly reducing the risk of data breaches and unauthorized access.

Importance of P2PE

Implementing P2PE can offer several benefits to payment gateways:

- Enhanced security: P2PE protects sensitive payment data from the point of capture to the payment gateway, minimizing the risk of data breaches and unauthorized access during transmission.

- Reduced scope of PCI DSS compliance: By encrypting sensitive data at the point of capture, payment gateways can further reduce the scope of their PCI DSS compliance requirements.

- Simplified security management: P2PE provides a comprehensive encryption solution that simplifies security management for merchants and payment gateways, reducing the need for multiple security technologies and processes.

Key Considerations For Implementation

Payment gateways should consider the following factors when implementing P2PE:

- Compliance: Ensure that the P2PE solution meets the requirements of the PCI P2PE standard and any other relevant industry standards and regulatory requirements.

- Integration: Verify that P2PE technology can be seamlessly integrated with the payment gateway's existing systems, applications, and infrastructure, as well as with merchants' point-of-sale (POS) systems.

- Encryption key management: Implement robust encryption key management practices, including secure key generation, storage, and rotation, to protect the P2PE encryption keys.

- Monitoring and maintenance: Continuously monitor and maintain the P2PE solution to ensure its ongoing effectiveness and address

Alternatives to Creating Your Own Payment Gateway

White label service

A white label service can be a quick way to get up and running offering your own payment solution. It can also reduce the cost of processing by reducing the number of middlemen between your business and your acquirer/processor.

There are many flavors of white label service, from hosted solution to dedicated gateway to licensed open source payment gateway software.

If you are worried that white label might not provide the level of customization you’re looking for, there are options. A client who spoke with us regarding that exact scenario learned that building a payment gateway from scratch was not a cost-effective solution for their issues regarding customizing their current white label gateway. Instead, they ended up negotiating for control over their source code in order to implement needed changes faster. You can also partner with a technology services provider to implement changes at your pace.

Replacement service provider

If you’re currently partnering with one of the well-known PSPs like Stripe, Paypal, or Square, there are alternatives out there. However, these providers are market leaders for a reason — their technical innovation has set them apart from the others.

As such, while you can partner with one of their competitors, the price charged will not be much lower than what you are currently paying. Likewise, it will be difficult to find an alternative that has significant technological advantages over them because of their market leader status. Keep in mind that processors often use mainframe legacy platforms, which tie you to a single point of connection to the banking system.

License payment gateway source code.

If you are a company with development resources but need to get to market quickly, then you can license the source code of an existing payment gateway. This way, you can deploy it in a PCI-certified environment of your choice and can customize the features you’d like.

Benefits and Challenges of Building a Custom Payment Gateway

Creating your own payment gateway comes with both advantages and disadvantages. Before deciding whether to build or buy, it is crucial to consider how building a payment gateway from scratch can benefit your business, and also what challenges you may face.

