Not long ago, seeing a concert meant picking up a ticket for $50 or so and showing up on the night with friends. Today, live events have become major investments—premium seats for major tours can easily cost hundreds, if not thousands of dollars.

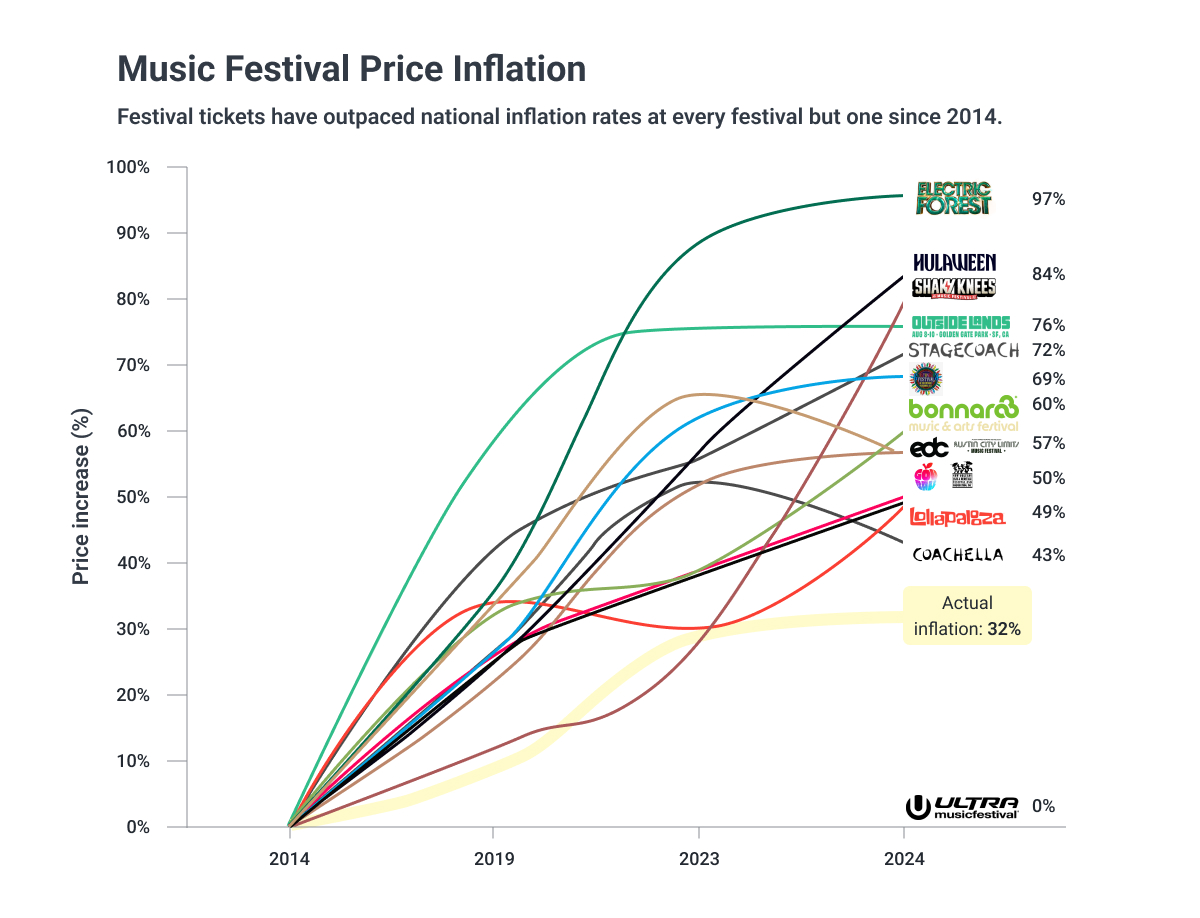

When Taylor Swift’s record-breaking Eras Tour tickets went on sale, prices soared past $1,500 for many fans. Similarly, music festival ticket prices have far outpaced the inflation rate, with many passes now costing several hundred to several thousand dollars.

