Remember the days when choosing a service provider meant dealing with physical software and constant upgrades? In 2006, the tech titans Google and Amazon spearheaded a revolution by embracing the boundless potential of cloud computing.

Nearly Half of Remittance Platforms are Stuck in 2006

Their visionary leap has since catalyzed transformations across numerous industries, yet the realm of money transfer and remittance platforms has been somewhat reluctant to fully embrace this web-based technology.

Understandable concerns surrounding security and regulations have contributed to a slower adoption rate.

While it is encouraging that over half of remittance software placements now reside on the cloud, a significant portion—40%—still rely on outdated means. 1

This lingering disparity presents both a challenge and an opportunity for the industry to navigate the path toward a more agile and secure future.

Unlocking the Potential of Cloud Migration:

With the rise of fintech and the accelerated digital transformation caused by COVID-19, those in the remittance and money transfer industry are now recognizing the potential of migrating their legacy applications to the cloud.

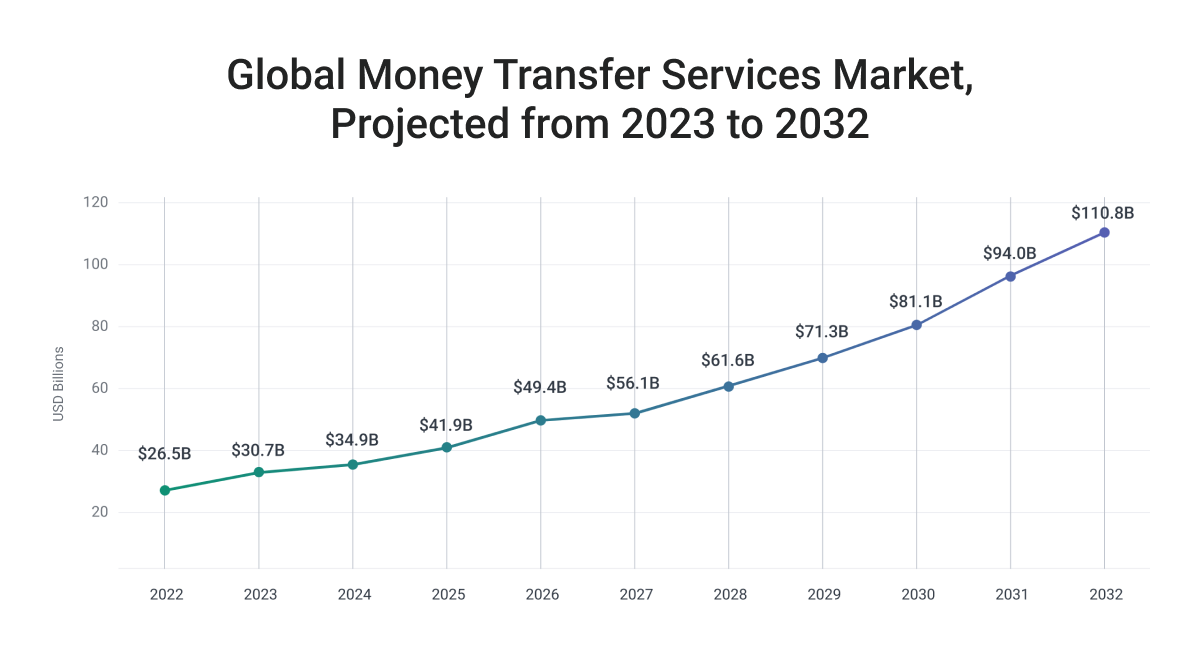

The Global Money Transfer Services Market is projected to experience substantial growth over the forecast period from 2023 to 2032.

According to a 2023 research report by Transparency Market Research, the market is expected to increase from $26.5 billion in 2022 to approximately $110.8 billion by 2032.

This growth highlights the immense potential and profitability of the money transfer and remittance industry.

As the market continues to expand, businesses that modernize their money transfer platforms through cloud migration will have a competitive edge, enabling them to capture a larger share of this lucrative market.

The Advantages of Migrating to the Cloud

Migrating money transfer and remittance platforms to the cloud offers a range of benefits that can empower businesses and enable them to stay competitive.