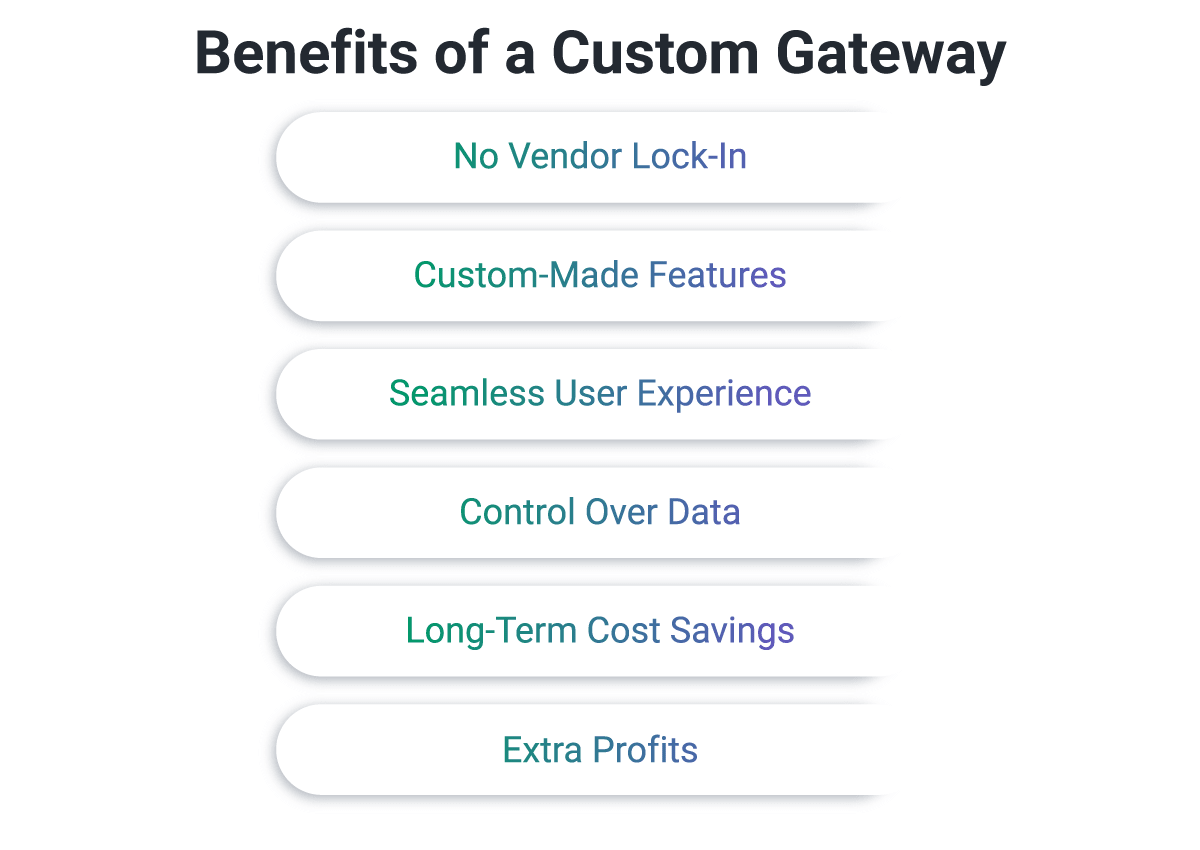

Benefits of Developing Your Own Payment Gateway

No Vendor Lock-In

By building your own payment gateway you’ll have the advantage of being independent of pay service companies. Dependency on an external provider can lead to vendor lock-in, a situation where you can’t switch your payment gateway without massive drawbacks. If you are locked in with a vendor, you have limited influence. The terms of use and fees for a payment gateway can change over time to your disadvantage. Plus, if the provider has economic or security issues, it can hurt the reputation of your own platform. Having your own solution allows you to correct shortcomings, and have control over security, fees, and terms of use.

Custom-Made Features

Want your platform to stand apart from the rest? Innovation and smart functionalities help platforms rise to the top and become successful. For unique businesses, by creating your own payment gateway you will be able to have access to all the features you’d like - from recurring payments, support for marketing campaigns, and even cryptocurrency support.

Seamless User Experience

When you design a payment gateway from scratch, you can fine-tune the user experience. User-friendly payment flows, interfaces, and navigation will keep users happy. You can create your own onboarding too, which will lessen friction for merchants. When you build your own payment gateway, you are able to control all aspects of the marketplace business, including user and admin experiences.

Control Over Data

Although self-hosting can come with some costs, data sovereignty provides many benefits. You have the ability to analyze your customers’ payment data to learn about how they use their marketplace and see trends on your platform. This helps you refine your platform’s usability, integrate new features based on what your customers prefer, and even save costs since you can choose between different payment service providers via smart routing.

Long-Term Cost Savings

While payment gateways may cost more upfront to build, in reality, when you develop this product you are investing in the long-term growth of your company. Third-party payment gateways come with their own costs, from sign-up fees to per-transaction charges, which add up over time.

However, it is important to keep in mind that even with your own gateway, you will still need to pay access fees, interchange fees, and more. The difference between using your own payment gateway and a third-party gateway is about 20 cents, so if you have a huge volume of clients, it may be worth it to build your own. For a smaller volume of transactions, you’d be better off with a third-party gateway.