And yet, demand for these events hasn’t faltered. Experiences, it seems, remain priceless—no matter the cost.

A Shift in How Fans Pay

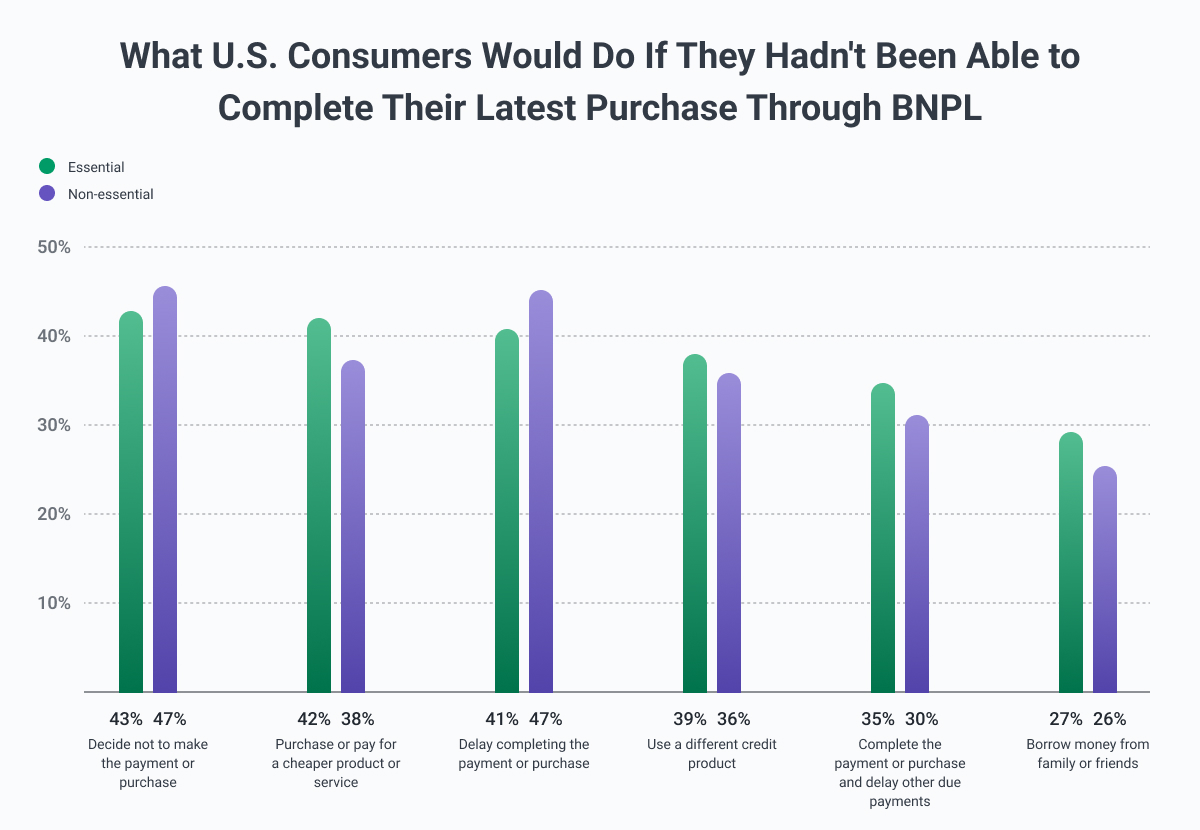

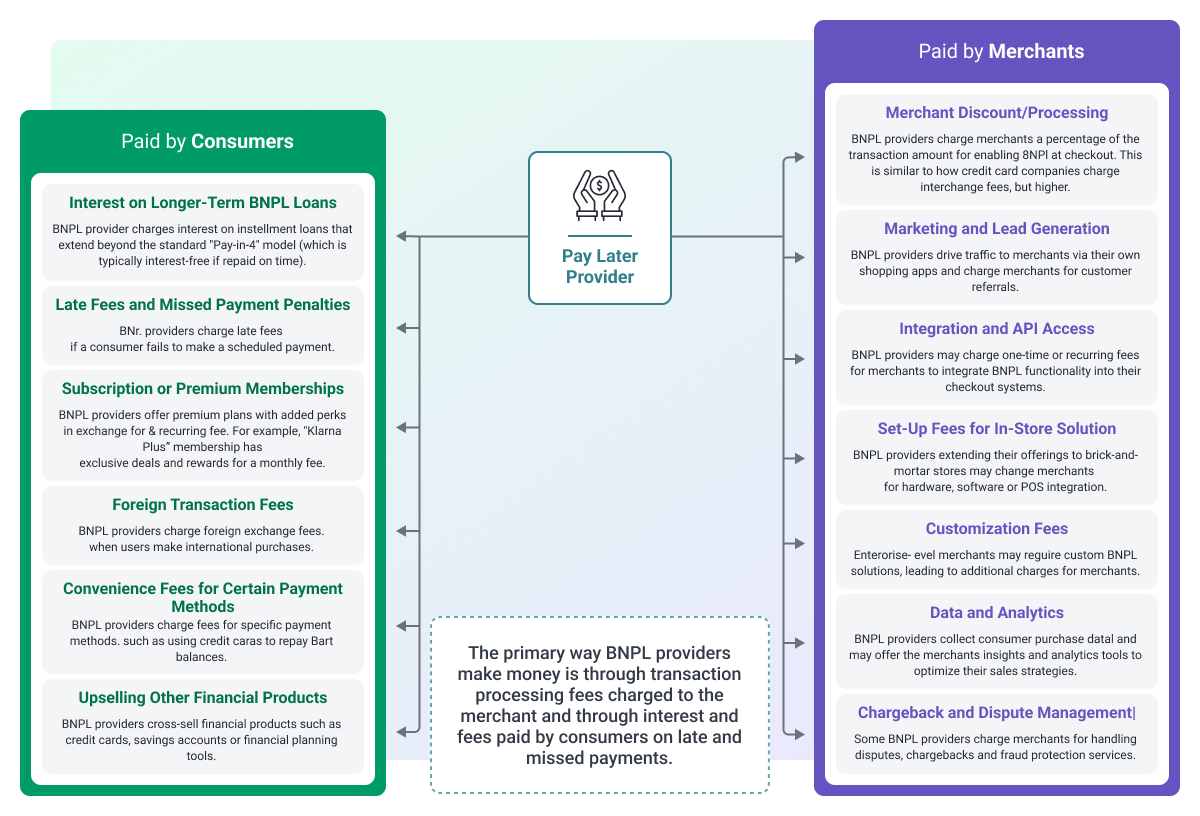

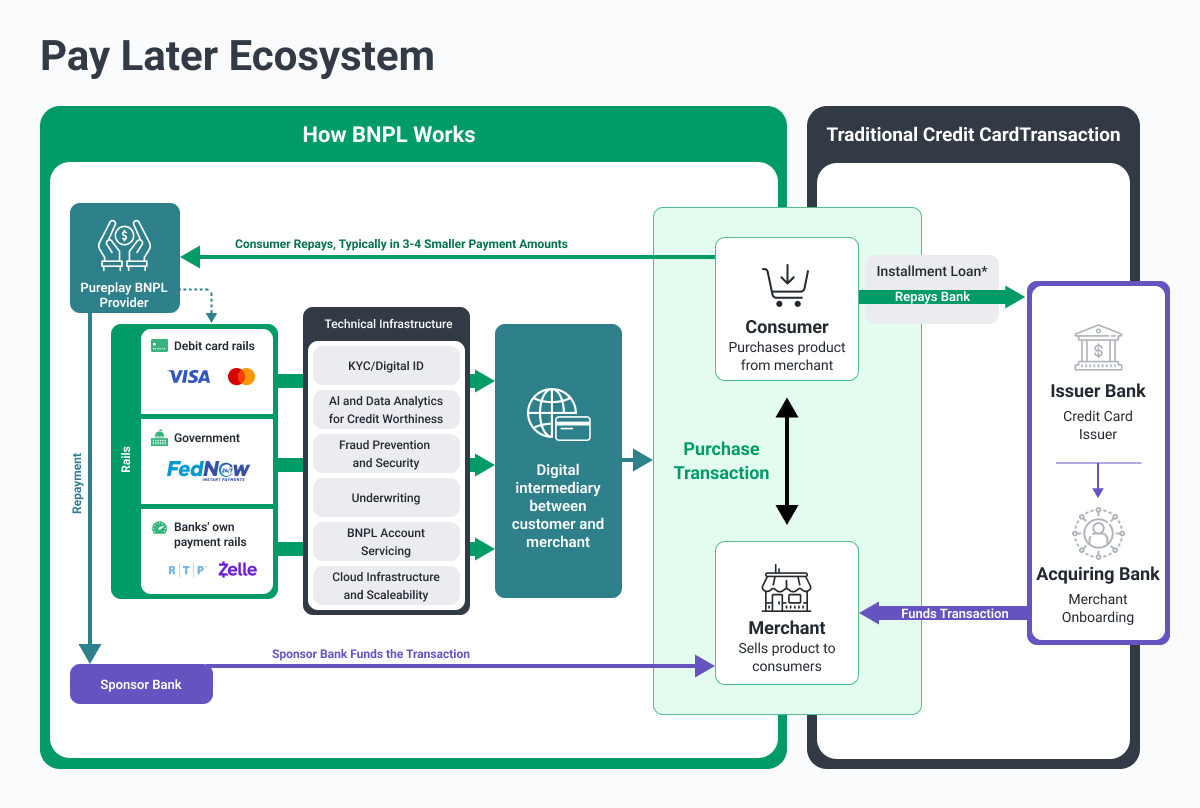

Even when fans are eager to attend an event, financial reality sometimes says otherwise. That’s where Buy Now, Pay Later (BNPL) comes in.

Already transforming retail and travel, BNPL has made its way into the ticketing industry, giving buyers more control over how and when they pay, and allowing ticketing platforms to remove friction at the most critical moment of the buyer journey: checkout.

As inflation and shifting consumer habits continue to reshape spending behavior, flexible payments are no longer a luxury - they’re an expectation. For platforms hoping to meet today’s buyers where they are, BNPL is quickly becoming essential.

The BNPL Market Explosion

BNPL’s rise has been nothing short of meteoric. In the U.S., usage has grown from $2 billion in 2019 to a projected $175 billion by 2025—an 88-fold increase in just six years.1

Globally, the market is expected to reach $560 billion this year and is forecasted to exceed $900 billion by 2032.2 While still only a fraction of the overall retail economy, BNPL is carving out a powerful niche by offering consumers a clear alternative to traditional credit cards.

This growth reflects not just clever marketing or fintech innovation, but a deeper change in consumer psychology. Buyers are more cautious, more selective, and more focused on payment transparency. BNPL offers them structured, interest-free payment plans that feel more manageable - and often come without the baggage of revolving credit debt.

A reported 380 million people globally used BNPL services in 2024, with that number set to exceed 670 million by 2028.4 In the U.S. alone, 128 million adults have already used BNPL in some form.1

These aren’t just people making impulse buys on fast fashion or electronics; increasingly, they’re using BNPL for higher-value discretionary purchases like travel, luxury goods, and yes, event tickets.

Why BNPL Resonates with Event-Goers

The demographic overlap between BNPL users and live event attendees is striking. Millennials and Gen Z, who make up the bulk of both audiences, are highly responsive to BNPL.