The most significant advantages, as described by Softjourn's Solution Architect, Taras Romaniv, include increased:

- Agility

- Scalability

- Availability

- Performance

- Disaster recovery capabilities

- Potential cost savings

- Security

Cloud platforms provide scalability, flexibility, and agility that legacy systems cannot match, enabling businesses to respond swiftly to changing market demands and customer needs.

Migrating money transfer systems and remittance payment systems to the cloud brings numerous specific benefits and insights to the table. Let's explore some key insights in detail:

Enhanced Scalability and Agility:

Cloud-based platforms provide unmatched scalability and agility compared to legacy systems.

Money transfer and remittance platforms often experience fluctuations in transaction volumes, especially during peak times.

With the cloud, businesses can easily scale their resources up or down based on demand, ensuring seamless operations and optimal performance.

This flexibility allows companies to accommodate growth, handle increased transaction volumes, and adapt to changing customer needs.

Improved Operational Efficiency:

Cloud migration enables money transfer platforms to streamline their operations and improve overall efficiency.

Traditional legacy systems often require extensive manual intervention and complex processes.

By leveraging cloud technologies, companies can automate various tasks, such as transaction processing, compliance checks, and reconciliation.

Automated workflows not only reduce the potential for human error but also free up valuable resources, enabling employees to focus on higher-value activities and strategic initiatives.

Enhanced Security and Compliance:

Data security and compliance are critical concerns in the money transfer industry.

Cloud providers offer advanced security features and robust encryption protocols to safeguard sensitive customer information.

They invest heavily in securing their infrastructure, implementing stringent access controls, and employing advanced threat detection and prevention measures.

Cloud platforms also provide tools and services to help businesses meet regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations.

Global Accessibility and Connectivity:

Cloud-based money transfer systems provide global accessibility and connectivity, enabling seamless cross-border transactions.

Users can access these platforms from anywhere with an internet connection, facilitating international money transfers and remittances.

Cloud-based systems also integrate with various payment networks and APIs, simplifying connectivity with financial institutions, mobile wallets, and other payment service providers.

This connectivity expands the reach of money transfer platforms, allowing them to serve a broader customer base.

Real-time Data Analytics and Insights:

Cloud-based platforms offer robust analytics and reporting capabilities that empower money transfer businesses to gain valuable insights from their data.

By leveraging real-time data analytics, companies can monitor transaction trends, identify potential risks, and make data-driven decisions.

These insights enable businesses to enhance customer experiences, optimize operational processes, and identify new business opportunities.

Cost Optimization and Scalable Pricing Models:

Cloud migration often brings cost optimization benefits to money transfer platforms.

Instead of investing in expensive hardware infrastructure and regular software upgrades, businesses can leverage the pay-as-you-go model offered by cloud providers.

This model allows companies to pay only for the resources they use, scaling their infrastructure and costs according to actual demand.

It eliminates the need for upfront capital expenditure and provides cost predictability, making financial planning more efficient. To further reduce cloud costs, consider FinOps Consulting Services.

Faster Time-to-Market for Innovation:

Cloud-based platforms enable money transfer businesses to leverage the latest technologies and innovations at a faster pace.

Cloud providers offer a wide range of services, such as artificial intelligence (AI), machine learning (ML), and blockchain, that can be readily integrated into money transfer systems.

This allows companies to introduce new features, improve user experiences, and drive innovation without the need for extensive development cycles.

Rapid deployment of new functionalities helps businesses stay competitive in a rapidly evolving market.

Considerations & Challenges for Cloud Migration

When considering the migration of money transfer systems and remittance payment systems to the cloud, it's important to keep in mind the following considerations and challenges:

Security and Compliance:

As money transfer platforms deal with sensitive financial information, security, and compliance become paramount.

Ensure that the chosen cloud provider has robust security measures in place, such as data encryption, access controls, and compliance with industry regulations (e.g., PCI DSS, AML, KYC).

Conduct a thorough assessment of the cloud provider's security certifications and audit reports to ensure they meet your specific compliance requirements.

Data Privacy and Sovereignty:

Depending on the jurisdiction where your business operates, there may be legal and regulatory requirements regarding data privacy and sovereignty.