Extra Profits

Usually you will not only break even on the initial costs of developing your own payment, but you can actually make a profit if you run your own payment gateway as a side business. You will have the opportunity to sell or rent it to other companies needing solutions with similar feature sets. Also, you can run other businesses using your own payment gateway.

Biggest Challenges for Building a Payment Gateway

Development and Maintenance Expenses

It comes as no surprise that creating a payment gateway takes great up-front development costs. It should also not be forgotten that payment gateways include additional, and sometimes recurring, expenses for maintenance, insurance, and other costs. Complying with new regulations and integrating new payment methods come with high costs, but are necessary to stay competitive in the market. For small businesses with tight budgets, developing your own payment gateway may not be the right solution for you.

Slower Time to Market

Building your own payment gateway, especially with tailor-made features, takes longer than integrating a third-party solution - this means that it will take much longer to get your marketplace up and performing.

To reduce development time, creating a payment gateway should be one of the first things your developers start to work on, once you have decided on how your marketplace should look. To speed up the process more, you can hire development teams that are experienced in creating custom payment gateways. You should also factor in that the required certification processes can be time-consuming and somewhat out of your control.

Responsibilities for Functionality and Compliance

As the developer and the owner of a payment gateway, all responsibilities for ensuring the functionality of your marketplace fall to you. This means your team will need to administer continuous comprehensive testing, maintenance, and debugging. You will have to deal with settlements, customer complaints, pending transactions, and many other client-facing issues that may develop. You will also be held accountable for PCI compliance and data security, which requires large costs and specific rules and restrictions. It is more than likely that you will need either additional know-how from your in-house team or from a reliable, external fintech partner.

Building a Payment Gateway from Scratch vs. Integrating with an Existing Payment Gateway (Comparison table)

Deciding whether to build a payment gateway from scratch or integrate with an existing one is crucial for businesses looking to streamline their payment processing infrastructure. This comparison table provides an overview of the advantages and disadvantages of each approach, considering factors such as cost, time to market, customization, security, scalability, and supported currencies and payment methods. By evaluating these criteria, businesses can make an informed decision that best suits their unique requirements and objectives, ensuring a smooth and efficient payment experience for their customers.

| Criteria | Create Your Own PG: Advantages | Create Your Own PG: Disadvantages | Integrate Existing PG: Advantages | Integrate Existing PG: Disadvantages |

| Cost | Full control over pricing | High upfront and maintenance costs | Lower initial costs | Transaction fees and potential hidden costs |

| Time to Market | No reliance on third-party APIs | Longer development and testing time | Faster implementation | Limited by the existing gateway's features |

| Customization | Unlimited feature possibilities | Requires extensive technical expertise | Limited customization | Dependence on the third-party's API |

| Security | Tailored security measures | Responsibility for meeting security standards | Established security measures | Reliance on the third-party's security |

| Scalability | Scalable based on business needs | Requires continuous updates and improvements | Scalability provided by the existing gateway | Potential limitations in scalability |

| Supported Currencies & Payment Methods | Complete control over supported options | Additional effort to integrate various methods | Wide range of options offered by existing gateways | Limited by the existing gateway's offerings |