They value flexibility, are often managing complex financial responsibilities, and are generally more skeptical of traditional credit instruments. BNPL gives them a transparent, lower-stress way to commit to experiences they care about.

And the impact on sales is measurable. A study by Affirm found that average order value increased by 85% when BNPL was enabled.3

The appeal is twofold: for buyers, it eases the decision-making process; for sellers, it leads to more sales, higher-value purchases, and expanded customer reach.

More Than a Payment Option: BNPL as a Strategic Tool

BNPL is often seen as a way to remove payment friction—but its impact goes far beyond checkout. For ticketing platforms, BNPL offers multiple strategic advantages that can directly influence revenue growth, customer loyalty, and market reach.

Reduced Cart Abandonment, Higher Conversion

High ticket prices can lead to hesitation and, ultimately, cart abandonment. BNPL reduces that friction by offering a manageable path to purchase. Buyers are more likely to follow through when the total cost is broken into smaller, predictable payments.

Mastercard found that BNPL reduces cart abandonment by 35% and increases conversions by 45%—a significant boost for any ticketing platform operating in a competitive market.3

“With trusted methods available during a typically higher-value transaction, the barrier to booking is removed, and conversion rates increase as the consumer is familiar with the methods,” says Sam Argyle, Managing Director at Alternative Airlines.2

A Tool for Cross-Selling and Upselling

BNPL doesn’t just help sell the ticket—it helps sell the experience. When the upfront cost isn’t a roadblock, customers are far more likely to add VIP upgrades, parking passes, merchandise, or food and beverage packages.

AttendStar, a ticketing platform that implemented BNPL, saw an average order value increase of $143 and a 115% bump for large outdoor events.3 Flexible payment options allow fans to indulge more in the moment, leading to higher overall sales.

Access for a Broader Audience

While BNPL is often associated with budget-conscious consumers, it’s used across income brackets. Some buyers use it out of necessity - particularly those aged 25 to 34 managing tighter budgets - while others use it strategically to manage cash flow, avoid interest on credit cards, or keep credit lines open for larger purchases.2

BNPL gives both groups a way to participate in experiences they value without compromising financial stability.

This is particularly evident in the festival market. A report by Skiddle and AIF showed a 48% rise in split payment usage for festival tickets year-over-year. These flexible options helped drive both early bird and last-minute purchases, proving that affordability at key stages of the sales cycle can make a significant difference.

“Accessibility for our customers is at an all-time high,” adds Argyle. “This appeals particularly to customers who might not have the funds upfront but can comfortably manage smaller, regular payments.”

Immediate Payouts, Minimal Risk for Platforms

Perhaps one of the most overlooked benefits of BNPL is that platforms get paid in full, upfront. There’s no delay in receiving funds, no need to wait for installment completion, and the platform doesn’t assume the financing risk. That responsibility is carried by the BNPL provider.

This structure not only ensures steady cash flow but also removes the financial uncertainty that might otherwise come with offering flexible payment options. It’s a win-win—buyers get more time to pay, and sellers still get paid on time.

Your Competitors Offer BNPL—Do You?

BNPL is no longer a competitive edge—it’s becoming a baseline expectation. Ticketmaster, StubHub, SeatGeek, Vivid Seats, and AttendStar are just some of the platforms that now offer BNPL through providers like Klarna, Affirm, Zip, Afterpay, and PayPal. As more of the industry moves in this direction, platforms that don’t adapt risk falling behind.

AttendStar described their experience with adding BNPL3:

“We released BNPL in December 2022, and it’s quickly becoming one of the key drivers of ticket sales growth for our clients this year! For that reason, we recommend that every event offer Buy Now Pay Later tickets.”

And it’s not just payments—more ticketing platforms are also upgrading their digital ticket delivery with tools like Apple and Google Wallet integrations. We recently helped Spektrix launch a no-code Custom Pass Builder, allowing event organizers to design branded mobile passes with ease.