Understand the data protection laws in the regions you operate in and ensure that the cloud provider adheres to those regulations.

Consider data residency options and ensure that customer data remains within the appropriate jurisdictions.

Migration Strategy and Planning:

Migrating a complex money transfer system to the cloud requires careful planning and a well-defined migration strategy.

Consider factors such as data migration, application re-architecture, and integration with existing systems.

Develop a comprehensive migration plan, including a phased approach and thorough testing, to minimize disruptions and ensure a smooth transition.

Network Connectivity and Latency:

Money transfer systems heavily rely on network connectivity to process transactions and interact with financial institutions.

Assess the network connectivity options provided by the cloud provider, including bandwidth, latency, and redundancy.

Evaluate if the cloud provider offers data centers in close proximity to your target markets to minimize latency and ensure optimal performance.

Vendor Lock-In and Exit Strategy:

Consider the potential risks of vendor lock-in when choosing a cloud provider.

Ensure that the cloud provider supports industry-standard technologies and open APIs, allowing for interoperability and portability of your applications and data.

Define an exit strategy that outlines how you can migrate your systems and data to another provider or back to an on-premises environment if necessary.

Cost Management and Optimization:

While cloud migration can offer cost-saving benefits, it's crucial to carefully manage and optimize costs.

Monitor resource utilization, leverage cost management tools provided by the cloud provider, and regularly review your infrastructure to eliminate unnecessary resources.

Consider leveraging reserved instances or spot instances for cost optimization, and keep track of any additional costs such as data transfer and storage fees.

Business Continuity and Disaster Recovery:

Ensure that the cloud provider offers robust backup and disaster recovery solutions to protect against data loss and service interruptions.

Establish comprehensive backup strategies, implement redundant systems, and regularly test your disaster recovery procedures to ensure business continuity in the event of disruptions.

Skillset and Expertise:

Cloud migration requires specific skills and expertise. Assess your internal IT team's capabilities and determine if additional training or external assistance is needed.

Consider partnering with cloud migration experts or consultants who have experience in migrating similar financial systems to ensure a successful and efficient migration process.

Examples of Money Transfer Systems’ Cloud Migration

Here are a few real-world successful examples of money transfer systems and remittance payment systems migrating to the cloud:

TransferWise (Wise): TransferWise is a prominent fintech company that offers an online money transfer platform. They migrated their entire infrastructure to the cloud, leveraging Amazon Web Services (AWS).

By moving to the cloud, TransferWise gained the scalability and flexibility required to handle its rapid growth and international expansion. The cloud migration enabled them to process transactions faster, enhance user experiences, and reduce operational costs.

Western Union: Western Union, a global leader in money transfer services, embraced cloud technology to modernize its legacy systems.

They adopted a hybrid cloud approach, combining both public and private cloud solutions. The migration allowed Western Union to improve its digital capabilities, enhance transaction processing speed, and provide customers with more convenient and secure ways to send and receive money globally.

Remitly: Remitly is a digital remittance platform that enables people to send money internationally. They migrated their infrastructure to the cloud, leveraging AWS.

This move allowed Remitly to improve its application performance, scalability, and security. With the cloud, Remitly was able to handle increased transaction volumes, ensure high availability, and introduce new features quickly to meet customer demands.

What do these examples share in common? They demonstrate how cloud technology can empower companies to overcome scalability limitations, enhance security and compliance, improve transaction processing speed, and provide superior customer experiences in the highly competitive money transfer and remittance industry.

{f170a0ce}

Embracing the Cloud for Future Success:

Migrating money transfer and remittance platforms to the cloud is a game-changing decision that can revolutionize the industry.

By embracing cloud technology, businesses can break free from the limitations of outdated systems, reduce technical debt, and unlock new levels of operational efficiency.

Migrating to the cloud is not only a technical upgrade but a strategic move that can redefine your business and unlock previously unimaginable opportunities.

So, whether you're already on your cloud migration journey or just starting to consider it, the time to act is now - and Softjourn is here to help!

We are trusted by clients in the money transfer and remittance industry, due to our expertise in helping them seamlessly move their systems to the cloud.

Contact us today to start (or finish!) your cloud migration journey. Take the leap, embrace the change, and let the cloud propel your business to new heights.