Neobanks are revolutionizing the financial landscape, but their path is far from smooth. From cybersecurity threats to fierce competition, these digital-first institutions face significant hurdles in 2026.

Neobanking Market Overview

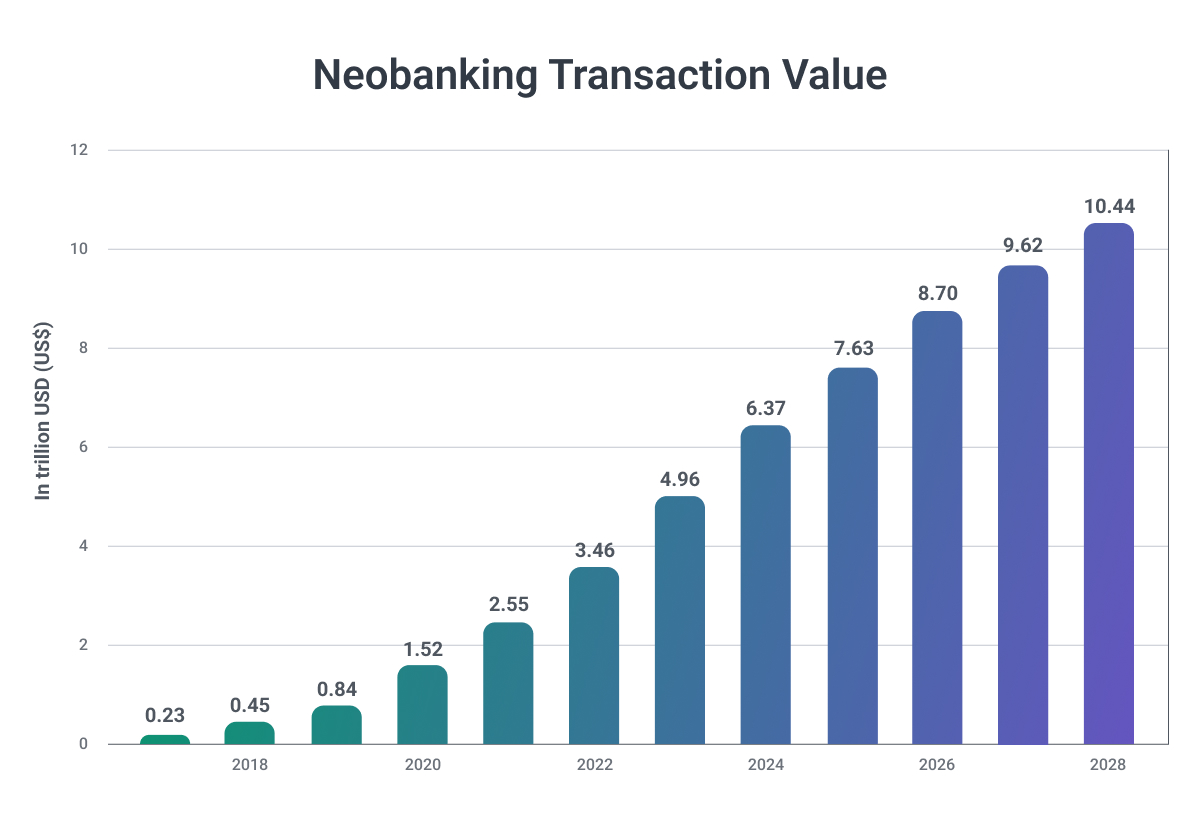

Due to rapid smartphone adoption, supportive open-banking rules, and high customer demand for intuitive digital experiences, neobanks like Nubank now serve more than 110 million customers. Chime, which completed a USD 864 million public offering in May 2025, show how digital-first models are moving into the financial mainstream. The neobanking market size is forecast to reach USD 12.42 trillion by 2030, reflecting a CAGR of 10.97%.