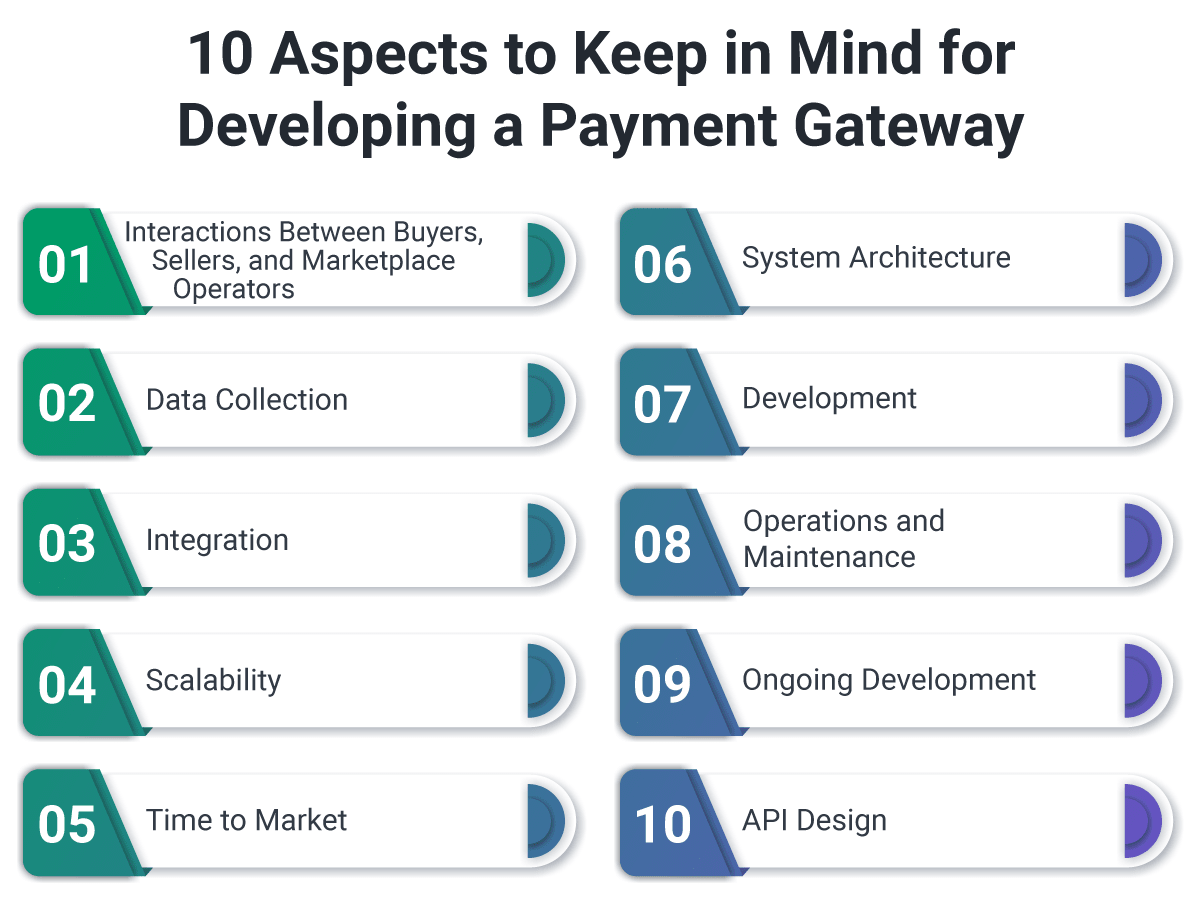

Aspects to Keep in Mind for Developing a Payment Gateway

Developing a payment gateway is not a walk in the park, however, with the knowledge of what it takes to build a payment gateway, you are one step closer to understanding what is required of this undertaking. Before you get started on creating your payment gateway, have a plan in mind for how the following core aspects factor into your payment gateway solution.

Interactions Between Buyers, Sellers, and Marketplace Operators

The foundation of your payment gateway solution should be built around the basic interactions between your buyers, sellers, and the platform itself. Before programming even starts, you will want to carefully consider what interaction flows should be set up, including how your consumers and sellers will use the payment gateway. To get started on this thought process, take into account the following questions:

- How much data will your platform collect from buyers?

- Will your customers be private, corporate, or both?

- Is your marketplace C2C, B2C, or B2B?

- Will you be onboarding private consumers or other companies?

- What legal requirements do you need to adhere to?

- Will your platform accept multi-party transactions?

- Will your features include multi-currency support?

Data Collecting

A key consideration before diving too deeply into design and development is how your system will handle customer and financial transaction data securely. In the case of development, this means using secure coding procedures. The payment gateway system you build must also comply with financial regulations and data protection policies, which may vary across countries.

Integration

If you offer online payment on your marketplace, you will come to a crossroads during development, where you must decide how to integrate payment service providers into your payment gateway. This can take two forms:

- PSP integration via API which uses an internal checkout page as a part of your platform’s frontend. Remember, designing this type of integration is the responsibility of your frontend team.

- Redirection, which leads the user to the Payment Provider’s designated, external checkout page.

Neither of these options is necessarily better nor worse than the other, but