Implementation Challenges—and How to Overcome Them

Despite its benefits, implementing BNPL isn’t entirely frictionless. For ticketing platforms, the primary concerns typically fall into three categories: risk, regulation, and complexity.

Fraud is an ongoing concern, especially in industries with high resale value like ticketing. BNPL providers often carry some of the fraud risk, but not all. Merchants may still face chargebacks, friendly fraud, or synthetic identity scams. To mitigate this, providers are increasingly offering robust fraud detection and real-time underwriting tools.

There's also the matter of compliance. Ensuring a seamless user experience while meeting regulatory standards, particularly around Know Your Customer (KYC) protocols, can be a balancing act.

Fortunately, many BNPL providers now offer pre-packaged compliance frameworks, helping platforms integrate without needing deep regulatory expertise.

Perhaps the most practical concern is integration. But even here, the outlook is positive. Most providers now offer well-documented APIs, white-label solutions, and modular features that allow even smaller teams to launch BNPL with minimal development overhead.

For platforms without in-house resources, third-party software development partners can handle the integration quickly and seamlessly, removing technical barriers and accelerating time to market.

What Makes a BNPL Rollout Successful?

For ticketing platforms ready to explore BNPL, success depends on more than just flipping a switch. The most effective BNPL implementations share three qualities: intentional placement, the right BNPL provider, and smart technical partnerships.

- How BNPL is presented on your platform matters. Don’t tuck it away at checkout—showcase it on event pages, seat selection screens, and marketing materials. Remind buyers that their favorite experiences are more accessible than they might think.

- Selecting the right BNPL provider is crucial. Look for a partner with experience in high-volume, high-urgency industries like ticketing, and prioritize those offering strong fraud prevention and flexible payment plans that match your audience's needs

- Don’t go at it alone - collaborating with an experienced software development partner can make implementation faster, smoother, and tailored to your platform’s unique needs. Whether you need full integration support or just an expert eye on the technical details, the right partner can help you launch BNPL with confidence.

With the right execution, BNPL can drive immediate revenue while strengthening your brand’s reputation for flexibility and customer care.

Your Buyers Are Ready for BNPL—Are You?

The benefits of BNPL are clear. For ticketing platforms, it’s a tool that drives conversion, increases order value, broadens your audience, and keeps you competitive in a fast-changing market. For consumers, it reduces stress, increases financial control, and opens the door to experiences they may otherwise skip.

As more consumers actively seek out BNPL and more platforms adopt it, flexible payment options will continue to shape the future of ticketing. If your platform isn’t offering BNPL yet, now is the time to start.

Whether you're looking to integrate a BNPL solution for the first time or optimize an existing setup, we can help make the technical side simple. Ready to explore BNPL for your platform? Let’s talk.

BNPL Updates

New EU Consumer Credit Rules to Reshape BNPL Landscape by 2026

The EU’s revised Consumer Credit Directive (CCD2), set for full implementation by late 2026, introduces stricter regulations for Buy Now, Pay Later (BNPL) services. BNPL providers must comply with local APR caps, conduct creditworthiness checks, and clearly communicate loan terms and risks.

The directive will pressure BNPL firms to adapt their pricing and business models to meet compliance across multiple countries. While these rules aim to boost consumer protection and reduce debt, they may also limit access to BNPL and raise operational costs.

[Source: Consultancy.eu, April 2025]

CFPB Pauses Enforcement of BNPL Rule

The Consumer Financial Protection Bureau announced it will not prioritize enforcement of its Buy Now, Pay Later rule under Regulation Z. Instead, the agency will shift focus to more urgent consumer protection issues - particularly those affecting servicemembers, veterans, and small businesses. The Bureau is also considering rescinding the BNPL rule entirely.

[Source: Consumer Financial Protection Bureau, May 2025]