Revolut and Klarna together reach roughly 135 million users, relying on global card networks and extensive merchant ecosystems. WeBank allocates over 10% of its yearly revenue to R&D, developing its own AI and cloud systems that significantly increase technical barriers to entry. In response, traditional banks are launching digital-only subsidiaries or offering embedded finance via API platforms, further intensifying competition.

Banks still hold a decisive advantage in user retention. Up to 85% of their conversions come from retargeting, resulting in day-30 retention rates that are 1.5–2x higher than those of neobanks. This durability is rooted in long-standing customer relationships: banks are highly effective at cross-selling within their existing base and shifting branch or web users into mobile, with owned media driving nearly 45% of all app installs.

Yet this strength exposes a vulnerability — banks are largely catering to the same customers. There’s no meaningful growth in net-new users, leaving them reliant on a slowly aging core audience.

Neobanks, in contrast, are winning the acquisition race. They have already surpassed traditional banks in both the UK and France, where consumers now choose neobanks and digital wallets at a 2:1 ratio. Their momentum is fueled by a modern, diversified media mix that blends owned channels with TikTok, SANs, ad networks, and DSPs, enabling rapid scale and strong penetration among younger demographics. But this growth comes with a trade-off: retention remains fragile. Only 3–4% of conversions are driven by retargeting, highlighting a persistent gap in long-term engagement.

The Fight Between the Old and New Banks

The surge in consumer demand for all-encompassing financial "super apps" is set to create significant ripples in the financial landscape of 2026. This trend will exert notable pressure on traditional financial institutions and amplify competition between neobanks and legacy banks.

A "super app" in finance refers to a comprehensive mobile application offering a wide array of financial services, spanning savings, investments, mortgages, and payments.

Neobanks, epitomized by platforms such as Revolut, are swiftly encroaching into the territory of "super apps." They are diversifying their service offerings by adding more features to a single mobile application, ranging from exclusive shopping perks and innovative savings tools to real-time currency conversions and seamless stock investing.

While these advancements have predominantly unfolded in consumer banking, 2025 is expected to witness a pivotal shift. Neobanks are poised to extend their payment capabilities to business-to-business (B2B) transactions, posing a formidable challenge to traditional banks on yet another front.

New Era for Fintechs

Fintechs have entered a new era where sustainable and profitable growth models are the priority rather than pursuing expansion at all costs.

The decade prior was marked by hypergrowth, with funding, valuations, and adoption numbers skyrocketing due to supportive conditions like increasing digitization. 2021 proved to be a peak, with over $90 billion invested into fintechs.

Since then, deteriorating macro conditions and a market correction reanchored inflated expectations. Funding levels dropped 40% year-over-year, IPO and SPAC activity slowed, and economic outlooks remain uncertain.

In Q3 2024, the global FinTech sector faced significant declines in both deal activity and funding, with year-over-year drops exceeding 50%. While there was a slight quarter-over-quarter improvement in deal volume, total funding for 2024 is projected to be nearly half of 2023 levels. This reflects a challenging environment characterized by cautious markets and more selective investor activity.

This shifting landscape means fintechs can no longer rely on easy access to capital to fuel unchecked growth. The focus has moved towards achieving profitability through optimized cost structures and stable unit economics. Priority has shifted from growth for growth's sake to operating sustainably.

Several intertwining trends will shape the next wave of fintech adoption. Radical digital transformation is revolutionizing the banking industry, with players competing to own distinct customer needs across five emerging arenas.

This disruption creates opportunities for fintechs. Separately, digital's share of banking interactions globally now sits at 73%, signaling rapid adoption. Additionally, consumers in many markets have similar levels of trust in fintechs as traditional institutions - 41% plan to increase fintech product use. Untapped potential for digital banking and remittance transfers remains immense, especially across emerging economies like Africa, which now has nearly 800 million mobile money accounts.

Currently, fintechs account for just 5% of total banking revenues worldwide. Estimates point to over $400 billion in fintech revenues by 2028, reflecting 15% compound annual growth and capturing significantly more market share from incumbents.

While the funding winter has impacted most fintechs, differences emerge across business models and maturity stages. For instance, early-stage fintechs focusing on seed and angel investments displayed more resilience, with capital invested growing 26% year-over-year.

Additionally, B2B fintech verticals outperformed B2C, as segments like banking-as-a-service and SME-focused solutions only witnessed funding declines of around 25%. This B2B growth results from businesses migrating to off-the-shelf digitized solutions for needs once fulfilled manually.

Finally, bread-and-butter lending and payments fintechs still received the largest overall funding share, indicating their market centrality. In summary, while no fintech remains completely unaffected by present challenges, factors like maturity stage and target market contribute towards divergence in fundraising performance.

Key Challenges for Digital-Only Banks

There are a few key challenges facing digital-only banks that may be flying under the radar:

- Differentiation in a commoditized market: With so many neobanks offering similar features, rates, and experiences to customers, standing out from the competition is becoming exceedingly difficult. Unless neobanks can provide truly unique value propositions, customer acquisition and retention could become a squeeze as consumers go for the cheapest or most convenient option.

- Dependence on partnerships for critical functions: Most neobanks rely on myriad partnerships with vendor providers to enable services like cards, payments, infrastructure, etc. This leaves them reliant on the reliability of partners in a fragmented vendor landscape. If key partners face disruptions, it directly impacts neobanks' performance.

- Grappling with regulations designed for incumbents: New rules and compliance obligations, like Anti Money Laundering (AML) and Know Your Customer (KYC), can weigh heavily on neobanks built for efficiency and speed. Navigating regulatory regimes intended for legacy banks saps resources and strains business models dependent on technology and risk profiling.

These issues, along with more prominent challenges like profitability, security, trust, and winning over older generations of customers, make building sustainable, long-term neobanking franchises extremely difficult.

However, overcoming the unique obstacles of vendor dependence and differentiation in an increasingly stratified market without much scale or brand recognition poses risks many don't fully appreciate. Addressing these quietly simmering issues behind the scenes will dictate who ultimately thrives in this competitive arena.

Other Challenges Neobanks Will Be Facing This Year

Battling for Profitability

A core struggle for many neobanks is identifying and executing profitable business models. Their streamlined, digital-first operations give them efficiencies over legacy banks. Acquiring customers and generating revenue from them remains an uphill climb.

Key pain points include:

- High customer acquisition costs eat into margins

- Low average revenue per customer accounts

- Difficulty cross-selling additional products

To overcome these profit pitfalls, neobanks need optimized customer targeting, stellar digital experiences that drive engagement, and strategic partnerships for offering other financial services.

Navigating Regulatory Environments

Rules around banking licenses, capital reserves, reporting standards, and other compliance issues create costly complexities for neobanks. Keeping pace with regulations designed more for traditional banks can be an operational and financial drain.

There is also uncertainty around how governments will adapt regulations to accommodate fintech challengers. Neobanks have to budget considerable resources for regulatory obligations.

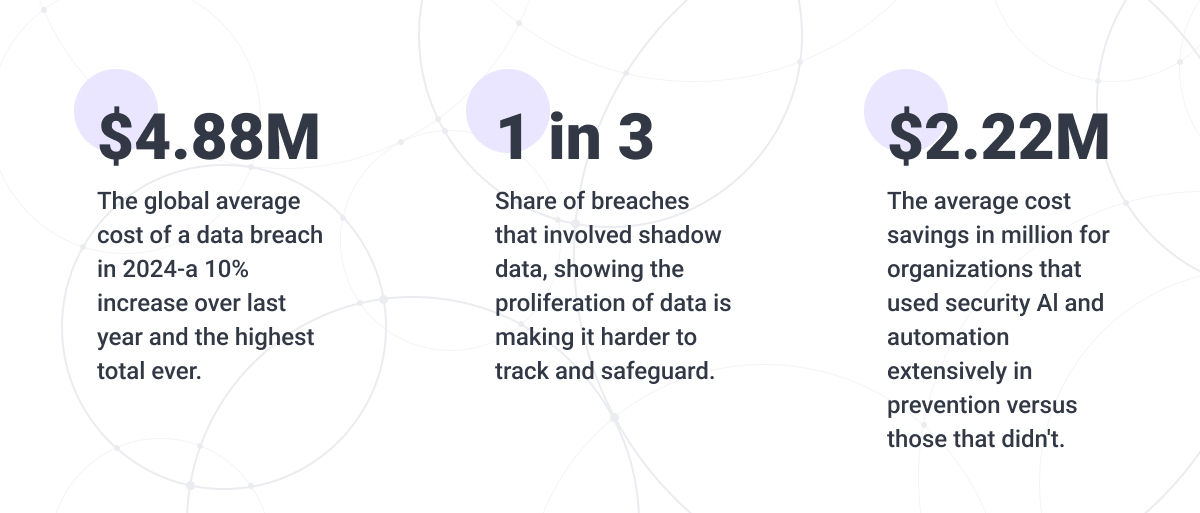

Guarding Against Cyber Threats

Lacking physical branches and assets makes neobanks prime targets for hackers, scammers, and digital fraudsters. Protecting customer data and money requires constant investment in security layers like encryption, multi-factor authentication, and AI and ML fraud monitoring. While helpful, these precautions cannot fully eliminate risks in an increasingly sophisticated threat landscape. Neobanks also have to educate users on best practices for account safety.

Building Trust and Loyalty

Generational affinity for digital experiences has fueled the early adopter user base for neobanks and converting broader consumer segments remains challenging.

Many people still have doubts about new fintech players versus the assumed stability of incumbent banks. Overcoming these perceptions requires advanced transparency, responsive customer service to provide the same reliability as traditional institutions.

Competing for Top Talent

The white-hot fintech sector intensified competition for engineers, designers, data scientists, and other critical technology roles. Many neobanks struggle with talent shortages, high turnover, and recruiter bidding wars. Their innovative cultures also contribute to burnout.

Building durable teams that sustain rapid iteration while avoiding fatigue is imperative but difficult. Creative approaches to nearshoring talent and working with remote teams can bring more experts and contribute to better working atmosphere in these fast-paced working environments.

What the Future Holds

In summary, neobanks face mounting challenges in 2026 that will test their sustainability and resilience. While the market for digital banking continues rapid expansion, fueled by strong consumer demand and mobile technology adoption, neobanks must evolve to overcome critical obstacles.

The key challenges covered in this article include: fierce competition against both legacy banks and other neobanks in an increasingly crowded market; reliance on patchworks of third-party vendors that leaves operations vulnerable; regulatory burdens not calibrated for new banking models; persistent unprofitability and difficulty monetizing users; cybersecurity threats targeting digital assets; lack of consumer trust compared to established institutions; talent retention struggles in a 'hot' industry; and uncertainty around future regulatory shifts.

While over $90 billion flowed into fintechs recently, the funding environment has cooled and economic outlooks remain cloudy. This means pursuing profitable business models is now mission-critical, rather than growth for growth's sake. Additionally, not all neobanks are impacted equally – B2B fintechs and more mature companies displayed greater fundraising resilience so far.

To build sustainable market positions, neobanks must provide differentiated value propositions and digitally-native experiences that foster genuine user engagement over the long-term. Streamlining compliance operations, optimizing cost structures, leveraging smart partnerships, and prioritizing security are also essential.

With mobile and digital rapidly becoming the norm for money management globally, opportunities for disruption abound. Fintechs still only control 5% of total banking revenues worldwide – by 2028, estimates point to $400 billion in revenues and significantly increased market share. Neobanks at the frontier now must focus on overcoming headwinds to lead the next wave of adoption.

Though the road ahead remains challenging, the potential scale of the prized market they’re pursuing brings motivation to tackle problems creatively.